Key Insights

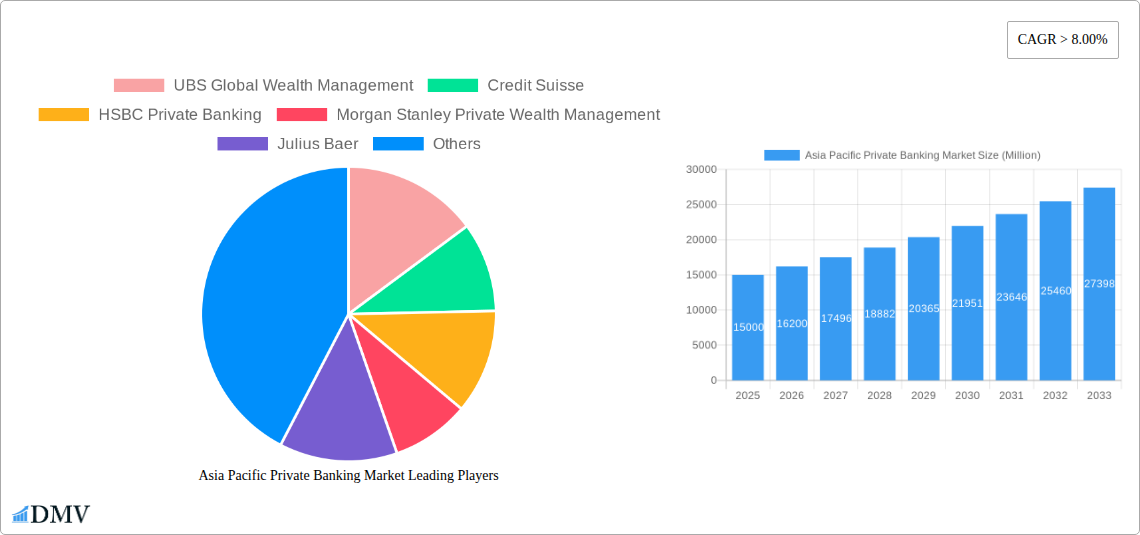

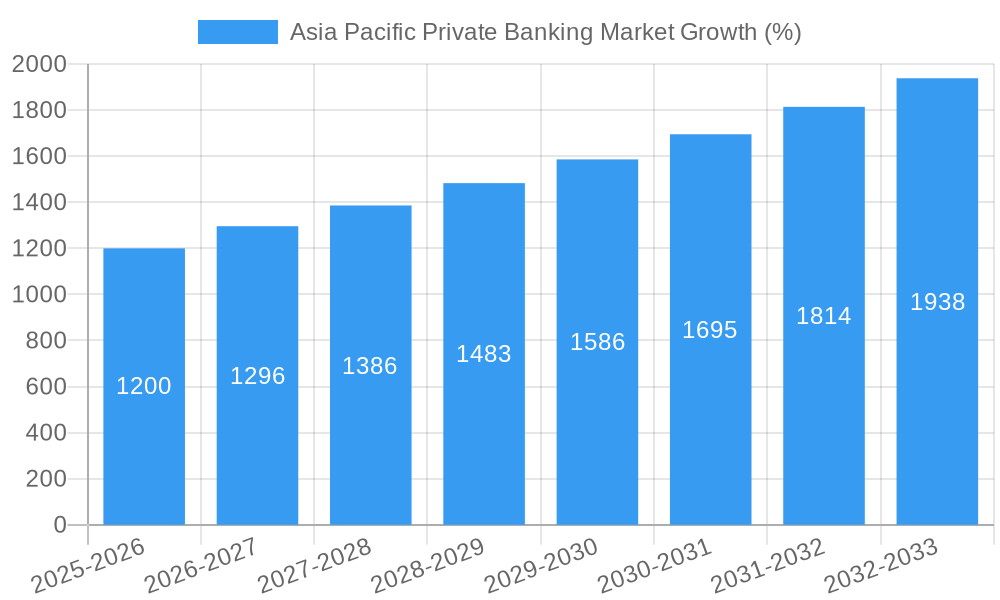

The Asia Pacific private banking market is experiencing robust growth, driven by a burgeoning high-net-worth individual (HNWI) population, increasing wealth concentration, and a rising demand for sophisticated wealth management solutions. The market's Compound Annual Growth Rate (CAGR) exceeding 8% from 2019 to 2024 indicates a significant upward trajectory. This expansion is fueled by several key factors: the region's dynamic economic growth, particularly in countries like China, India, and Singapore; increasing financial literacy and awareness of wealth management products; and the growing adoption of digital platforms and fintech solutions for wealth management services. Furthermore, favorable government policies aimed at attracting foreign investment and promoting financial inclusion are contributing to market expansion. Competition is fierce, with established global players like UBS, Credit Suisse, and JP Morgan Private Bank vying for market share alongside strong regional players like DBS Bank and Bank of Singapore. These institutions are focusing on personalized services, innovative investment strategies, and expanding their digital offerings to cater to the evolving needs of their clients.

Despite the positive growth outlook, the market faces certain challenges. Regulatory scrutiny and compliance costs are increasing, demanding significant investments from private banks. Geopolitical uncertainties and economic volatility in certain parts of the region also pose risks. Additionally, attracting and retaining skilled wealth management professionals remains a critical challenge in a competitive talent market. To mitigate these challenges, private banks are investing in advanced technology, strengthening risk management frameworks, and focusing on developing their workforce through specialized training and development programs. The forecast period of 2025-2033 promises continued growth, driven by the long-term positive economic outlook for the Asia-Pacific region and the persistent demand for sophisticated wealth management services amongst a growing HNWI population. Market segmentation will continue to evolve, with a focus on catering to specific demographics and investment preferences.

Asia Pacific Private Banking Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific private banking market, offering valuable insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) and predictive modeling to deliver actionable intelligence. The market's size is projected to reach xx Million by 2033, reflecting substantial growth potential.

Asia Pacific Private Banking Market Composition & Trends

This section delves into the competitive dynamics of the Asia Pacific private banking market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. We analyze the market share distribution amongst key players, including UBS Global Wealth Management, Credit Suisse, HSBC Private Banking, Morgan Stanley Private Wealth Management, Julius Baer, J P Morgan Private Bank, Bank of Singapore, Goldman Sachs Private Wealth Management, Citi Bank, and DBS (list not exhaustive). The report also quantifies M&A deal values, revealing trends in market consolidation and strategic partnerships.

- Market Concentration: Analysis of market share held by top 5 players, highlighting dominant players and emerging competitors. The estimated market concentration ratio (CR5) in 2025 is xx%.

- Innovation Catalysts: Examination of fintech advancements, digitalization initiatives, and regulatory changes driving innovation within the sector. This includes a detailed exploration of the impact of open banking and API adoption.

- Regulatory Landscape: Assessment of evolving regulatory frameworks across key Asia Pacific markets, including their impact on compliance costs and business strategies. Specific regulations impacting data privacy and cross-border wealth management are analyzed.

- Substitute Products: Evaluation of alternative investment vehicles and wealth management solutions that pose potential challenges to traditional private banking models.

- End-User Profiles: Segmentation of the high-net-worth individual (HNWI) and ultra-high-net-worth individual (UHNW) client base across different demographics and investment preferences.

- M&A Activity: Overview of recent mergers, acquisitions, and joint ventures in the Asia Pacific private banking industry, with an analysis of their strategic implications and market impact. Total M&A deal value during the historical period is estimated at xx Million.

Asia Pacific Private Banking Market Industry Evolution

This section provides a comprehensive overview of the Asia Pacific private banking market's growth trajectory, technological advancements, and evolving client demands over the study period. It analyzes shifts in investment strategies, the adoption of digital solutions, and the increasing importance of personalized wealth management services. Growth rates are presented annually, highlighting periods of acceleration and deceleration. The impact of macroeconomic factors, such as economic growth, inflation and interest rate changes, on market evolution are thoroughly examined. Specific data points are included, such as the adoption rate of digital platforms among private banking clients, projected to reach xx% by 2033. The influence of regulatory changes and geopolitical events on market evolution is also carefully considered.

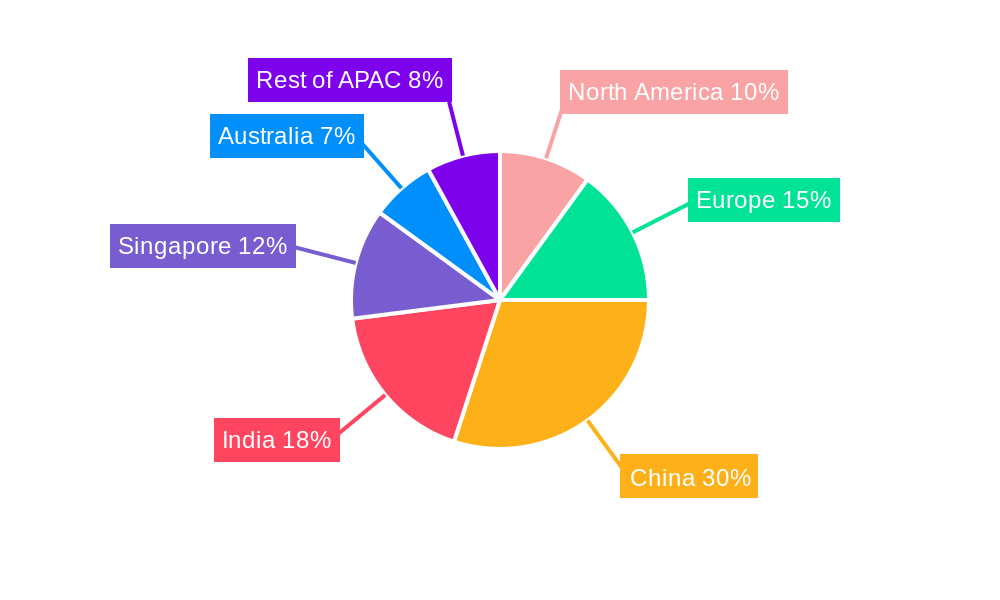

Leading Regions, Countries, or Segments in Asia Pacific Private Banking Market

This section identifies the dominant regions, countries, or segments within the Asia Pacific private banking market and explores the factors driving their success. We will analyze market share by region and country, identifying key drivers of growth such as favorable economic conditions, regulatory frameworks, and investment trends.

- Key Drivers of Dominance:

- Singapore: Strong regulatory environment, established financial infrastructure, and strategic location.

- Hong Kong: Access to mainland China's wealth and sophisticated financial markets.

- Australia: High per capita wealth and sophisticated investment culture.

- Other key markets: Japan, India, and other emerging economies showing high growth potential.

- In-depth Analysis: This section provides a detailed analysis of the factors driving the dominance of specific regions and countries. Factors considered include wealth concentration, regulatory frameworks and stability, economic growth and stability, and the availability of skilled professionals.

Asia Pacific Private Banking Market Product Innovations

This section focuses on recent product innovations within the Asia Pacific private banking market. This includes examining the features and functions of novel digital platforms, the adoption of innovative investment strategies, and the introduction of new wealth management tools and services. We highlight the unique selling propositions of these new products and services, including their technological advancements and enhanced user experience, resulting in improved client engagement and satisfaction. The impact of these innovations on market competitiveness and client acquisition is assessed.

Propelling Factors for Asia Pacific Private Banking Market Growth

Several factors are driving the growth of the Asia Pacific private banking market. These include the rising number of high-net-worth individuals (HNWIs) in the region, fueled by robust economic growth in many countries. The increasing adoption of technology, particularly digital platforms and online banking services, enhances accessibility and efficiency for both clients and banks. Furthermore, favorable regulatory environments in some markets encourage investment and wealth management activities.

Obstacles in the Asia Pacific Private Banking Market

Despite its growth potential, the Asia Pacific private banking market faces several challenges. Increased regulatory scrutiny and compliance costs are significant barriers, impacting profitability and operational efficiency. Geopolitical uncertainties and macroeconomic volatility can also negatively impact investor sentiment and investment flows. Furthermore, intense competition amongst established players and the emergence of new fintech disruptors create pressure on margins and market share. The estimated impact of these obstacles on market growth is quantified in the report.

Future Opportunities in Asia Pacific Private Banking Market

The Asia Pacific private banking market presents numerous future opportunities. The expansion into underserved markets in Southeast Asia and other emerging economies holds significant growth potential. The increasing adoption of artificial intelligence (AI) and big data analytics can enhance risk management, investment strategies, and customer service. Furthermore, catering to the evolving needs of younger, tech-savvy HNWIs presents a major opportunity for private banks to grow their client base.

Major Players in the Asia Pacific Private Banking Market Ecosystem

- UBS Global Wealth Management

- Credit Suisse

- HSBC Private Banking

- Morgan Stanley Private Wealth Management

- Julius Baer

- J P Morgan Private Bank

- Bank of Singapore

- Goldman Sachs Private Wealth Management

- Citi Bank

- DBS

- List Not Exhaustive

Key Developments in Asia Pacific Private Banking Market Industry

- November 2022: SBC Global Private Banking launched its discretionary digital platform (DPM) in Asia, becoming the first bank in the region to offer this service on a mobile app. This highlights the increasing adoption of digital technologies in the sector.

- February 2023: GXS, a digital bank majority-owned by Grab, expanded services. Its innovative approach to banking, offering high-interest rates on time deposits, signifies a disruption in the traditional banking model and attracts younger demographics.

Strategic Asia Pacific Private Banking Market Forecast

The Asia Pacific private banking market is poised for continued growth, driven by the rising HNWI population, technological advancements, and expanding market opportunities in emerging economies. The strategic forecast indicates a robust expansion in the coming years, fueled by increased demand for sophisticated wealth management solutions and the adoption of innovative technologies. This presents significant potential for private banks to capture market share and expand their client base through targeted investments in digital capabilities and tailored financial offerings.

Asia Pacific Private Banking Market Segmentation

-

1. Type

- 1.1. Asset Management Service

- 1.2. Insurance Service

- 1.3. Trust Service

- 1.4. Tax Consulting

- 1.5. Real Estate Consulting

-

2. Application

- 2.1. Personal

- 2.2. Enterprise

Asia Pacific Private Banking Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Private Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Insurance Business in Asia Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Private Banking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Asset Management Service

- 5.1.2. Insurance Service

- 5.1.3. Trust Service

- 5.1.4. Tax Consulting

- 5.1.5. Real Estate Consulting

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal

- 5.2.2. Enterprise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 UBS Global Wealth Management

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Credit Suisse

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HSBC Private Banking

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Morgan Stanley Private Wealth Management

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Julius Baer

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 J P Morgan Private Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bank of Singapore

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goldman Sachs Private Wealth Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Citi Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DBS**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UBS Global Wealth Management

List of Figures

- Figure 1: Asia Pacific Private Banking Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Private Banking Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Private Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Private Banking Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia Pacific Private Banking Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia Pacific Private Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Private Banking Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Asia Pacific Private Banking Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Asia Pacific Private Banking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: New Zealand Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Indonesia Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Malaysia Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Singapore Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Thailand Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Vietnam Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Philippines Asia Pacific Private Banking Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Private Banking Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Asia Pacific Private Banking Market?

Key companies in the market include UBS Global Wealth Management, Credit Suisse, HSBC Private Banking, Morgan Stanley Private Wealth Management, Julius Baer, J P Morgan Private Bank, Bank of Singapore, Goldman Sachs Private Wealth Management, Citi Bank, DBS**List Not Exhaustive.

3. What are the main segments of the Asia Pacific Private Banking Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Insurance Business in Asia Pacific.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: GXS, a digital bank majority owned by Grab, operator of Southeast Asia's ubiquitous super app, expanded services since opening in September. GXS's app hardly looks like a banking app. The app updates GXS account holders with daily reports on how much interest their deposits have accrued. While a regular savings account offers 0.08% interest, time deposits, opened for specific purposes such as travel or layaway purchases, earn 3.48%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Private Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Private Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Private Banking Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Private Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence