Key Insights

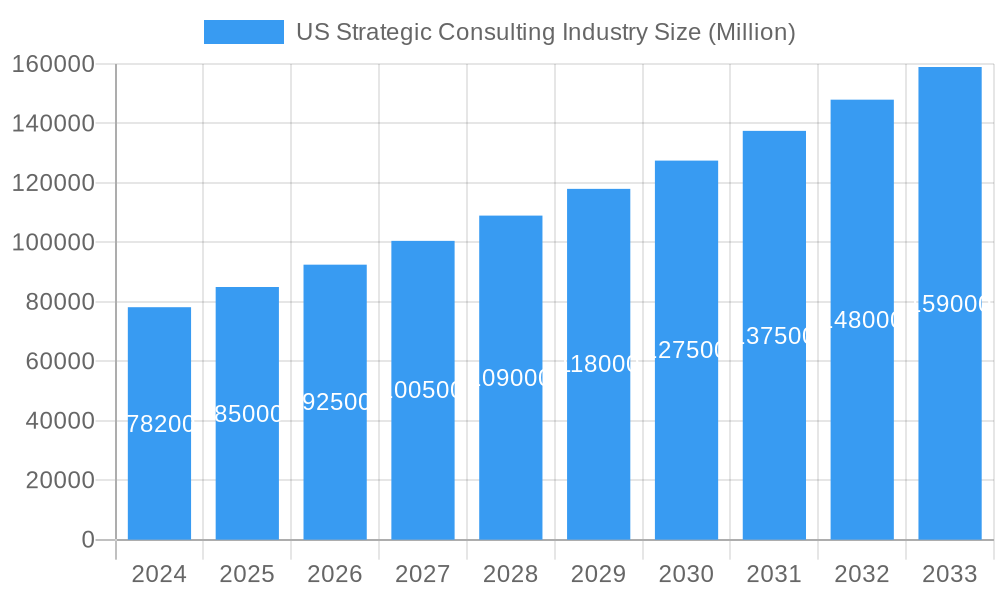

The US strategic consulting market is poised for significant expansion, reflecting a robust demand for expert guidance in navigating complex business landscapes. With an estimated market size of $78.2 billion in 2024, the industry is projected to experience a CAGR of 8.78% over the forecast period of 2025-2033. This growth is fueled by several key drivers, including the accelerating digital transformation across all sectors, the increasing need for data analytics and AI integration to gain competitive advantages, and the constant pressure on organizations to innovate and adapt to rapidly evolving market conditions. The post-pandemic economic recovery and the ongoing geopolitical shifts further necessitate strategic planning and advisory services to mitigate risks and capitalize on emerging opportunities. The financial services, life sciences and healthcare, and retail sectors are anticipated to remain major contributors to this growth, driven by regulatory changes, technological advancements, and evolving consumer behaviors.

US Strategic Consulting Industry Market Size (In Billion)

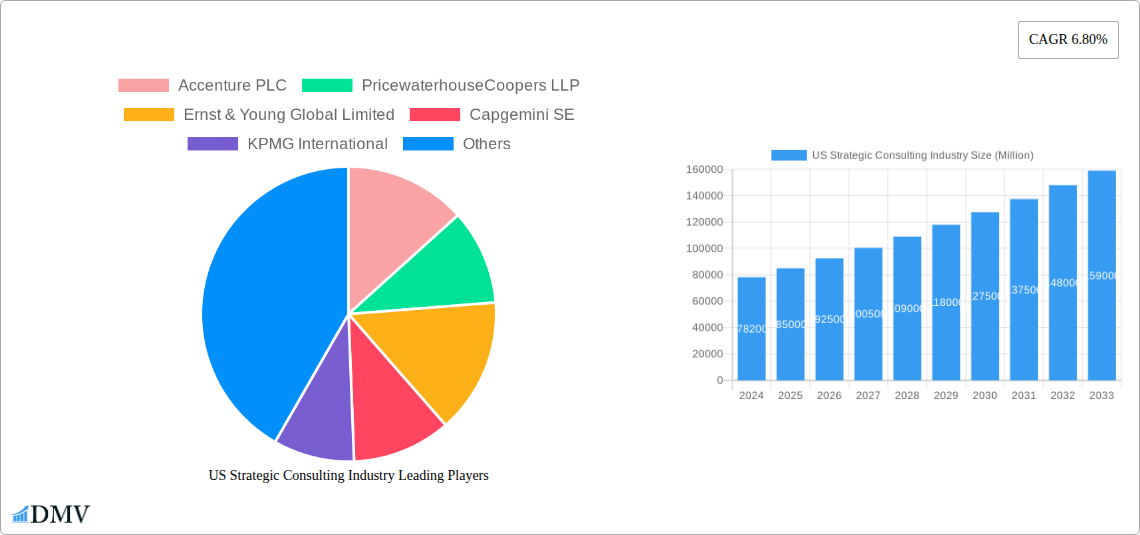

The strategic consulting landscape in the US is characterized by a dynamic interplay of growth opportunities and certain market restraints. While the market size is substantial and projected to expand, challenges such as the intense competition among established global players and boutique firms, as well as the increasing commoditization of certain consulting services, require firms to continuously innovate their offerings and demonstrate clear value. Furthermore, economic uncertainties and potential budget constraints within client organizations could temper the pace of growth in specific periods. However, the fundamental need for strategic foresight in areas like sustainability, supply chain resilience, and talent management is expected to outweigh these restraints. Leading firms such as Accenture PLC, PricewaterhouseCoopers LLP, Ernst & Young Global Limited, and McKinsey & Company are actively investing in specialized capabilities and digital tools to address these evolving client needs and maintain their competitive edge in this vibrant market.

US Strategic Consulting Industry Company Market Share

This comprehensive report offers an in-depth analysis of the dynamic US Strategic Consulting Industry, providing invaluable insights for stakeholders navigating this multi-billion dollar market. Spanning the historical period of 2019–2024 and projecting to 2033, with a base year of 2025, this research illuminates market composition, evolutionary trends, and future growth trajectories. Delve into the strategies of industry titans like Accenture PLC, PricewaterhouseCoopers LLP, Ernst & Young Global Limited, Capgemini SE, KPMG International, Boston Consulting Group, A T Kearney Inc, McKinsey & Company, Bain & Company, and Roland Berger, and understand the critical factors shaping the competitive landscape.

US Strategic Consulting Industry Market Composition & Trends

The US Strategic Consulting Industry exhibits a moderately concentrated market structure, driven by a select group of global consulting powerhouses and a growing segment of specialized boutique firms. Innovation is significantly catalyzed by the increasing demand for digital transformation consulting, data analytics services, and AI strategy development. Regulatory landscapes, while generally favorable, introduce compliance considerations, particularly within the Financial Services and Life Sciences and Healthcare sectors. Substitute products, such as in-house consulting capabilities and off-the-shelf software solutions, pose a growing challenge, necessitating continuous value proposition enhancement by strategic consultants. End-user profiles are diverse, ranging from large enterprises seeking to optimize operations to burgeoning startups requiring market entry strategies. Mergers and acquisitions (M&A) are a significant feature, with deal values frequently reaching the multi-billion dollar mark. For instance, the June 2022 McKinsey & Company acquisition of Caserta, a prominent data analytics firm, exemplifies the industry's drive to bolster specialized capabilities. This strategic move, valued in the hundreds of millions of dollars, underscores the trend of acquiring niche expertise to serve complex client needs, further solidifying McKinsey's position in advanced data analytics consulting and AI-driven strategy.

- Market Share Distribution: Dominated by a handful of top-tier firms, with a substantial portion of revenue generated by the top 5 players.

- M&A Deal Values: Numerous multi-billion dollar transactions observed, primarily focused on acquiring specialized technology and data analytics expertise.

- Innovation Catalysts: Growing demand for cloud consulting, cybersecurity strategy, and sustainability consulting.

- Regulatory Impact: Compliance mandates in financial services consulting and healthcare consulting influence service offerings.

US Strategic Consulting Industry Industry Evolution

The US Strategic Consulting Industry has witnessed remarkable evolution, transitioning from traditional strategy formulation to comprehensive implementation and advisory services. Over the study period of 2019–2033, the market has experienced robust growth, averaging an estimated XX% annual growth rate from 2019 to 2024. This expansion is primarily fueled by the accelerating pace of technological innovation and the increasing complexity of global business environments. Digital transformation consulting has emerged as a paramount driver, with companies across all sectors investing billions to modernize their operations, enhance customer experiences, and leverage data for competitive advantage. The base year of 2025 is estimated to see a market size in the hundreds of billions of dollars, with significant contributions from the financial services industry, life sciences and healthcare sector, and retail market. Shifting consumer demands, characterized by a preference for personalized experiences and on-demand services, have compelled businesses to seek strategic guidance on adapting their business models. The adoption of advanced analytics, artificial intelligence (AI), and machine learning (ML) by consulting firms themselves has further enhanced their ability to deliver data-driven insights and measurable outcomes. The forecast period of 2025–2033 projects continued growth, projected at XX% to XX% annually, as businesses increasingly rely on expert strategic advice to navigate disruptive technologies, evolving market landscapes, and geopolitical uncertainties. The McKinsey & Company acquisition of Caserta in June 2022 serves as a prime example of this evolution, with the firm significantly bolstering its data analytics consulting and AI implementation capabilities. This strategic move allows McKinsey to offer more sophisticated solutions for Fortune 100 companies looking to establish cutting-edge data architectures and leverage big data analytics for strategic decision-making.

Leading Regions, Countries, or Segments in US Strategic Consulting Industry

Within the vast landscape of the US Strategic Consulting Industry, the Financial Services sector consistently emerges as the dominant end-user industry. This dominance is underpinned by a confluence of factors, including the sector's inherent complexity, stringent regulatory demands, and a perpetual need for adaptation in the face of technological disruption and evolving customer expectations. The financial services consulting market alone is estimated to be worth billions of dollars, driven by extensive investments in digital transformation, risk management consulting, regulatory compliance advisory, and fintech integration. Consulting firms are crucial in helping banks, investment firms, and insurance providers navigate the challenges posed by cybersecurity threats, the rise of digital payment solutions, and the increasing adoption of blockchain technology.

The Life Sciences and Healthcare sector also represents a significant and growing segment, with billions invested annually. Consulting services here are vital for navigating complex regulatory frameworks such as FDA approvals, driving innovation in drug discovery and development, optimizing hospital operations, and implementing healthcare IT solutions. The increasing focus on personalized medicine and the growing demand for advanced diagnostics have further amplified the need for strategic guidance.

The Retail sector, though experiencing its own set of disruptions, also commands billions in consulting expenditure. This includes strategies for e-commerce optimization, supply chain management improvements, customer experience enhancement, and adapting to changing consumer purchasing habits. The ongoing digital shift and the imperative to create seamless omnichannel experiences are key drivers.

While Government sector consulting is substantial, often involving large-scale public policy and program management projects, and the Energy sector is critical, particularly in navigating the transition to sustainable sources, Financial Services remains the most impactful segment in terms of consistent, high-value consulting engagements and overall market contribution.

- Financial Services Dominance: Driven by digital transformation, regulatory pressures, and fintech advancements. Key areas include digital banking strategy, risk and compliance consulting, and AI in financial services.

- Life Sciences & Healthcare Growth: Fueled by innovation in drug development, personalized medicine, and healthcare IT adoption. Healthcare analytics consulting and biotech consulting are on the rise.

- Retail Adaptation: Focus on e-commerce strategy, supply chain optimization, and customer journey mapping.

- Government Sector: Significant opportunities in public sector consulting and digital government initiatives.

- Energy Transition: Consulting for renewable energy strategies and sustainability reporting.

US Strategic Consulting Industry Product Innovations

Recent product innovations in the US Strategic Consulting Industry are heavily influenced by the integration of advanced technologies. Consulting firms are increasingly developing proprietary AI-powered analytics platforms and data visualization tools to deliver more precise and actionable insights to clients. These innovations enable faster identification of market trends, optimization of business processes, and more sophisticated scenario planning. Furthermore, the development of specialized digital transformation frameworks and cloud strategy accelerators allows consultants to streamline the implementation of complex IT projects, leading to reduced project timelines and cost savings for clients. The emphasis is on creating solutions that not only advise but also directly contribute to the tangible improvement of client performance and market competitiveness, particularly in areas like AI consulting and big data consulting.

Propelling Factors for US Strategic Consulting Industry Growth

The US Strategic Consulting Industry is propelled by several key factors. Technological advancements, particularly in AI, machine learning, and big data analytics, enable consultants to offer more sophisticated and data-driven solutions. The relentless drive for digital transformation across all sectors necessitates expert guidance, creating a sustained demand for strategic advisory services. Economic volatility and geopolitical uncertainties also spur demand for risk management consulting and resilience strategy development. Regulatory shifts, such as those in the financial services and healthcare sectors, create complex compliance challenges that require specialized consulting expertise. The increasing complexity of global supply chains and the growing importance of sustainability consulting further contribute to market expansion.

Obstacles in the US Strategic Consulting Industry Market

Despite its growth, the US Strategic Consulting Industry faces several obstacles. Intense competitive pressures from established players and emerging boutique firms can lead to pricing wars and margin erosion. The increasing reliance on technology also presents a challenge, requiring continuous investment in talent and infrastructure to stay ahead. Talent acquisition and retention remain critical, as specialized skills are in high demand. Economic downturns can lead to reduced client spending on consulting services, impacting revenue streams. Furthermore, some clients are developing more sophisticated in-house capabilities, reducing their reliance on external consultants for certain tasks.

Future Opportunities in US Strategic Consulting Industry

Emerging opportunities in the US Strategic Consulting Industry are abundant. The burgeoning field of AI ethics consulting and responsible AI development presents a significant growth area. The ongoing global push for sustainability and ESG (Environmental, Social, and Governance) compliance creates vast opportunities for strategic guidance. The continued evolution of blockchain technology and its application in various industries, from finance to supply chain management, will also drive demand for specialized consulting. Furthermore, the increasing need for change management consulting in an era of rapid technological and organizational shifts offers substantial potential. The expansion of digital healthcare consulting and personalized education solutions also represents untapped markets.

Major Players in the US Strategic Consulting Industry Ecosystem

- Accenture PLC

- PricewaterhouseCoopers LLP

- Ernst & Young Global Limited

- Capgemini SE

- KPMG International

- Boston Consulting Group

- A T Kearney Inc

- McKinsey & Company

- Bain & Company

- Roland Berger

Key Developments in US Strategic Consulting Industry Industry

- June 2022: McKinsey & Company acquires Caserta, a New York-based data analytics consulting and implementation firm. This strategic move significantly strengthens McKinsey's data analytics capabilities and positions them to offer more robust solutions for clients seeking to roadmap, design, and implement cutting-edge data architectures, particularly serving Fortune 100 companies.

Strategic US Strategic Consulting Industry Market Forecast

The US Strategic Consulting Industry is poised for continued robust growth, driven by the persistent need for digital transformation, AI integration, and sustainability strategies. The increasing complexity of the global business environment, coupled with evolving regulatory landscapes, will further cement the role of strategic consultants in guiding organizations towards resilience and competitive advantage. The acquisition of specialized firms, like the McKinsey & Company acquisition of Caserta, highlights the industry's commitment to enhancing data-driven advisory services and delivering advanced technological solutions, ensuring a bright future for the market, estimated to reach hundreds of billions of dollars in the coming years.

US Strategic Consulting Industry Segmentation

-

1. END-USER INDUSTRY

- 1.1. Financial Services

- 1.2. Life Sciences and Healthcare

- 1.3. Retail

- 1.4. Government

- 1.5. Energy

- 1.6. Other End-user Industries

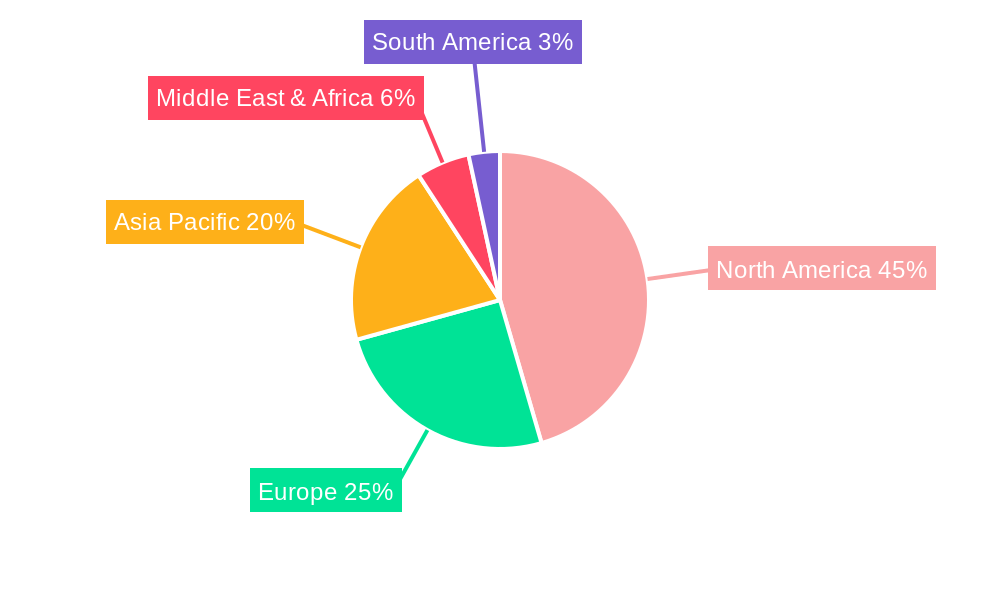

US Strategic Consulting Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Strategic Consulting Industry Regional Market Share

Geographic Coverage of US Strategic Consulting Industry

US Strategic Consulting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain

- 3.3. Market Restrains

- 3.3.1. Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain

- 3.4. Market Trends

- 3.4.1. United States Strategic Consulting Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 5.1.1. Financial Services

- 5.1.2. Life Sciences and Healthcare

- 5.1.3. Retail

- 5.1.4. Government

- 5.1.5. Energy

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 6. North America US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 6.1.1. Financial Services

- 6.1.2. Life Sciences and Healthcare

- 6.1.3. Retail

- 6.1.4. Government

- 6.1.5. Energy

- 6.1.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 7. South America US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 7.1.1. Financial Services

- 7.1.2. Life Sciences and Healthcare

- 7.1.3. Retail

- 7.1.4. Government

- 7.1.5. Energy

- 7.1.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 8. Europe US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 8.1.1. Financial Services

- 8.1.2. Life Sciences and Healthcare

- 8.1.3. Retail

- 8.1.4. Government

- 8.1.5. Energy

- 8.1.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 9. Middle East & Africa US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 9.1.1. Financial Services

- 9.1.2. Life Sciences and Healthcare

- 9.1.3. Retail

- 9.1.4. Government

- 9.1.5. Energy

- 9.1.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 10. Asia Pacific US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 10.1.1. Financial Services

- 10.1.2. Life Sciences and Healthcare

- 10.1.3. Retail

- 10.1.4. Government

- 10.1.5. Energy

- 10.1.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accenture PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PricewaterhouseCoopers LLP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ernst & Young Global Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Capgemini SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KPMG International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Boston Consulting Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 A T Kearney Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 McKinsey & Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bain & Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Roland Berge

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Accenture PLC

List of Figures

- Figure 1: Global US Strategic Consulting Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 3: North America US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 4: North America US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 7: South America US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 8: South America US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 11: Europe US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 12: Europe US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 15: Middle East & Africa US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 16: Middle East & Africa US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 19: Asia Pacific US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 20: Asia Pacific US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 2: Global US Strategic Consulting Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 4: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 9: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 14: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 25: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 33: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Strategic Consulting Industry?

The projected CAGR is approximately 8.78%.

2. Which companies are prominent players in the US Strategic Consulting Industry?

Key companies in the market include Accenture PLC, PricewaterhouseCoopers LLP, Ernst & Young Global Limited, Capgemini SE, KPMG International, Boston Consulting Group, A T Kearney Inc, McKinsey & Company, Bain & Company, Roland Berge.

3. What are the main segments of the US Strategic Consulting Industry?

The market segments include END-USER INDUSTRY.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain.

6. What are the notable trends driving market growth?

United States Strategic Consulting Services Market.

7. Are there any restraints impacting market growth?

Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain.

8. Can you provide examples of recent developments in the market?

June 2022 - McKinsey & Company has acquired Caserta, a New York-based data analytics consulting and implementation firm. McKinsey strengthens data capabilities with the Caserta acquisition; Caserta, the firm, works with Fortune 100 companies to roadmap, design, and implement cutting-edge data architectures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Strategic Consulting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Strategic Consulting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Strategic Consulting Industry?

To stay informed about further developments, trends, and reports in the US Strategic Consulting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence