Key Insights

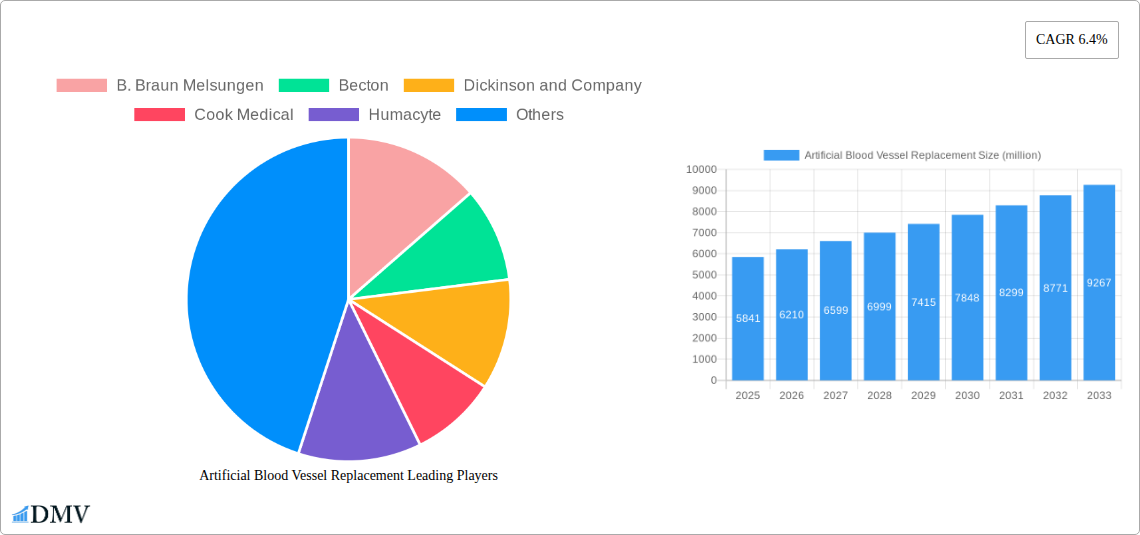

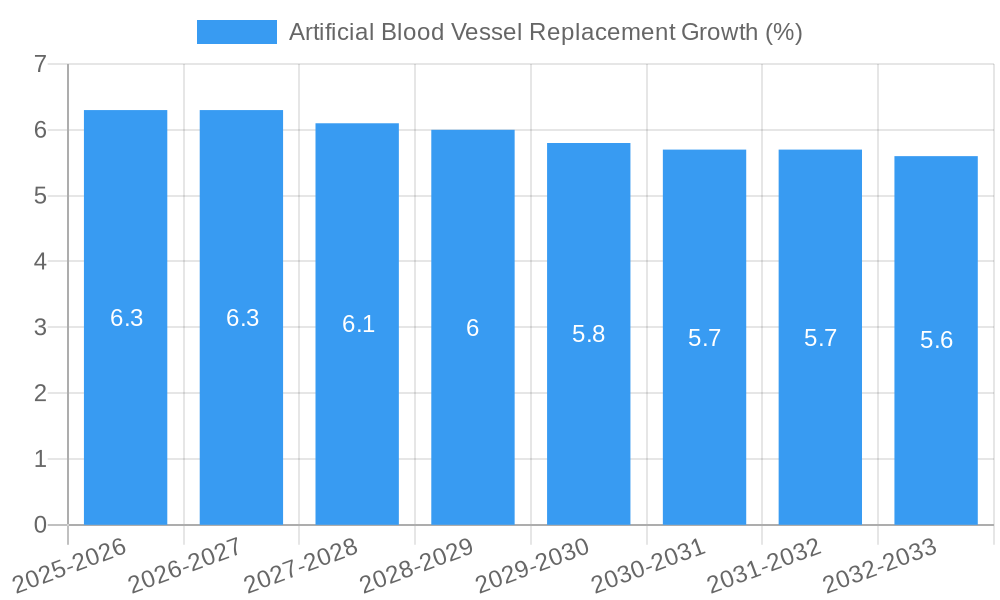

The global Artificial Blood Vessel Replacement market is poised for significant expansion, projected to reach a substantial market size of $5,841 million. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.4% from 2025 to 2033. Key drivers propelling this market forward include the increasing prevalence of cardiovascular diseases such as aortic and peripheral artery conditions, coupled with a rising demand for effective hemodialysis access solutions. Advances in biomaterials and surgical techniques are also playing a crucial role, enabling the development of more sophisticated and durable artificial blood vessels. The market is witnessing a strong trend towards the adoption of advanced materials like elastomers and polyethylene terephthalate, offering improved biocompatibility and mechanical properties compared to traditional polydioxanone or other generic alternatives. This innovation is critical in addressing the limitations of existing treatments and improving patient outcomes.

Furthermore, the market's growth is being significantly influenced by an aging global population, which inherently carries a higher risk of vascular complications. As healthcare infrastructure continues to develop in emerging economies and awareness about cardiovascular health improves, the demand for artificial blood vessel replacements is expected to accelerate. Despite the promising outlook, the market faces certain restraints. High costs associated with research, development, and manufacturing of these advanced medical devices can pose a barrier, particularly in price-sensitive markets. Stringent regulatory approvals also add to the time and expense of bringing new products to market. However, the persistent unmet medical need for effective and long-term solutions for vascular reconstruction, alongside ongoing technological advancements and strategic collaborations among key players like Medtronic, Becton, Dickinson and Company, and W. L. Gore and Associates, are expected to outweigh these challenges, ensuring a dynamic and expanding market landscape.

Artificial Blood Vessel Replacement Market Composition & Trends

The global artificial blood vessel replacement market, valued at an estimated XXX million in the base year of 2025, is characterized by a dynamic and evolving landscape. Market concentration is moderately fragmented, with key players like Medtronic, B. L. Gore and Associates, and Becton, Dickinson and Company holding significant shares. Innovation catalysts are primarily driven by advancements in biomaterials and regenerative medicine, pushing the boundaries of synthetic and bioengineered graft performance. The regulatory landscape, while stringent, is becoming more streamlined for novel technologies, especially those demonstrating superior safety and efficacy profiles. Substitute products, including autologous vein grafts, still hold a strong position, but artificial alternatives are gaining traction due to their availability and predictability. End-user profiles are diverse, encompassing patients suffering from cardiovascular diseases, peripheral artery disease, and those requiring hemodialysis access. Mergers and acquisitions (M&A) are a significant trend, with strategic deals totaling approximately XXX million aimed at expanding product portfolios and geographical reach. For instance, recent M&A activities have focused on acquiring companies with novel bioengineered vascular graft technologies.

- Market Share Distribution (Estimated 2025):

- Dominant players: XXX%

- Mid-tier companies: XXX%

- Emerging players: XXX%

- M&A Deal Values (Historical 2019-2024):

- Total estimated value: XXX million

- Average deal size: XXX million

Artificial Blood Vessel Replacement Industry Evolution

The artificial blood vessel replacement industry has witnessed a remarkable evolution over the study period of 2019–2033, driven by an increasing prevalence of cardiovascular and peripheral vascular diseases worldwide. Market growth trajectories are projected to be robust, with an estimated Compound Annual Growth Rate (CAGR) of XXX% from 2025 to 2033. This expansion is underpinned by continuous technological advancements in materials science, manufacturing processes, and a deeper understanding of vascular biology. Early in the historical period (2019-2024), the market was largely dominated by traditional prosthetic grafts, primarily made of materials like Polyester Terephthalate (PET). However, shifting consumer demands, influenced by a growing awareness of minimally invasive procedures and the desire for longer-lasting, more biocompatible solutions, have spurred the development of advanced synthetic and, more recently, bioengineered grafts.

Technological advancements have been pivotal. The refinement of polymer science has led to the development of more flexible, durable, and thrombogenic-resistant elastomeric grafts. Furthermore, research into bio-integrative materials, such as those incorporating growth factors or cellular components, is paving the way for next-generation vascular prosthetics that can actively promote healing and integration with host tissues. The adoption metrics for these advanced technologies are steadily increasing, albeit with higher initial costs. Patient outcomes and surgeon preference are increasingly leaning towards grafts that offer superior patency rates and reduced complication risks. The integration of these advanced materials and designs has been critical in addressing the limitations of older generation grafts, such as anastomotic leakage and infection. The industry is moving beyond simple replacement to a more regenerative approach, aiming to restore native vascular function.

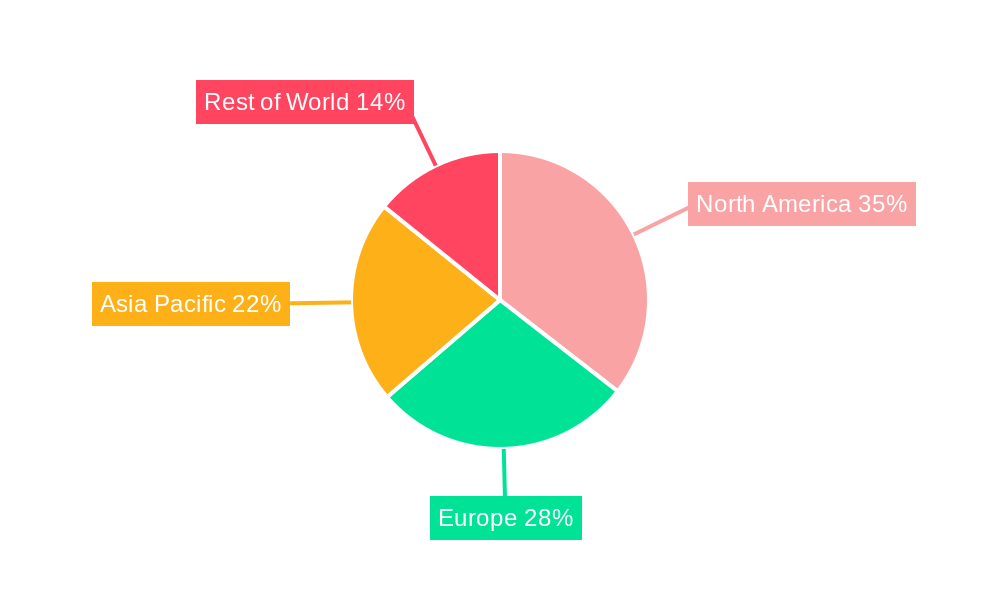

Leading Regions, Countries, or Segments in Artificial Blood Vessel Replacement

North America currently stands as the dominant region in the artificial blood vessel replacement market, driven by a confluence of factors including high healthcare expenditure, a large patient pool suffering from cardiovascular and peripheral artery diseases, and a strong emphasis on adopting innovative medical technologies. Within North America, the United States leads in terms of market share, fueled by extensive research and development activities, well-established healthcare infrastructure, and favorable reimbursement policies for advanced vascular grafts. The application segment of Aortic Disease in this region accounts for a substantial portion of the market revenue, given the high incidence of aortic aneurysms and dissections requiring complex surgical interventions.

The Types segment is witnessing a significant shift, with a growing preference for advanced Elastomer and emerging bioengineered materials over traditional Polydioxanone and Polyethylene Terephthalate grafts, particularly for complex reconstructions. Key drivers for this dominance include:

- Investment Trends: Substantial investments in R&D by leading companies like Medtronic and W. L. Gore and Associates, alongside venture capital funding for innovative startups, are accelerating product development and market penetration.

- Regulatory Support: While stringent, regulatory pathways in the US and Canada are relatively well-defined for novel medical devices, encouraging manufacturers to bring advanced solutions to market.

- Technological Adoption: A healthcare system that readily adopts cutting-edge technologies, coupled with a skilled surgical workforce adept at implanting advanced grafts, further solidifies North America's leadership.

- Prevalence of Chronic Diseases: The high prevalence of diabetes, hypertension, and aging populations in North America contributes to a persistent and growing demand for effective cardiovascular and peripheral vascular treatments.

In-depth analysis of dominance factors reveals that the proactive approach to managing chronic conditions, coupled with a strong payer mix that supports advanced treatment options, makes North America a fertile ground for the artificial blood vessel replacement market. The focus on improving patient quality of life and reducing long-term healthcare costs through durable and effective vascular grafts is a primary motivator for market expansion and technological advancement within the region.

Artificial Blood Vessel Replacement Product Innovations

Product innovations in artificial blood vessel replacement are rapidly advancing, focusing on enhanced biocompatibility, improved patency rates, and reduced thrombogenicity. Companies are developing next-generation synthetic grafts with novel surface modifications and integrated drug-delivery systems to prevent inflammation and thrombosis. Bioengineered grafts utilizing decellularized extracellular matrices or tissue-engineered scaffolds are showing promise for complete host integration, offering the potential for true biological replacement rather than prosthetic substitution. Performance metrics such as burst strength, suture retention, and long-term graft patency are continuously being optimized, with emerging technologies aiming for superior clinical outcomes compared to historical benchmarks. Unique selling propositions often revolve around reduced invasiveness, faster patient recovery, and improved quality of life.

Propelling Factors for Artificial Blood Vessel Replacement Growth

The artificial blood vessel replacement market is propelled by several key growth drivers. A significant factor is the increasing global prevalence of cardiovascular diseases, peripheral artery disease (PAD), and end-stage renal disease necessitating hemodialysis access, all of which directly drive demand for vascular grafts. Technological advancements in biomaterials science are creating more sophisticated, durable, and biocompatible grafts, leading to better patient outcomes. Furthermore, an aging global population, which is more susceptible to vascular conditions, contributes to sustained market growth. Favorable reimbursement policies in many developed economies and a growing emphasis on minimally invasive surgical techniques also encourage the adoption of advanced artificial blood vessels.

Obstacles in the Artificial Blood Vessel Replacement Market

Despite its promising growth, the artificial blood vessel replacement market faces several obstacles. Stringent regulatory approval processes in various regions can delay the market entry of innovative products, increasing development costs and timelines. The high cost associated with advanced artificial blood vessels can limit their accessibility in resource-constrained healthcare settings, posing an affordability challenge. Supply chain disruptions, as experienced in recent years, can impact the availability of raw materials and finished products. Moreover, the established preference for autologous grafts in certain surgical scenarios, due to their perceived biological superiority, presents a competitive challenge that needs to be overcome by demonstrating clear advantages of artificial alternatives.

Future Opportunities in Artificial Blood Vessel Replacement

Future opportunities in the artificial blood vessel replacement market are abundant, driven by ongoing research and evolving healthcare needs. The development of bio-regenerative vascular grafts that mimic native tissue properties offers a significant avenue for innovation, potentially leading to complete vascular restoration. Expansion into emerging markets with growing healthcare infrastructure and increasing awareness of cardiovascular diseases presents a vast untapped potential. Advancements in personalized medicine, where grafts can be tailored to individual patient needs and disease profiles, will also create new opportunities. The integration of smart technologies for graft monitoring and data collection for remote patient management is another exciting prospect.

Major Players in the Artificial Blood Vessel Replacement Ecosystem

- B. Braun Melsungen

- Becton, Dickinson and Company

- Cook Medical

- Humacyte

- Jotec GmbH

- LeMaitre Vascular

- Medtronic

- Techshot

- Terumo Medical

- W. L. Gore and Associates

Key Developments in Artificial Blood Vessel Replacement Industry

- 2023: Humacyte receives FDA Breakthrough Device designation for its human acellular vessel (HAV) for treating complex vascular reconstruction, signaling significant progress in bioengineered solutions.

- 2023: LeMaitre Vascular acquires a suite of peripheral vascular products, expanding its portfolio and market reach in PAD treatment.

- 2022: W. L. Gore & Associates continues to invest in research for next-generation vascular grafts with enhanced durability and thrombotic resistance.

- 2021: Medtronic launches an advanced ePTFE graft with improved handling characteristics for complex vascular bypass procedures.

- 2020: Cook Medical focuses on developing advanced solutions for hemodialysis access, including novel graft materials to reduce infection rates.

Strategic Artificial Blood Vessel Replacement Market Forecast

The strategic forecast for the artificial blood vessel replacement market anticipates robust growth, driven by sustained demand from expanding indications such as Aortic Disease and Peripheral Artery Disease, alongside critical applications in Hemodialysis. The forecast period (2025–2033) will witness a pronounced shift towards advanced materials like Elastomer, with ongoing research in bio-integrated and regenerative vascular grafts poised to redefine treatment paradigms. Key players are expected to continue their innovation pipelines, focusing on enhancing graft performance and patient outcomes, thereby capitalizing on the increasing global burden of vascular pathologies and the drive for more effective and durable treatment solutions.

Artificial Blood Vessel Replacement Segmentation

-

1. Application

- 1.1. Aortic Disease

- 1.2. Peripheral Artery Disease

- 1.3. Hemodialysis

-

2. Types

- 2.1. Polydioxanone

- 2.2. Elastomer

- 2.3. Polyethylene Terephthalate

- 2.4. Others

Artificial Blood Vessel Replacement Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Artificial Blood Vessel Replacement REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artificial Blood Vessel Replacement Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aortic Disease

- 5.1.2. Peripheral Artery Disease

- 5.1.3. Hemodialysis

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Polydioxanone

- 5.2.2. Elastomer

- 5.2.3. Polyethylene Terephthalate

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Artificial Blood Vessel Replacement Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aortic Disease

- 6.1.2. Peripheral Artery Disease

- 6.1.3. Hemodialysis

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Polydioxanone

- 6.2.2. Elastomer

- 6.2.3. Polyethylene Terephthalate

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Artificial Blood Vessel Replacement Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aortic Disease

- 7.1.2. Peripheral Artery Disease

- 7.1.3. Hemodialysis

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Polydioxanone

- 7.2.2. Elastomer

- 7.2.3. Polyethylene Terephthalate

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Artificial Blood Vessel Replacement Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aortic Disease

- 8.1.2. Peripheral Artery Disease

- 8.1.3. Hemodialysis

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Polydioxanone

- 8.2.2. Elastomer

- 8.2.3. Polyethylene Terephthalate

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Artificial Blood Vessel Replacement Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aortic Disease

- 9.1.2. Peripheral Artery Disease

- 9.1.3. Hemodialysis

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Polydioxanone

- 9.2.2. Elastomer

- 9.2.3. Polyethylene Terephthalate

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Artificial Blood Vessel Replacement Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aortic Disease

- 10.1.2. Peripheral Artery Disease

- 10.1.3. Hemodialysis

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Polydioxanone

- 10.2.2. Elastomer

- 10.2.3. Polyethylene Terephthalate

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 B. Braun Melsungen

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Becton

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dickinson and Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cook Medical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Humacyte

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jotec GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LeMaitre Vascular

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Medtronic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Techshot

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Terumo Medical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 W. L. Gore and Associates

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 B. Braun Melsungen

List of Figures

- Figure 1: Global Artificial Blood Vessel Replacement Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Artificial Blood Vessel Replacement Revenue (million), by Application 2024 & 2032

- Figure 3: North America Artificial Blood Vessel Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Artificial Blood Vessel Replacement Revenue (million), by Types 2024 & 2032

- Figure 5: North America Artificial Blood Vessel Replacement Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Artificial Blood Vessel Replacement Revenue (million), by Country 2024 & 2032

- Figure 7: North America Artificial Blood Vessel Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Artificial Blood Vessel Replacement Revenue (million), by Application 2024 & 2032

- Figure 9: South America Artificial Blood Vessel Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Artificial Blood Vessel Replacement Revenue (million), by Types 2024 & 2032

- Figure 11: South America Artificial Blood Vessel Replacement Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Artificial Blood Vessel Replacement Revenue (million), by Country 2024 & 2032

- Figure 13: South America Artificial Blood Vessel Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Artificial Blood Vessel Replacement Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Artificial Blood Vessel Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Artificial Blood Vessel Replacement Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Artificial Blood Vessel Replacement Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Artificial Blood Vessel Replacement Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Artificial Blood Vessel Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Artificial Blood Vessel Replacement Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Artificial Blood Vessel Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Artificial Blood Vessel Replacement Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Artificial Blood Vessel Replacement Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Artificial Blood Vessel Replacement Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Artificial Blood Vessel Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Artificial Blood Vessel Replacement Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Artificial Blood Vessel Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Artificial Blood Vessel Replacement Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Artificial Blood Vessel Replacement Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Artificial Blood Vessel Replacement Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Artificial Blood Vessel Replacement Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Artificial Blood Vessel Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Artificial Blood Vessel Replacement Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Blood Vessel Replacement?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Artificial Blood Vessel Replacement?

Key companies in the market include B. Braun Melsungen, Becton, Dickinson and Company, Cook Medical, Humacyte, Jotec GmbH, LeMaitre Vascular, Medtronic, Techshot, Terumo Medical, W. L. Gore and Associates.

3. What are the main segments of the Artificial Blood Vessel Replacement?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 5841 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artificial Blood Vessel Replacement," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artificial Blood Vessel Replacement report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artificial Blood Vessel Replacement?

To stay informed about further developments, trends, and reports in the Artificial Blood Vessel Replacement, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence