Key Insights

The North American swine feed market is projected for robust expansion, anticipated to reach $112.86 billion by 2025. This growth trajectory, with a Compound Annual Growth Rate (CAGR) of 4.5% from 2025, is propelled by escalating pork consumption and a heightened demand for premium protein sources. Market dynamics will be influenced by factors such as feed ingredient costs, disease incidence, and evolving consumer preferences. Key growth drivers include advancements in feed formulation for enhanced nutrient efficiency and reduced environmental impact, alongside the increasing adoption of precision feeding technologies and a growing emphasis on animal welfare.

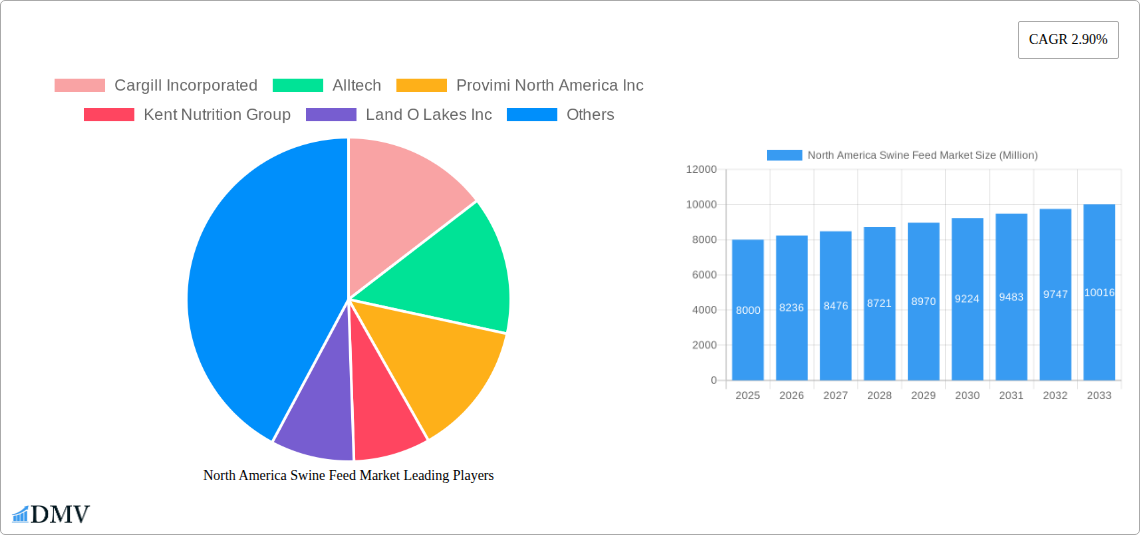

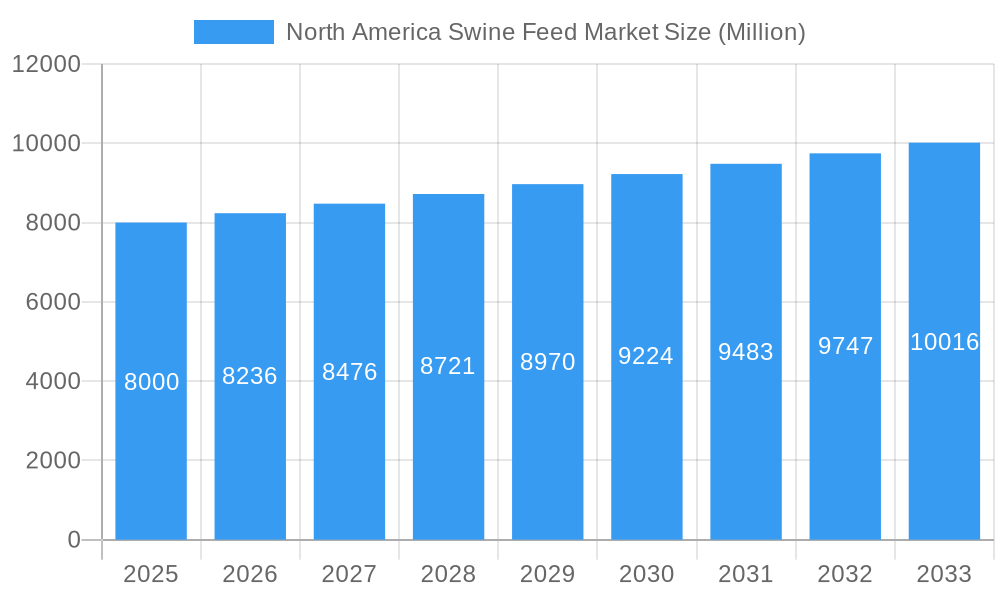

North America Swine Feed Market Market Size (In Billion)

The cereals and cereal by-products segment currently leads the market due to its cost-effectiveness and widespread availability. However, the supplements segment, comprising vitamins, amino acids, and probiotics, is poised for significant growth. This surge is attributed to rising consumer demand for healthier pork products produced using sustainable feed practices, and an increased understanding of the benefits of these additives for animal health, growth performance, and overall meat quality. Leading industry players such as Cargill, Alltech, and ADM are spearheading innovation through strategic collaborations and dedicated research and development, resulting in the introduction of novel feed additives and optimized feed management solutions.

North America Swine Feed Market Company Market Share

Market expansion is tempered by certain challenges. Volatility in raw material prices, particularly for grains and oilseeds, directly impacts swine feed production costs and profitability. Furthermore, stringent regulations governing feed safety and environmental considerations related to manure management present ongoing hurdles for producers and feed manufacturers. Despite these constraints, the North American swine feed market offers substantial opportunities, supported by favorable government policies for the agricultural sector, a growing middle class with increased disposable income, and continuous industry innovation. The United States dominates the regional market due to its substantial swine population and more developed agricultural infrastructure compared to Canada and Mexico. Future market evolution will depend on the interplay of these growth drivers, regulatory landscapes, and the increasing consumer focus on sustainable and ethically produced pork.

North America Swine Feed Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America swine feed market, offering invaluable insights for stakeholders seeking to navigate this dynamic industry. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report delves into market trends, competitive landscapes, and future growth prospects. With detailed segmentation by feed type (Cereals, Cereal By-products, Oilseed Meals, Oil, Molasses, Supplements, Others) and supplement type (Vitamins, Amino Acids, Antibiotics, Enzymes, Anti-oxidants, Acidifiers, Probiotics & Prebiotics, Others), this report is a critical resource for strategic decision-making. The total market size is projected to reach xx Million by 2033.

North America Swine Feed Market Composition & Trends

This section examines the competitive dynamics of the North America swine feed market, including market share distribution among key players like Cargill Incorporated, Alltech, Provimi North America Inc, Kent Nutrition Group, Land O Lakes Inc, GVF Group of Companies, United Animal Health, ADM Animal Nutrition, and Lallemand Inc. We analyze market concentration, identifying the leading players and their respective market shares (e.g., Cargill holding xx% market share in 2025). The report also explores innovation drivers, such as advancements in feed formulation and nutritional technologies, and assesses the impact of regulatory landscapes, including FDA regulations and environmental concerns. Furthermore, it details substitute product analysis and profiles end-users, focusing on large-scale swine farms and integrated agricultural businesses. Finally, it quantifies M&A activities within the industry, estimating the total value of deals in the past five years at approximately xx Million.

- Market Concentration: High, with top 5 players controlling xx% of the market in 2025.

- M&A Activity: Total deal value (2020-2024) estimated at xx Million.

- Key Innovation Drivers: Precision nutrition, sustainable feed solutions, and technological advancements in feed processing.

- Regulatory Landscape: Compliance with FDA regulations, environmental regulations, and animal welfare standards.

North America Swine Feed Market Industry Evolution

This section charts the evolution of the North America swine feed market, detailing historical growth trajectories (2019-2024) and projecting future growth rates (2025-2033). We analyze technological advancements influencing feed production and efficiency, focusing on automation, data analytics, and precision feeding technologies. The report also analyzes shifting consumer demands, including increasing consumer awareness of animal welfare and sustainability, and the growing demand for antibiotic-free and organically produced swine feed. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

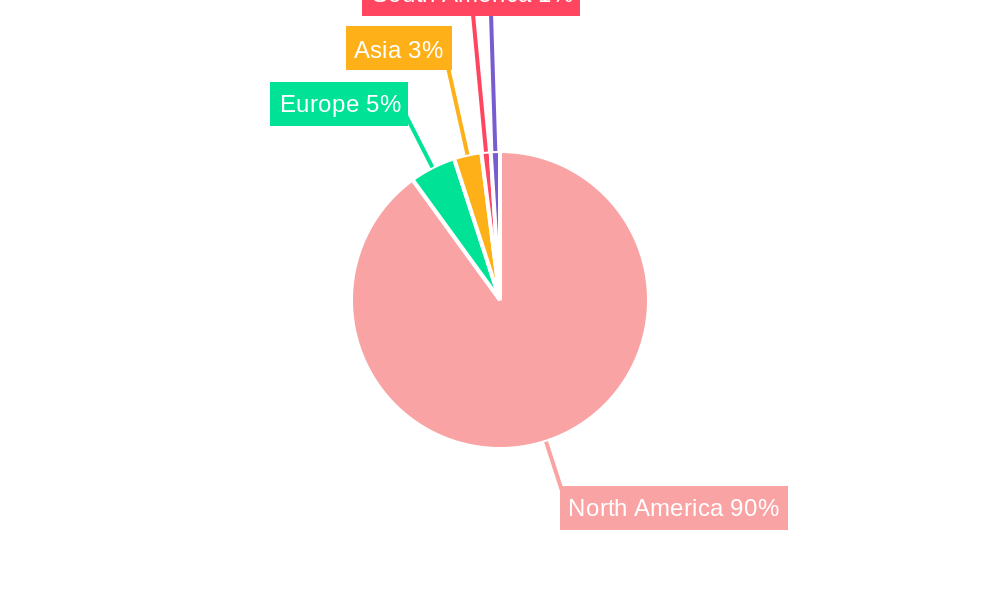

Leading Regions, Countries, or Segments in North America Swine Feed Market

This section pinpoints the leading regions, countries, and segments within the North America swine feed market. Based on our analysis, the dominant segment by type in 2025 is projected to be Cereals, driven by [reasons provided in the paragraph below]. The leading region is expected to be [Region Name], due to factors such as [reasons provided in the paragraph below]. This section will also identify the leading segment by supplement type.

- Cereals: High demand due to cost-effectiveness and widespread availability.

- [Region Name]: Strong swine production base, favorable government policies and supportive infrastructure for the feed industry.

- [Leading Supplement Type]: This supplement type is showing increasing demand due to [reasons].

The dominance of these segments stems from several factors, including favorable government policies supporting agricultural growth, substantial investments in swine farming infrastructure, and robust consumer demand for pork products.

North America Swine Feed Market Product Innovations

Recent innovations include the development of specialized feed formulations tailored to specific swine breeds and growth stages, incorporating advanced nutritional profiles to optimize growth and minimize waste. These formulations often incorporate novel ingredients and technological advancements in feed processing, leading to improved digestibility and nutrient utilization. This has resulted in improved feed conversion ratios (FCR) and reduced environmental impact. Unique selling propositions include enhanced animal health benefits, such as improved gut health and immunity, contributing to reduced antibiotic use.

Propelling Factors for North America Swine Feed Market Growth

Several factors drive the growth of the North America swine feed market. Technological advancements like precision feeding systems and automated feed mills significantly enhance efficiency and reduce waste. Economic factors such as increasing global demand for pork and rising disposable incomes boost the market. Favorable government policies supporting the agricultural sector, including subsidies and research funding, also play a crucial role.

Obstacles in the North America Swine Feed Market

The market faces challenges such as fluctuating raw material prices, leading to price volatility and impacting profitability. Supply chain disruptions due to weather events and geopolitical instability also pose a risk. Furthermore, increasing competition from both domestic and international players creates pricing pressure. Regulatory changes related to animal feed safety and environmental protection also introduce challenges for producers.

Future Opportunities in North America Swine Feed Market

Future opportunities include the increasing demand for sustainable and environmentally friendly feed solutions. Technological advancements, particularly in precision feeding and data analytics, offer significant potential for optimizing feed utilization and reducing environmental impact. Furthermore, the growing market for specialized and functional feed products catering to specific consumer preferences and health concerns presents attractive prospects.

Major Players in the North America Swine Feed Market Ecosystem

- Cargill Incorporated

- Alltech

- Provimi North America Inc

- Kent Nutrition Group

- Land O Lakes Inc

- GVF Group of Companies

- United Animal Health

- ADM Animal Nutrition

- Lallemand Inc

Key Developments in North America Swine Feed Market Industry

- 2023 Q3: Cargill Incorporated launched a new line of sustainable swine feed.

- 2022 Q4: ADM Animal Nutrition acquired a smaller feed company, expanding its market share.

- 2021 Q1: New FDA regulations impacted the use of certain feed additives. (Further details of these developments and others will be provided in the full report).

Strategic North America Swine Feed Market Forecast

The North America swine feed market is poised for continued growth driven by increasing global demand for pork and technological advancements in feed production. This growth will be further fueled by an increasing focus on sustainable and healthy feed solutions, creating opportunities for innovative players to capture market share. The market's future success hinges on adapting to evolving consumer demands and navigating regulatory landscapes effectively.

North America Swine Feed Market Segmentation

-

1. Type

- 1.1. Cereals

- 1.2. Cereal By-products

- 1.3. Oilseed Meals

- 1.4. Molasses

- 1.5. Supplements

- 1.6. Others

-

2. Supplement Type

- 2.1. Vitamins

- 2.2. Amino Acids

- 2.3. Antibiotics

- 2.4. Enzymes

- 2.5. Anti-oxidants

- 2.6. Acidifiers

- 2.7. Probiotics & Prebiotics

- 2.8. Others

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Swine Feed Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Swine Feed Market Regional Market Share

Geographic Coverage of North America Swine Feed Market

North America Swine Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Pork Meat

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cereals

- 5.1.2. Cereal By-products

- 5.1.3. Oilseed Meals

- 5.1.4. Molasses

- 5.1.5. Supplements

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Supplement Type

- 5.2.1. Vitamins

- 5.2.2. Amino Acids

- 5.2.3. Antibiotics

- 5.2.4. Enzymes

- 5.2.5. Anti-oxidants

- 5.2.6. Acidifiers

- 5.2.7. Probiotics & Prebiotics

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cereals

- 6.1.2. Cereal By-products

- 6.1.3. Oilseed Meals

- 6.1.4. Molasses

- 6.1.5. Supplements

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Supplement Type

- 6.2.1. Vitamins

- 6.2.2. Amino Acids

- 6.2.3. Antibiotics

- 6.2.4. Enzymes

- 6.2.5. Anti-oxidants

- 6.2.6. Acidifiers

- 6.2.7. Probiotics & Prebiotics

- 6.2.8. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cereals

- 7.1.2. Cereal By-products

- 7.1.3. Oilseed Meals

- 7.1.4. Molasses

- 7.1.5. Supplements

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Supplement Type

- 7.2.1. Vitamins

- 7.2.2. Amino Acids

- 7.2.3. Antibiotics

- 7.2.4. Enzymes

- 7.2.5. Anti-oxidants

- 7.2.6. Acidifiers

- 7.2.7. Probiotics & Prebiotics

- 7.2.8. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cereals

- 8.1.2. Cereal By-products

- 8.1.3. Oilseed Meals

- 8.1.4. Molasses

- 8.1.5. Supplements

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Supplement Type

- 8.2.1. Vitamins

- 8.2.2. Amino Acids

- 8.2.3. Antibiotics

- 8.2.4. Enzymes

- 8.2.5. Anti-oxidants

- 8.2.6. Acidifiers

- 8.2.7. Probiotics & Prebiotics

- 8.2.8. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cereals

- 9.1.2. Cereal By-products

- 9.1.3. Oilseed Meals

- 9.1.4. Molasses

- 9.1.5. Supplements

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Supplement Type

- 9.2.1. Vitamins

- 9.2.2. Amino Acids

- 9.2.3. Antibiotics

- 9.2.4. Enzymes

- 9.2.5. Anti-oxidants

- 9.2.6. Acidifiers

- 9.2.7. Probiotics & Prebiotics

- 9.2.8. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Cargill Incorporated

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alltech

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Provimi North America Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kent Nutrition Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Land O Lakes Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GVF Group of Companies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 United Animal Healt

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ADM Animal Nutrition

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Lallemand Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Cargill Incorporated

List of Figures

- Figure 1: North America Swine Feed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Swine Feed Market Share (%) by Company 2025

List of Tables

- Table 1: North America Swine Feed Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 3: North America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Swine Feed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Swine Feed Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 7: North America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Swine Feed Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 11: North America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Swine Feed Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 15: North America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Swine Feed Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 19: North America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Swine Feed Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Swine Feed Market?

Key companies in the market include Cargill Incorporated, Alltech, Provimi North America Inc, Kent Nutrition Group, Land O Lakes Inc, GVF Group of Companies, United Animal Healt, ADM Animal Nutrition, Lallemand Inc.

3. What are the main segments of the North America Swine Feed Market?

The market segments include Type, Supplement Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 112.86 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Growing Demand for Pork Meat.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Swine Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Swine Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Swine Feed Market?

To stay informed about further developments, trends, and reports in the North America Swine Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence