Key Insights

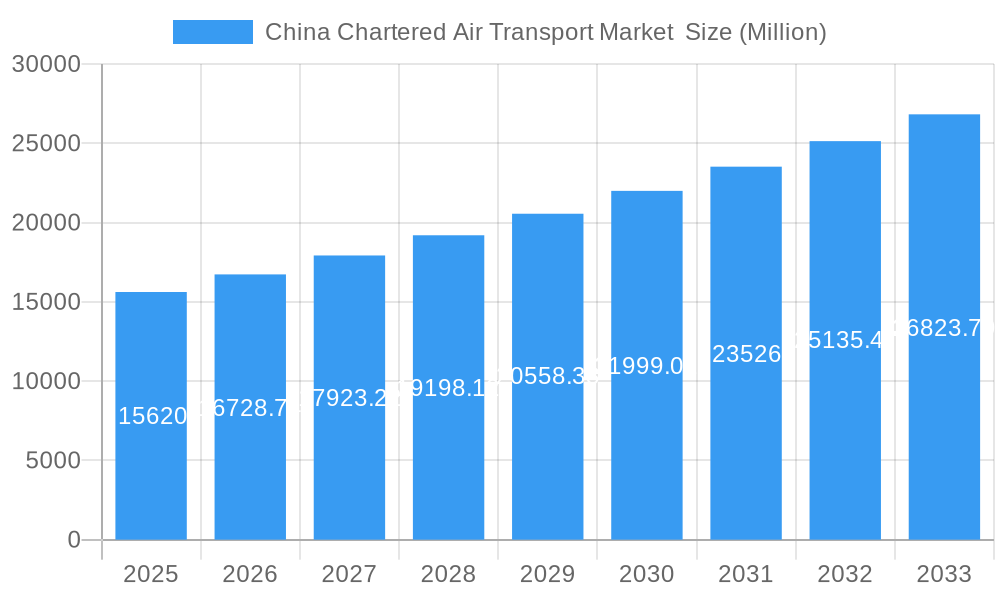

The China chartered air transport market, valued at $15.62 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.07% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for efficient logistics solutions within China's burgeoning e-commerce sector significantly contributes to market growth. Furthermore, the rising affluence of the Chinese population is driving demand for private and luxury air travel, further boosting the chartered air transport segment. Specific cargo types, such as time-critical cargo (pharmaceuticals, high-value goods), heavy and oversized cargo (machinery, industrial components), and dangerous goods, are significant drivers. Government initiatives aimed at improving infrastructure and streamlining regulations within the aviation sector are also supportive of market expansion. The diverse range of players, including established airlines like China Southern Airlines General Aviation and specialized operators such as Deerjet and Reignwood Star General Aviation, adds competitive dynamism and service diversification. However, potential challenges like fluctuating fuel prices and the need for continuous investment in advanced technologies and skilled personnel could influence market trajectory.

China Chartered Air Transport Market Market Size (In Billion)

The segmentation reveals a diverse market landscape. Time-critical cargo likely commands the largest share due to the premium placed on speed and reliability. The heavy and oversized cargo segment is expected to experience strong growth due to the expansion of manufacturing and infrastructure projects. Animal transportation represents a niche but potentially lucrative segment, while the 'other cargo types' category encompasses a variety of goods with varying growth potential. Regional analysis, although limited to China in this data, suggests a concentrated market with opportunities for growth across different provinces and regions, depending on industrial development and infrastructure investments. The forecast period of 2025-2033 suggests continued market expansion, with potential adjustments based on economic shifts and regulatory developments. The historical period (2019-2024) likely served as a foundation for understanding the current market dynamics and informed projections for the future.

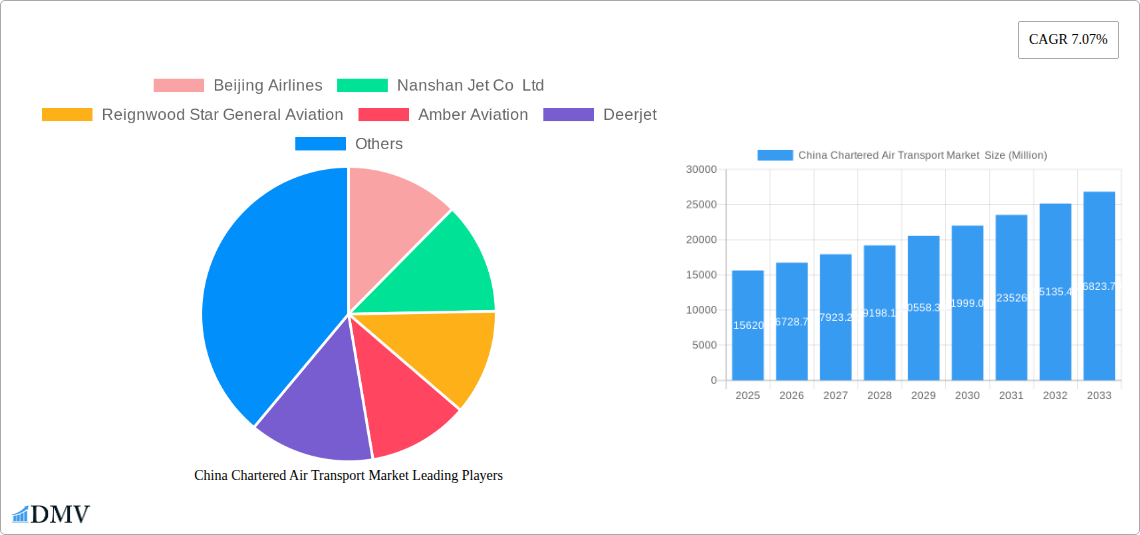

China Chartered Air Transport Market Company Market Share

China Chartered Air Transport Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic China chartered air transport market, offering crucial insights for stakeholders seeking to navigate this rapidly evolving landscape. With a comprehensive study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report delivers a robust understanding of past performance, present dynamics, and future projections. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033.

China Chartered Air Transport Market Composition & Trends

This section dissects the intricate structure of the China chartered air transport market, examining market concentration, innovative drivers, regulatory frameworks, substitute offerings, end-user profiles, and mergers & acquisitions (M&A) activity. The market exhibits a moderately concentrated structure, with key players like Beijing Airlines and China Southern Airlines General Aviation holding significant shares. However, numerous smaller operators such as Nanshan Jet Co Ltd, Reignwood Star General Aviation, and Deerjet contribute to market dynamism.

- Market Share Distribution: Beijing Airlines holds an estimated xx% market share in 2025, followed by China Southern Airlines General Aviation at xx%. Smaller players collectively account for approximately xx%.

- Innovation Catalysts: Technological advancements in aircraft technology, improved logistics software, and the growing adoption of data analytics are key drivers of innovation.

- Regulatory Landscape: The Civil Aviation Administration of China (CAAC) plays a crucial role in shaping market regulations, influencing safety standards, and operational guidelines. Stringent regulations contribute to a safer yet potentially more complex operating environment.

- Substitute Products: While limited direct substitutes exist, ground transportation options such as high-speed rail present indirect competition for certain cargo types.

- End-User Profiles: The market caters to a diverse range of end-users, including businesses needing time-sensitive cargo delivery, e-commerce companies requiring rapid delivery solutions, and specialized industries handling dangerous goods, animals, and oversized cargo.

- M&A Activities: The historical period (2019-2024) witnessed several M&A deals, with a total estimated value of XX Million. Consolidation is expected to continue as larger players aim for increased market share and operational efficiency.

China Chartered Air Transport Market Industry Evolution

This section delves into the evolutionary trajectory of the China chartered air transport market. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, driven by factors such as the expansion of e-commerce, the surge in cross-border trade, and the increasing demand for efficient logistics solutions. The forecast period (2025-2033) projects a CAGR of xx%, fueled by the ongoing development of China's infrastructure and a growing emphasis on supply chain optimization. The adoption of advanced technologies such as real-time tracking systems and predictive maintenance is further accelerating market expansion.

Technological advancements, particularly in aircraft design and operational efficiency, are significant factors shaping industry evolution. The development of more fuel-efficient aircraft and enhanced flight management systems is reducing operational costs and improving service delivery. Shifting consumer demands, characterized by increased expectations for speed, reliability, and transparency in logistics, are driving the adoption of advanced tracking and communication technologies.

Leading Regions, Countries, or Segments in China Chartered Air Transport Market

The coastal regions of China, particularly the Yangtze River Delta (including Shanghai, Zhejiang, and Jiangsu) and the Pearl River Delta (including Guangdong), dominate the chartered air transport market. This dominance stems from their high concentration of manufacturing, export-oriented businesses, and extensive port facilities. The Time Critical Cargo segment holds the largest market share, propelled by the demand for expedited delivery in industries such as pharmaceuticals and high-tech manufacturing.

Key Drivers for Dominant Regions:

- High economic activity: Concentrated industrial hubs and thriving economies fuel high demand for fast and reliable transportation.

- Extensive infrastructure: Well-developed airports and logistics networks enhance operational efficiency.

- Government support: Favorable policies and initiatives promoting economic development foster growth in the air charter sector.

Key Drivers for Time Critical Cargo Segment:

- E-commerce boom: The rapid expansion of online retail intensifies the demand for speedy deliveries.

- Pharmaceutical industry growth: Time-sensitive pharmaceuticals necessitate urgent transportation solutions.

- High-value goods: The need to transport high-value, perishable, or sensitive goods quickly drives the demand for charter services.

China Chartered Air Transport Market Product Innovations

Recent innovations focus on enhanced tracking and monitoring systems, offering real-time visibility of cargo location and status. The implementation of blockchain technology in some operations is improving transparency and security. Specialized aircraft modifications, such as temperature-controlled compartments and reinforced cargo bays, cater to specific industry needs. These innovations directly impact performance metrics, reducing delivery times, lowering losses, and improving overall customer satisfaction. Unique selling propositions revolve around enhanced speed, reliability, and customized solutions tailored to individual clients’ needs.

Propelling Factors for China Chartered Air Transport Market Growth

Several factors fuel the market's robust growth. The burgeoning e-commerce sector necessitates rapid and efficient logistics solutions, driving demand for air charter services. Government initiatives supporting infrastructure development and the expansion of international trade further contribute to market expansion. Technological advancements like improved flight tracking and management systems enhance operational efficiency and reduce costs. The increasing demand for specialized cargo transport, such as temperature-sensitive goods and hazardous materials, presents significant opportunities for growth.

Obstacles in the China Chartered Air Transport Market Market

Despite its potential, the market faces obstacles. Stringent regulatory requirements can complicate operations and increase compliance costs. Fluctuations in fuel prices and potential supply chain disruptions due to geopolitical events affect profitability. Intense competition among various players, particularly within the smaller segments, can impact market margins. These factors need careful consideration for effective market participation.

Future Opportunities in China Chartered Air Transport Market

Emerging opportunities exist in the expansion of air freight to less-served regions, leveraging technological advancements for improved efficiency and reduced costs. Further penetration into specialized markets like the transport of perishable goods, pharmaceuticals, and high-value items can create significant revenue streams. The growing adoption of sustainable aviation fuels and the development of carbon offsetting schemes could open new avenues for environmentally conscious operators.

Major Players in the China Chartered Air Transport Market Ecosystem

- Beijing Airlines

- Nanshan Jet Co Ltd

- Reignwood Star General Aviation

- Amber Aviation

- Deerjet

- ZYB Lily Jet Ltd

- China Southern Airlines General Aviation

- Sino Jet

- Baa Jet Management Ltd

- Donghai Jet Co Ltd

- Jiangsu Jet

Key Developments in China Chartered Air Transport Market Industry

- October 2023: Air Charter Services expands its presence in Shanghai and surrounding provinces, signaling increased focus on this key market region.

- July 2023: Jayud launches new air charter services, strengthening its Southeast Asian presence and enhancing customer reach.

Strategic China Chartered Air Transport Market Market Forecast

The China chartered air transport market is poised for continued growth, driven by robust economic expansion, rising e-commerce activity, and technological advancements. Opportunities abound in niche segments and in expanding services to underserved regions. Strategic investments in infrastructure and technological upgrades will play a vital role in shaping the market's future trajectory, creating both opportunities and challenges for market players.

China Chartered Air Transport Market Segmentation

-

1. type

- 1.1. Time Critical Cargo

- 1.2. Heavy and Oversized Cargo

- 1.3. Dangerous Cargo

- 1.4. Animal Transportation

- 1.5. Other Cargo Types

China Chartered Air Transport Market Segmentation By Geography

- 1. China

China Chartered Air Transport Market Regional Market Share

Geographic Coverage of China Chartered Air Transport Market

China Chartered Air Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for businesses; Increasing disposable income

- 3.3. Market Restrains

- 3.3.1. Regulatory challenges; Infrastructure limitations

- 3.4. Market Trends

- 3.4.1. Booming Chartered Freight Transport Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Chartered Air Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by type

- 5.1.1. Time Critical Cargo

- 5.1.2. Heavy and Oversized Cargo

- 5.1.3. Dangerous Cargo

- 5.1.4. Animal Transportation

- 5.1.5. Other Cargo Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Beijing Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nanshan Jet Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reignwood Star General Aviation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amber Aviation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deerjet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ZYB Lily Jet Ltd *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Southern Airlines General Aviation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sino Jet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baa Jet Management Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Donghai Jet Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jiangsu Jet

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Beijing Airlines

List of Figures

- Figure 1: China Chartered Air Transport Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Chartered Air Transport Market Share (%) by Company 2025

List of Tables

- Table 1: China Chartered Air Transport Market Revenue Million Forecast, by type 2020 & 2033

- Table 2: China Chartered Air Transport Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: China Chartered Air Transport Market Revenue Million Forecast, by type 2020 & 2033

- Table 4: China Chartered Air Transport Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Chartered Air Transport Market ?

The projected CAGR is approximately 7.07%.

2. Which companies are prominent players in the China Chartered Air Transport Market ?

Key companies in the market include Beijing Airlines, Nanshan Jet Co Ltd, Reignwood Star General Aviation, Amber Aviation, Deerjet, ZYB Lily Jet Ltd *List Not Exhaustive, China Southern Airlines General Aviation, Sino Jet, Baa Jet Management Ltd, Donghai Jet Co Ltd, Jiangsu Jet.

3. What are the main segments of the China Chartered Air Transport Market ?

The market segments include type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for businesses; Increasing disposable income.

6. What are the notable trends driving market growth?

Booming Chartered Freight Transport Segment.

7. Are there any restraints impacting market growth?

Regulatory challenges; Infrastructure limitations.

8. Can you provide examples of recent developments in the market?

October 2023: Air Charter Services, the aircraft charter broker, has increased its efforts to concentrate on Shanghai and the surrounding provinces, including Zhejiang and Jiangsu, by relocating its office in Shanghai to bigger premises.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Chartered Air Transport Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Chartered Air Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Chartered Air Transport Market ?

To stay informed about further developments, trends, and reports in the China Chartered Air Transport Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence