Key Insights

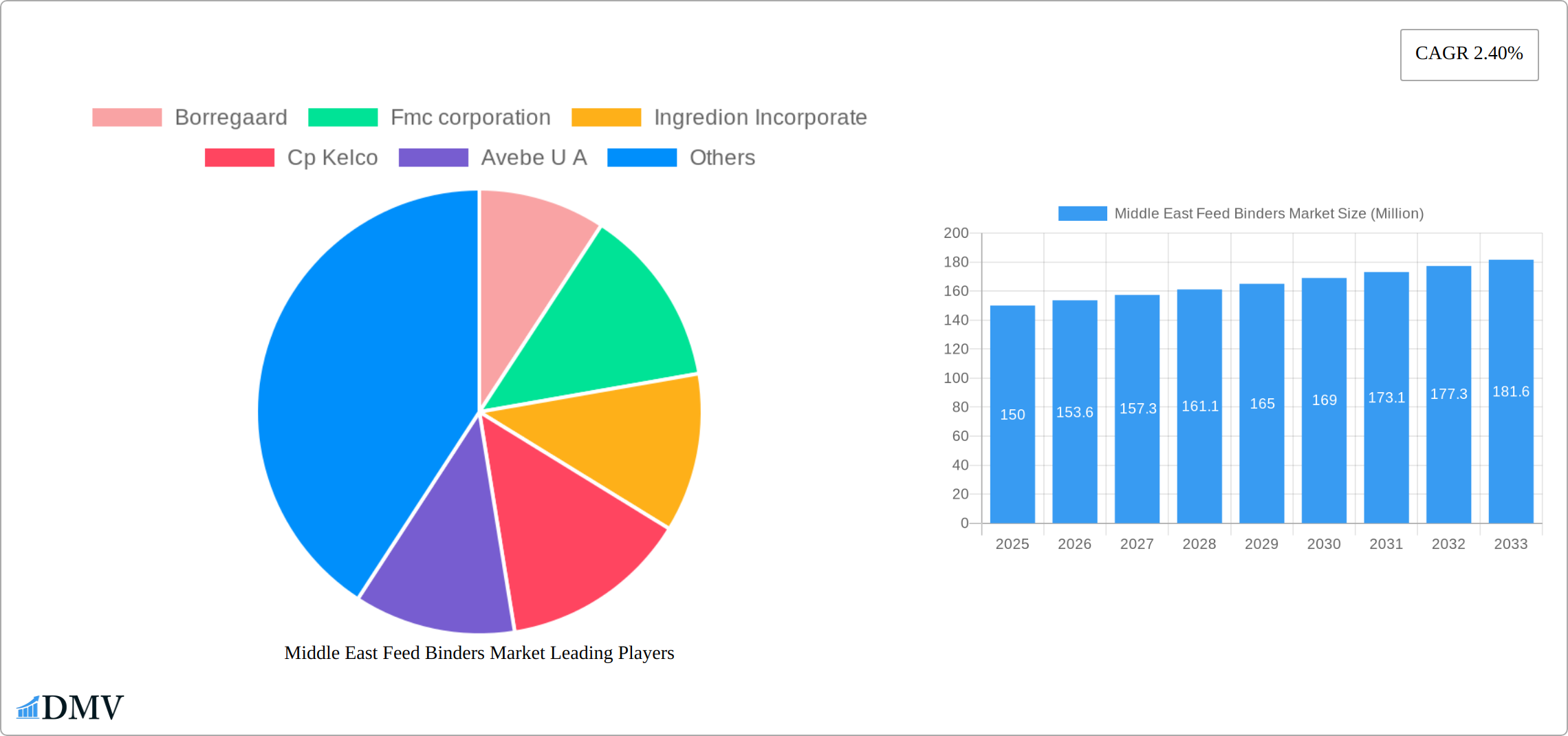

The Middle East Feed Binders market, valued at approximately $XXX million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.40% from 2025 to 2033. This expansion is fueled by several key factors. The region's burgeoning livestock industry, particularly in poultry and ruminants, is driving demand for efficient and cost-effective feed binders. Increased consumer demand for animal protein, coupled with government initiatives promoting agricultural development and food security, further contributes to market growth. The shift towards higher-quality, performance-enhancing feed formulations, which often incorporate advanced binder technologies, presents another significant growth opportunity. While challenges exist, such as fluctuating raw material prices and potential environmental concerns related to certain binder types, the overall market outlook remains positive.

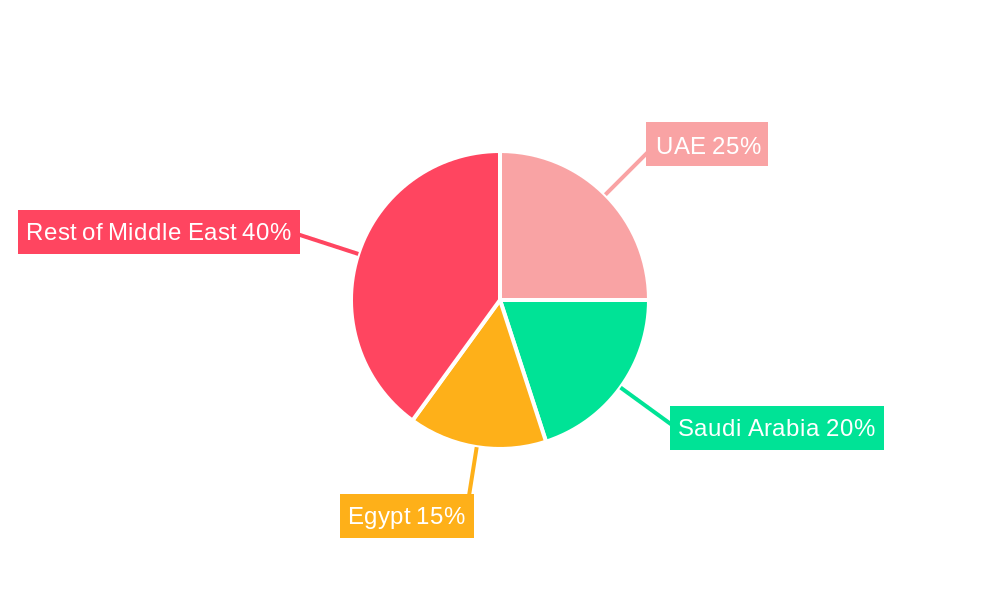

Market segmentation reveals a notable preference for natural binders over synthetic alternatives, reflecting a growing consumer awareness regarding feed sustainability and animal health. Within animal types, ruminants and poultry segments dominate the market share, mirroring the substantial livestock populations in the region. Key players like Borregaard, FMC Corporation, Ingredion Incorporated, and others are actively shaping the market through innovation, strategic partnerships, and expansion initiatives. Geographic analysis indicates significant market potential across the Middle East, with the UAE, Saudi Arabia, and Egypt emerging as key markets. Continued investments in infrastructure development, coupled with favorable government policies, are anticipated to further stimulate market expansion throughout the forecast period (2025-2033). The consistent, albeit moderate, growth projected highlights the resilience and long-term prospects of the Middle East Feed Binders market. Further research into specific regional variations and consumer preferences will enhance a more precise understanding of the market's future trajectory.

Middle East Feed Binders Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Middle East Feed Binders market, offering valuable insights for stakeholders seeking to navigate this dynamic landscape. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report meticulously examines market size, growth drivers, challenges, and future opportunities, providing a robust forecast from 2025 to 2033. Key segments analyzed include natural and synthetic binders, catering to ruminants, poultry, swine, aquaculture, and other animal types. Leading players like Borregaard, FMC Corporation, Ingredion Incorporated, CP Kelco, Avebe U.A., Archer Daniels Midland Company, Cargill Inc., and Beneo GmbH are profiled, revealing their market strategies and competitive positioning.

Middle East Feed Binders Market Market Composition & Trends

The Middle East Feed Binders market is characterized by a moderately concentrated landscape, with the top five key players projected to command approximately 65-70% of the market share by 2026. This concentration is underpinned by factors such as significant economies of scale, established brand recognition, and secure access to essential raw materials. A primary driver for market expansion is the continuous innovation in feed binder technology, spurred by an increasing imperative for enhanced feed efficiency, improved animal health outcomes, and the overarching goal of sustainable livestock production. The regulatory framework, encompassing stringent feed safety standards and evolving environmental regulations, plays a pivotal role in shaping market dynamics and influencing product development. While alternative binding agents present a competitive threat, the accelerating adoption of sustainable feed practices offers a dual landscape of challenges and substantial opportunities. The end-user base, predominantly comprising large-scale feed producers and integrated livestock operations, significantly dictates market demand patterns. Strategic mergers and acquisitions (M&A), with an estimated deal value of approximately $150-180 Million USD in 2025, are further consolidating the market and fostering rapid technological advancements and market reach.

- Market Share Distribution (2026 Projection): Top 5 players – 65-70%; Others – 30-35%.

- M&A Deal Value (2025 Projection): Approximately $150-180 Million USD.

- Key Innovation Catalysts: Driving factors include the pursuit of superior feed efficiency, paramount importance of enhanced animal health and well-being, and the imperative for sustainable and environmentally responsible feed production.

- Regulatory Landscape: The focus is increasingly on robust feed safety protocols, stringent environmental sustainability mandates, and the ethical considerations of animal welfare.

Middle East Feed Binders Market Industry Evolution

The Middle East Feed Binders market has witnessed robust growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is propelled by factors such as rising livestock production, increasing demand for animal protein, and growing adoption of advanced feed formulations. Technological advancements, such as the development of novel binder formulations with enhanced performance characteristics, have significantly contributed to market expansion. Shifting consumer demands, particularly towards healthier and more sustainable animal products, are driving the adoption of natural and functional feed binders. The market is expected to maintain a significant growth trajectory during the forecast period (2025-2033), with a projected CAGR of xx%, driven by factors like population growth, rising disposable incomes, and increasing urbanization.

Leading Regions, Countries, or Segments in Middle East Feed Binders Market

The poultry segment holds the largest market share within the animal type category, driven by the high demand for poultry products in the region. This is further fueled by rising consumption of meat due to population growth and increasing purchasing power. The natural binders segment dominates the type category, driven by growing consumer preference for natural and organic animal feed. Saudi Arabia and the UAE are the leading countries in the Middle East Feed Binders market, benefitting from significant investments in livestock farming and robust poultry industries.

- Key Drivers for Poultry Segment Dominance: High demand for poultry meat, favorable government policies, and increasing investment in poultry farming.

- Key Drivers for Natural Binders Segment Dominance: Growing consumer preference for natural and organic feed, increasing awareness of animal health and welfare, and supportive regulatory frameworks.

- Key Drivers for Saudi Arabia and UAE Dominance: Significant investments in agricultural infrastructure, substantial livestock populations, and strong government support for the feed industry.

Middle East Feed Binders Market Product Innovations

Recent advancements within the Middle East Feed Binders market are at the forefront of developing novel binder formulations designed for superior binding capabilities, enhanced digestibility, and a notable increase in nutritional value. These innovations are a direct response to the escalating demand for improved feed efficiency, robust animal health, and the overarching need for sustainable feed production practices. Furthermore, the development of 'functional binders' that offer added health benefits, such as promoting gut health and bolstering immunity, represents a significant and lucrative avenue for market growth. These progressive advancements are collectively contributing to the optimization of overall animal feed performance, leading to demonstrable improvements in animal productivity and a consequently enhanced profitability for livestock farmers across the region.

Propelling Factors for Middle East Feed Binders Market Growth

The Middle East Feed Binders market is propelled by several key factors. Firstly, the rising demand for animal protein, driven by population growth and increasing urbanization, is fueling market expansion. Secondly, advancements in feed technology and the development of novel binder formulations are enhancing feed efficiency and animal health. Thirdly, government initiatives and supportive policies aimed at promoting livestock production contribute to market growth. The increasing investment in research and development of sustainable feed solutions is also playing a crucial role.

Obstacles in the Middle East Feed Binders Market Market

The Middle East Feed Binders market navigates several significant challenges. Foremost among these are the inherent volatilities in raw material prices, which directly impact production costs and can compress profit margins. Supply chain vulnerabilities, exacerbated by geopolitical instability or unpredictable climatic events, pose a constant threat to the consistent availability of crucial feed binder components. The competitive arena is also intensely fierce, with a robust presence of both domestic and international players, often leading to considerable downward pressure on pricing. Additionally, navigating complex regulatory landscapes and adhering to increasingly stringent environmental standards can introduce substantial compliance costs for manufacturers, further complicating market operations.

Future Opportunities in Middle East Feed Binders Market

The trajectory of future opportunities in the Middle East Feed Binders market is strongly aligned with the escalating global demand for sustainable and environmentally conscious feed solutions. Expansion into nascent markets and the strategic targeting of niche segments, such as specialized feed formulations for the growing pet food industry, present promising avenues for diversification and growth. Technological breakthroughs, particularly in the realm of precision feeding technologies and the development of novel, high-efficacy feed additives, hold immense potential for market expansion. The increasing sophistication of demand for customized feed solutions, meticulously tailored to specific animal breeds and their unique nutritional requirements, is creating further opportunities for specialized product development and market penetration.

Major Players in the Middle East Feed Binders Market Ecosystem

- Borregaard

- FMC Corporation

- Ingredion Incorporated

- CP Kelco

- Avebe U.A.

- Archer Daniels Midland Company

- Cargill Inc.

- Beneo GmbH

- Novozymes A/S

- DuPont de Nemours, Inc.

- Lallemand Inc.

- Kerry Group Plc

Key Developments in Middle East Feed Binders Market Industry

- 2023 Q4: Cargill Inc. announced a strategic investment in a new feed production facility in Saudi Arabia.

- 2022 Q3: Ingredion Incorporated launched a new line of natural feed binders tailored to the Middle Eastern market.

- 2021 Q1: A joint venture between Borregaard and a local Middle Eastern company was established to produce specialized feed binders.

Strategic Middle East Feed Binders Market Market Forecast

The Middle East Feed Binders market is poised for significant growth during the forecast period, driven by increasing livestock production, rising demand for animal protein, and technological advancements. Opportunities in sustainable feed solutions and niche markets will fuel further expansion. The market's future hinges on navigating challenges like fluctuating raw material prices and maintaining a competitive edge through innovation and strategic partnerships. The forecast suggests substantial market expansion, with a considerable increase in market value and volume by 2033.

Middle East Feed Binders Market Segmentation

-

1. Type

- 1.1. Natural Binders

- 1.2. Synthetic Binders

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Others

-

3. Geography

- 3.1. Egypt

- 3.2. Saudi Arabia

- 3.3. United Arab Emirates

- 3.4. Rest of Middle East

Middle East Feed Binders Market Segmentation By Geography

- 1. Egypt

- 2. Saudi Arabia

- 3. United Arab Emirates

- 4. Rest of Middle East

Middle East Feed Binders Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Meat and Animal Based Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural Binders

- 5.1.2. Synthetic Binders

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Egypt

- 5.3.2. Saudi Arabia

- 5.3.3. United Arab Emirates

- 5.3.4. Rest of Middle East

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.4.2. Saudi Arabia

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Egypt Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural Binders

- 6.1.2. Synthetic Binders

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Egypt

- 6.3.2. Saudi Arabia

- 6.3.3. United Arab Emirates

- 6.3.4. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural Binders

- 7.1.2. Synthetic Binders

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Egypt

- 7.3.2. Saudi Arabia

- 7.3.3. United Arab Emirates

- 7.3.4. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Arab Emirates Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural Binders

- 8.1.2. Synthetic Binders

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Egypt

- 8.3.2. Saudi Arabia

- 8.3.3. United Arab Emirates

- 8.3.4. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural Binders

- 9.1.2. Synthetic Binders

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminants

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Egypt

- 9.3.2. Saudi Arabia

- 9.3.3. United Arab Emirates

- 9.3.4. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United Arab Emirates Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 11. Saudi Arabia Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 12. Qatar Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 13. Israel Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 14. Egypt Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 15. Oman Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Middle East Middle East Feed Binders Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Borregaard

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Fmc corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Ingredion Incorporate

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Cp Kelco

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Avebe U A

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Archer Daniels Midland Company

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Cargill Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Beneo Gmbh

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.1 Borregaard

List of Figures

- Figure 1: Middle East Feed Binders Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Feed Binders Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Feed Binders Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Feed Binders Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East Feed Binders Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 4: Middle East Feed Binders Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle East Feed Binders Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East Feed Binders Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Arab Emirates Middle East Feed Binders Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Middle East Feed Binders Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Qatar Middle East Feed Binders Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Israel Middle East Feed Binders Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Egypt Middle East Feed Binders Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Oman Middle East Feed Binders Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Middle East Middle East Feed Binders Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Middle East Feed Binders Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Middle East Feed Binders Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 16: Middle East Feed Binders Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Middle East Feed Binders Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Middle East Feed Binders Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Middle East Feed Binders Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 20: Middle East Feed Binders Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Middle East Feed Binders Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Middle East Feed Binders Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Middle East Feed Binders Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 24: Middle East Feed Binders Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Middle East Feed Binders Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Middle East Feed Binders Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Middle East Feed Binders Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 28: Middle East Feed Binders Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Middle East Feed Binders Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Feed Binders Market?

The projected CAGR is approximately 2.40%.

2. Which companies are prominent players in the Middle East Feed Binders Market?

Key companies in the market include Borregaard, Fmc corporation, Ingredion Incorporate, Cp Kelco, Avebe U A, Archer Daniels Midland Company, Cargill Inc, Beneo Gmbh.

3. What are the main segments of the Middle East Feed Binders Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Demand for Meat and Animal Based Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Feed Binders Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Feed Binders Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Feed Binders Market?

To stay informed about further developments, trends, and reports in the Middle East Feed Binders Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence