Key Insights

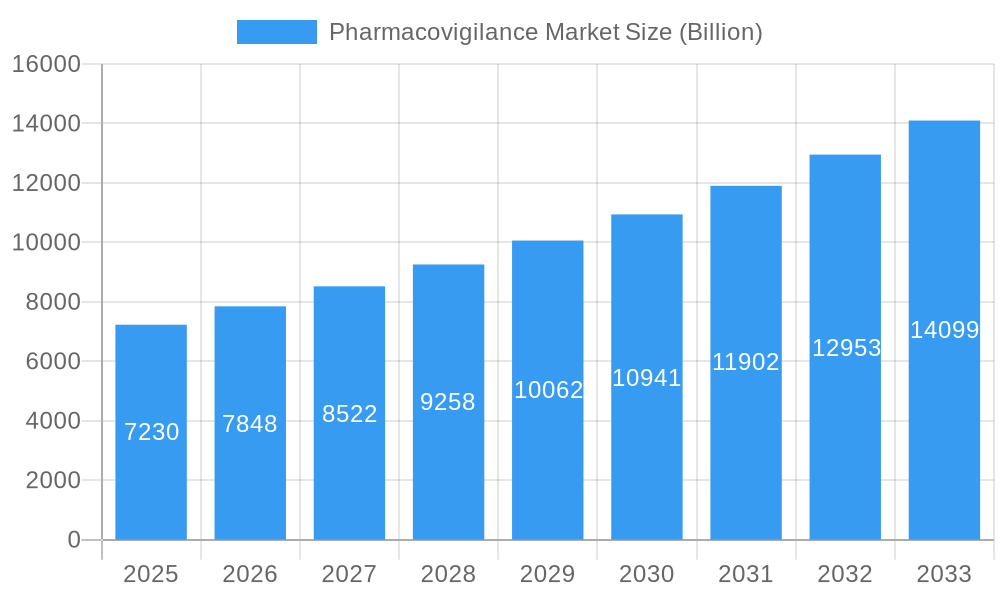

The global pharmacovigilance market, valued at $7.23 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.65% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of adverse drug reactions (ADRs) necessitates robust pharmacovigilance systems to ensure patient safety and regulatory compliance. Stringent regulatory guidelines enforced by agencies like the FDA and EMA are further fueling market growth, prompting pharmaceutical companies to invest heavily in advanced pharmacovigilance technologies and services. The rising adoption of electronic health records (EHRs) and the increasing availability of big data analytics offer significant opportunities for efficient ADR detection and analysis, contributing to market expansion. Furthermore, the growing outsourcing of pharmacovigilance functions by pharmaceutical companies to specialized contract research organizations (CROs) is a major market driver. This trend allows companies to focus on core competencies while leveraging the expertise of CROs in managing complex pharmacovigilance activities.

Pharmacovigilance Market Market Size (In Billion)

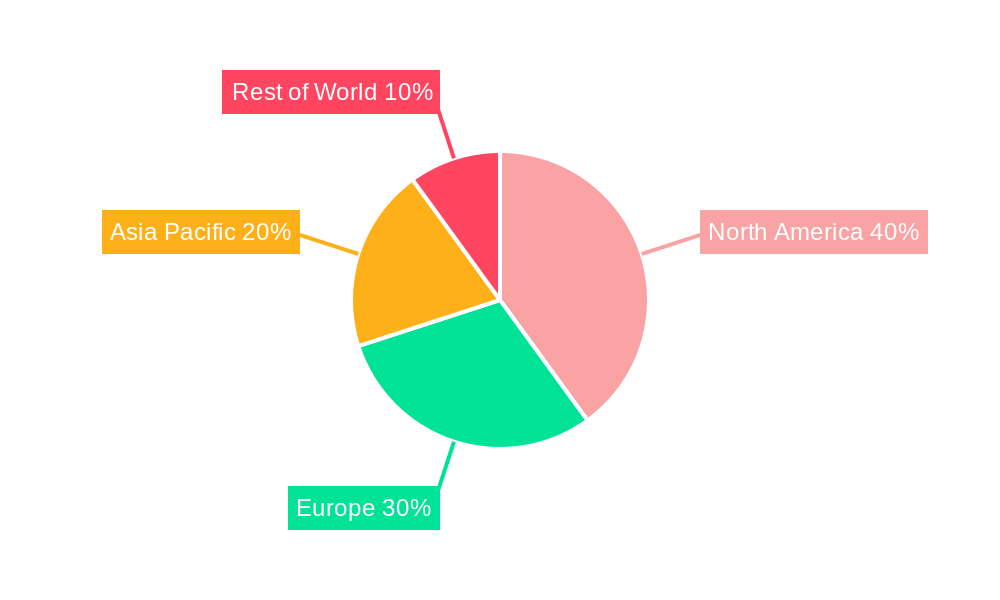

Market segmentation reveals significant opportunities across various end-users, clinical trial phases, and service providers. Hospitals and pharmaceutical companies constitute the largest end-user segments. Within clinical trial phases, Phase III and IV trials contribute substantially to market revenue due to the heightened focus on post-market surveillance and safety monitoring. The contract outsourcing segment within service providers is witnessing rapid growth, reflecting the industry-wide preference for outsourcing pharmacovigilance activities. The adoption of advanced technologies like AI and machine learning for signal detection and risk assessment is expected to reshape the market landscape in the coming years, pushing the market towards more proactive and predictive pharmacovigilance strategies. Geographic segmentation shows strong growth potential in emerging markets like Asia Pacific, driven by increasing healthcare spending and the growing pharmaceutical industry in regions like China and India. North America and Europe will continue to hold substantial market shares owing to established regulatory frameworks and robust healthcare infrastructure.

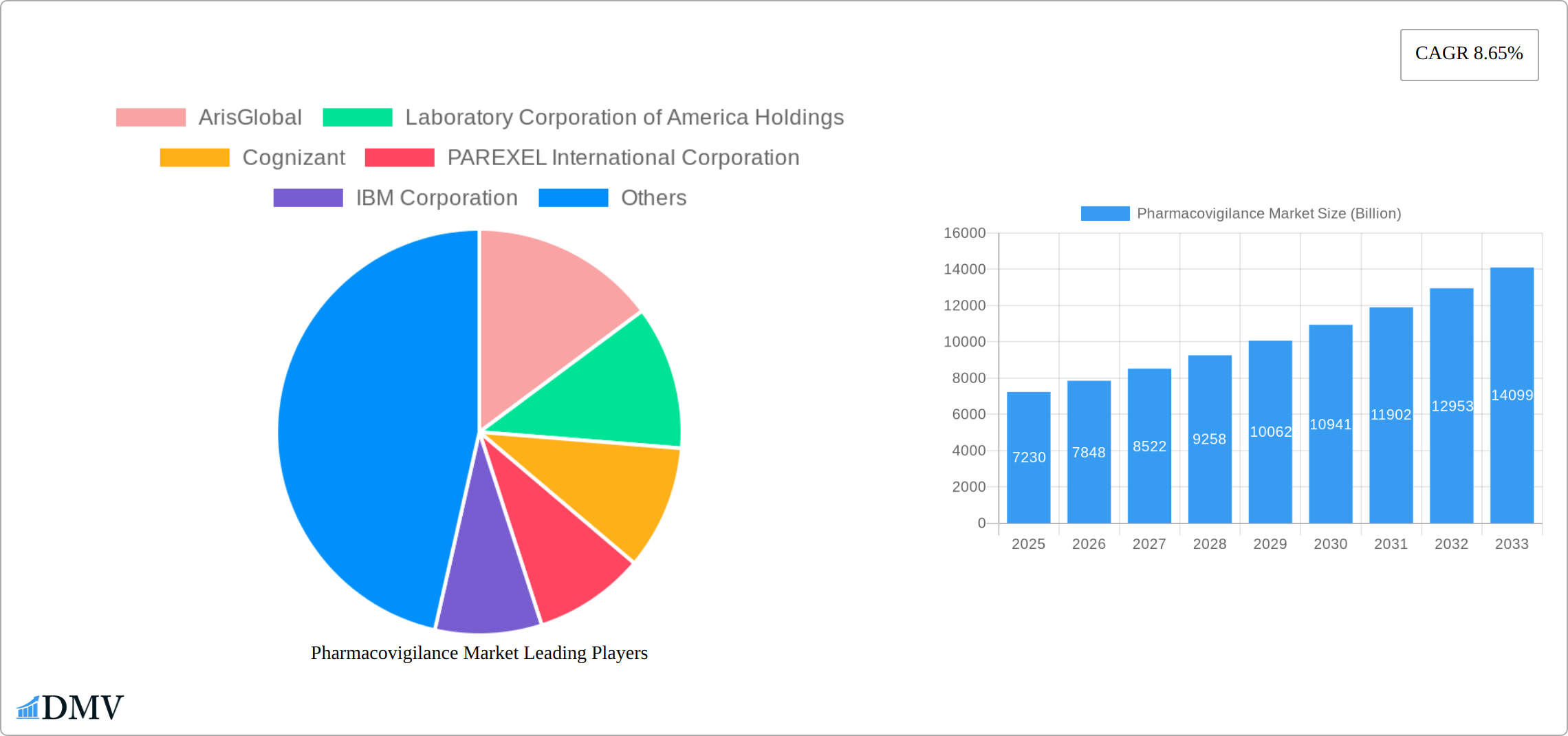

Pharmacovigilance Market Company Market Share

Pharmacovigilance Market Market Composition & Trends

The Pharmacovigilance Market exhibits significant concentration, with a few key players dominating the landscape. Leading companies such as ArisGlobal, Laboratory Corporation of America Holdings, and Cognizant hold substantial market shares, driving growth through innovation and strategic mergers and acquisitions (M&A). Analysis reveals that the top five players collectively control over 50% of the global market. The M&A activity has been particularly robust in recent years, with some deals exceeding $2 billion, demonstrating the industry's commitment to expanding service capabilities and global reach. This consolidation reflects the increasing complexity and regulatory demands within the field.

Innovation within the Pharmacovigilance Market is fueled by advancements in technology, especially in data analytics and artificial intelligence (AI). These technologies are transforming drug safety monitoring and reporting, enabling more efficient and accurate identification of adverse drug reactions (ADRs). Evolving regulatory landscapes, particularly in North America and Europe, with their increasingly stringent pharmacovigilance guidelines, are compelling companies to adopt more sophisticated and robust systems. While alternative safety monitoring tools are emerging as substitute products, their impact on the market share of established players remains relatively limited at this time.

The primary end-users are pharmaceutical companies, followed by hospitals and other healthcare providers. The strong demand from pharmaceutical companies stems from the need to meet stringent safety regulations and optimize clinical trial processes. A key market trend is the increasing outsourcing of pharmacovigilance services to Contract Research Organizations (CROs), significantly contributing to market expansion. This trend allows pharmaceutical companies to focus on their core competencies while leveraging the specialized expertise of CROs in drug safety monitoring.

- Market Concentration: High concentration with key players controlling a significant market share.

- Innovation Catalysts: AI, machine learning, and advanced data analytics drive efficiency and accuracy.

- Regulatory Landscapes: Stringent guidelines in North America and Europe are accelerating the adoption of advanced technologies.

- Substitute Products: Emerging but not yet significantly disrupting the market.

- End-User Profiles: Pharmaceutical companies, hospitals, and other healthcare providers.

- M&A Activities: High levels of activity, with substantial deal values indicating consolidation and expansion.

Pharmacovigilance Market Industry Evolution

The Pharmacovigilance Market has witnessed significant evolution over the study period of 2019–2033, with a notable growth trajectory driven by technological advancements and increasing consumer demand for safer pharmaceuticals. The market's growth rate is projected to be approximately 7.5% CAGR from 2025 to 2033, reflecting the rising importance of drug safety monitoring across the globe. Technological advancements, particularly in big data analytics and artificial intelligence, have revolutionized pharmacovigilance by enabling real-time monitoring and predictive analysis of adverse drug reactions (ADRs). This has led to a higher adoption rate of pharmacovigilance services, with over 60% of pharmaceutical companies now integrating advanced pharmacovigilance solutions into their operations.

The shift in consumer demand has also played a crucial role in the industry's evolution. Patients and healthcare providers are increasingly aware of the potential risks associated with medications, leading to a higher demand for comprehensive safety monitoring. This demand is further amplified by the growing number of clinical trials, which necessitates robust pharmacovigilance systems to ensure patient safety throughout the drug development process. The market's growth is also supported by the expansion of clinical trial phases, with Phase III and Phase IV trials showing the highest adoption of pharmacovigilance services due to their large-scale nature and long-term monitoring requirements.

Regulatory bodies have been instrumental in shaping the industry's evolution, with new guidelines and standards being implemented to enhance drug safety. For instance, the European Medicines Agency (EMA) has introduced more stringent pharmacovigilance requirements, compelling companies to invest in advanced systems and processes. This regulatory push has not only improved safety standards but also opened up new opportunities for service providers specializing in pharmacovigilance.

Leading Regions, Countries, or Segments in Pharmacovigilance Market

The North American region stands out as the dominant player in the Pharmacovigilance Market, driven by its advanced healthcare infrastructure, stringent regulatory environment, and high investment in pharmaceutical R&D. The United States, in particular, leads the market due to its large pharmaceutical industry and the presence of key market players. Within the segments, pharmaceutical companies are the leading end users, accounting for a significant portion of the market due to their need for comprehensive drug safety monitoring.

- Key Drivers in North America:

- High investment in pharmaceutical R&D.

- Stringent regulatory environment.

- Advanced healthcare infrastructure.

The dominance of the United States can be attributed to several factors, including the concentration of major pharmaceutical companies and a robust regulatory framework that mandates thorough pharmacovigilance practices. The FDA's stringent guidelines on drug safety monitoring have propelled the adoption of advanced pharmacovigilance solutions, making the U.S. a hub for innovation in this field.

Within the clinical trial phases, Phase III and Phase IV are the most dominant segments due to their extensive nature and the necessity for long-term safety monitoring. These phases require robust pharmacovigilance systems to track adverse events over extended periods, ensuring the safety of drugs post-market approval.

- Key Drivers in Clinical Trial Phases:

- Extensive nature of Phase III and Phase IV trials.

- Need for long-term safety monitoring.

In terms of service providers, contract outsourcing has emerged as a dominant segment, driven by the cost-effectiveness and specialized expertise offered by CROs. Companies are increasingly outsourcing their pharmacovigilance operations to focus on core competencies while ensuring compliance with regulatory standards.

- Key Drivers in Service Providers:

- Cost-effectiveness of contract outsourcing.

- Specialized expertise offered by CROs.

The type of reporting segment sees Spontaneous Reporting as the leading method, primarily due to its simplicity and widespread use across the industry. However, there is a growing trend towards more advanced reporting methods like EHR Mining, which leverages electronic health records to provide more comprehensive safety data.

- Key Drivers in Type of Reporting:

- Simplicity and widespread use of Spontaneous Reporting.

- Growing adoption of EHR Mining for comprehensive data.

Pharmacovigilance Market Product Innovations

Product innovations in the Pharmacovigilance Market are centered around the integration of artificial intelligence and machine learning to enhance drug safety monitoring. These technologies enable real-time analysis of adverse events, predictive modeling of potential risks, and automated reporting, significantly improving the efficiency and accuracy of pharmacovigilance processes. A notable innovation is the development of AI-driven platforms that can analyze large datasets from clinical trials and post-market surveillance, identifying patterns and anomalies that might be missed by traditional methods. These platforms offer unique selling propositions such as scalability, real-time data processing, and predictive analytics, positioning them as critical tools for pharmaceutical companies and CROs.

Propelling Factors for Pharmacovigilance Market Growth

The growth of the Pharmacovigilance Market is propelled by several key factors. Technological advancements, such as AI and big data analytics, enhance the ability to monitor and analyze drug safety more effectively. Economic factors, including increased investment in healthcare and pharmaceutical R&D, drive demand for pharmacovigilance services. Regulatory influences, such as stricter safety guidelines from agencies like the FDA and EMA, compel companies to adopt robust pharmacovigilance systems. For example, the partnership between Cognizant and Medable Inc. in February 2022 exemplifies how technological collaborations can advance pharmacovigilance capabilities.

Obstacles in the Pharmacovigilance Market Market

The Pharmacovigilance Market faces several obstacles that could impede its growth. Regulatory challenges, such as varying pharmacovigilance requirements across different regions, create compliance complexities for global companies. Supply chain disruptions, particularly those exacerbated by global events like pandemics, can delay the implementation of pharmacovigilance systems. Competitive pressures are intense, with new entrants and established players vying for market share, leading to price wars and margin compression. These factors collectively pose significant barriers, potentially impacting the market's growth trajectory.

Future Opportunities in Pharmacovigilance Market

The Pharmacovigilance Market presents numerous future opportunities. The rise of decentralized clinical trials offers new avenues for pharmacovigilance services, as seen in the partnership between LINK Medical and Viedoc in February 2022. Emerging markets in Asia-Pacific and Latin America are witnessing increased investment in healthcare, creating demand for pharmacovigilance solutions. Technological advancements, such as blockchain for secure data sharing and IoT for real-time monitoring, are poised to revolutionize the market, offering new growth prospects.

Major Players in the Pharmacovigilance Market Ecosystem

Key Developments in Pharmacovigilance Market Industry

- February 2022: Cognizant entered into a partnership with Medable Inc. to jointly deliver clinical research solutions based on Medable's software-as-a-service platform for decentralized clinical trials. This partnership enhances the market's capabilities in pharmacovigilance by leveraging advanced technology for remote monitoring and data collection.

- February 2022: LINK Medical and Viedoc entered into a partnership established by Viedoc and designed to improve trial efficiency for LINK Medical and its clients. The partnership allows for a continuous exchange of experience, needs, and ideas, as well as the testing of new features, which contributes to the advancement of pharmacovigilance practices in clinical trials.

Strategic Pharmacovigilance Market Market Forecast

The Pharmacovigilance Market is poised for robust growth over the forecast period of 2025–2033, driven by technological advancements, increasing regulatory demands, and expanding clinical trial activities. The integration of AI and big data analytics will continue to revolutionize pharmacovigilance, offering new opportunities for market players. Emerging markets, particularly in Asia-Pacific and Latin America, are expected to witness significant growth due to increased healthcare investments. The market's potential lies in its ability to adapt to new technologies and regulatory environments, positioning it for sustained expansion and innovation.

Pharmacovigilance Market Segmentation

-

1. Clinical Trial Phase

- 1.1. Preclinical

- 1.2. Phase I

- 1.3. Phase II

- 1.4. Phase III

- 1.5. Phase IV

-

2. Service Provider

- 2.1. In-house

- 2.2. Contract Outsourcing

-

3. Type of Reporting

- 3.1. Spontaneous Reporting

- 3.2. Intensified ADR Reporting

- 3.3. Targeted Spontaneous Reporting

- 3.4. Cohort Event Monitoring

- 3.5. EHR Mining

-

4. End User

- 4.1. Hospitals

- 4.2. Pharmaceutical Companies

- 4.3. Other End Users

Pharmacovigilance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pharmacovigilance Market Regional Market Share

Geographic Coverage of Pharmacovigilance Market

Pharmacovigilance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Drug Consumption and Drug Development Rates; Growing Incidence Rates of Adverse Drug Reaction and Drug Toxicity; Increasing Trend of Outsourcing Pharmacovigilance Services

- 3.3. Market Restrains

- 3.3.1. High Risk Associated with Data Security; Lack of Global Regulatory Harmonization and Lack of Data Standardization for Adverse Event Collection

- 3.4. Market Trends

- 3.4.1. The Pharmaceutical Companies Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 5.1.1. Preclinical

- 5.1.2. Phase I

- 5.1.3. Phase II

- 5.1.4. Phase III

- 5.1.5. Phase IV

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. In-house

- 5.2.2. Contract Outsourcing

- 5.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 5.3.1. Spontaneous Reporting

- 5.3.2. Intensified ADR Reporting

- 5.3.3. Targeted Spontaneous Reporting

- 5.3.4. Cohort Event Monitoring

- 5.3.5. EHR Mining

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Hospitals

- 5.4.2. Pharmaceutical Companies

- 5.4.3. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 6. North America Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 6.1.1. Preclinical

- 6.1.2. Phase I

- 6.1.3. Phase II

- 6.1.4. Phase III

- 6.1.5. Phase IV

- 6.2. Market Analysis, Insights and Forecast - by Service Provider

- 6.2.1. In-house

- 6.2.2. Contract Outsourcing

- 6.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 6.3.1. Spontaneous Reporting

- 6.3.2. Intensified ADR Reporting

- 6.3.3. Targeted Spontaneous Reporting

- 6.3.4. Cohort Event Monitoring

- 6.3.5. EHR Mining

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Hospitals

- 6.4.2. Pharmaceutical Companies

- 6.4.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 7. Europe Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 7.1.1. Preclinical

- 7.1.2. Phase I

- 7.1.3. Phase II

- 7.1.4. Phase III

- 7.1.5. Phase IV

- 7.2. Market Analysis, Insights and Forecast - by Service Provider

- 7.2.1. In-house

- 7.2.2. Contract Outsourcing

- 7.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 7.3.1. Spontaneous Reporting

- 7.3.2. Intensified ADR Reporting

- 7.3.3. Targeted Spontaneous Reporting

- 7.3.4. Cohort Event Monitoring

- 7.3.5. EHR Mining

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Hospitals

- 7.4.2. Pharmaceutical Companies

- 7.4.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 8. Asia Pacific Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 8.1.1. Preclinical

- 8.1.2. Phase I

- 8.1.3. Phase II

- 8.1.4. Phase III

- 8.1.5. Phase IV

- 8.2. Market Analysis, Insights and Forecast - by Service Provider

- 8.2.1. In-house

- 8.2.2. Contract Outsourcing

- 8.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 8.3.1. Spontaneous Reporting

- 8.3.2. Intensified ADR Reporting

- 8.3.3. Targeted Spontaneous Reporting

- 8.3.4. Cohort Event Monitoring

- 8.3.5. EHR Mining

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Hospitals

- 8.4.2. Pharmaceutical Companies

- 8.4.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 9. Middle East and Africa Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 9.1.1. Preclinical

- 9.1.2. Phase I

- 9.1.3. Phase II

- 9.1.4. Phase III

- 9.1.5. Phase IV

- 9.2. Market Analysis, Insights and Forecast - by Service Provider

- 9.2.1. In-house

- 9.2.2. Contract Outsourcing

- 9.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 9.3.1. Spontaneous Reporting

- 9.3.2. Intensified ADR Reporting

- 9.3.3. Targeted Spontaneous Reporting

- 9.3.4. Cohort Event Monitoring

- 9.3.5. EHR Mining

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Hospitals

- 9.4.2. Pharmaceutical Companies

- 9.4.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 10. South America Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 10.1.1. Preclinical

- 10.1.2. Phase I

- 10.1.3. Phase II

- 10.1.4. Phase III

- 10.1.5. Phase IV

- 10.2. Market Analysis, Insights and Forecast - by Service Provider

- 10.2.1. In-house

- 10.2.2. Contract Outsourcing

- 10.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 10.3.1. Spontaneous Reporting

- 10.3.2. Intensified ADR Reporting

- 10.3.3. Targeted Spontaneous Reporting

- 10.3.4. Cohort Event Monitoring

- 10.3.5. EHR Mining

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Hospitals

- 10.4.2. Pharmaceutical Companies

- 10.4.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ArisGlobal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Laboratory Corporation of America Holdings

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cognizant

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PAREXEL International Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wipro Ltd*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ICON PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Accenture

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BioClinica

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Linical Accelovance

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IQVIA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TAKE Solutions Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ITClinical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Capgemini

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 United BioSource Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 ArisGlobal

List of Figures

- Figure 1: Global Pharmacovigilance Market Revenue Breakdown (Billion, %) by Region 2025 & 2033

- Figure 2: North America Pharmacovigilance Market Revenue (Billion), by Clinical Trial Phase 2025 & 2033

- Figure 3: North America Pharmacovigilance Market Revenue Share (%), by Clinical Trial Phase 2025 & 2033

- Figure 4: North America Pharmacovigilance Market Revenue (Billion), by Service Provider 2025 & 2033

- Figure 5: North America Pharmacovigilance Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 6: North America Pharmacovigilance Market Revenue (Billion), by Type of Reporting 2025 & 2033

- Figure 7: North America Pharmacovigilance Market Revenue Share (%), by Type of Reporting 2025 & 2033

- Figure 8: North America Pharmacovigilance Market Revenue (Billion), by End User 2025 & 2033

- Figure 9: North America Pharmacovigilance Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Pharmacovigilance Market Revenue (Billion), by Country 2025 & 2033

- Figure 11: North America Pharmacovigilance Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Pharmacovigilance Market Revenue (Billion), by Clinical Trial Phase 2025 & 2033

- Figure 13: Europe Pharmacovigilance Market Revenue Share (%), by Clinical Trial Phase 2025 & 2033

- Figure 14: Europe Pharmacovigilance Market Revenue (Billion), by Service Provider 2025 & 2033

- Figure 15: Europe Pharmacovigilance Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 16: Europe Pharmacovigilance Market Revenue (Billion), by Type of Reporting 2025 & 2033

- Figure 17: Europe Pharmacovigilance Market Revenue Share (%), by Type of Reporting 2025 & 2033

- Figure 18: Europe Pharmacovigilance Market Revenue (Billion), by End User 2025 & 2033

- Figure 19: Europe Pharmacovigilance Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: Europe Pharmacovigilance Market Revenue (Billion), by Country 2025 & 2033

- Figure 21: Europe Pharmacovigilance Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Pharmacovigilance Market Revenue (Billion), by Clinical Trial Phase 2025 & 2033

- Figure 23: Asia Pacific Pharmacovigilance Market Revenue Share (%), by Clinical Trial Phase 2025 & 2033

- Figure 24: Asia Pacific Pharmacovigilance Market Revenue (Billion), by Service Provider 2025 & 2033

- Figure 25: Asia Pacific Pharmacovigilance Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 26: Asia Pacific Pharmacovigilance Market Revenue (Billion), by Type of Reporting 2025 & 2033

- Figure 27: Asia Pacific Pharmacovigilance Market Revenue Share (%), by Type of Reporting 2025 & 2033

- Figure 28: Asia Pacific Pharmacovigilance Market Revenue (Billion), by End User 2025 & 2033

- Figure 29: Asia Pacific Pharmacovigilance Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Pharmacovigilance Market Revenue (Billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Pharmacovigilance Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Pharmacovigilance Market Revenue (Billion), by Clinical Trial Phase 2025 & 2033

- Figure 33: Middle East and Africa Pharmacovigilance Market Revenue Share (%), by Clinical Trial Phase 2025 & 2033

- Figure 34: Middle East and Africa Pharmacovigilance Market Revenue (Billion), by Service Provider 2025 & 2033

- Figure 35: Middle East and Africa Pharmacovigilance Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 36: Middle East and Africa Pharmacovigilance Market Revenue (Billion), by Type of Reporting 2025 & 2033

- Figure 37: Middle East and Africa Pharmacovigilance Market Revenue Share (%), by Type of Reporting 2025 & 2033

- Figure 38: Middle East and Africa Pharmacovigilance Market Revenue (Billion), by End User 2025 & 2033

- Figure 39: Middle East and Africa Pharmacovigilance Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Pharmacovigilance Market Revenue (Billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Pharmacovigilance Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Pharmacovigilance Market Revenue (Billion), by Clinical Trial Phase 2025 & 2033

- Figure 43: South America Pharmacovigilance Market Revenue Share (%), by Clinical Trial Phase 2025 & 2033

- Figure 44: South America Pharmacovigilance Market Revenue (Billion), by Service Provider 2025 & 2033

- Figure 45: South America Pharmacovigilance Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 46: South America Pharmacovigilance Market Revenue (Billion), by Type of Reporting 2025 & 2033

- Figure 47: South America Pharmacovigilance Market Revenue Share (%), by Type of Reporting 2025 & 2033

- Figure 48: South America Pharmacovigilance Market Revenue (Billion), by End User 2025 & 2033

- Figure 49: South America Pharmacovigilance Market Revenue Share (%), by End User 2025 & 2033

- Figure 50: South America Pharmacovigilance Market Revenue (Billion), by Country 2025 & 2033

- Figure 51: South America Pharmacovigilance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 2: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 3: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 4: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 5: Global Pharmacovigilance Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 6: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 7: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 8: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 9: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 10: Global Pharmacovigilance Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 11: United States Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 14: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 15: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 16: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 17: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 18: Global Pharmacovigilance Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 19: Germany Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 25: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 26: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 27: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 28: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 29: Global Pharmacovigilance Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 30: China Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 31: Japan Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 32: India Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 33: Australia Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 34: South Korea Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 36: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 37: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 38: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 39: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 40: Global Pharmacovigilance Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 41: GCC Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 42: South Africa Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 44: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 45: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 46: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 47: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 48: Global Pharmacovigilance Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 49: Brazil Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 50: Argentina Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 51: Rest of South America Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmacovigilance Market?

The projected CAGR is approximately 8.65%.

2. Which companies are prominent players in the Pharmacovigilance Market?

Key companies in the market include ArisGlobal, Laboratory Corporation of America Holdings, Cognizant, PAREXEL International Corporation, IBM Corporation, Wipro Ltd*List Not Exhaustive, ICON PLC, Accenture, BioClinica, Linical Accelovance, IQVIA, TAKE Solutions Ltd, ITClinical, Capgemini, United BioSource Corporation.

3. What are the main segments of the Pharmacovigilance Market?

The market segments include Clinical Trial Phase, Service Provider, Type of Reporting, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.23 Billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Drug Consumption and Drug Development Rates; Growing Incidence Rates of Adverse Drug Reaction and Drug Toxicity; Increasing Trend of Outsourcing Pharmacovigilance Services.

6. What are the notable trends driving market growth?

The Pharmaceutical Companies Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

High Risk Associated with Data Security; Lack of Global Regulatory Harmonization and Lack of Data Standardization for Adverse Event Collection.

8. Can you provide examples of recent developments in the market?

In February 2022, Cognizant entered into a partnership with Medable Inc. to jointly deliver clinical research solutions based on Medable's software-as-a-service platform for decentralized clinical trials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmacovigilance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmacovigilance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmacovigilance Market?

To stay informed about further developments, trends, and reports in the Pharmacovigilance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence