Key Insights

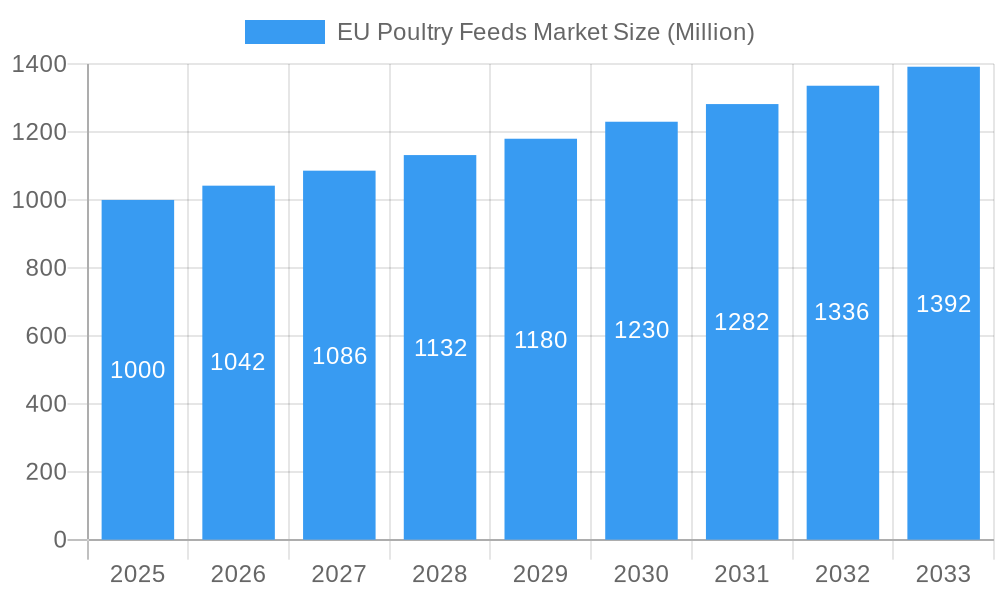

The EU poultry feeds market, valued at approximately €[Estimate based on market size XX and value unit Million – Let's assume XX = 1000 for this example, making it €1000 million in 2025] in 2025, exhibits a robust growth trajectory, projected to expand at a compound annual growth rate (CAGR) of 4.20% from 2025 to 2033. This growth is driven by several key factors. Increasing poultry consumption within the EU, fueled by rising populations and changing dietary habits, creates consistent demand for high-quality poultry feed. Furthermore, advancements in feed formulation and technology, focusing on improved nutrient utilization and disease resistance, contribute to increased productivity and profitability for poultry farmers. The market is segmented by animal type (layers, broilers, turkeys, and others) and ingredient type (cereals, oilseed meals, molasses, fish oils and fish meals, supplements, and others). Broiler feed currently dominates the market due to the high demand for broiler meat, while cereals and oilseed meals form the largest portion of the ingredient segment, reflecting their cost-effectiveness and nutritional value. The competitive landscape includes major players such as Royal Agrifirm Group, Roquette Freres, Nutreco NV, BASF SE, and Cargill, who are actively involved in innovation, mergers, and acquisitions to consolidate their market position.

EU Poultry Feeds Market Market Size (In Billion)

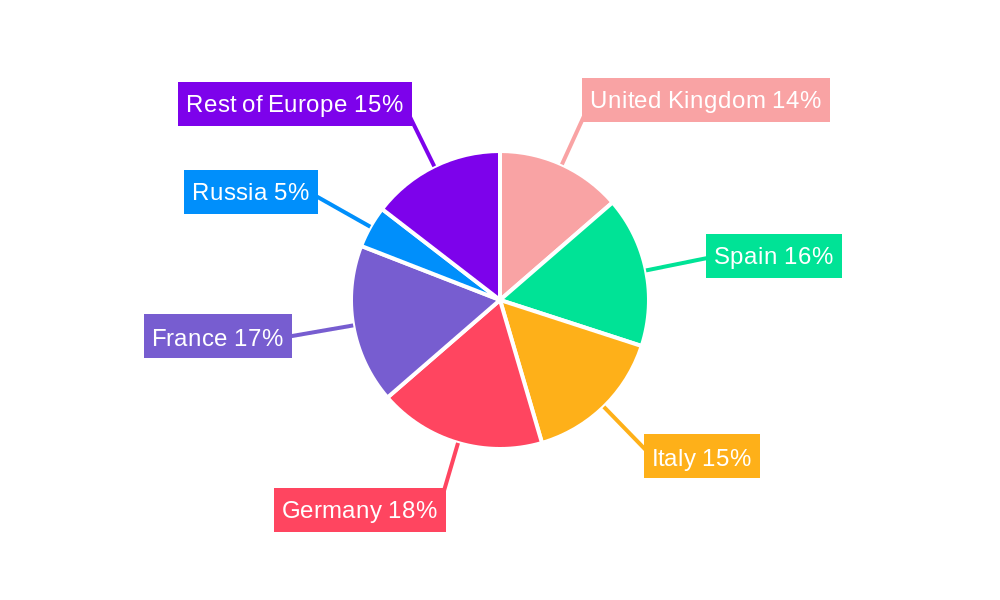

Regional variations exist within the EU market. Countries like Spain, Italy, France, and Germany, characterized by significant poultry production, represent substantial market segments. The UK market, while experiencing its own unique post-Brexit challenges, maintains a considerable size. However, restraining factors include fluctuating raw material prices, stringent regulatory compliance requirements for feed safety and environmental sustainability, and the potential impact of avian flu outbreaks, which can disrupt production and create supply chain uncertainties. The long-term forecast anticipates continued growth, albeit at a potentially moderated pace, owing to factors such as increasing feed costs, environmental regulations focused on reducing the environmental impact of poultry farming, and ongoing geopolitical uncertainties. Market players are likely to continue focusing on developing sustainable feed solutions and optimizing their supply chains to mitigate these challenges.

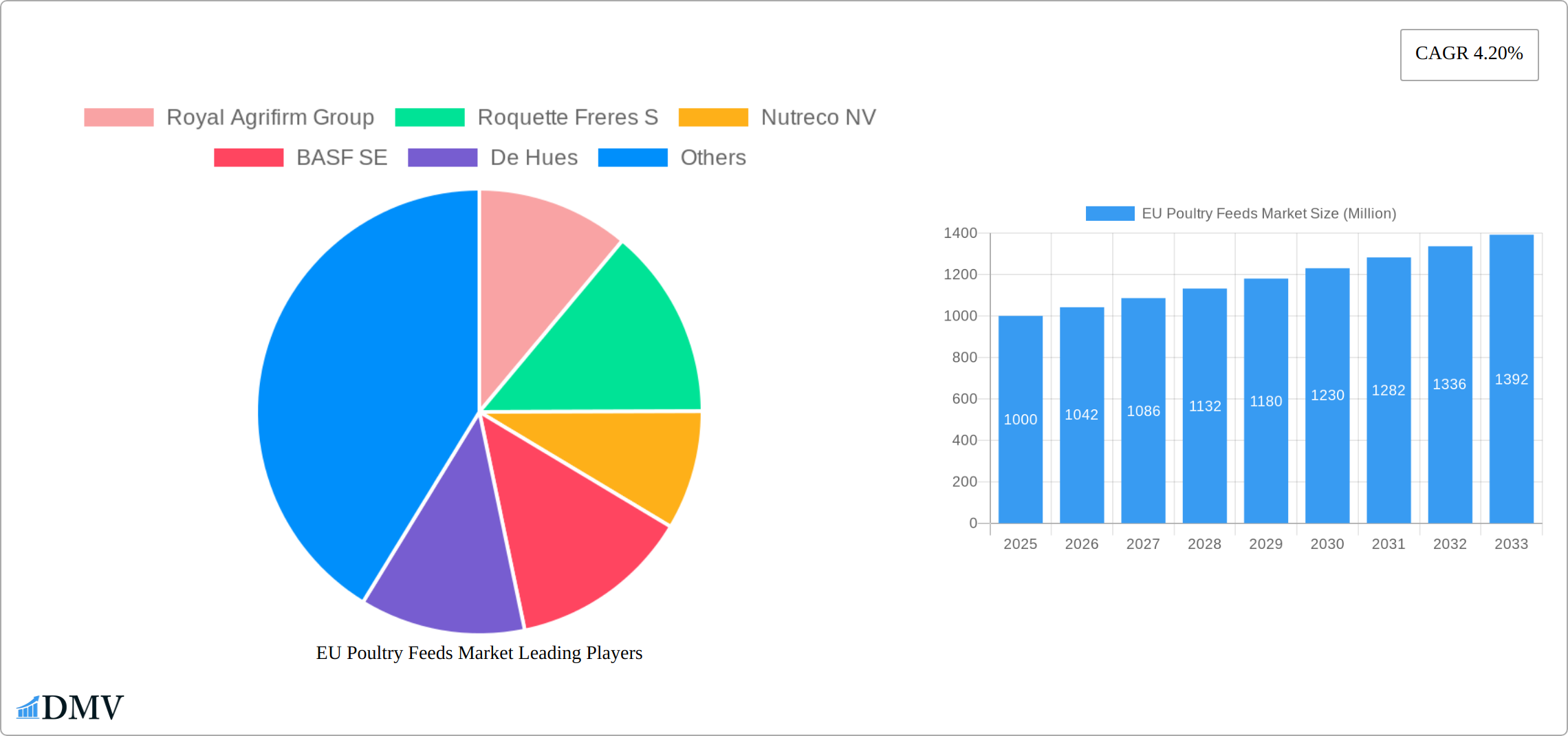

EU Poultry Feeds Market Company Market Share

EU Poultry Feeds Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the EU Poultry Feeds Market, offering a comprehensive overview of market trends, competitive dynamics, and future growth prospects. Valued at xx Million in 2025, the market is poised for significant expansion, reaching xx Million by 2033. The report covers the period from 2019 to 2033, with 2025 serving as the base year. This in-depth study is essential for stakeholders seeking to understand the intricacies of this dynamic market and make informed strategic decisions.

EU Poultry Feeds Market Market Composition & Trends

This section offers a comprehensive analysis of the EU poultry feeds market, dissecting its structure and identifying prevailing trends. We meticulously examine market concentration, pinpointing key industry players and their estimated market shares. While precise individual company data remains dynamic, we project a significant combined market share of approximately 30% for industry giants Cargill and Nutreco in 2025. The report further explores the vanguard of innovation within the sector, with a sharp focus on the development of cutting-edge feed formulations and advanced technologies meticulously designed to bolster poultry health, optimize productivity, and champion sustainability.

The regulatory framework exerts a profound influence on the EU poultry feeds market. Landmark legislation, such as the January 2022 prohibition on the routine administration of antibiotics in farmed animals, has fundamentally reshaped industry practices and ignited a surge in innovation for alternative feed additives. This report provides an in-depth examination of the ramifications of such stringent regulations on overall market dynamics. Moreover, we delve into the potential impact of substitute products, analyzing their capacity to influence market growth trajectories. Finally, this section profiles end-user segments, offering detailed characterizations of poultry producers based on their operational scale, areas of specialization, and geographical distribution. Mergers and Acquisitions (M&A) activity is another critical area of focus, featuring a detailed breakdown of significant transactions, including their valuation and strategic implications for market consolidation. For instance, De Heus' strategic acquisition of Golpasz in 2021 demonstrably enhanced its competitive standing within the Polish market.

- Market Concentration: Anticipated xx% market share to be controlled by the top 5 players by 2025, indicating a trend towards consolidation.

- M&A Activity: In-depth analysis of pivotal deals, including the De Heus acquisition of Golpasz, and their transformative impact on market structure. The estimated total M&A deal value in the historical period (2019-2024) stands at an impressive xx Million, highlighting active consolidation.

- Regulatory Landscape: A comprehensive evaluation of current and upcoming EU regulations that significantly impact feed composition standards, antibiotic usage policies, and overall animal welfare practices.

- Substitute Products: A thorough assessment of the evolving landscape of alternative feed ingredients and their potential to disrupt existing market shares and drive demand for novel solutions.

EU Poultry Feeds Market Industry Evolution

This section provides a detailed analysis of the EU poultry feeds market's growth trajectory, technological advancements, and evolving consumer preferences. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors, including rising poultry consumption, increasing demand for high-quality feed, and technological advancements in feed formulation and processing. The adoption of precision feeding technologies and data-driven approaches to feed management is also significantly impacting the industry, leading to improved efficiency and sustainability. Changes in consumer preferences regarding poultry production methods, including concerns about animal welfare and antibiotic use, are influencing the demand for sustainably produced poultry feeds.

Leading Regions, Countries, or Segments in EU Poultry Feeds Market

This section identifies the leading regions, countries, and segments within the EU poultry feeds market.

Animal Type:

- Broiler: This segment dominates the market due to high broiler meat consumption across the EU. Key drivers include high demand for affordable protein sources and favorable government policies supporting poultry farming.

- Layer: The layer segment also holds a significant market share driven by consistent egg consumption across EU countries.

- Turkey: This segment shows moderate growth with increasing demand for turkey meat during festive seasons.

- Other Animal Types: This segment comprises smaller poultry types and holds a smaller market share compared to broilers and layers.

Ingredient:

- Cereals: This remains the dominant ingredient segment, owing to its cost-effectiveness and widespread availability.

- Oilseed Meals: The usage of oilseed meals is steadily increasing due to their nutritional value and sustainability aspects.

- Supplements: This segment is experiencing robust growth due to increasing focus on poultry health and productivity. Demand is driven by the need to compensate for the loss of antibiotics in the feed.

The report provides a detailed analysis of each segment, highlighting key market drivers, including investment trends and regulatory support. The dominance of specific segments is further analyzed in relation to factors such as consumer preferences, feed efficiency, and production costs.

EU Poultry Feeds Market Product Innovations

Recent innovations in the EU poultry feeds market focus on improving feed efficiency, optimizing nutrient digestibility, and enhancing poultry health. Cargill's introduction of mini-pellet chick feed in September 2022 exemplifies this trend, offering precise nutrient delivery for optimal chick development. Technological advancements include the utilization of advanced analytical techniques to tailor feed formulations to specific poultry needs and the incorporation of probiotics and prebiotics to improve gut health and reduce reliance on antibiotics. These innovations contribute to enhanced poultry growth, reduced feed costs, and increased sustainability.

Propelling Factors for EU Poultry Feeds Market Growth

The trajectory of the EU poultry feeds market is significantly influenced by a confluence of robust growth drivers. The sustained and increasing demand for poultry products, propelled by global population expansion and evolving dietary preferences, stands as a primary catalyst. Concurrently, continuous technological advancements in feed formulation techniques and processing methodologies are instrumental in enhancing operational efficiency and achieving cost reductions. Favorable governmental policies and incentives designed to support and advance the poultry industry further contribute positively to market expansion. Furthermore, the accelerating adoption of sustainable farming practices is increasingly shaping consumer preferences and, consequently, the demand for environmentally conscious feed ingredients.

Obstacles in the EU Poultry Feeds Market Market

The EU poultry feeds market faces several challenges. Fluctuations in raw material prices, particularly for cereals and oilseeds, create pricing volatility. Supply chain disruptions due to geopolitical instability and climate change can severely impact availability and cost. Intense competition among numerous feed manufacturers also puts pressure on profitability. Furthermore, stringent regulations regarding feed composition and antibiotic use necessitate significant investments in compliance and innovation.

Future Opportunities in EU Poultry Feeds Market

The future landscape of the EU poultry feeds market is ripe with opportunities, particularly in the development and widespread adoption of novel feed ingredients and advanced technologies that prioritize both sustainability and enhanced animal welfare. The burgeoning demand for poultry products that are certified organic and produced through sustainable farming methods presents a substantial and expanding market niche. The integration of precision feeding technologies, coupled with data-driven approaches to feed management, offers significant potential for optimizing feed utilization, improving overall bird health, and substantially reducing the environmental footprint of poultry farming. Strategic expansion into specialized market segments, such as those catering to unique poultry breeds and the rapidly growing organic poultry farming sector, also represents a highly promising avenue for sustained growth and profitability.

Major Players in the EU Poultry Feeds Market Ecosystem

- Royal Agrifirm Group

- Roquette Freres S.A.

- Nutreco NV

- BASF SE

- De Heus

- Alltech Inc.

- Cargill Inc.

- Danish Agro

- Terrena

Key Developments in EU Poultry Feeds Market Industry

- September 2022: Cargill unveiled an innovative new mini-pellet chick feed designed to significantly enhance early chick development and optimize nutrient digestibility. This forward-thinking innovation directly addresses a critical market need for superior feed efficiency during the crucial early growth stages of chicks.

- January 2022: The European Union implemented a pivotal ban on the routine use of antibiotics in farmed animals. This monumental regulatory shift has compelled the industry to adapt proactively, stimulating extensive innovation in antibiotic alternatives and profoundly influencing feed formulation strategies. This development has dramatically amplified the demand for alternative feed additives and reinforced the importance of sustainable farming practices.

- March 2021: De Heus executed a strategic acquisition of Golpasz, a move that substantially bolstered its market presence and competitive position within the Polish broiler feed sector. This acquisition has effectively expanded De Heus’ market reach and augmented its production capabilities, leading to a notable increase in its overall market share.

Strategic EU Poultry Feeds Market Market Forecast

The EU poultry feeds market is poised for substantial and sustained growth throughout the forecast period (2025-2033). This positive outlook is underpinned by a dynamic interplay of driving forces. Escalating poultry consumption patterns, coupled with relentless technological innovation in feed production and processing, alongside the widespread adoption of environmentally responsible farming practices, will continue to be pivotal in shaping market dynamics. Emerging opportunities within specialized feed formulations, the strategic sourcing of sustainable ingredients, and the implementation of advanced precision feeding technologies are anticipated to be key drivers of future market expansion, promising considerable potential for innovative and agile market players.

EU Poultry Feeds Market Segmentation

-

1. Animal Type

- 1.1. Layer

- 1.2. Broiler

- 1.3. Turkey

- 1.4. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Oilseed Meals

- 2.3. Molasses

- 2.4. Fish Oils and Fish Meals

- 2.5. Supplements

- 2.6. Other Ingredients

EU Poultry Feeds Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Italy

- 4. France

- 5. Spain

- 6. Russia

- 7. Rest of Europe

EU Poultry Feeds Market Regional Market Share

Geographic Coverage of EU Poultry Feeds Market

EU Poultry Feeds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Fish Consumption; Rise in Export-oriented Aquaculture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets

- 3.4. Market Trends

- 3.4.1. Growing Meat Production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Layer

- 5.1.2. Broiler

- 5.1.3. Turkey

- 5.1.4. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Oilseed Meals

- 5.2.3. Molasses

- 5.2.4. Fish Oils and Fish Meals

- 5.2.5. Supplements

- 5.2.6. Other Ingredients

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Spain

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. United Kingdom EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Layer

- 6.1.2. Broiler

- 6.1.3. Turkey

- 6.1.4. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Oilseed Meals

- 6.2.3. Molasses

- 6.2.4. Fish Oils and Fish Meals

- 6.2.5. Supplements

- 6.2.6. Other Ingredients

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Germany EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Layer

- 7.1.2. Broiler

- 7.1.3. Turkey

- 7.1.4. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Oilseed Meals

- 7.2.3. Molasses

- 7.2.4. Fish Oils and Fish Meals

- 7.2.5. Supplements

- 7.2.6. Other Ingredients

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Italy EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Layer

- 8.1.2. Broiler

- 8.1.3. Turkey

- 8.1.4. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Oilseed Meals

- 8.2.3. Molasses

- 8.2.4. Fish Oils and Fish Meals

- 8.2.5. Supplements

- 8.2.6. Other Ingredients

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. France EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Layer

- 9.1.2. Broiler

- 9.1.3. Turkey

- 9.1.4. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Oilseed Meals

- 9.2.3. Molasses

- 9.2.4. Fish Oils and Fish Meals

- 9.2.5. Supplements

- 9.2.6. Other Ingredients

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Spain EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Layer

- 10.1.2. Broiler

- 10.1.3. Turkey

- 10.1.4. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Oilseed Meals

- 10.2.3. Molasses

- 10.2.4. Fish Oils and Fish Meals

- 10.2.5. Supplements

- 10.2.6. Other Ingredients

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Russia EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 11.1.1. Layer

- 11.1.2. Broiler

- 11.1.3. Turkey

- 11.1.4. Other Animal Types

- 11.2. Market Analysis, Insights and Forecast - by Ingredient

- 11.2.1. Cereals

- 11.2.2. Oilseed Meals

- 11.2.3. Molasses

- 11.2.4. Fish Oils and Fish Meals

- 11.2.5. Supplements

- 11.2.6. Other Ingredients

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 12. Rest of Europe EU Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Animal Type

- 12.1.1. Layer

- 12.1.2. Broiler

- 12.1.3. Turkey

- 12.1.4. Other Animal Types

- 12.2. Market Analysis, Insights and Forecast - by Ingredient

- 12.2.1. Cereals

- 12.2.2. Oilseed Meals

- 12.2.3. Molasses

- 12.2.4. Fish Oils and Fish Meals

- 12.2.5. Supplements

- 12.2.6. Other Ingredients

- 12.1. Market Analysis, Insights and Forecast - by Animal Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Royal Agrifirm Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Roquette Freres S

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nutreco NV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 BASF SE

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 De Hues

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Alltech Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Cargill Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Danish Agro

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Terrena

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Royal Agrifirm Group

List of Figures

- Figure 1: Global EU Poultry Feeds Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United Kingdom EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 3: United Kingdom EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: United Kingdom EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 5: United Kingdom EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 6: United Kingdom EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 7: United Kingdom EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Germany EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 9: Germany EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: Germany EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 11: Germany EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 12: Germany EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Germany EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Italy EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 15: Italy EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Italy EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 17: Italy EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 18: Italy EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Italy EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: France EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 21: France EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 22: France EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 23: France EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 24: France EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 25: France EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Spain EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 27: Spain EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Spain EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 29: Spain EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 30: Spain EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Spain EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Russia EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 33: Russia EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 34: Russia EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 35: Russia EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 36: Russia EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Russia EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of Europe EU Poultry Feeds Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 39: Rest of Europe EU Poultry Feeds Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 40: Rest of Europe EU Poultry Feeds Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 41: Rest of Europe EU Poultry Feeds Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 42: Rest of Europe EU Poultry Feeds Market Revenue (Million), by Country 2025 & 2033

- Figure 43: Rest of Europe EU Poultry Feeds Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 2: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 3: Global EU Poultry Feeds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 5: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 6: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 8: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 9: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 11: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 12: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 14: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 15: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 17: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 18: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 20: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 21: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global EU Poultry Feeds Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 23: Global EU Poultry Feeds Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 24: Global EU Poultry Feeds Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EU Poultry Feeds Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the EU Poultry Feeds Market?

Key companies in the market include Royal Agrifirm Group, Roquette Freres S, Nutreco NV, BASF SE, De Hues, Alltech Inc, Cargill Inc, Danish Agro, Terrena.

3. What are the main segments of the EU Poultry Feeds Market?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Fish Consumption; Rise in Export-oriented Aquaculture.

6. What are the notable trends driving market growth?

Growing Meat Production Drives the Market.

7. Are there any restraints impacting market growth?

Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets.

8. Can you provide examples of recent developments in the market?

Sept 2022: Cargill introduced a new mini-pellet chick feed to promote chick start in the first 120 hours of a bird's life, which includes precise amounts of protein, starch, fat, and additives in highly digestible ingredients to promote maximum nutrient digestibility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EU Poultry Feeds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EU Poultry Feeds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EU Poultry Feeds Market?

To stay informed about further developments, trends, and reports in the EU Poultry Feeds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence