Key Insights

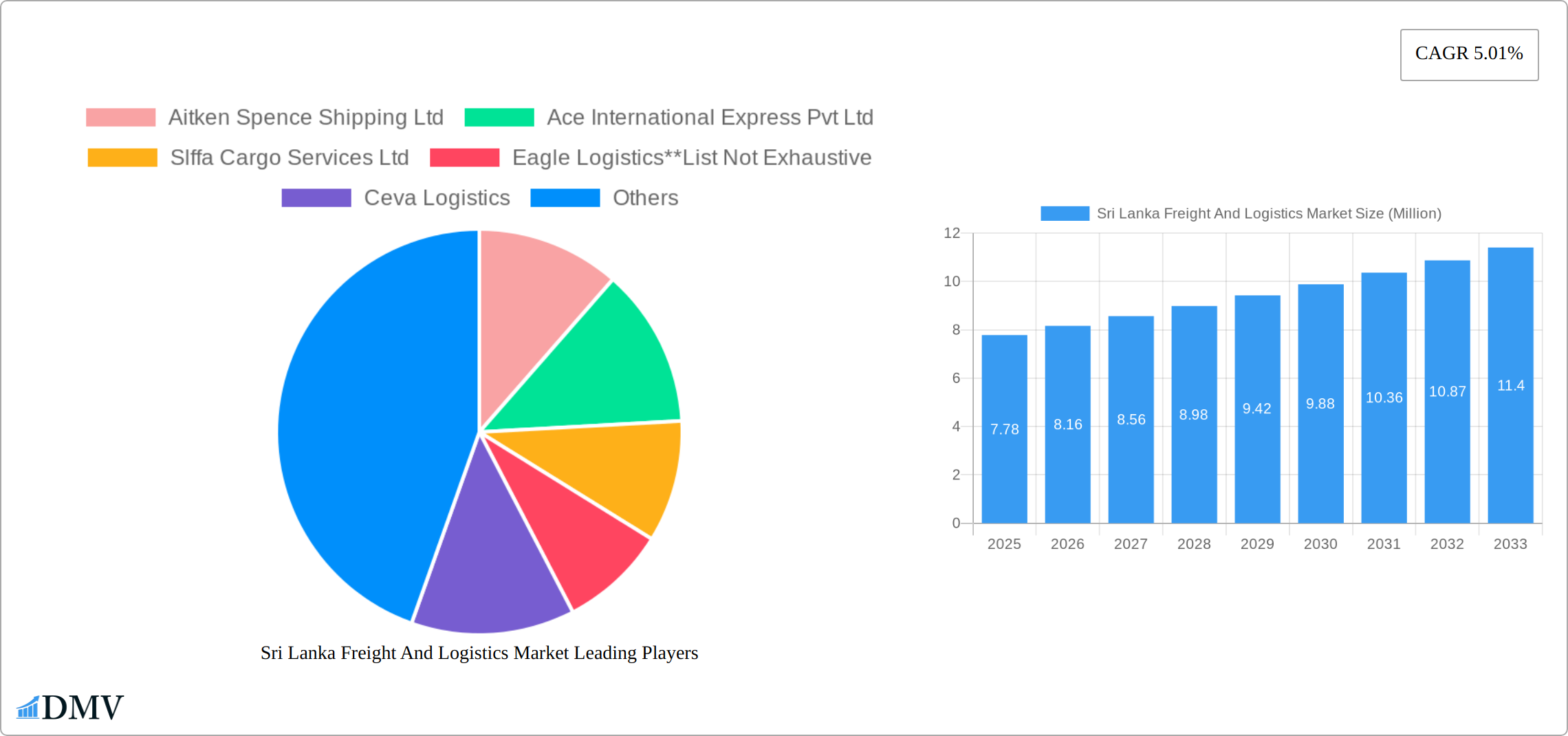

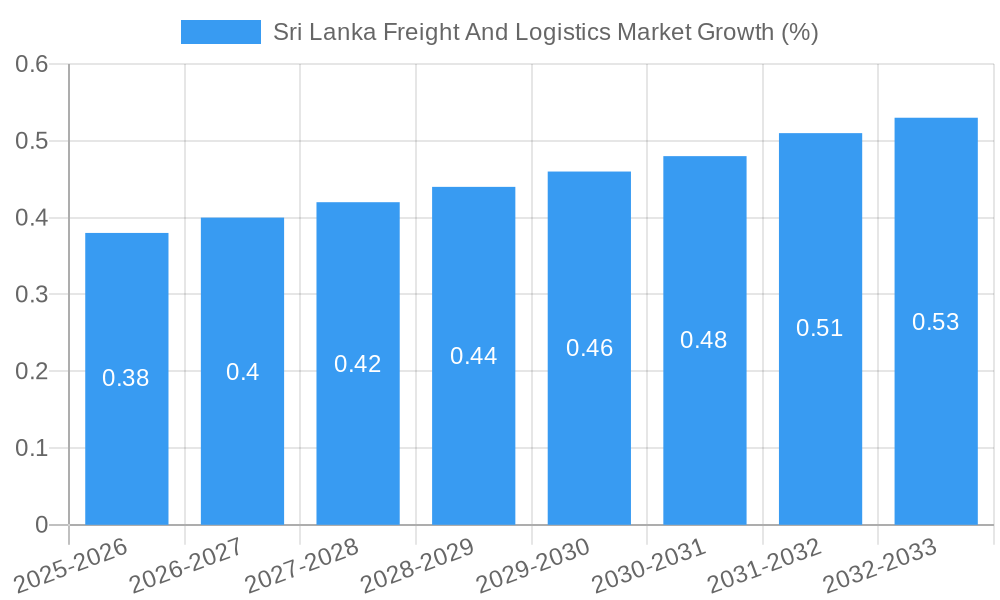

The Sri Lanka freight and logistics market, valued at $7.78 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.01% from 2025 to 2033. This expansion is driven by several key factors. The nation's burgeoning tourism sector fuels demand for efficient import and export logistics, while increasing e-commerce activity necessitates sophisticated last-mile delivery solutions. Furthermore, ongoing infrastructure development, including port upgrades and improved road networks, contributes to smoother operations and reduced transit times. The market is segmented by end-user industry (Manufacturing & Automotive, Oil & Gas, Mining & Quarrying, Agriculture, Fishing & Forestry, Construction, Distributive Trade) and function (Freight Transport, Ocean/Sea Warehousing, Freight Forwarding, Value-Added Services). The presence of established players like Aitken Spence Shipping Ltd and Ceva Logistics, alongside numerous local and international companies, indicates a competitive yet dynamic market landscape. However, challenges remain, including potential fluctuations in global fuel prices impacting transportation costs and the need for continued investment in technology to enhance supply chain efficiency and transparency.

Growth within specific segments is anticipated to vary. Ocean/Sea warehousing and freight forwarding are likely to experience significant growth due to Sri Lanka's strategic location as a maritime hub. The manufacturing and automotive sectors, given their reliance on timely and efficient logistics, will be major contributors to the market's overall expansion. The consistent CAGR reflects a positive outlook, albeit one that needs to adapt to geopolitical and economic uncertainties. Future growth will depend on the government's continued investment in infrastructure, effective regulatory frameworks, and the adoption of advanced technologies such as blockchain and AI within the logistics industry. This will not only improve efficiency but also enhance the overall competitiveness of Sri Lanka's freight and logistics sector in the global market.

Sri Lanka Freight and Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Sri Lanka freight and logistics market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

Sri Lanka Freight and Logistics Market Composition & Trends

The Sri Lanka freight and logistics market exhibits a moderately concentrated structure, with several large players like Aitken Spence Shipping Ltd, Ace International Express Pvt Ltd, and Ceva Logistics holding significant market share. However, the presence of numerous smaller, specialized firms contributes to a competitive landscape. Market share distribution varies significantly across segments, with the manufacturing and automotive sector currently dominating.

- Market Concentration: Moderate, with a few major players and several smaller operators.

- Innovation Catalysts: Government investments in port infrastructure, technological advancements in tracking and management systems, and the growing e-commerce sector.

- Regulatory Landscape: A blend of government regulations and industry self-regulation, with ongoing efforts to streamline processes and improve efficiency.

- Substitute Products/Services: Limited direct substitutes, but competition exists from alternative transportation modes and regional logistics providers.

- End-User Profiles: Diverse, including manufacturers, exporters, importers, and retailers across various sectors. Manufacturing and Automotive hold a dominant share.

- M&A Activities: The Sri Lanka freight and logistics market has witnessed several M&A deals in recent years, valued at an estimated XX Million collectively. These deals primarily focused on expanding service portfolios and geographical reach. For instance, a merger between two regional freight forwarders could represent a consolidation trend within the sector.

Sri Lanka Freight and Logistics Market Industry Evolution

The Sri Lanka freight and logistics market has experienced fluctuating growth over the historical period (2019-2024), influenced by global economic conditions and domestic policy shifts. However, recent infrastructural improvements and government initiatives signal a positive outlook. Technological advancements, such as the adoption of advanced tracking systems, automated warehousing, and data analytics, are transforming operational efficiency. This is further boosted by growing consumer demand for faster and more reliable delivery services, primarily driven by e-commerce expansion. The market is forecast to expand at a CAGR of XX% over the forecast period, driven by improving trade relations and robust infrastructure investment. This evolution sees an increasing focus on value-added services, reflecting the changing needs of businesses seeking greater supply chain transparency and control. The adoption of digitalization within logistics has improved efficiency but faces challenges in legacy systems upgrade in some parts of the industry.

Leading Regions, Countries, or Segments in Sri Lanka Freight and Logistics Market

The Colombo port region remains the dominant hub for freight and logistics activities in Sri Lanka, owing to its strategic location and well-established infrastructure. Within the end-user industry segment, Manufacturing and Automotive lead due to significant export and import volumes. In the functional segments, freight forwarding and warehousing dominate, reflecting the logistical needs of diverse industries.

- Key Drivers (Manufacturing and Automotive): High export volumes, government incentives for manufacturing, and the presence of established automotive assembly plants.

- Key Drivers (Freight Forwarding): Strong import and export activity, the need for efficient movement of goods, and the growth of e-commerce.

- Key Drivers (Warehousing): Rising demand for efficient storage solutions, growth of e-commerce requiring last-mile delivery support, and the development of modern warehousing facilities near ports.

- Dominance Factors (Colombo Port): Strategic location, existing infrastructure, government investment in modernization, and strong connectivity to global shipping routes.

Sri Lanka Freight and Logistics Market Product Innovations

Recent innovations in the Sri Lanka freight and logistics market encompass the implementation of advanced tracking and monitoring systems, the use of AI-powered route optimization software, and the integration of blockchain technology to enhance supply chain transparency. The adoption of these technologies offers enhanced efficiency, reduced costs, and improved security, creating unique selling propositions for logistics providers that can successfully integrate and utilize them.

Propelling Factors for Sri Lanka Freight and Logistics Market Growth

The Sri Lanka freight and logistics market is propelled by several key factors. Government investments in port infrastructure, such as the expansion of the Trincomalee Port, are improving capacity and efficiency. The growth of e-commerce is driving demand for faster and more reliable delivery services. Furthermore, increasing foreign direct investment (FDI) in manufacturing and other sectors is fueling trade volumes and related logistics activity.

Obstacles in the Sri Lanka Freight And Logistics Market

The Sri Lanka freight and logistics market faces challenges such as infrastructure limitations beyond the major ports, bureaucratic hurdles impacting customs clearance times, and occasional port congestion leading to delays. Furthermore, fluctuating fuel prices and geopolitical uncertainties contribute to operational cost volatility. The impact of these obstacles on overall efficiency and cost is estimated at approximately XX Million annually.

Future Opportunities in Sri Lanka Freight And Logistics Market

Future opportunities lie in expanding cold chain logistics to support the growth of perishable goods exports, leveraging technological advancements such as drone delivery for faster last-mile solutions, and developing specialized logistics services for emerging sectors such as renewable energy. Focus on sustainable practices like green logistics initiatives would increase competitiveness and provide a growth pathway for forward-thinking organizations.

Major Players in the Sri Lanka Freight And Logistics Market Ecosystem

- Aitken Spence Shipping Ltd

- Ace International Express Pvt Ltd

- SLFFA Cargo Services Ltd

- Eagle Logistics

- Ceva Logistics

- Hayleys Free Zone Ltd

- MIT Cargo Pvt Ltd

- A P L Logistics Lanka Pvt Ltd

- Freight Links International Pvt Ltd

- DSV Pership Pvt Ltd

Key Developments in Sri Lanka Freight and Logistics Market Industry

- February 2023: The Sri Lanka Ports Authority (SLPA) announced plans to invest in the expansion of the Trincomalee Port, including the construction of a warehouse and administrative building, deepening the jetty, and attracting cruise vessels. This investment is expected to significantly boost the port's capacity and attract further foreign investment.

- February 2023: The Trincomalee port received a USD 7.52 Million night navigation facility from Japan, enhancing operational efficiency and safety. This upgrade will likely improve the port's competitiveness and attract more shipping traffic, contributing to increased logistics activity.

Strategic Sri Lanka Freight and Logistics Market Forecast

The Sri Lanka freight and logistics market is poised for robust growth, driven by infrastructure development, technological advancements, and a burgeoning e-commerce sector. Further government initiatives to ease logistical bottlenecks and improve connectivity will further enhance market potential, making it a lucrative sector for both domestic and international investors. The positive growth trend is expected to continue throughout the forecast period, with considerable potential for expansion in specialized services and technology integration.

Sri Lanka Freight And Logistics Market Segmentation

-

1. End User Industry

- 1.1. Manufacturing and Automotive

- 1.2. Oil and Gas, Mining, and Quarrying

- 1.3. Agriculture, Fishing, and Forestry

- 1.4. Construction

- 1.5. Distributive Trade

-

2. Function

-

2.1. Freight Transport

- 2.1.1. Road

- 2.1.2. Rail

- 2.1.3. Air

- 2.1.4. Ocean/Sea

- 2.2. Warehousing

- 2.3. Freight Forwarding

- 2.4. Value Added Services

-

2.1. Freight Transport

Sri Lanka Freight And Logistics Market Segmentation By Geography

- 1. Sri Lanka

Sri Lanka Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth of E-Commerce Sector4.; Growing Manufacturing Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Fuel Prices and Energy Issues4.; Inflation in Sri Lanka

- 3.4. Market Trends

- 3.4.1. Increase in Sea Freight Transport

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sri Lanka Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Manufacturing and Automotive

- 5.1.2. Oil and Gas, Mining, and Quarrying

- 5.1.3. Agriculture, Fishing, and Forestry

- 5.1.4. Construction

- 5.1.5. Distributive Trade

- 5.2. Market Analysis, Insights and Forecast - by Function

- 5.2.1. Freight Transport

- 5.2.1.1. Road

- 5.2.1.2. Rail

- 5.2.1.3. Air

- 5.2.1.4. Ocean/Sea

- 5.2.2. Warehousing

- 5.2.3. Freight Forwarding

- 5.2.4. Value Added Services

- 5.2.1. Freight Transport

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sri Lanka

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Aitken Spence Shipping Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ace International Express Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Slffa Cargo Services Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eagle Logistics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ceva Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hayleys Free Zone Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MIT Cargo Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 A P L Logistics Lanka Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Freight Links International Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dsv Pership Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aitken Spence Shipping Ltd

List of Figures

- Figure 1: Sri Lanka Freight And Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sri Lanka Freight And Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Sri Lanka Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sri Lanka Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Sri Lanka Freight And Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 4: Sri Lanka Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Sri Lanka Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Sri Lanka Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 7: Sri Lanka Freight And Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 8: Sri Lanka Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sri Lanka Freight And Logistics Market?

The projected CAGR is approximately 5.01%.

2. Which companies are prominent players in the Sri Lanka Freight And Logistics Market?

Key companies in the market include Aitken Spence Shipping Ltd, Ace International Express Pvt Ltd, Slffa Cargo Services Ltd, Eagle Logistics**List Not Exhaustive, Ceva Logistics, Hayleys Free Zone Ltd, MIT Cargo Pvt Ltd, A P L Logistics Lanka Pvt Ltd, Freight Links International Pvt Ltd, Dsv Pership Pvt Ltd.

3. What are the main segments of the Sri Lanka Freight And Logistics Market?

The market segments include End User Industry, Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.78 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth of E-Commerce Sector4.; Growing Manufacturing Sector.

6. What are the notable trends driving market growth?

Increase in Sea Freight Transport.

7. Are there any restraints impacting market growth?

4.; Increasing Fuel Prices and Energy Issues4.; Inflation in Sri Lanka.

8. Can you provide examples of recent developments in the market?

February 2023: In a bid to expand the Trincomalee Port, the Sri Lanka Ports Authority (SLPA) is expected to invest to build a warehouse and administrative building and add several other infrastructures to it, announced the Minister of Ports and Shipping of Srilanka. The Jetty would be deeper and would initiate programs to attract cruise and passenger vessels to the harbor as well. The Trincomalee Port has made profits in the recent past which would be plowed in to invest to add these infrastructures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sri Lanka Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sri Lanka Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sri Lanka Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Sri Lanka Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence