Key Insights

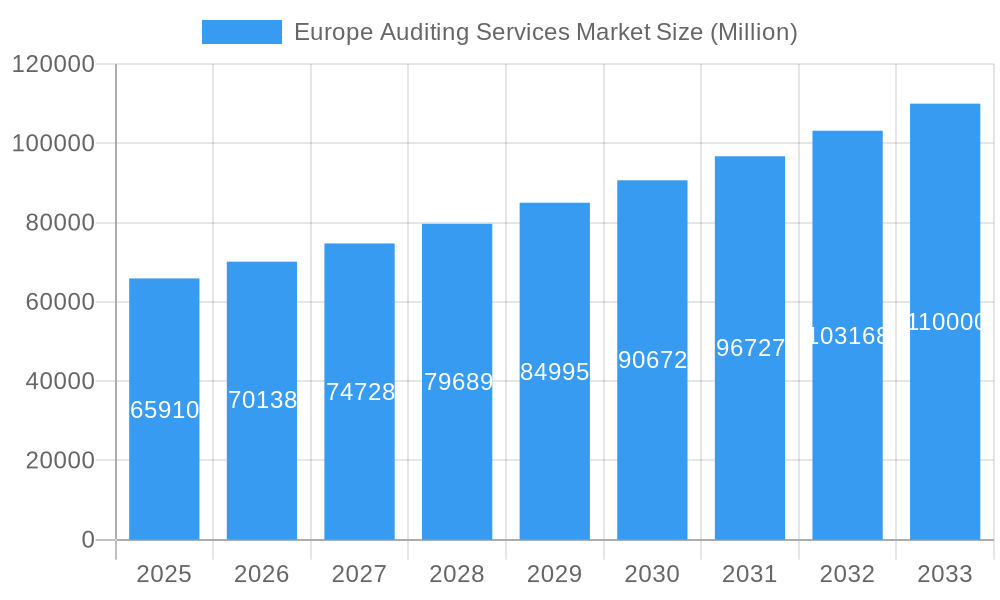

The European auditing services market, valued at €65.91 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.33% from 2025 to 2033. This expansion is fueled by several key factors. Increased regulatory scrutiny across various sectors, particularly in finance and healthcare, necessitates stringent auditing practices, driving demand for professional services. The rising complexity of global business operations and the growing adoption of advanced technologies like AI and machine learning in auditing further contribute to market growth. Moreover, the increasing prevalence of cross-border transactions and international expansion strategies of businesses necessitate the expertise of global auditing firms, bolstering market expansion. The market's competitive landscape is dominated by major players such as Deloitte, EY, KPMG, PwC, and several other prominent firms, engaged in intense competition for clients while simultaneously consolidating their market share through strategic acquisitions and expansion into niche service areas.

Europe Auditing Services Market Market Size (In Billion)

This significant growth is expected to continue through 2033, driven by several factors including the increasing adoption of International Financial Reporting Standards (IFRS) across Europe, the growing emphasis on corporate governance and risk management, and the emergence of new technological advancements that are transforming the audit process. However, market growth may encounter some challenges. Economic fluctuations and uncertainties in the European Union could impact business spending on auditing services. Furthermore, the increasing competition amongst auditing firms, coupled with pricing pressures, could impact profit margins for some players. Despite these potential restraints, the overall outlook for the European auditing services market remains positive, driven by the fundamental need for independent assurance and robust financial reporting across various sectors. The focus on digital transformation and increasing demand for specialized audit services, such as cybersecurity and data analytics audits, are poised to create new opportunities for market expansion in the long term.

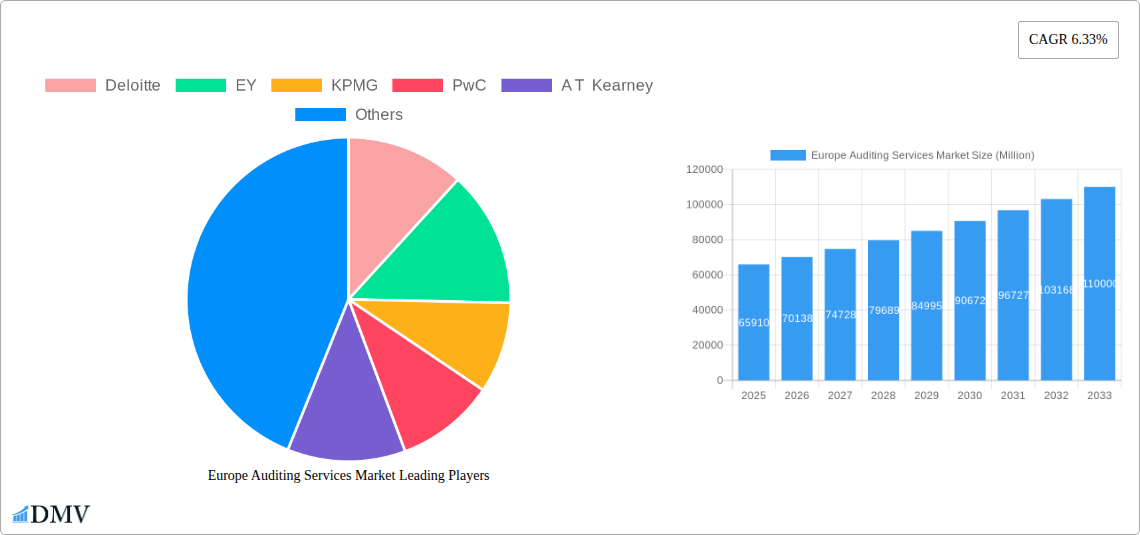

Europe Auditing Services Market Company Market Share

Europe Auditing Services Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Auditing Services Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with 2025 as the base and estimated year, this study offers invaluable insights for stakeholders seeking to understand and navigate this dynamic market. The market is expected to reach xx Million by 2033.

Europe Auditing Services Market Market Composition & Trends

This section delves into the intricate composition of the European auditing services market, examining market concentration, innovation drivers, regulatory landscapes, and competitive dynamics. The analysis unveils the market share distribution among key players, highlighting the dominance of the "Big Four" – Deloitte, EY, KPMG, and PwC – while also acknowledging the contributions of other significant players such as A T Kearney, Grant Thornton LLP, Bain & Company, BDO USA, Rodl and Partners, and Alvarez & Marsal. The report also considers the influence of substitute products, evolving end-user profiles, and the impact of mergers and acquisitions (M&A) activities. M&A deal values are analyzed to understand their effect on market consolidation and competitive landscape. The historical period (2019-2024) provides a baseline for understanding current market trends.

- Market Concentration: The market exhibits a high degree of concentration, with the Big Four accounting for approximately xx% of the market share in 2024.

- Innovation Catalysts: Increasing regulatory scrutiny and the demand for enhanced transparency are driving innovation in auditing methodologies and technologies.

- Regulatory Landscape: EU regulations like IFRS and ESMA directives significantly shape the auditing landscape, impacting service offerings and compliance requirements.

- Substitute Products: The rise of automated auditing tools and AI-powered solutions is gradually altering the traditional service provision model.

- End-User Profiles: The report segments end-users based on industry, company size, and geographic location, providing a granular understanding of market demand.

- M&A Activities: The report analyzes recent M&A deals, including deal values and their implications for market consolidation. For example, the combined market share of the acquirer and target in recent mergers is estimated at approximately xx%.

Europe Auditing Services Market Industry Evolution

This section provides a comprehensive analysis of the Europe Auditing Services Market’s evolution, tracing its growth trajectory from 2019 to 2033. The report meticulously examines technological advancements, shifting consumer demands, and the overall market dynamics. Specific data points, including growth rates and adoption metrics for new technologies, are presented to support the analysis. The impact of the COVID-19 pandemic and the subsequent economic recovery on the market are also considered. Furthermore, the report forecasts future market trends based on current growth patterns and anticipated technological disruptions. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%. This analysis provides a clear picture of the market's past performance and its potential future growth.

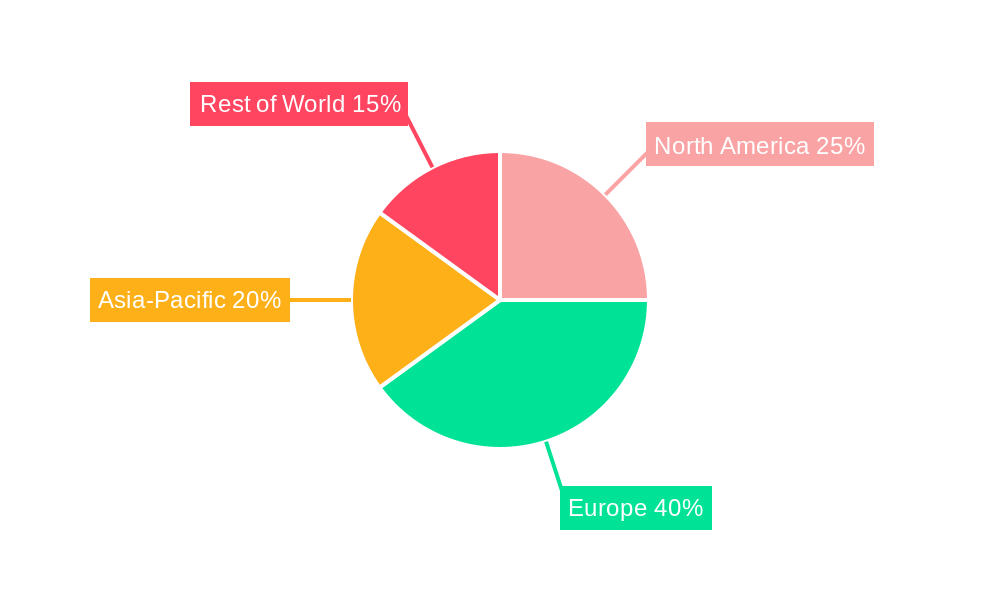

Leading Regions, Countries, or Segments in Europe Auditing Services Market

This section identifies the dominant regions, countries, and segments within the European auditing services market. The report highlights key drivers of growth in these areas, including investment trends, regulatory support, and economic conditions. The dominance of specific regions or segments is analyzed in detail, explaining the factors that contribute to their leading positions.

- United Kingdom: Strong financial sector, robust regulatory framework, and a large pool of skilled professionals contribute to the UK's leading position.

- Germany: Significant industrial base, a complex regulatory environment, and a high concentration of multinational corporations drive demand for auditing services.

- France: A substantial economy, stringent regulatory requirements, and a growing focus on corporate governance support the market's growth in France.

- Key Drivers: Increased regulatory scrutiny, growing corporate complexity, and the need for enhanced transparency are driving demand across all leading regions.

Europe Auditing Services Market Product Innovations

The European auditing services market is experiencing a dynamic transformation fueled by rapid technological advancements and an increasing demand for sophisticated client solutions. Leading firms are actively integrating next-generation tools, including advanced AI-powered data analytics engines for deeper insights, robust blockchain solutions to ensure unparalleled security and transaction transparency, and scalable cloud-based platforms that optimize service delivery workflows. These cutting-edge innovations are not only enhancing operational efficiency and reducing cost structures but also significantly improving accuracy and providing auditors with powerful unique selling propositions to maintain a competitive edge. Early adopters of these integrated technologies have reported an impressive average productivity increase of approximately 15-20%, with further gains anticipated as adoption becomes more widespread.

Propelling Factors for Europe Auditing Services Market Growth

Several factors are driving the growth of the European auditing services market. Technological advancements, such as AI and automation, are enhancing efficiency and expanding service offerings. The increasing complexity of businesses and stringent regulatory environments necessitates robust auditing practices, fueling market demand. Favorable economic conditions in many European countries also contribute to the growth of the market. Finally, the increasing awareness of corporate governance and transparency further reinforces the need for professional auditing services.

Obstacles in the Europe Auditing Services Market Market

While the European auditing services market demonstrates robust growth potential, it is not without its hurdles. Navigating the intricate and ever-evolving landscape of stringent regulatory frameworks and associated compliance mandates presents a considerable challenge, often leading to increased operational costs and resource allocation. Furthermore, persistent global supply chain disruptions and a discernible shortage of highly skilled auditing professionals can impede the consistent and timely delivery of services. The market also grapples with intense competition, especially from the established dominance of the Big Four firms, which exert considerable pressure on pricing strategies and profit margins for smaller and mid-sized audit entities. Without effective strategies to mitigate these factors, market expansion could be curtailed. The estimated negative impact of regulatory complexities on overall market growth is conservatively pegged at around 8-12%.

Future Opportunities in Europe Auditing Services Market

The European auditing services market is brimming with compelling future opportunities, particularly for forward-thinking and agile firms. The widespread adoption and continued evolution of cloud computing technologies and blockchain present fertile ground for developing and offering novel, value-added service lines that address emerging client needs. There is substantial untapped potential in expanding service footprints into rapidly developing emerging markets within Europe, alongside a significant and growing demand from the Small and Medium-sized Enterprise (SME) sector for specialized and accessible auditing solutions. Furthermore, cultivating expertise in niche industry sectors and developing highly customized, client-centric service packages are crucial strategies for differentiation and success in an increasingly crowded and competitive marketplace.

Key Developments in Europe Auditing Services Market Industry

- April 2023: PwC Switzerland strategically acquired Avoras, significantly broadening its capabilities in SAP-enabled business transformation services, with a particular focus on the dynamic pharmaceuticals and life sciences sectors.

- June 2023: KPMG bolstered its IT services division by acquiring QuadriO, a distinguished German SAP consultancy, thereby enhancing its expertise and service offerings, especially for clients within the banking industry.

Strategic Europe Auditing Services Market Market Forecast

The Europe Auditing Services Market is confidently projected to experience sustained and significant growth. This expansion will be propelled by a confluence of factors including the relentless pace of technological innovation, escalating regulatory oversight across various industries, and the ever-increasing complexity inherent in modern business operations. The market is anticipated to witness particularly robust growth in specialized areas such as advanced data analytics, comprehensive cybersecurity auditing, and the crucial domain of sustainable business practices and ESG (Environmental, Social, and Governance) reporting. The landscape will continue to be shaped by ongoing merger and acquisition (M&A) activities and the dynamic emergence of innovative service models, presenting both considerable opportunities and strategic challenges for all market participants. The long-term outlook for the industry remains exceptionally positive, indicating a promising trajectory for continued evolution and success.

Europe Auditing Services Market Segmentation

-

1. Type

- 1.1. Internal Audit

- 1.2. External Audit

-

2. Service Line

- 2.1. Operational Audits

- 2.2. Financial Audits

- 2.3. Advisory and Consulting

- 2.4. Investigation Audits

- 2.5. Information System Audits

- 2.6. Compliance Audits

- 2.7. Other Service Lines

Europe Auditing Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Auditing Services Market Regional Market Share

Geographic Coverage of Europe Auditing Services Market

Europe Auditing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market

- 3.3. Market Restrains

- 3.3.1. Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market

- 3.4. Market Trends

- 3.4.1. External Audit is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Auditing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Internal Audit

- 5.1.2. External Audit

- 5.2. Market Analysis, Insights and Forecast - by Service Line

- 5.2.1. Operational Audits

- 5.2.2. Financial Audits

- 5.2.3. Advisory and Consulting

- 5.2.4. Investigation Audits

- 5.2.5. Information System Audits

- 5.2.6. Compliance Audits

- 5.2.7. Other Service Lines

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deloitte

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EY

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KPMG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PwC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 A T Kearney

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Grant Thornton LLP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bain & Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BDO USA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rodl and Partners

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alvarez & Marsal**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Deloitte

List of Figures

- Figure 1: Europe Auditing Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Auditing Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Auditing Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Auditing Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Auditing Services Market Revenue Million Forecast, by Service Line 2020 & 2033

- Table 4: Europe Auditing Services Market Volume Billion Forecast, by Service Line 2020 & 2033

- Table 5: Europe Auditing Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Auditing Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Auditing Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Auditing Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Auditing Services Market Revenue Million Forecast, by Service Line 2020 & 2033

- Table 10: Europe Auditing Services Market Volume Billion Forecast, by Service Line 2020 & 2033

- Table 11: Europe Auditing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Auditing Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Auditing Services Market?

The projected CAGR is approximately 6.33%.

2. Which companies are prominent players in the Europe Auditing Services Market?

Key companies in the market include Deloitte, EY, KPMG, PwC, A T Kearney, Grant Thornton LLP, Bain & Company, BDO USA, Rodl and Partners, Alvarez & Marsal**List Not Exhaustive.

3. What are the main segments of the Europe Auditing Services Market?

The market segments include Type, Service Line.

4. Can you provide details about the market size?

The market size is estimated to be USD 65.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market.

6. What are the notable trends driving market growth?

External Audit is Driving the Market.

7. Are there any restraints impacting market growth?

Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market.

8. Can you provide examples of recent developments in the market?

In April 2023, PwC Switzerland pursued an expansion strategy by acquiring Avoras, a renowned SAP-enabled business transformation services provider for the pharmaceutical and life sciences industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Auditing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Auditing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Auditing Services Market?

To stay informed about further developments, trends, and reports in the Europe Auditing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence