Key Insights

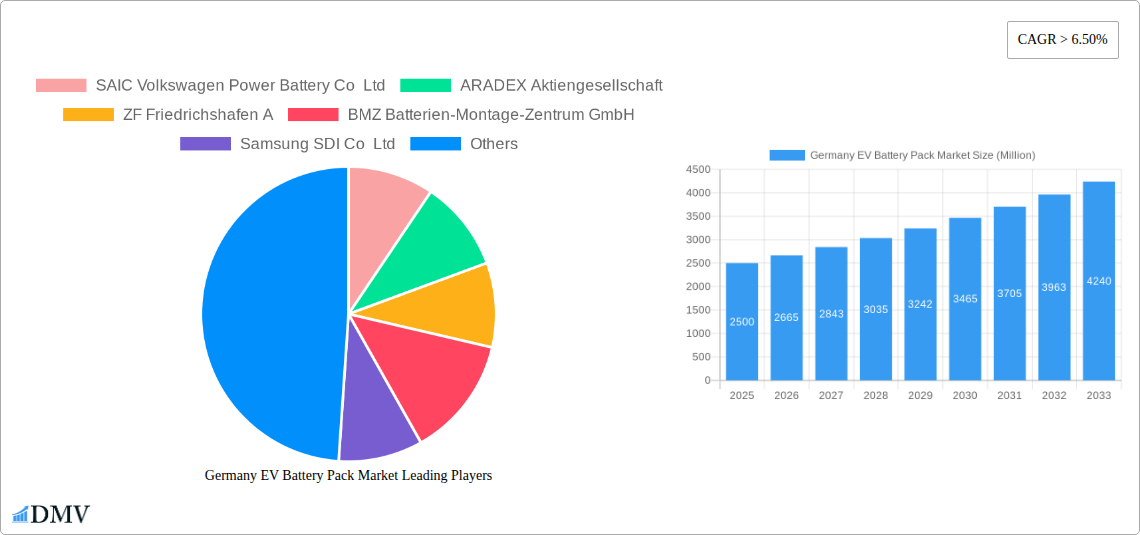

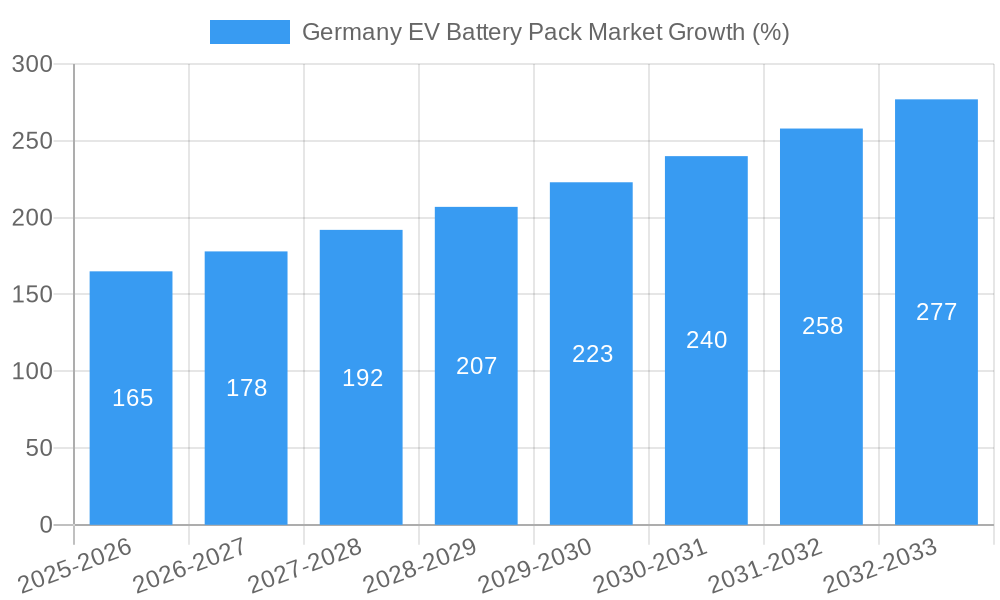

The German EV battery pack market is experiencing robust growth, driven by the increasing adoption of electric vehicles (EVs) within the country and stringent emission regulations promoting electric mobility. The market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market size), is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 6.50% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, significant government investments in EV infrastructure and incentives for EV purchases are stimulating demand. Secondly, technological advancements in battery chemistry (NMC, NCA, LFP) are leading to increased energy density, longer lifespan, and reduced costs, making EVs more attractive to consumers. Furthermore, the diverse range of EV battery pack types catering to various vehicle segments (passenger cars, LCVs, buses) contributes to market expansion. Germany's strong automotive manufacturing base also provides a crucial domestic market for EV battery packs, with major players like Volkswagen, BMW, and Mercedes-Benz driving demand. The increasing focus on sustainable and domestically sourced materials is also creating opportunities for local battery pack manufacturers and suppliers.

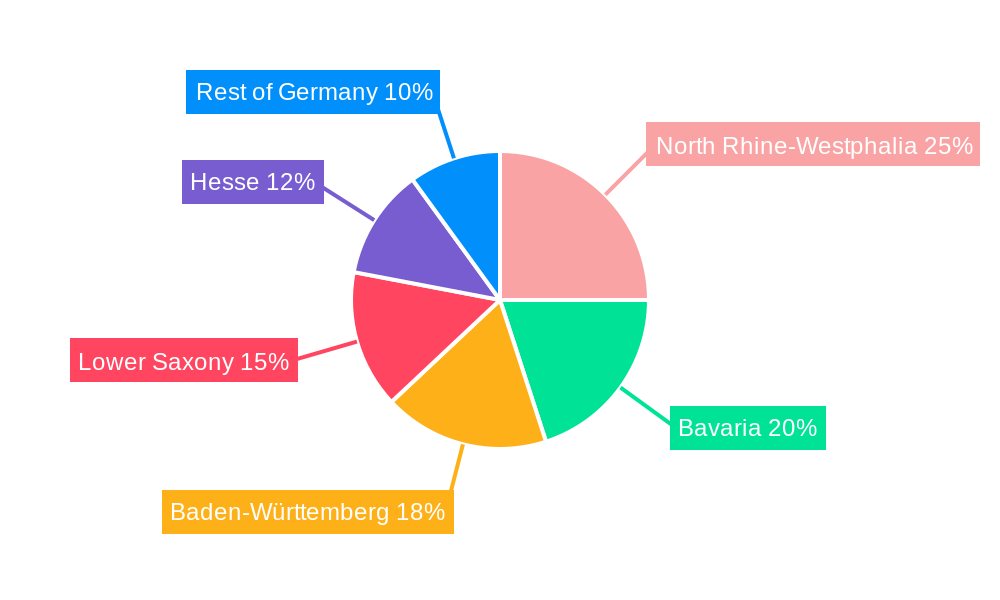

However, challenges remain. The high initial cost of EV battery packs compared to conventional vehicles continues to be a barrier for widespread adoption. Supply chain disruptions and the reliance on imported raw materials pose potential risks to market stability. Competition from established international battery manufacturers presents a challenge for domestic players. Nevertheless, the long-term outlook for the German EV battery pack market remains positive. Ongoing research and development, coupled with supportive government policies, will likely overcome these challenges and ensure sustained growth through 2033. The market segmentation by battery chemistry (LFP, NCA, NMC), capacity, form factor (cylindrical, pouch, prismatic), and vehicle type provides insights for targeted investment and strategic planning. The concentration of battery production in regions like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse further highlights the geographic distribution of growth potential.

Germany EV Battery Pack Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Germany EV Battery Pack Market, offering a comprehensive overview of its current state, future trajectory, and key players. From market size and segmentation to technological advancements and competitive landscape, this report equips stakeholders with crucial data-driven insights for strategic decision-making. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Germany EV Battery Pack Market Market Composition & Trends

The German EV battery pack market is experiencing robust growth, driven by stringent emission regulations, increasing EV adoption, and substantial government incentives. Market concentration is moderate, with several key players holding significant shares, but also allowing space for emerging companies and innovation. The market's evolution is significantly influenced by technological advancements, particularly in battery chemistry (NMC, LFP, NCA) and battery form factors (prismatic, cylindrical, pouch). Regulatory landscapes, including subsidies and environmental standards, continue to shape market dynamics. Substitute products, such as fuel cell technology, pose a limited threat presently due to higher costs and infrastructural challenges. End-users encompass a diverse range, including passenger car manufacturers, commercial vehicle producers (LCV, M&HDT, Bus), and battery pack assemblers. M&A activity remains significant, with deal values reaching xx Million in 2024.

- Market Share Distribution (2024): CATL: xx%; LG Energy Solution: xx%; Samsung SDI: xx%; Others: xx%

- M&A Deal Value (2024): xx Million

- Key Innovation Catalysts: Improved battery energy density, faster charging times, enhanced safety features, and cost reductions.

- Regulatory Landscape: Stringent emission regulations and government subsidies strongly favor EV adoption.

Germany EV Battery Pack Market Industry Evolution

The German EV battery pack market has exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. This growth is propelled by the increasing demand for electric vehicles across various segments (Passenger Cars, LCV, M&HDT, Bus), fueled by government initiatives promoting electromobility and escalating consumer awareness of environmental concerns. Technological advancements, such as the development of high-energy-density battery chemistries like NMC and advancements in battery management systems (BMS), contribute to enhanced performance and range, driving market expansion. Shifting consumer preferences towards sustainable transportation solutions and improved battery life are also significant contributing factors. The market is witnessing an increase in the adoption of battery packs with capacities above 80 kWh, reflecting a trend towards longer driving ranges. Furthermore, the rise of fast-charging technology is further accelerating market growth. The transition to solid-state batteries is expected to revolutionize the industry in the coming years, promising even greater energy density and safety.

Leading Regions, Countries, or Segments in Germany EV Battery Pack Market

The passenger car segment dominates the German EV battery pack market, holding the largest market share, driven by the increasing popularity of electric passenger vehicles. However, other segments like LCV and M&HDT are also showcasing significant growth potential. The NMC battery chemistry currently holds a leading position due to its balance of energy density, cost, and performance. The demand for higher capacity battery packs (above 80 kWh) is growing rapidly, reflecting consumer preferences for extended driving ranges. Prismatic battery form is currently preferred due to its high energy density and scalability, though pouch and cylindrical cells also have significant market shares.

- Key Drivers:

- Substantial government investments in EV infrastructure and incentives.

- Stringent emission regulations pushing for vehicle electrification.

- Growing consumer preference for electric vehicles.

- Technological advancements enhancing battery performance and cost-effectiveness.

- Dominance Factors: The dominance of the passenger car segment is attributed to its large market size and the rapid increase in sales of electric passenger vehicles. The popularity of NMC chemistry results from its superior energy density, cost-effectiveness, and cycle life. High-capacity batteries are becoming increasingly attractive to customers seeking longer driving ranges.

Germany EV Battery Pack Market Product Innovations

Recent innovations focus on enhancing energy density, extending battery lifespan, improving safety features, and reducing costs. The development of solid-state batteries and advancements in battery management systems are transforming the market, providing longer driving ranges, faster charging times, and improved overall vehicle performance. Unique selling propositions encompass enhanced safety mechanisms, superior thermal management, and improved cycle life. These innovations offer significant advantages, attracting consumers and increasing market competitiveness.

Propelling Factors for Germany EV Battery Pack Market Growth

The German EV battery pack market's expansion is primarily fueled by stringent environmental regulations aimed at reducing carbon emissions, substantial government subsidies and tax incentives promoting EV adoption, and growing consumer awareness regarding the environmental benefits of electric vehicles. Technological advancements in battery chemistry, energy density, and charging infrastructure further accelerate market growth.

Obstacles in the Germany EV Battery Pack Market Market

The growth of the German EV battery pack market faces challenges like the high initial cost of EVs, the limited availability of charging infrastructure in certain regions, and potential supply chain disruptions impacting raw material availability and manufacturing processes. Furthermore, the intense competition among various battery manufacturers and the fluctuations in raw material prices pose considerable challenges. These factors can collectively impact overall market expansion.

Future Opportunities in Germany EV Battery Pack Market

Future opportunities lie in the development and adoption of solid-state batteries, advancements in fast-charging technologies, and the expansion of battery recycling infrastructure. The increasing demand for electric commercial vehicles (buses, LCVs, M&HDTs) and the exploration of innovative battery chemistries present lucrative growth avenues. Furthermore, the integration of smart battery management systems enhances overall market potential.

Major Players in the Germany EV Battery Pack Market Ecosystem

- SAIC Volkswagen Power Battery Co Ltd

- ARADEX Aktiengesellschaft

- ZF Friedrichshafen A.G. (ZF Friedrichshafen)

- BMZ Batterien-Montage-Zentrum GmbH

- Samsung SDI Co Ltd (Samsung SDI)

- LG Energy Solution Ltd (LG Energy Solution)

- Monbat AD

- Valeo Siemens eAutomotive (Valeo)

- Deutsche ACCUmotive GmbH & Co KG

- Contemporary Amperex Technology Co Ltd (CATL) (CATL)

- Robert Bosch GmbH (Robert Bosch)

- BYD Company Ltd (BYD)

- Groupe Renault (Renault Group)

- SK Innovation Co Ltd (SK Innovation)

- Automotive Cells Company (ACC)

- Dynamis Batterien GmbH

Key Developments in Germany EV Battery Pack Market Industry

- May 2023: CATL Geely (Sichuan) Power Battery Co., Ltd. achieved carbon neutrality in 2022, as certified by TÜV Rheinland.

- May 2023: CATL launched its first battery cell manufacturing facility outside of China in Erfurt, Germany.

- February 2023: ACC signed a contract with CRITT M2A for quality testing of its Gigafactory battery production.

Strategic Germany EV Battery Pack Market Market Forecast

The German EV battery pack market is poised for significant growth, driven by a confluence of factors including supportive government policies, technological advancements in battery technology, and increasing consumer demand for electric vehicles. The focus on sustainable transportation solutions and the development of high-performance, cost-effective battery packs will shape the market's future. The market's robust growth trajectory is expected to continue throughout the forecast period, making it an attractive investment opportunity.

Germany EV Battery Pack Market Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

- 1.4. Passenger Car

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Battery Chemistry

- 3.1. LFP

- 3.2. NCA

- 3.3. NCM

- 3.4. NMC

- 3.5. Others

-

4. Capacity

- 4.1. 15 kWh to 40 kWh

- 4.2. 40 kWh to 80 kWh

- 4.3. Above 80 kWh

- 4.4. Less than 15 kWh

-

5. Battery Form

- 5.1. Cylindrical

- 5.2. Pouch

- 5.3. Prismatic

-

6. Method

- 6.1. Laser

- 6.2. Wire

-

7. Component

- 7.1. Anode

- 7.2. Cathode

- 7.3. Electrolyte

- 7.4. Separator

-

8. Material Type

- 8.1. Cobalt

- 8.2. Lithium

- 8.3. Manganese

- 8.4. Natural Graphite

- 8.5. Nickel

- 8.6. Other Materials

Germany EV Battery Pack Market Segmentation By Geography

- 1. Germany

Germany EV Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems

- 3.3. Market Restrains

- 3.3.1. Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.1.4. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Battery Chemistry

- 5.3.1. LFP

- 5.3.2. NCA

- 5.3.3. NCM

- 5.3.4. NMC

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. 15 kWh to 40 kWh

- 5.4.2. 40 kWh to 80 kWh

- 5.4.3. Above 80 kWh

- 5.4.4. Less than 15 kWh

- 5.5. Market Analysis, Insights and Forecast - by Battery Form

- 5.5.1. Cylindrical

- 5.5.2. Pouch

- 5.5.3. Prismatic

- 5.6. Market Analysis, Insights and Forecast - by Method

- 5.6.1. Laser

- 5.6.2. Wire

- 5.7. Market Analysis, Insights and Forecast - by Component

- 5.7.1. Anode

- 5.7.2. Cathode

- 5.7.3. Electrolyte

- 5.7.4. Separator

- 5.8. Market Analysis, Insights and Forecast - by Material Type

- 5.8.1. Cobalt

- 5.8.2. Lithium

- 5.8.3. Manganese

- 5.8.4. Natural Graphite

- 5.8.5. Nickel

- 5.8.6. Other Materials

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. North Rhine-Westphalia Germany EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany EV Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SAIC Volkswagen Power Battery Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ARADEX Aktiengesellschaft

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ZF Friedrichshafen A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BMZ Batterien-Montage-Zentrum GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung SDI Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LG Energy Solution Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Monbat AD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Valeo Siemens eAutomotive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Deutsche ACCUmotive GmbH & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Contemporary Amperex Technology Co Ltd (CATL)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Robert Bosch GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BYD Company Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Groupe Renault

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 SK Innovation Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Automotive Cells Company (ACC)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Dynamis Batterien GmbH

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 SAIC Volkswagen Power Battery Co Ltd

List of Figures

- Figure 1: Germany EV Battery Pack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany EV Battery Pack Market Share (%) by Company 2024

List of Tables

- Table 1: Germany EV Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany EV Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 3: Germany EV Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Germany EV Battery Pack Market Revenue Million Forecast, by Battery Chemistry 2019 & 2032

- Table 5: Germany EV Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 6: Germany EV Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 7: Germany EV Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 8: Germany EV Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 9: Germany EV Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 10: Germany EV Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 11: Germany EV Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North Rhine-Westphalia Germany EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Bavaria Germany EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Baden-Württemberg Germany EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Lower Saxony Germany EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Hesse Germany EV Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany EV Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 18: Germany EV Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 19: Germany EV Battery Pack Market Revenue Million Forecast, by Battery Chemistry 2019 & 2032

- Table 20: Germany EV Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 21: Germany EV Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 22: Germany EV Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 23: Germany EV Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Germany EV Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 25: Germany EV Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany EV Battery Pack Market?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the Germany EV Battery Pack Market?

Key companies in the market include SAIC Volkswagen Power Battery Co Ltd, ARADEX Aktiengesellschaft, ZF Friedrichshafen A, BMZ Batterien-Montage-Zentrum GmbH, Samsung SDI Co Ltd, LG Energy Solution Ltd, Monbat AD, Valeo Siemens eAutomotive, Deutsche ACCUmotive GmbH & Co KG, Contemporary Amperex Technology Co Ltd (CATL), Robert Bosch GmbH, BYD Company Ltd, Groupe Renault, SK Innovation Co Ltd, Automotive Cells Company (ACC), Dynamis Batterien GmbH.

3. What are the main segments of the Germany EV Battery Pack Market?

The market segments include Body Type, Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint.

8. Can you provide examples of recent developments in the market?

May 2023: CATL announced that CATL Geely (Sichuan) Power Battery Co., Ltd. (CATL Geely) obtained a carbon neutrality certificate from TÜV Rheinland, marking that the company realized carbon neutrality in 2022. CATL Geely is a wholly-owned subsidiary of CATL Geely Power Battery Co., Ltd., a joint venture between CATL and Zeekr.May 2023: Invest in Thuringia announced that Contemporary Amperex Technology Co. Ltd. (CATL) is building its first battery cell manufacturing facility outside of China in the industry park “Erfurter Kreuz” and officially launched its local production of lithium-ion cells at the end of January 2023.February 2023: ACC has signed a contract with CRITT M2A, a leading reference center for electromobility, for the quality testing of its first Gigafactory battery production in Billy-Berclau Douvrin.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany EV Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany EV Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany EV Battery Pack Market?

To stay informed about further developments, trends, and reports in the Germany EV Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence