Key Insights

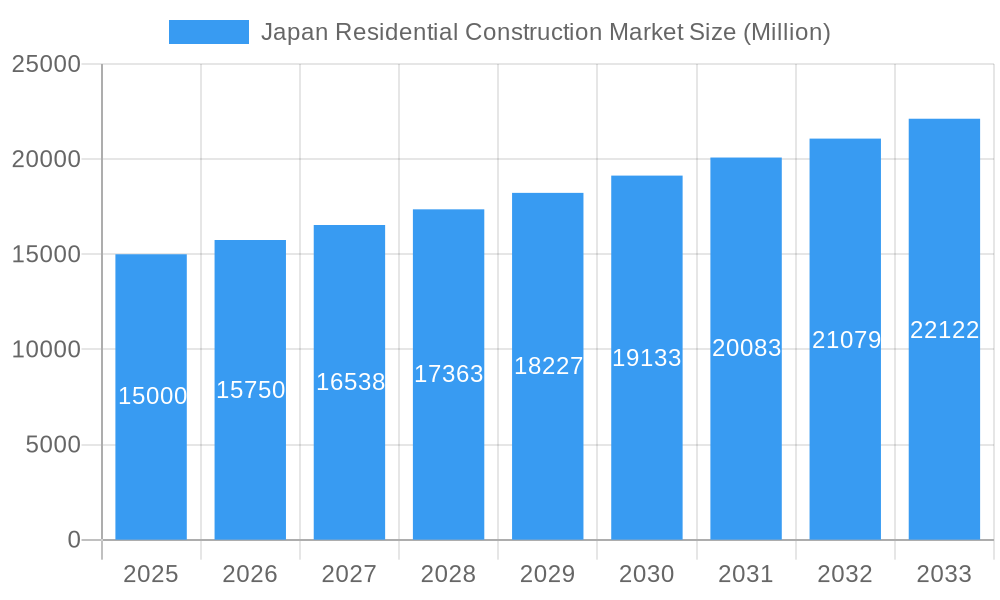

The Japan residential construction market, valued at approximately $652.7 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.15% through 2033. This growth is propelled by demographic shifts, government-led urban renewal, and evolving consumer preferences. An aging population and a contracting workforce are increasing demand for compact, manageable residences, such as apartments and condominiums. Government initiatives focused on urban redevelopment and infrastructure upgrades are stimulating new construction, particularly in metropolitan hubs like Kanto and Kansai. Furthermore, changing lifestyle trends and a growing middle class are driving demand for advanced, sustainable housing with smart home technologies. Renovation projects are also a significant contributor, driven by modernization and energy efficiency improvements. Key market participants, including Daiwa House, Sekisui House, and Mitsubishi Estate Co., Ltd., are innovating with designs and construction methods.

Japan Residential Construction Market Market Size (In Billion)

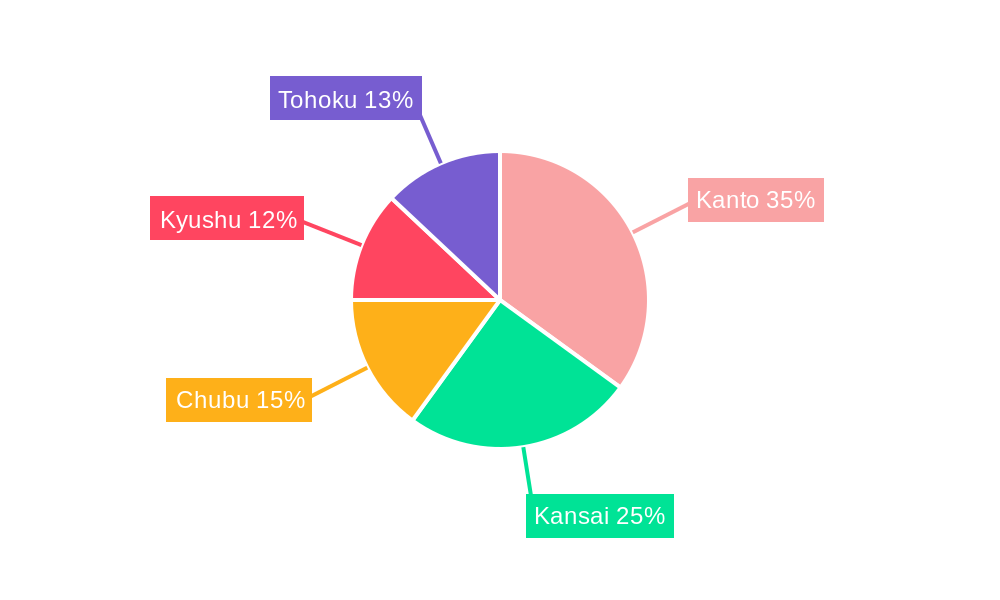

Despite positive growth prospects, the market faces constraints such as land scarcity and high construction costs in urban areas. Stringent building regulations can also complicate project timelines. Economic volatility and shifts in government policy may influence market performance. Nevertheless, sustained housing demand in Japan's urban and suburban areas supports a positive market outlook. Segmentation by property type (apartments & condominiums, villas, others) and construction type (new builds, renovations) highlights diverse consumer needs, creating opportunities for specialized offerings. Regional growth is expected to be led by Kanto and Kansai, owing to their high population density and economic vitality.

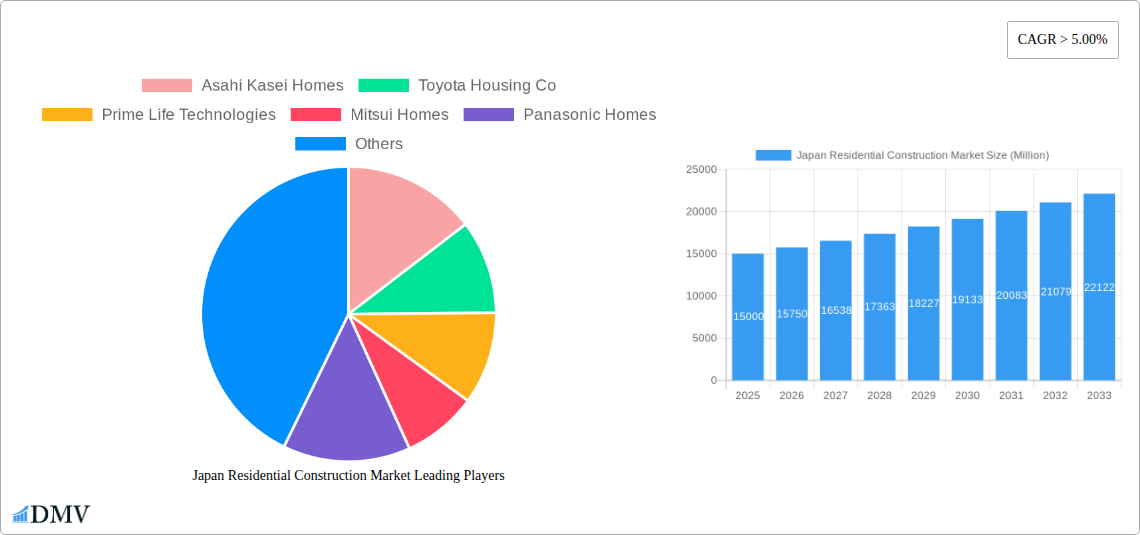

Japan Residential Construction Market Company Market Share

Japan Residential Construction Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Japan Residential Construction Market, offering a comprehensive overview of market trends, key players, and future growth projections. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market value is projected to reach xx Million by 2033.

Japan Residential Construction Market Composition & Trends

The Japanese residential construction market, valued at xx Million in 2024, presents a complex landscape shaped by several interwoven factors. Market concentration is moderately high, with key players like Sekisui House and Daiwa House holding significant shares. However, a fragmented mid-market segment also exists, fostering competition. Innovation is driven by increasing demand for sustainable and technologically advanced housing, including Zero Energy Homes (ZEHs) and earthquake-resistant structures. Stringent building codes and land scarcity influence the regulatory landscape, while rising material costs and labor shortages pose challenges. Substitute products, such as repurposed commercial spaces, have limited impact due to cultural preferences for single-family homes. End-users predominantly comprise young professionals, families, and the aging population, each with varying needs.

- Market Share Distribution (2024): Sekisui House (xx%), Daiwa House (xx%), Mitsui Homes (xx%), Others (xx%)

- M&A Activity (2019-2024): Total deal value estimated at xx Million, with a notable increase in activity since 2022.

- Innovation Catalysts: Government incentives for energy-efficient homes, technological advancements in construction materials, and growing consumer demand for smart homes.

Japan Residential Construction Market Industry Evolution

The Japanese residential construction market demonstrates a pattern of moderate growth, influenced by several key factors. From 2019 to 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of xx%, driven by factors such as government initiatives supporting housing development and the ongoing need for housing upgrades. Technological advancements, such as the integration of IoT and smart home technologies, are reshaping the landscape, offering consumers enhanced convenience and energy efficiency. The adoption rate of ZEH technologies is gradually increasing, driven by both regulatory pressures and rising consumer awareness of sustainability. Shifting consumer demands toward smaller, more energy-efficient homes are impacting the market, while an aging population contributes to increased demand for age-friendly housing solutions. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033), propelled by continuous innovation and supportive government policies. Increased adoption of prefabricated construction methods is expected to enhance efficiency and reduce construction timelines.

Leading Regions, Countries, or Segments in Japan Residential Construction Market

The Kanto region, encompassing Tokyo and surrounding prefectures, remains the dominant segment in the Japanese residential construction market. This dominance is largely attributable to high population density, strong economic activity, and robust infrastructural development.

- Key Drivers for Kanto Region Dominance:

- High population concentration and continuous urbanization.

- Significant investment in infrastructure and real estate projects.

- Strong economic activity and high purchasing power.

- Favorable government policies and incentives.

The Apartment & Condominium segment constitutes the largest share of the market due to affordability and space efficiency, particularly in urban areas. New construction projects consistently outpace renovation projects due to higher profit margins and a greater demand for modern housing.

- Dominance Factors for Apartment & Condominiums:

- Higher demand in urban centers where land is scarce.

- Relatively lower costs compared to villa construction.

- Suitability for diverse demographics (students, young professionals, families).

Japan Residential Construction Market Product Innovations

Recent innovations focus on sustainability and enhanced seismic resistance. Panasonic Homes' Casart Black & Stone model exemplifies this trend, offering superior earthquake protection and achieving a Grade 3 seismic performance rating under the Housing Performance Indication System. Increased use of prefabricated modules and smart home technologies enhances construction speed, energy efficiency, and convenience. These innovations target a market increasingly concerned about environmental impact and resilience to natural disasters.

Propelling Factors for Japan Residential Construction Market Growth

Several factors fuel market growth, including government initiatives promoting sustainable housing, increasing urbanization, and technological advancements that improve construction efficiency. Furthermore, the aging population fuels demand for specialized housing designs, while rising disposable incomes enable increased investment in higher-quality homes. Tax incentives and relaxed mortgage regulations also play a significant role.

Obstacles in the Japan Residential Construction Market

Key obstacles include labor shortages, high material costs, and stringent regulatory hurdles that increase project timelines and costs. Supply chain disruptions and rising land prices further exacerbate challenges. Competition from established players necessitates innovation and cost-effective solutions for sustained growth. These factors collectively limit the market's expansion rate.

Future Opportunities in Japan Residential Construction Market

Emerging opportunities lie in the increasing demand for sustainable and resilient homes, including ZEH and smart home technologies. The aging population presents an opportunity to create age-friendly housing solutions. Expanding into rural areas with government support and investment in affordable housing solutions further presents promising opportunities.

Major Players in the Japan Residential Construction Market Ecosystem

- Asahi Kasei Homes

- Toyota Housing Co

- Prime Life Technologies

- Mitsui Homes

- Panasonic Homes

- Misawa Homes

- Tama Home

- Sekisui House

- Sumitomo Forestry

- Daiwa House

Key Developments in Japan Residential Construction Market Industry

- November 2022: Asahi Kasei Homes acquired 100% ownership of all the subsidiaries of Focus Company, strengthening its position in the order-built unit home market across Japan, North America, and Australia.

- April 2022: Panasonic Homes launched the Casart Black & Stone ZEH model, featuring a high seismic performance rating and an earthquake safety warranty.

Strategic Japan Residential Construction Market Forecast

The Japanese residential construction market is poised for continued growth, driven by technological advancements, supportive government policies, and evolving consumer demands. The focus on sustainable and resilient homes, coupled with innovative construction methods, will shape the market's trajectory in the coming years. The market's potential is significant, especially considering the ongoing need for housing upgrades and new developments to meet the demands of a growing and aging population.

Japan Residential Construction Market Segmentation

-

1. Type

- 1.1. Apartment & Condominiums

- 1.2. Villas

- 1.3. Other Types

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

Japan Residential Construction Market Segmentation By Geography

- 1. Japan

Japan Residential Construction Market Regional Market Share

Geographic Coverage of Japan Residential Construction Market

Japan Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase FDI in construction in Asia-Pacific; Minimized Construction Wastage

- 3.3. Market Restrains

- 3.3.1. Availability of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Foreign Investments in Japan is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Residential Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartment & Condominiums

- 5.1.2. Villas

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Asahi Kasei Homes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toyota Housing Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prime Life Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsui Homes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Homes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Misawa Homes

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tama Home**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sekisui House

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 sumitomo forestry

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Daiwa House

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Asahi Kasei Homes

List of Figures

- Figure 1: Japan Residential Construction Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Residential Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Residential Construction Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Japan Residential Construction Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 3: Japan Residential Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Residential Construction Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Japan Residential Construction Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 6: Japan Residential Construction Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Residential Construction Market?

The projected CAGR is approximately 4.15%.

2. Which companies are prominent players in the Japan Residential Construction Market?

Key companies in the market include Asahi Kasei Homes, Toyota Housing Co, Prime Life Technologies, Mitsui Homes, Panasonic Homes, Misawa Homes, Tama Home**List Not Exhaustive, Sekisui House, sumitomo forestry, Daiwa House.

3. What are the main segments of the Japan Residential Construction Market?

The market segments include Type, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 652.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase FDI in construction in Asia-Pacific; Minimized Construction Wastage.

6. What are the notable trends driving market growth?

Foreign Investments in Japan is Driving the Market.

7. Are there any restraints impacting market growth?

Availability of Skilled Labor.

8. Can you provide examples of recent developments in the market?

November 2022: Asahi Kasei Homes acquired 100% ownership of all the subsidiaries of Focus Company. This acquisition will help Asahi Kasei Homes strengthen its core business of order-built unit homes in Japan, North America, and Australia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Residential Construction Market?

To stay informed about further developments, trends, and reports in the Japan Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence