Key Insights

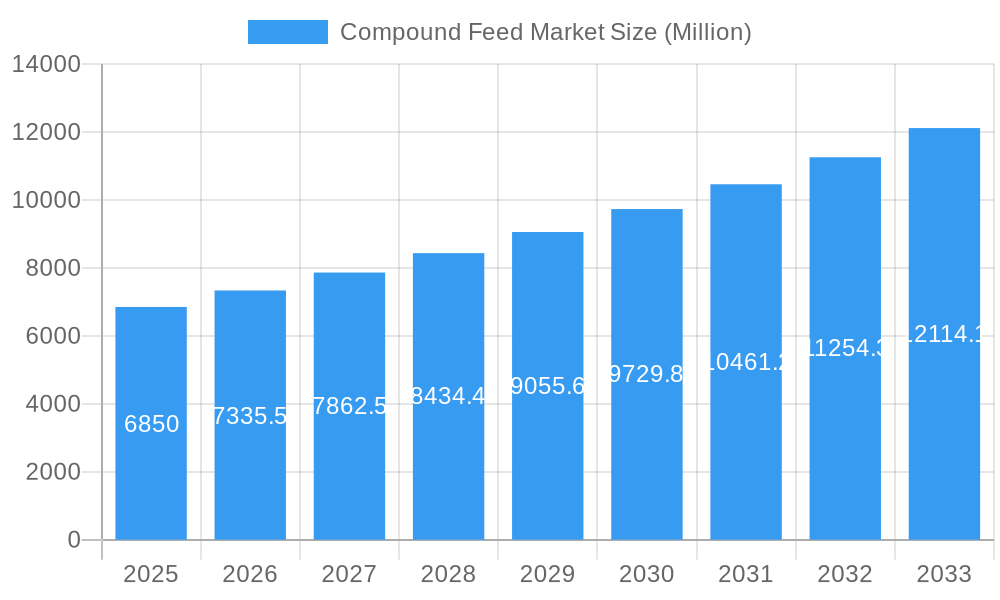

The GCC compound feed market, valued at $6.85 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033. This expansion is fueled by several key factors. The rising demand for animal protein in the region, coupled with the increasing intensification of livestock farming, necessitates higher volumes of efficient and nutritious compound feed. Furthermore, the growing awareness of animal health and productivity among farmers is driving the adoption of specialized feed formulations enriched with vitamins, minerals, and prebiotics. The diversification of animal protein sources, including poultry, ruminants, and aquaculture, further contributes to market expansion. Competition among established players like Parabel, Al-Sayer Group, and Agthia, alongside regional players, fosters innovation and the introduction of new product formulations catering to specific animal needs and dietary requirements. Challenges include fluctuating raw material prices, particularly cereals and by-products, which impact production costs and profitability. However, ongoing investments in research and development, particularly in sustainable and locally sourced ingredients, are expected to mitigate these challenges and support long-term market growth.

Compound Feed Market Market Size (In Billion)

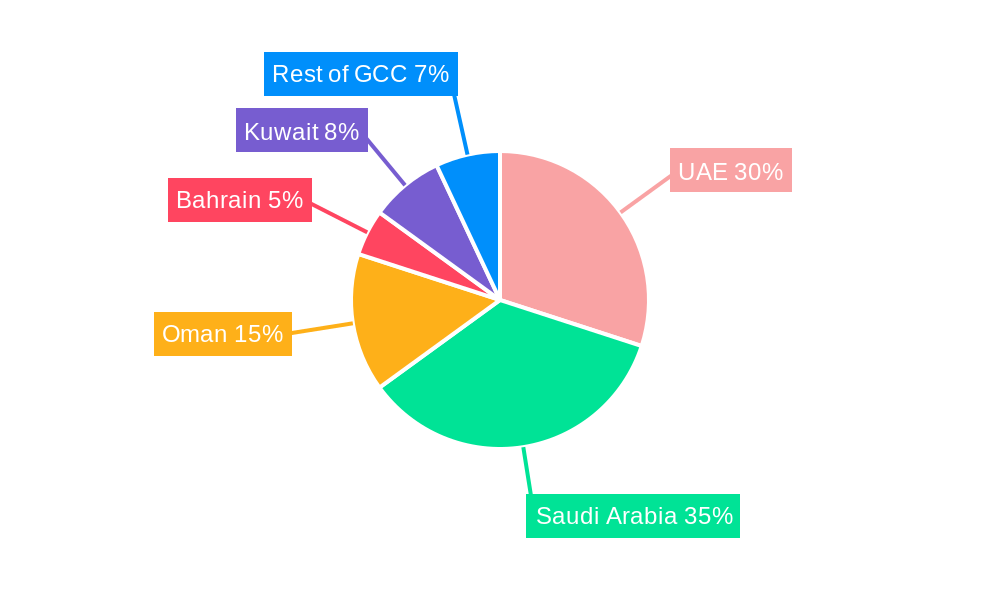

The segmentation of the market reveals significant opportunities within specific animal types and ingredient categories. Ruminants, poultry, and swine remain dominant segments, while aquaculture is witnessing impressive growth driven by rising seafood consumption. Within ingredients, cereals and cakes & meals form the backbone of compound feed formulations, while the demand for specialized supplements continues to increase. Regional variations exist within the GCC, with the UAE, Saudi Arabia, and Oman representing the largest markets. Future growth will be influenced by government policies promoting sustainable livestock farming and food security, as well as technological advancements in feed production and formulation. The continuous focus on improving feed efficiency and animal welfare will also shape market dynamics throughout the forecast period.

Compound Feed Market Company Market Share

Compound Feed Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Compound Feed Market, offering a detailed examination of market trends, competitive landscape, and future growth prospects from 2019 to 2033. The study encompasses key segments including animal type (ruminants, poultry, swine, aquaculture, and others) and ingredients (cereals, cakes & meals, by-products, and supplements), providing stakeholders with a granular understanding of this dynamic market valued at xx Million in 2025. The report leverages extensive primary and secondary research, offering actionable insights for informed decision-making. The base year for this report is 2025, with the forecast period spanning 2025-2033 and the historical period covering 2019-2024.

Compound Feed Market Composition & Trends

This section delves into the intricate structure of the compound feed market, evaluating its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market's competitive intensity is analyzed, revealing the market share distribution among key players like Parabel, Al-Sayer Group, Agthia, Al Ghurair Foods Llc, Oman Flour Mills Company, Omani National Livestock Development Co, Fujairah Feed Factor, Arasco, Delmon Poultry Compan, IFFCO, and Trouw Nutrition. We examine the impact of regulatory changes on market dynamics, identify key substitute products, and profile the end-user segments driving market growth. Furthermore, the report assesses the strategic implications of recent M&A activities, including deal values (estimated at xx Million collectively in the past five years).

- Market Concentration: Highly fragmented with top 5 players holding approximately xx% market share in 2025.

- Innovation Catalysts: Focus on sustainable feed solutions, precision feeding technologies, and improved feed efficiency.

- Regulatory Landscape: Stringent regulations regarding feed safety and animal welfare are shaping market practices.

- Substitute Products: Limited direct substitutes, but alternative protein sources (e.g., insect meal) are gaining traction.

- End-User Profiles: Dominated by large-scale commercial farms and increasingly by smaller, specialized farms.

- M&A Activities: Consolidation expected to increase, driven by economies of scale and expansion into new markets.

Compound Feed Market Industry Evolution

The compound feed market has witnessed a dynamic evolution, characterized by consistent growth and increasing sophistication. From 2019 to 2025, the industry experienced a significant expansion, and projections indicate continued robust performance until 2033. This growth is underpinned by relentless technological advancements. Precision feeding technologies, which optimize nutrient delivery and minimize waste, alongside sophisticated feed formulation techniques, are pivotal in enhancing both efficiency and overall productivity across livestock operations. Simultaneously, a significant shift in consumer preferences is reshaping the market. The growing demand for sustainably produced animal products is directly influencing feed manufacturers to prioritize and develop eco-friendly feed solutions, further driving innovation. The market is anticipated to achieve a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period, propelled by the ever-increasing global demand for meat and the expansion of livestock farming globally. Innovations in feed formulation and advanced delivery systems have demonstrably improved feed conversion ratios and led to a reduction in operational costs for producers.

Leading Regions, Countries, or Segments in Compound Feed Market

A detailed analysis of the compound feed market reveals distinct leadership across various geographical regions, countries, and specific segments. The Asia-Pacific region is projected to maintain its dominant position, largely attributed to its rapid economic growth and a burgeoning demand for animal protein. Within the diverse animal type landscape, Poultry and Ruminants stand out as the leading segments, reflecting their substantial contribution to global meat and dairy production. On the ingredient front, Cereals and By-products continue to be the most significant categories, forming the foundational components of many compound feed formulations.

-

Key Drivers for Asia-Pacific Dominance:

- Rapidly Expanding Livestock Sector: Fueled by a growing global population and a rising per capita income, leading to increased consumption of animal protein.

- Government Support for Agricultural Development: Strategic investments in subsidies, infrastructure development, and research initiatives are bolstering the agricultural and livestock sectors.

- Growing Adoption of Advanced Farming Techniques: The embrace of modern, efficient, and technology-driven farming practices is significantly enhancing livestock productivity and overall efficiency.

-

Key Drivers for Poultry Segment Dominance:

- High Demand for Poultry Products: Poultry remains a preferred choice due to its affordability, versatility in culinary applications, and relatively straightforward production processes.

- Superior Feed Conversion Ratio: Poultry exhibits a significantly higher feed conversion efficiency compared to many other livestock types, making it economically attractive for feed producers.

- Continuous Innovation in Poultry Feed Formulations: Ongoing research and development in poultry feed are focused on optimizing nutrient profiles, enhancing gut health, and improving disease resistance, leading to greater efficiency and healthier flocks.

-

Key Drivers for Cereals Segment Dominance:

- Wide Availability and Affordability: Cereals are abundantly available globally, making them a cost-effective and accessible primary ingredient for compound feeds.

- High Nutritional Value: These ingredients are rich sources of essential carbohydrates and energy, crucial for the growth, development, and overall well-being of various livestock species.

- Established Supply Chains: Robust and well-developed global supply chains ensure reliable sourcing, efficient logistics, and consistent availability for feed manufacturers.

Compound Feed Market Product Innovations

Recent innovations in compound feed include the development of novel feed additives that enhance animal health, improve feed conversion ratios, and reduce environmental impact. The use of precision feeding technologies allows for customized feed formulations tailored to specific animal needs and production goals, leading to increased efficiency and reduced feed waste. Furthermore, the integration of data analytics and AI allows for optimized feed management and improved traceability throughout the supply chain. These advancements are transforming the compound feed industry, driving market growth and enhancing the sustainability of animal farming.

Propelling Factors for Compound Feed Market Growth

Several factors are driving the growth of the compound feed market. The expanding global population and rising per capita income have increased demand for animal protein. Technological advancements in feed formulation and delivery systems have improved feed efficiency and reduced costs. Moreover, supportive government policies and initiatives in several regions are fostering the growth of the livestock sector.

Obstacles in the Compound Feed Market

The compound feed market, while experiencing robust growth, navigates a complex landscape of challenges. Fluctuating raw material prices, driven by factors such as weather patterns, geopolitical events, and global demand, can significantly impact production costs and profit margins. Stringent regulatory requirements concerning feed safety, composition, and environmental impact necessitate continuous compliance and investment in quality control. Furthermore, the increasing competition from both established players and emerging market entrants intensifies pressure on pricing and innovation. Supply chain disruptions, as highlighted by recent global events, can pose substantial risks to production continuity and the timely availability of essential ingredients. The growing imperative for sustainable and environmentally friendly feed solutions, while a significant opportunity for forward-thinking companies, also presents a challenge in terms of research, development, and the integration of new, sustainable practices and ingredients into existing production models.

Future Opportunities in Compound Feed Market

Future opportunities exist in developing innovative feed solutions that address sustainability concerns, improve animal health, and enhance production efficiency. The increasing adoption of precision feeding technologies and the use of data analytics are expected to drive market growth. Expanding into new markets and tapping into emerging consumer trends will also create significant opportunities for compound feed manufacturers.

Major Players in the Compound Feed Market Ecosystem

- Parabel

- Al-Sayer Group

- Agthia

- Al Ghurair Foods Llc

- Oman Flour Mills Company

- Omani National Livestock Development Co

- Fujairah Feed Factor

- Arasco

- Delmon Poultry Compan

- IFFCO

- Trouw Nutrition

Key Developments in Compound Feed Market Industry

- 2023-Q3: IFFCO unveiled an innovative new line of sustainable compound feed, emphasizing reduced environmental impact and enhanced animal welfare.

- 2022-Q4: Al-Sayer Group strategically expanded its market presence by acquiring a smaller, regional feed producer, aiming to consolidate its market share and operational capabilities.

- 2021-Q2: New and more rigorous regulations pertaining to feed additives were implemented across several key global markets, requiring manufacturers to adapt their formulations and sourcing strategies.

- 2020-Q1: The global compound feed industry experienced significant supply chain disruptions and operational adjustments directly attributed to the widespread impact of the COVID-19 pandemic.

Strategic Compound Feed Market Market Forecast

The compound feed market is poised for significant growth in the coming years, driven by several factors including population growth, rising meat consumption, and ongoing technological advancements. The focus on sustainable and efficient feed solutions will continue to shape the market landscape, presenting opportunities for companies that can innovate and adapt to these evolving demands. This translates into a robust market with significant potential for continued expansion over the forecast period.

Compound Feed Market Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-products

- 2.4. Supplements

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. Oman

- 3.4. Bahrain

- 3.5. Kuwait

- 3.6. Rest of GCC Countries

Compound Feed Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Oman

- 4. Bahrain

- 5. Kuwait

- 6. Rest of GCC Countries

Compound Feed Market Regional Market Share

Geographic Coverage of Compound Feed Market

Compound Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Poultry Feed Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Oman

- 5.3.4. Bahrain

- 5.3.5. Kuwait

- 5.3.6. Rest of GCC Countries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. Oman

- 5.4.4. Bahrain

- 5.4.5. Kuwait

- 5.4.6. Rest of GCC Countries

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. United Arab Emirates Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes & Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. Oman

- 6.3.4. Bahrain

- 6.3.5. Kuwait

- 6.3.6. Rest of GCC Countries

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Saudi Arabia Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes & Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. Oman

- 7.3.4. Bahrain

- 7.3.5. Kuwait

- 7.3.6. Rest of GCC Countries

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Oman Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes & Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. Oman

- 8.3.4. Bahrain

- 8.3.5. Kuwait

- 8.3.6. Rest of GCC Countries

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Bahrain Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes & Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. Oman

- 9.3.4. Bahrain

- 9.3.5. Kuwait

- 9.3.6. Rest of GCC Countries

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Kuwait Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminants

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Cakes & Meals

- 10.2.3. By-products

- 10.2.4. Supplements

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. United Arab Emirates

- 10.3.2. Saudi Arabia

- 10.3.3. Oman

- 10.3.4. Bahrain

- 10.3.5. Kuwait

- 10.3.6. Rest of GCC Countries

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Rest of GCC Countries Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 11.1.1. Ruminants

- 11.1.2. Poultry

- 11.1.3. Swine

- 11.1.4. Aquaculture

- 11.1.5. Other Animal Types

- 11.2. Market Analysis, Insights and Forecast - by Ingredient

- 11.2.1. Cereals

- 11.2.2. Cakes & Meals

- 11.2.3. By-products

- 11.2.4. Supplements

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. United Arab Emirates

- 11.3.2. Saudi Arabia

- 11.3.3. Oman

- 11.3.4. Bahrain

- 11.3.5. Kuwait

- 11.3.6. Rest of GCC Countries

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Parabel

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Al-Sayer Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Agthia

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Al Ghurair Foods Llc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Oman Flour Mills Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Omani National Livestock Development Co

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fujairah Feed Factor

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Arasco

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Delmon Poultry Compan

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 IFFCO

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Trouw Nutrition

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Parabel

List of Figures

- Figure 1: Global Compound Feed Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United Arab Emirates Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 3: United Arab Emirates Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: United Arab Emirates Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 5: United Arab Emirates Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 6: United Arab Emirates Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 7: United Arab Emirates Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United Arab Emirates Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 9: United Arab Emirates Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Saudi Arabia Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 11: Saudi Arabia Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: Saudi Arabia Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 13: Saudi Arabia Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 14: Saudi Arabia Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 15: Saudi Arabia Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Saudi Arabia Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Saudi Arabia Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Oman Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 19: Oman Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 20: Oman Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 21: Oman Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 22: Oman Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 23: Oman Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Oman Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Oman Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Bahrain Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 27: Bahrain Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Bahrain Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 29: Bahrain Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 30: Bahrain Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 31: Bahrain Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Bahrain Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Bahrain Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Kuwait Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 35: Kuwait Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 36: Kuwait Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 37: Kuwait Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 38: Kuwait Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 39: Kuwait Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Kuwait Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Kuwait Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of GCC Countries Compound Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 43: Rest of GCC Countries Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 44: Rest of GCC Countries Compound Feed Market Revenue (Million), by Ingredient 2025 & 2033

- Figure 45: Rest of GCC Countries Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 46: Rest of GCC Countries Compound Feed Market Revenue (Million), by Geography 2025 & 2033

- Figure 47: Rest of GCC Countries Compound Feed Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of GCC Countries Compound Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Rest of GCC Countries Compound Feed Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 2: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 3: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Compound Feed Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 7: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 10: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 11: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 14: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 15: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 18: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 19: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 22: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 23: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Compound Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 26: Global Compound Feed Market Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 27: Global Compound Feed Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Compound Feed Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compound Feed Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Compound Feed Market?

Key companies in the market include Parabel, Al-Sayer Group, Agthia, Al Ghurair Foods Llc, Oman Flour Mills Company, Omani National Livestock Development Co, Fujairah Feed Factor, Arasco, Delmon Poultry Compan, IFFCO, Trouw Nutrition.

3. What are the main segments of the Compound Feed Market?

The market segments include Animal Type, Ingredient, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Poultry Feed Dominates the Market.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compound Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compound Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compound Feed Market?

To stay informed about further developments, trends, and reports in the Compound Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence