Key Insights

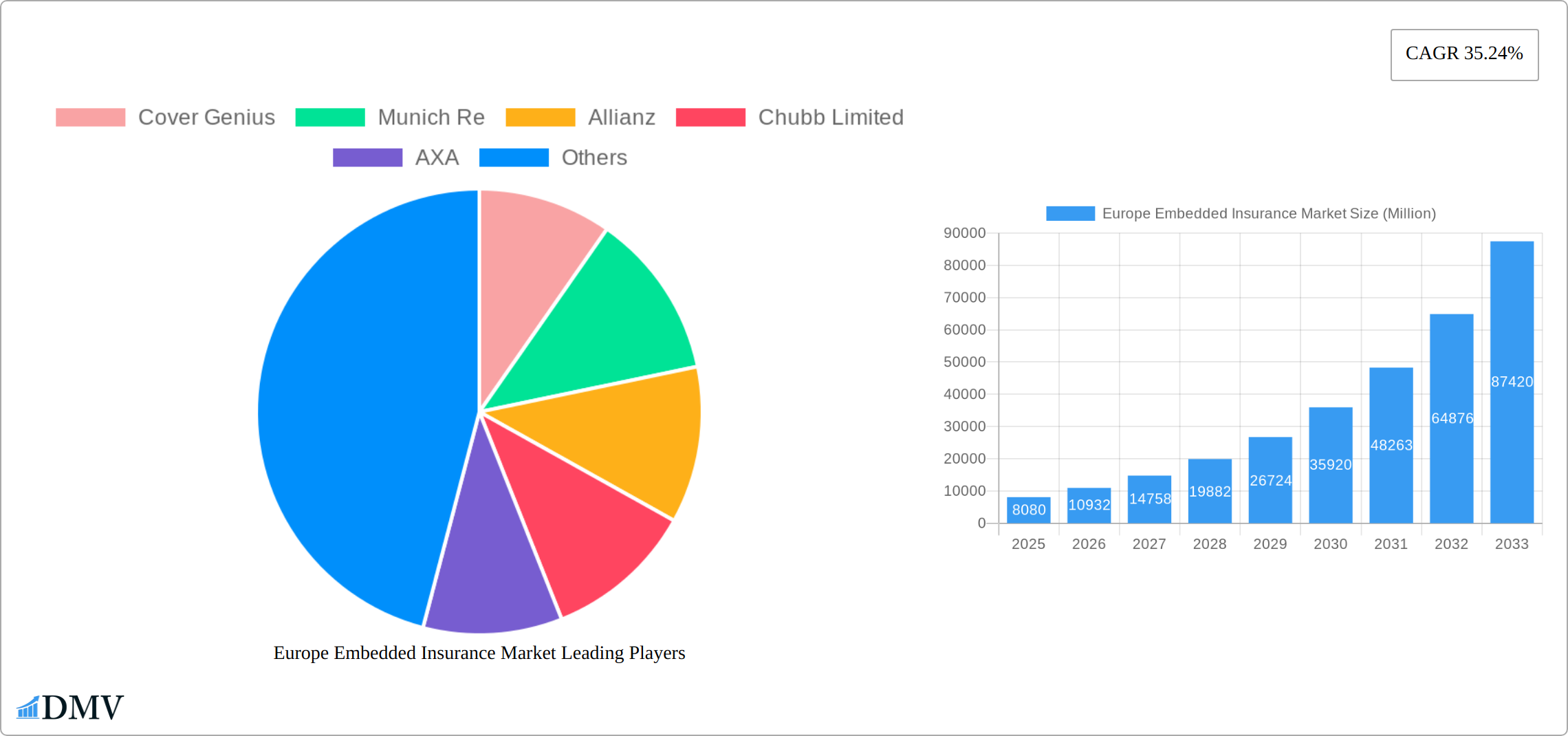

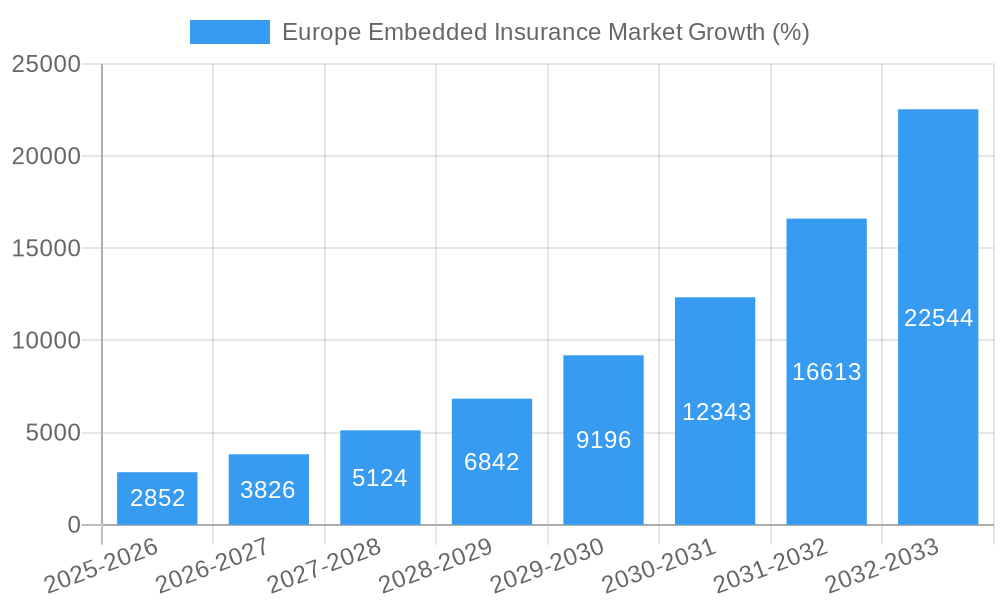

The European embedded insurance market is experiencing explosive growth, projected to reach \$8.08 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 35.24% from 2025 to 2033. This surge is driven by several key factors. Firstly, the increasing adoption of digital technologies and e-commerce platforms is creating seamless integration points for insurance products within various online services and purchasing processes. Consumers are increasingly receptive to convenient, embedded insurance options, particularly for smaller, supplementary coverages like mobile phone protection or travel insurance bundled with flight bookings. Secondly, the growing demand for personalized insurance solutions is driving innovation. Insurers are leveraging data analytics to create tailored policies that better align with individual needs and risk profiles, making embedded insurance more attractive. Finally, regulatory changes across Europe are fostering a more favorable environment for embedded insurance, streamlining processes and encouraging market expansion.

However, the market faces certain challenges. One key restraint is the need for enhanced data security and privacy protection, particularly considering the sensitive personal information involved in insurance transactions. Building consumer trust is crucial to overcoming concerns about data breaches and ensuring the smooth adoption of embedded insurance models. Another significant factor is the need for robust technological infrastructure to support the integration of insurance products across diverse platforms. The development and maintenance of seamless integration capabilities require significant investment and expertise from both insurers and technology providers. Despite these challenges, the long-term outlook for the European embedded insurance market remains incredibly positive, driven by continuous technological advancements, evolving consumer expectations, and a supportive regulatory landscape. The major players – including Cover Genius, Munich Re, Allianz, Chubb Limited, AXA, Assicurazioni Generali, Companjon, Qover, Swiss Re, and Zurich – are actively shaping this dynamic market landscape through strategic partnerships and innovative product offerings.

Europe Embedded Insurance Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Europe Embedded Insurance Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033.

Europe Embedded Insurance Market Composition & Trends

The Europe Embedded Insurance Market exhibits a moderately concentrated landscape, with key players like Munich Re, Allianz, Chubb Limited, AXA, Assicurazioni Generali, Cover Genius, Companjon, Qover, Swiss Re, and Zurich holding significant market share. However, the market is witnessing an influx of innovative insurtech startups, increasing competition and driving market fragmentation.

- Market Concentration: The market share is distributed amongst established players and emerging Insurtech companies, with the top 5 players holding an estimated xx% market share in 2025.

- Innovation Catalysts: Technological advancements such as AI-powered risk assessment and personalized insurance offerings are key drivers of innovation.

- Regulatory Landscape: Evolving regulations surrounding data privacy and insurance distribution are shaping market dynamics.

- Substitute Products: Traditional insurance models pose a competitive threat to embedded insurance.

- End-User Profiles: The primary end-users span various sectors including travel, e-commerce, and fintech.

- M&A Activities: The market has seen several significant M&A deals in recent years, with deal values ranging from xx Million to xx Million. These activities reflect the consolidation and growth within the sector.

Europe Embedded Insurance Market Industry Evolution

The Europe Embedded Insurance Market has witnessed substantial growth during the historical period (2019-2024), driven by increasing digitalization and the growing preference for seamless customer experiences. The market's Compound Annual Growth Rate (CAGR) during this period is estimated to be xx%. This growth is projected to continue during the forecast period (2025-2033), with a projected CAGR of xx%, fuelled by several key factors. Technological advancements like API integrations and AI-driven pricing models are streamlining insurance distribution and personalization, leading to higher adoption rates. Shifting consumer demands towards convenient and digitally-driven services are further accelerating market growth. The increasing integration of insurance within various online platforms and applications is also a significant contributor to the market's expansion. Specific data on adoption rates across different sectors is currently unavailable, but early indicators suggest high potential across industries like travel and e-commerce.

Leading Regions, Countries, or Segments in Europe Embedded Insurance Market

While precise market share data for specific regions and segments remains under development, early indications suggest that Western Europe (e.g., UK, Germany, France) is currently the leading region for embedded insurance adoption. This dominance is attributable to several factors:

- Key Drivers:

- High levels of digitalization and internet penetration.

- Progressive regulatory frameworks fostering innovation.

- Significant investments in Insurtech startups.

- Strong presence of established insurance companies and technologically advanced financial institutions.

- Dominance Factors: The mature digital infrastructure and a strong focus on customer experience in these countries provide a fertile ground for the growth of embedded insurance. The presence of major players and a supportive regulatory environment also play significant roles. Further research is needed to precisely quantify market shares for individual countries.

Europe Embedded Insurance Market Product Innovations

Recent product innovations include AI-driven pricing models, personalized insurance offerings, and seamless integration with various platforms. These advancements enhance customer experience and create tailored solutions based on individual risk profiles and preferences. Unique selling propositions include frictionless purchase processes, faster claims processing, and greater transparency. Technological advancements such as API integrations and blockchain technology are improving efficiency and security.

Propelling Factors for Europe Embedded Insurance Market Growth

Several factors contribute to the growth of the Europe Embedded Insurance Market. Technological advancements, such as improved API integrations and AI-driven risk assessment, are streamlining the insurance purchasing process and enabling more personalized offerings. The increasing digitalization of various sectors, particularly the travel and e-commerce industries, presents significant opportunities for embedded insurance solutions. Favorable regulatory frameworks in several European countries are also supporting market growth.

Obstacles in the Europe Embedded Insurance Market

Challenges facing the market include regulatory uncertainties surrounding data privacy and compliance. Supply chain disruptions can affect the delivery of insurance products. Intense competition from established insurers and emerging Insurtech companies poses a significant challenge. These factors could potentially reduce market growth by an estimated xx% if not adequately addressed.

Future Opportunities in Europe Embedded Insurance Market

Future opportunities lie in expanding into new market segments, such as the healthcare and automotive industries. The adoption of new technologies, such as blockchain and IoT, can further enhance the efficiency and security of embedded insurance solutions. Meeting evolving customer demands for personalized and transparent insurance products will be critical for future success.

Major Players in the Europe Embedded Insurance Market Ecosystem

- Cover Genius

- Munich Re

- Allianz

- Chubb Limited

- AXA

- Assicurazioni Generali

- Companjon

- Qover

- Swiss Re

- Zurich

- List Not Exhaustive

Key Developments in Europe Embedded Insurance Market Industry

- November 2023: Cover Genius partners with SAS, providing travel protection to passengers across 25+ European countries and the US.

- January 2024: Cover Genius and Vueling collaborate to offer protection to over 30 million travelers.

- March 2024: Chubb Limited launches a global platform for transactional risk liability insurance.

Strategic Europe Embedded Insurance Market Forecast

The Europe Embedded Insurance Market is poised for significant growth driven by increasing digitalization, favorable regulatory environments, and the rising demand for convenient insurance solutions. Expanding into new sectors, embracing technological advancements, and focusing on personalized customer experiences will be key to unlocking the full market potential. The market is expected to continue its robust growth trajectory throughout the forecast period, offering substantial opportunities for both established players and emerging Insurtech companies.

Europe Embedded Insurance Market Segmentation

-

1. Insurance Line

- 1.1. Electronics

- 1.2. Furniture

- 1.3. Sports Equipment

- 1.4. Travel Insurance

- 1.5. Other Insurance Lines

-

2. Channel

- 2.1. Online

- 2.2. Offline

Europe Embedded Insurance Market Segmentation By Geography

- 1. UK

- 2. France

- 3. Germany

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Embedded Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 35.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market

- 3.4. Market Trends

- 3.4.1. Digitalization and High-speed Internet to Propel the European Embedded Insurance Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Line

- 5.1.1. Electronics

- 5.1.2. Furniture

- 5.1.3. Sports Equipment

- 5.1.4. Travel Insurance

- 5.1.5. Other Insurance Lines

- 5.2. Market Analysis, Insights and Forecast - by Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UK

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Insurance Line

- 6. UK Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance Line

- 6.1.1. Electronics

- 6.1.2. Furniture

- 6.1.3. Sports Equipment

- 6.1.4. Travel Insurance

- 6.1.5. Other Insurance Lines

- 6.2. Market Analysis, Insights and Forecast - by Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Insurance Line

- 7. France Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance Line

- 7.1.1. Electronics

- 7.1.2. Furniture

- 7.1.3. Sports Equipment

- 7.1.4. Travel Insurance

- 7.1.5. Other Insurance Lines

- 7.2. Market Analysis, Insights and Forecast - by Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Insurance Line

- 8. Germany Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance Line

- 8.1.1. Electronics

- 8.1.2. Furniture

- 8.1.3. Sports Equipment

- 8.1.4. Travel Insurance

- 8.1.5. Other Insurance Lines

- 8.2. Market Analysis, Insights and Forecast - by Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Insurance Line

- 9. Italy Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance Line

- 9.1.1. Electronics

- 9.1.2. Furniture

- 9.1.3. Sports Equipment

- 9.1.4. Travel Insurance

- 9.1.5. Other Insurance Lines

- 9.2. Market Analysis, Insights and Forecast - by Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Insurance Line

- 10. Spain Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insurance Line

- 10.1.1. Electronics

- 10.1.2. Furniture

- 10.1.3. Sports Equipment

- 10.1.4. Travel Insurance

- 10.1.5. Other Insurance Lines

- 10.2. Market Analysis, Insights and Forecast - by Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Insurance Line

- 11. Rest of Europe Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Insurance Line

- 11.1.1. Electronics

- 11.1.2. Furniture

- 11.1.3. Sports Equipment

- 11.1.4. Travel Insurance

- 11.1.5. Other Insurance Lines

- 11.2. Market Analysis, Insights and Forecast - by Channel

- 11.2.1. Online

- 11.2.2. Offline

- 11.1. Market Analysis, Insights and Forecast - by Insurance Line

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cover Genius

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Munich Re

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Allianz

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Chubb Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AXA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Assicurazioni Generali

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Companjon

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Qover

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Swiss Re

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Zurich**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cover Genius

List of Figures

- Figure 1: Global Europe Embedded Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Europe Embedded Insurance Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: UK Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 4: UK Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 5: UK Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 6: UK Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 7: UK Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 8: UK Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 9: UK Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 10: UK Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 11: UK Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 12: UK Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 13: UK Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: UK Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 15: France Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 16: France Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 17: France Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 18: France Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 19: France Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 20: France Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 21: France Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 22: France Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 23: France Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 24: France Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 25: France Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: France Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Germany Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 28: Germany Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 29: Germany Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 30: Germany Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 31: Germany Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 32: Germany Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 33: Germany Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 34: Germany Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 35: Germany Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Germany Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Germany Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Germany Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Italy Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 40: Italy Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 41: Italy Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 42: Italy Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 43: Italy Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 44: Italy Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 45: Italy Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 46: Italy Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 47: Italy Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Italy Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Italy Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Italy Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Spain Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 52: Spain Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 53: Spain Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 54: Spain Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 55: Spain Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 56: Spain Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 57: Spain Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 58: Spain Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 59: Spain Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Spain Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Spain Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Spain Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Rest of Europe Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 64: Rest of Europe Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 65: Rest of Europe Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 66: Rest of Europe Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 67: Rest of Europe Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 68: Rest of Europe Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 69: Rest of Europe Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 70: Rest of Europe Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 71: Rest of Europe Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Rest of Europe Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 73: Rest of Europe Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Rest of Europe Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Europe Embedded Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Europe Embedded Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 4: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 5: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 6: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 7: Global Europe Embedded Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Europe Embedded Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 10: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 11: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 12: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 13: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 16: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 17: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 18: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 19: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 21: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 22: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 23: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 24: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 25: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 28: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 29: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 30: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 31: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 34: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 35: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 36: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 37: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 39: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 40: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 41: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 42: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 43: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Embedded Insurance Market?

The projected CAGR is approximately 35.24%.

2. Which companies are prominent players in the Europe Embedded Insurance Market?

Key companies in the market include Cover Genius, Munich Re, Allianz, Chubb Limited, AXA, Assicurazioni Generali, Companjon, Qover, Swiss Re, Zurich**List Not Exhaustive.

3. What are the main segments of the Europe Embedded Insurance Market?

The market segments include Insurance Line, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market.

6. What are the notable trends driving market growth?

Digitalization and High-speed Internet to Propel the European Embedded Insurance Market.

7. Are there any restraints impacting market growth?

Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market.

8. Can you provide examples of recent developments in the market?

March 2024: Chubb Limited recently unveiled a global platform aimed at offering transactional risk liability insurance products in international markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Embedded Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Embedded Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Embedded Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Embedded Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence