Key Insights

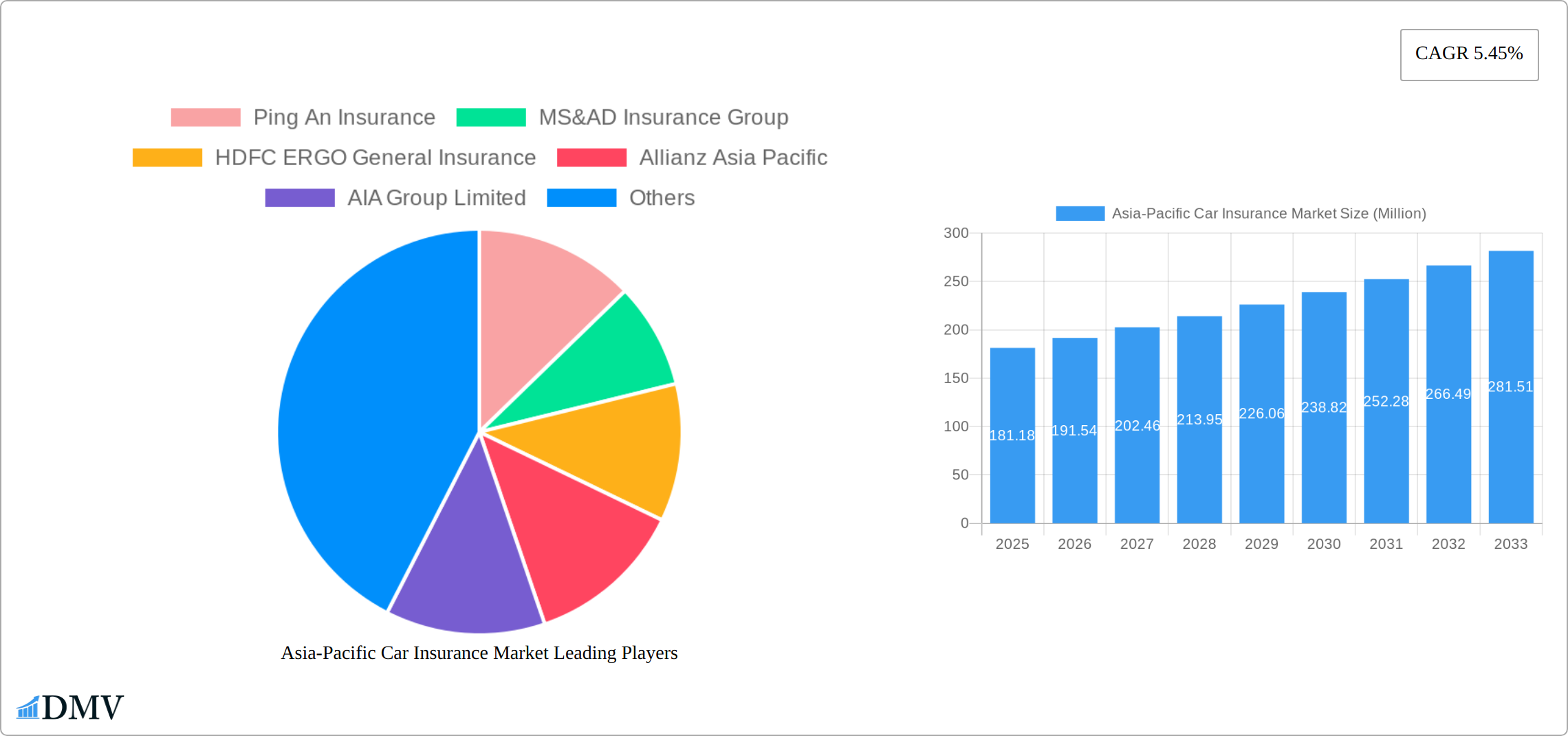

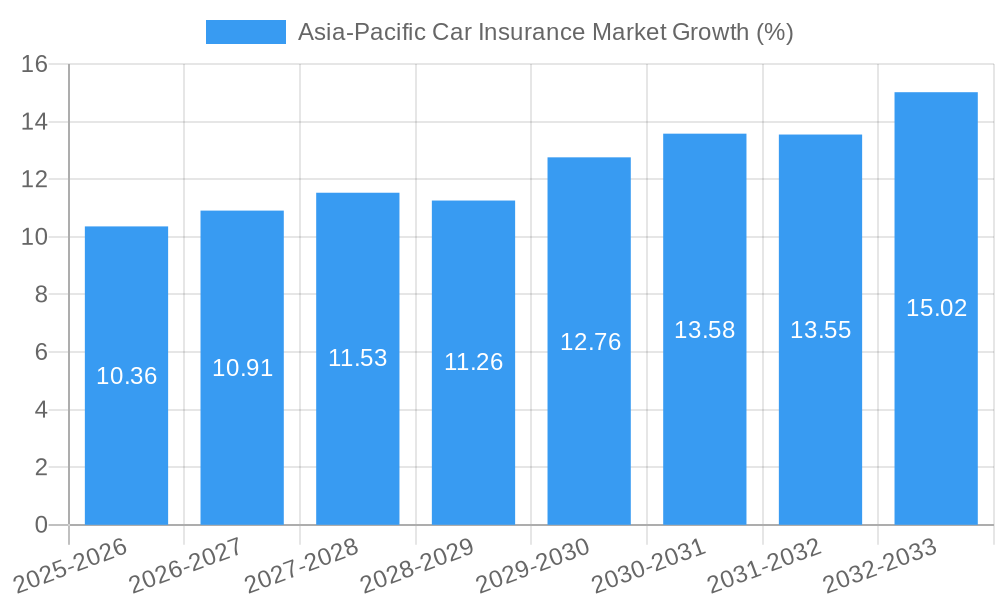

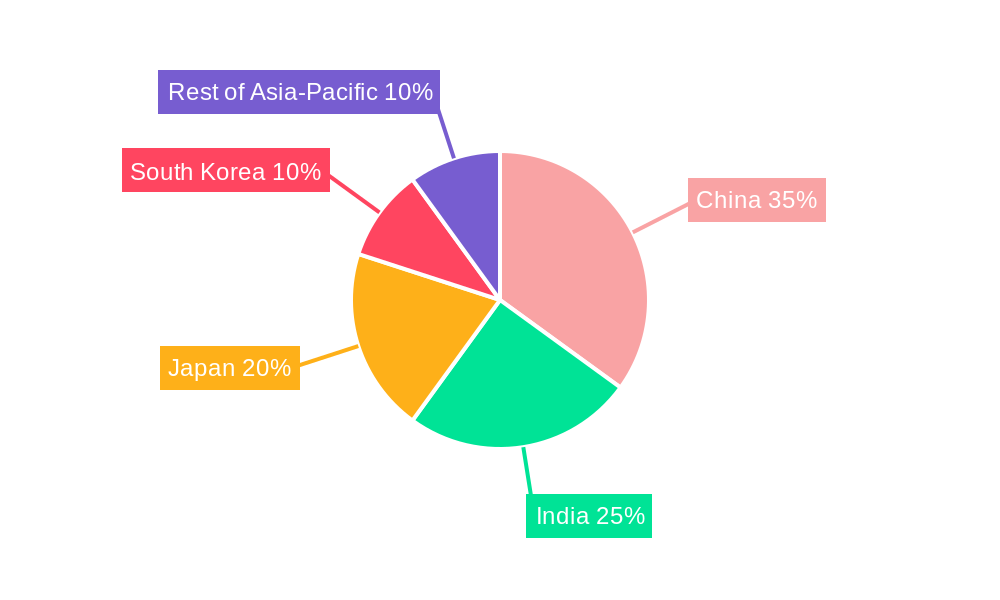

The Asia-Pacific car insurance market, valued at $181.18 million in 2025, is projected to experience robust growth, driven by a rising number of vehicle owners, increasing vehicle sales, and a growing awareness of insurance benefits across the region. The market's 5.45% CAGR from 2025 to 2033 indicates significant expansion opportunities. Key growth drivers include the expanding middle class in countries like India and China, leading to increased disposable income and vehicle purchases. Furthermore, stricter government regulations regarding mandatory insurance coverage and a rising preference for comprehensive insurance policies contribute to market expansion. The market is segmented by application (personal and commercial vehicles), distribution channels (direct sales, agents, brokers, banks, online platforms), coverage type (third-party liability, collision/comprehensive), and geography (China, Japan, India, South Korea, and the rest of Asia-Pacific). China and India are expected to be the largest contributors to market growth due to their large populations and rapid economic development. However, challenges such as fluctuating fuel prices, economic downturns, and intense competition among insurers could potentially restrain market growth. The increasing adoption of telematics and digital insurance platforms is a significant trend shaping the future of the market, offering opportunities for enhanced risk assessment, personalized pricing, and improved customer experience.

Competition in the Asia-Pacific car insurance market is fierce, with established players like Ping An Insurance, MS&AD Insurance Group, and HDFC ERGO General Insurance alongside international giants such as Allianz and Zurich. These companies are actively investing in technological advancements and strategic partnerships to expand their market share. The market is also witnessing the emergence of Insurtech companies offering innovative products and services. The success of insurers will depend on their ability to adapt to changing consumer preferences, leverage technology effectively, and offer competitive pricing and comprehensive coverage options tailored to the specific needs of diverse customer segments across the region. The forecast period of 2025-2033 presents considerable growth potential for car insurance providers who can successfully navigate these dynamic market conditions.

Asia-Pacific Car Insurance Market Market Composition & Trends

The Asia-Pacific car insurance market is characterized by a dynamic interplay of market concentration, innovation catalysts, and regulatory landscapes. The market is moderately concentrated, with the top players like Ping An Insurance and MS&AD Insurance Group holding significant shares. In 2025, Ping An Insurance is estimated to hold approximately 15% of the market share, while MS&AD Insurance Group commands around 10%. The market is propelled by continuous innovation, driven by technological advancements such as telematics and AI, which are reshaping insurance offerings and customer interactions.

- Innovation Catalysts: The adoption of telematics and mobile apps for real-time driving data collection is a major trend. These technologies enable personalized insurance products, enhancing customer engagement and retention.

- Regulatory Landscapes: Countries like China and Japan have stringent regulations that ensure consumer protection but also encourage innovation. For instance, China's regulatory framework supports the use of big data in insurance, fostering a data-driven market.

- Substitute Products: Traditional insurance products face competition from peer-to-peer insurance models, which are gaining traction in markets like India and South Korea.

- End-User Profiles: The market caters to a diverse range of end-users, from individual car owners to large fleet operators. Personal vehicle insurance remains the dominant segment, accounting for about 70% of the market in 2025.

- M&A Activities: The Asia-Pacific region has witnessed significant M&A activities, with deal values reaching around 500 Million in 2023. Notable acquisitions include Tokio Marine's purchase of a stake in a Southeast Asian insurer, aiming to expand its regional footprint.

Asia-Pacific Car Insurance Market Industry Evolution

The Asia-Pacific car insurance market has undergone significant evolution over the study period from 2019 to 2033. In 2025, the market size is estimated at 150 Billion, expected to grow at a CAGR of 6% during the forecast period of 2025-2033. This growth is driven by increasing vehicle ownership, rising awareness of insurance benefits, and technological advancements that enhance product offerings and customer experience.

Technological advancements have been pivotal, with the integration of AI and machine learning for risk assessment and premium calculation. For instance, in Japan, the adoption of AI in underwriting processes has increased by 20% since 2020, leading to more accurate pricing models. Additionally, the shift towards digital platforms for policy management and claims processing has been notable, with online sales channels growing by 15% annually.

Consumer demands are also shifting, with a growing preference for comprehensive coverage that includes additional benefits like roadside assistance and accident forgiveness. In India, the demand for comprehensive coverage has surged by 25% over the last three years, reflecting a more risk-averse consumer base. Furthermore, the rise of electric vehicles is influencing market dynamics, with specialized insurance products for EVs gaining popularity across the region.

Leading Regions, Countries, or Segments in Asia-Pacific Car Insurance Market

China stands out as the dominant country in the Asia-Pacific car insurance market, driven by its vast population and increasing vehicle penetration. In 2025, China's market is expected to be valued at 60 Billion, representing 40% of the region's total market size.

- Key Drivers in China:

- Investment Trends: Significant investments in digital infrastructure have facilitated the growth of online insurance platforms.

- Regulatory Support: The Chinese government's supportive policies towards the insurance sector encourage innovation and market expansion.

- Economic Growth: Rapid urbanization and rising disposable incomes are increasing vehicle ownership and insurance demand.

In-depth analysis reveals that China's dominance is further bolstered by its large and growing middle class, which is more inclined to purchase comprehensive insurance. The country's regulatory environment also supports the adoption of new technologies, such as telematics, which are integrated into insurance products to offer personalized premiums based on driving behavior.

Among the segments, personal vehicles remain the largest, accounting for 70% of the market in 2025. This segment is driven by the increasing number of private car owners across the region, particularly in countries like India and Japan. The personal vehicle segment benefits from targeted marketing strategies and tailored insurance products that cater to individual needs.

- Key Drivers in Personal Vehicles Segment:

- Consumer Awareness: Rising awareness of the benefits of car insurance, especially in emerging markets.

- Product Customization: Insurers are offering customizable policies that appeal to a wide range of consumers.

- Technological Integration: The use of telematics to offer usage-based insurance is particularly popular among young drivers.

Asia-Pacific Car Insurance Market Product Innovations

Innovations in the Asia-Pacific car insurance market are centered around enhancing customer experience and risk management. The introduction of telematics-based policies, such as Edelweiss General Insurance's 'Switch', allows for real-time driving behavior monitoring and dynamic premium adjustments. These innovations not only improve the accuracy of risk assessment but also offer customers the flexibility of pay-as-you-drive insurance. The unique selling proposition of these products lies in their ability to provide personalized and cost-effective insurance solutions, leveraging advanced technologies like AI and IoT for better performance metrics.

Propelling Factors for Asia-Pacific Car Insurance Market Growth

The growth of the Asia-Pacific car insurance market is propelled by several key factors:

- Technological Advancements: The integration of AI and telematics into insurance products enhances risk assessment and customer engagement.

- Economic Growth: Rising disposable incomes and vehicle ownership in countries like China and India drive demand for insurance.

- Regulatory Support: Favorable government policies encourage innovation and market expansion, particularly in digital insurance solutions.

Obstacles in the Asia-Pacific Car Insurance Market Market

The Asia-Pacific car insurance market faces several obstacles that could impede its growth:

- Regulatory Challenges: Stringent regulations in some countries can slow down the adoption of new technologies.

- Supply Chain Disruptions: Global supply chain issues can affect the availability of vehicles and, consequently, insurance demand.

- Competitive Pressures: Intense competition among insurers leads to price wars, impacting profitability.

Future Opportunities in Asia-Pacific Car Insurance Market

The Asia-Pacific car insurance market presents several future opportunities:

- Emerging Markets: Untapped potential in countries like Indonesia and Vietnam offers growth prospects.

- Technological Innovations: Continued advancements in AI and IoT will lead to more personalized insurance products.

- Consumer Trends: Increasing demand for sustainable and electric vehicle insurance opens new market segments.

Major Players in the Asia-Pacific Car Insurance Market Ecosystem

- Ping An Insurance

- MS&AD Insurance Group

- HDFC ERGO General Insurance

- Allianz Asia Pacific

- AIA Group Limited

- Zurich Insurance Group

- PICC

- Tokio Marine

- Sompo Japan Nipponkoa Insurance

- National Insurance Company

- TATA AIG General Insurance

- Bajaj Allianz General Insurance

- SBI General Insurance

- IAG (Insurance Australia Group)

Key Developments in Asia-Pacific Car Insurance Market Industry

- July 2022: Edelweiss General Insurance launched 'Switch', a fully digital, mobile telematics-based motor policy. This innovation resulted in further expansion toward real-time driving scores and dynamically calculated premium-based car insurance services, enhancing market dynamics.

- July 2023: Lexasure Financial Group partnered with My Car Consultant Pte. Ltd. to offer data-driven, self-insured car insurance in South and Southeast Asia. This collaboration is set to influence market dynamics by introducing innovative insurance solutions tailored to regional needs.

Strategic Asia-Pacific Car Insurance Market Market Forecast

The Asia-Pacific car insurance market is poised for robust growth, with a projected CAGR of 6% from 2025 to 2033. Key growth catalysts include the increasing adoption of digital technologies, rising vehicle ownership, and supportive regulatory environments. Future opportunities lie in emerging markets and the growing demand for specialized insurance products for electric vehicles. The market's potential is further enhanced by continuous innovation in product offerings and distribution channels, promising a dynamic and expanding landscape for stakeholders.

Asia-Pacific Car Insurance Market Segmentation

-

1. Coverage

- 1.1. Third-Party Liability Coverage

- 1.2. Collision/Comprehensive/Other Optional Coverage

-

2. Application

- 2.1. Personal Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Individual Agents

- 3.3. Brokers

- 3.4. Banks

- 3.5. Online

- 3.6. Other Distribution Channels

Asia-Pacific Car Insurance Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Car Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in the Region; China and India Driving the Market with Higher Car Accident Events

- 3.3. Market Restrains

- 3.3.1. Lower Value of Non Life Insurance Penetration in the Region; Decline in Car Insurance Premium Rates with Government Regulations

- 3.4. Market Trends

- 3.4.1. China Leading the Asia Pacific Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Third-Party Liability Coverage

- 5.1.2. Collision/Comprehensive/Other Optional Coverage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Individual Agents

- 5.3.3. Brokers

- 5.3.4. Banks

- 5.3.5. Online

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. China Asia-Pacific Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Ping An Insurance

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 MS&AD Insurance Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HDFC ERGO General Insurance

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Allianz Asia Pacific

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 AIA Group Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Zurich Insurance Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 PICC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Tokio Marine

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Sompo Japan Nipponkoa Insurance

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 National Insurance Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 TATA AIG General Insurance**List Not Exhaustive

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Bajaj Allianz General Insurance

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 SBI General Insurance

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 IAG (Insurance Australia Group)

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Ping An Insurance

List of Figures

- Figure 1: Asia-Pacific Car Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Car Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 3: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 15: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Car Insurance Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Asia-Pacific Car Insurance Market?

Key companies in the market include Ping An Insurance, MS&AD Insurance Group, HDFC ERGO General Insurance, Allianz Asia Pacific, AIA Group Limited, Zurich Insurance Group, PICC, Tokio Marine, Sompo Japan Nipponkoa Insurance, National Insurance Company, TATA AIG General Insurance**List Not Exhaustive, Bajaj Allianz General Insurance, SBI General Insurance, IAG (Insurance Australia Group).

3. What are the main segments of the Asia-Pacific Car Insurance Market?

The market segments include Coverage, Application , Distribution Channel .

4. Can you provide details about the market size?

The market size is estimated to be USD 181.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in the Region; China and India Driving the Market with Higher Car Accident Events.

6. What are the notable trends driving market growth?

China Leading the Asia Pacific Market.

7. Are there any restraints impacting market growth?

Lower Value of Non Life Insurance Penetration in the Region; Decline in Car Insurance Premium Rates with Government Regulations.

8. Can you provide examples of recent developments in the market?

July 2022: Edelweiss General Insurance launched a comprehensive motor insurance product named 'Switch' which exists as a fully digital, mobile telematics-based motor policy that detects motion and automatically activates insurance when the vehicle is driven. This resulted in further expansion toward real-time driving scores and dynamically calculated premium-based car insurance services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Car Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Car Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Car Insurance Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Car Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence