Key Insights

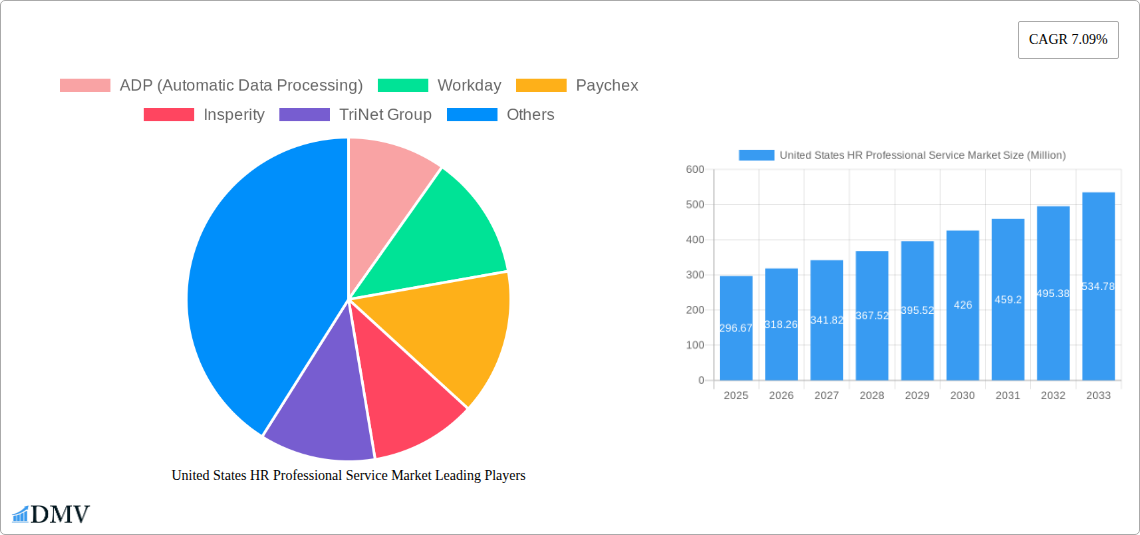

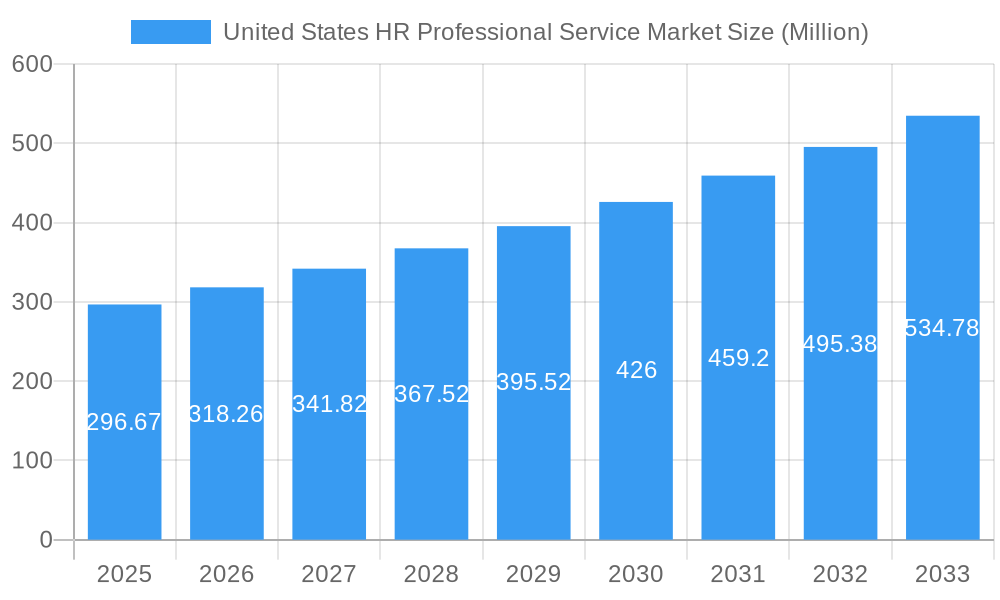

The United States HR professional services market, currently valued at $296.67 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 7.09% from 2025 to 2033. This growth is fueled by several key factors. The increasing complexity of employment regulations and the rising demand for specialized HR expertise are driving organizations to outsource HR functions. Furthermore, the adoption of advanced technologies like HR analytics and AI-powered platforms is streamlining HR processes and boosting efficiency, further fueling market expansion. The market's expansion is also supported by a growing focus on employee well-being and talent management, leading companies to invest more in strategic HR initiatives. Major players like ADP, Workday, and Paychex are benefiting from this trend, leveraging their established presence and technological advancements to capture significant market share. The market segmentation likely includes services such as recruitment, payroll processing, benefits administration, training and development, and HR consulting. Competitive pressures are expected to remain strong, driving innovation and the emergence of new service offerings.

United States HR Professional Service Market Market Size (In Million)

While the market shows strong growth potential, certain challenges exist. Rising labor costs and increasing competition from smaller, niche providers could exert pressure on profit margins. Moreover, ensuring data security and compliance with evolving privacy regulations presents ongoing challenges for HR service providers. Despite these restraints, the long-term outlook for the US HR professional services market remains positive, driven by sustained demand for efficient and effective HR solutions across diverse industries. The market's continued evolution will likely involve increased technology integration, a growing focus on data-driven decision-making, and an emphasis on delivering personalized HR experiences tailored to the specific needs of individual organizations.

United States HR Professional Service Market Company Market Share

United States HR Professional Service Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States HR professional service market, offering valuable insights for stakeholders seeking to navigate this dynamic landscape. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market trends, competitive dynamics, and future growth projections, empowering informed decision-making. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

United States HR Professional Service Market Composition & Trends

This section delves into the intricate structure of the US HR professional service market, examining market concentration, innovation drivers, regulatory influences, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market is characterized by a combination of large established players and emerging niche providers.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. This is expected to slightly decrease by 2033 to xx% due to increased competition.

- Innovation Catalysts: Technological advancements like AI, machine learning, and automation are driving significant innovation, particularly in areas like talent acquisition, HR analytics, and employee engagement.

- Regulatory Landscape: Compliance requirements (e.g., equal pay legislation, data privacy regulations) significantly impact market operations and strategic planning for HR service providers. Changes in legislation are creating both challenges and opportunities for market participants.

- Substitute Products: Internal HR departments and off-the-shelf HR software represent alternative solutions, influencing market growth and driving service providers to enhance their value proposition.

- End-User Profiles: The primary end-users are diverse, spanning large enterprises, SMEs, and non-profit organizations across various industries. Each segment exhibits unique needs and preferences influencing the service offerings of HR providers.

- M&A Activities: The market has witnessed significant M&A activity in recent years, with deal values exceeding xx Million in 2024 alone. Key acquisitions are often driven by the need to expand service offerings, enhance technological capabilities, and access new client segments. For example, Workday's acquisition of HiredScore exemplifies this trend.

United States HR Professional Service Market Industry Evolution

This section analyzes the evolution of the US HR professional service market, charting growth trajectories, technological advancements, and changing consumer demands. The market has shown consistent growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is anticipated to continue in the forecast period (2025-2033) although at a potentially moderated rate (CAGR of xx%), influenced by factors like economic conditions and technological saturation. The increasing adoption of cloud-based HR solutions, coupled with the rising demand for data-driven HR insights, is significantly shaping market dynamics. This shift necessitates adaptation from HR service providers to deliver integrated, technology-enabled solutions. Further, the demand for specialized HR services like talent management, compensation consulting, and employee well-being programs is also increasing.

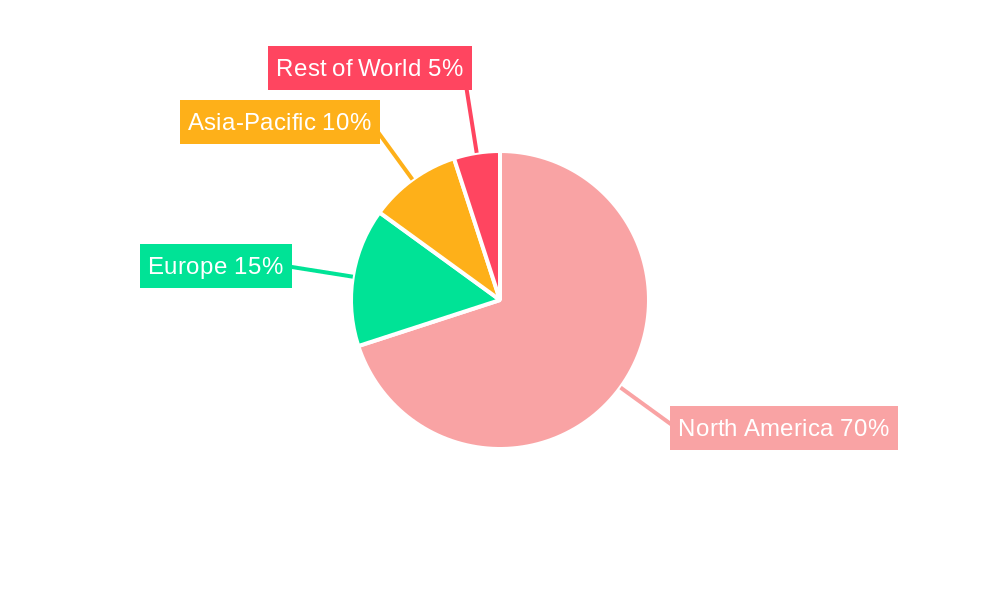

Leading Regions, Countries, or Segments in United States HR Professional Service Market

While data on regional breakdown is currently unavailable (xx), we predict that the largest market segment will be the large enterprise sector, driven by their need for comprehensive HR solutions and significant investment in HR technology.

- Key Drivers for Large Enterprise Dominance:

- High Investment Capacity: Large enterprises possess substantial financial resources to invest in sophisticated HR solutions.

- Complex HR Needs: Their complex organizational structures and diverse workforce necessitate comprehensive HR services.

- Strategic HR Focus: Large enterprises increasingly recognize HR's strategic role in driving business outcomes.

The report will offer a detailed analysis of these and other factors.

United States HR Professional Service Market Product Innovations

Recent product innovations include the integration of AI and machine learning for talent acquisition, predictive analytics for workforce planning, and personalized employee experience platforms. These innovations enhance efficiency, improve decision-making, and offer unique selling propositions that differentiate service providers in the market. The focus is shifting from traditional transactional services towards strategic partnerships focused on long-term value creation for clients.

Propelling Factors for United States HR Professional Service Market Growth

Several factors contribute to the growth of the US HR professional service market. Technological advancements are leading to automation of HR processes and enabling data-driven decision-making. The growing focus on employee well-being and engagement drives demand for specialized HR services. Lastly, evolving labor laws and compliance requirements necessitate the expertise offered by professional service providers.

Obstacles in the United States HR Professional Service Market Market

Significant challenges remain. Economic downturns can lead to reduced spending on HR services, impacting market growth. Intense competition among established players and new entrants necessitates continuous innovation to stay ahead. Finally, adapting to rapid technological changes and maintaining compliance with evolving regulatory landscapes present ongoing hurdles.

Future Opportunities in United States HR Professional Service Market

Future opportunities include the expansion of services into emerging areas like HR technology implementation, data analytics, and global talent management. The increasing adoption of AI and automation presents opportunities for creating specialized solutions. Additionally, addressing the evolving needs of a diverse and multi-generational workforce will create significant demand for innovative HR services.

Major Players in the United States HR Professional Service Market Ecosystem

- ADP (Automatic Data Processing)

- Workday

- Paychex

- Insperity

- TriNet Group

- ManpowerGroup

- Kelly Services

- TrueBlue

- ASGN

- Mercer

- List Not Exhaustive

Key Developments in United States HR Professional Service Market Industry

- April 2024: Workday completed its acquisition of HiredScore, integrating AI-driven talent acquisition capabilities into its offerings. This significantly enhances its competitive position in the talent acquisition technology space.

- February 2024: ADP's 18th consecutive year on FORTUNE's "World's Most Admired Companies" list underscores its sustained market leadership and robust brand reputation.

Strategic United States HR Professional Service Market Market Forecast

The US HR professional service market is poised for continued growth, driven by technological advancements, evolving workforce dynamics, and increasing demand for strategic HR solutions. The market's future trajectory will be shaped by the ability of service providers to adapt to the changing needs of businesses and leverage emerging technologies to deliver innovative and value-added services. The integration of AI and machine learning will be central to future success, along with a focus on data-driven insights and personalized employee experiences.

United States HR Professional Service Market Segmentation

-

1. Provider Type

- 1.1. Consulting Companies

- 1.2. Software-As-A-Service Providers Companies

-

2. Function Type

- 2.1. Recruitment and Talent Acquisition

- 2.2. Benefits and Claims Management

- 2.3. Workforce Planning and Analytics

- 2.4. Payroll and Compensation Management

- 2.5. Other Functions

-

3. End User Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. IT & Telecom

- 3.4. Manufacturing

- 3.5. Retail

- 3.6. Government

- 3.7. Other Industries

United States HR Professional Service Market Segmentation By Geography

- 1. United States

United States HR Professional Service Market Regional Market Share

Geographic Coverage of United States HR Professional Service Market

United States HR Professional Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Stringent Labor Laws Drive Demand for Specialized HR Services

- 3.2.2 While AI

- 3.2.3 Analytics

- 3.2.4 and Cloud Solutions Enhance Efficiency and Decision-making in HR; Emphasis on Well-being

- 3.2.5 Diversity

- 3.2.6 and Inclusion Initiatives to Improve Employee Satisfaction and Retention

- 3.3. Market Restrains

- 3.3.1 Stringent Labor Laws Drive Demand for Specialized HR Services

- 3.3.2 While AI

- 3.3.3 Analytics

- 3.3.4 and Cloud Solutions Enhance Efficiency and Decision-making in HR; Emphasis on Well-being

- 3.3.5 Diversity

- 3.3.6 and Inclusion Initiatives to Improve Employee Satisfaction and Retention

- 3.4. Market Trends

- 3.4.1. Technological Advancements and Complexity of Labor Laws and Regulations are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States HR Professional Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 5.1.1. Consulting Companies

- 5.1.2. Software-As-A-Service Providers Companies

- 5.2. Market Analysis, Insights and Forecast - by Function Type

- 5.2.1. Recruitment and Talent Acquisition

- 5.2.2. Benefits and Claims Management

- 5.2.3. Workforce Planning and Analytics

- 5.2.4. Payroll and Compensation Management

- 5.2.5. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. IT & Telecom

- 5.3.4. Manufacturing

- 5.3.5. Retail

- 5.3.6. Government

- 5.3.7. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADP (Automatic Data Processing)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Workday

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Paychex

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Insperity

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TriNet Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ManpowerGroup

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kelly Services

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TrueBlue

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ASGN

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mercer**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADP (Automatic Data Processing)

List of Figures

- Figure 1: United States HR Professional Service Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States HR Professional Service Market Share (%) by Company 2025

List of Tables

- Table 1: United States HR Professional Service Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 2: United States HR Professional Service Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 3: United States HR Professional Service Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 4: United States HR Professional Service Market Volume Billion Forecast, by Function Type 2020 & 2033

- Table 5: United States HR Professional Service Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 6: United States HR Professional Service Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 7: United States HR Professional Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States HR Professional Service Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: United States HR Professional Service Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 10: United States HR Professional Service Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 11: United States HR Professional Service Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 12: United States HR Professional Service Market Volume Billion Forecast, by Function Type 2020 & 2033

- Table 13: United States HR Professional Service Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 14: United States HR Professional Service Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 15: United States HR Professional Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States HR Professional Service Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States HR Professional Service Market?

The projected CAGR is approximately 7.09%.

2. Which companies are prominent players in the United States HR Professional Service Market?

Key companies in the market include ADP (Automatic Data Processing), Workday, Paychex, Insperity, TriNet Group, ManpowerGroup, Kelly Services, TrueBlue, ASGN, Mercer**List Not Exhaustive.

3. What are the main segments of the United States HR Professional Service Market?

The market segments include Provider Type, Function Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 296.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Labor Laws Drive Demand for Specialized HR Services. While AI. Analytics. and Cloud Solutions Enhance Efficiency and Decision-making in HR; Emphasis on Well-being. Diversity. and Inclusion Initiatives to Improve Employee Satisfaction and Retention.

6. What are the notable trends driving market growth?

Technological Advancements and Complexity of Labor Laws and Regulations are Driving the Market.

7. Are there any restraints impacting market growth?

Stringent Labor Laws Drive Demand for Specialized HR Services. While AI. Analytics. and Cloud Solutions Enhance Efficiency and Decision-making in HR; Emphasis on Well-being. Diversity. and Inclusion Initiatives to Improve Employee Satisfaction and Retention.

8. Can you provide examples of recent developments in the market?

April 2024: Workday completed its acquisition of HiredScore, integrating AI-driven talent acquisition capabilities into its offerings. The acquisition aims to enhance HiredScore's talent orchestration features, aligning with HR goals from recruitment to training. Workday's extensive resources are expected to bolster HiredScore's growth and innovation beyond its previous capabilities as an independent entity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States HR Professional Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States HR Professional Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States HR Professional Service Market?

To stay informed about further developments, trends, and reports in the United States HR Professional Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence