Key Insights

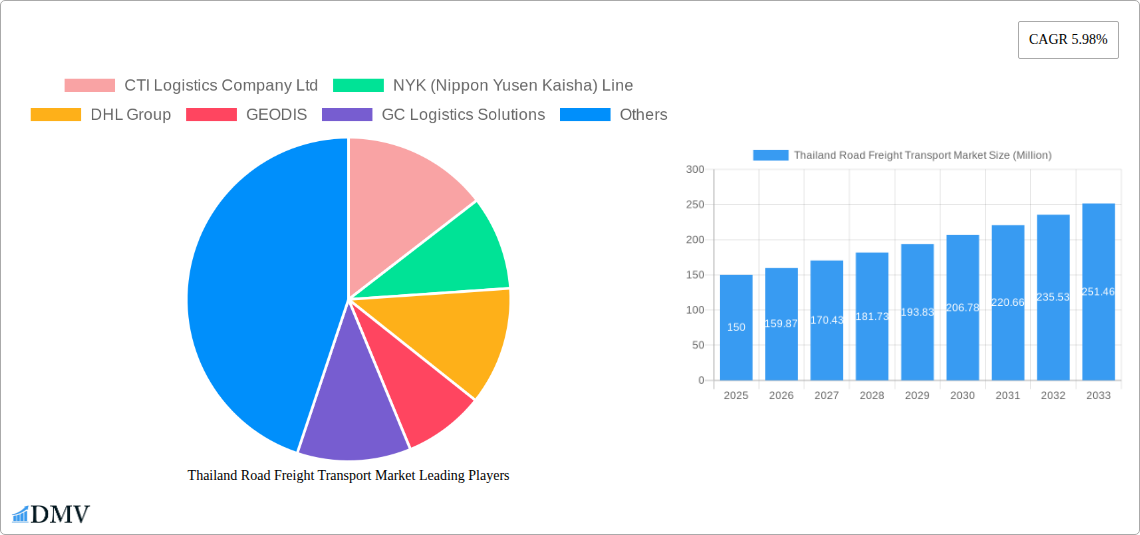

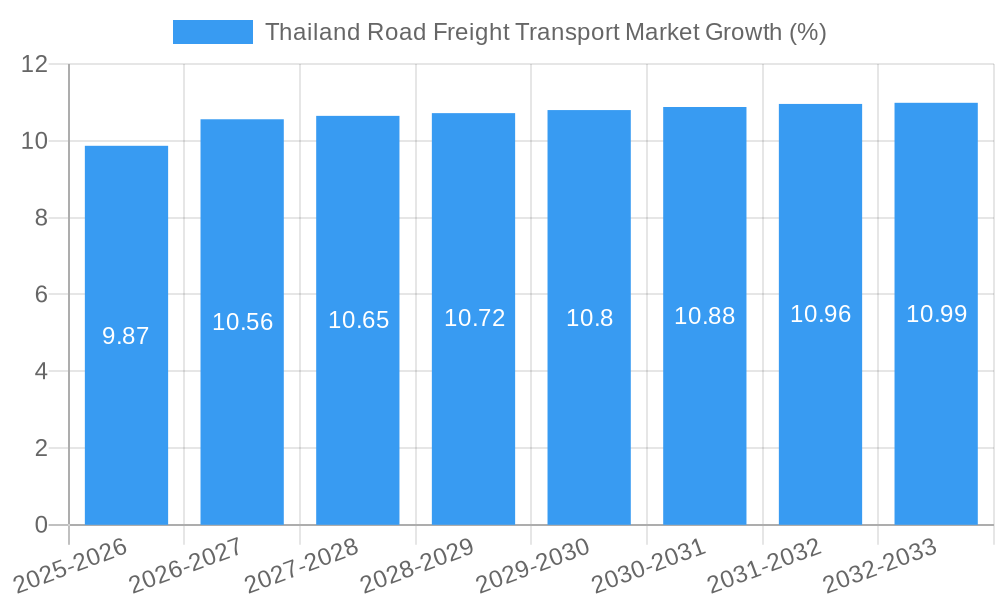

The Thailand road freight transport market, valued at approximately [Estimate based on Market Size XX and extrapolation – e.g., 150 million USD] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector in Thailand is significantly increasing demand for efficient and reliable last-mile delivery solutions, directly impacting road freight volumes. Furthermore, the country's robust industrial growth, particularly in manufacturing, construction, and agriculture, necessitates the movement of raw materials and finished goods, contributing to the market's dynamism. Growth in cross-border trade, both within ASEAN and globally, also boosts the demand for international road freight services. However, challenges remain. Infrastructure limitations, including congested roads and a lack of adequate warehousing facilities in certain regions, pose constraints on efficient operations. Fluctuations in fuel prices and driver shortages also represent ongoing concerns for market participants. Market segmentation reveals that full-truckload (FTL) services likely dominate, given the scale of industrial activity and long-haul transportation needs. Temperature-controlled transportation is a significant segment, catering to the food and beverage industries, emphasizing the need for specialized logistics solutions.

The market's future trajectory will be shaped by several trends. Technological advancements, such as the adoption of telematics and GPS tracking systems, are improving operational efficiency and enhancing supply chain visibility. The growing emphasis on sustainable logistics, driven by environmental concerns, is leading to increased adoption of fuel-efficient vehicles and eco-friendly transportation practices. Consolidation within the industry through mergers and acquisitions is expected to enhance the competitiveness and scale of operations. Key players in the market, including CTI Logistics Company Ltd, NYK Line, DHL Group, GEODIS, and others, are actively investing in infrastructure upgrades and technological innovation to maintain their market positions and cater to evolving customer demands. A focus on improving regulatory frameworks and streamlining customs procedures will be crucial for facilitating seamless cross-border transportation and optimizing supply chain efficiency. The market's potential is considerable, presenting opportunities for both established players and emerging logistics providers to capitalize on the increasing demand for reliable and efficient road freight solutions.

Thailand Road Freight Transport Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Thailand road freight transport market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It offers invaluable insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed strategic decisions within this rapidly evolving sector. The market is projected to reach xx Million by 2033, driven by factors detailed within.

Thailand Road Freight Transport Market Composition & Trends

This section delves into the current state of the Thailand road freight transport market, examining its structure, key trends, and influencing factors. The market is characterized by a moderately concentrated landscape with several key players vying for market share. Innovation is being driven by a push for sustainability and technological advancements in fleet management and logistics solutions. The regulatory landscape is constantly evolving, impacting operational efficiency and compliance. Substitute products, such as rail transport, pose a level of competition, particularly for long-haul shipments.

Market Concentration: The market share is distributed among key players like DHL Group, GEODIS, Kerry Logistics Network Limited, and others, with DHL Group holding an estimated xx% market share in 2025. Smaller, regional players constitute the remaining share.

Innovation Catalysts: The rise of electric vehicles, advancements in telematics, and the adoption of route optimization software are significant catalysts for innovation.

Regulatory Landscape: Government regulations regarding emissions, road safety, and driver hours significantly impact operational costs and strategies.

Substitute Products: Rail freight and other multimodal options offer competitive alternatives, especially for high-volume, long-distance shipments.

End-User Profiles: The market caters to a diverse range of end-user industries, including manufacturing, retail, and agriculture, each with unique transportation needs.

M&A Activities: The past five years have witnessed several M&A deals, though the precise deal values remain unavailable (xx Million) for the period 2019-2024. These activities reflect the market's consolidation and the pursuit of operational synergies.

Thailand Road Freight Transport Market Industry Evolution

The Thailand road freight transport market has witnessed consistent growth over the period 2019-2024, driven by a robust economy and expanding e-commerce. Annual growth rates averaged xx% during this period. Technological advancements, particularly the adoption of GPS tracking, route optimization software, and the increasing use of electric vehicles, have significantly improved efficiency and reduced operational costs. Consumer demand continues to shift towards faster and more reliable delivery options, creating pressure on logistics providers to enhance their services and capabilities. The ongoing electrification of fleets signifies a major shift toward environmentally friendly operations within the market. Growth is projected to average xx% annually from 2025 to 2033, reaching a market value of xx Million by 2033. This growth is fueled by continued economic expansion, expanding e-commerce activities, and increasing investments in infrastructure.

Leading Regions, Countries, or Segments in Thailand Road Freight Transport Market

The leading segments within the Thailand road freight transport market reflect the country's economic structure and logistical needs.

Key Drivers and Dominance Factors:

- Goods Configuration: Solid goods dominate the market due to the prevalence of manufacturing and retail industries, although the fluid goods sector is seeing steady growth.

- Temperature Control: Non-temperature-controlled transportation holds a larger market share reflecting the bulk of goods transported. However, the temperature-controlled segment is experiencing growth driven by the food and pharmaceutical sectors.

- End-User Industry: Manufacturing, wholesale and retail trade remain the largest end-user segments, reflecting the country's industrial output and consumer spending. The agricultural sector also contributes significantly.

- Destination: Domestic transportation constitutes the larger segment, driven by intra-regional trade and distribution networks. The international segment is witnessing expansion due to increased cross-border commerce.

- Truckload Specification: Full Truck Load (FTL) remains a dominant mode, however, Less than Truck Load (LTL) is gaining traction due to the growth in e-commerce and smaller shipments.

- Containerization: Containerized freight is prevalent, particularly for international shipments, while non-containerized transport dominates in the domestic sector.

- Distance: Short-haul transportation represents the larger market share given the country's geographical constraints and distribution patterns; however, long-haul transport is important for inter-regional trade.

The Bangkok metropolitan area, owing to its status as the economic hub and concentration of both manufacturing and consumption, represents the dominant region.

Thailand Road Freight Transport Market Product Innovations

Recent innovations have focused on improving efficiency, sustainability, and tracking capabilities. This includes the adoption of electric vehicles, advanced telematics systems for real-time tracking and route optimization, and the implementation of sophisticated warehouse management systems. These innovations offer enhanced visibility and control throughout the supply chain, leading to cost savings and improved customer satisfaction. Unique selling propositions often center around faster delivery times, increased transparency, and sustainable practices.

Propelling Factors for Thailand Road Freight Transport Market Growth

Several factors are driving growth in the Thailand road freight transport market. These include robust economic expansion boosting trade volumes, the increasing adoption of e-commerce which fuels demand for last-mile delivery services, and government initiatives to improve infrastructure. Technological advancements in fleet management and route optimization also contribute to efficiency gains, driving market expansion. Furthermore, ongoing investments in logistics infrastructure across the nation are enhancing connectivity and supporting business growth.

Obstacles in the Thailand Road Freight Transport Market

Challenges include fluctuating fuel prices that affect operational costs, traffic congestion in major urban areas which leads to delays and increased fuel consumption, and a shortage of skilled drivers. Regulatory changes and compliance requirements can also create hurdles. The competitive landscape also contributes, with intense pricing pressure and a constant need to maintain high service levels. These obstacles collectively impact profitability and efficiency within the sector.

Future Opportunities in Thailand Road Freight Transport Market

Future opportunities lie in the growing adoption of sustainable technologies, such as electric and hybrid vehicles. Expanding into the e-commerce sector presents significant potential, particularly in last-mile delivery solutions. Focusing on niche markets like temperature-controlled transportation for pharmaceuticals and specialized goods also offers growth prospects. Furthermore, integration with other modes of transportation through multimodal solutions will further enhance efficiency and market reach.

Major Players in the Thailand Road Freight Transport Market Ecosystem

- CTI Logistics Company Ltd

- NYK (Nippon Yusen Kaisha) Line

- DHL Group

- GEODIS

- GC Logistics Solutions

- Linfox Pty Ltd

- Profreight Grou

- Kerry Logistics Network Limited

Key Developments in Thailand Road Freight Transport Market Industry

- August 2023: GEODIS expanded its road network from Southeast Asia to China, enhancing multimodal options.

- October 2023: DHL Global Forwarding Thailand deployed electric vans and trucks in Bangkok, focusing on sustainable last-mile delivery.

- January 2024: DHL Supply Chain Thailand partnered with Green Spot to introduce an electric 18-wheeler, promoting sustainability.

These developments highlight the industry's commitment to sustainability and efficiency improvements.

Strategic Thailand Road Freight Transport Market Forecast

The Thailand road freight transport market is poised for continued growth, fueled by strong economic fundamentals and the increasing adoption of advanced technologies. Opportunities in sustainability, e-commerce fulfillment, and specialized logistics will drive expansion. The market's projected growth rate signifies significant potential for investors and industry participants alike. The focus on efficient and sustainable practices will shape the future landscape of the market.

Thailand Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Thailand Road Freight Transport Market Segmentation By Geography

- 1. Thailand

Thailand Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CTI Logistics Company Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NYK (Nippon Yusen Kaisha) Line

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GEODIS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GC Logistics Solutions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Linfox Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Profreight Grou

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kerry Logistics Network Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 CTI Logistics Company Ltd

List of Figures

- Figure 1: Thailand Road Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Road Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Thailand Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Thailand Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Thailand Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Thailand Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Thailand Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Thailand Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Thailand Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Thailand Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Thailand Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Thailand Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Thailand Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 13: Thailand Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 14: Thailand Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 15: Thailand Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 16: Thailand Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 17: Thailand Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 18: Thailand Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Road Freight Transport Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Thailand Road Freight Transport Market?

Key companies in the market include CTI Logistics Company Ltd, NYK (Nippon Yusen Kaisha) Line, DHL Group, GEODIS, GC Logistics Solutions, Linfox Pty Ltd, Profreight Grou, Kerry Logistics Network Limited.

3. What are the main segments of the Thailand Road Freight Transport Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

January 2024: DHL Supply Chain Thailand has partnered with Green Spot, the leading soy milk manufacturer in Thailand, to introduce an electric 18-wheeler , marking a significant step towards both companies’ commitment to a greener and more sustainable future. This fully electric vehicle is capable of traveling up to 350km on a single charge. The vehicle takes approximately two hours to charge and is projected to reduce CO₂ emissions by 60 tons annually.October 2023: DHL Global Forwarding Thailand has deployed electric vans and trucks in Bangkok offering a more sustainable last-mile delivery solution for customers. The launch marks another milestones from the company in its efforts to reduce carbon footprint. These initial vehicles will cover a monthly distance exceeding 28,000 kilometers in operation and deliver approximately 1,000 tons of shipments to customers.August 2023: GEODIS has expanded its Road Network from Southeast Asia (SEA) to China providing secure day-definite, and environmentally friendly solutions connecting Singapore, Malaysia, Thailand, Vietnam, and China. GEODIS Road Network is integrated with major air and sea ports and offers multimodal options to meet customer needs. Road network has offically launched on August 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Thailand Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence