Key Insights

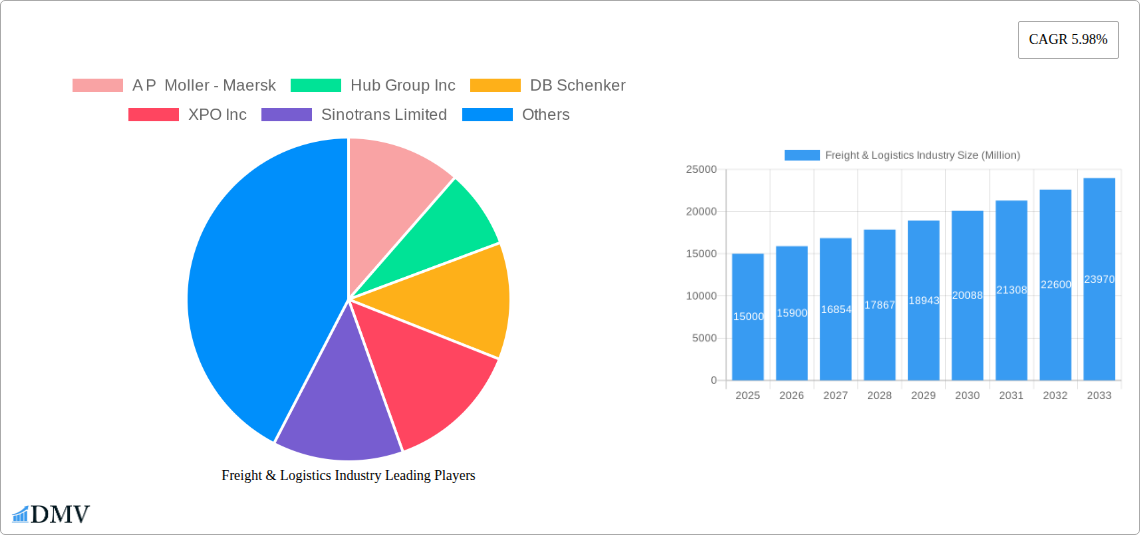

The global freight and logistics industry is experiencing robust growth, driven by the expansion of e-commerce, globalization of supply chains, and increasing demand for efficient transportation solutions across diverse sectors. The industry's Compound Annual Growth Rate (CAGR) of 5.98% from 2019 to 2024 indicates a significant upward trajectory, projected to continue into the forecast period (2025-2033). Key drivers include the rise of technological advancements such as automation, AI-powered route optimization, and real-time tracking systems, improving efficiency and reducing costs. Furthermore, the increasing focus on sustainability and reducing carbon emissions is shaping industry trends, pushing companies to adopt greener logistics practices and invest in alternative fuel vehicles. While factors like geopolitical instability and fluctuating fuel prices pose restraints, the overall market outlook remains positive. The segmentation reveals significant contributions from temperature-controlled services, essential for transporting perishable goods like food and pharmaceuticals, and the agriculture, fishing, and forestry sector, highlighting the crucial role of logistics in supporting essential industries. The dominance of companies like Maersk, DHL, and UPS underscores the highly competitive landscape, with companies increasingly focusing on strategic partnerships and acquisitions to expand their market share and service offerings. The courier, express, and parcel (CEP) segment within logistics functions is a particularly dynamic area, reflecting the surging growth of e-commerce deliveries. The industry's success hinges on adapting to changing consumer demands, technological advancements, and global economic shifts.

The future of the freight and logistics industry is intertwined with the continuing expansion of global trade and the evolving needs of businesses across various sectors. Growth will be fueled by advancements in automation, the adoption of big data analytics for improved supply chain management, and the continued rise of e-commerce, particularly in developing economies. Companies are investing heavily in technological upgrades, improving infrastructure, and exploring innovative solutions to enhance efficiency, track shipments in real-time, and meet the demands for faster and more reliable deliveries. The industry is likely to witness increased consolidation, with larger players acquiring smaller companies to gain a competitive edge. Sustainability initiatives will remain crucial, as businesses strive to minimize their environmental impact through the use of cleaner energy sources and environmentally friendly transportation modes. Regulatory changes and evolving trade policies also present both challenges and opportunities, requiring companies to adapt and navigate the complexities of international trade effectively. This dynamic environment will continue to reshape the industry landscape, presenting both risks and rewards for stakeholders in the coming decade.

Freight & Logistics Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the global freight & logistics industry, encompassing market trends, leading players, technological advancements, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. We delve into the intricate dynamics of this multi-billion dollar industry, offering crucial insights for stakeholders, investors, and industry professionals. The report utilizes data from a range of sources, covering millions of transactions and shipments, allowing for precise forecasting and actionable intelligence.

Freight & Logistics Industry Market Composition & Trends

This section dissects the competitive landscape, highlighting market concentration and the dynamics driving innovation. We analyze the regulatory environment impacting the industry, including potential shifts in policy and their impact on market players. Furthermore, we investigate substitute products, end-user industry profiles, and significant M&A activities, presenting a comprehensive view of the industry's structure and evolution.

- Market Concentration: The global freight and logistics market demonstrates a moderately concentrated structure, with a few dominant players commanding significant market share. The top 10 companies collectively hold an estimated xx% of the market, with the remaining share distributed among numerous smaller entities.

- Innovation Catalysts: Technological advancements like AI, blockchain, and IoT are significantly reshaping the sector, driving efficiencies and creating new service offerings. The report details the impact of these technologies and their adoption rates within the industry.

- Regulatory Landscape: Varying regulatory frameworks across regions influence operational costs, compliance requirements, and market entry barriers. The report explores these variances and their consequential impact on competitiveness.

- Substitute Products: The emergence of alternative logistics solutions, including autonomous vehicles and drone delivery, presents both challenges and opportunities for established players. We evaluate the potential disruption and the market share these alternatives may capture by 2033.

- End-User Profiles: The report categorizes end-user industries, including Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; and Others, analyzing their unique logistics needs and their influence on market demand.

- M&A Activities: Significant merger and acquisition (M&A) activity has reshaped the market landscape over the past five years. Total M&A deal value has reached approximately $xx Million during the historical period (2019-2024), with an average deal size of approximately $xx Million. The report identifies key trends and predicts future M&A activity.

Freight & Logistics Industry Evolution

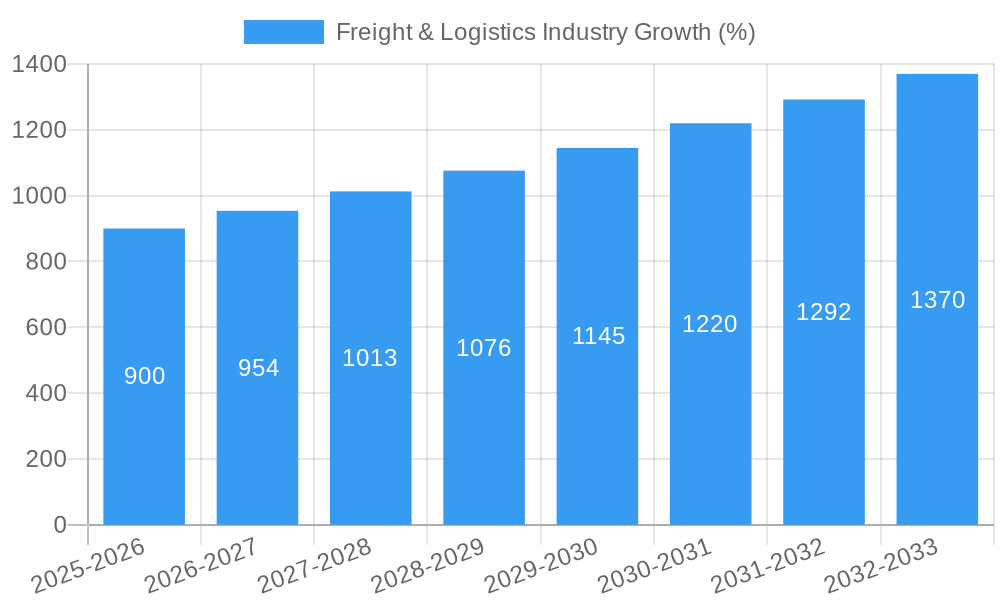

This section examines the historical and projected growth trajectories of the freight & logistics industry. We analyze the influence of technological advancements, such as automated warehousing, predictive analytics, and route optimization software, on market growth and efficiency. Shifting consumer demands, including e-commerce growth and the increasing need for faster delivery times, are also examined. The forecast period (2025-2033) indicates a projected compound annual growth rate (CAGR) of xx%, driven by e-commerce expansion and technological integration. This detailed analysis explores specific data points highlighting market size fluctuations over the historical period. The impact of macroeconomic factors on market growth, such as global trade volumes and economic cycles, is also considered. Adoption of new technologies is estimated to reach xx% by 2033.

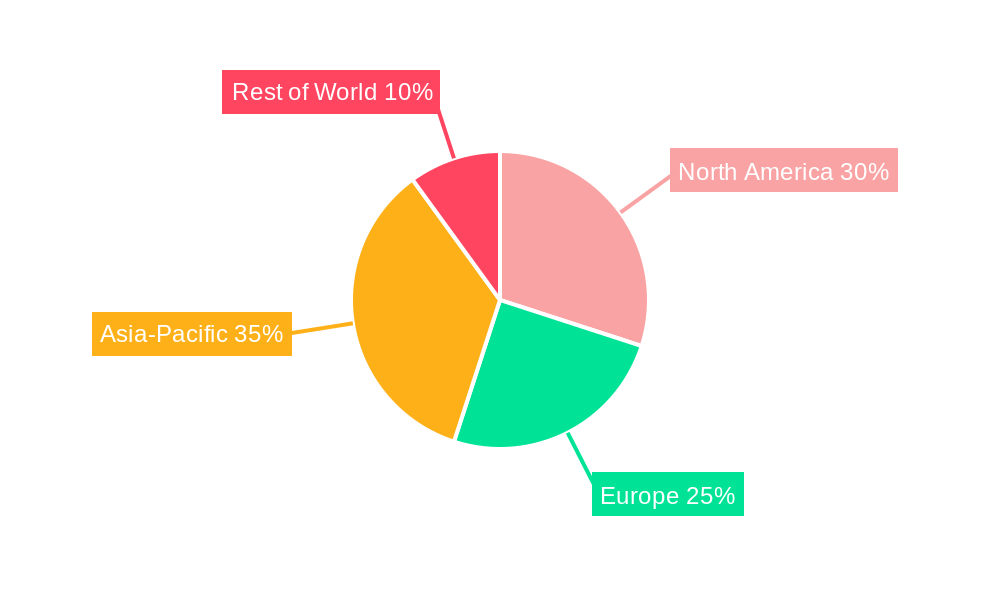

Leading Regions, Countries, or Segments in Freight & Logistics Industry

This section identifies the dominant regions, countries, and segments within the freight & logistics industry. We analyze various factors contributing to their leadership positions.

- Dominant Regions: [Analysis of leading regions, e.g., North America, Asia-Pacific, Europe, etc., explaining their market dominance based on factors such as infrastructure development, economic growth, and consumer behavior. This will include quantifiable data showing market share distribution and growth rates].

- Dominant Countries: [Analysis of leading countries within dominant regions, explaining factors like government policies, investment in infrastructure, and the presence of key players.]

- Dominant Segments:

- Temperature Controlled: This segment is experiencing significant growth fueled by the increasing demand for temperature-sensitive products in the food and pharmaceutical industries.

- Other Services: This diverse segment encompasses a wide range of logistics services, including warehousing, fulfillment, and last-mile delivery. Growth is driven by e-commerce expansion and supply chain optimization initiatives.

- End-User Industries: Manufacturing and Wholesale and Retail Trade currently represent the largest end-user segments, driven by robust global trade and e-commerce growth.

- Logistics Function: The Courier, Express, and Parcel (CEP) segment shows consistently strong growth, reflecting the rise of e-commerce and consumer expectations for rapid delivery. Market size in this segment is predicted to reach $xx Million by 2033.

Key drivers for each dominant segment are highlighted, along with in-depth analysis of their dominance factors. Investment trends, regulatory support, and technological advancements shaping the growth within each segment are explored.

Freight & Logistics Industry Product Innovations

This section explores the latest product innovations, including advancements in transportation technologies, such as autonomous vehicles and drones. New software solutions enabling real-time tracking and predictive analytics are also highlighted. The improvements in warehouse automation, such as robotics and AI-powered inventory management systems, are analyzed, underscoring their impact on efficiency and cost reduction. These innovations directly improve delivery speed, accuracy, and overall customer satisfaction, enhancing the unique selling propositions offered by freight and logistics companies.

Propelling Factors for Freight & Logistics Industry Growth

The growth of the freight & logistics industry is propelled by several key factors. E-commerce expansion significantly increases demand for efficient and reliable delivery services. Technological advancements, like AI-powered route optimization and automated warehousing, enhance operational efficiency and reduce costs. Favorable government policies and investments in infrastructure further support industry growth. The increasing globalization of trade necessitates robust and efficient logistics networks, driving market expansion.

Obstacles in the Freight & Logistics Industry Market

Despite its growth potential, the freight & logistics industry faces numerous obstacles. Supply chain disruptions, such as port congestion and labor shortages, cause significant delays and increase costs. Fluctuating fuel prices directly impact transportation expenses. Stringent regulatory compliance requirements necessitate considerable investments in technology and compliance programs. Intense competition among numerous players adds pressure on pricing and profitability. The combined impact of these factors currently accounts for an estimated xx% reduction in industry profits annually.

Future Opportunities in Freight & Logistics Industry

The freight & logistics industry presents many opportunities for future growth. The expansion of e-commerce into new markets creates a demand for efficient last-mile delivery solutions. Technological advancements, like blockchain technology for improved supply chain transparency and autonomous vehicles for cost-effective transport, provide immense growth potential. The increasing focus on sustainability opens opportunities for green logistics solutions, such as electric vehicles and eco-friendly packaging.

Major Players in the Freight & Logistics Industry Ecosystem

- A P Moller - Maersk

- Hub Group Inc

- DB Schenker

- XPO Inc

- Sinotrans Limited

- Hellmann Worldwide Logistics

- Bollore logistics

- Orient Overseas Container Line (OOCL Logistics)

- Total Quality Logistics

- Landstar System Inc

- JD Logistics

- C H Robinson

- NYK (Nippon Yusen Kaisha) Line

- Culina Group

- Yamato Holdings Co Ltd

- DHL Group

- Uber Technologies Inc

- LOGWIN

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- CTS Logistics Group

- Poste Italiane

- GEODIS

- Dachser

- Penske Logistics

- Mainfreight

- LX International Corp

- FedEx

- GXO Logistics

- Kintetsu World Express

- Savino Del Bene

- Kuehne + Nagel

- United Parcel Service of America Inc (UPS)

- International Distributions Services

- Americold

- La Poste Group

- CJ Logistics

- TIBA Group

- Aramex

- Allcargo Logistics Ltd

- NFI Industries

- Japan Post Holdings Co Ltd

- J B Hunt Transport Inc

- KEX Express (US) LLC

- DP World

- Expeditors International of Washington Inc

- Ryder System Inc

- CMA CGM Group

Key Developments in Freight & Logistics Industry Industry

- March 2024: Aramex expands its presence in Saudi Arabia with a new regional office in Riyadh, aiming to enhance its services and contribute to the Kingdom's Vision 2030 logistics goals.

- March 2024: Aramex introduces a fleet of electric motorcycles for last-mile delivery in the UAE, aligning with its sustainability goals of 98% electric vehicles by 2030.

- February 2024: C.H. Robinson launches new AI-powered technology to optimize appointment scheduling for freight pickup and delivery, improving efficiency across its extensive network.

Strategic Freight & Logistics Industry Market Forecast

The freight & logistics market is poised for robust growth driven by ongoing technological advancements, expanding e-commerce, and increasing global trade. The convergence of automation, data analytics, and sustainable practices will reshape industry operations. New market entrants and innovative business models will enhance competition, while strategic alliances and M&A activity will continue to consolidate market share. The industry's future depends on its ability to adapt to evolving consumer demands, embrace technological innovations, and address environmental concerns. The projected market size for 2033 is estimated at $xx Million.

Freight & Logistics Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Freight & Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Freight & Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Logistics Function

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.2.1.1. By Destination Type

- 6.2.1.1.1. Domestic

- 6.2.1.1.2. International

- 6.2.1.1. By Destination Type

- 6.2.2. Freight Forwarding

- 6.2.2.1. By Mode Of Transport

- 6.2.2.1.1. Air

- 6.2.2.1.2. Sea and Inland Waterways

- 6.2.2.1.3. Others

- 6.2.2.1. By Mode Of Transport

- 6.2.3. Freight Transport

- 6.2.3.1. Pipelines

- 6.2.3.2. Rail

- 6.2.3.3. Road

- 6.2.4. Warehousing and Storage

- 6.2.4.1. By Temperature Control

- 6.2.4.1.1. Non-Temperature Controlled

- 6.2.4.1. By Temperature Control

- 6.2.5. Other Services

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Logistics Function

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.2.1.1. By Destination Type

- 7.2.1.1.1. Domestic

- 7.2.1.1.2. International

- 7.2.1.1. By Destination Type

- 7.2.2. Freight Forwarding

- 7.2.2.1. By Mode Of Transport

- 7.2.2.1.1. Air

- 7.2.2.1.2. Sea and Inland Waterways

- 7.2.2.1.3. Others

- 7.2.2.1. By Mode Of Transport

- 7.2.3. Freight Transport

- 7.2.3.1. Pipelines

- 7.2.3.2. Rail

- 7.2.3.3. Road

- 7.2.4. Warehousing and Storage

- 7.2.4.1. By Temperature Control

- 7.2.4.1.1. Non-Temperature Controlled

- 7.2.4.1. By Temperature Control

- 7.2.5. Other Services

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Logistics Function

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.2.1.1. By Destination Type

- 8.2.1.1.1. Domestic

- 8.2.1.1.2. International

- 8.2.1.1. By Destination Type

- 8.2.2. Freight Forwarding

- 8.2.2.1. By Mode Of Transport

- 8.2.2.1.1. Air

- 8.2.2.1.2. Sea and Inland Waterways

- 8.2.2.1.3. Others

- 8.2.2.1. By Mode Of Transport

- 8.2.3. Freight Transport

- 8.2.3.1. Pipelines

- 8.2.3.2. Rail

- 8.2.3.3. Road

- 8.2.4. Warehousing and Storage

- 8.2.4.1. By Temperature Control

- 8.2.4.1.1. Non-Temperature Controlled

- 8.2.4.1. By Temperature Control

- 8.2.5. Other Services

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Logistics Function

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.2.1.1. By Destination Type

- 9.2.1.1.1. Domestic

- 9.2.1.1.2. International

- 9.2.1.1. By Destination Type

- 9.2.2. Freight Forwarding

- 9.2.2.1. By Mode Of Transport

- 9.2.2.1.1. Air

- 9.2.2.1.2. Sea and Inland Waterways

- 9.2.2.1.3. Others

- 9.2.2.1. By Mode Of Transport

- 9.2.3. Freight Transport

- 9.2.3.1. Pipelines

- 9.2.3.2. Rail

- 9.2.3.3. Road

- 9.2.4. Warehousing and Storage

- 9.2.4.1. By Temperature Control

- 9.2.4.1.1. Non-Temperature Controlled

- 9.2.4.1. By Temperature Control

- 9.2.5. Other Services

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Freight & Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Logistics Function

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.2.1.1. By Destination Type

- 10.2.1.1.1. Domestic

- 10.2.1.1.2. International

- 10.2.1.1. By Destination Type

- 10.2.2. Freight Forwarding

- 10.2.2.1. By Mode Of Transport

- 10.2.2.1.1. Air

- 10.2.2.1.2. Sea and Inland Waterways

- 10.2.2.1.3. Others

- 10.2.2.1. By Mode Of Transport

- 10.2.3. Freight Transport

- 10.2.3.1. Pipelines

- 10.2.3.2. Rail

- 10.2.3.3. Road

- 10.2.4. Warehousing and Storage

- 10.2.4.1. By Temperature Control

- 10.2.4.1.1. Non-Temperature Controlled

- 10.2.4.1. By Temperature Control

- 10.2.5. Other Services

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 A P Moller - Maersk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hub Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DB Schenker

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 XPO Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sinotrans Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hellmann Worldwide Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bollore logistics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Orient Overseas Container Line (OOCL Logistics)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Total Quality Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Landstar System Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 JD Logistics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 C H Robinson

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 NYK (Nippon Yusen Kaisha) Line

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Culina Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yamato Holdings Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 DHL Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Uber Technologies Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 LOGWIN

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 CTS Logistics Group

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Poste Italiane

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 GEODIS

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Dachser

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Penske Logistics

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Mainfreight

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 LX International Corp

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 FedEx

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 GXO Logistics

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Kintetsu World Express

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Savino Del Bene

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 Kuehne + Nagel

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 United Parcel Service of America Inc (UPS)

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 International Distributions Services

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.34 Americold

- 11.2.34.1. Overview

- 11.2.34.2. Products

- 11.2.34.3. SWOT Analysis

- 11.2.34.4. Recent Developments

- 11.2.34.5. Financials (Based on Availability)

- 11.2.35 La Poste Group

- 11.2.35.1. Overview

- 11.2.35.2. Products

- 11.2.35.3. SWOT Analysis

- 11.2.35.4. Recent Developments

- 11.2.35.5. Financials (Based on Availability)

- 11.2.36 CJ Logistics

- 11.2.36.1. Overview

- 11.2.36.2. Products

- 11.2.36.3. SWOT Analysis

- 11.2.36.4. Recent Developments

- 11.2.36.5. Financials (Based on Availability)

- 11.2.37 TIBA Group

- 11.2.37.1. Overview

- 11.2.37.2. Products

- 11.2.37.3. SWOT Analysis

- 11.2.37.4. Recent Developments

- 11.2.37.5. Financials (Based on Availability)

- 11.2.38 Aramex

- 11.2.38.1. Overview

- 11.2.38.2. Products

- 11.2.38.3. SWOT Analysis

- 11.2.38.4. Recent Developments

- 11.2.38.5. Financials (Based on Availability)

- 11.2.39 Allcargo Logistics Ltd

- 11.2.39.1. Overview

- 11.2.39.2. Products

- 11.2.39.3. SWOT Analysis

- 11.2.39.4. Recent Developments

- 11.2.39.5. Financials (Based on Availability)

- 11.2.40 NFI Industries

- 11.2.40.1. Overview

- 11.2.40.2. Products

- 11.2.40.3. SWOT Analysis

- 11.2.40.4. Recent Developments

- 11.2.40.5. Financials (Based on Availability)

- 11.2.41 Japan Post Holdings Co Ltd

- 11.2.41.1. Overview

- 11.2.41.2. Products

- 11.2.41.3. SWOT Analysis

- 11.2.41.4. Recent Developments

- 11.2.41.5. Financials (Based on Availability)

- 11.2.42 J B Hunt Transport Inc

- 11.2.42.1. Overview

- 11.2.42.2. Products

- 11.2.42.3. SWOT Analysis

- 11.2.42.4. Recent Developments

- 11.2.42.5. Financials (Based on Availability)

- 11.2.43 KEX Express (US) LLC

- 11.2.43.1. Overview

- 11.2.43.2. Products

- 11.2.43.3. SWOT Analysis

- 11.2.43.4. Recent Developments

- 11.2.43.5. Financials (Based on Availability)

- 11.2.44 DP World

- 11.2.44.1. Overview

- 11.2.44.2. Products

- 11.2.44.3. SWOT Analysis

- 11.2.44.4. Recent Developments

- 11.2.44.5. Financials (Based on Availability)

- 11.2.45 Expeditors International of Washington Inc

- 11.2.45.1. Overview

- 11.2.45.2. Products

- 11.2.45.3. SWOT Analysis

- 11.2.45.4. Recent Developments

- 11.2.45.5. Financials (Based on Availability)

- 11.2.46 Ryder System Inc

- 11.2.46.1. Overview

- 11.2.46.2. Products

- 11.2.46.3. SWOT Analysis

- 11.2.46.4. Recent Developments

- 11.2.46.5. Financials (Based on Availability)

- 11.2.47 CMA CGM Group

- 11.2.47.1. Overview

- 11.2.47.2. Products

- 11.2.47.3. SWOT Analysis

- 11.2.47.4. Recent Developments

- 11.2.47.5. Financials (Based on Availability)

- 11.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Global Freight & Logistics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Freight & Logistics Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 3: North America Freight & Logistics Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 4: North America Freight & Logistics Industry Revenue (Million), by Logistics Function 2024 & 2032

- Figure 5: North America Freight & Logistics Industry Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 6: North America Freight & Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Freight & Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Freight & Logistics Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 9: South America Freight & Logistics Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 10: South America Freight & Logistics Industry Revenue (Million), by Logistics Function 2024 & 2032

- Figure 11: South America Freight & Logistics Industry Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 12: South America Freight & Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Freight & Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Freight & Logistics Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 15: Europe Freight & Logistics Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 16: Europe Freight & Logistics Industry Revenue (Million), by Logistics Function 2024 & 2032

- Figure 17: Europe Freight & Logistics Industry Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 18: Europe Freight & Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Freight & Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Freight & Logistics Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 21: Middle East & Africa Freight & Logistics Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 22: Middle East & Africa Freight & Logistics Industry Revenue (Million), by Logistics Function 2024 & 2032

- Figure 23: Middle East & Africa Freight & Logistics Industry Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 24: Middle East & Africa Freight & Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Freight & Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Freight & Logistics Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 27: Asia Pacific Freight & Logistics Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 28: Asia Pacific Freight & Logistics Industry Revenue (Million), by Logistics Function 2024 & 2032

- Figure 29: Asia Pacific Freight & Logistics Industry Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 30: Asia Pacific Freight & Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Freight & Logistics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Freight & Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Global Freight & Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 7: Global Freight & Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 13: Global Freight & Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 18: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 19: Global Freight & Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 30: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 31: Global Freight & Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Freight & Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 39: Global Freight & Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 40: Global Freight & Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Freight & Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Freight & Logistics Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Freight & Logistics Industry?

Key companies in the market include A P Moller - Maersk, Hub Group Inc, DB Schenker, XPO Inc, Sinotrans Limited, Hellmann Worldwide Logistics, Bollore logistics, Orient Overseas Container Line (OOCL Logistics), Total Quality Logistics, Landstar System Inc, JD Logistics, C H Robinson, NYK (Nippon Yusen Kaisha) Line, Culina Group, Yamato Holdings Co Ltd, DHL Group, Uber Technologies Inc, LOGWIN, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), CTS Logistics Group, Poste Italiane, GEODIS, Dachser, Penske Logistics, Mainfreight, LX International Corp, FedEx, GXO Logistics, Kintetsu World Express, Savino Del Bene, Kuehne + Nagel, United Parcel Service of America Inc (UPS), International Distributions Services, Americold, La Poste Group, CJ Logistics, TIBA Group, Aramex, Allcargo Logistics Ltd, NFI Industries, Japan Post Holdings Co Ltd, J B Hunt Transport Inc, KEX Express (US) LLC, DP World, Expeditors International of Washington Inc, Ryder System Inc, CMA CGM Group.

3. What are the main segments of the Freight & Logistics Industry?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

March 2024: Aramex had strengthened its presence in Saudi Arabia with the inauguration of a new regional office in Riyadh, to significantly enhance Aramex's capabilities to serve new and existing businesses across the region and also to boost the Kingdom's logistics infrastructure and to contribute to the Vision 2030 goal of establishing Saudi Arabia as a global logistics hub.March 2024: Aramex had introduced a fleet of fully electric motorcycles to its last-mile delivery vehicles in the United Arab Emirates (UAE). This initiative is part of Aramex’s long-term strategic goal to achieve a total fleet of 98% Electric Vehicles (EVs) by 2030, aligned with Science Based Targets initiative (SBTi) target that Aramex is committed to. The e-bikes were introduced after intensive testing of several different models and manufacturers, and Aramex finalized the selected model based on its enduring performance and stability, particularly in local weather conditions.February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Freight & Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Freight & Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Freight & Logistics Industry?

To stay informed about further developments, trends, and reports in the Freight & Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence