Key Insights

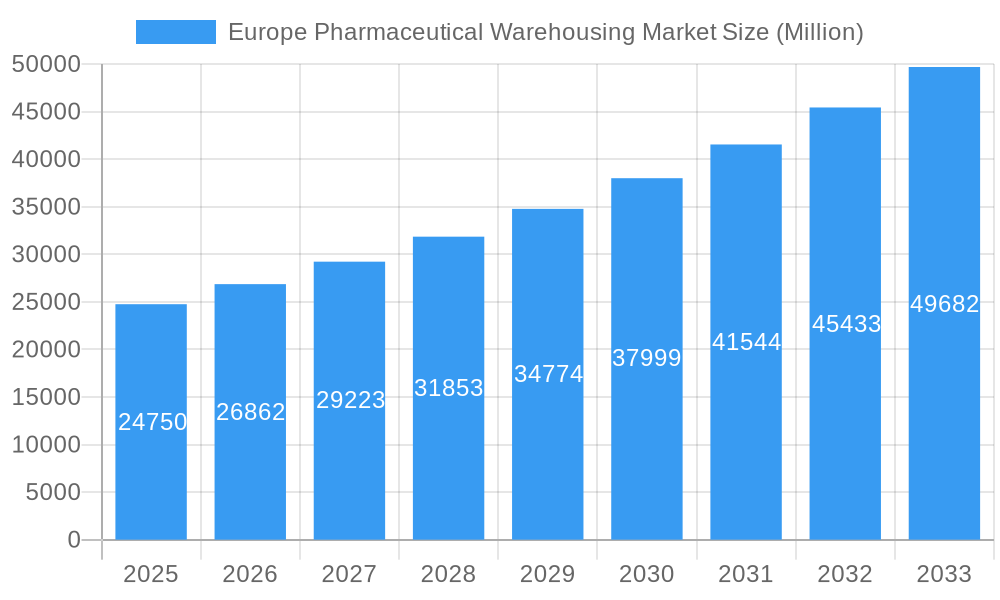

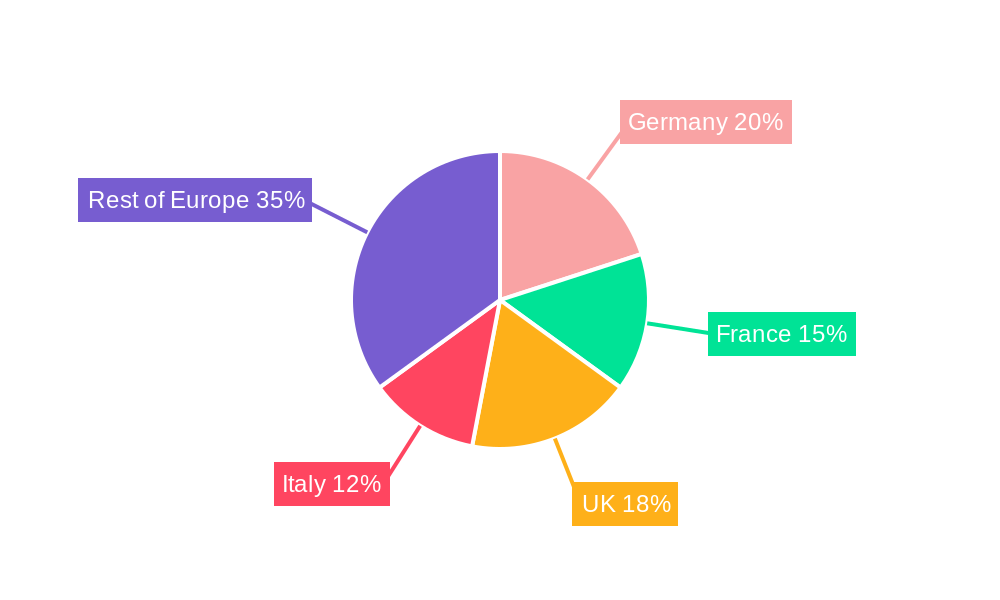

The European pharmaceutical warehousing market, valued at €24.75 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 8.26% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of chronic diseases necessitates efficient pharmaceutical supply chains, fueling demand for specialized warehousing solutions. Stringent regulatory compliance requirements for pharmaceutical storage and handling are driving investment in advanced cold chain and non-cold chain facilities. Furthermore, the growing e-commerce sector within the pharmaceutical industry necessitates sophisticated warehousing and logistics solutions capable of handling increased order volumes and ensuring timely delivery. The market is segmented by warehouse type (cold chain and non-cold chain) and application (pharmaceutical factories, pharmacies, hospitals, and others), with cold chain warehousing representing a significant portion due to the temperature-sensitive nature of many pharmaceutical products. Germany, France, the United Kingdom, and Italy are key market contributors within Europe, driven by established pharmaceutical industries and advanced healthcare infrastructure. However, market growth is also anticipated in other European countries as healthcare systems and pharmaceutical sectors continue to evolve.

Europe Pharmaceutical Warehousing Market Market Size (In Billion)

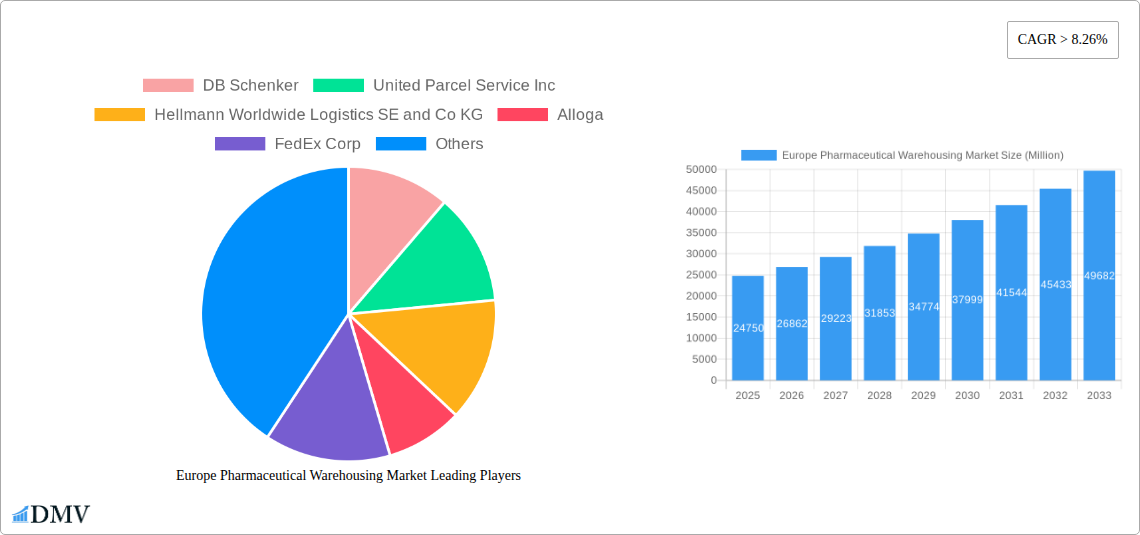

The competitive landscape includes both large multinational logistics providers such as DB Schenker, UPS, FedEx, and Kuehne + Nagel, and specialized pharmaceutical logistics companies like Alloga and Bio Pharma Logistics. These companies are actively investing in technological advancements, including automation, data analytics, and improved traceability systems, to enhance efficiency and comply with evolving regulatory demands. The market's future growth will depend on continued innovation in warehouse technologies, further expansion of e-pharmacy services, and sustained investment in improving healthcare infrastructure across Europe. The projected market value in 2033, extrapolated from the provided CAGR and 2025 value, indicates significant market potential for pharmaceutical warehousing in Europe.

Europe Pharmaceutical Warehousing Market Company Market Share

Europe Pharmaceutical Warehousing Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Pharmaceutical Warehousing Market, offering a comprehensive overview of its current state and future trajectory. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report delves into market size, segmentation, key players, and growth drivers, equipping stakeholders with the knowledge needed to navigate this dynamic sector. The market is projected to reach xx Million by 2033.

Europe Pharmaceutical Warehousing Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the European pharmaceutical warehousing sector. We examine market concentration, revealing the market share distribution amongst key players like DB Schenker, United Parcel Service Inc, Hellmann Worldwide Logistics SE and Co KG, Alloga, FedEx Corp, Rhenus SE and Co KG, Bio Pharma Logistics, Kuehne Nagel Management AG, XPO Logistics Inc, GEODIS SA, and KRC Logistics (list not exhaustive). The report also explores the impact of mergers and acquisitions (M&A) activities, analyzing deal values and their influence on market consolidation. Innovation within cold chain and non-cold chain warehousing solutions, driven by advancements in temperature monitoring and automation, is thoroughly assessed. Furthermore, we examine the evolving regulatory landscape and its effects on market participants and discuss the role of substitute products and evolving end-user profiles across pharmaceutical factories, pharmacies, and hospitals. The total M&A deal value in the observed period is estimated at xx Million.

- Market Share Distribution: A detailed breakdown of market share held by leading companies.

- M&A Activity: Analysis of significant M&A transactions, including deal values and their strategic implications.

- Regulatory Landscape: Assessment of key regulations impacting the market and their future implications.

- Innovation Catalysts: Exploration of technological advancements driving efficiency and growth.

Europe Pharmaceutical Warehousing Market Industry Evolution

This section charts the evolution of the European pharmaceutical warehousing market from 2019 to 2033. We analyze the market's growth trajectory, pinpointing key periods of expansion and contraction. This analysis considers technological advancements such as automated storage and retrieval systems (AS/RS), robotics, and the Internet of Things (IoT) in warehouse management, tracking their adoption rates and their impact on efficiency and cost reduction. Moreover, the report examines shifts in consumer demands, considering the increasing need for specialized warehousing solutions, especially in the cold chain sector. Detailed growth rates and adoption metrics for key technologies are provided, revealing the market's dynamism and future potential. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%.

Leading Regions, Countries, or Segments in Europe Pharmaceutical Warehousing Market

This section identifies the leading regions, countries, and segments within the European pharmaceutical warehousing market. A detailed analysis will highlight the dominance of specific regions and nations, examining the factors contributing to this leadership. The report will compare and contrast the growth of cold chain and non-cold chain warehousing segments and assess their performance in various applications, including pharmaceutical factories, pharmacies, hospitals, and other end-users.

- Cold Chain Warehouse: Key drivers include stringent temperature control requirements and growing demand for temperature-sensitive pharmaceutical products.

- Non-Cold Chain Warehouse: Growth is driven by the warehousing needs of non-temperature sensitive pharmaceutical products and related supplies.

- Pharmaceutical Factory: High growth attributed to increased production and distribution needs.

- Pharmacy: Driven by the decentralized nature of pharmaceutical dispensing and the need for efficient inventory management.

- Hospital: Hospitals require secure and reliable warehousing to manage supplies and medications efficiently.

Europe Pharmaceutical Warehousing Market Product Innovations

This section details the most significant product innovations within the European pharmaceutical warehousing market. We describe new technologies, such as automated guided vehicles (AGVs) and advanced warehouse management systems (WMS), and their impact on warehouse efficiency, inventory control, and overall supply chain optimization. The unique selling propositions (USPs) of these innovations are highlighted, including their ability to improve traceability, reduce waste, and enhance overall supply chain visibility.

Propelling Factors for Europe Pharmaceutical Warehousing Market Growth

Several factors contribute to the growth of the European pharmaceutical warehousing market. Technological advancements, such as automated systems and advanced data analytics, are leading to improved efficiency and reduced costs. The increasing demand for specialized cold chain warehousing solutions is another key driver, driven by the growing market for temperature-sensitive pharmaceutical products. Moreover, favorable regulatory policies supporting pharmaceutical industry growth are fostering the expansion of warehousing capacity across Europe.

Obstacles in the Europe Pharmaceutical Warehousing Market

The European pharmaceutical warehousing market faces several challenges. Stringent regulatory requirements and compliance costs can be significant barriers to entry. Supply chain disruptions, exacerbated by geopolitical uncertainties and increased transportation costs, pose an ongoing threat to market stability. Intense competition among established players and the increasing need to manage risks associated with temperature-sensitive goods are further obstacles that need careful consideration.

Future Opportunities in Europe Pharmaceutical Warehousing Market

The future of the European pharmaceutical warehousing market looks promising. Emerging technologies, such as blockchain and artificial intelligence (AI), offer substantial opportunities for enhancing efficiency and security across the supply chain. The expanding need for specialized cold chain logistics in emerging European markets will also drive growth. Moreover, the increasing demand for efficient and reliable warehousing solutions across the pharmaceutical industry presents significant opportunities for companies to capture market share.

Major Players in the Europe Pharmaceutical Warehousing Market Ecosystem

- DB Schenker

- United Parcel Service Inc (UPS)

- Hellmann Worldwide Logistics SE and Co KG

- Alloga

- FedEx Corp (FedEx)

- Rhenus SE and Co KG

- Bio Pharma Logistics

- Kuehne Nagel Management AG (Kuehne + Nagel)

- XPO Logistics Inc (XPO Logistics)

- GEODIS SA (GEODIS)

- KRC Logistics

Key Developments in Europe Pharmaceutical Warehousing Market Industry

- June 2023: ViaPharma signed a 20-year lease agreement with CTP for two Czech CTParks, adding almost 27,000 sq m of pharmaceutical warehousing space. This expansion signifies significant investment in the Czech Republic's pharmaceutical logistics sector.

- August 2022: UPS's acquisition of BomiGroup, a leading healthcare logistics provider in Italy, significantly expanded its temperature-controlled warehousing capacity across 14 countries, reinforcing its position as a major player in the European pharmaceutical warehousing market.

Strategic Europe Pharmaceutical Warehousing Market Forecast

The European pharmaceutical warehousing market is poised for continued growth, driven by technological advancements, increasing demand for cold chain logistics, and favorable regulatory environments. Future opportunities lie in embracing emerging technologies and expanding into high-growth markets. The market's potential for expansion remains substantial, presenting significant opportunities for existing players and new entrants alike.

Europe Pharmaceutical Warehousing Market Segmentation

-

1. Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Others

Europe Pharmaceutical Warehousing Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Russia

- 1.5. Spain

- 1.6. Rest of Europe

Europe Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of Europe Pharmaceutical Warehousing Market

Europe Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The rise in demand for outsourcing pharmaceutical warehousing services; The demand for efficiency

- 3.2.2 visibility

- 3.2.3 and product safety from pharmaceutical companies

- 3.3. Market Restrains

- 3.3.1. Lack of efficient logistics support in emerging economies

- 3.4. Market Trends

- 3.4.1. Rise in the demand Pharmaceutical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hellmann Worldwide Logistics SE and Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alloga

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rhenus SE and Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bio Pharma Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne Nagel Management AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 XPO Logistics Inc **List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GEODIS SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KRC Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pharmaceutical Warehousing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Germany Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: UK Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Russia Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Warehousing Market?

The projected CAGR is approximately > 8.26%.

2. Which companies are prominent players in the Europe Pharmaceutical Warehousing Market?

Key companies in the market include DB Schenker, United Parcel Service Inc, Hellmann Worldwide Logistics SE and Co KG, Alloga, FedEx Corp, Rhenus SE and Co KG, Bio Pharma Logistics, Kuehne Nagel Management AG, XPO Logistics Inc **List Not Exhaustive, GEODIS SA, KRC Logistics.

3. What are the main segments of the Europe Pharmaceutical Warehousing Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.75 Million as of 2022.

5. What are some drivers contributing to market growth?

The rise in demand for outsourcing pharmaceutical warehousing services; The demand for efficiency. visibility. and product safety from pharmaceutical companies.

6. What are the notable trends driving market growth?

Rise in the demand Pharmaceutical.

7. Are there any restraints impacting market growth?

Lack of efficient logistics support in emerging economies.

8. Can you provide examples of recent developments in the market?

June 2023: ViaPharma signed a 20-year lease agreement with the developer CTP for two Czech CTParks. CTP will prepare and hand over the premises, with a total area of almost 27,000 sq m and several specific modifications for the pharmaceutical industry, at the end of 2023. CTPark Ostrava Poruba and CTPark Brno Líšeň will be the next locations of cooperation. ViaPharma already leased three warehouses in Romania, including the largest ever pharmaceutical warehouse in the country with an area of 35,000 sq m in CTPark Mogosoaia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence