Key Insights

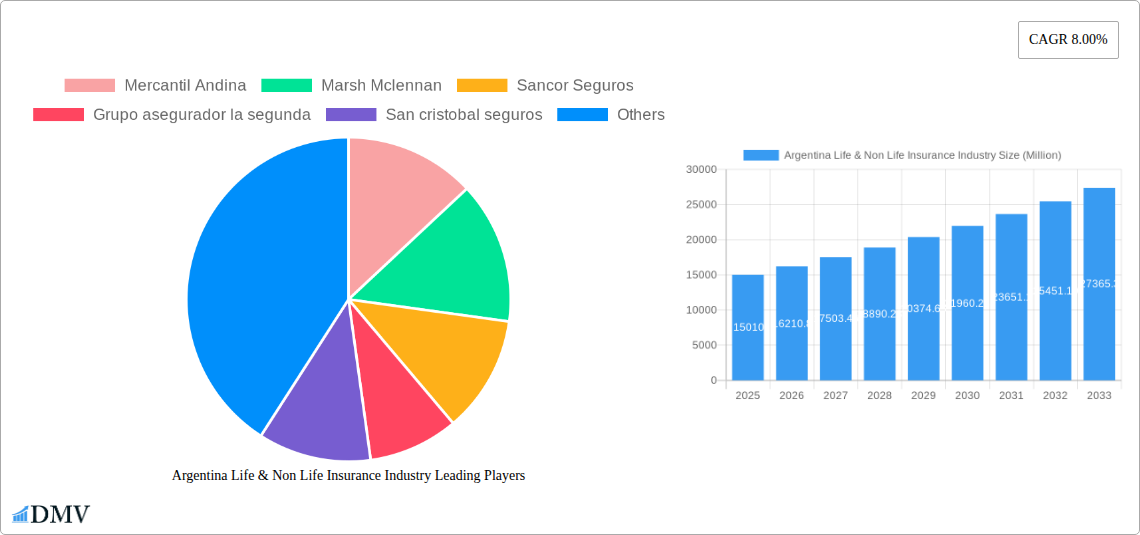

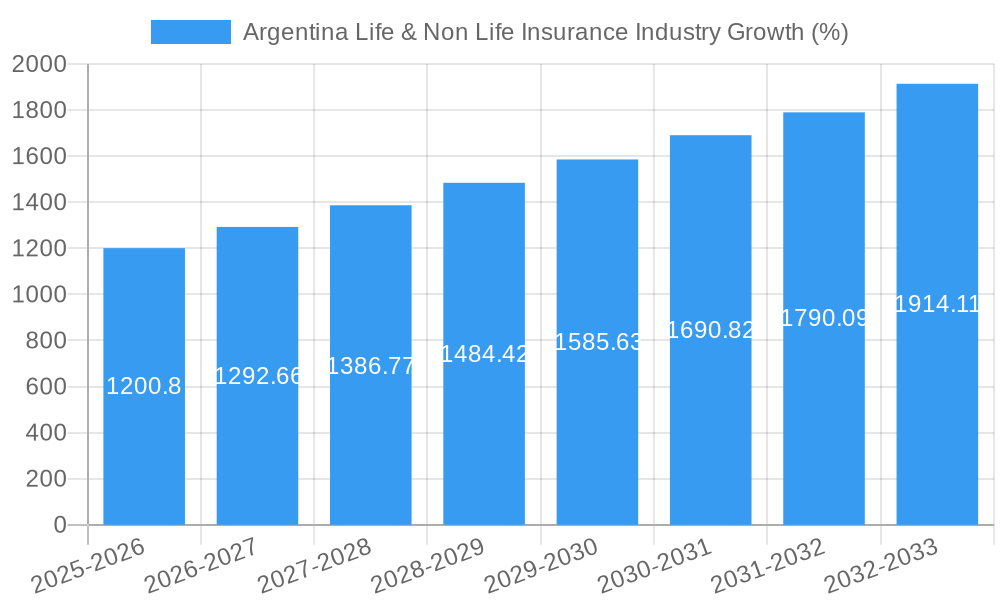

The Argentina Life & Non-Life Insurance market, valued at $15.01 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033. This expansion is driven by several key factors. Increasing awareness of the importance of insurance, particularly in a volatile economic environment, is fueling demand for both life and non-life policies. Government initiatives promoting financial inclusion and insurance penetration are also contributing to market growth. Furthermore, the rising middle class and increased disposable incomes are enabling more Argentinians to afford insurance products. Technological advancements, such as digital distribution channels and data analytics, are streamlining operations and improving customer experience, further stimulating market growth. However, economic instability and inflation pose challenges to the sector. Regulatory changes and fluctuating currency values also present uncertainties that need to be considered. Competition is fierce among established players like Mercantil Andina, Marsh McLennan, Sancor Seguros, and Grupo Asegurador La Segunda, alongside regional and international insurers. The market is segmented by product type (life, health, property, casualty, etc.) and distribution channels (agents, brokers, online platforms). The forecast anticipates continued growth, though the rate may fluctuate based on macroeconomic conditions. The next decade will see a focus on product innovation, digital transformation, and risk management solutions tailored to the evolving needs of the Argentinian population.

The dominance of established players in Argentina's insurance sector reflects a degree of market maturity, but the ongoing growth presents opportunities for both expansion of existing players and entry of new competitors, particularly in niche segments. Growth will likely be driven by a combination of higher insurance penetration rates among the burgeoning middle class, and the introduction of innovative product offerings tailored to the specific needs of the Argentine market. Given the strong growth forecast, strategic partnerships and mergers & acquisitions can be anticipated in the coming years, furthering industry consolidation and enhancing the competitive landscape. The success of insurers will depend on their ability to adapt to evolving customer needs, leverage technological advancements effectively, and navigate the country's economic and regulatory environment.

Argentina Life & Non-Life Insurance Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Argentina life and non-life insurance industry, offering invaluable insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and make strategic decisions. The report covers the period 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. This detailed analysis utilizes robust data and expert insights to provide a clear picture of the market’s current state and future trajectory. The total market size in 2025 is estimated at xx Million.

Argentina Life & Non-Life Insurance Industry Market Composition & Trends

This section analyzes the competitive landscape, innovative drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity within the Argentinian insurance market. The market is characterized by a moderate level of concentration, with key players holding significant market shares. The distribution is as follows: Sancor Seguros holds approximately xx% market share, Grupo Asegurador La Segunda holds xx%, and other major players such as Mercantil Andina, Chubb, and others collectively hold the remaining xx%. Innovation is driven by technological advancements, particularly in areas such as AI-powered pricing and digital distribution channels. Regulatory changes influence market dynamics significantly, shaping product offerings and operational strategies. Substitute products, such as self-insurance or microinsurance schemes, pose varying degrees of competitive pressure. The M&A landscape has seen xx Million in deal value over the past five years, primarily driven by consolidation among smaller players seeking to enhance scale and competitiveness.

- Market Share Distribution: Sancor Seguros (xx%), Grupo Asegurador La Segunda (xx%), Others (xx%).

- M&A Deal Value (2019-2024): xx Million

- Key Innovation Catalysts: AI-powered pricing, digital distribution.

- Regulatory Landscape: Significant impact on product offerings and operational strategies.

Argentina Life & Non-Life Insurance Industry Industry Evolution

The Argentinian life and non-life insurance market has experienced xx% growth between 2019 and 2024. This growth is primarily attributed to a combination of factors, including the increasing penetration of insurance products among the population, evolving consumer preferences towards greater financial protection, and technological advancements driving efficiency and innovation within the industry. The adoption of digital technologies, such as mobile apps and online platforms, is accelerating, facilitating easier access to insurance products and services. This shift mirrors broader trends in consumer behavior, with a growing demand for personalized and tailored insurance solutions. The market is projected to continue its growth trajectory, with an expected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated xx Million by 2033. This growth will likely be influenced by economic recovery, regulatory reforms, and the continued adoption of innovative technologies.

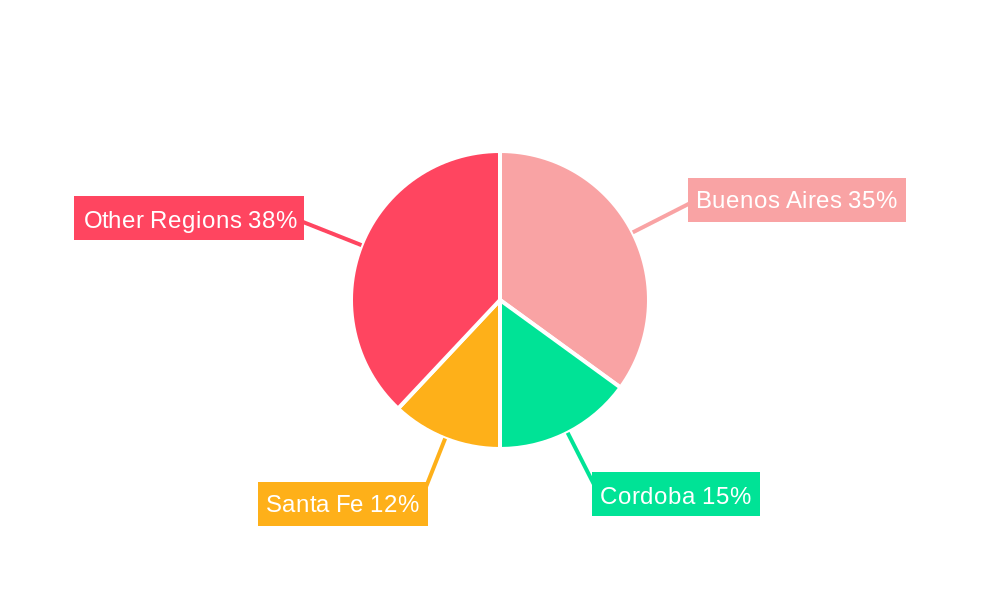

Leading Regions, Countries, or Segments in Argentina Life & Non-Life Insurance Industry

The Buenos Aires region dominates the Argentinian life and non-life insurance market, accounting for approximately xx% of the total market value. This dominance stems from several key factors:

- High Population Density: Buenos Aires houses a significant portion of Argentina's population, leading to a large potential customer base.

- Economic Activity: Buenos Aires is the economic hub, driving higher insurance demand across various sectors.

- Regulatory Support: Favorable regulatory policies and infrastructure contribute to market growth within the region.

- Investment Trends: Significant investment in infrastructure and technology fosters market expansion.

This concentration reflects the regional disparities in economic development and insurance penetration across Argentina. However, opportunities for growth exist in other regions as income levels rise and insurance awareness increases.

Argentina Life & Non-Life Insurance Industry Product Innovations

Recent product innovations include AI-driven pricing models that offer more accurate and personalized premiums. This is coupled with the rise of digital distribution channels for quicker and more efficient service delivery. Insurers are also developing specialized products catering to specific market segments and evolving risk profiles, reflecting market demand for tailored insurance solutions. These innovations aim to enhance customer experience, improve efficiency, and maintain a competitive edge in the market. For instance, the introduction of microinsurance products targets underserved populations, expanding market reach and promoting financial inclusion.

Propelling Factors for Argentina Life & Non-Life Insurance Industry Growth

Several factors contribute to the growth of the Argentinian insurance market. Technological advancements, particularly in areas such as AI and big data analytics, are enhancing efficiency and customer experience. Economic growth and rising disposable incomes are increasing the affordability and demand for insurance products. Furthermore, supportive regulatory policies encourage market expansion and foster competition. Government initiatives promoting financial inclusion and insurance penetration among previously underserved segments are also significant drivers of growth.

Obstacles in the Argentina Life & Non-Life Insurance Industry Market

Challenges facing the Argentinian insurance market include macroeconomic instability which often impacts consumer purchasing power and investor confidence. Regulatory hurdles, including complex bureaucratic processes, also present obstacles. Furthermore, high inflation rates affect pricing strategies and profitability. Competition, both from established players and new entrants, demands continuous innovation and efficiency improvements to maintain a competitive advantage.

Future Opportunities in Argentina Life & Non-Life Insurance Industry

Future opportunities lie in expanding insurance penetration among the underinsured population, particularly in rural areas. The development of innovative insurance products tailored to the specific needs of different consumer segments also holds significant potential. Leveraging technology to enhance customer service and streamline operations will remain crucial for maintaining a competitive edge. Moreover, partnerships with fintech companies and other technology providers can foster innovation and expand market reach.

Major Players in the Argentina Life & Non-Life Insurance Industry Ecosystem

- Mercantil Andina

- Marsh Mclennan

- Sancor Seguros

- Grupo asegurador la segunda

- San cristobal seguros

- Chubb

- Parana Seguros

- Holando Seguros

- Experta Aseguradora de Riesgos del Trabajo S A

- Federacion Patronal Seguros

- Orbis Seguros

- Seguros Sura

Key Developments in Argentina Life & Non-Life Insurance Industry Industry

- June 2022: Seguros Sura partnered with Akur8, an AI pricing platform, to enhance its insurance pricing process across Argentina, Chile, and Colombia, automating life insurance pricing. This significantly improves efficiency and accuracy in premium calculations.

- October 2022: La Segunda introduced three new features for crop insurance, covering replanting expenses, extending hail and fire coverage, and offering policy discounts for late corn. This expands the coverage options and affordability of crop insurance, addressing a critical need for farmers.

Strategic Argentina Life & Non-Life Insurance Industry Market Forecast

The Argentinian life and non-life insurance market is poised for sustained growth, driven by technological innovation, economic recovery, and increasing insurance awareness among the population. The market's potential for expansion is significant, particularly in underserved segments and regions. Continued investments in digital infrastructure and the development of tailored insurance solutions will be key to unlocking this growth potential. The market is projected to experience substantial expansion in the coming years, presenting lucrative opportunities for existing and new players alike.

Argentina Life & Non Life Insurance Industry Segmentation

-

1. Type

-

1.1. Life insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non- life insurance

- 1.2.1. Motor

- 1.2.2. Home

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Rest of Non-Life Insurance

-

1.1. Life insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Argentina Life & Non Life Insurance Industry Segmentation By Geography

- 1. Argentina

Argentina Life & Non Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Focus Towards Digitization in the Life Insurance and Non-life Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Life & Non Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non- life insurance

- 5.1.2.1. Motor

- 5.1.2.2. Home

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Rest of Non-Life Insurance

- 5.1.1. Life insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Mercantil Andina

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marsh Mclennan

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sancor Seguros

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Grupo asegurador la segunda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 San cristobal seguros

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chubb

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Parana Seguros

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Holando Seguros

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Experta Aseguradora de Riesgos del Trabajo S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Federacion Patronal Seguros

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Orbis Seguros

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seguros Sura**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Mercantil Andina

List of Figures

- Figure 1: Argentina Life & Non Life Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina Life & Non Life Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 13: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Life & Non Life Insurance Industry?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Argentina Life & Non Life Insurance Industry?

Key companies in the market include Mercantil Andina, Marsh Mclennan, Sancor Seguros, Grupo asegurador la segunda, San cristobal seguros, Chubb, Parana Seguros, Holando Seguros, Experta Aseguradora de Riesgos del Trabajo S A, Federacion Patronal Seguros, Orbis Seguros, Seguros Sura**List Not Exhaustive.

3. What are the main segments of the Argentina Life & Non Life Insurance Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.01 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Focus Towards Digitization in the Life Insurance and Non-life Insurance Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Seguros Sura collaborated with Akur8, an AI pricing platform, to boost its insurance pricing process across Argentina, Chile, and Colombia. This partnership will help Seguros Sura to automate the pricing process of their life insurance products to harmonize practices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Life & Non Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Life & Non Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Life & Non Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Argentina Life & Non Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence