Key Insights

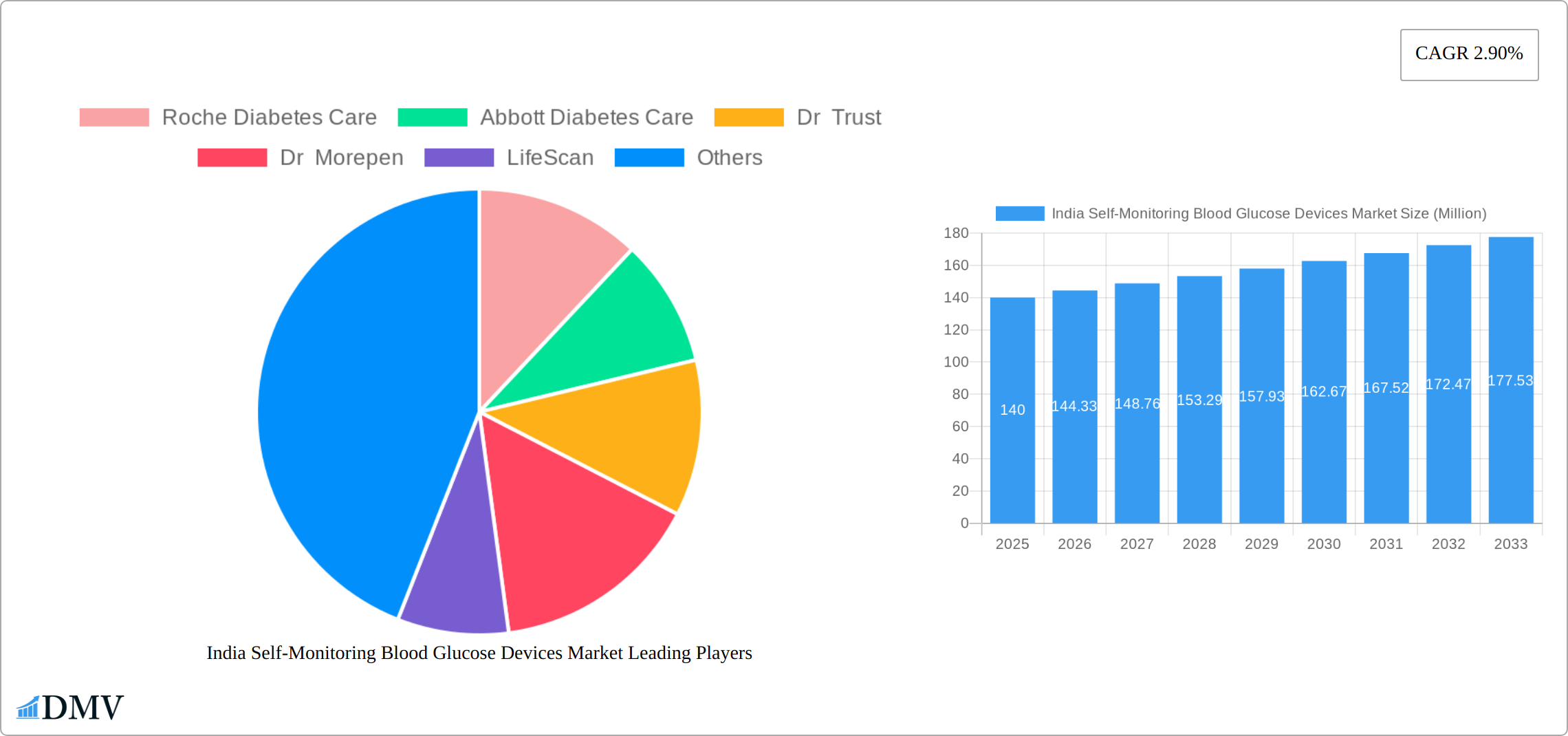

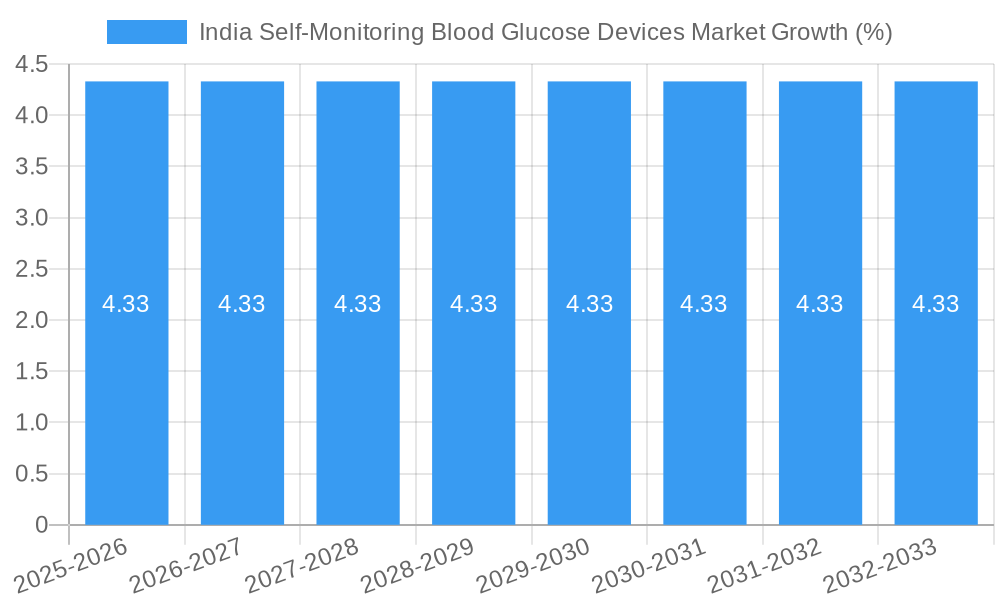

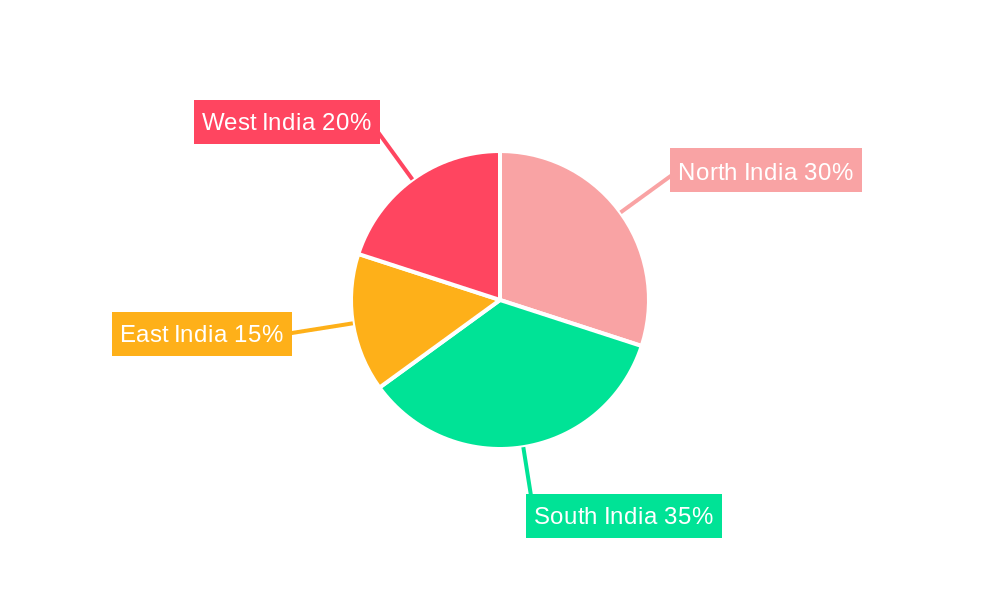

The India self-monitoring blood glucose (SMBG) devices market, valued at approximately ₹140 million in 2025, is projected to experience steady growth, driven by rising diabetes prevalence, increasing awareness of proactive diabetes management, and expanding access to healthcare services. The market's Compound Annual Growth Rate (CAGR) of 2.90% from 2025 to 2033 indicates a sustained, albeit moderate, expansion. Key market segments include glucometer devices, test strips, and lancets, with major players like Roche Diabetes Care, Abbott Diabetes Care, and LifeScan dominating the market share. Growth is further fueled by the increasing adoption of advanced glucometer technologies offering features such as connectivity and data management capabilities, catering to the rising demand for personalized diabetes care. However, the market faces constraints, including the high cost of SMBG devices and supplies, particularly impacting low-income populations. Furthermore, the market penetration of SMBG devices in rural areas remains relatively low, presenting a significant growth opportunity. Regional variations exist within India, with northern and southern regions potentially showing higher demand due to varying prevalence rates and healthcare infrastructure. The market is expected to see increased penetration of affordable and user-friendly devices over the next decade.

The forecast period of 2025-2033 will see consistent growth, influenced by factors such as government initiatives promoting diabetes awareness and prevention programs, coupled with an expanding middle class with increased disposable income. The increasing number of private clinics and healthcare providers across India also contribute to improved accessibility for diabetes patients. The market will likely see innovation in device technology, aiming for greater accuracy, ease of use, and connectivity features to enhance patient compliance and data-driven diabetes management. Furthermore, the market's competitive landscape will continue to evolve, with potential mergers, acquisitions, and new product launches driving growth and influencing market share among established and emerging players. However, maintaining affordability and addressing regional disparities remain significant challenges in ensuring widespread access and effective diabetes management throughout India.

India Self-Monitoring Blood Glucose Devices Market Market Composition & Trends

The India Self-Monitoring Blood Glucose Devices Market is characterized by a dynamic interplay of innovation, regulation, and market consolidation. The market concentration is high, with major players like Roche Diabetes Care, Abbott Diabetes Care, and LifeScan dominating with a combined market share of approximately 60%. Innovation is catalyzed by the increasing prevalence of diabetes, pushing companies to develop more user-friendly and accurate devices. The regulatory landscape is stringent, with the Central Drugs Standard Control Organization (CDSCO) overseeing the approval and quality of devices. Substitute products such as continuous glucose monitoring systems are gaining traction, though self-monitoring devices remain the preferred choice for many due to cost-effectiveness.

End-user profiles reveal a diverse customer base, ranging from urban to rural populations, with varying levels of awareness and affordability. Mergers and acquisitions are pivotal in shaping the market landscape. For instance, the acquisition of Bayer Diabetes Care by Ascensia Diabetes Care in 2016 for $1.2 Million has led to a stronger presence in the Indian market. The market also sees frequent collaborations, as seen with the partnership between Roche Diabetes Care and Sanmina-SCI India in May 2023, aimed at local manufacturing and distribution.

- Market Share Distribution: Roche Diabetes Care (25%), Abbott Diabetes Care (20%), LifeScan (15%), Others (40%)

- M&A Deal Values: Bayer Diabetes Care acquisition by Ascensia Diabetes Care - $1.2 Million

India Self-Monitoring Blood Glucose Devices Market Industry Evolution

The India Self-Monitoring Blood Glucose Devices Market has undergone significant evolution over the study period from 2019 to 2033. The market has experienced a steady growth trajectory, with a compounded annual growth rate (CAGR) of 7.5% from 2019 to 2024. This growth is attributed to the rising diabetes prevalence, increased health awareness, and technological advancements in glucose monitoring devices. Technological innovations, such as the integration of Bluetooth and mobile apps for real-time data tracking, have revolutionized patient care and management. For instance, the adoption rate of smart glucometers increased by 30% in the last three years, reflecting a shift towards more technologically advanced solutions.

Consumer demands have shifted towards devices that offer greater convenience and accuracy. The introduction of no-coding glucometers and devices with smaller blood sample requirements has met these demands effectively. Additionally, the market has seen a surge in demand for affordable options, leading to the emergence of local brands like Dr Trust and Dr Morepen, which offer competitive pricing without compromising on quality. The market's growth is also supported by government initiatives like the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS), which aims to enhance diabetes care infrastructure across the country.

Leading Regions, Countries, or Segments in India Self-Monitoring Blood Glucose Devices Market

Within the India Self-Monitoring Blood Glucose Devices Market, the segment of Test Strips emerges as the dominant player, commanding over 50% of the market share. This dominance can be attributed to several key factors:

- High Consumption Rates: The recurring need for test strips drives consistent demand.

- Affordability: Test strips are generally more affordable than glucometer devices, making them accessible to a broader population.

- Regulatory Support: Government policies promoting diabetes screening and management have increased the usage of test strips.

In-depth analysis reveals that the dominance of test strips is also fueled by strategic investments from leading companies. For instance, Abbott Diabetes Care and Roche Diabetes Care have significantly invested in R&D to enhance the accuracy and usability of their test strips. Furthermore, the widespread availability of these products through pharmacies and online platforms has bolstered their market position. The regulatory environment in India supports this segment, with initiatives like the Ayushman Bharat scheme facilitating easier access to healthcare products, including test strips.

- Investment Trends: Abbott Diabetes Care - $50 Million in R&D for test strips, Roche Diabetes Care - $40 Million in test strip technology

- Regulatory Support: Ayushman Bharat scheme, NPCDCS

India Self-Monitoring Blood Glucose Devices Market Product Innovations

The India Self-Monitoring Blood Glucose Devices Market has witnessed significant product innovations aimed at enhancing user experience and accuracy. Notable advancements include the development of no-coding glucometers, which simplify the testing process, and the integration of smart technology allowing for real-time data tracking and analysis. Companies like Abbott Diabetes Care and Roche Diabetes Care have introduced devices with smaller blood sample requirements, making testing less invasive. These innovations not only improve patient compliance but also cater to the growing demand for more convenient and reliable diabetes management tools.

Propelling Factors for India Self-Monitoring Blood Glucose Devices Market Growth

Several key factors are driving the growth of the India Self-Monitoring Blood Glucose Devices Market. Technological advancements, such as the integration of smart features and connectivity, are enhancing user experience and compliance. Economically, the rising disposable income and increased health awareness among the population are boosting demand. Regulatory initiatives like the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS) are also pivotal, as they promote diabetes management and screening, thereby increasing the need for blood glucose monitoring devices.

Obstacles in the India Self-Monitoring Blood Glucose Devices Market Market

The India Self-Monitoring Blood Glucose Devices Market faces several obstacles that could hinder its growth. Regulatory challenges, such as stringent approval processes, can delay product launches and increase costs. Supply chain disruptions, particularly evident during global events like pandemics, can lead to product shortages and increased prices. Competitive pressures from both international and local players drive down margins and necessitate continuous innovation. These factors collectively impact the market's ability to meet the growing demand for effective diabetes management solutions.

Future Opportunities in India Self-Monitoring Blood Glucose Devices Market

The India Self-Monitoring Blood Glucose Devices Market presents numerous future opportunities. Expansion into rural markets, where diabetes prevalence is rising, offers untapped potential. The integration of AI and machine learning for personalized diabetes management could revolutionize the market. Additionally, the trend towards home healthcare and telemedicine opens new avenues for device manufacturers to cater to a growing segment of health-conscious consumers seeking convenient and effective solutions.

Major Players in the India Self-Monitoring Blood Glucose Devices Market Ecosystem

- Roche Diabetes Care

- Abbott Diabetes Care

- Dr Trust

- Dr Morepen

- LifeScan

- Menarini

- BeatO

- Arkray Inc

- Ascensia Diabetes Care

Key Developments in India Self-Monitoring Blood Glucose Devices Market Industry

- May 2023: Roche Diabetes Care collaborated with Sanmina-SCI India and Parekh Integrated Services for manufacturing and distribution of blood glucose devices. The production of Accu-Chek Active meters in Chennai underscores a commitment to local manufacturing and aligns with global quality standards. This move is expected to enhance market penetration and consumer trust due to the 'Made in India' tag.

- March 2022: Zyla Health launched an integrated offering with Accu-Chek, providing a smart glucometer and continuous diabetes care. Available on Amazon and Flipkart, this initiative has the potential to significantly improve diabetes management across the country by combining technology with expert care.

Strategic India Self-Monitoring Blood Glucose Devices Market Market Forecast

The strategic forecast for the India Self-Monitoring Blood Glucose Devices Market indicates robust growth driven by technological innovations and increasing health awareness. The market is poised to capitalize on future opportunities such as the expansion into rural markets and the integration of AI for personalized diabetes management. The forecast period from 2025 to 2033 is expected to see a continued rise in demand, fueled by government initiatives and a growing emphasis on home healthcare solutions, positioning the market for significant expansion and market potential.

India Self-Monitoring Blood Glucose Devices Market Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

India Self-Monitoring Blood Glucose Devices Market Segmentation By Geography

- 1. India

India Self-Monitoring Blood Glucose Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Roche Diabetes Care

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Abbott Diabetes Care

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dr Trust

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dr Morepen

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 LifeScan

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Menarini

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BeatO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Arkray Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ascensia Diabetes Care

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Roche Diabetes Care

List of Figures

- Figure 1: India Self-Monitoring Blood Glucose Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Self-Monitoring Blood Glucose Devices Market Share (%) by Company 2024

List of Tables

- Table 1: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: North India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: South India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: East India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: West India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: West India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 18: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 19: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Self-Monitoring Blood Glucose Devices Market?

The projected CAGR is approximately 2.90%.

2. Which companies are prominent players in the India Self-Monitoring Blood Glucose Devices Market?

Key companies in the market include Roche Diabetes Care, Abbott Diabetes Care, Dr Trust, Dr Morepen, LifeScan, Menarini, BeatO, Arkray Inc, Ascensia Diabetes Care.

3. What are the main segments of the India Self-Monitoring Blood Glucose Devices Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 140 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in India.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

May 2023: Roche Diabetes Care has collaborated with Sanmina-SCI India and Parekh Integrated Services for manufacturing and distribution of the blood glucose devices. The production of Accu-Chek Active metres will take place in Sanmina’s multi-client manufacturing site in Chennai, in line with globally approved quality standards, the company has said. The new Accu-Chek Active product packs will now display the ‘Made in India’ tag.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Self-Monitoring Blood Glucose Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Self-Monitoring Blood Glucose Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Self-Monitoring Blood Glucose Devices Market?

To stay informed about further developments, trends, and reports in the India Self-Monitoring Blood Glucose Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence