Key Insights

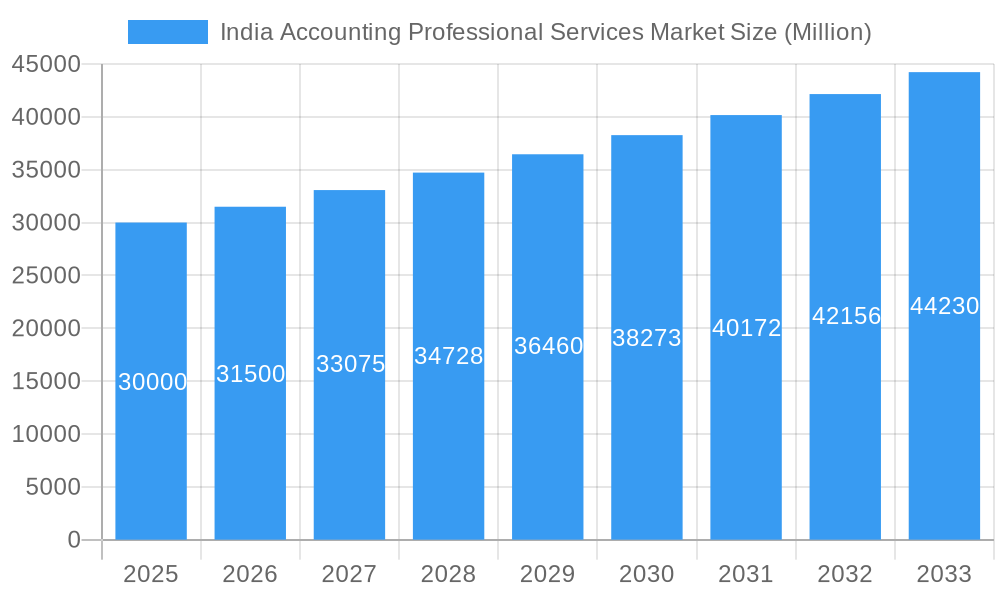

The India Accounting Professional Services market is poised for significant expansion, driven by India's robust economic growth, increasing regulatory complexity, and the widespread adoption of advanced technologies such as AI and cloud computing. The market size is projected to reach $534.21 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 3.32% from the base year 2025. Key growth sectors including IT, pharmaceuticals, and e-commerce are fueling demand for sophisticated accounting and auditing solutions. The imperative for compliance with evolving Indian and international accounting standards (IFRS, Ind AS) further bolsters market expansion. Digital transformation initiatives and the growing trend of outsourcing accounting functions are also critical growth catalysts.

India Accounting Professional Services Market Market Size (In Billion)

Despite a positive outlook, the market encounters challenges, including intense competition from established global players and numerous domestic firms. Attracting and retaining skilled accounting professionals presents a significant hurdle due to global talent shortages. Fluctuating economic conditions and geopolitical uncertainties may also impact growth trajectories. Nevertheless, specialized service segments such as forensic accounting, tax advisory, and internal audit offer substantial opportunities, with consistent growth anticipated across all market segments.

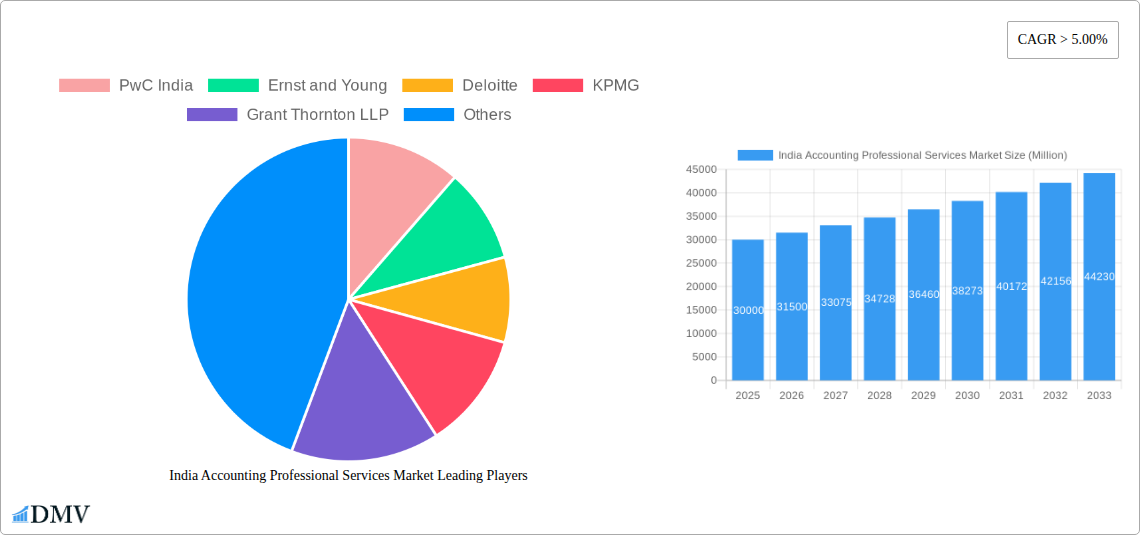

India Accounting Professional Services Market Company Market Share

This comprehensive market research report offers an in-depth analysis of the India Accounting Professional Services Market, providing critical insights into market dynamics, growth projections, and future opportunities for stakeholders. Covering the forecast period 2025-2033, with a base year of 2025, this report is an essential resource for businesses, investors, and policymakers. The estimated market size for 2025 is $534.21 billion.

India Accounting Professional Services Market Market Composition & Trends

The Indian accounting professional services market is characterized by a moderately concentrated landscape, with major players like PwC India, Ernst & Young, Deloitte, KPMG, and Grant Thornton LLP holding significant market share. However, several mid-sized and boutique firms contribute significantly to the overall market dynamism. The market is driven by increasing regulatory compliance needs, the growing complexity of financial reporting, and the rising adoption of digital technologies. Innovation catalysts include the development of cloud-based accounting software, AI-powered audit tools, and blockchain technology for enhanced transparency. The regulatory landscape, influenced by bodies like the Institute of Chartered Accountants of India (ICAI), shapes the industry's practices and standards. Substitute products include in-house accounting departments, but the demand for specialized expertise continues to drive market growth. End-users span diverse sectors including manufacturing, IT, BFSI, and retail. The M&A activity witnessed recently, such as PwC India’s acquisition of Venerate Solutions in August 2022, demonstrates the strategic importance of inorganic growth and market consolidation. While precise market share distribution and M&A deal values are proprietary data within the full report, preliminary estimates suggest a xx% market share for the top 5 players in 2025. M&A activity in the past 5 years has totaled approximately xx Million.

- Market Concentration: Moderately concentrated, with top players holding significant share.

- Innovation Catalysts: Cloud-based accounting, AI-powered tools, blockchain technology.

- Regulatory Landscape: Heavily influenced by ICAI and other regulatory bodies.

- Substitute Products: In-house accounting departments, but specialized expertise remains in demand.

- End-User Profiles: Diverse, including manufacturing, IT, BFSI, and retail.

- M&A Activities: Significant activity, indicating market consolidation and growth strategies.

India Accounting Professional Services Market Industry Evolution

The Indian accounting professional services market has experienced significant growth over the historical period (2019-2024), driven by factors like economic expansion, increasing foreign investment, and the implementation of new accounting standards. Technological advancements, particularly the adoption of cloud-based accounting software and data analytics tools, are transforming the industry. The market has witnessed a shift in client demands towards more specialized services, such as forensic accounting, risk management, and advisory services. Growth rates have averaged approximately xx% annually during the historical period, with projections indicating a continued expansion at xx% annually during the forecast period. Adoption of cloud-based accounting software has increased from xx% in 2019 to an estimated xx% in 2025, with a projected xx% adoption rate by 2033. This growth is fueled by the need for enhanced efficiency, scalability, and cost-effectiveness. The increasing adoption of data analytics is enabling more sophisticated insights into financial data and facilitating better decision-making for businesses. The market is witnessing a trend towards outsourcing of accounting functions by SMEs, further driving market expansion.

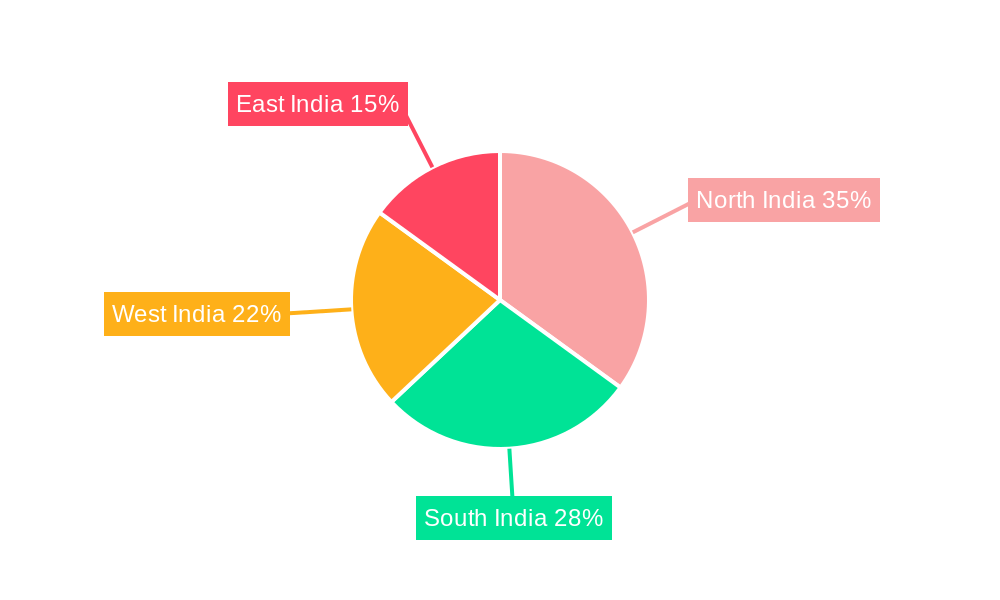

Leading Regions, Countries, or Segments in India Accounting Professional Services Market

The major metropolitan areas like Mumbai, Delhi, Bangalore, and Hyderabad dominate the India Accounting Professional Services Market. This dominance stems from the concentration of large corporations, multinational companies, and a significant pool of skilled professionals. The BFSI sector is currently the largest segment, accounting for approximately xx% of the market in 2025.

- Key Drivers for Dominance:

- High concentration of businesses: Major metropolitan areas are hubs for large corporations.

- Skilled workforce: Abundance of qualified accountants and professionals.

- Regulatory environment: Favorable regulatory landscape encourages business growth.

- Investment trends: Significant investments in infrastructure and technology.

The dominance of these regions is likely to persist due to continuous economic growth and investment in these areas. The BFSI sector’s continued growth, fuelled by increased financial transactions and compliance requirements, will further solidify its position as a leading segment.

India Accounting Professional Services Market Product Innovations

Recent innovations in the Indian accounting professional services market include the development of specialized software for tax compliance, AI-driven audit tools that enhance efficiency and accuracy, and blockchain-based solutions for improved transparency and security. These innovations are transforming traditional accounting practices, making them more efficient and cost-effective. The unique selling propositions (USPs) of these new products are speed, accuracy, and reduction of human error, leading to increased client satisfaction and a competitive advantage.

Propelling Factors for India Accounting Professional Services Market Growth

The growth of the Indian accounting professional services market is propelled by several key factors. The burgeoning Indian economy is a primary driver, fueling demand for accounting and financial services across diverse sectors. Government initiatives to promote ease of doing business and digitalization also stimulate the market. The increasing adoption of automation technologies and advanced analytics further enhances efficiency and productivity, leading to market expansion. Stringent regulatory compliance standards necessitate specialized expertise, creating substantial demand for professional accounting services. The growing awareness of corporate governance and risk management further boosts the market.

Obstacles in the India Accounting Professional Services Market Market

Despite significant growth, challenges persist. Intense competition among established players and new entrants can lead to price wars and reduced profit margins. A shortage of skilled professionals, especially those with specialized expertise in emerging areas, limits the industry's capacity. Regulatory changes and compliance complexities can increase operational costs and require substantial adaptation. Economic downturns can impact client spending on professional services. Data security concerns related to cloud-based solutions are also a potential restraint, although this is mitigated by the increasing deployment of robust security measures.

Future Opportunities in India Accounting Professional Services Market

Future opportunities lie in expanding into niche segments, such as sustainable finance and ESG reporting. The increasing adoption of cloud-based and AI-powered solutions offers ample scope for innovation and service enhancement. Expansion into smaller cities and towns holds significant potential, catering to the growing needs of SMEs. Offering specialized consulting services beyond core accounting functions, such as business advisory and digital transformation assistance, also opens up avenues for growth. The rising adoption of blockchain technology for secure and transparent financial transactions presents promising opportunities for specialized service offerings.

Major Players in the India Accounting Professional Services Market Ecosystem

- PwC India

- Ernst & Young

- Deloitte

- KPMG

- Grant Thornton LLP

- BDO India

- RSM

- SS Kothari Mehta & Co

- ASA and Associates

- Nangia and Co

List Not Exhaustive

Key Developments in India Accounting Professional Services Market Industry

- August 2022: PwC India acquires Venerate Solutions, strengthening its Salesforce consulting capabilities.

- October 2022: KPMG in India partners with IBSFINtech to offer corporate treasury automation solutions.

These developments reflect the industry's focus on technological advancements and strategic acquisitions to enhance service offerings and expand market share.

Strategic India Accounting Professional Services Market Market Forecast

The Indian accounting professional services market is poised for robust growth in the coming years, driven by sustained economic expansion, increased regulatory compliance requirements, and the growing adoption of advanced technologies. Emerging opportunities in areas like ESG reporting, digital transformation services, and blockchain-based solutions will further fuel market expansion. The market's future growth trajectory is expected to remain positive, supported by the increasing sophistication of financial services and the evolving needs of businesses.

India Accounting Professional Services Market Segmentation

-

1. Type Of Service

- 1.1. Tax Preperation Services

- 1.2. Book Keeping Services

- 1.3. Payroll Services

- 1.4. Others

India Accounting Professional Services Market Segmentation By Geography

- 1. India

India Accounting Professional Services Market Regional Market Share

Geographic Coverage of India Accounting Professional Services Market

India Accounting Professional Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Secure Cloud Accounting Solution is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Accounting Professional Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type Of Service

- 5.1.1. Tax Preperation Services

- 5.1.2. Book Keeping Services

- 5.1.3. Payroll Services

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type Of Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PwC India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ernst and Young

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deloitte

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KPMG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grant Thornton LLP

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BDO India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RSM

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SS Kothari Mehta & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ASA and Associates

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nangia and Co **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PwC India

List of Figures

- Figure 1: India Accounting Professional Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Accounting Professional Services Market Share (%) by Company 2025

List of Tables

- Table 1: India Accounting Professional Services Market Revenue billion Forecast, by Type Of Service 2020 & 2033

- Table 2: India Accounting Professional Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India Accounting Professional Services Market Revenue billion Forecast, by Type Of Service 2020 & 2033

- Table 4: India Accounting Professional Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Accounting Professional Services Market?

The projected CAGR is approximately 3.32%.

2. Which companies are prominent players in the India Accounting Professional Services Market?

Key companies in the market include PwC India, Ernst and Young, Deloitte, KPMG, Grant Thornton LLP, BDO India, RSM, SS Kothari Mehta & Co, ASA and Associates, Nangia and Co **List Not Exhaustive.

3. What are the main segments of the India Accounting Professional Services Market?

The market segments include Type Of Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 534.21 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Secure Cloud Accounting Solution is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2022, In order to provide their clients with a comprehensive suite of corporate treasury automation solutions and assist them in hastening the digital transformation of their treasury department, KPMG in India and IBSFINtech today established an alliance connection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Accounting Professional Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Accounting Professional Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Accounting Professional Services Market?

To stay informed about further developments, trends, and reports in the India Accounting Professional Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence