Key Insights

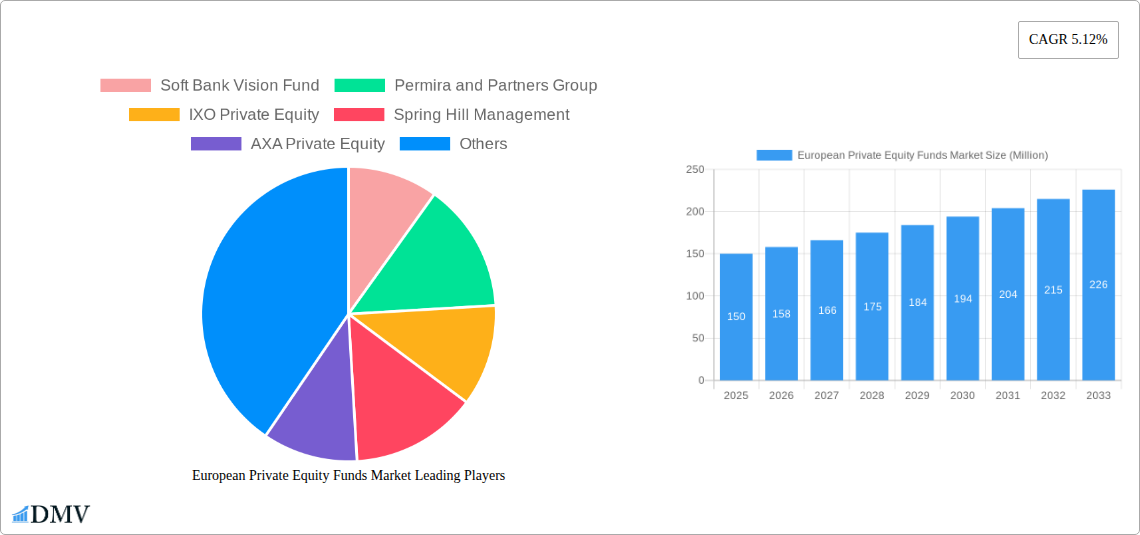

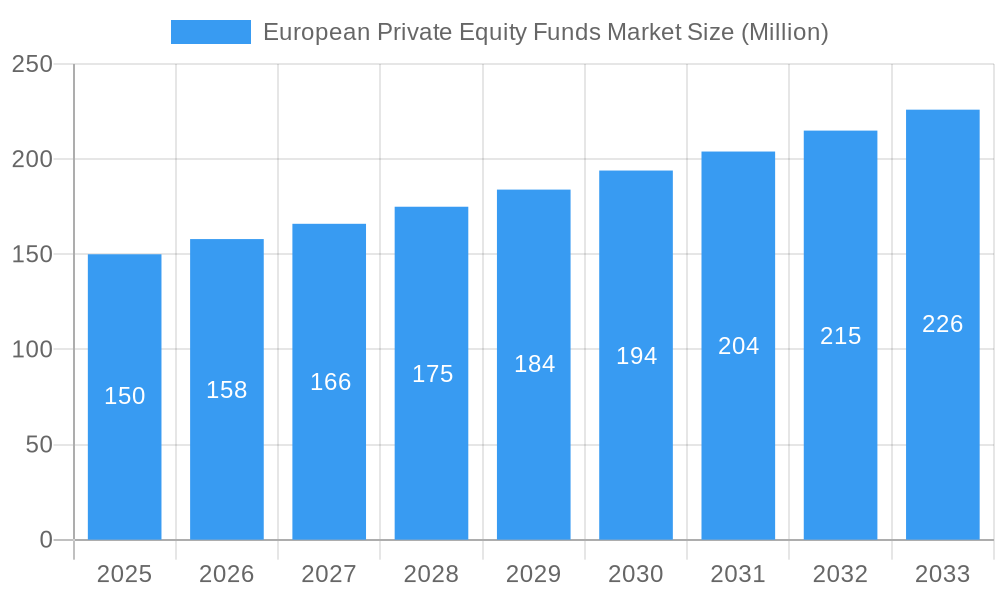

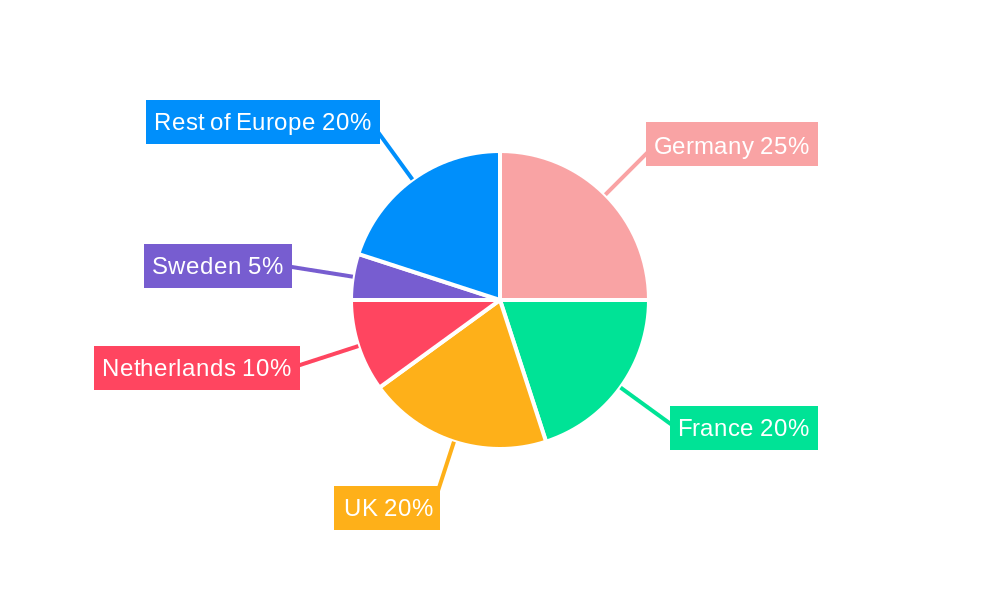

The European private equity (PE) funds market, valued at €150 million in 2025, is projected to experience robust growth, driven by several key factors. A consistently high CAGR of 5.12% indicates a positive outlook for the forecast period (2025-2033). This growth is fueled by increasing institutional investor interest in alternative asset classes like private equity, seeking higher returns than traditional investments. The market is segmented by investment type (large, mid, and small-cap) and application (early-stage venture capital, private equity, and leveraged buyouts), offering diverse investment opportunities. Significant activity is observed across major European economies, particularly Germany, France, the UK, and the Netherlands, which benefit from established financial infrastructure and a strong entrepreneurial ecosystem. While regulatory changes and macroeconomic uncertainties present potential headwinds, the long-term growth prospects remain promising, driven by ongoing technological advancements and increasing cross-border investment activity within the European Union.

European Private Equity Funds Market Market Size (In Million)

The competitive landscape is characterized by a mix of global giants like SoftBank Vision Fund, Permira, and Partners Group, alongside regional players such as IXO Private Equity and Accent Equity Partners. These firms compete on the basis of investment strategy, deal sourcing capabilities, and portfolio management expertise. The increasing prevalence of sophisticated data analytics and technology-driven deal-sourcing methods is expected to further intensify competition. Furthermore, the growing focus on Environmental, Social, and Governance (ESG) factors is influencing investment decisions, with PE firms increasingly integrating ESG considerations into their due diligence processes. This trend is likely to attract more socially conscious investors and drive further growth in the sector. The market's expansion will depend on successful exits, sustained economic growth across Europe, and the continued availability of attractive investment opportunities.

European Private Equity Funds Market Company Market Share

European Private Equity Funds Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the European Private Equity Funds Market, covering the period from 2019 to 2033. It delves into market dynamics, competitive landscapes, and future growth trajectories, offering invaluable insights for stakeholders across the industry. With a base year of 2025 and a forecast period spanning 2025-2033, this report is a critical resource for strategic decision-making. The market is projected to reach xx Million by 2033.

European Private Equity Funds Market Market Composition & Trends

This section analyzes the European Private Equity Funds Market's structure and key trends. We examine market concentration, revealing the market share distribution among major players like SoftBank Vision Fund, Permira, Partners Group, IXO Private Equity, Spring Hill Management, AXA Private Equity, Oakley Capital, Heartland, CVC Capital Partners, Accent Equity Partners, Apax Partners, and other key players. The report also explores innovation catalysts, regulatory influences impacting investment strategies, and the role of substitute products. Detailed analysis of M&A activities, including deal values and their impact on market consolidation, is provided. The historical period (2019-2024) serves as a foundation for understanding current market conditions. We examine end-user profiles and their investment preferences, further segmenting the market by investment type (Large Cap, Mid Cap, Small Cap) and application (Early Stage Venture Capital Investment, Private Equity, Leverage Buyout). The report estimates that the market share of Large Cap investments is approximately xx%, Mid Cap at xx%, and Small Cap at xx% in 2025. Total M&A deal value in 2024 is estimated at xx Million.

- Market Concentration: Analysis of market share held by top players.

- Innovation Catalysts: Examination of technological advancements driving market growth.

- Regulatory Landscape: Assessment of regulations influencing investment strategies.

- Substitute Products: Evaluation of alternative investment options.

- End-User Profiles: Detailed segmentation of investors based on investment preferences.

- M&A Activities: Comprehensive analysis of mergers and acquisitions, including deal values.

European Private Equity Funds Market Industry Evolution

This section offers a detailed analysis of the European Private Equity Funds Market's growth trajectory from 2019 to 2033. It explores the influence of technological advancements, such as the increasing use of AI in due diligence and portfolio management, on market dynamics. We also examine the impact of evolving consumer demands and preferences on investment strategies. The report identifies key factors contributing to market growth, quantifying their impact with specific data points such as compound annual growth rates (CAGR) and adoption metrics for various investment strategies. For instance, the adoption rate of Leverage Buyout strategies is projected to increase by xx% from 2025 to 2033. The shift towards online investments and the growing importance of ESG (Environmental, Social, and Governance) factors are also analyzed. Specific data points detailing growth rates for different investment types and applications will be included.

Leading Regions, Countries, or Segments in European Private Equity Funds Market

This section identifies the leading regions, countries, and segments within the European Private Equity Funds Market. A detailed analysis of dominance factors is presented, examining investment trends, regulatory support, and market maturity. The analysis focuses on the aforementioned segmentation by investment type (Large Cap, Mid Cap, Small Cap) and application (Early Stage Venture Capital Investment, Private Equity, Leverage Buyout).

- Key Drivers for Leading Segments:

- Investment Trends: Analysis of prevailing investment preferences.

- Regulatory Support: Assessment of government policies promoting investment.

- Market Maturity: Evaluation of the level of development in different segments.

European Private Equity Funds Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics within the European Private Equity Funds Market. We explore unique selling propositions and technological advancements that are reshaping the industry. The focus is on innovative investment strategies, advanced analytical tools, and improved risk management techniques.

Propelling Factors for European Private Equity Funds Market Growth

This section identifies key growth drivers, focusing on technological advancements, economic factors, and regulatory influences. The increasing availability of data and analytics, favorable economic conditions in certain European countries, and supportive regulatory frameworks are analyzed for their impact on market growth.

Obstacles in the European Private Equity Funds Market Market

This section examines barriers and restraints impacting the European Private Equity Funds Market. We assess regulatory challenges, potential supply chain disruptions, and competitive pressures, providing quantifiable impacts where possible. The impact of geopolitical instability and economic downturns on investment decisions is also discussed.

Future Opportunities in European Private Equity Funds Market

This section explores emerging opportunities for growth, focusing on new markets, technological advancements, and evolving consumer trends. The potential for expansion into under-served sectors and the adoption of new investment technologies are analyzed.

Major Players in the European Private Equity Funds Market Ecosystem

- SoftBank Vision Fund

- Permira

- Partners Group

- IXO Private Equity

- Spring Hill Management

- AXA Private Equity

- Oakley Capital

- Heartland

- CVC Capital Partners

- Accent Equity Partners

- Other Key Players (List Not Exhaustive)

- Apax Partners

Key Developments in European Private Equity Funds Market Industry

- February 2023: Oakley Capital raises a record Euro 2.85 Billion (USD 3.13 Billion) for its fifth flagship fund, signaling continued investment in online consumer trends, cloud migration, and quality education.

- February 2023: Apax seeks to acquire up to a 40% stake in a company valued at USD 2.1 billion, aiming for greater market control and strategic investment planning.

Strategic European Private Equity Funds Market Market Forecast

This section summarizes the growth catalysts and market potential for the European Private Equity Funds Market. It emphasizes the long-term growth opportunities presented by technological advancements, evolving investment strategies, and expanding market access. The predicted growth trajectory and the potential for further market consolidation are highlighted.

European Private Equity Funds Market Segmentation

-

1. Investment Type

- 1.1. Large Cap

- 1.2. Mid Cap

- 1.3. Small Cap

-

2. Application

- 2.1. Early Stage Venture Capital Investment

- 2.2. Private Equity

- 2.3. Leverage Buyout

European Private Equity Funds Market Segmentation By Geography

- 1. Italy

- 2. Germany

- 3. France

- 4. Switzerland

- 5. United Kingdom

- 6. Rest of Europe

European Private Equity Funds Market Regional Market Share

Geographic Coverage of European Private Equity Funds Market

European Private Equity Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Family Owned Companies Witnessing Majority Shareholding in Private Equity Industry of Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 5.1.1. Large Cap

- 5.1.2. Mid Cap

- 5.1.3. Small Cap

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Early Stage Venture Capital Investment

- 5.2.2. Private Equity

- 5.2.3. Leverage Buyout

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Switzerland

- 5.3.5. United Kingdom

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 6. Italy European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investment Type

- 6.1.1. Large Cap

- 6.1.2. Mid Cap

- 6.1.3. Small Cap

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Early Stage Venture Capital Investment

- 6.2.2. Private Equity

- 6.2.3. Leverage Buyout

- 6.1. Market Analysis, Insights and Forecast - by Investment Type

- 7. Germany European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investment Type

- 7.1.1. Large Cap

- 7.1.2. Mid Cap

- 7.1.3. Small Cap

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Early Stage Venture Capital Investment

- 7.2.2. Private Equity

- 7.2.3. Leverage Buyout

- 7.1. Market Analysis, Insights and Forecast - by Investment Type

- 8. France European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investment Type

- 8.1.1. Large Cap

- 8.1.2. Mid Cap

- 8.1.3. Small Cap

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Early Stage Venture Capital Investment

- 8.2.2. Private Equity

- 8.2.3. Leverage Buyout

- 8.1. Market Analysis, Insights and Forecast - by Investment Type

- 9. Switzerland European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investment Type

- 9.1.1. Large Cap

- 9.1.2. Mid Cap

- 9.1.3. Small Cap

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Early Stage Venture Capital Investment

- 9.2.2. Private Equity

- 9.2.3. Leverage Buyout

- 9.1. Market Analysis, Insights and Forecast - by Investment Type

- 10. United Kingdom European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investment Type

- 10.1.1. Large Cap

- 10.1.2. Mid Cap

- 10.1.3. Small Cap

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Early Stage Venture Capital Investment

- 10.2.2. Private Equity

- 10.2.3. Leverage Buyout

- 10.1. Market Analysis, Insights and Forecast - by Investment Type

- 11. Rest of Europe European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Investment Type

- 11.1.1. Large Cap

- 11.1.2. Mid Cap

- 11.1.3. Small Cap

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Early Stage Venture Capital Investment

- 11.2.2. Private Equity

- 11.2.3. Leverage Buyout

- 11.1. Market Analysis, Insights and Forecast - by Investment Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Soft Bank Vision Fund

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Permira and Partners Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IXO Private Equity

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Spring Hill Management

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AXA Private Equity

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Oakley Capital

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Heartland

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 CVC Capital Partners

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Accent Equity Partners*

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Other Key Players*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Apax Partners

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Soft Bank Vision Fund

List of Figures

- Figure 1: European Private Equity Funds Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Private Equity Funds Market Share (%) by Company 2025

List of Tables

- Table 1: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 2: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: European Private Equity Funds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 5: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 8: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 11: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 14: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 17: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 20: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Private Equity Funds Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the European Private Equity Funds Market?

Key companies in the market include Soft Bank Vision Fund, Permira and Partners Group, IXO Private Equity, Spring Hill Management, AXA Private Equity, Oakley Capital, Heartland, CVC Capital Partners, Accent Equity Partners*, Other Key Players*List Not Exhaustive, Apax Partners.

3. What are the main segments of the European Private Equity Funds Market?

The market segments include Investment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Family Owned Companies Witnessing Majority Shareholding in Private Equity Industry of Europe.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

In February 2023, Oakley Capital raises a record Euro 2.85 Billion (USD 3.13 Billion) for its fifth flagship fund. Oakley will continue to invest behind the long-term megatrends that have underpinned growth and returns across economic cycles, including the consumer shift to online, business migration to the Cloud, and the growing global demand for quality, accessible education.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Private Equity Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Private Equity Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Private Equity Funds Market?

To stay informed about further developments, trends, and reports in the European Private Equity Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence