Key Insights

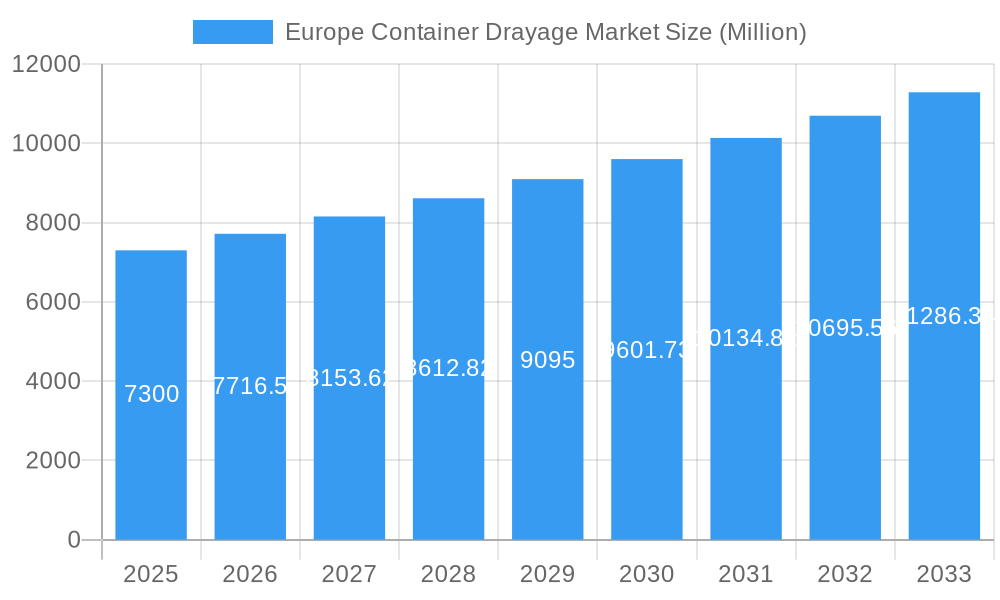

The Europe Container Drayage Market, valued at €7.3 billion in 2025, is projected to experience robust growth, driven by the increasing volume of containerized goods moving through European ports and a rising demand for efficient and reliable last-mile delivery solutions. The market's 5.5% CAGR from 2025 to 2033 indicates a significant expansion, fueled by factors such as the growth of e-commerce, improved port infrastructure, and the ongoing optimization of supply chains within the region. Key players like DHL, DB Schenker, Kuehne + Nagel, and major shipping lines are investing heavily in technological advancements and expanding their drayage networks to meet this escalating demand. While challenges like driver shortages and fluctuating fuel prices may pose some constraints, the overall market outlook remains positive, particularly considering the strategic importance of efficient container drayage in facilitating international trade within Europe.

Europe Container Drayage Market Market Size (In Billion)

Further growth will be propelled by several interconnected factors. The expanding e-commerce sector necessitates swift and dependable delivery networks, significantly increasing the demand for drayage services. Moreover, increasing adoption of advanced logistics technologies, including route optimization software and real-time tracking systems, contributes to operational efficiency and cost reduction, making drayage a more attractive option for businesses. Regional variations in market growth will likely be influenced by the concentration of port activities, the density of industrial centers, and the overall strength of the regional economies. The market's competitive landscape, characterized by established players and emerging specialized providers, suggests a continuous push towards innovation and service enhancements to capture market share. Sustained investments in sustainable practices, addressing environmental concerns associated with trucking, will also become a vital factor shaping future market trends.

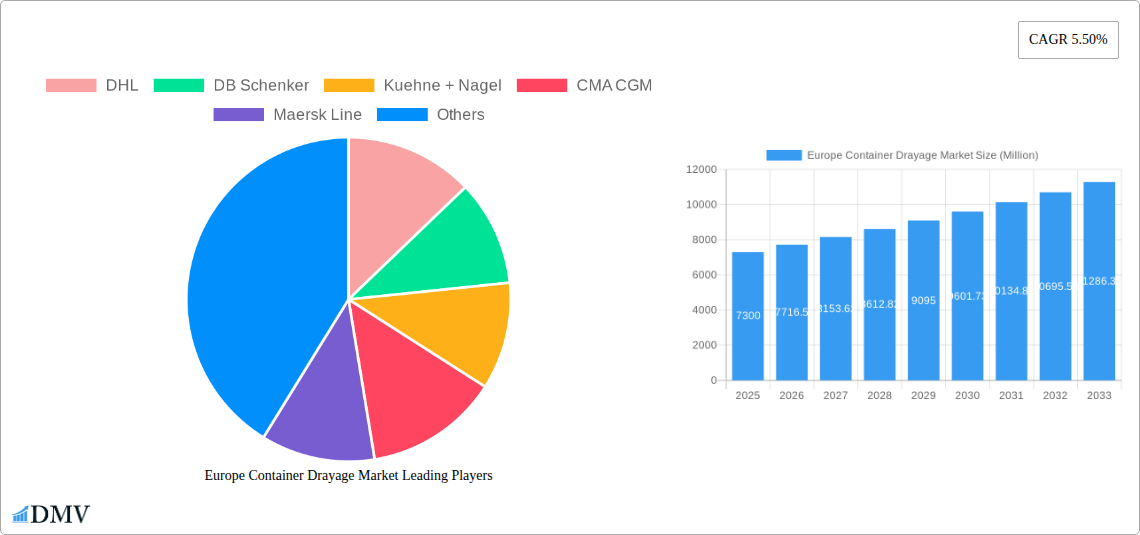

Europe Container Drayage Market Company Market Share

Europe Container Drayage Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Container Drayage Market, offering valuable insights for stakeholders seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market trends, competitive landscapes, and future growth prospects. The report utilizes a robust methodology, incorporating historical data (2019-2024), current estimations (2025), and detailed forecasts (2025-2033) to deliver actionable intelligence. The total market value is expected to reach xx Million by 2033.

Europe Container Drayage Market Composition & Trends

This section delves into the intricate composition of the European container drayage market, examining its concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market is characterized by a moderately consolidated structure, with a few dominant players commanding significant market share. However, smaller, specialized companies are also present, catering to niche segments.

- Market Concentration: The top 10 players (including DHL, DB Schenker, Kuehne + Nagel, CMA CGM, Maersk Line, Hapag-Lloyd, MSC, COSCO Shipping, Evergreen Marine, and Yang Ming, plus 6-3 other companies) account for approximately xx% of the market share in 2025. The market share distribution is expected to evolve due to ongoing M&A activities and the entry of new players.

- Innovation Catalysts: Technological advancements like AI-powered route optimization, IoT-enabled container tracking, and automated trucking are reshaping the landscape. Furthermore, the growing focus on sustainability is driving the adoption of electric and alternative fuel vehicles.

- Regulatory Landscape: Varying regulations across European nations concerning emissions, driver hours, and infrastructure development pose both challenges and opportunities. Harmonization efforts by the EU are expected to foster market growth.

- Substitute Products: While limited direct substitutes exist, the market faces indirect competition from rail and inland waterway transport. The choice of drayage often depends on factors such as speed, cost, and infrastructure availability.

- End-User Profiles: Key end-users comprise importers, exporters, freight forwarders, and logistics providers across various industries like manufacturing, retail, and consumer goods.

- M&A Activities: The past five years have witnessed a significant number of M&A deals, with an estimated total transaction value of xx Million. These activities are driven by the need for consolidation, expansion into new markets, and access to advanced technologies.

Europe Container Drayage Market Industry Evolution

The European container drayage market exhibits a dynamic evolution, shaped by evolving growth trajectories, technological innovations, and shifting consumer demands. The market has witnessed a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), driven by factors such as increasing global trade, expanding e-commerce, and the growing need for efficient supply chain management. This growth trajectory is projected to continue in the forecast period (2025-2033), albeit at a slightly moderated pace, due to factors like economic fluctuations and geopolitical uncertainties. Technological advancements, including the deployment of advanced telematics and the rise of autonomous vehicles, are further revolutionizing the sector.

The increasing adoption of digital platforms and data-driven decision-making, the growing emphasis on supply chain visibility, and the evolving demands for sustainable transportation solutions have become key factors. The shift towards more efficient and transparent transportation solutions, coupled with the focus on enhanced data management and integration, will continue to influence the market’s development. The adoption of smart logistics and predictive analytics continues to rise, facilitating optimized route planning, enhanced inventory management, and real-time tracking of goods.

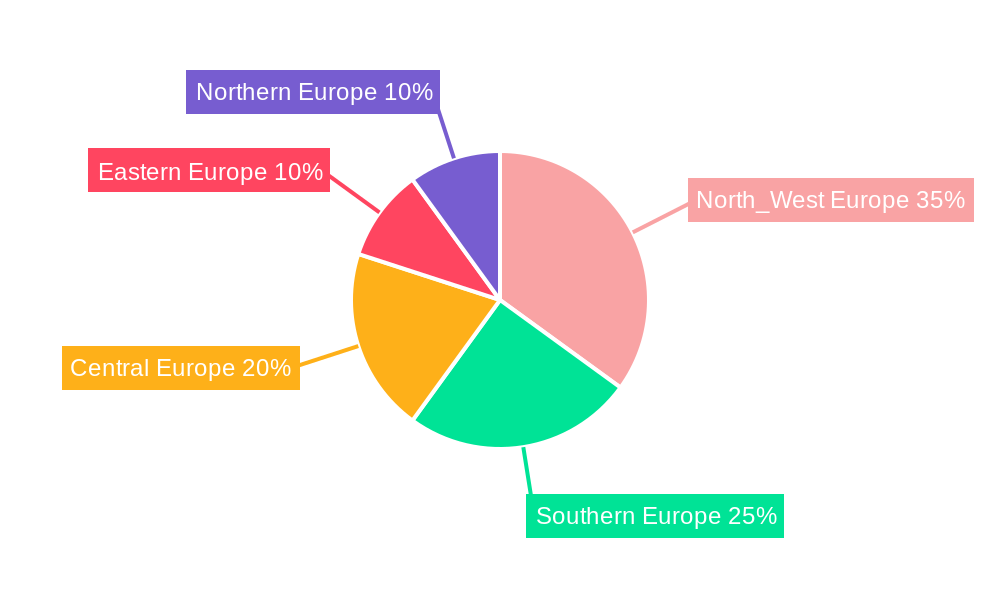

Leading Regions, Countries, or Segments in Europe Container Drayage Market

While precise data on regional dominance requires further analysis, several factors point towards strong performance in specific regions. High population density, robust industrial clusters, and well-developed infrastructure are key determinants of success.

- Key Drivers:

- High volumes of seaborne trade: Major ports like Rotterdam, Hamburg, and Antwerp drive significant demand for drayage services.

- Government support for infrastructure upgrades: Investments in road networks, intermodal terminals, and rail connections enhance efficiency and capacity.

- Favorable regulatory environments: Clear policies on trucking and logistics facilitate streamlined operations.

- Dominance Factors: The leading regions benefit from a combination of high import/export volumes, advanced infrastructure, efficient logistics networks, and supportive regulatory frameworks. This synergy creates an ideal environment for the growth and expansion of container drayage operations. Furthermore, clusters of manufacturing and distribution centers contribute to increased demand.

Europe Container Drayage Market Product Innovations

Recent innovations focus on enhancing efficiency, sustainability, and transparency within the container drayage sector. These include the integration of telematics systems for real-time tracking and data analysis, the adoption of optimized routing algorithms, and the exploration of alternative fuels to reduce environmental impact. Furthermore, companies are introducing innovative software platforms that provide comprehensive visibility and control over the entire drayage process. These platforms streamline communication, automate tasks, and facilitate better collaboration among stakeholders. Companies are emphasizing unique selling propositions (USPs) such as faster transit times, improved tracking, and increased efficiency, leveraging technological advancements to enhance customer experience and value.

Propelling Factors for Europe Container Drayage Market Growth

Several key factors propel the growth of the Europe container drayage market. These include:

- Expanding global trade: The increasing volume of international trade fuels demand for efficient last-mile delivery solutions.

- Growth of e-commerce: The surge in online shopping necessitates fast and reliable drayage services for timely order fulfillment.

- Technological advancements: Innovations in logistics technology enhance efficiency, transparency, and sustainability.

- Improved infrastructure: Investments in port infrastructure and transportation networks contribute to seamless operations.

Obstacles in the Europe Container Drayage Market

The market faces certain challenges:

- Driver shortages: A lack of qualified drivers can constrain capacity and increase costs.

- Fuel price volatility: Fluctuations in fuel prices impact operational profitability.

- Congestion at ports and terminals: Delays due to congestion lead to increased costs and reduced efficiency.

- Stringent environmental regulations: Compliance with increasingly stringent emission standards requires significant investments.

Future Opportunities in Europe Container Drayage Market

Future opportunities lie in:

- Expansion into new markets: Untapped potential exists in less-developed regions with growing trade volumes.

- Adoption of automation and AI: Autonomous trucks and AI-powered route optimization hold significant promise.

- Development of sustainable solutions: Demand for eco-friendly drayage services is increasing.

Major Players in the Europe Container Drayage Market Ecosystem

Key Developments in Europe Container Drayage Market Industry

- June 2024: PKP Cargo and COSCO announced a partnership to enhance intermodal flows throughout Europe, expanding services across Western, Central, and Eastern Europe, significantly boosting COSCO's rail freight presence.

- May 2024: Mullen Group Ltd. acquired ContainerWorld Forwarding Services Inc., expanding its reach in the North American logistics market, though not directly impacting the European market.

Strategic Europe Container Drayage Market Forecast

The Europe container drayage market is poised for continued growth, driven by the ongoing expansion of global trade, the rise of e-commerce, and the increasing adoption of innovative technologies. Opportunities exist in optimizing existing operations, embracing sustainable practices, and exploring new market segments. The market's future trajectory will depend on factors like economic stability, infrastructure development, and technological advancements. The projected growth is expected to remain robust, exceeding xx Million by 2033.

Europe Container Drayage Market Segmentation

-

1. Mode of Transport

- 1.1. Rail

- 1.2. Road

- 1.3. Other Modes of Transport

Europe Container Drayage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Container Drayage Market Regional Market Share

Geographic Coverage of Europe Container Drayage Market

Europe Container Drayage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market

- 3.4. Market Trends

- 3.4.1. Demand for Containers Driven by Cross-border E-commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Rail

- 5.1.2. Road

- 5.1.3. Other Modes of Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuehne + Nagel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CMA CGM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maersk Line

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hapag-Lloyd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MSC (Mediterranean Shipping Company)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 COSCO Shipping

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evergreen Marine

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yang Ming**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Europe Container Drayage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Container Drayage Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Europe Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 3: Europe Container Drayage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Container Drayage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Europe Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 6: Europe Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 7: Europe Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Europe Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Container Drayage Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Europe Container Drayage Market?

Key companies in the market include DHL, DB Schenker, Kuehne + Nagel, CMA CGM, Maersk Line, Hapag-Lloyd, MSC (Mediterranean Shipping Company), COSCO Shipping, Evergreen Marine, Yang Ming**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Europe Container Drayage Market?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.30 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market.

6. What are the notable trends driving market growth?

Demand for Containers Driven by Cross-border E-commerce.

7. Are there any restraints impacting market growth?

4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2024: PKP Cargo and COSCO announced that they are poised to enhance intermodal flows throughout Europe. Focusing on transport and logistics, their partnership is strategically geared toward robust development. Together, they plan to extend intermodal services, spanning Western, Central, and Eastern Europe. PKP Cargo also plays a pivotal role in strengthening COSCO's rail freight presence in Europe.May 2024: Mullen Group Ltd finalized its acquisition of ContainerWorld Forwarding Services Inc. ContainerWorld, headquartered in Richmond, British Columbia, has been a key player in the logistics scene since its establishment in 1993. Specializing in tailored supply chain solutions, ContainerWorld primarily caters to Canada's alcoholic beverage and hospitality industries. Going forward, ContainerWorld will function as a standalone subsidiary under Mullen Group's ownership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Container Drayage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Container Drayage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Container Drayage Market?

To stay informed about further developments, trends, and reports in the Europe Container Drayage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence