Key Insights

The Netherlands luxury residential real estate market, valued at approximately €5 billion in 2025, is experiencing robust growth, projected to maintain a CAGR exceeding 3% through 2033. This expansion is fueled by several key drivers. Firstly, a strong economy and increasing high-net-worth individual (HNWI) population within the Netherlands are driving demand for premium properties. Secondly, a limited supply of luxury homes, particularly in prime locations like Amsterdam, Rotterdam, and The Hague, contributes to price appreciation. Thirdly, a preference for sustainable and modern luxury homes is shaping the market, influencing construction and renovation trends. Foreign investment also plays a significant role, with international buyers attracted to the country's stability, strong infrastructure, and high quality of life. However, challenges such as increasing construction costs and stringent building regulations could potentially restrain market growth in the coming years. The market segmentation reveals that apartments and condominiums in major cities command the highest prices, while villas and landed houses in suburban areas offer a different segment of the luxury market.

Netherlands Luxury Residential Real Estate Market Market Size (In Billion)

The market's growth trajectory is expected to be influenced by several factors. Continued economic stability and increasing disposable incomes will likely support demand. Furthermore, ongoing urban development projects in key cities and the ongoing appeal of Netherlands’ lifestyle and culture will likely attract both domestic and international investors. Conversely, potential interest rate hikes and economic uncertainty could temper growth. The competitive landscape is dominated by established players such as BPD, Christie's International Real Estate, and Sotheby's International Realty, alongside prominent local developers like Van Wanrooji Construction and Development and Dura Vermeer Groep. These firms cater to the evolving preferences of luxury buyers through innovative designs, sustainable features, and high-quality construction, driving further market segmentation and specialized offerings.

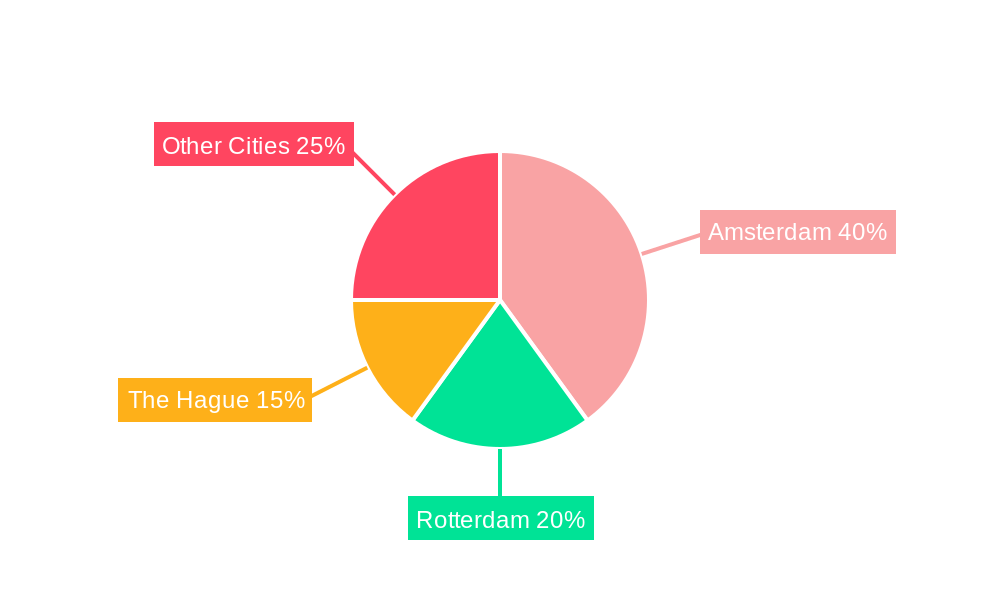

Netherlands Luxury Residential Real Estate Market Company Market Share

Netherlands Luxury Residential Real Estate Market: A Comprehensive Market Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Netherlands luxury residential real estate market, providing crucial data and forecasts for stakeholders from 2019 to 2033. We delve into market composition, industry evolution, leading segments, and key players, offering valuable insights to inform strategic decision-making. The base year for this report is 2025, with estimations for 2025 and forecasts spanning 2025-2033, encompassing the historical period of 2019-2024. Expect detailed analysis across various segments, including apartments and condominiums, villas and landed houses, and key cities like Amsterdam, Rotterdam, and The Hague. The report's value lies in its granular data, strategic insights, and forward-looking projections, empowering investors, developers, and industry professionals to navigate the dynamic Netherlands luxury real estate landscape. Market values are expressed in Millions.

Netherlands Luxury Residential Real Estate Market Composition & Trends

This section evaluates the competitive landscape of the Netherlands luxury residential real estate market, encompassing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity. The market is characterized by a moderate level of concentration, with several key players commanding significant market share, but with ample room for smaller niche players to flourish.

Market Share Distribution (2024 Estimate): Amsterdam (40%), Rotterdam (25%), The Hague (15%), Other Cities (20%). This distribution is expected to shift slightly in the forecast period. The exact figures for individual players are proprietary information contained within the full report.

Innovation Catalysts: Increasing demand for sustainable and smart homes, coupled with advancements in construction technologies (e.g., 3D modeling for property visualization by BPD), are significant drivers.

Regulatory Landscape: Government regulations concerning energy efficiency, building codes, and environmental impact assessments influence market dynamics. Specific details concerning the implications of these are elaborated in the report.

Substitute Products: While luxury alternatives are limited, factors like increased rental prices in certain areas may indirectly impact market demand.

End-User Profiles: High-net-worth individuals (HNWIs), both domestic and international, form the primary end-user base. Demand varies based on lifestyle preferences and investment strategies.

M&A Activities (2019-2024): xx Million in total deal value across several transactions. The full report provides detailed analysis of individual deals and their impact on the market.

Netherlands Luxury Residential Real Estate Market Industry Evolution

This section examines the evolution of the Netherlands luxury residential real estate market, considering market growth trajectories, technological advancements, and shifts in consumer preferences from 2019-2033. The market has demonstrated consistent growth over the historical period. This growth is anticipated to continue during the forecast period, though at a potentially moderated rate due to macroeconomic factors.

The market has witnessed notable innovations, including the adoption of 3D modeling in property sales by BPD in April 2022. Technological advancements are increasingly influencing construction methods, home designs, and property management.

Consumer preferences are trending toward sustainable and energy-efficient housing, smart home technologies, and properties located in desirable urban areas with good connectivity. This evolution is driving a demand for luxury homes that integrate these features. The report provides detailed analysis of market growth rates, segmented by property type and location. The projected compound annual growth rate (CAGR) for the period 2025-2033 is estimated to be xx%.

Leading Regions, Countries, or Segments in Netherlands Luxury Residential Real Estate Market

Amsterdam consistently ranks as the leading market for luxury residential real estate in the Netherlands, followed by Rotterdam and The Hague. "Other Cities" comprises a significant and growing segment of luxury market activity outside of those major centers.

Key Drivers:

- Amsterdam: High demand, limited supply, strong economic activity, international appeal, and investment potential are primary drivers for the dominance of Amsterdam in luxury real estate market.

- Rotterdam & The Hague: These cities benefit from their own distinct economic strengths, upscale infrastructure developments, and proximity to Amsterdam, all of which contribute to sustained luxury real estate demand.

- Other Cities: Growth in this segment is fueled by a growing affluent population choosing alternative locations with a quieter yet equally upscale lifestyle.

Detailed analysis of each city's market dynamics, including pricing trends and inventory levels, is presented in the complete report.

Netherlands Luxury Residential Real Estate Market Product Innovations

The market is experiencing notable product innovations, primarily focused on sustainable design, smart home integration, and improved construction techniques. Examples include energy-efficient building materials, the increasing incorporation of renewable energy sources, and the integration of smart home technology for enhanced security and convenience. These innovations are reflected in higher property values and increased buyer demand for properties with such modern amenities.

Propelling Factors for Netherlands Luxury Residential Real Estate Market Growth

Several factors are contributing to growth within the Netherlands luxury residential real estate market. These include:

- Strong Economic Performance: The Netherlands enjoys a robust economy that supports high levels of disposable income among HNWIs.

- Favorable Regulatory Environment: Government initiatives supporting sustainable building practices and infrastructure development.

- Technological Advancements: Innovations in construction and smart home technology are enhancing property values and attracting luxury buyers.

Obstacles in the Netherlands Luxury Residential Real Estate Market

The market faces certain challenges, including:

- High Construction Costs: Rising material and labor costs impact profitability and potentially limit supply.

- Supply Chain Disruptions: Global supply chain constraints occasionally affect the availability of materials, leading to project delays.

- Regulatory Hurdles: Navigating environmental regulations and obtaining necessary permits can pose challenges to developers.

Future Opportunities in Netherlands Luxury Residential Real Estate Market

The Netherlands luxury residential real estate market presents several promising opportunities for future growth:

- Demand for Sustainable Housing: The increasing preference for energy-efficient and eco-friendly properties presents a significant opportunity for developers and builders.

- Growth in Secondary Cities: Expanding luxury residential projects outside major urban centers could tap into untapped demand.

- Investment in Smart Home Technology: Smart home integrations are becoming a key differentiating factor in luxury properties.

Major Players in the Netherlands Luxury Residential Real Estate Market Ecosystem

- BPD

- Christie's International Real Estate

- Van Wanrooji Construction and Development

- Sotheby's International Realty

- Dura Vermeer Groep

- Provast

- Van Wijnen

- Volker Wessels

- Heijmans

- Vorm

Key Developments in Netherlands Luxury Residential Real Estate Market Industry

- May 2022: VORM commenced construction of the Klipper district in Spijkenisse, featuring 48 sustainable and smart homes, showcasing the trend towards environmentally conscious luxury developments.

- April 2022: BPD integrated 3D model visualization into their home purchase contracts, a technological advancement enhancing the buyer experience and potentially accelerating sales.

Strategic Netherlands Luxury Residential Real Estate Market Forecast

The Netherlands luxury residential real estate market is poised for continued growth, driven by strong economic fundamentals, technological innovation, and evolving consumer preferences. While challenges remain regarding costs and supply chains, the long-term outlook remains positive, with significant potential for expansion in various segments and locations. The strategic focus on sustainable and technologically advanced properties is expected to fuel further growth in the forecast period.

Netherlands Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. Amsterdam

- 2.2. Rotterdam

- 2.3. The Hague

- 2.4. Other Cities

Netherlands Luxury Residential Real Estate Market Segmentation By Geography

- 1. Netherlands

Netherlands Luxury Residential Real Estate Market Regional Market Share

Geographic Coverage of Netherlands Luxury Residential Real Estate Market

Netherlands Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure.

- 3.3. Market Restrains

- 3.3.1. High cost of the construction projects; Limited space availability for new projects

- 3.4. Market Trends

- 3.4.1. Growing Number of High Net Worth Individuals Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Amsterdam

- 5.2.2. Rotterdam

- 5.2.3. The Hague

- 5.2.4. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BPD

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Christie's International Real Estate

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Van Wanrooji Construction and Development

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sotheby's International Realty

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dura Vermeer Groep**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Provast

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Van Wijnen

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Volker Wessels

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Heijmans

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vorm

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BPD

List of Figures

- Figure 1: Netherlands Luxury Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Netherlands Luxury Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 3: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 6: Netherlands Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Luxury Residential Real Estate Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Netherlands Luxury Residential Real Estate Market?

Key companies in the market include BPD, Christie's International Real Estate, Van Wanrooji Construction and Development, Sotheby's International Realty, Dura Vermeer Groep**List Not Exhaustive, Provast, Van Wijnen, Volker Wessels, Heijmans, Vorm.

3. What are the main segments of the Netherlands Luxury Residential Real Estate Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure..

6. What are the notable trends driving market growth?

Growing Number of High Net Worth Individuals Driving the Market.

7. Are there any restraints impacting market growth?

High cost of the construction projects; Limited space availability for new projects.

8. Can you provide examples of recent developments in the market?

May 2022: The construction of the new Klipper district in the port area of Spijkenisse started officially. The Rotterdam project developer and builder VORM is responsible for the construction of a total of 48 sustainable and smart homes. The energy-neutral new housing estate, with single-family homes, townhouses, and sturdy quay houses, is part of the Port, the overarching area development De Elementen. The completion of the Klipper subproject is planned for the end of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Netherlands Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence