Key Insights

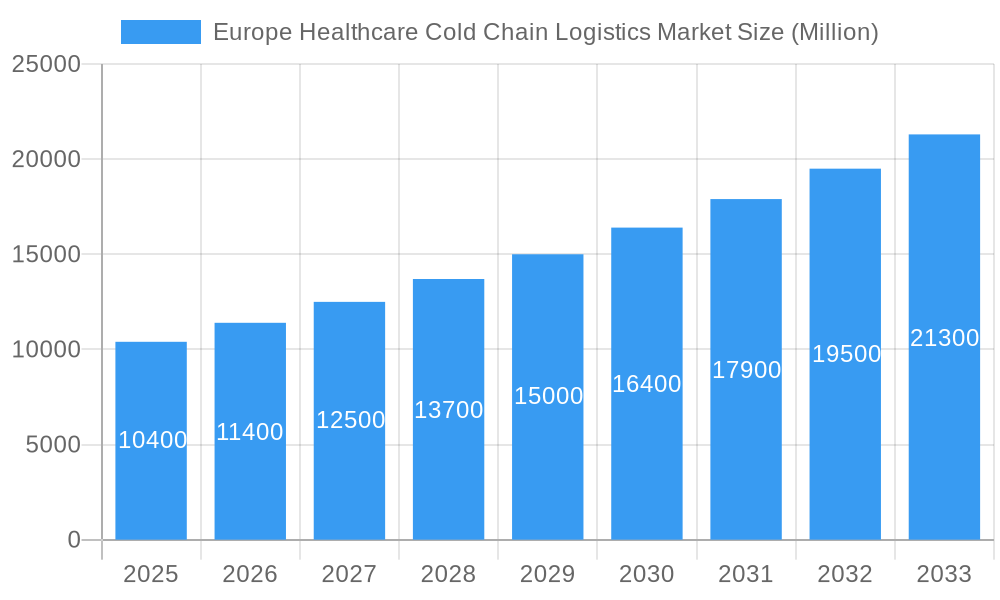

The European healthcare cold chain logistics market, valued at €10.4 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing prevalence of temperature-sensitive pharmaceuticals, including biologics, vaccines, and clinical trial materials, necessitates sophisticated cold chain solutions for maintaining product efficacy and patient safety. Stringent regulatory requirements concerning product integrity and traceability further propel market expansion. Growth is particularly strong in segments like biopharmaceuticals and vaccines due to ongoing pharmaceutical innovation and increasing vaccination programs across Europe. The market is segmented geographically, with Germany, France, and Spain representing major contributors. Furthermore, value-added services such as packaging, labeling, and specialized transportation are gaining traction, as companies seek to enhance supply chain efficiency and minimize risk. While the rising cost of transportation and storage presents a challenge, technological advancements in monitoring and tracking systems are mitigating these concerns. The competitive landscape features established logistics providers like DB Schenker and DHL, alongside specialized cold chain logistics companies such as Marken and Biocair, indicating significant market consolidation and a need for specialized expertise.

Europe Healthcare Cold Chain Logistics Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a continued upward trajectory, fueled by an aging population requiring more healthcare products, technological innovations in cold chain management (e.g., smart sensors and IoT-enabled tracking), and the expansion of clinical trials across the region. Growth will be influenced by evolving healthcare infrastructure and increasing investment in advanced cold chain infrastructure. Key players are likely to focus on strategic partnerships, acquisitions, and expansion of their service portfolios to maintain a competitive edge. While regional variations in market growth are expected, the overall outlook remains positive, suggesting a significant opportunity for stakeholders in the European healthcare cold chain logistics sector. The market is expected to see increased adoption of sustainable and environmentally friendly cold chain solutions to meet growing environmental concerns and regulatory pressures.

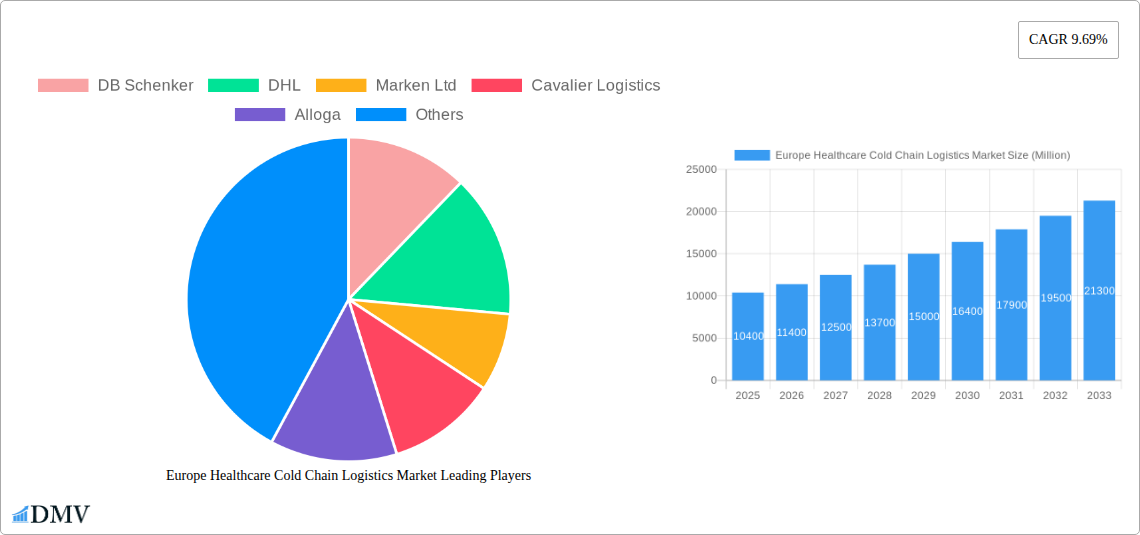

Europe Healthcare Cold Chain Logistics Market Company Market Share

Europe Healthcare Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Healthcare Cold Chain Logistics Market, offering a comprehensive overview of market dynamics, key players, and future growth projections. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving market. The market size in 2025 is estimated at xx Million, with projections for significant growth throughout the forecast period.

Europe Healthcare Cold Chain Logistics Market Market Composition & Trends

The European healthcare cold chain logistics market is characterized by a moderately concentrated landscape, with key players such as DB Schenker, DHL, Marken Ltd, and Kuehne + Nagel holding significant market share. However, the market also features a considerable number of smaller, specialized players, particularly in niche areas like clinical trial material transportation. Market share distribution is dynamic, influenced by factors including technological innovation, regulatory changes, and strategic mergers and acquisitions (M&A) activity. The last five years have witnessed a surge in M&A activity, with deal values exceeding xx Million in aggregate, indicating a push for consolidation and expansion within the sector. Innovation is driven by the constant need for improved temperature control, enhanced monitoring technologies, and efficient logistics solutions, especially for sensitive biologics. Stringent regulatory compliance is paramount, especially concerning data integrity and product safety. Substitute products are minimal, although some companies are exploring alternative packaging and transport methods to improve cost-effectiveness and reduce environmental impact. The end-user profile includes hospitals, clinics, pharmaceutical manufacturers, and biotechnology companies, each with distinct logistical requirements.

- Market Concentration: Moderately concentrated with significant players, but also many smaller specialized firms.

- Innovation Catalysts: Improved temperature control, monitoring technologies, efficient logistics solutions.

- Regulatory Landscape: Stringent compliance requirements impacting operations and investments.

- Substitute Products: Limited substitutes, with focus on optimization of existing solutions.

- End-User Profiles: Hospitals, clinics, pharmaceutical and biotechnology companies.

- M&A Activity: Significant activity in recent years, with total deal values exceeding xx Million.

Europe Healthcare Cold Chain Logistics Market Industry Evolution

The European healthcare cold chain logistics market has experienced substantial growth over the past five years (2019-2024), fueled by an increasing demand for temperature-sensitive pharmaceuticals, vaccines, and clinical trial materials. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven by several factors. The rise in chronic diseases, an aging population, and increased investment in research and development of biologics have significantly boosted the demand for efficient and reliable cold chain solutions. Technological advancements, such as the adoption of real-time tracking systems, IoT-enabled sensors, and advanced packaging materials, have enhanced the security and reliability of the cold chain, leading to higher adoption rates across the sector. Changing consumer demands, including greater transparency and traceability of pharmaceuticals, are further driving innovation and market growth. The forecast period (2025-2033) projects continued expansion, with a projected CAGR of xx%, driven by factors such as growing demand for personalized medicines, ongoing investment in infrastructure, and increasing focus on sustainable cold chain practices.

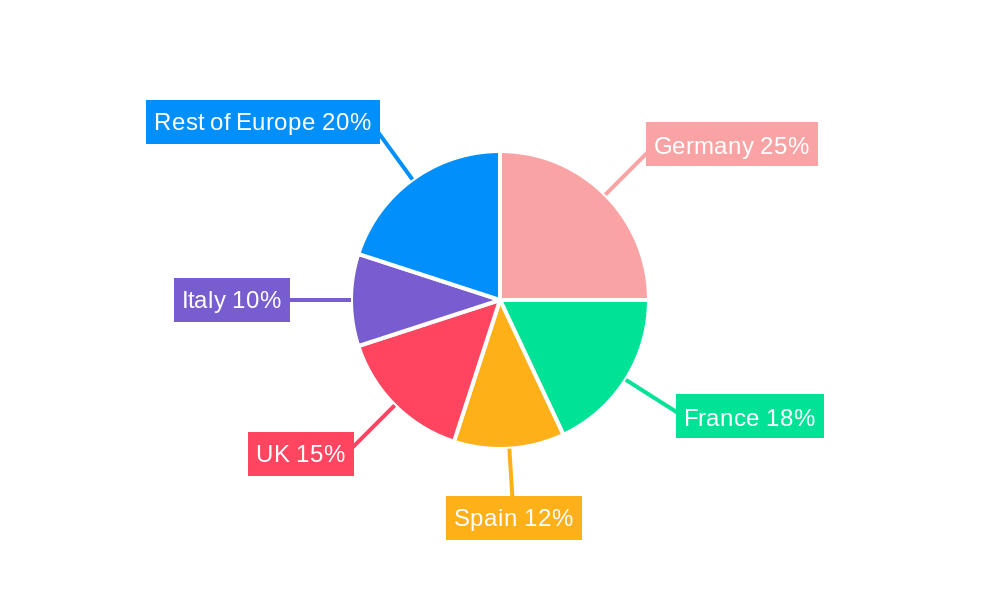

Leading Regions, Countries, or Segments in Europe Healthcare Cold Chain Logistics Market

Germany, France, and Spain represent the leading national markets within Europe for healthcare cold chain logistics, contributing significantly to the overall market size. The "Rest of Europe" segment also exhibits strong growth potential.

By Country:

- Germany: Strong pharmaceutical manufacturing base, robust infrastructure.

- France: Significant presence of major pharmaceutical companies, advanced logistics networks.

- Spain: Growing pharmaceutical industry, strategic location for distribution.

- Rest of Europe: Significant growth potential driven by increasing healthcare investments.

By Product: Biopharmaceuticals lead the market due to their high value and temperature sensitivity, followed by vaccines and clinical trial materials.

By Services: Transportation represents the largest segment, but value-added services like packaging and labeling are gaining traction, driven by increasing regulatory demands and the need for product integrity.

By End User: Pharmaceutical and Biopharmaceutical companies are the largest end-users, driven by their need to maintain the integrity of their products throughout the supply chain.

The dominance of these regions and segments is attributable to several key drivers:

- Investment Trends: Significant investments in cold chain infrastructure, technology, and logistics capabilities.

- Regulatory Support: Favorable regulatory frameworks promoting the growth and development of the industry.

- Pharmaceutical Industry Concentration: The presence of major pharmaceutical companies and biotechnology firms.

Europe Healthcare Cold Chain Logistics Market Product Innovations

Recent innovations include the development of passive and active temperature-controlled containers offering improved insulation and temperature monitoring capabilities. Advances in packaging materials, such as specialized insulated liners and refrigerant packs, enhance product protection during transit. Real-time GPS tracking and data logging devices provide increased visibility and ensure adherence to stringent quality control standards. These innovations enhance product safety, improve supply chain efficiency, and reduce the risk of spoilage or degradation. Unique selling propositions include reduced transportation costs, improved product shelf life, enhanced data security, and increased compliance with regulatory requirements.

Propelling Factors for Europe Healthcare Cold Chain Logistics Market Growth

Several factors are driving market growth, including:

- Technological Advancements: Improved temperature control systems, real-time tracking, and data analytics.

- Economic Factors: Rising healthcare spending, growth of the pharmaceutical and biotechnology sectors.

- Regulatory Influences: Stringent regulations emphasizing product safety and quality control, driving investment in advanced technologies. Examples include the EU's Good Distribution Practice (GDP) guidelines for medicinal products.

Obstacles in the Europe Healthcare Cold Chain Logistics Market Market

The market faces challenges including:

- Regulatory Challenges: Compliance with stringent regulations and evolving standards can be costly and complex.

- Supply Chain Disruptions: Global events (e.g., pandemics, geopolitical instability) can disrupt transportation and logistics. These disruptions can cause delays and increased costs, impacting the bottom line of the cold chain industry by xx Million annually.

- Competitive Pressures: Intense competition from established players and new entrants can squeeze profit margins.

Future Opportunities in Europe Healthcare Cold Chain Logistics Market

Significant opportunities exist in:

- Expansion into Emerging Markets: Growing healthcare spending in Eastern European countries presents untapped potential.

- Technological Innovation: Continued development and adoption of advanced technologies, such as AI-powered predictive analytics and blockchain for enhanced supply chain visibility and security.

- Sustainable Solutions: Increasing demand for eco-friendly cold chain solutions and reduction of carbon footprint.

Major Players in the Europe Healthcare Cold Chain Logistics Market Ecosystem

- DB Schenker

- DHL

- Marken Ltd

- Cavalier Logistics

- Alloga

- Kuehne + Nagel

- Envirotainer

- 73 Other Companies

- Carrier Transicold

- Primafrio

- Biocair

Key Developments in Europe Healthcare Cold Chain Logistics Market Industry

- 2022 Q3: DHL launched a new temperature-controlled air freight service for pharmaceuticals.

- 2023 Q1: Marken announced a strategic partnership with a leading vaccine manufacturer.

- 2024 Q2: Kuehne + Nagel invested in a new temperature-controlled warehouse facility in Germany. (Further developments will be added based on actual data.)

Strategic Europe Healthcare Cold Chain Logistics Market Market Forecast

The Europe healthcare cold chain logistics market is poised for substantial growth, driven by an aging population, increasing demand for temperature-sensitive pharmaceuticals, and continued technological advancements. This growth will be fueled by investments in infrastructure, increased adoption of advanced technologies, and a focus on sustainable practices. Opportunities abound in emerging markets and the development of innovative solutions to address current market challenges. The long-term forecast projects a continued upward trajectory, with significant potential for market expansion and increased player activity.

Europe Healthcare Cold Chain Logistics Market Segmentation

-

1. Product

- 1.1. Biopharmaceuticals

- 1.2. Vaccines

- 1.3. Clinical Trial Materials

-

2. Services

- 2.1. Transportation

- 2.2. Storage

- 2.3. Value Added Services (Packaging and Labeling)

-

3. End User

- 3.1. Hospitals, Clinics and Pharmaceuticals

- 3.2. Biopharmaceutical

- 3.3. Biotechnology

Europe Healthcare Cold Chain Logistics Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Healthcare Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Europe Healthcare Cold Chain Logistics Market

Europe Healthcare Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Vaccine Distribution; Growing Pharmaceutical and Biotechnology Industries

- 3.3. Market Restrains

- 3.3.1. High Initial Capital Investment; Risk of Temperature Excursions

- 3.4. Market Trends

- 3.4.1. The OTC Pharmaceuticals Consumption is Projected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Healthcare Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Biopharmaceuticals

- 5.1.2. Vaccines

- 5.1.3. Clinical Trial Materials

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Transportation

- 5.2.2. Storage

- 5.2.3. Value Added Services (Packaging and Labeling)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals, Clinics and Pharmaceuticals

- 5.3.2. Biopharmaceutical

- 5.3.3. Biotechnology

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marken Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cavalier Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alloga

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Envirotainer**List Not Exhaustive 7 3 Other Companie

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Carrier Transicold

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Primafrio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Biocair

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe Healthcare Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Healthcare Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 3: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 7: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Healthcare Cold Chain Logistics Market?

The projected CAGR is approximately 9.69%.

2. Which companies are prominent players in the Europe Healthcare Cold Chain Logistics Market?

Key companies in the market include DB Schenker, DHL, Marken Ltd, Cavalier Logistics, Alloga, Kuehne + Nagel, Envirotainer**List Not Exhaustive 7 3 Other Companie, Carrier Transicold, Primafrio, Biocair.

3. What are the main segments of the Europe Healthcare Cold Chain Logistics Market?

The market segments include Product, Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Vaccine Distribution; Growing Pharmaceutical and Biotechnology Industries.

6. What are the notable trends driving market growth?

The OTC Pharmaceuticals Consumption is Projected to Grow Significantly.

7. Are there any restraints impacting market growth?

High Initial Capital Investment; Risk of Temperature Excursions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Healthcare Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Healthcare Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Healthcare Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Europe Healthcare Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence