Key Insights

The UK Sports Promoters Market is forecast to reach 35.9 million by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 3.81% from 2024 to 2033. This robust growth is propelled by the sustained popularity of major sporting events and a growing appetite for niche sports. The increasing integration of digital media and data-driven marketing strategies is enhancing audience reach and revenue generation through sponsorships, broadcasting rights, and merchandise. Strategic collaborations between promoters, sports governing bodies, and corporate sponsors are further solidifying market appeal and driving expansion. Key challenges include economic volatility affecting consumer discretionary spending and the potential for event disruptions. The market is segmented across major sports such as football, rugby, and horse racing, alongside emerging disciplines. Leading entities like Matchroom Sport and Queensberry Promotions are instrumental in shaping the market landscape.

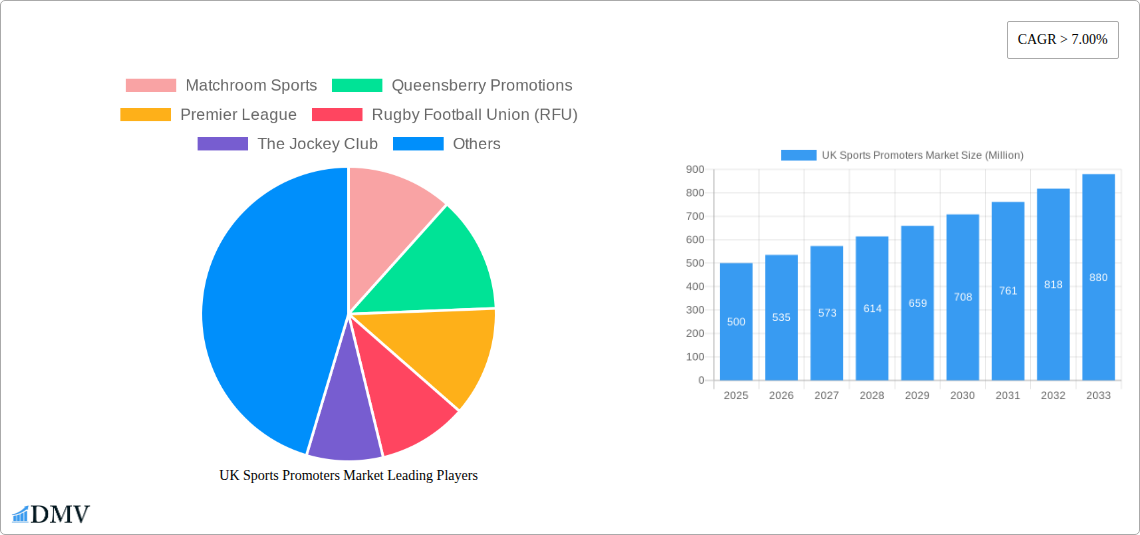

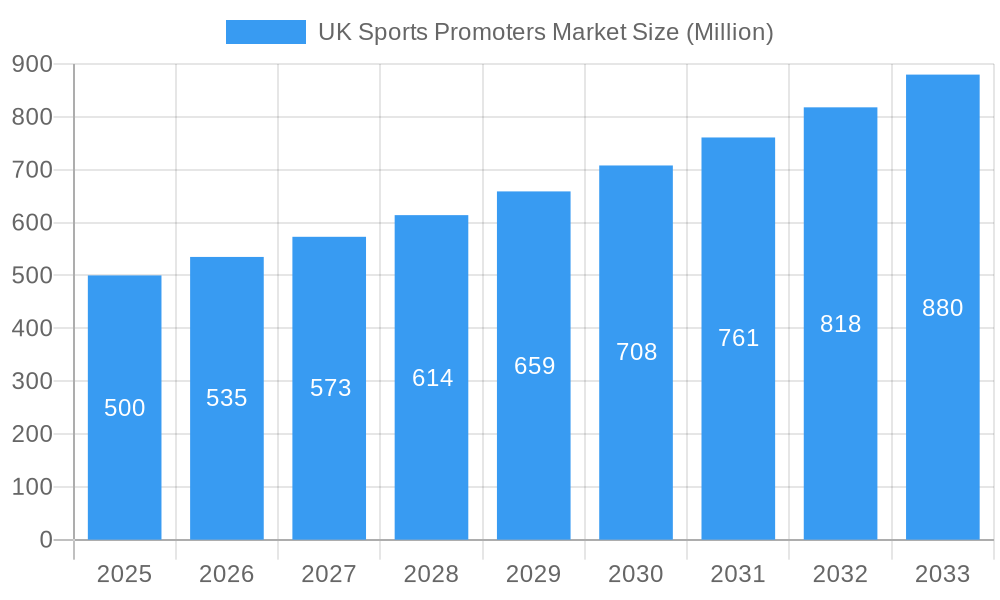

UK Sports Promoters Market Market Size (In Million)

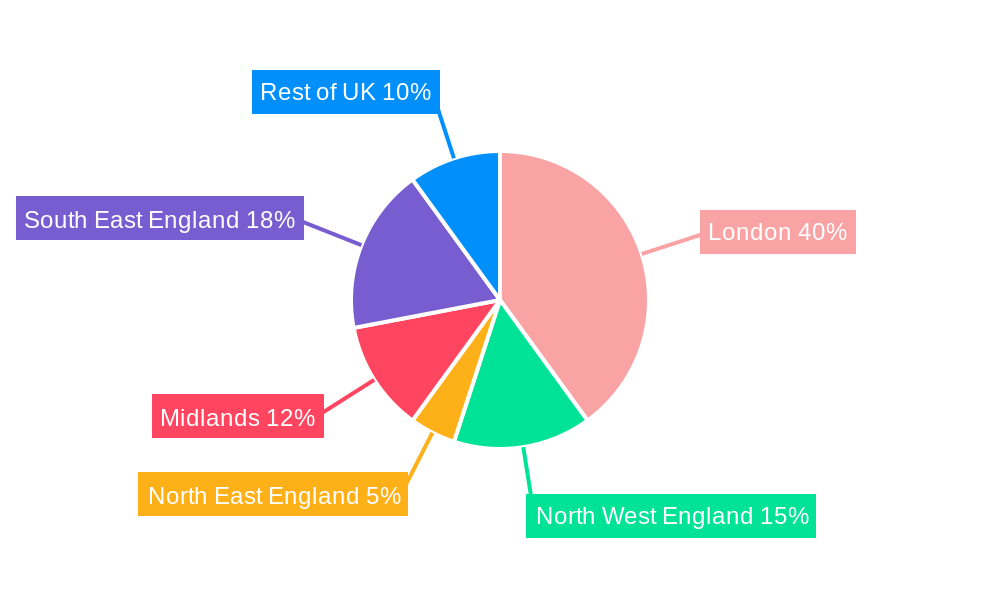

Geographically, market concentration is observed in major urban centers, with potential for increased regional distribution driven by the rise of local sporting events. The competitive environment features a blend of established industry leaders and agile new entrants. Future success hinges on innovative promotional tactics, diversification of event portfolios, and strategic partnerships. The adoption of emerging technologies for event promotion and fan engagement will be crucial for sustained competitive advantage.

UK Sports Promoters Market Company Market Share

UK Sports Promoters Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the UK Sports Promoters Market, offering a comprehensive overview of its current state and future trajectory. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024. The market is valued at £XX Million in 2025 and is projected to reach £XX Million by 2033.

UK Sports Promoters Market Market Composition & Trends

The UK sports promoters market is characterized by a moderately concentrated landscape, with key players such as Matchroom Sport, Queensberry Promotions, and the Premier League holding significant market share. However, a multitude of smaller promoters also contribute significantly, creating a dynamic and competitive environment. Market share distribution in 2025 is estimated as follows: Matchroom Sports (XX%), Queensberry Promotions (XX%), Premier League (XX%), and others (XX%). Innovation is driven by technological advancements in data analytics, fan engagement, and broadcasting. Regulatory frameworks, including those related to broadcasting rights, sponsorship, and athlete welfare, significantly influence market dynamics. Substitute products, such as esports and virtual sporting events, are emerging but haven't significantly impacted the core market yet. End-users comprise a diverse range, from individual athletes and teams to large corporate sponsors and broadcasting networks. M&A activity has been relatively modest in recent years, with deal values averaging around £XX Million per transaction. Notable examples include [insert specific M&A examples if available, otherwise state "no significant M&A activity reported in recent years"].

- Market Concentration: Moderately concentrated, with a few major players and numerous smaller firms.

- Innovation Catalysts: Data analytics, fan engagement technologies, and broadcast innovations.

- Regulatory Landscape: Significant influence on broadcasting rights, sponsorship, and athlete welfare.

- Substitute Products: Emerging esports and virtual sports pose a potential long-term threat.

- End-User Profiles: Diverse range including athletes, teams, sponsors, and broadcasters.

- M&A Activity: Moderate activity, with average deal values around £XX Million.

UK Sports Promoters Market Industry Evolution

The UK sports promoters market has experienced steady growth over the past five years, driven by increasing media rights revenue, expanding sponsorship deals, and rising fan engagement. The market's growth trajectory is projected to continue, albeit at a slightly moderated pace due to economic factors and increased competition. Technological advancements, such as AI-powered performance analysis (as exemplified by Sport-tech 50's Talent Pathway ID) and enhanced broadcasting capabilities, have significantly boosted efficiency and fan engagement. Consumer demands are shifting towards more personalized experiences and interactive content, pushing promoters to innovate in areas such as digital platforms and immersive events. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, exceeding £XX Million by 2033. Increased adoption of data analytics for optimizing event planning and athlete management has contributed to this growth. Shifting consumer preferences towards digital engagement and personalized experiences is driving innovation and market expansion. The impact of global economic conditions and sponsorship revenue volatility on market growth is continuously monitored and factored into the report’s projections.

Leading Regions, Countries, or Segments in UK Sports Promoters Market

London remains the dominant region within the UK sports promoters market, driven by a high concentration of major sporting events, venues, and media companies. This dominance is fueled by significant investment in infrastructure, a supportive regulatory environment, and a large pool of skilled professionals.

- Key Drivers in London's Dominance:

- High Concentration of Major Sporting Events: London hosts numerous high-profile events attracting global attention.

- Robust Infrastructure: World-class venues and supporting infrastructure contribute to operational efficiency.

- Supportive Regulatory Environment: Favorable policies and regulations foster investment and growth.

- Skilled Workforce: Access to a large pool of talented professionals in sports management and related fields.

Other regions, such as Manchester and other major cities, contribute to overall market growth but lag behind London's influence. The dominance of London is likely to persist due to the network effects created by the concentration of events, infrastructure, and talent in the capital.

UK Sports Promoters Market Product Innovations

Recent product innovations focus on enhancing fan engagement and improving athlete performance. AI-powered performance analysis tools, improved digital platforms for ticket sales and live streaming, and the integration of VR/AR technologies are transforming the industry. These innovations offer unique selling propositions focused on providing better data-driven insights to enhance performance and offering more personalized experiences to fans. The successful implementation of these technologies is expected to further drive market growth and enhance the value proposition for both athletes and fans.

Propelling Factors for UK Sports Promoters Market Growth

Several factors propel growth within the UK sports promoters market. Technological advancements like AI-driven performance analysis and immersive fan experiences are enhancing engagement. Economic factors, such as increased disposable incomes and corporate sponsorship, further stimulate market expansion. Supportive government regulations and policies related to sports development and broadcasting contribute significantly. The rising popularity of global sports and the increasing demand for high-quality sporting entertainment are all contributing to the growth of the market.

Obstacles in the UK Sports Promoters Market

Challenges facing the UK sports promoters market include regulatory uncertainty surrounding broadcasting rights and sponsorship deals. Supply chain disruptions, particularly those impacting event logistics and infrastructure, can create operational bottlenecks. Intense competition from established and emerging players requires continuous innovation to maintain market share. Economic downturns can significantly impact sponsorship revenue and affect consumer spending on sports events. The overall impact of these factors is currently estimated at £XX Million annually.

Future Opportunities in UK Sports Promoters Market

Emerging opportunities include tapping into new market segments, such as esports and niche sports, through strategic partnerships. Leveraging emerging technologies such as blockchain for ticket sales and transparency and exploring alternative revenue streams (e.g., fan tokens, NFTs) presents significant potential. Catering to the evolving needs of a younger, digitally native audience through personalized experiences is key to sustainable growth. International expansion, particularly in growing markets, could broaden revenue streams.

Major Players in the UK Sports Promoters Market Ecosystem

- Matchroom Sport

- Queensberry Promotions

- Premier League

- Rugby Football Union (RFU)

- The Jockey Club

- SYL Sports And Wellness

- Reech Sports

- Strive Sports Management

- Sports Resource Group

- Metcalf Multisports

Key Developments in UK Sports Promoters Market Industry

- June 2023: Sport-tech 50 introduced Talent Pathway ID, an AI-powered performance analysis tool, enhancing athlete training and coaching strategies. This boosts the market by improving athlete performance and creating new revenue streams for data-driven insights.

- April 2023: Madison Square Garden Entertainment Corp.'s successful spin-off from Sphere Entertainment Co. signifies increased investment and market diversification within the entertainment sector, indirectly impacting the UK market through potential partnerships and investment.

Strategic UK Sports Promoters Market Forecast

The UK sports promoters market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and sustained investment. The market's potential is significant, with opportunities spanning new technologies, international expansion, and the diversification of revenue streams. This growth trajectory should be viewed in the context of potential macro-economic challenges and ongoing regulatory shifts. The integration of innovative technologies, coupled with effective marketing and engagement strategies, will play a key role in shaping future market trends.

UK Sports Promoters Market Segmentation

-

1. Type of Sports

- 1.1. Soccer

- 1.2. Formula 1

- 1.3. Basketball

- 1.4. Tennis

- 1.5. Other Types of Sports

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Ticket

- 2.4. Sponsoring

UK Sports Promoters Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Sports Promoters Market Regional Market Share

Geographic Coverage of UK Sports Promoters Market

UK Sports Promoters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Number of Spectators Watching Sports

- 3.3. Market Restrains

- 3.3.1. Increase in Number of Spectators Watching Sports

- 3.4. Market Trends

- 3.4.1. Athletes Influencers is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Sports

- 5.1.1. Soccer

- 5.1.2. Formula 1

- 5.1.3. Basketball

- 5.1.4. Tennis

- 5.1.5. Other Types of Sports

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Ticket

- 5.2.4. Sponsoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Sports

- 6. North America UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Sports

- 6.1.1. Soccer

- 6.1.2. Formula 1

- 6.1.3. Basketball

- 6.1.4. Tennis

- 6.1.5. Other Types of Sports

- 6.2. Market Analysis, Insights and Forecast - by Revenue Source

- 6.2.1. Media Rights

- 6.2.2. Merchandising

- 6.2.3. Ticket

- 6.2.4. Sponsoring

- 6.1. Market Analysis, Insights and Forecast - by Type of Sports

- 7. South America UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Sports

- 7.1.1. Soccer

- 7.1.2. Formula 1

- 7.1.3. Basketball

- 7.1.4. Tennis

- 7.1.5. Other Types of Sports

- 7.2. Market Analysis, Insights and Forecast - by Revenue Source

- 7.2.1. Media Rights

- 7.2.2. Merchandising

- 7.2.3. Ticket

- 7.2.4. Sponsoring

- 7.1. Market Analysis, Insights and Forecast - by Type of Sports

- 8. Europe UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Sports

- 8.1.1. Soccer

- 8.1.2. Formula 1

- 8.1.3. Basketball

- 8.1.4. Tennis

- 8.1.5. Other Types of Sports

- 8.2. Market Analysis, Insights and Forecast - by Revenue Source

- 8.2.1. Media Rights

- 8.2.2. Merchandising

- 8.2.3. Ticket

- 8.2.4. Sponsoring

- 8.1. Market Analysis, Insights and Forecast - by Type of Sports

- 9. Middle East & Africa UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Sports

- 9.1.1. Soccer

- 9.1.2. Formula 1

- 9.1.3. Basketball

- 9.1.4. Tennis

- 9.1.5. Other Types of Sports

- 9.2. Market Analysis, Insights and Forecast - by Revenue Source

- 9.2.1. Media Rights

- 9.2.2. Merchandising

- 9.2.3. Ticket

- 9.2.4. Sponsoring

- 9.1. Market Analysis, Insights and Forecast - by Type of Sports

- 10. Asia Pacific UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Sports

- 10.1.1. Soccer

- 10.1.2. Formula 1

- 10.1.3. Basketball

- 10.1.4. Tennis

- 10.1.5. Other Types of Sports

- 10.2. Market Analysis, Insights and Forecast - by Revenue Source

- 10.2.1. Media Rights

- 10.2.2. Merchandising

- 10.2.3. Ticket

- 10.2.4. Sponsoring

- 10.1. Market Analysis, Insights and Forecast - by Type of Sports

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Matchroom Sports

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Queensberry Promotions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Premier League

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rugby Football Union (RFU)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Jockey Club

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SYL Sports And Wellness

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Reech Sports

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Strive Sports Management

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sports Resource Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Metcalf Multisports**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Matchroom Sports

List of Figures

- Figure 1: Global UK Sports Promoters Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America UK Sports Promoters Market Revenue (million), by Type of Sports 2025 & 2033

- Figure 3: North America UK Sports Promoters Market Revenue Share (%), by Type of Sports 2025 & 2033

- Figure 4: North America UK Sports Promoters Market Revenue (million), by Revenue Source 2025 & 2033

- Figure 5: North America UK Sports Promoters Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 6: North America UK Sports Promoters Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America UK Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Sports Promoters Market Revenue (million), by Type of Sports 2025 & 2033

- Figure 9: South America UK Sports Promoters Market Revenue Share (%), by Type of Sports 2025 & 2033

- Figure 10: South America UK Sports Promoters Market Revenue (million), by Revenue Source 2025 & 2033

- Figure 11: South America UK Sports Promoters Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 12: South America UK Sports Promoters Market Revenue (million), by Country 2025 & 2033

- Figure 13: South America UK Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Sports Promoters Market Revenue (million), by Type of Sports 2025 & 2033

- Figure 15: Europe UK Sports Promoters Market Revenue Share (%), by Type of Sports 2025 & 2033

- Figure 16: Europe UK Sports Promoters Market Revenue (million), by Revenue Source 2025 & 2033

- Figure 17: Europe UK Sports Promoters Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 18: Europe UK Sports Promoters Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe UK Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Sports Promoters Market Revenue (million), by Type of Sports 2025 & 2033

- Figure 21: Middle East & Africa UK Sports Promoters Market Revenue Share (%), by Type of Sports 2025 & 2033

- Figure 22: Middle East & Africa UK Sports Promoters Market Revenue (million), by Revenue Source 2025 & 2033

- Figure 23: Middle East & Africa UK Sports Promoters Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 24: Middle East & Africa UK Sports Promoters Market Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Sports Promoters Market Revenue (million), by Type of Sports 2025 & 2033

- Figure 27: Asia Pacific UK Sports Promoters Market Revenue Share (%), by Type of Sports 2025 & 2033

- Figure 28: Asia Pacific UK Sports Promoters Market Revenue (million), by Revenue Source 2025 & 2033

- Figure 29: Asia Pacific UK Sports Promoters Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 30: Asia Pacific UK Sports Promoters Market Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 2: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 3: Global UK Sports Promoters Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 5: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 6: Global UK Sports Promoters Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 11: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 12: Global UK Sports Promoters Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 17: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 18: Global UK Sports Promoters Market Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 29: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 30: Global UK Sports Promoters Market Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 38: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 39: Global UK Sports Promoters Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: China UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Sports Promoters Market?

The projected CAGR is approximately 3.81%.

2. Which companies are prominent players in the UK Sports Promoters Market?

Key companies in the market include Matchroom Sports, Queensberry Promotions, Premier League, Rugby Football Union (RFU), The Jockey Club, SYL Sports And Wellness, Reech Sports, Strive Sports Management, Sports Resource Group, Metcalf Multisports**List Not Exhaustive.

3. What are the main segments of the UK Sports Promoters Market?

The market segments include Type of Sports, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.9 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Number of Spectators Watching Sports.

6. What are the notable trends driving market growth?

Athletes Influencers is Driving the Market.

7. Are there any restraints impacting market growth?

Increase in Number of Spectators Watching Sports.

8. Can you provide examples of recent developments in the market?

June 2023: Sport-tech 50 introduced Talent Pathway ID, a groundbreaking addition to its lineup, offering AI-powered performance analysis for both athletes and coaches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Sports Promoters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Sports Promoters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Sports Promoters Market?

To stay informed about further developments, trends, and reports in the UK Sports Promoters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence