Key Insights

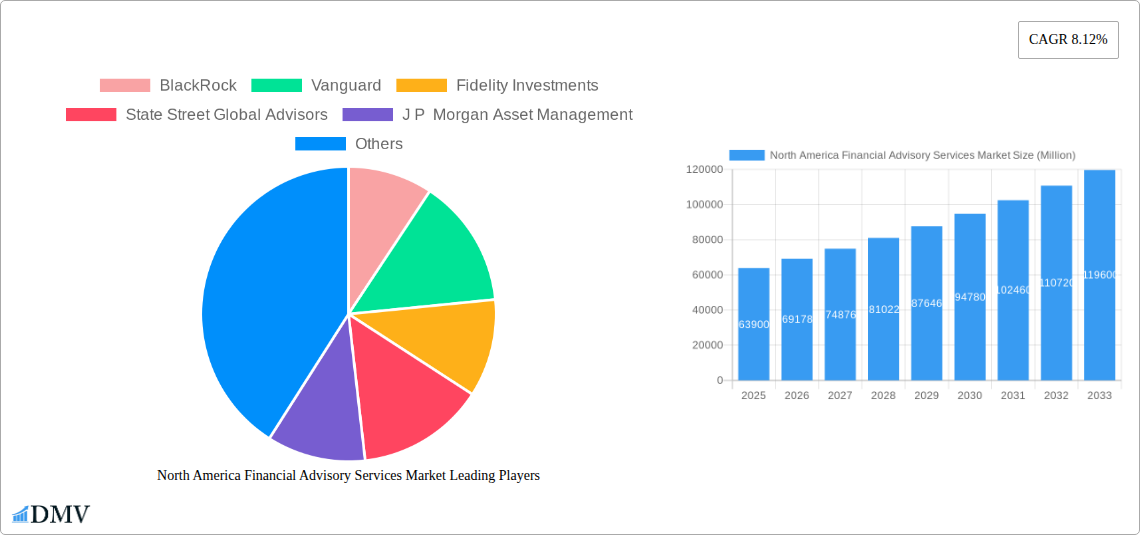

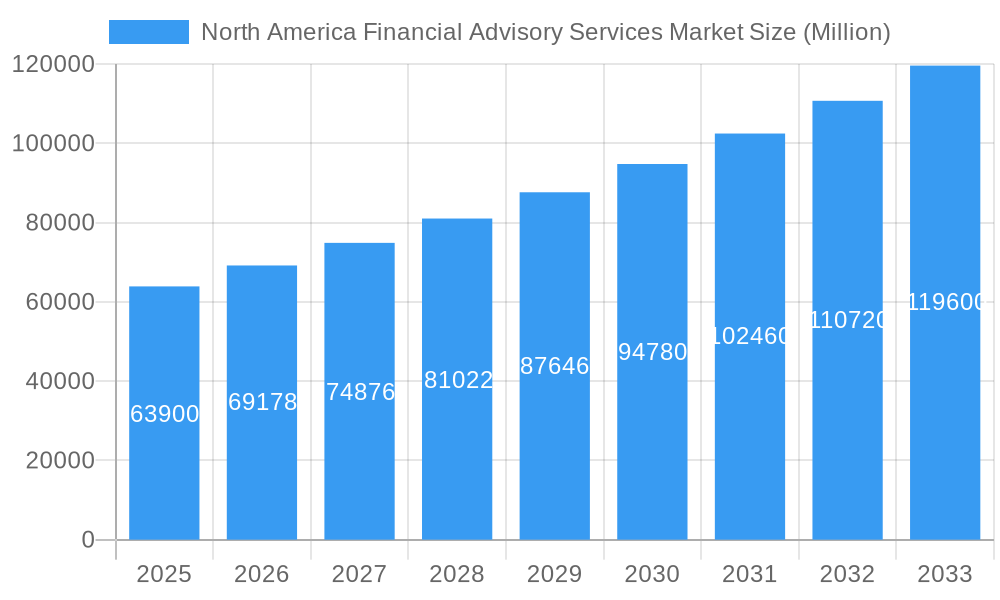

The North America financial advisory services market, valued at $63.90 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing complexity of financial instruments and regulations, coupled with a growing affluent population seeking personalized wealth management solutions, fuels demand for professional financial advice. Technological advancements, such as robo-advisors and AI-powered platforms, are streamlining processes and enhancing efficiency, while simultaneously broadening access to financial advice. However, competition among established players like BlackRock, Vanguard, Fidelity Investments, and State Street Global Advisors, as well as consulting firms like BCG, EY, Bain, PWC, and Deloitte, remains intense. Maintaining client trust and adapting to evolving regulatory landscapes are crucial for sustained success. The market's fragmentation, with a mix of large institutional players and smaller boutique firms, presents both opportunities and challenges.

North America Financial Advisory Services Market Market Size (In Billion)

The projected Compound Annual Growth Rate (CAGR) of 8.12% from 2025 to 2033 suggests a significant expansion of the market. This growth will likely be fueled by increasing demand for retirement planning services, driven by aging populations and shifting demographics. Furthermore, the rise of sustainable and responsible investing is creating new niche markets within the financial advisory sector. While regulatory scrutiny and potential economic downturns pose risks, the long-term outlook for the North America financial advisory services market remains positive. The market's evolution hinges on the ability of firms to leverage technology, cultivate strong client relationships, and adapt their offerings to meet the evolving needs of a diverse clientele. The integration of advanced analytics and data-driven insights will be key to providing personalized and effective financial advice in the years to come.

North America Financial Advisory Services Market Company Market Share

North America Financial Advisory Services Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America Financial Advisory Services market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report is essential for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is estimated to be valued at xx Million in 2025 and is projected to experience significant growth throughout the forecast period.

North America Financial Advisory Services Market Composition & Trends

This section delves into the intricate composition of the North America financial advisory services market, examining its concentration levels, innovative drivers, regulatory landscape, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. We analyze the market share distribution amongst key players, revealing the competitive dynamics at play. For instance, the top five players – BlackRock, Vanguard, Fidelity Investments, State Street Global Advisors, and J P Morgan Asset Management – are estimated to hold a combined market share of xx% in 2025. The report also explores the impact of recent M&A activities, including deal values and their influence on market consolidation. We analyze the impact of regulatory changes like the Dodd-Frank Act and its influence on the advisory landscape and discuss how technological advancements, such as AI-driven portfolio management tools, are reshaping the industry. The report further profiles key end-users, including high-net-worth individuals, institutional investors, and corporations, highlighting their unique needs and preferences.

- Market Concentration: High, with a few dominant players controlling a significant share.

- Innovation Catalysts: Technological advancements (AI, robo-advisors), regulatory changes.

- Regulatory Landscape: Complex and evolving, impacting compliance costs and service offerings.

- Substitute Products: Self-directed investment platforms, ETF's, robo-advisors.

- End-User Profiles: High-net-worth individuals, institutional investors, corporations, and retail investors.

- M&A Activity: Significant activity observed in recent years, driven by consolidation and expansion strategies. Estimated total M&A deal value for 2024 was xx Million.

North America Financial Advisory Services Market Industry Evolution

This section provides a comprehensive analysis of the North America financial advisory services market's evolutionary path. We examine the market's growth trajectory, technological advancements, and shifts in consumer demand, providing specific data points on growth rates and adoption metrics throughout the study period (2019-2024). The report analyzes how the increasing adoption of digital technologies, including AI-powered solutions and online platforms, is reshaping the delivery of financial advisory services. The changing demographics and financial literacy levels of the population are also crucial factors influencing consumer demand. The report quantifies these changes and their impact on the market's growth trajectory. Furthermore, we look at macroeconomic factors like interest rate changes and their subsequent effect on client investment strategies and the demand for financial advisory services. The report also examines emerging trends, such as the growing demand for ESG (environmental, social, and governance) investing, and their impact on the market’s future. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated to be xx%.

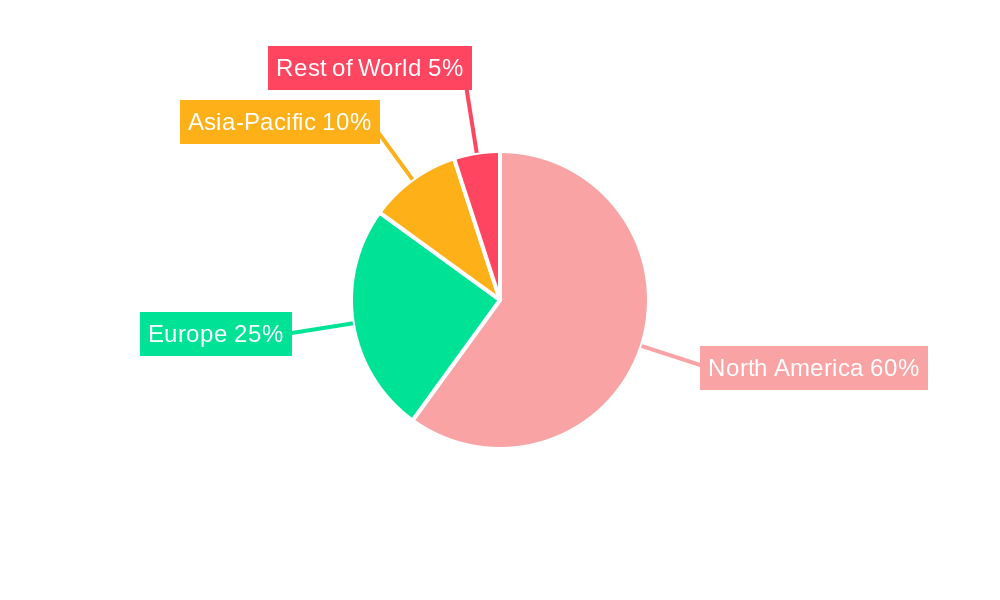

Leading Regions, Countries, or Segments in North America Financial Advisory Services Market

This section meticulously identifies the dominant regions, countries, and key segments propelling the North American financial advisory services market. A granular analysis delves into the multifaceted factors underpinning their leadership, offering strategic insights for stakeholders.

- Key Drivers for Dominant Region/Segment:

- Exceptional concentration of wealth and a substantial high-net-worth individual (HNWI) population, driving demand for sophisticated advisory services.

- A robust and evolving regulatory framework that fosters trust, transparency, and sustainable growth within the industry.

- Pioneering adoption rates of cutting-edge technologies and innovative service delivery models, enhancing client engagement and operational efficiency.

- A dense ecosystem of established and emerging financial institutions, coupled with a dynamic landscape of specialized advisory firms, fostering competition and specialization.

- Increasing demand for specialized advisory services catering to unique client needs, such as estate planning, tax optimization, and philanthropic giving.

The report further dissects the intricate market dynamics within these leading territories, scrutinizing investment flows, the impact of regulatory shifts, and the competitive panorama. This in-depth exploration empowers stakeholders to discern regional nuances and strategically refine their market approaches for maximum impact.

North America Financial Advisory Services Market Product Innovations

This section illuminates the forefront of product innovation within the North American financial advisory services market, detailing groundbreaking applications and performance benchmarks. We spotlight compelling unique selling propositions (USPs) and transformative technological advancements, including the proliferation of sophisticated robo-advisors, highly personalized financial planning platforms, and advanced AI-driven portfolio optimization solutions. These innovations are fundamentally reshaping operational efficiencies, elevating client experiences, and streamlining advisory processes. The democratizing effect of enhanced accessibility to financial guidance through intuitive online and mobile interfaces is fundamentally altering the industry's trajectory. The profound implications of these paradigm shifts on market expansion, competitive dynamics, and client engagement are comprehensively examined.

Propelling Factors for North America Financial Advisory Services Market Growth

Several key factors are driving the growth of the North America financial advisory services market. Technological advancements, such as AI-powered portfolio management and robo-advisors, are increasing efficiency and accessibility. Economic growth and rising disposable incomes are leading to increased investment activity and demand for professional financial guidance. Favorable regulatory frameworks and government initiatives supporting financial literacy also contribute significantly.

Obstacles in the North America Financial Advisory Services Market

Despite positive growth prospects, the North America financial advisory services market faces significant challenges. Stringent regulatory compliance requirements increase operational costs and complexity. Supply chain disruptions and economic downturns can impact investor sentiment and demand. Intense competition among established players and new entrants also creates pressure on pricing and profitability. These factors can negatively affect market expansion and profitability for businesses within the market. We estimate these factors will reduce the market growth rate by approximately xx% by 2033.

Future Opportunities in North America Financial Advisory Services Market

The North American financial advisory services market is poised for significant growth, presenting a wealth of promising opportunities. The strategic expansion into underserved markets, particularly small and medium-sized businesses (SMBs) and the burgeoning millennial demographic, represents a substantial avenue for untapped potential. The accelerating integration of FinTech innovations, including advancements in blockchain technology and the evolving landscape of cryptocurrency advisory, offers fertile ground for novel service offerings and strategic differentiation. Furthermore, proactively addressing the escalating consumer demand for sustainable and ethically driven investment solutions, often referred to as Environmental, Social, and Governance (ESG) investing, aligns seamlessly with contemporary consumer values and presents a critical opportunity for market leadership.

Major Players in the North America Financial Advisory Services Market Ecosystem

Key Developments in North America Financial Advisory Services Market Industry

- February 2023: Deloitte significantly broadened its service portfolio for startups and scale-ups by strategically acquiring 27pilots, a prominent German incubator, venture capitalist, and matchmaking platform, enhancing its ability to support entrepreneurial ventures.

- January 2023: Fidelity Investments fortified its capabilities in automated equity management and financing software for private companies through the strategic acquisition of Shoobx, further solidifying its position in supporting private market growth.

- December 2022: EY announced a significant expansion of its digital transformation services by acquiring EY Seren, a leading digital design and innovation consultancy, strengthening its ability to deliver end-to-end digital solutions for clients.

- November 2022: PwC launched a new suite of AI-powered advisory tools designed to help clients navigate complex regulatory environments and enhance risk management strategies, demonstrating a commitment to leveraging advanced technology for advisory services.

Strategic North America Financial Advisory Services Market Forecast

The North America financial advisory services market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and favorable regulatory environments. The increasing adoption of digital tools and the expanding demand for personalized financial planning will propel market expansion. The emergence of new investment products and services, alongside the rising awareness of ESG investing, will create further opportunities for growth and market diversification throughout the forecast period. The market is expected to reach xx Million by 2033, representing a substantial increase from its 2025 valuation.

North America Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

- 1.6. Others

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

- 3.7. Others

North America Financial Advisory Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Financial Advisory Services Market Regional Market Share

Geographic Coverage of North America Financial Advisory Services Market

North America Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Use of Robot Advisory Services is Growing in North America.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vanguard

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fidelity Investments

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 State Street Global Advisors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J P Morgan Asset Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boston Consulting Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ernst & Young Global Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bain & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PWC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deloitte**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BlackRock

List of Figures

- Figure 1: North America Financial Advisory Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Financial Advisory Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Financial Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Financial Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Financial Advisory Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: North America Financial Advisory Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: North America Financial Advisory Services Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 6: North America Financial Advisory Services Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 7: North America Financial Advisory Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Financial Advisory Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Financial Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Financial Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: North America Financial Advisory Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: North America Financial Advisory Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: North America Financial Advisory Services Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 14: North America Financial Advisory Services Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: North America Financial Advisory Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Financial Advisory Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Financial Advisory Services Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the North America Financial Advisory Services Market?

Key companies in the market include BlackRock, Vanguard, Fidelity Investments, State Street Global Advisors, J P Morgan Asset Management, Boston Consulting Group, Ernst & Young Global Limited, Bain & Company, PWC, Deloitte**List Not Exhaustive.

3. What are the main segments of the North America Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.90 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Use of Robot Advisory Services is Growing in North America..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Deloitte boosted its start-up and scale-up capabilities by acquiring 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 pilots as part of its portfolio, Deloitte can better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth to technology, infrastructure, and venture capital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the North America Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence