Key Insights

The Spanish e-brokerage market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.5%. This upward trajectory is fueled by increasing internet and smartphone penetration, a digitally adept young population, and the proliferation of intuitive mobile trading applications. These factors significantly lower the barrier to entry for retail investors, broadening the market's reach. Competitive pricing strategies adopted by both incumbent firms and new entrants, alongside regulatory enhancements that bolster transparency and investor protection, are further stimulating market expansion. Key market size estimations indicate a market size of 15.37 billion in the base year of 2025, with significant growth anticipated through 2033. While market volatility and inherent online trading risks present challenges, particularly for novice investors, the sector's continued development hinges on robust cybersecurity and cultivating customer trust. The market is segmented by investor demographics, trading strategies, and platform functionalities, with a pronounced emphasis on mobile-first solutions. Ongoing technological advancements and evolving investor preferences are expected to sustain this positive market momentum.

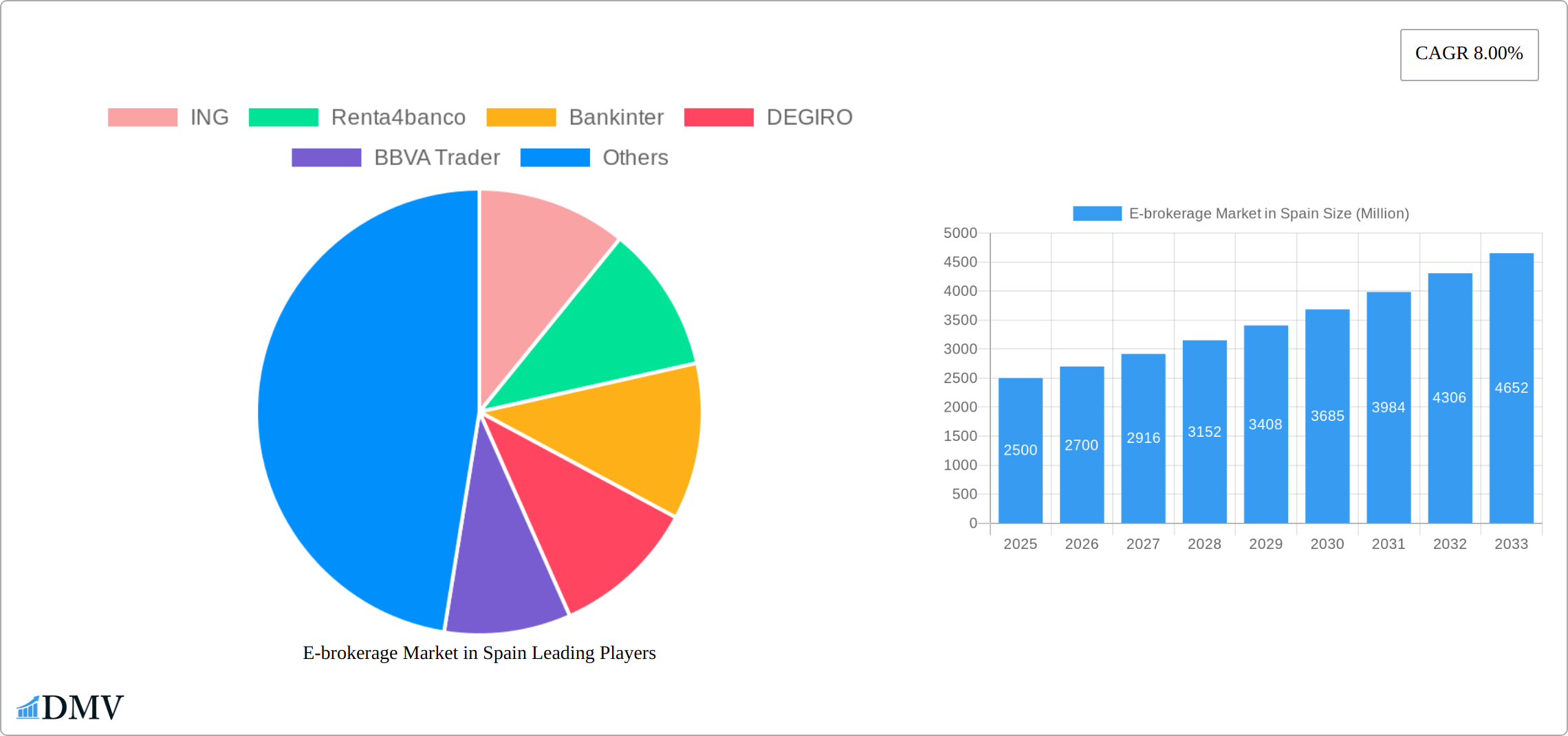

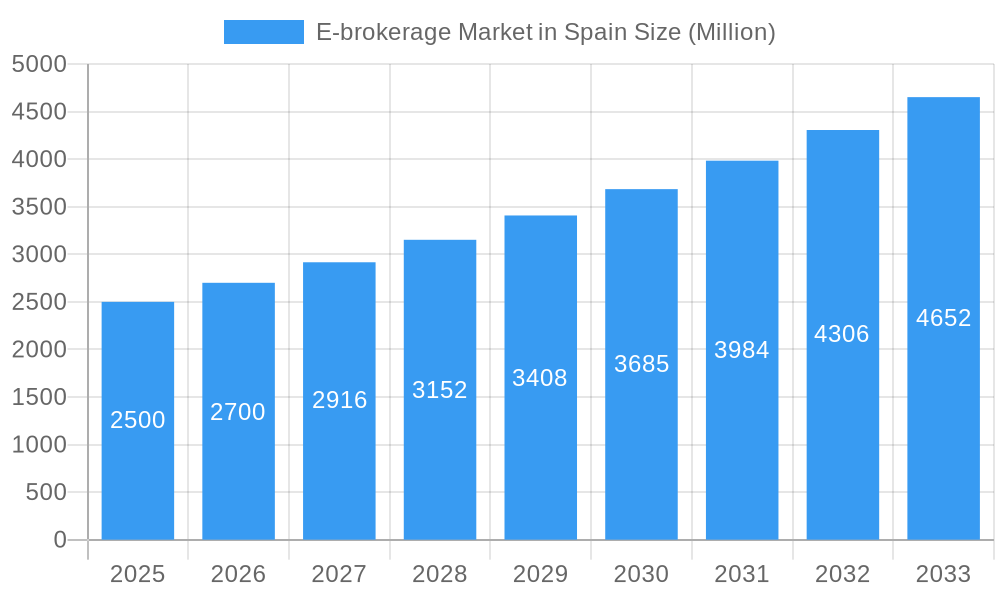

E-brokerage Market in Spain Market Size (In Billion)

The e-brokerage landscape in Spain is characterized by intense competition, with established financial institutions and specialized online brokers vying for market dominance. Success is predicated on a comprehensive product portfolio, technological innovation, superior customer service, and adaptability to evolving regulatory frameworks. Strategic expansion into less saturated regions within Spain, coupled with targeted marketing and enhanced user experiences, is crucial for firms aiming to capture a larger market share. Overall, the Spanish e-brokerage sector represents a compelling investment opportunity, provided firms effectively manage risks and remain agile in response to technological and regulatory shifts.

E-brokerage Market in Spain Company Market Share

E-brokerage Market in Spain: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Spanish e-brokerage market, offering invaluable insights for stakeholders seeking to understand market dynamics, investment opportunities, and future growth prospects. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We delve into market composition, industry evolution, leading players, and key developments, providing a comprehensive overview of this dynamic sector. The report uses Million (M) for all monetary values.

E-brokerage Market in Spain Market Composition & Trends

This section evaluates the Spanish e-brokerage market's competitive landscape, identifying key trends shaping its evolution. We analyze market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activity. The report leverages data from the historical period (2019-2024) to inform the analysis and forecast.

Market Concentration: The Spanish e-brokerage market exhibits a moderately concentrated structure, with a few major players controlling a significant share. The exact market share distribution among key players like ING, Renta4banco, Bankinter, DEGIRO, BBVA Trader, and others will be detailed in the full report. We project a xx% market share for ING in 2025.

Innovation Catalysts: Technological advancements, such as AI-powered trading platforms and mobile-first solutions, are driving innovation. Regulatory changes also significantly influence the market.

Regulatory Landscape: The Spanish regulatory environment plays a crucial role, impacting market entry, compliance, and overall market growth. The report provides a thorough review of relevant legislation and its implications.

Substitute Products: Traditional brokerage services and alternative investment platforms pose competitive threats to e-brokerage firms. We analyze the competitive pressures arising from these substitute products.

End-User Profiles: We segment the user base based on demographics, investment experience, and trading preferences to understand specific needs and market segments.

M&A Activities: The e-brokerage sector has witnessed significant M&A activity. For instance, the 2020 acquisition of DeGiro by Flatex for €250M significantly reshaped the European market. The report details other notable M&A deals and their impact, including deal values where available (xx M for other deals in 2019-2024).

E-brokerage Market in Spain Industry Evolution

This section examines the evolution of the Spanish e-brokerage market, focusing on market growth trajectories, technological advancements, and evolving consumer preferences. We analyze historical data (2019-2024) and project future trends (2025-2033). The market is projected to experience a CAGR of xx% during the forecast period, driven by increasing internet and mobile penetration, coupled with rising retail investor participation. The adoption of advanced technologies like algorithmic trading and robo-advisors is also impacting market growth. Changing consumer preferences towards convenience and personalized services continue to reshape the landscape.

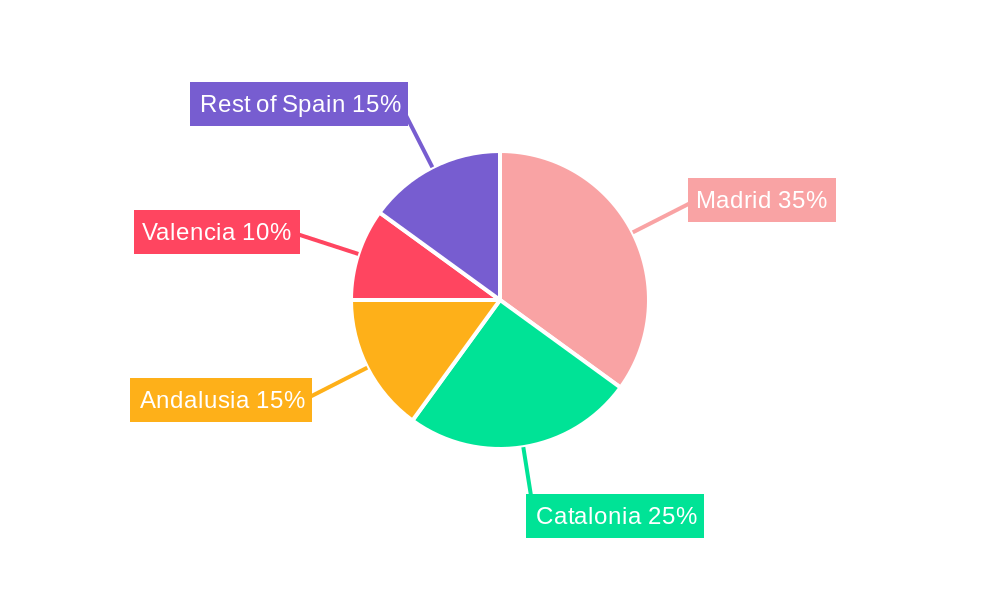

Leading Regions, Countries, or Segments in E-brokerage Market in Spain

This section pinpoints the leading regions and segments within the dynamic Spanish e-brokerage market. While Spain is a unified nation, it's crucial to acknowledge potential regional disparities in e-brokerage adoption rates, investor behaviors, and platform preferences. This analysis will illuminate the critical factors underpinning the prominence of specific areas or investor groups within the market.

-

Key Catalysts:

- Significant investment in financial technology (FinTech) innovation across key urban centers and economically robust regions.

- Divergent regulatory frameworks and supportive measures that may favor certain autonomous communities or specialized financial zones.

- Variations in investor demographics, financial literacy levels, and risk appetites influenced by local economic conditions and cultural investment patterns.

-

Determinants of Dominance: The report will delve into the contributing factors behind the ascendance of particular regions or market segments. This includes an in-depth examination of local economic performance, prevailing investor sentiment, the widespread availability and adoption of advanced technological infrastructure, and the presence of well-established financial hubs.

E-brokerage Market in Spain Product Innovations

The Spanish e-brokerage market is characterized by ongoing product innovation. New platforms offer enhanced user interfaces, advanced trading tools, and personalized investment advice. We see a trend towards fractional share trading, which allows investors to buy partial shares, increasing accessibility. The integration of AI and machine learning in trading algorithms and risk management tools is another significant development, improving efficiency and decision-making for both retail and institutional clients.

Propelling Factors for E-brokerage Market in Spain Growth

The Spanish e-brokerage landscape is propelled by a confluence of powerful drivers. The pervasive reach of high-speed internet and the widespread adoption of mobile devices are fundamentally enhancing accessibility to sophisticated online trading platforms, democratizing investment opportunities. Furthermore, an increasingly supportive regulatory environment, coupled with a burgeoning base of retail investors keen to participate in financial markets, is significantly fueling market expansion. The overarching trend of digital transformation in financial services is a cornerstone of this growth, as consumers increasingly embrace digital solutions for managing their investments.

Obstacles in the E-brokerage Market in Spain Market

Despite positive growth prospects, several challenges hinder the market. Stringent regulatory compliance requirements can pose significant barriers to entry for new players. Cybersecurity threats and the risk of data breaches are substantial concerns. Intense competition among established players and the potential for market volatility also contribute to challenges. The impact of these obstacles is quantified in the complete report.

Future Opportunities in E-brokerage Market in Spain

The future trajectory of the Spanish e-brokerage market is rich with promising opportunities. The continued evolution of mobile trading capabilities, alongside the integration of cutting-edge technologies such as blockchain for enhanced security and transparency, and artificial intelligence (AI) for personalized insights and algorithmic trading, will profoundly reshape the sector. Strategic expansion into currently underserved market segments, particularly among younger demographics or those in less digitally connected regions, and the development of highly specialized services tailored to the nuanced needs of diverse investor profiles, will be paramount for achieving sustained competitive advantage and market leadership.

Key Developments in E-brokerage Market in Spain Industry

- April 2020: German Flatex completes its 100% acquisition of DeGiro for €250M, creating a leading online broker in Europe.

- Early 2021: DeGiro BV merges with flatexDEGIRO Bank AG, further strengthening its market position.

- July 2021: Interactive Brokers introduces a simplified flat fee structure for stock trading in Europe, aiming to expand its customer base.

Strategic E-brokerage Market in Spain Market Forecast

The Spanish e-brokerage market is firmly positioned for robust and sustained growth. This expansion will be fueled by ongoing technological advancements, the evolving preferences of a more digitally savvy investor base, and a continually supportive regulatory landscape. The accelerating digitalization of financial services across the board, alongside the increasing engagement of retail investors seeking accessible and efficient investment channels, will be key to further market expansion in the forthcoming years. Significant opportunities exist for market participants to leverage emerging technologies and develop highly tailored offerings that cater to specific investor segments, thereby securing a distinct competitive edge in this dynamic and rapidly evolving market. The comprehensive report provides detailed quantitative forecasts for the period spanning 2025-2033.

E-brokerage Market in Spain Segmentation

-

1. Investor

- 1.1. Retail

- 1.2. Institutional

-

2. Operation

- 2.1. Domestic

- 2.2. Foreign

E-brokerage Market in Spain Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-brokerage Market in Spain Regional Market Share

Geographic Coverage of E-brokerage Market in Spain

E-brokerage Market in Spain REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Financial Products contribute to highest percentage of Family assets of Spanish

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investor

- 5.1.1. Retail

- 5.1.2. Institutional

- 5.2. Market Analysis, Insights and Forecast - by Operation

- 5.2.1. Domestic

- 5.2.2. Foreign

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Investor

- 6. North America E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investor

- 6.1.1. Retail

- 6.1.2. Institutional

- 6.2. Market Analysis, Insights and Forecast - by Operation

- 6.2.1. Domestic

- 6.2.2. Foreign

- 6.1. Market Analysis, Insights and Forecast - by Investor

- 7. South America E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investor

- 7.1.1. Retail

- 7.1.2. Institutional

- 7.2. Market Analysis, Insights and Forecast - by Operation

- 7.2.1. Domestic

- 7.2.2. Foreign

- 7.1. Market Analysis, Insights and Forecast - by Investor

- 8. Europe E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investor

- 8.1.1. Retail

- 8.1.2. Institutional

- 8.2. Market Analysis, Insights and Forecast - by Operation

- 8.2.1. Domestic

- 8.2.2. Foreign

- 8.1. Market Analysis, Insights and Forecast - by Investor

- 9. Middle East & Africa E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investor

- 9.1.1. Retail

- 9.1.2. Institutional

- 9.2. Market Analysis, Insights and Forecast - by Operation

- 9.2.1. Domestic

- 9.2.2. Foreign

- 9.1. Market Analysis, Insights and Forecast - by Investor

- 10. Asia Pacific E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investor

- 10.1.1. Retail

- 10.1.2. Institutional

- 10.2. Market Analysis, Insights and Forecast - by Operation

- 10.2.1. Domestic

- 10.2.2. Foreign

- 10.1. Market Analysis, Insights and Forecast - by Investor

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ING

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renta4banco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bankinter

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DEGIRO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BBVA Trader

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IC Market

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AVA Trade

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FP Market

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 tastyworks

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pepperstone**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ING

List of Figures

- Figure 1: Global E-brokerage Market in Spain Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 3: North America E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 4: North America E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 5: North America E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 6: North America E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 7: North America E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 9: South America E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 10: South America E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 11: South America E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 12: South America E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 13: South America E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 15: Europe E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 16: Europe E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 17: Europe E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 18: Europe E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 21: Middle East & Africa E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 22: Middle East & Africa E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 23: Middle East & Africa E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 24: Middle East & Africa E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 27: Asia Pacific E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 28: Asia Pacific E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 29: Asia Pacific E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 30: Asia Pacific E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 2: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 3: Global E-brokerage Market in Spain Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 5: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 6: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 11: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 12: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 17: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 18: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 29: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 30: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 38: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 39: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-brokerage Market in Spain?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the E-brokerage Market in Spain?

Key companies in the market include ING, Renta4banco, Bankinter, DEGIRO, BBVA Trader, IC Market, AVA Trade, FP Market, tastyworks, Pepperstone**List Not Exhaustive.

3. What are the main segments of the E-brokerage Market in Spain?

The market segments include Investor, Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.37 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Financial Products contribute to highest percentage of Family assets of Spanish.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In early 2021, DeGiro BV merged with flatexDEGIRO Bank AG, creating the largest online foreclosure broker in Europe with its own banking license. Also in April 2020, German Flatex completes its 100% acquisition of DeGiro. The Deal value of the acquisition was 250 EURO million. With this Flatex Degiro become the leading online broker in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-brokerage Market in Spain," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-brokerage Market in Spain report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-brokerage Market in Spain?

To stay informed about further developments, trends, and reports in the E-brokerage Market in Spain, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence