Key Insights

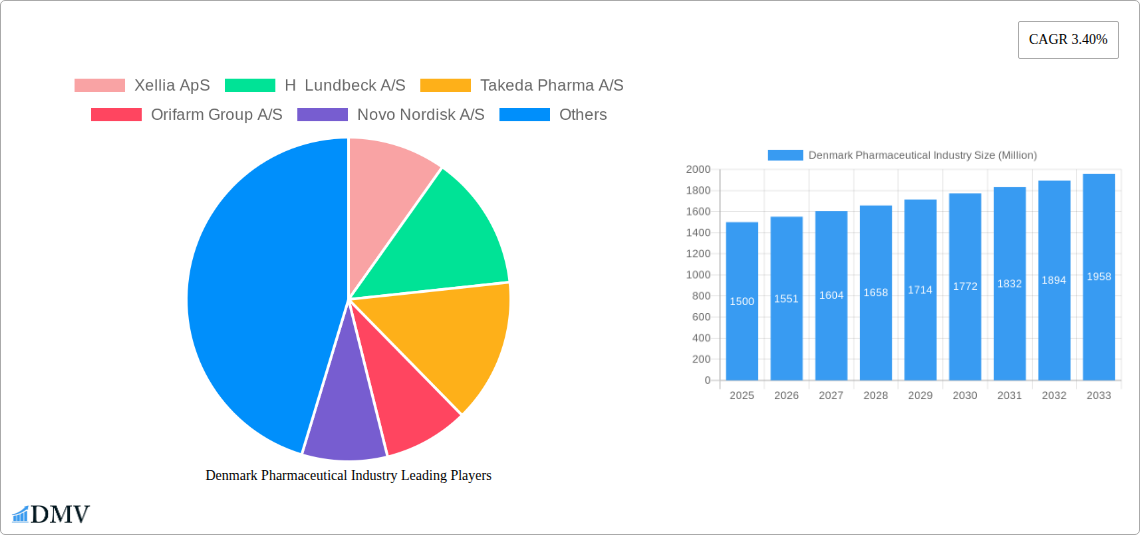

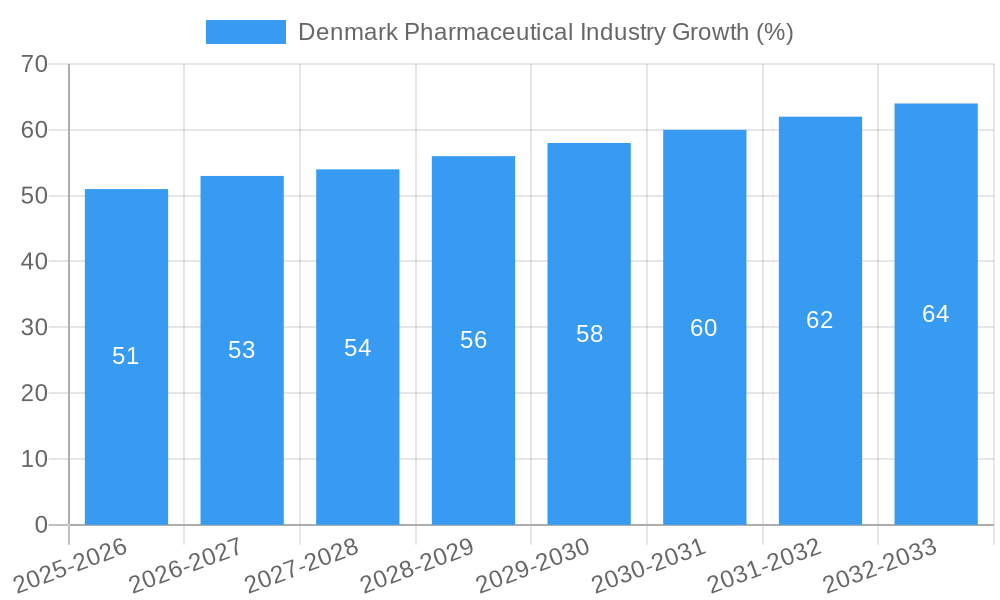

The Denmark pharmaceutical market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market size data), is projected to exhibit steady growth at a compound annual growth rate (CAGR) of 3.40% from 2025 to 2033. This expansion is driven by several key factors. A robust aging population necessitates increased demand for chronic disease management medications, particularly within segments like cardiovascular, musculoskeletal, and nervous system treatments. Furthermore, rising healthcare expenditure and government initiatives promoting better healthcare access contribute to market growth. The increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions fuels demand for prescription drugs, notably within the Alimentary Tract and Metabolism and Cardiovascular System therapeutic classes. The presence of established pharmaceutical companies like Novo Nordisk A/S and Leo Pharma A/S, along with foreign players, further strengthens the market's competitiveness and innovation. While the market faces potential restraints, such as pricing pressures and stringent regulatory approvals, the overall outlook remains positive, supported by continuous advancements in pharmaceutical research and development.

The market segmentation reveals significant opportunities. Prescription drugs (Rx) dominate the market share, reflecting the prevalence of chronic diseases. Within therapeutic classes, Alimentary Tract and Metabolism, Cardiovascular System, and Nervous System drugs are expected to experience substantial growth due to the aforementioned population demographics and disease prevalence. The hospital sector plays a crucial role in drug distribution, with primary care also holding significant market share. Growth within the OTC drug segment might be relatively slower due to factors like consumer preference for prescription treatments for serious ailments. The competitive landscape is characterized by both domestic and international pharmaceutical companies, creating a dynamic environment fostering both competition and collaboration in R&D and market penetration. Strategic partnerships and acquisitions are likely to shape market dynamics in the forecast period.

Denmark Pharmaceutical Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Denmark pharmaceutical market, covering its current state, future projections, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report leverages rigorous data analysis and industry expertise to offer actionable insights into market size, trends, and competitive dynamics. Total market value projections are presented in Millions.

Denmark Pharmaceutical Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities within the Danish pharmaceutical market. The report meticulously analyzes market share distribution among key players and provides insights into the value of significant M&A deals.

- Market Concentration: The Danish pharmaceutical market exhibits a moderately concentrated structure, with a few large multinational corporations holding significant market share, while a number of smaller specialized companies cater to niche areas. Novo Nordisk, for instance, dominates with an estimated xx% market share in 2025. The remaining share is divided amongst other major players, including H. Lundbeck, Leo Pharma, and others.

- Innovation Catalysts: Strong governmental support for R&D, a skilled workforce, and a robust intellectual property framework stimulate pharmaceutical innovation in Denmark. Collaboration between academic institutions and pharmaceutical companies further fuels this innovation ecosystem.

- Regulatory Landscape: The Danish Medicines Agency (Lægemiddelstyrelsen) plays a crucial role in regulating the pharmaceutical industry, ensuring product safety and efficacy. The regulatory landscape, while rigorous, is generally considered supportive of industry growth. This section will detail specific regulations influencing market access and product approvals.

- Substitute Products: The presence of generic medications and biosimilars presents competitive pressure for innovative pharmaceutical products. This competitive pressure influences pricing and market share dynamics. The report will quantify the impact of substitute products on market growth.

- End-User Profiles: This section will detail the various end-users of pharmaceutical products in Denmark, including hospitals, pharmacies, and private clinics, providing a breakdown of market segments by user type and prescription volume.

- M&A Activities: The report will identify and analyze significant M&A activities within the Danish pharmaceutical industry during the historical period (2019-2024). Data on deal values (in Millions) will be provided where available. For example, the impact of any strategic acquisitions on market consolidation will be assessed. We estimate xx Million in M&A activity during the historical period.

Denmark Pharmaceutical Industry Industry Evolution

This section delves into the evolution of the Danish pharmaceutical market, analyzing market growth trajectories, technological advancements, and evolving consumer demands. Specific data points, including growth rates and adoption metrics for key technologies, will be presented. The analysis will cover the historical period (2019-2024) and extend to the forecast period (2025-2033), providing insights into anticipated trends and their implications for market participants. The impact of the COVID-19 pandemic and its subsequent effects on R&D, production, and market access will be examined. The report will discuss the increasing focus on personalized medicine and the adoption of digital health technologies, along with their impact on market growth and future strategies for pharmaceutical companies. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period. Further, the adoption of advanced analytics in drug discovery and development will be analyzed, showing a predicted increase of xx% in its use by 2033.

Leading Regions, Countries, or Segments in Denmark Pharmaceutical Industry

This section identifies the dominant regions, countries, or segments within the Danish pharmaceutical market, categorized by prescription type (Prescription Drugs (Rx), OTC Drugs), ATC/Therapeutic Class (Alimentary Tract and Metabolism, Blood and Blood Forming Organs, Cardiovascular System, Dermatological Drugs, Genitourinary System and Reproductive Hormones, Systemic Hormonal Preparations, excluding Reproductive Hormones and Insulin, Antiinfectives for Systemic Use, Antineoplastic and Immunomodulating Agents, Musculoskeletal System, Nervous System, Antiparasitic Products, Insecticides and Repellents, Respiratory System, Sensory Organs, Various ATC Structures), and sector (Primary Sector, Hospital Sector).

Key Drivers:

- Investment Trends: Significant investments in R&D and manufacturing capacity are driving growth in specific segments.

- Regulatory Support: Government initiatives and regulatory frameworks that encourage innovation and market access are further fostering growth within leading segments.

Dominance Factors: The detailed analysis of dominance factors will include market size, growth rates, profitability and competitive intensity within each dominant segment. The report will further provide insights into the factors driving the dominance of each sector, including economic factors, changing healthcare patterns, technological advancement, and healthcare policies.

Denmark Pharmaceutical Industry Product Innovations

This section highlights recent product innovations, their applications, and performance metrics. It will showcase unique selling propositions (USPs) and technological advancements impacting the Danish pharmaceutical landscape. Examples include the introduction of novel drug delivery systems, breakthroughs in targeted therapies, and the development of biosimilars, along with their impact on treatment outcomes.

Propelling Factors for Denmark Pharmaceutical Industry Growth

Key growth drivers include increasing prevalence of chronic diseases, government initiatives to improve healthcare access, ongoing investments in R&D, and the emergence of new therapeutic areas. The report will further elaborate on the supportive regulatory environment and the skilled workforce within the Danish pharmaceutical industry, providing specific examples of government policies and initiatives fostering industry growth. The influx of foreign investment into pharmaceutical R&D and the strategic partnerships between Danish companies and international players will also be noted.

Obstacles in the Denmark Pharmaceutical Industry Market

Challenges include increasing pricing pressures, stringent regulatory hurdles, potential supply chain disruptions, and intense competition from both domestic and international players. The report will delve into the potential impact of these obstacles, providing quantifiable examples wherever possible.

Future Opportunities in Denmark Pharmaceutical Industry

Emerging opportunities exist in personalized medicine, biosimilars, and digital health technologies. The report will explore potential market expansions into new therapeutic areas, driven by advancements in biotechnology and the rise of new disease models. It will also emphasize the growing importance of data analytics in drug discovery and development.

Major Players in the Denmark Pharmaceutical Industry Ecosystem

- Xellia ApS

- H Lundbeck A/S

- Takeda Pharma A/S

- Orifarm Group A/S

- Novo Nordisk A/S

- Ferring Pharmaceuticals A/S

- Leo Pharma A/S

- FUJIFILM Diosynth Biotechnologies

- Sandoz A/S

- ALK-Abell A/S

Key Developments in Denmark Pharmaceutical Industry Industry

- July 2022: Bavarian Nordic expands its monkeypox vaccine production capacity to 10 Million doses. This significantly strengthens Denmark's position in the global vaccine market.

- June 2022: Novo Nordisk A/S partners with Echosens to improve early diagnosis of NASH. This collaboration enhances patient care and could lead to increased demand for related pharmaceutical products.

Strategic Denmark Pharmaceutical Industry Market Forecast

The Danish pharmaceutical market is poised for continued growth driven by factors such as technological advancements, a supportive regulatory environment, and increasing prevalence of chronic diseases. The forecast period (2025-2033) anticipates strong growth, driven by continued investments in R&D and the expansion of market segments. The report offers insights into specific growth opportunities within various therapeutic areas and product categories, paving the way for strategic decision-making within the sector.

Denmark Pharmaceutical Industry Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Alimentary Tract and Metabolism

- 1.2. Blood and Blood Forming Organs

- 1.3. Cardiovascular System

- 1.4. Dermatological Drugs

- 1.5. Genitourinary System and Reproductive Hormones

- 1.6. Systemic

- 1.7. Antiinfectives for Systemic Use

- 1.8. Antineoplastic and Immunomodulating Agents

- 1.9. Musculoskeletal System

- 1.10. Nervous System

- 1.11. Antipara

- 1.12. Respiratory System

- 1.13. Sensory Organs

- 1.14. Various ATC Structures

-

2. Sector

- 2.1. Primary Sector

- 2.2. Hospital Sector

-

3. Prescription Type

- 3.1. Prescription Drugs (Rx)

- 3.2. OTC Drugs

Denmark Pharmaceutical Industry Segmentation By Geography

- 1. Denmark

Denmark Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Collaboration between Private and Public Sector; Rising Funding for Research and Development

- 3.3. Market Restrains

- 3.3.1. High Tax Rates on Pharmaceutical Products

- 3.4. Market Trends

- 3.4.1. Prescription Drugs (Rx) accounted for the Significant Share of the Total Pharmaceutical Sales in Denmark

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Alimentary Tract and Metabolism

- 5.1.2. Blood and Blood Forming Organs

- 5.1.3. Cardiovascular System

- 5.1.4. Dermatological Drugs

- 5.1.5. Genitourinary System and Reproductive Hormones

- 5.1.6. Systemic

- 5.1.7. Antiinfectives for Systemic Use

- 5.1.8. Antineoplastic and Immunomodulating Agents

- 5.1.9. Musculoskeletal System

- 5.1.10. Nervous System

- 5.1.11. Antipara

- 5.1.12. Respiratory System

- 5.1.13. Sensory Organs

- 5.1.14. Various ATC Structures

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Primary Sector

- 5.2.2. Hospital Sector

- 5.3. Market Analysis, Insights and Forecast - by Prescription Type

- 5.3.1. Prescription Drugs (Rx)

- 5.3.2. OTC Drugs

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Xellia ApS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 H Lundbeck A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda Pharma A/S

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Orifarm Group A/S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Novo Nordisk A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ferring Pharmaceuticals A/S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leo Pharma A/S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FUJIFILM Diosynth Biotechnologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sandoz A/S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ALK-Abell A/S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Xellia ApS

List of Figures

- Figure 1: Denmark Pharmaceutical Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Pharmaceutical Industry Share (%) by Company 2024

List of Tables

- Table 1: Denmark Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Pharmaceutical Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Denmark Pharmaceutical Industry Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 4: Denmark Pharmaceutical Industry Volume K Unit Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 5: Denmark Pharmaceutical Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Denmark Pharmaceutical Industry Volume K Unit Forecast, by Sector 2019 & 2032

- Table 7: Denmark Pharmaceutical Industry Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 8: Denmark Pharmaceutical Industry Volume K Unit Forecast, by Prescription Type 2019 & 2032

- Table 9: Denmark Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Denmark Pharmaceutical Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Denmark Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Denmark Pharmaceutical Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Denmark Pharmaceutical Industry Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 14: Denmark Pharmaceutical Industry Volume K Unit Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 15: Denmark Pharmaceutical Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Denmark Pharmaceutical Industry Volume K Unit Forecast, by Sector 2019 & 2032

- Table 17: Denmark Pharmaceutical Industry Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 18: Denmark Pharmaceutical Industry Volume K Unit Forecast, by Prescription Type 2019 & 2032

- Table 19: Denmark Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Denmark Pharmaceutical Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Pharmaceutical Industry?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Denmark Pharmaceutical Industry?

Key companies in the market include Xellia ApS, H Lundbeck A/S, Takeda Pharma A/S, Orifarm Group A/S, Novo Nordisk A/S, Ferring Pharmaceuticals A/S, Leo Pharma A/S, FUJIFILM Diosynth Biotechnologies, Sandoz A/S, ALK-Abell A/S.

3. What are the main segments of the Denmark Pharmaceutical Industry?

The market segments include ATC/Therapeutic Class, Sector, Prescription Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Collaboration between Private and Public Sector; Rising Funding for Research and Development.

6. What are the notable trends driving market growth?

Prescription Drugs (Rx) accounted for the Significant Share of the Total Pharmaceutical Sales in Denmark.

7. Are there any restraints impacting market growth?

High Tax Rates on Pharmaceutical Products.

8. Can you provide examples of recent developments in the market?

In July 2022, Bavarian Nordic, the Danish company is expanding its production capacity to 10 million doses of the monkeypox vaccine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Denmark Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence