Key Insights

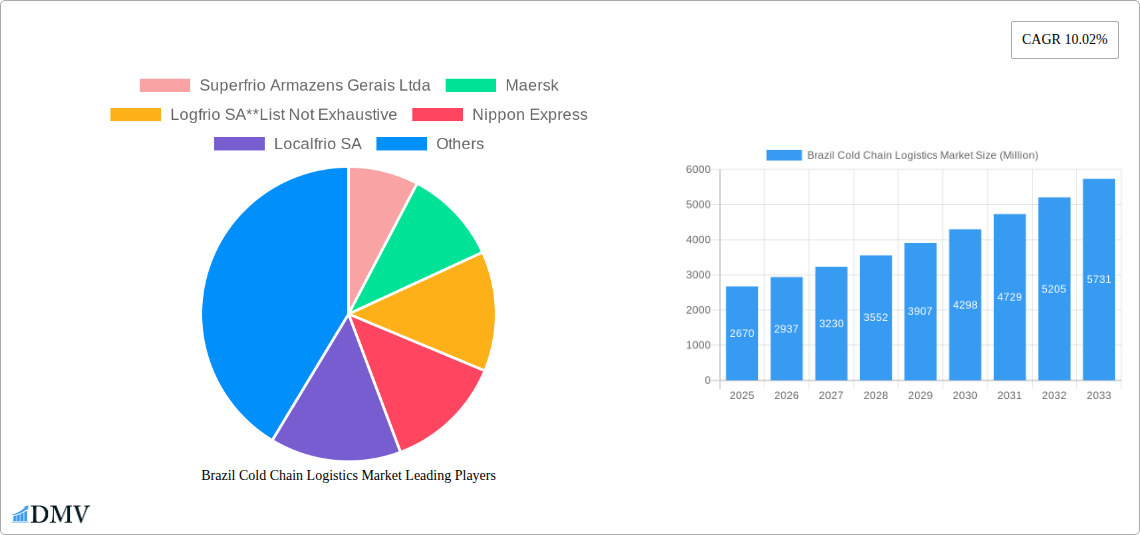

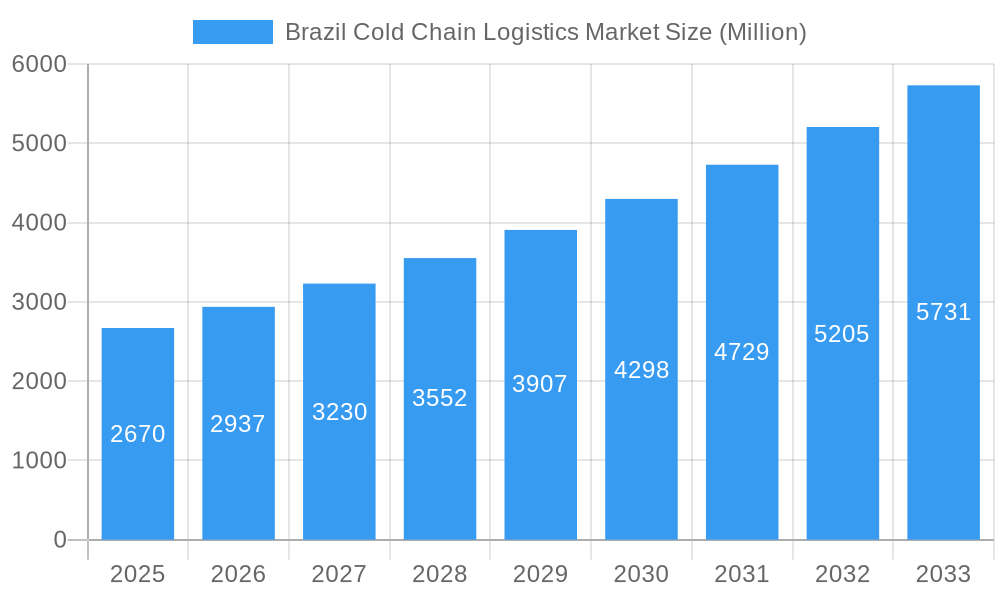

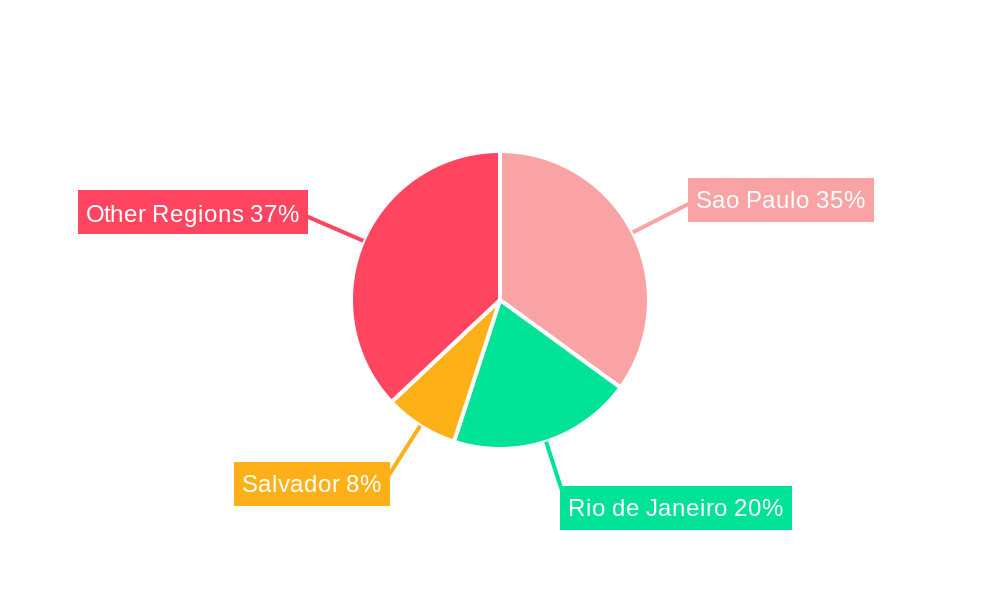

The Brazil cold chain logistics market, valued at $2.67 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.02% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning e-commerce sector in Brazil is fueling demand for efficient and reliable temperature-controlled transportation and storage solutions, particularly for perishable goods like fresh produce, meats, and pharmaceuticals. Furthermore, rising disposable incomes and a growing middle class are increasing consumption of temperature-sensitive products, further bolstering market growth. Government initiatives promoting food safety and infrastructure development are also playing a crucial role. Key segments within the market include storage, transportation, and value-added services such as blast freezing and inventory management. The chilled and frozen temperature segments are both experiencing significant growth, driven by the increasing demand for various temperature-sensitive products across diverse application areas. Major cities such as Sao Paulo, Rio de Janeiro, and Salvador are key contributors to market volume due to their high population density and robust economic activities. The competitive landscape is characterized by a mix of large multinational players like Maersk and Nippon Express, alongside established local companies such as Superfrio Armazens Gerais Ltda and Localfrio SA. These companies are constantly investing in advanced technologies and infrastructure to meet the evolving demands of the market.

Brazil Cold Chain Logistics Market Market Size (In Billion)

The market's future growth trajectory is promising, particularly considering the potential for further expansion into less-developed regions of Brazil. However, challenges remain, including the need for continuous investment in cold chain infrastructure, particularly in rural areas, to overcome logistical hurdles. Regulatory compliance and the implementation of stringent food safety standards also present both opportunities and challenges. The overall market outlook remains optimistic, driven by the interplay of increasing consumer demand, supportive government policies, and the continuous innovation within the cold chain logistics sector. The presence of both established and emerging players ensures a dynamic and competitive environment, further stimulating market growth and efficiency.

Brazil Cold Chain Logistics Market Company Market Share

Brazil Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Brazil cold chain logistics market, offering crucial insights for stakeholders seeking to navigate this rapidly evolving sector. Spanning the period from 2019 to 2033, with a focus on 2025, this research dives deep into market trends, competitive landscapes, and future growth projections. The report is meticulously crafted to offer actionable intelligence, empowering businesses to make informed decisions and capitalize on emerging opportunities within the Brazilian cold chain logistics ecosystem.

Brazil Cold Chain Logistics Market Composition & Trends

This section meticulously examines the Brazilian cold chain logistics market’s structure, pinpointing key trends that shape its trajectory. We analyze market concentration, revealing the market share distribution amongst major players. The report further explores the innovative forces driving market evolution, delves into the regulatory landscape impacting operations, assesses the presence of substitute products, and profiles the end-user base across various sectors. Finally, a comprehensive overview of mergers and acquisitions (M&A) activities is presented, including estimated deal values (in Millions).

- Market Concentration: The market exhibits a [xx]% concentration ratio with the top 5 players controlling an estimated [xx]% of the market in 2025.

- Innovation Catalysts: Technological advancements in temperature-controlled transportation and warehousing are driving significant efficiency gains.

- Regulatory Landscape: Stringent food safety regulations and evolving environmental standards are shaping industry practices.

- Substitute Products: The emergence of alternative preservation methods (e.g., modified atmosphere packaging) presents a level of competition.

- End-User Profiles: Key end-users span across diverse sectors including horticulture, meat & poultry, pharmaceuticals, and processed foods.

- M&A Activities: From 2019-2024, [xx] M&A deals were recorded, with a total estimated value of [xx] Million. Significant transactions included [mention specific examples if available].

Brazil Cold Chain Logistics Market Industry Evolution

This section provides a detailed analysis of the Brazilian cold chain logistics market’s growth trajectory from 2019 to 2033. We explore the market's historical performance (2019-2024), analyzing growth rates and identifying key factors that have influenced market expansion. We then delve into the anticipated evolution of the market during the forecast period (2025-2033). This includes projections on market size (in Millions), exploring the impact of technological advancements and evolving consumer preferences on market dynamics. Specific data points are incorporated to illustrate the growth trajectory and adoption rates of new technologies, along with projections for market size and value. The analysis considers factors such as increasing disposable incomes driving demand for refrigerated products, along with the development of sophisticated cold chain infrastructure.

Leading Regions, Countries, or Segments in Brazil Cold Chain Logistics Market

This section identifies the leading regions, countries, and segments within the Brazilian cold chain logistics market. São Paulo, Rio de Janeiro, and Salvador are analyzed based on market share, growth drivers, and future potential. The report similarly breaks down market performance based on service type (storage, transportation, value-added services), temperature type (chilled, frozen), and application (horticulture, meats, pharmaceuticals, etc.).

- By Key Cities:

- São Paulo: Dominates due to its robust infrastructure and high concentration of food processing and distribution facilities. Significant investments in warehousing and transportation infrastructure continue to drive growth.

- Rio de Janeiro: Shows strong growth potential driven by tourism and a significant population. Improvements in infrastructure are key to expanding its capacity.

- Salvador: Displays significant growth potential, especially in the handling of perishable goods, but faces challenges relating to infrastructure development.

- By Service: Storage currently represents the largest segment, followed by transportation, with value-added services exhibiting the highest growth potential.

- By Temperature Type: The frozen segment leads due to the growing demand for frozen foods and pharmaceuticals.

- By Application: The food and beverage sector (meats, fish, poultry, processed foods, and horticulture) commands the largest share, with the pharmaceuticals and life sciences segment exhibiting high growth.

Brazil Cold Chain Logistics Market Product Innovations

This section explores recent product innovations within the Brazilian cold chain logistics market, highlighting advancements in refrigerated transportation, warehousing technologies, and value-added services. These innovations focus on improved temperature control, enhanced tracking and monitoring capabilities, and increased efficiency in handling perishable goods. The unique selling propositions and technological advancements that enhance the cold chain's efficiency and reduce waste are also emphasized.

Propelling Factors for Brazil Cold Chain Logistics Market Growth

Several key factors are driving the growth of the Brazil cold chain logistics market. Technological advancements, such as real-time temperature monitoring and automated warehousing systems, are increasing efficiency and reducing losses. Economic growth and a rising middle class are fueling demand for fresh and processed foods, while government regulations promoting food safety and quality standards are driving investment in infrastructure and technology. The expansion of e-commerce further adds to the need for robust and reliable cold chain logistics.

Obstacles in the Brazil Cold Chain Logistics Market

Despite its growth potential, the Brazil cold chain logistics market faces challenges. Inadequate infrastructure in certain regions, particularly in terms of warehousing and transportation networks, results in higher costs and increased spoilage. Supply chain disruptions, exacerbated by factors such as weather events and transportation bottlenecks, also cause significant delays and increase costs. Furthermore, intense competition amongst established players and the entry of new players can create pricing pressures. Regulatory complexities and inconsistencies across different states add to the challenges faced by companies operating in this sector. These factors can collectively impact operational efficiency and profitability.

Future Opportunities in Brazil Cold Chain Logistics Market

The Brazil cold chain logistics market presents several promising opportunities. The expansion of e-commerce, especially for grocery and fresh produce, is creating significant demand for efficient and reliable cold chain solutions. Technological advancements, such as the Internet of Things (IoT) and blockchain technology, offer potential to enhance transparency, traceability, and efficiency. The growing demand for cold chain services in the pharmaceuticals and life sciences sector provides further opportunities for growth. Focusing on sustainable practices and environmentally friendly solutions can help companies attract customers and gain a competitive edge.

Major Players in the Brazil Cold Chain Logistics Market Ecosystem

- Superfrio Armazens Gerais Ltda

- Maersk [link to Maersk's global website]

- Logfrio SA

- Nippon Express [link to Nippon Express's global website]

- Localfrio SA

- Comfrio

- Martini Meat SA

- Arfrio Armazens Gerais Frigorificos

- Friozem Armazens Frigorificos Ltda

- Brado Logistica SA

- CAP Logistica Frigorificada Ltda

- Brasfrigo SA

Key Developments in Brazil Cold Chain Logistics Market Industry

- [Month, Year]: [Company A] launched a new temperature-controlled trucking service, enhancing its reach across the country.

- [Month, Year]: [Company B] invested [xx] Million in expanding its cold storage facilities in [City].

- [Month, Year]: A merger between [Company C] and [Company D] created a larger player in the refrigerated transportation sector.

- [Month, Year]: New regulations regarding food safety and temperature control were implemented, impacting the industry’s operating standards. (Add more bullet points as needed with specific dates and details)

Strategic Brazil Cold Chain Logistics Market Forecast

The Brazil cold chain logistics market is poised for robust growth, driven by technological advancements, increasing consumer demand, and government initiatives. The expansion of e-commerce, coupled with rising disposable incomes and a growing focus on food safety, will continue to fuel market expansion. Opportunities abound in enhancing infrastructure, adopting innovative technologies, and expanding services to underserved areas. The market is expected to see sustained growth, exceeding [xx] Million by 2033, offering attractive investment opportunities for both domestic and international players.

Brazil Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Meats, Fish, and Poultry

- 3.3. Processed Food Products

- 3.4. Pharmaceuticals, Life Sciences, and Chemicals

- 3.5. Other Applications

-

4. Key Cities

- 4.1. Sao Paulo

- 4.2. Rio de Janeiro

- 4.3. Salvador

Brazil Cold Chain Logistics Market Segmentation By Geography

- 1. Brazil

Brazil Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Brazil Cold Chain Logistics Market

Brazil Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Payments from Mobile

- 3.4. Market Trends

- 3.4.1. Increasing Meat Exports to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Meats, Fish, and Poultry

- 5.3.3. Processed Food Products

- 5.3.4. Pharmaceuticals, Life Sciences, and Chemicals

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Key Cities

- 5.4.1. Sao Paulo

- 5.4.2. Rio de Janeiro

- 5.4.3. Salvador

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Superfrio Armazens Gerais Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maersk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logfrio SA**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Localfrio SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Comfrio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Martini Meat SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arfrio Armazens Gerais Frigorificos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Friozem Armazens Frigorificos Ltda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brado Logistica SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CAP Logistica Frigorificada Ltda

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Brasfrigo SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Superfrio Armazens Gerais Ltda

List of Figures

- Figure 1: Brazil Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 5: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 8: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 10: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Cold Chain Logistics Market?

The projected CAGR is approximately 10.02%.

2. Which companies are prominent players in the Brazil Cold Chain Logistics Market?

Key companies in the market include Superfrio Armazens Gerais Ltda, Maersk, Logfrio SA**List Not Exhaustive, Nippon Express, Localfrio SA, Comfrio, Martini Meat SA, Arfrio Armazens Gerais Frigorificos, Friozem Armazens Frigorificos Ltda, Brado Logistica SA, CAP Logistica Frigorificada Ltda, Brasfrigo SA.

3. What are the main segments of the Brazil Cold Chain Logistics Market?

The market segments include Service, Temperature Type, Application, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.67 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used.

6. What are the notable trends driving market growth?

Increasing Meat Exports to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Usage of Payments from Mobile.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Brazil Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence