Key Insights

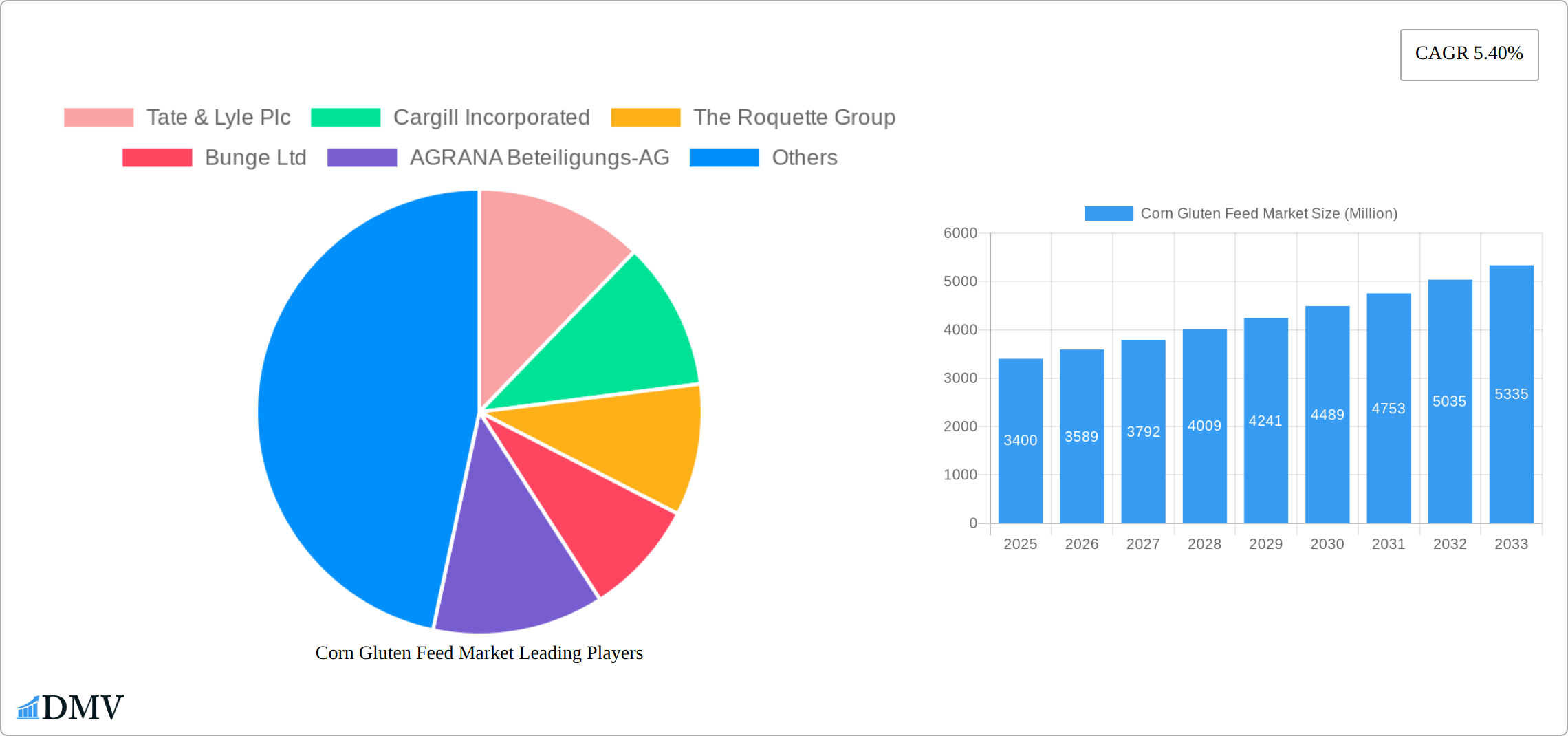

The global corn gluten feed market, valued at $3.40 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.40% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for animal feed, particularly in the swine, poultry, and cattle industries, is a major catalyst. Corn gluten feed offers a cost-effective and nutritious alternative to traditional feed sources, boosting its appeal among livestock producers seeking to optimize feed costs and animal health. Furthermore, the rising global population and growing meat consumption are contributing to increased demand for animal protein, indirectly boosting the market for corn gluten feed. The growing aquaculture sector also presents a significant opportunity, as corn gluten feed is increasingly incorporated into fish and shrimp feed formulations. Geographic expansion into developing economies, where livestock farming is expanding rapidly, is another significant factor driving market growth. However, challenges such as fluctuating corn prices, potential for supply chain disruptions, and the emergence of alternative feed ingredients could present some constraints to market growth. Nevertheless, the overall outlook for the corn gluten feed market remains positive, with substantial growth anticipated over the forecast period.

Corn Gluten Feed Market Market Size (In Billion)

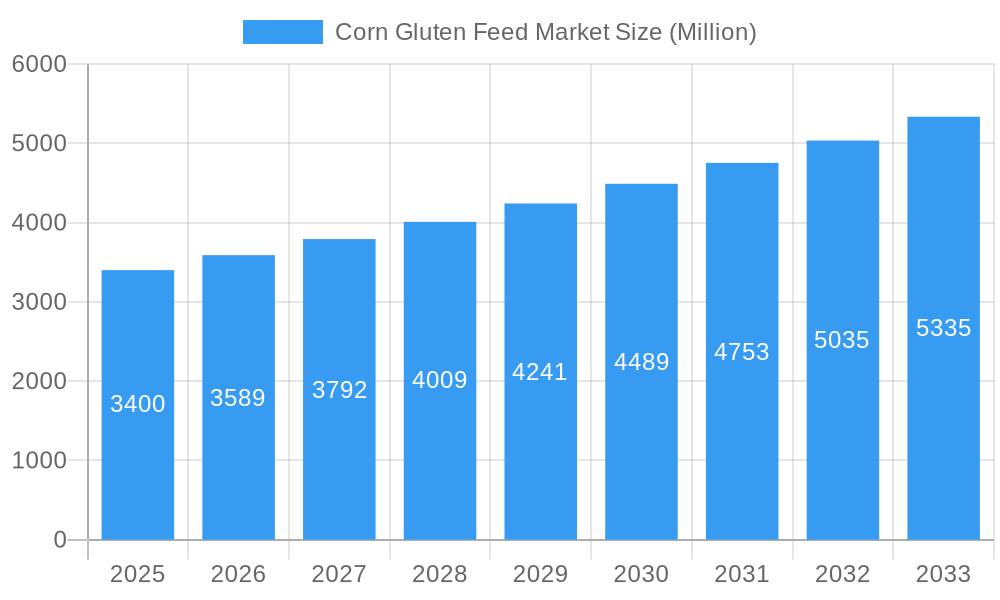

The market segmentation reveals significant opportunities across different applications and regions. North America, with its established livestock industry and large corn production capacity, currently holds a substantial market share. However, the Asia-Pacific region is expected to witness the fastest growth due to rapidly expanding livestock farming and aquaculture activities in countries like China and India. Companies like Tate & Lyle Plc, Cargill Incorporated, and Archer Daniels Midland Company are key players, leveraging their established supply chains and processing capabilities to capture market share. Competition is expected to intensify, with smaller players focusing on niche applications and regional markets. Furthermore, innovative product development and strategic partnerships, including collaborations with feed manufacturers, are crucial for success in this dynamic market. The continued focus on sustainable and environmentally friendly production methods will also shape the future trajectory of the corn gluten feed market.

Corn Gluten Feed Market Company Market Share

Corn Gluten Feed Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Corn Gluten Feed Market, offering a detailed perspective on market dynamics, growth trajectories, and future opportunities. Covering the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this study is essential for stakeholders seeking to understand and capitalize on this dynamic market. The global Corn Gluten Feed Market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Corn Gluten Feed Market Market Composition & Trends

This section delves into the intricate structure of the Corn Gluten Feed market, evaluating its concentration, innovation drivers, regulatory environment, substitute products, and end-user profiles. We analyze mergers and acquisitions (M&A) activity, providing insights into deal values and their impact on market share distribution. The market is moderately consolidated, with key players like Cargill Incorporated, Archer Daniels Midland Company, and Tate & Lyle Plc holding significant shares. However, smaller, specialized companies are also emerging, contributing to increased competition.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Corn Gluten Feed market in 2024 is estimated to be xx, indicating a moderately consolidated market.

- Innovation Catalysts: Advancements in feed formulation and processing technologies, coupled with increasing demand for sustainable and cost-effective animal feed, are driving innovation.

- Regulatory Landscape: Regulations concerning feed safety and environmental impact are influencing market dynamics and driving the adoption of sustainable practices.

- Substitute Products: Soybean meal and other protein sources pose competition, prompting continuous innovation within the Corn Gluten Feed sector.

- End-User Profiles: The primary end-users are the swine, poultry, cattle, and aquaculture industries, each with specific requirements influencing demand.

- M&A Activity: The total value of M&A deals in the Corn Gluten Feed market between 2019 and 2024 is estimated at xx Million, with the average deal size being xx Million. These transactions have primarily focused on expanding production capacity and market reach.

Corn Gluten Feed Market Industry Evolution

The Corn Gluten Feed market has undergone a dynamic transformation, driven by a confluence of factors including escalating livestock production, the persistent demand for cost-effective and nutrient-rich animal sustenance, and evolving consumer preferences. Historically, the market has charted a course of consistent expansion. Technological advancements have been pivotal, with innovations in feed processing and formulation consistently elevating product quality and operational efficiency. More recently, a significant influence has emerged from shifting consumer demands towards animal products that are perceived as sustainably sourced and ethically produced. From 2019 to 2024, the market demonstrated a Compound Annual Growth Rate (CAGR) of **[Insert CAGR % here]**, a trajectory projected to continue its upward movement. This sustained growth is underpinned by a burgeoning global appetite for meat and an increasing requirement for animal feed rich in protein. Emerging technologies, such as precision fermentation, are poised to play a more prominent role in shaping the future landscape of the market, although their current penetration remains nascent at **[Insert Penetration % here]**.

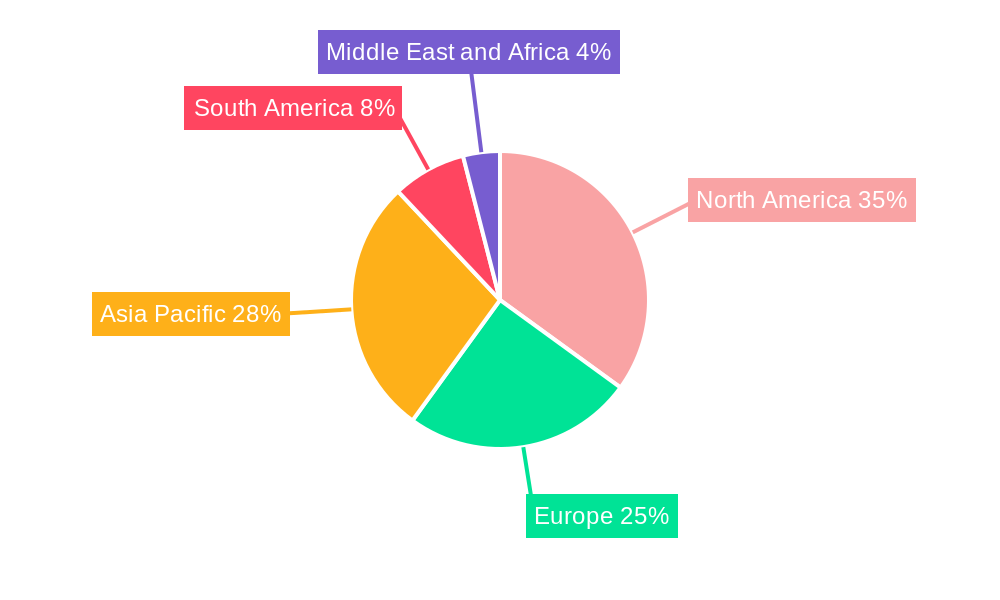

Leading Regions, Countries, or Segments in Corn Gluten Feed Market

This section identifies the dominant regions, countries, and segments within the Corn Gluten Feed market. Analysis reveals that North America currently holds the largest market share, followed by Europe and Asia-Pacific. Within the application segments, the swine and poultry industries are major consumers of Corn Gluten Feed. The high demand in these sectors is driven by the feed's nutritional value and cost-effectiveness.

- Key Drivers for North America's Dominance:

- Large-scale corn production.

- Well-established livestock industry.

- Strong government support for agricultural development.

- Key Drivers for Swine Feed Segment Dominance:

- High nutritional value of Corn Gluten Feed for swine.

- Cost-effectiveness compared to alternative feed sources.

- Increasing global swine production.

- Significant investments in swine farming infrastructure.

The analysis also considers other sources like Wheat, Corn, Barley, Rye and Maize, revealing Corn as the dominant source.

Corn Gluten Feed Market Product Innovations

Recent strides in Corn Gluten Feed have predominantly centered on optimizing its nutritional density and enhancing its inherent digestibility. A key trend is the development of highly specialized formulations meticulously engineered to cater to the distinct nutritional requirements of various animal species. This strategic approach involves augmenting protein content and refining amino acid profiles, which directly translates to improved animal growth rates and more efficient feed conversion ratios. These advancements are synergistically supported by state-of-the-art processing technologies, ensuring the delivery of a consistently superior and high-quality product to the market.

Propelling Factors for Corn Gluten Feed Market Growth

The robust expansion of the Corn Gluten Feed market is propelled by a multifaceted interplay of driving forces. Foremost among these is the escalating global demand for animal protein, which, in turn, amplifies the need for animal feed that is both economically viable and nutritionally complete. Complementing this is the continuous stream of technological advancements in corn processing and feed formulation, which consistently elevate product efficacy and operational efficiency. Furthermore, a supportive ecosystem of government policies and regulations, which champion and promote sustainable agricultural practices, is actively encouraging the broader adoption and integration of Corn Gluten Feed within the industry.

Obstacles in the Corn Gluten Feed Market Market

Despite the positive outlook, the Corn Gluten Feed market faces certain challenges. Fluctuations in corn prices can impact the cost of production and profitability. Supply chain disruptions due to weather patterns or geopolitical events can cause shortages. Competition from alternative protein sources also presents a significant challenge. The cumulative effect of these challenges could potentially lead to a xx% reduction in market growth during periods of significant disruption.

Future Opportunities in Corn Gluten Feed Market

The Corn Gluten Feed market is ripe with promising avenues for future expansion and innovation. A significant opportunity lies in strategically penetrating new geographical markets, with a particular focus on developing economies that are experiencing burgeoning livestock sectors. Technological innovation remains a critical frontier, with developments in precision fermentation and the creation of novel feed formulations expected to substantially enhance the product's intrinsic value proposition. Moreover, the growing consumer consciousness regarding sustainability and ethical sourcing in animal product consumption presents a compelling opportunity for market players to differentiate themselves by championing and transparently communicating their commitment to environmentally responsible practices throughout their production chains.

Major Players in the Corn Gluten Feed Market Ecosystem

- Tate & Lyle Plc

- Cargill Incorporated

- The Roquette Group

- Bunge Ltd

- AGRANA Beteiligungs-AG

- Archer Daniels Midland Company

- Aemetis

- Tereos

- Ingredion Incorporated

- Commodity Specialists Company

Key Developments in Corn Gluten Feed Market Industry

- 2023-Q3: Cargill Incorporated announced a significant expansion of its corn processing facility, boosting production capacity to meet growing demand. This strategic investment underscores the company's commitment to strengthening its market presence.

- 2022-Q4: Archer Daniels Midland Company unveiled a new generation of high-protein Corn Gluten Feed formulations, specifically designed to optimize performance within the demanding poultry industry. This innovation reflects a focus on specialized solutions.

- 2021-Q2: Tate & Lyle Plc made a substantial investment in cutting-edge research and development initiatives aimed at further improving the digestibility and bioavailability of its Corn Gluten Feed products. This commitment to R&D highlights a dedication to product enhancement.

- Further granular details and analysis on other significant developments, including emerging players and regional market shifts, will be elaborated upon in the comprehensive full report.

Strategic Corn Gluten Feed Market Market Forecast

The Corn Gluten Feed market is poised for continued growth, driven by increasing global demand for animal protein, technological advancements, and favorable regulatory policies. Emerging markets and innovative product formulations offer significant opportunities for expansion and market share gains. The long-term outlook for the Corn Gluten Feed market remains positive, projecting substantial growth over the next decade, despite potential challenges related to fluctuating commodity prices and supply chain stability.

Corn Gluten Feed Market Segmentation

-

1. Source

- 1.1. Wheat

- 1.2. Corn

- 1.3. Barley

- 1.4. Rye

- 1.5. Maize

- 1.6. Others

-

2. Application

- 2.1. Swine

- 2.2. Poultry

- 2.3. Cattle

- 2.4. Aquaculture

Corn Gluten Feed Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Rest of Middle East and Africa

Corn Gluten Feed Market Regional Market Share

Geographic Coverage of Corn Gluten Feed Market

Corn Gluten Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Animal-Based Protein Sources

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Corn Gluten Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Wheat

- 5.1.2. Corn

- 5.1.3. Barley

- 5.1.4. Rye

- 5.1.5. Maize

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Swine

- 5.2.2. Poultry

- 5.2.3. Cattle

- 5.2.4. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North America Corn Gluten Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Wheat

- 6.1.2. Corn

- 6.1.3. Barley

- 6.1.4. Rye

- 6.1.5. Maize

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Swine

- 6.2.2. Poultry

- 6.2.3. Cattle

- 6.2.4. Aquaculture

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Europe Corn Gluten Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Wheat

- 7.1.2. Corn

- 7.1.3. Barley

- 7.1.4. Rye

- 7.1.5. Maize

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Swine

- 7.2.2. Poultry

- 7.2.3. Cattle

- 7.2.4. Aquaculture

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Asia Pacific Corn Gluten Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Wheat

- 8.1.2. Corn

- 8.1.3. Barley

- 8.1.4. Rye

- 8.1.5. Maize

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Swine

- 8.2.2. Poultry

- 8.2.3. Cattle

- 8.2.4. Aquaculture

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. South America Corn Gluten Feed Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Wheat

- 9.1.2. Corn

- 9.1.3. Barley

- 9.1.4. Rye

- 9.1.5. Maize

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Swine

- 9.2.2. Poultry

- 9.2.3. Cattle

- 9.2.4. Aquaculture

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Middle East and Africa Corn Gluten Feed Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Wheat

- 10.1.2. Corn

- 10.1.3. Barley

- 10.1.4. Rye

- 10.1.5. Maize

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Swine

- 10.2.2. Poultry

- 10.2.3. Cattle

- 10.2.4. Aquaculture

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tate & Lyle Plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cargill Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Roquette Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bunge Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AGRANA Beteiligungs-AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Archer Daniels Midland Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aemetis*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tereos

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ingredion Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Commodity Specialists Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tate & Lyle Plc

List of Figures

- Figure 1: Corn Gluten Feed Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Corn Gluten Feed Market Share (%) by Company 2025

List of Tables

- Table 1: Corn Gluten Feed Market Revenue Million Forecast, by Source 2020 & 2033

- Table 2: Corn Gluten Feed Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Corn Gluten Feed Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Corn Gluten Feed Market Revenue Million Forecast, by Source 2020 & 2033

- Table 5: Corn Gluten Feed Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Corn Gluten Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Corn Gluten Feed Market Revenue Million Forecast, by Source 2020 & 2033

- Table 12: Corn Gluten Feed Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Corn Gluten Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Corn Gluten Feed Market Revenue Million Forecast, by Source 2020 & 2033

- Table 21: Corn Gluten Feed Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Corn Gluten Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Corn Gluten Feed Market Revenue Million Forecast, by Source 2020 & 2033

- Table 28: Corn Gluten Feed Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Corn Gluten Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Corn Gluten Feed Market Revenue Million Forecast, by Source 2020 & 2033

- Table 34: Corn Gluten Feed Market Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Corn Gluten Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: South Africa Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Corn Gluten Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Corn Gluten Feed Market?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the Corn Gluten Feed Market?

Key companies in the market include Tate & Lyle Plc, Cargill Incorporated, The Roquette Group, Bunge Ltd, AGRANA Beteiligungs-AG, Archer Daniels Midland Company, Aemetis*List Not Exhaustive, Tereos, Ingredion Incorporated, Commodity Specialists Company.

3. What are the main segments of the Corn Gluten Feed Market?

The market segments include Source, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Demand for Animal-Based Protein Sources.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Corn Gluten Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Corn Gluten Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Corn Gluten Feed Market?

To stay informed about further developments, trends, and reports in the Corn Gluten Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence