Key Insights

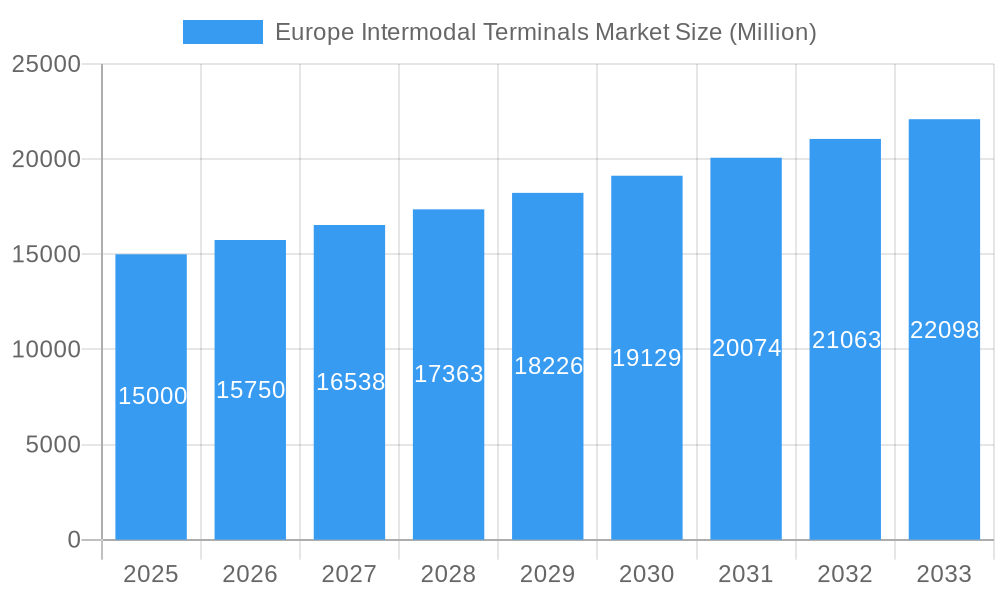

The European intermodal terminals market is poised for significant expansion, driven by the escalating demand for efficient and sustainable logistics solutions. A projected compound annual growth rate (CAGR) of 6.3% from 2025 to 2033 underscores this robust growth trajectory. Key growth catalysts include the burgeoning e-commerce sector, which necessitates faster and more dependable supply chains, stringent environmental regulations favoring intermodal transport over sole reliance on road freight, and the continuous expansion of manufacturing and automotive industries across Europe. The market is segmented by transportation mode (rail, road, air, maritime) and end-user industries, illustrating its diverse applications.

Europe Intermodal Terminals Market Market Size (In Billion)

Key European economies such as Germany, France, the UK, and the Netherlands are expected to spearhead market growth, supported by their advanced logistics infrastructure and substantial freight volumes. Intense competition among prominent players, including DP World, Rail Cargo Group, and COSCO SHIPPING Ports, is anticipated to foster innovation and operational enhancements. Ongoing investments in efficient rail networks and improved intermodal transfer facilities will further accelerate market development.

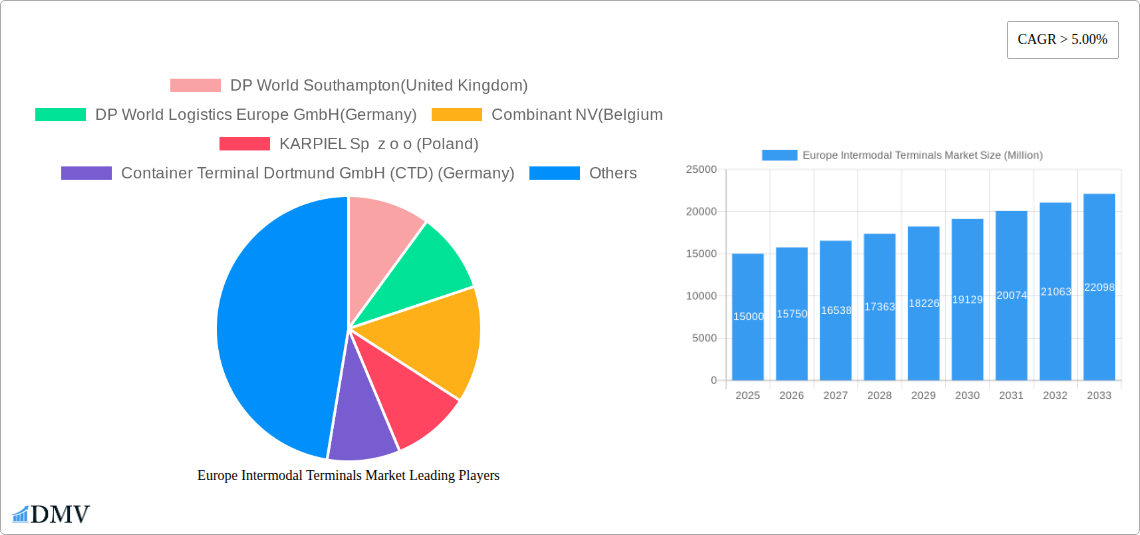

Europe Intermodal Terminals Market Company Market Share

The forecast period (2025-2033) will witness accelerated growth, fueled by substantial investments in infrastructure modernization and the integration of technological advancements like automation and digitalization in terminal operations. The global imperative for sustainable practices in logistics will further boost the adoption of intermodal solutions, enabling businesses to reduce their carbon footprint. However, market expansion may be moderated by volatile fuel prices, geopolitical uncertainties impacting trade routes, and the substantial capital required for infrastructure upgrades. The diverse end-user base and transportation modes present significant opportunities for specialized service providers and further market segmentation, emphasizing the critical need for strategic planning and adaptability within the European intermodal terminals sector.

Europe Intermodal Terminals Market: Size, Growth & Forecast Report (2025-2033)

This comprehensive market report offers an in-depth analysis of the European Intermodal Terminals Market, providing a detailed overview of market dynamics, growth drivers, challenges, and future opportunities. The analysis covers the period from 2019 to 2033, with 2025 serving as the base year. The market size is projected to reach $2.33 billion by 2033, signifying substantial growth potential. This detailed research equips stakeholders with essential data and insights for effective navigation of this dynamic market.

Europe Intermodal Terminals Market Market Composition & Trends

This section meticulously examines the competitive landscape of the Europe Intermodal Terminals market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The market exhibits a moderately concentrated structure, with key players holding significant market share. However, the entry of smaller, specialized firms is also evident.

Market Share Distribution (2024 Estimates):

- DP World: xx%

- Rail Cargo Group: xx%

- COSCO SHIPPING Ports: xx%

- Other players: xx%

Innovation Catalysts: The market is driven by technological advancements in automation, digitalization, and data analytics, leading to increased efficiency and reduced operational costs. The adoption of sustainable practices, such as the use of alternative fuels and environmentally friendly equipment, is also gaining momentum.

Regulatory Landscape: Stringent environmental regulations and safety standards are shaping market dynamics, encouraging the adoption of sustainable and safe intermodal transport solutions. Furthermore, government initiatives promoting infrastructure development and multimodal transport are fostering market expansion.

Substitute Products: Road-only transport presents a primary substitute, although its limitations regarding cost, emissions, and capacity are being increasingly recognized, especially for longer distances and large volumes.

End-User Profiles: The key end-user segments include manufacturing and automotive, oil, gas, and mining, agriculture, and distributive trade. Each segment presents unique characteristics concerning transportation requirements and volume.

M&A Activities: The past five years have witnessed several notable M&A transactions, with a total deal value exceeding xx Million. These consolidations have aimed to enhance market share, expand service offerings, and achieve economies of scale.

Europe Intermodal Terminals Market Industry Evolution

The Europe Intermodal Terminals market has experienced substantial growth over the historical period (2019-2024), driven by the increasing demand for efficient and sustainable logistics solutions. The Compound Annual Growth Rate (CAGR) during this period was estimated at xx%. Technological advancements, such as automated guided vehicles (AGVs) and advanced container handling systems, are significantly improving operational efficiency and reducing transit times. Shifting consumer demands towards faster and more reliable delivery are also shaping industry trends, incentivizing continuous innovation and infrastructure upgrades. The market is expected to maintain a strong growth trajectory during the forecast period (2025-2033), propelled by increasing e-commerce activities, growing cross-border trade, and continuous investment in intermodal infrastructure. Adoption of digital technologies like blockchain for enhanced supply chain transparency also anticipates contributing towards improved market growth. Specific data on adoption of new technologies isn't publicly available; however, industry reports suggest growth in the double-digit range annually for automated solutions.

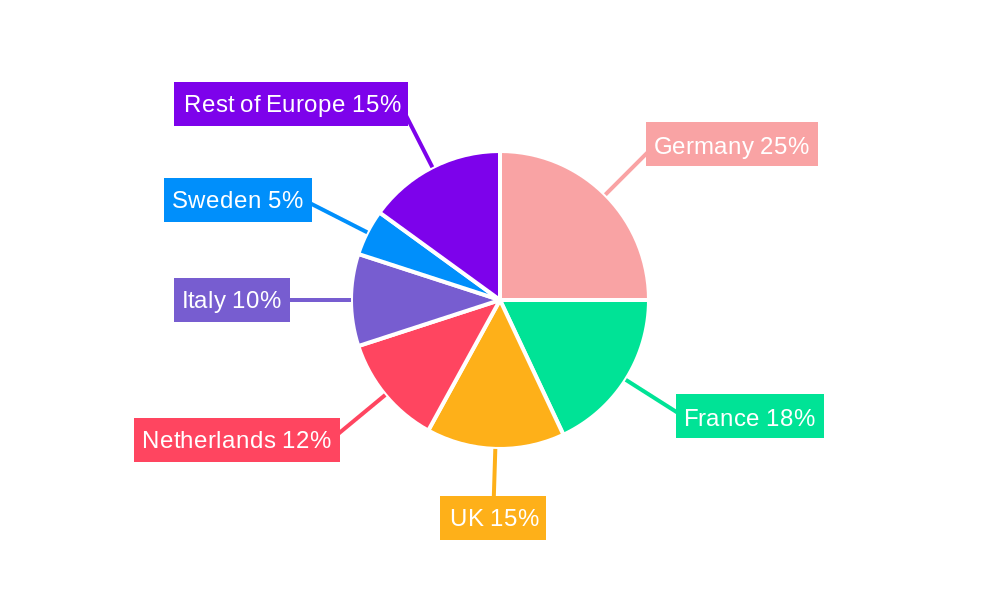

Leading Regions, Countries, or Segments in Europe Intermodal Terminals Market

Dominant Regions/Countries: Germany and the Netherlands emerge as leading regions, due to their well-established intermodal infrastructure, strategic geographic locations, and high concentration of manufacturing and distribution activities. The Benelux region, including Belgium, also showcases significant activity.

Dominant Segments:

- By Transportation Mode: Maritime and Road Transport holds the largest market share, driven by the high volume of goods transported through major seaports and the subsequent road transport for final delivery.

- By End-User: The Manufacturing and Automotive segment leads due to its high demand for efficient and reliable transport of goods and components.

Key Drivers for Dominant Segments:

- High investment in infrastructure: significant investments in port facilities, rail networks, and road infrastructure are enhancing the efficiency and capacity of intermodal terminals.

- Government support: initiatives and policies promoting sustainable transport solutions and multimodal transport are fostering market growth.

- Strategic location: the geographical position of terminals allows for efficient connections with major European markets and beyond.

- Strong industry clusters: concentration of manufacturing, logistics, and distribution activities around key terminals drives high volume and demand.

Europe Intermodal Terminals Market Product Innovations

Recent innovations focus on enhancing efficiency, safety, and sustainability. Automated stacking cranes, advanced terminal operating systems (TOS), and real-time tracking technologies are improving operational efficiency and reducing costs. Furthermore, the adoption of alternative fuels, such as LNG and biofuels, is reducing the environmental impact of intermodal operations. This combination offers unique selling propositions focusing on speed, cost-effectiveness, and reduced carbon footprint.

Propelling Factors for Europe Intermodal Terminals Market Growth

Several factors are propelling the growth of the Europe Intermodal Terminals market. Increased globalization and cross-border trade necessitates efficient logistics solutions, leading to increased demand for intermodal transport. Technological advancements, as previously mentioned, are improving the speed, efficiency, and cost-effectiveness of operations. Moreover, supportive government policies and infrastructure investments further stimulate market expansion.

Obstacles in the Europe Intermodal Terminals Market Market

The market faces certain challenges, including high infrastructure costs, potential supply chain disruptions due to geopolitical events, and intense competition among terminal operators. Regulatory hurdles and fluctuating fuel prices also pose challenges to profitability. These factors can lead to price volatility and restrict consistent growth to some degree. Quantifiable impacts are difficult to establish precisely, but industry estimations suggest that unpredictable geopolitical events can impact growth by up to xx% in severely affected years.

Future Opportunities in Europe Intermodal Terminals Market

Future opportunities lie in the expansion of intermodal networks, the integration of new technologies, and the growing demand for sustainable logistics solutions. Expansion into emerging markets, particularly within Eastern Europe, presents significant potential. The development of smart ports and the use of big data analytics for improved operational efficiency offer further opportunities for market players.

Major Players in the Europe Intermodal Terminals Market Ecosystem

- DP World Southampton (United Kingdom)

- DP World Logistics Europe GmbH (Germany)

- Combinant NV (Belgium)

- KARPIEL Sp z o o (Poland)

- Container Terminal Dortmund GmbH (CTD) (Germany)

- Rail Cargo Group (Austria)

- INTERPORT Terminal Kosice (Romania)

- COSCO SHIPPING Ports (Spain) Terminals S L U (Spain)

- EuroTerminal Emmen-Coevorden-Hardenberg b v (Netherlands)

- Rail Hub Transylvania (Romania)

Key Developments in Europe Intermodal Terminals Market Industry

- November 2022: CSP Spain inaugurated a new express service between Spain and Turkey, significantly boosting its Valencian terminal's throughput and establishing a new trade route.

- October 2022: CSP Iberian Valencia terminal successfully completed an unprecedented operation involving the unloading of three yachts, showcasing its capability to handle specialized cargo and enhance its service portfolio.

Strategic Europe Intermodal Terminals Market Market Forecast

The Europe Intermodal Terminals market is poised for continued growth, driven by robust economic activity, increasing e-commerce, and advancements in technology. The market's potential is considerable, particularly considering the ongoing investments in infrastructure and the commitment to sustainable transport solutions across the continent. The forecast period of 2025-2033 projects robust growth, exceeding the average annual rate observed during the historical period.

Europe Intermodal Terminals Market Segmentation

-

1. Transportation Mode

- 1.1. Rail and Road Transport

- 1.2. Air and Road Transport

- 1.3. Maritime and Road Transport

-

2. End-User

- 2.1. Manufacturing and Automotive

- 2.2. Oil, Gas, and Mining

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distributive Trade

- 2.6. Others

Europe Intermodal Terminals Market Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Spain

- 5. Rest of Europe

Europe Intermodal Terminals Market Regional Market Share

Geographic Coverage of Europe Intermodal Terminals Market

Europe Intermodal Terminals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. Growth of Webshop Traffic Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 5.1.1. Rail and Road Transport

- 5.1.2. Air and Road Transport

- 5.1.3. Maritime and Road Transport

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil, Gas, and Mining

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distributive Trade

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Spain

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 6. Germany Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 6.1.1. Rail and Road Transport

- 6.1.2. Air and Road Transport

- 6.1.3. Maritime and Road Transport

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Manufacturing and Automotive

- 6.2.2. Oil, Gas, and Mining

- 6.2.3. Agriculture, Fishing, and Forestry

- 6.2.4. Construction

- 6.2.5. Distributive Trade

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 7. France Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 7.1.1. Rail and Road Transport

- 7.1.2. Air and Road Transport

- 7.1.3. Maritime and Road Transport

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Manufacturing and Automotive

- 7.2.2. Oil, Gas, and Mining

- 7.2.3. Agriculture, Fishing, and Forestry

- 7.2.4. Construction

- 7.2.5. Distributive Trade

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 8. United Kingdom Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 8.1.1. Rail and Road Transport

- 8.1.2. Air and Road Transport

- 8.1.3. Maritime and Road Transport

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Manufacturing and Automotive

- 8.2.2. Oil, Gas, and Mining

- 8.2.3. Agriculture, Fishing, and Forestry

- 8.2.4. Construction

- 8.2.5. Distributive Trade

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 9. Spain Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 9.1.1. Rail and Road Transport

- 9.1.2. Air and Road Transport

- 9.1.3. Maritime and Road Transport

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Manufacturing and Automotive

- 9.2.2. Oil, Gas, and Mining

- 9.2.3. Agriculture, Fishing, and Forestry

- 9.2.4. Construction

- 9.2.5. Distributive Trade

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 10. Rest of Europe Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 10.1.1. Rail and Road Transport

- 10.1.2. Air and Road Transport

- 10.1.3. Maritime and Road Transport

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Manufacturing and Automotive

- 10.2.2. Oil, Gas, and Mining

- 10.2.3. Agriculture, Fishing, and Forestry

- 10.2.4. Construction

- 10.2.5. Distributive Trade

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DP World Southampton(United Kingdom)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DP World Logistics Europe GmbH(Germany)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Combinant NV(Belgium

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 KARPIEL Sp z o o (Poland)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Container Terminal Dortmund GmbH (CTD) (Germany)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rail Cargo Group(Austria)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 INTERPORT Terminal Kosice(Romania)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 COSCO SHIPPING Ports (Spain) Terminals S L U (Spain)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EuroTerminal Emmen-Coevorden-Hardenberg b v (Netherlands)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rail Hub Transylvania(Romania)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DP World Southampton(United Kingdom)

List of Figures

- Figure 1: Europe Intermodal Terminals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Intermodal Terminals Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 2: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Europe Intermodal Terminals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 5: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 8: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 9: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 11: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 14: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 17: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Intermodal Terminals Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Europe Intermodal Terminals Market?

Key companies in the market include DP World Southampton(United Kingdom), DP World Logistics Europe GmbH(Germany), Combinant NV(Belgium, KARPIEL Sp z o o (Poland), Container Terminal Dortmund GmbH (CTD) (Germany), Rail Cargo Group(Austria), INTERPORT Terminal Kosice(Romania), COSCO SHIPPING Ports (Spain) Terminals S L U (Spain), EuroTerminal Emmen-Coevorden-Hardenberg b v (Netherlands), Rail Hub Transylvania(Romania).

3. What are the main segments of the Europe Intermodal Terminals Market?

The market segments include Transportation Mode, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

Growth of Webshop Traffic Drives the Market.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

November 2022: CSP Spain Inaugurated a new express service between Spain and Turkey in the Valencian terminal of CSP Spain. The service is promoted by the company Cordelia Container Shipping Line and among its stops, the Valencian terminal of CSP Spain. It is a weekly service, with two vessels involved with an approximate capacity of 700 TEUS.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Intermodal Terminals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Intermodal Terminals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Intermodal Terminals Market?

To stay informed about further developments, trends, and reports in the Europe Intermodal Terminals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence