Key Insights

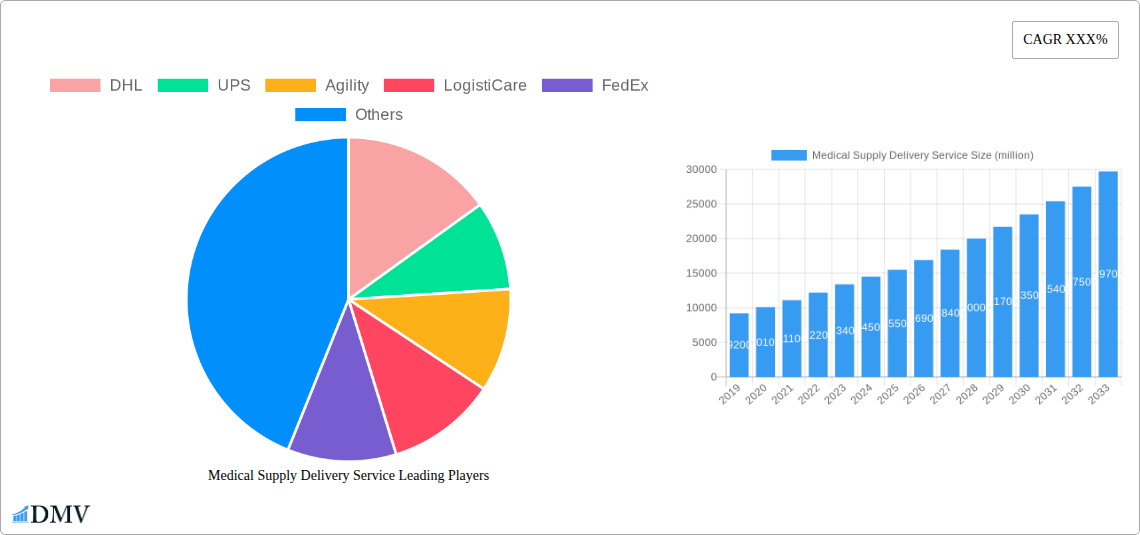

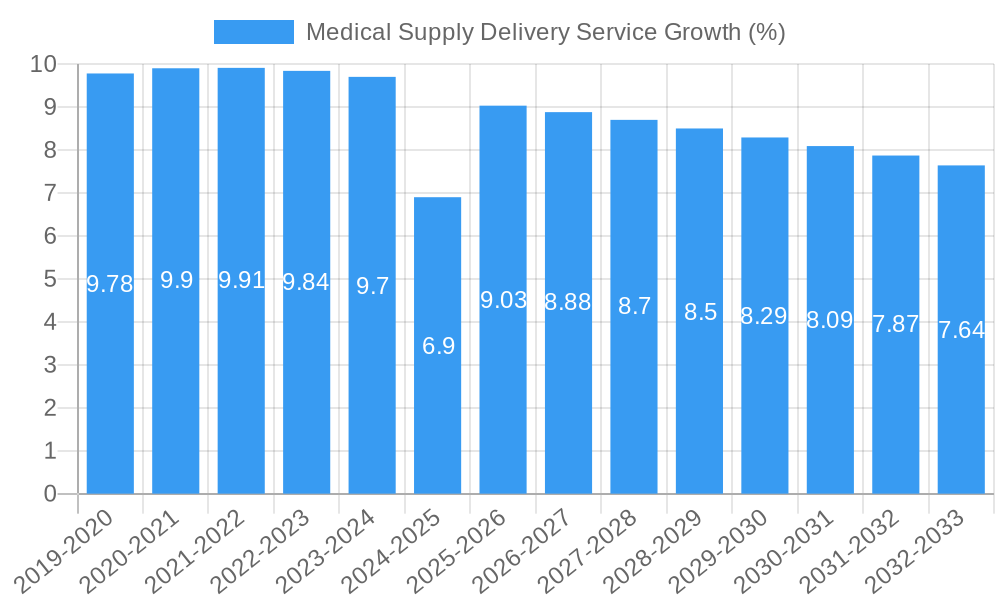

The global Medical Supply Delivery Service market is poised for significant expansion, projected to reach an estimated $15,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.5% anticipated through 2033. This dynamic growth is primarily propelled by escalating healthcare demands, an increasing prevalence of chronic diseases, and the critical need for efficient and timely delivery of medical supplies. The COVID-19 pandemic, in particular, underscored the vital importance of a resilient medical supply chain, accelerating investments in specialized delivery solutions. Key drivers include the expanding reach of telehealth services, which necessitate reliable remote delivery of medications and diagnostic kits, and the growing adoption of advanced logistics technologies. The integration of AI and real-time tracking systems is enhancing supply chain visibility and operational efficiency, further fueling market adoption. Furthermore, the rising disposable incomes in emerging economies and improved healthcare infrastructure are contributing to increased demand for specialized medical delivery services.

The market is segmented across diverse applications, with Medical Supplies currently dominating due to the sheer volume and variety of items requiring timely distribution, followed by Emergency Services which demand rapid and dependable logistics for life-saving equipment and pharmaceuticals. The Lab Specimens and Reports segment is also witnessing steady growth, driven by the increasing volume of diagnostic testing. On the supply side, Courier Delivery remains the predominant mode, offering established infrastructure and broad coverage. However, the emergence of Drone Delivery is a transformative trend, particularly for reaching remote or hard-to-access locations, improving response times for critical medical needs, and reducing ground transportation bottlenecks. Major players like DHL, UPS, and FedEx are actively investing in specialized medical logistics capabilities, while innovative companies such as Zipline and Matternet are pioneering drone-based delivery solutions, signaling a shift towards more advanced and specialized logistics networks within the healthcare sector.

Medical Supply Delivery Service Market Composition & Trends

The global Medical Supply Delivery Service market is experiencing a dynamic evolution, driven by increasing healthcare demands and rapid technological integration. Market concentration is moderately fragmented, with major players like DHL, UPS, Agility, LogistiCare, FedEx, CEVA Logistics, International SOS, Matternet, Zipline, Flirtey, and Swoop Aero vying for significant market share. Innovation catalysts are primarily focused on speed, reliability, and cost-efficiency in medical logistics. The regulatory landscape, while vital for ensuring patient safety and compliance, also presents a complex framework that service providers must navigate. Substitute products, such as traditional postal services for non-critical items, exist but are often outpaced by specialized medical logistics solutions. End-user profiles range from large hospital networks and pharmaceutical manufacturers to smaller clinics, research laboratories, and even individual patients requiring home delivery of medical essentials. Mergers and acquisition (M&A) activities are on the rise as companies seek to consolidate their market positions, expand service offerings, and gain access to new technologies or geographical regions. Recent M&A deal values have reached hundreds of millions, indicative of the sector's growth potential. The market share distribution is heavily influenced by the scale and scope of services offered, with courier delivery services holding a substantial portion, while drone delivery services are rapidly gaining traction in specific niches. The growing need for efficient delivery of medical supplies, emergency services, and lab specimens and reports underpins the sustained investment and strategic maneuvering within this crucial sector.

Medical Supply Delivery Service Industry Evolution

The Medical Supply Delivery Service industry has witnessed a remarkable transformation over the historical period of 2019–2024, setting a robust foundation for substantial growth in the coming years. The market has moved from a predominantly traditional courier-based model to an increasingly sophisticated ecosystem integrating advanced technologies. This evolution has been propelled by a confluence of factors, including the escalating global healthcare expenditure, the growing prevalence of chronic diseases necessitating continuous supply of medications and equipment, and the increasing demand for faster and more reliable delivery of critical medical items. During the study period (2019–2033), the market has charted a consistent upward trajectory. The base year of 2025 represents a pivotal point, with significant investments being channeled into optimizing logistics networks and embracing new delivery methods. The forecast period (2025–2033) is projected to see an accelerated growth rate, estimated at a Compound Annual Growth Rate (CAGR) of approximately 9.5%. This surge is attributed to the wider adoption of drone delivery for last-mile logistics, especially in remote and underserved areas, and the continuous innovation in cold chain logistics for temperature-sensitive pharmaceuticals and biologics. Technological advancements have been a primary driver, with the implementation of AI-powered route optimization, real-time tracking, blockchain for supply chain transparency, and autonomous delivery systems significantly enhancing efficiency and reducing delivery times. Consumer demand has shifted towards greater convenience, speed, and reliability, pushing service providers to develop agile and customer-centric solutions. The COVID-19 pandemic, during the historical period, acted as a significant catalyst, highlighting the critical importance of a resilient and efficient medical supply chain and accelerating the adoption of technologies that enable rapid and secure delivery of essential medical products, vaccines, and testing kits. This period underscored the vulnerability of traditional supply chains and spurred innovation and investment in alternative delivery methods, thereby shaping the industry's future growth trajectory.

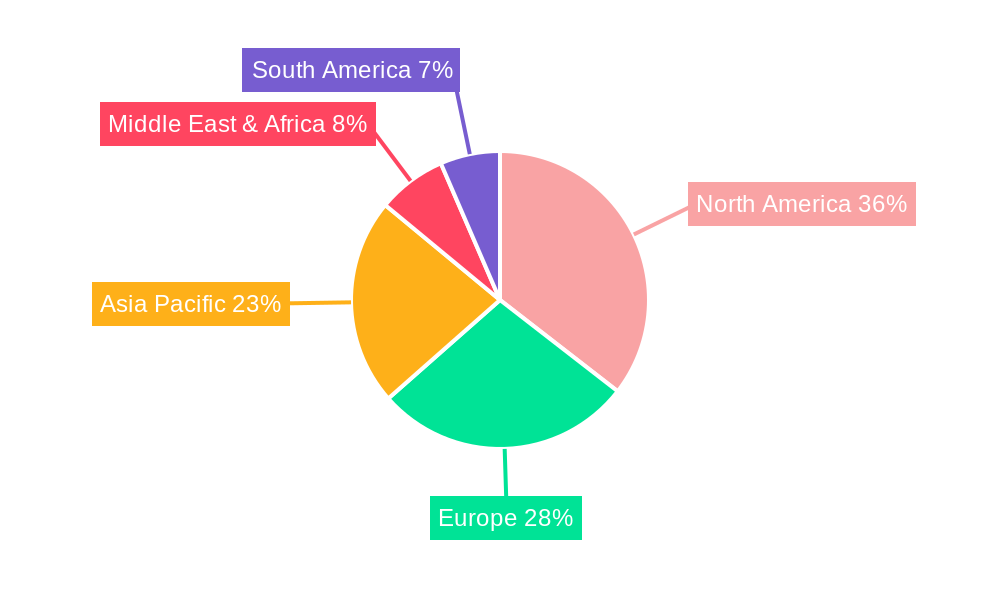

Leading Regions, Countries, or Segments in Medical Supply Delivery Service

The Medical Supplies segment, within the broader Application category, stands as the dominant force in the global Medical Supply Delivery Service market. This dominance is particularly pronounced in North America and Europe, with the United States and Germany leading the charge in terms of market value and volume. The Type: Courier Delivery continues to hold the largest market share due to its established infrastructure and widespread applicability for a vast array of medical products. However, Type: Drone Delivery is experiencing explosive growth and is poised to revolutionize the delivery of specific medical supplies, particularly in emergency services and remote healthcare access.

Key drivers underpinning the dominance of Medical Supplies delivery include:

- Aging Global Population: An increasing elderly demographic necessitates consistent delivery of chronic care medications, medical devices, and mobility aids, directly fueling demand for medical supply delivery.

- Rising Chronic Disease Incidence: The proliferation of diseases like diabetes, cardiovascular conditions, and respiratory ailments requires a steady and reliable supply of pharmaceuticals and specialized equipment, making medical supply delivery indispensable.

- Healthcare Infrastructure Expansion: Growth in healthcare facilities, particularly in developing economies, leads to increased procurement and distribution of medical supplies, thereby driving demand for efficient delivery services.

- E-commerce Growth in Healthcare: The burgeoning trend of online pharmacies and direct-to-consumer sales of medical products necessitates robust and specialized delivery networks.

In-depth analysis reveals that the United States, with its advanced healthcare system, significant pharmaceutical industry, and substantial investment in logistics technology, represents the single largest market for medical supply delivery. The country benefits from a favorable regulatory environment that increasingly supports innovative delivery methods. Germany, as a major European hub, also exhibits strong growth due to its robust healthcare infrastructure, a well-developed logistics network, and a high demand for specialized medical treatments and supplies. The increasing focus on home healthcare and personalized medicine further amplifies the need for efficient and timely delivery of medical supplies directly to patients' residences, solidifying the segment's leading position. While drone delivery is still in its nascent stages compared to courier services, its rapid adoption in specific applications like delivering blood products, vaccines, and emergency medical kits to hard-to-reach areas is a significant indicator of its future potential. Countries with challenging geographical terrains or underdeveloped road networks are particularly keen on leveraging drone technology for medical supply delivery, indicating a strong regional push for this advanced delivery method. The overall market's reliance on a continuous and secure flow of medical supplies ensures the sustained growth and leadership of this critical segment.

Medical Supply Delivery Service Product Innovations

Product innovations in Medical Supply Delivery Service are revolutionizing efficiency and accessibility. Companies are developing advanced temperature-controlled packaging solutions that maintain precise temperatures for sensitive pharmaceuticals and biologics for extended periods, ensuring product integrity during transit. Autonomous drones, like those from Zipline and Matternet, are being optimized for speed and payload capacity, enabling rapid delivery of critical medical supplies to remote or disaster-stricken areas. Smart logistics platforms leveraging AI and IoT sensors offer real-time tracking, predictive analytics for route optimization, and enhanced inventory management, minimizing delays and waste. Unique selling propositions include guaranteed delivery windows, specialized handling for hazardous materials, and secure, tamper-evident packaging. Technological advancements are enabling end-to-end visibility and control over the medical supply chain, from point of origin to patient delivery.

Propelling Factors for Medical Supply Delivery Service Growth

Several key factors are propelling the growth of the Medical Supply Delivery Service market. Technologically, the advent of drone delivery systems, AI-powered logistics, and IoT for real-time tracking is enhancing speed, efficiency, and reach, particularly in remote areas. Economically, rising global healthcare expenditures and the increasing demand for pharmaceuticals and medical devices necessitate robust delivery networks. Regulatory support for faster emergency medical transportation and the expansion of telehealth services, which often require timely delivery of medications and supplies, further contribute to market expansion.

Obstacles in the Medical Supply Delivery Service Market

Significant obstacles hinder the Medical Supply Delivery Service market. Stringent regulatory hurdles, especially concerning the transportation of hazardous medical materials and the operation of autonomous vehicles like drones, can lead to delays and increased compliance costs. Supply chain disruptions, as witnessed during global health crises or geopolitical instability, can severely impact the availability and timely delivery of essential medical supplies. Furthermore, intense competitive pressures among established players and emerging entrants can lead to price wars and reduced profit margins. The high capital investment required for advanced logistics infrastructure, particularly for drone fleets and cold chain management, also presents a barrier to entry for smaller companies.

Future Opportunities in Medical Supply Delivery Service

Emerging opportunities in the Medical Supply Delivery Service market are abundant. The expansion of drone delivery networks into new geographical regions, particularly in underserved communities and developing nations, presents a significant growth avenue. The increasing adoption of personalized medicine and at-home healthcare services will drive demand for specialized and direct-to-patient delivery solutions. Furthermore, the integration of blockchain technology for enhanced supply chain transparency and security offers opportunities for building greater trust and efficiency. The development of more sustainable and eco-friendly delivery methods also aligns with growing environmental consciousness and presents a niche for innovation.

Major Players in the Medical Supply Delivery Service Ecosystem

- DHL

- UPS

- Agility

- LogistiCare

- FedEx

- CEVA Logistics

- The Wing

- International SOS

- Matternet

- Zipline

- Flirtey

- Swoop Aero

Key Developments in Medical Supply Delivery Service Industry

- March 2023: Zipline launched expanded drone delivery operations for blood products in Nigeria, significantly improving access to critical medical supplies.

- January 2023: Matternet partnered with a major healthcare provider in the US to establish a permanent drone delivery network for lab specimens, demonstrating long-term viability.

- November 2022: Flirtey secured regulatory approval for commercial drone delivery of medical supplies in a specific US region, paving the way for wider adoption.

- September 2022: Swoop Aero announced a significant funding round to scale its drone delivery services for healthcare in Africa.

- July 2022: UPS Healthcare expanded its cold chain logistics capabilities with advanced temperature monitoring solutions to meet growing demand for vaccine and biologic delivery.

- April 2022: DHL launched a new initiative focused on sustainable logistics solutions within the healthcare sector, emphasizing reduced carbon footprint.

- February 2022: CEVA Logistics acquired a specialized medical logistics company to enhance its pharmaceutical and healthcare service offerings in Asia.

- December 2021: LogistiCare announced an integration with a leading telehealth platform to streamline the delivery of prescriptions and medical equipment to homebound patients.

- October 2021: International SOS expanded its medical evacuation and repatriation services, relying heavily on efficient and secure medical supply delivery.

- May 2020: FedEx enhanced its capabilities for delivering temperature-sensitive medical shipments during the COVID-19 pandemic, showcasing its operational resilience.

Strategic Medical Supply Delivery Service Market Forecast

The strategic forecast for the Medical Supply Delivery Service market is exceptionally promising, driven by a confluence of technological advancements and escalating healthcare demands. The continued expansion of drone delivery networks, coupled with innovations in AI and IoT for logistics, will unlock new efficiencies and reach previously inaccessible areas, particularly for emergency medical services and lab specimens. The increasing focus on personalized medicine and home healthcare will further fuel the demand for specialized and reliable delivery solutions. Emerging markets in Asia and Africa are poised for significant growth as they adopt advanced logistics to bridge healthcare gaps. Investments in cold chain infrastructure and sustainable delivery practices will also be critical, shaping a future where faster, safer, and more accessible medical supply delivery becomes the global standard, with an estimated market value of over one million dollars by 2033.

Medical Supply Delivery Service Segmentation

-

1. Application

- 1.1. Medical Supplies

- 1.2. Emergency Services

- 1.3. Lab Specimens and Reports

-

2. Type

- 2.1. Courier Delivery

- 2.2. Drone Delivery

Medical Supply Delivery Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Supply Delivery Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Supply Delivery Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical Supplies

- 5.1.2. Emergency Services

- 5.1.3. Lab Specimens and Reports

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Courier Delivery

- 5.2.2. Drone Delivery

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Supply Delivery Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical Supplies

- 6.1.2. Emergency Services

- 6.1.3. Lab Specimens and Reports

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Courier Delivery

- 6.2.2. Drone Delivery

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Supply Delivery Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical Supplies

- 7.1.2. Emergency Services

- 7.1.3. Lab Specimens and Reports

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Courier Delivery

- 7.2.2. Drone Delivery

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Supply Delivery Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical Supplies

- 8.1.2. Emergency Services

- 8.1.3. Lab Specimens and Reports

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Courier Delivery

- 8.2.2. Drone Delivery

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Supply Delivery Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical Supplies

- 9.1.2. Emergency Services

- 9.1.3. Lab Specimens and Reports

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Courier Delivery

- 9.2.2. Drone Delivery

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Supply Delivery Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical Supplies

- 10.1.2. Emergency Services

- 10.1.3. Lab Specimens and Reports

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Courier Delivery

- 10.2.2. Drone Delivery

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DHL

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 UPS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Agility

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LogistiCare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FedEx

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CEVA Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Wing

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 International SOS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Matternet

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zipline

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Flirtey

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Swoop Aero

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 DHL

List of Figures

- Figure 1: Global Medical Supply Delivery Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical Supply Delivery Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical Supply Delivery Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical Supply Delivery Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Medical Supply Delivery Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Medical Supply Delivery Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical Supply Delivery Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Supply Delivery Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical Supply Delivery Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical Supply Delivery Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Medical Supply Delivery Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Medical Supply Delivery Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical Supply Delivery Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Supply Delivery Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical Supply Delivery Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical Supply Delivery Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Medical Supply Delivery Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Medical Supply Delivery Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical Supply Delivery Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical Supply Delivery Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical Supply Delivery Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical Supply Delivery Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Medical Supply Delivery Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Medical Supply Delivery Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical Supply Delivery Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Supply Delivery Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical Supply Delivery Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical Supply Delivery Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Medical Supply Delivery Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Medical Supply Delivery Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Supply Delivery Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Supply Delivery Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Supply Delivery Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical Supply Delivery Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Medical Supply Delivery Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Supply Delivery Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Supply Delivery Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Medical Supply Delivery Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical Supply Delivery Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical Supply Delivery Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Medical Supply Delivery Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Supply Delivery Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical Supply Delivery Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Medical Supply Delivery Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical Supply Delivery Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical Supply Delivery Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Medical Supply Delivery Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical Supply Delivery Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical Supply Delivery Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Medical Supply Delivery Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical Supply Delivery Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Supply Delivery Service?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Medical Supply Delivery Service?

Key companies in the market include DHL, UPS, Agility, LogistiCare, FedEx, CEVA Logistics, The Wing, International SOS, Matternet, Zipline, Flirtey, Swoop Aero.

3. What are the main segments of the Medical Supply Delivery Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Supply Delivery Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Supply Delivery Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Supply Delivery Service?

To stay informed about further developments, trends, and reports in the Medical Supply Delivery Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence