Key Insights

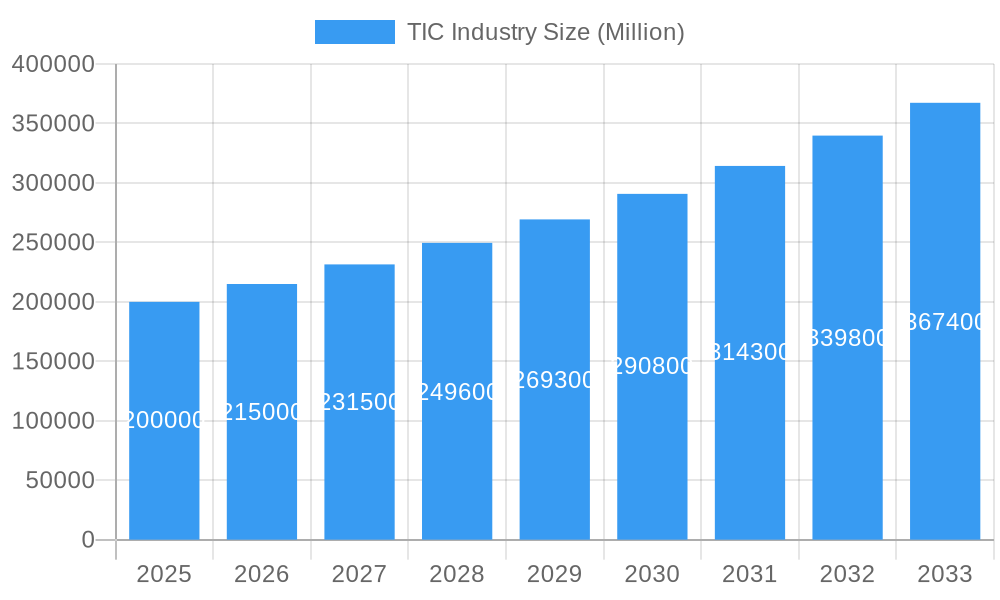

The global Testing, Inspection, and Certification (TIC) market is poised for substantial expansion. Driven by increasing regulatory compliance demands across sectors such as food safety, environmental protection, and product quality, the industry is experiencing robust growth. The intricate nature of modern global supply chains necessitates independent verification, further fueling demand for TIC services. Growing consumer awareness regarding product safety and sustainability is also a significant growth catalyst, particularly in emerging economies. The market is projected to reach $417.76 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.6%. Leading entities like SGS, Bureau Veritas, Intertek, and TÜV SUD are prominent market players, capitalizing on their extensive networks and comprehensive service portfolios. However, the industry faces challenges including intense competition, price sensitivity, and the imperative for ongoing investment in advanced technologies and skilled professionals. Opportunities for expansion are abundant in developing economies with rapidly industrializing sectors. Key industry verticals such as automotive, healthcare, and manufacturing represent significant segments, each with distinct TIC requirements and growth potential. The historical period (2019-2024) demonstrated consistent market growth, laying the foundation for the accelerated expansion anticipated in the coming years.

TIC Industry Market Size (In Billion)

The TIC market's dynamism demands continuous adaptation and innovation. Companies are increasingly integrating digital technologies, including Artificial Intelligence (AI) and the Internet of Things (IoT), to enhance operational efficiency, refine data analytics, and deliver more advanced service offerings. This technological integration is redefining the competitive arena, favoring organizations that can effectively harness new technologies to optimize processes and provide superior client value. The future success of the TIC industry hinges on its ability to adapt to evolving regulatory landscapes, meet diverse client needs across various industries, and embrace digital transformation for sustainable growth. Agile companies with technological expertise and a profound understanding of client-specific requirements will lead the way. The persistent rise in consumer demand for safe, sustainable, and high-quality products will continue to drive significant growth within the industry.

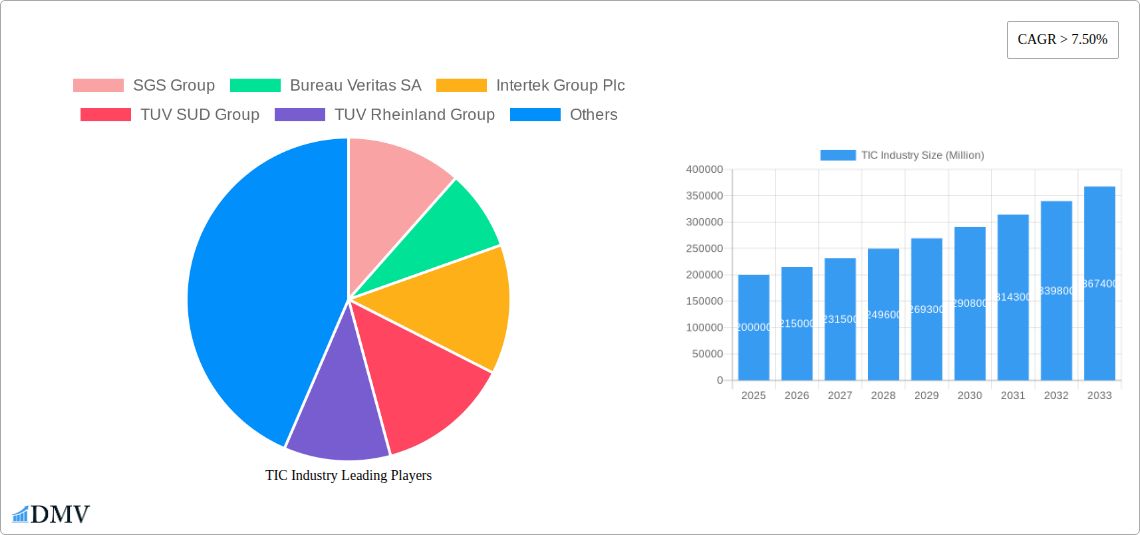

TIC Industry Company Market Share

TIC Industry Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the global Testing, Inspection, and Certification (TIC) industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a focus on 2025, this report dissects market trends, competitive landscapes, and future opportunities, projecting a robust growth trajectory. The study encompasses a thorough examination of major players, including SGS Group, Bureau Veritas SA, Intertek Group Plc, TÜV SÜD Group, TÜV Rheinland Group, AsiaInspection Ltd, British Standards Institution Group, Keller-Frei Zurich, Centre Testing International (CTI), Hohenstein Institute, SAI Global Ltd, TESTEX AG, and Eurofins Scientific (list not exhaustive), across various segments. The report's data-driven projections and in-depth analysis are crucial for informed decision-making and strategic planning. The total market value is predicted to reach XX Million by 2033.

TIC Industry Market Composition & Trends

This section evaluates the market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities within the TIC industry. The market is characterized by a relatively concentrated landscape, with a few large players holding significant market share. However, the entry of smaller, specialized firms continues to reshape the competitive dynamics.

Market Share Distribution (2024 Estimate):

- SGS Group: XX%

- Bureau Veritas SA: XX%

- Intertek Group Plc: XX%

- TÜV SÜD Group: XX%

- Others: XX%

Innovation Catalysts: Digitalization, automation, and the increasing demand for sustainable and ethical practices are driving innovation. New technologies like AI and blockchain are being integrated into TIC services, enhancing efficiency and transparency.

Regulatory Landscape: Stringent regulations concerning product safety, environmental protection, and quality standards are shaping the TIC market. Compliance requirements necessitate robust testing and certification processes, boosting industry growth.

Substitute Products: Limited direct substitutes exist for core TIC services; however, companies may choose to perform internal testing or leverage alternative validation methods, depending on the industry and regulatory requirements.

End-User Profiles: The TIC industry serves a diverse range of end-users, including manufacturers, importers, exporters, retailers, and governments. Demand varies across sectors, with some (e.g., healthcare, automotive) exhibiting stricter regulatory mandates.

M&A Activities: Consolidation through M&A activities is common, with deal values exceeding XX Million in recent years, driven by the pursuit of economies of scale, expanded service portfolios, and geographic reach.

TIC Industry Evolution

This section analyzes the historical and projected growth trajectory of the TIC market, encompassing technological advancements, evolving consumer demands, and shifting industry dynamics.

The TIC industry has demonstrated steady growth over the past decade, fueled by globalization, rising consumer expectations for product quality and safety, and increasing regulatory scrutiny. The historical period (2019-2024) saw a Compound Annual Growth Rate (CAGR) of XX%, while the forecast period (2025-2033) is projected to exhibit a CAGR of XX%. This growth is being driven by several key factors: the rising adoption of advanced technologies, increasing demand for specialized testing services (e.g., environmental testing, food safety), and the expanding global trade landscape. Significant technological advancements, particularly in automation and data analytics, are boosting efficiency and precision. The demand for sustainability and ethical sourcing is driving growth in related TIC segments, such as environmental and social responsibility certifications. Consumer demands for transparency and product traceability are also influencing industry developments. Overall, the industry’s evolution is characterized by ongoing innovation, consolidation, and adaptation to evolving regulatory and consumer needs.

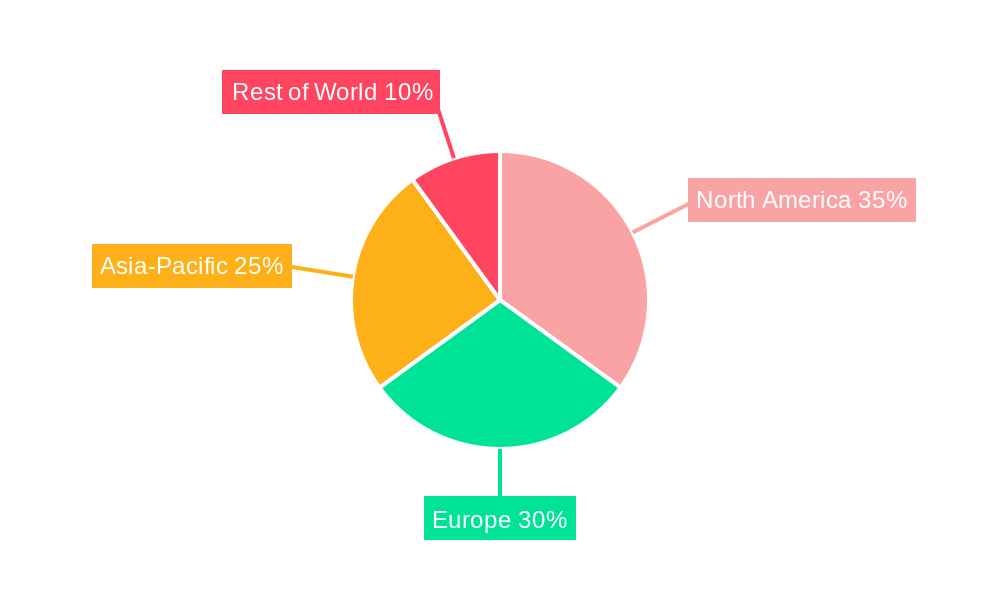

Leading Regions, Countries, or Segments in TIC Industry

This section identifies the leading regions, countries, and market segments within the TIC industry. North America and Europe have traditionally dominated the market, driven by stringent regulatory environments and established industrial bases. However, the Asia-Pacific region is experiencing rapid growth, fueled by rising manufacturing activity and increasing consumer spending.

Key Drivers of Regional Dominance:

- North America: Strong regulatory framework, robust industrial base, and high consumer awareness of product safety and quality.

- Europe: Similar to North America, with a highly developed regulatory landscape and a well-established TIC ecosystem.

- Asia-Pacific: Rapid industrialization, increasing consumer spending, and a growing middle class driving demand for quality assurance and certification services.

The automotive, food and beverage, and healthcare segments are currently the largest, reflecting significant regulatory requirements and robust safety concerns. The increasing adoption of sustainability standards is also rapidly expanding the segment of environmentally focused TIC services.

TIC Industry Product Innovations

The TIC industry is witnessing continuous innovation, with new technologies and service offerings constantly emerging. Significant advancements include the integration of AI and machine learning algorithms to automate processes, improve accuracy, and reduce costs. Blockchain technology is being explored for enhancing data security and traceability across the supply chain. The development of portable and rapid testing devices is expanding the accessibility and efficiency of testing services. The emphasis on sustainability is driving innovation in areas like carbon footprint assessments and circular economy certification. These improvements enhance efficiency, precision, and the overall value proposition for clients.

Propelling Factors for TIC Industry Growth

Several key factors are driving the growth of the TIC industry. Firstly, the increasing complexity of global supply chains necessitates rigorous quality control and risk management. Secondly, escalating consumer awareness of product safety and quality is leading to heightened demand for independent verification. Thirdly, the strengthening of government regulations and standards worldwide necessitates compliance-focused TIC services. Finally, the ongoing development and adoption of innovative technologies within the sector, such as AI and automation, are fostering efficiency and accuracy.

Obstacles in the TIC Industry Market

The TIC industry faces certain challenges, including intense competition among established players and emerging firms. Supply chain disruptions can impact the availability of testing equipment and materials. Varying regulatory landscapes across different regions can increase compliance costs and complexity. These challenges call for strategic adaptability and technological advancement to maintain competitiveness and operational resilience. Furthermore, securing skilled talent remains a critical challenge for many businesses.

Future Opportunities in TIC Industry

Emerging opportunities exist in several areas. The growth of e-commerce and digitalization presents opportunities for digital TIC services. The increasing demand for sustainability certifications in various sectors opens avenues for growth. Expansion into emerging markets with less developed testing infrastructure creates potential for significant market entry. The continued development and adoption of advanced technologies, such as AI and automation, offers significant opportunities for efficiency gains and service innovation.

Major Players in the TIC Industry Ecosystem

- SGS Group

- Bureau Veritas SA

- Intertek Group Plc

- TÜV SÜD Group

- TÜV Rheinland Group

- AsiaInspection Ltd

- British Standards Institution Group

- Keller-Frei Zurich

- Centre Testing International (CTI)

- Hohenstein Institute

- SAI Global Ltd

- TESTEX AG

- Eurofins Scientific

Key Developments in TIC Industry

- January 2022: SGS Group partnered with Microsoft to develop a new digital TIC service, leveraging Microsoft's data solutions and SGS's global network. This significantly enhances the potential for digital transformation within the industry.

- March 2022: TÜV Rheinland partnered with The BHive platform to provide a seamless approach to chemical testing and management in the textile and fashion industry, accelerating the phasing out of hazardous chemicals. This collaboration signifies a crucial step towards greater sustainability within the sector.

Strategic TIC Industry Market Forecast

The TIC industry is poised for continued growth, driven by technological advancements, increasing regulatory scrutiny, and the rising demand for product quality and safety assurances. The market is expected to experience significant expansion, with substantial opportunities in emerging markets and specialized testing segments. Continued innovation and strategic partnerships will be crucial for success in this evolving landscape. The adoption of digital technologies and sustainable practices will further drive the market's future growth and shape its trajectory.

TIC Industry Segmentation

-

1. Application

- 1.1. Textile Testing

- 1.2. Textile Inspection

- 1.3. Textile Certification

TIC Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Latin America

- 5. Middle East

TIC Industry Regional Market Share

Geographic Coverage of TIC Industry

TIC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Trade of Textile Products Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global TIC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Textile Testing

- 5.1.2. Textile Inspection

- 5.1.3. Textile Certification

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America TIC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Textile Testing

- 6.1.2. Textile Inspection

- 6.1.3. Textile Certification

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Asia Pacific TIC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Textile Testing

- 7.1.2. Textile Inspection

- 7.1.3. Textile Certification

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe TIC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Textile Testing

- 8.1.2. Textile Inspection

- 8.1.3. Textile Certification

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America TIC Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Textile Testing

- 9.1.2. Textile Inspection

- 9.1.3. Textile Certification

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East TIC Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Textile Testing

- 10.1.2. Textile Inspection

- 10.1.3. Textile Certification

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SGS Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bureau Veritas SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek Group Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TUV SUD Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TUV Rheinland Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AsiaInspection Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 British Standards Institution Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Keller-Frei Zurich

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Centre Testing International (CTI)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hohenstein Institute

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SAI Global Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TESTEX AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eurofins Scientific**List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 SGS Group

List of Figures

- Figure 1: Global TIC Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: Asia Pacific TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Latin America TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East TIC Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global TIC Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the TIC Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the TIC Industry?

Key companies in the market include SGS Group, Bureau Veritas SA, Intertek Group Plc, TUV SUD Group, TUV Rheinland Group, AsiaInspection Ltd, British Standards Institution Group, Keller-Frei Zurich, Centre Testing International (CTI), Hohenstein Institute, SAI Global Ltd, TESTEX AG, Eurofins Scientific**List Not Exhaustive.

3. What are the main segments of the TIC Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 417.76 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Trade of Textile Products Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Jan 2022: Switzerland-based testing and certification group SGS announced a partnership with Microsoft to develop a new digital TIC service. This collaboration will leverage Microsoft's cross-industry expertise, advanced data solutions and productivity platforms, integrated with SGS's global service network and leading industry capabilities to develop innovative solutions for customers in the Testing, Inspection and Certification (TIC) industry .

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "TIC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the TIC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the TIC Industry?

To stay informed about further developments, trends, and reports in the TIC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence