Key Insights

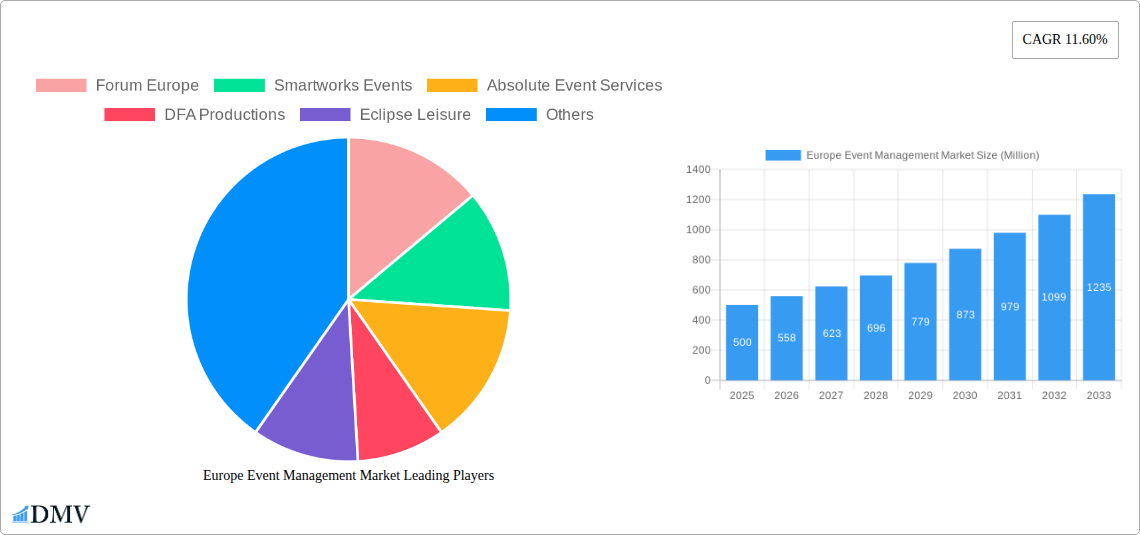

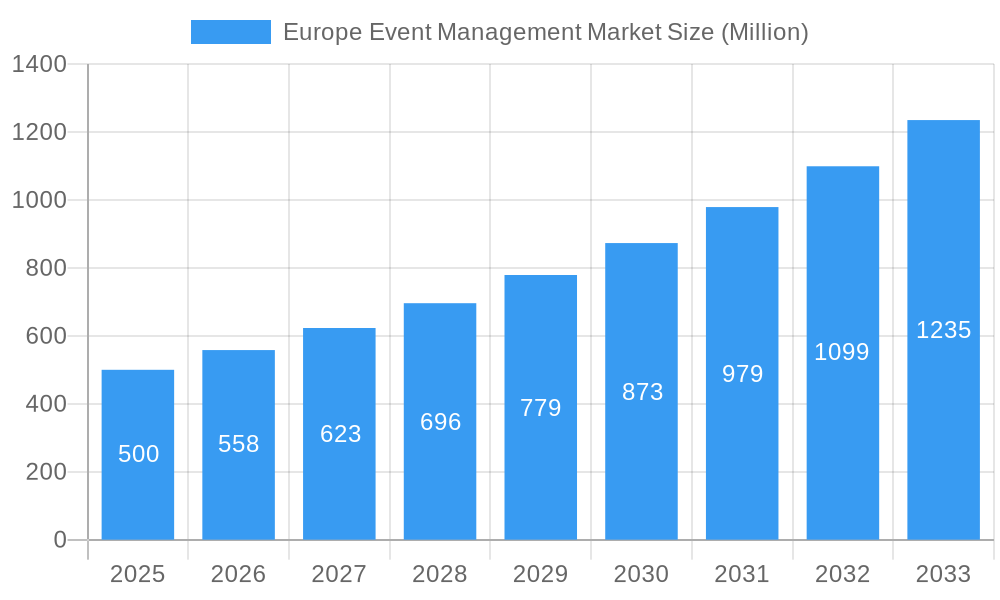

The European Event Management Market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 11.60% from 2025 to 2033. This robust growth trajectory is propelled by several key factors, including the escalating demand for corporate events, conferences, and festivals. Technological advancements in virtual and hybrid event platforms are also enhancing efficiency and broadening reach, attracting new market participants and stimulating expansion. Furthermore, the increasing adoption of experiential marketing by businesses, aimed at creating memorable brand interactions, is a substantial growth driver. While economic fluctuations may pose challenges, the inherent resilience of the events sector and the adaptive capabilities of event management firms are expected to mitigate these impacts. The market is segmented by event type, encompassing corporate, social, and cultural events, and by service offerings, such as planning, execution, and technology solutions, presenting diverse avenues for growth. Leading players, including Forum Europe and Smartworks Events, are actively leveraging strategic partnerships, technological innovation, and market expansion to capitalize on these opportunities. Continuous innovation and adaptation to evolving customer expectations and technological advancements are critical for maintaining a competitive edge. The growing demand for sustainable and eco-friendly event practices represents a significant emerging trend that is increasingly being addressed by industry professionals.

Europe Event Management Market Market Size (In Billion)

With a projected CAGR of 11.60% and an estimated market size of 2502.1 million in the base year 2025, the European Event Management Market is set for substantial growth throughout the forecast period. This expansion reflects not only an increase in event volume but also a rise in the sophistication of event planning and execution, leading to higher average event expenditures. This growth presents lucrative opportunities for both established and emerging companies, fostering innovation and intensifying competition within the sector. The diverse range of services, event types, and geographical coverage offers ample scope for specialization and strategic collaborations, further fueling market expansion and attracting investment. Sustained growth will necessitate ongoing adaptation to shifting customer preferences, technological disruptions, and economic uncertainties.

Europe Event Management Market Company Market Share

Europe Event Management Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Event Management Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The total market size in 2025 is estimated at xx Million.

Europe Event Management Market Composition & Trends

This section delves into the intricate composition of the Europe event management market, examining its concentration, innovation drivers, regulatory landscape, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately fragmented structure, with no single dominant player commanding over 20% market share in 2025. However, several large players, including those mentioned below, are vying for greater market share through strategic acquisitions and organic growth.

Market Concentration: The top 5 players collectively hold approximately xx% of the market share in 2025, indicating a competitive landscape.

Innovation Catalysts: Technological advancements such as virtual and hybrid event platforms, AI-powered event planning tools, and improved data analytics are driving innovation and efficiency.

Regulatory Landscape: EU regulations concerning data privacy (GDPR), accessibility, and sustainability are shaping market practices and influencing operational strategies.

Substitute Products: The rise of virtual and online events presents a significant substitute, though in-person events retain significant appeal for networking and engagement.

End-User Profiles: The market caters to diverse end-users, encompassing corporations, government agencies, non-profit organizations, and educational institutions.

M&A Activities: The historical period (2019-2024) witnessed xx Million in M&A deals, with an average deal size of xx Million. This trend is expected to continue, driven by consolidation and expansion strategies.

Europe Event Management Market Industry Evolution

The Europe event management market has experienced significant evolution over the past few years. From 2019 to 2024, the market witnessed a compound annual growth rate (CAGR) of xx%, primarily driven by a resurgence of in-person events post-pandemic and the increasing adoption of hybrid event formats. Technological advancements, particularly the integration of digital tools and platforms, have significantly streamlined event planning and execution. The shifting consumer demand towards personalized and experiential events has also propelled market growth. Furthermore, the increasing adoption of sustainable practices within the event industry is influencing operational strategies and shaping consumer preferences. Looking ahead, the forecast period (2025-2033) projects a CAGR of xx%, fueled by continued technological innovation, evolving consumer preferences, and the expansion of the hybrid event model.

Leading Regions, Countries, or Segments in Europe Event Management Market

The UK and Germany remain the leading markets in Europe, driven by robust economies, established event infrastructure, and significant corporate and government spending. Other key countries include France, Italy, and Spain, each possessing unique characteristics that influence their position within the market.

Key Drivers for UK Dominance:

- High concentration of corporate headquarters and major international events.

- Well-developed infrastructure and experienced event professionals.

- Strong government support for tourism and events.

Key Drivers for German Dominance:

- Significant industrial strength and robust corporate event spending.

- Large population and a well-established MICE (Meetings, Incentives, Conferences, and Exhibitions) sector.

- Government initiatives promoting innovation and sustainability in the events industry.

France, Italy, and Spain also contribute significantly to market growth, with thriving tourism sectors and a burgeoning interest in corporate and cultural events. The market segmentation is also evolving, with increased demand for niche events focusing on specific industries or interests.

Europe Event Management Market Product Innovations

Recent innovations include virtual event platforms offering immersive experiences, AI-powered event planning tools optimizing logistics and resource allocation, and sustainable event practices minimizing environmental impact. These advancements enhance event efficiency, attendee engagement, and overall value proposition. The integration of data analytics provides valuable insights into attendee behavior and preferences, enabling event organizers to tailor experiences and improve ROI.

Propelling Factors for Europe Event Management Market Growth

Several factors contribute to the market's growth. The resurgence of in-person events following the pandemic is a primary driver. Technological advancements, such as hybrid event platforms, are increasing the reach and accessibility of events. Furthermore, increasing corporate budgets for events, fuelled by economic recovery, and government support for tourism and cultural events are contributing to expansion.

Obstacles in the Europe Event Management Market

The market faces challenges such as economic uncertainty impacting event budgets, supply chain disruptions affecting logistics and resource availability, and intense competition requiring differentiation and value-added services. Regulatory changes and evolving safety standards also require continuous adaptation.

Future Opportunities in Europe Event Management Market

Emerging opportunities lie in the expansion of hybrid and virtual event formats, the growth of niche event segments catering to specific industries or demographics, and the integration of new technologies to enhance attendee experience and event efficiency. Sustainable event practices also offer significant growth potential.

Major Players in the Europe Event Management Market Ecosystem

- Forum Europe

- Smartworks Events

- Absolute Event Services

- DFA Productions

- Eclipse Leisure

- Felix

- Hughes Productions

- Irwin Video

- JP Events Ltd

- Off Limits

- Owl Live

- List Not Exhaustive

Key Developments in Europe Event Management Market Industry

- May 2022: Forum Europe, in collaboration with CEPS, EUI, IAI, and The Providence Group, hosted events on the EU-US Trade and Technology Dialogue, showcasing the increasing importance of policy-focused events.

- October 2021: Smart Events partnered with HQ to raise funds for charitable service and development, highlighting the role of events in social impact.

Strategic Europe Event Management Market Forecast

The Europe event management market is poised for continued growth, driven by technological innovation, shifting consumer preferences, and economic recovery. The increasing adoption of hybrid and virtual event formats, coupled with the expansion of niche event segments, presents significant opportunities for market expansion and growth over the forecast period (2025-2033). The market is expected to reach xx Million by 2033.

Europe Event Management Market Segmentation

-

1. Type

- 1.1. Corporate Events

- 1.2. Association Events

- 1.3. Non-Profit Events

-

2. Application

- 2.1. Individual User

- 2.2. Corporate Organization

- 2.3. Public Organization

- 2.4. Others

Europe Event Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Event Management Market Regional Market Share

Geographic Coverage of Europe Event Management Market

Europe Event Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rise in Disposable Income Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Event Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Events

- 5.1.2. Association Events

- 5.1.3. Non-Profit Events

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Individual User

- 5.2.2. Corporate Organization

- 5.2.3. Public Organization

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Forum Europe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Smartworks Events

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Absolute Event Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DFA Productions

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eclipse Leisure

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Felix

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hughes Productions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Irwin Video

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JP Events Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Off Limits

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Owl Live**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Forum Europe

List of Figures

- Figure 1: Europe Event Management Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Event Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Event Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Event Management Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Europe Event Management Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Event Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Europe Event Management Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Europe Event Management Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Event Management Market?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Europe Event Management Market?

Key companies in the market include Forum Europe, Smartworks Events, Absolute Event Services, DFA Productions, Eclipse Leisure, Felix, Hughes Productions, Irwin Video, JP Events Ltd, Off Limits, Owl Live**List Not Exhaustive.

3. What are the main segments of the Europe Event Management Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2502.1 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rise in Disposable Income Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On May 2022, In coordination with CEPS, the European University Institute (EUI), the Istituto Affari Internazionali (IAI), and The Providence Group, Forum Europe will host several events on the EU-US Trade and Technology Dialogue.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Event Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Event Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Event Management Market?

To stay informed about further developments, trends, and reports in the Europe Event Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence