Key Insights

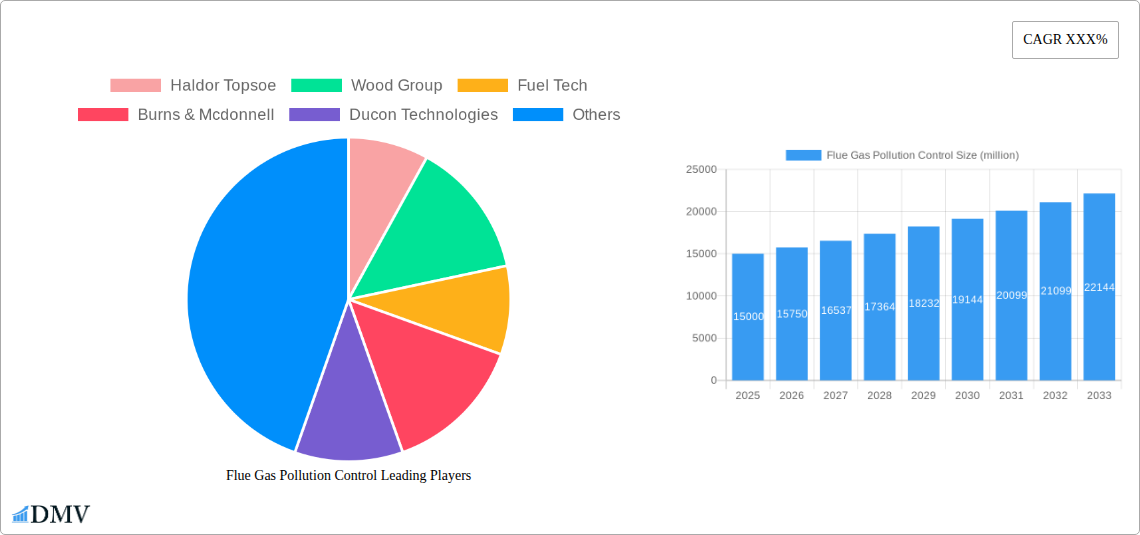

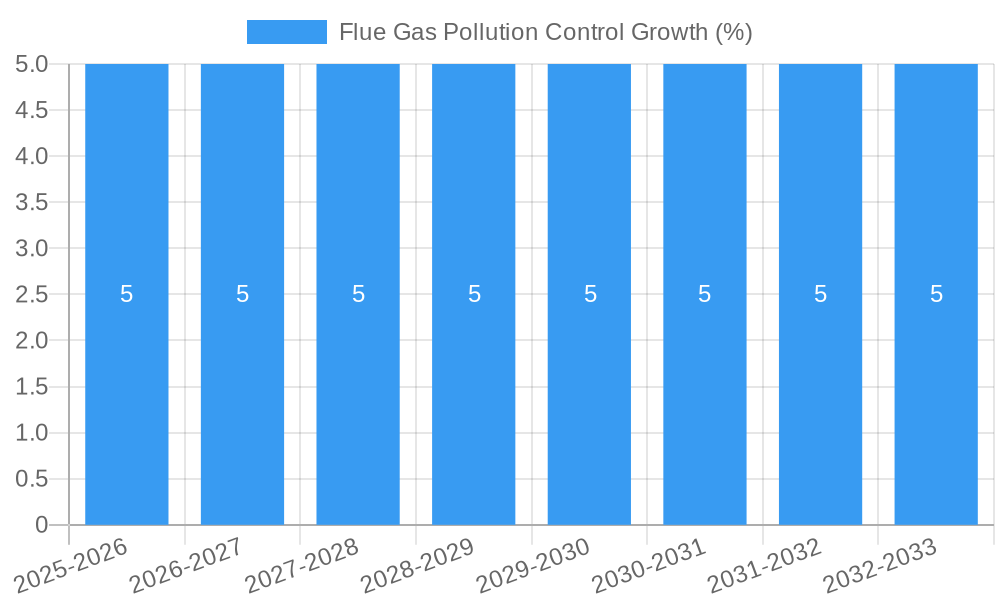

The global Flue Gas Pollution Control market is poised for substantial growth, projected to reach a significant market size, driven by escalating environmental regulations and a growing awareness of air quality's impact on public health. This market is experiencing a robust Compound Annual Growth Rate (CAGR), reflecting increasing investments in technologies designed to mitigate emissions from industrial processes and power generation. Key drivers include stricter government mandates on pollutants like sulfur dioxide (SO2), nitrogen oxides (NOx), and particulate matter, coupled with the expansion of industrial sectors, particularly in emerging economies. The demand for advanced flue gas treatment solutions is further amplified by the pressing need to reduce greenhouse gas emissions and combat climate change. Technologies such as scrubbers for desulfurization and selective catalytic reduction (SCR) for denitrification are gaining prominence, contributing to the market's upward trajectory.

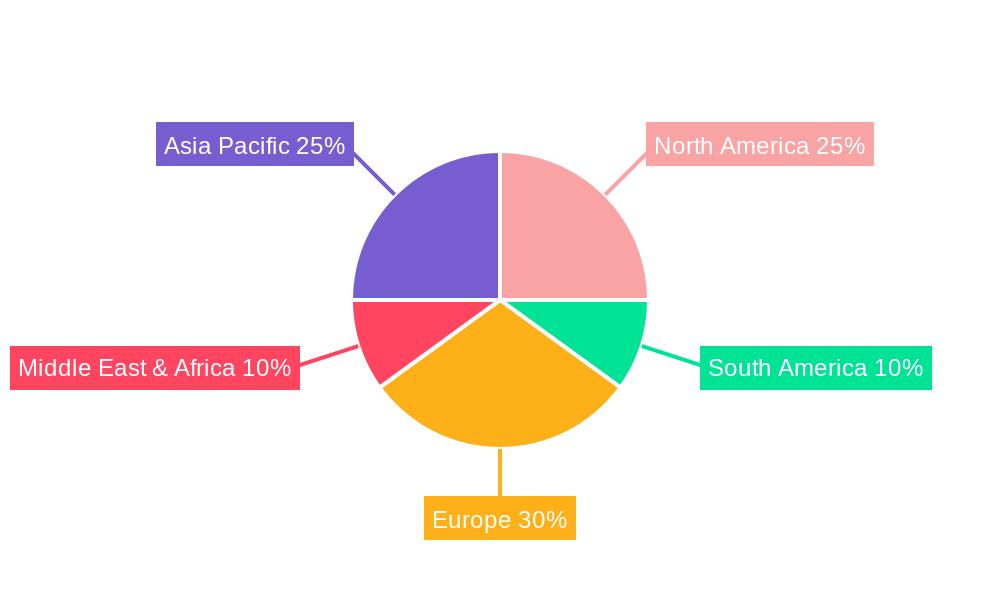

The market is segmented across various applications, with the chemical industry and municipal waste treatment facilities being significant contributors to demand. The 'Dust Removal Control' segment, crucial for capturing particulate matter, holds a substantial share, while 'Desulphurisation Control' and 'Denitrification Control' segments are expected to witness accelerated growth due to stringent SO2 and NOx emission standards. Geographically, the Asia Pacific region, led by China and India, is emerging as a dominant force due to rapid industrialization and government initiatives focused on improving air quality. North America and Europe continue to be mature markets with a steady demand for retrofitting existing infrastructure and adopting newer, more efficient pollution control systems. Restraints in the market, such as high initial capital investment for advanced systems and the operational complexity of certain technologies, are being addressed through ongoing research and development, focusing on cost-effective and energy-efficient solutions, thereby ensuring sustained market expansion in the coming years.

Certainly! Here is an SEO-optimized and insightful report description for Flue Gas Pollution Control, crafted with your specific requirements in mind:

Flue Gas Pollution Control Market Composition & Trends

The global Flue Gas Pollution Control market is characterized by a dynamic interplay of innovation, stringent environmental regulations, and evolving industry needs. With a market size projected to reach several million by 2033, this sector is witnessing significant consolidation and strategic collaborations among key players. The concentration of market share is gradually shifting as new technologies emerge, driving competition and fostering a landscape ripe for M&A activities. The value of M&A deals in the historical period (2019-2024) alone is estimated in the hundreds of millions, indicating a robust appetite for growth and market expansion. Regulatory frameworks worldwide are becoming increasingly stringent, acting as a primary catalyst for innovation in industrial emissions control and air pollution abatement technologies. Companies are actively investing in R&D to develop more efficient and cost-effective solutions for desulphurisation control, denitrification control, and dust removal control. The threat of substitute products remains low due to the inherent nature of industrial processes, but ongoing advancements in alternative energy sources could indirectly influence demand over the long term. End-user profiles span a wide spectrum, from heavy industries like power generation and manufacturing to critical sectors such as chemical and municipalities, each with unique emission control challenges and compliance requirements.

- Market Share Distribution: Dominated by established players, but with growing influence from specialized technology providers.

- M&A Deal Values (Historical Period 2019-2024): Estimated in the range of [Insert Estimated Value] million.

- Innovation Catalysts: Escalating environmental compliance mandates, technological breakthroughs in scrubbing and filtration, and demand for sustainable industrial operations.

- Regulatory Landscapes: Increasingly stringent emission standards globally, driving investment in advanced air quality management systems.

- Substitute Products: Limited direct substitutes for established flue gas treatment processes, but indirect impact from renewable energy adoption.

- End-User Profiles: Power generation, petrochemicals, cement, steel, chemical manufacturing, waste-to-energy, and municipal facilities.

Flue Gas Pollution Control Industry Evolution

The Flue Gas Pollution Control industry has undergone a profound transformation over the historical period (2019-2024), driven by a confluence of environmental imperatives, technological innovation, and evolving global economic trends. During this period, the market has demonstrated consistent growth trajectories, averaging an estimated [Insert Growth Rate]% annually. This expansion is largely attributable to the escalating global concern for air quality and the corresponding implementation of stricter environmental regulations by governmental bodies across continents. As a result, industries worldwide are compelled to invest significantly in flue gas treatment solutions to minimize their environmental footprint and comply with emission limits for pollutants such as sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter.

Technological advancements have been at the forefront of this evolution. Early adoption metrics show a substantial increase in the deployment of advanced desulphurisation control systems, particularly wet scrubbers and dry sorbent injection methods, which have seen their market penetration grow by an estimated [Insert Adoption Metric]% since 2019. Similarly, denitrification control technologies, including Selective Catalytic Reduction (SCR) and Selective Non-Catalytic Reduction (SNCR), have witnessed significant uptake due to their effectiveness in reducing NOx emissions, a major contributor to smog and acid rain. The market for dust removal control technologies, encompassing baghouses and electrostatic precipitators, has also seen steady growth, driven by the need to capture fine particulate matter.

Shifting consumer and societal demands for cleaner air and sustainable industrial practices have further amplified the industry's growth. Companies are increasingly recognizing that robust emissions control is not just a compliance issue but a crucial aspect of corporate social responsibility and brand reputation. This has led to a greater emphasis on adopting integrated pollution control strategies that offer higher efficiency and lower operational costs. The base year of 2025 is projected to witness a market value of several million, with a strong forecast period (2025-2033) anticipating continued expansion as investments in cleaner technologies accelerate. The industry's evolution is marked by a transition from basic pollution mitigation to sophisticated, data-driven air quality management, integrating advanced monitoring and control systems to optimize performance and ensure continuous compliance. This dynamic landscape underscores the critical role of flue gas pollution control in achieving global sustainability goals.

Leading Regions, Countries, or Segments in Flue Gas Pollution Control

The Flue Gas Pollution Control market exhibits significant regional and sectoral dominance, driven by a complex interplay of regulatory stringency, industrial activity, and economic development. Among the Application segments, the Chemical industry stands out as a pivotal area for industrial emissions control. This dominance stems from the inherent nature of chemical manufacturing processes, which often generate a broad spectrum of pollutants requiring sophisticated abatement technologies. The chemical sector's continuous drive for operational efficiency and product quality, coupled with increasingly stringent environmental regulations globally, compels substantial investment in advanced flue gas treatment solutions. Countries with robust chemical manufacturing bases, such as China, the United States, and Germany, are therefore leading the charge in adopting these technologies.

Within the Type segment, Desulphurisation Control technologies command a significant market share. The ubiquitous presence of sulfur dioxide (SOx) emissions, particularly from the combustion of fossil fuels in power generation and heavy industries, makes SOx abatement a primary focus. Regions with a high reliance on coal-fired power plants, such as parts of Asia and Eastern Europe, are experiencing substantial demand for desulphurisation systems. Similarly, Denitrification Control technologies are gaining immense traction as regulations targeting nitrogen oxides (NOx) emissions become more pervasive. The rising awareness of NOx's contribution to ground-level ozone and respiratory illnesses is driving adoption in regions with dense urban populations and significant vehicular and industrial emissions.

Dominant Application: Chemical:

- Key Drivers: High volume and variety of emissions, stringent regulatory compliance for hazardous air pollutants, and demand for process efficiency.

- Investment Trends: Significant capital expenditure on advanced scrubbing and filtration technologies.

- Regulatory Support: Strict environmental standards for SOx, NOx, particulate matter, and VOCs.

- Market Size Impact: Contributes a substantial portion of the overall flue gas treatment systems market value.

Dominant Type: Desulphurisation Control:

- Key Drivers: Ubiquitous SOx emissions from fossil fuel combustion, legacy power plant upgrades, and industrial facility compliance.

- Technological Advancements: Dominance of wet scrubbers and increasing adoption of dry sorbent injection and circulating fluidised bed technologies.

- Regional Focus: High demand in regions with significant coal-fired power generation capacity and heavy industries.

- Market Growth: Expected to maintain a strong growth trajectory due to ongoing energy infrastructure development and emissions reduction targets.

Dominant Type: Denitrification Control:

- Key Drivers: Growing awareness of NOx's health and environmental impacts, stricter air quality standards, and demand for cleaner combustion processes.

- Technological Advancements: Widespread adoption of SCR and SNCR, with ongoing innovation in catalyst efficiency and system integration.

- Regional Focus: Strong demand in industrialized nations and urban areas with high traffic and industrial density.

- Market Growth: Anticipated to be a key growth segment driven by new installations and retrofitting projects.

The Municipalities segment, while also a significant contributor, often focuses on waste-to-energy plants and municipal solid waste incineration, where dust removal control and SOx/NOx reduction are paramount. The "Others" category encompasses a diverse range of applications, from small-scale industrial boilers to agricultural emissions, each with its own set of challenges and technological requirements. Overall, the interplay of these factors positions the chemical sector and desulphurisation/denitrification technologies as central to the current and future landscape of flue gas pollution control.

Flue Gas Pollution Control Product Innovations

Innovations in flue gas pollution control are rapidly transforming the industry, offering enhanced efficiency and reduced environmental impact. Companies are developing next-generation catalysts for denitrification control that exhibit superior performance at lower temperatures, thereby reducing energy consumption and operational costs. Advanced scrubbing technologies are emerging with modular designs for easier installation and maintenance, alongside enhanced sorbent materials for more effective desulphurisation control. Furthermore, smart monitoring systems integrated with AI are optimizing the performance of dust removal control equipment like baghouses and electrostatic precipitators, ensuring real-time compliance and predictive maintenance. These advancements not only meet increasingly stringent regulatory demands but also present unique selling propositions centered on sustainability and economic viability in the industrial emissions control sector.

Propelling Factors for Flue Gas Pollution Control Growth

The Flue Gas Pollution Control market is propelled by a confluence of potent factors. Foremost is the escalating global regulatory pressure to curb industrial emissions, mandating reductions in SOx, NOx, and particulate matter, thereby driving demand for air pollution abatement technologies. Technological advancements, particularly in areas like Selective Catalytic Reduction (SCR) for denitrification control and advanced scrubbing techniques for desulphurisation control, are making solutions more efficient and cost-effective. Economic growth in emerging markets fuels industrial expansion, necessitating the implementation of flue gas treatment systems. Moreover, increasing corporate social responsibility initiatives and growing public awareness of air quality issues are compelling industries to proactively invest in cleaner operations, further stimulating the adoption of comprehensive emissions control strategies.

Obstacles in the Flue Gas Pollution Control Market

Despite robust growth, the Flue Gas Pollution Control market faces several significant obstacles. High initial capital investment for advanced flue gas treatment systems, especially for retrofitting older industrial facilities, can be a substantial barrier, particularly for small and medium-sized enterprises. Stringent and sometimes inconsistent regulatory frameworks across different regions create complexity and compliance challenges. Supply chain disruptions for critical raw materials used in catalysts and sorbents can lead to increased costs and production delays, impacting project timelines. Furthermore, the ongoing shift towards renewable energy sources, while positive for the environment, may indirectly lead to a gradual decline in demand for certain traditional industrial emissions control technologies in the long term, necessitating adaptation and diversification within the sector.

Future Opportunities in Flue Gas Pollution Control

The Flue Gas Pollution Control industry is poised for significant future opportunities driven by emerging trends and evolving needs. The increasing adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies presents a substantial growth avenue, integrating seamlessly with existing flue gas treatment systems. The development of novel, cost-effective catalysts for denitrification control and sorbents for desulphurisation control will open new market segments. Furthermore, the growing demand for integrated air quality management solutions that combine real-time monitoring, data analytics, and automated control systems for optimizing dust removal control and other emissions presents a fertile ground for innovation. Emerging economies with rapidly industrializing sectors and evolving environmental regulations also represent key growth markets for comprehensive industrial emissions control solutions.

Major Players in the Flue Gas Pollution Control Ecosystem

- Haldor Topsoe

- Wood Group

- Fuel Tech

- Burns & Mcdonnell

- Ducon Technologies

- Babcock & Wilcox Company

- Steinmüller Babcock Environment GmbH

- Clyde Bergemann Power Group

- Doosan Power Systems

- Flsmidth & Co.

- Bilfinger Noell GmbH

- Feida Environmental

Key Developments in Flue Gas Pollution Control Industry

- 2024: Launch of a new generation of low-dust SCR catalysts offering improved NOx reduction efficiency and extended lifespan, impacting denitrification control systems.

- 2023: Major acquisition of a specialized provider of advanced scrubbing technologies, consolidating market share in desulphurisation control.

- 2022: Introduction of a smart, IoT-enabled monitoring system for baghouses, enhancing real-time performance tracking and predictive maintenance for dust removal control.

- 2021: Development of a pilot project for integrated CCUS and flue gas treatment, showcasing future synergies for air pollution abatement technologies.

- 2020: Announcement of new emission standards for industrial boilers in key regions, driving demand for retrofitting and upgrading existing flue gas pollution control infrastructure.

- 2019: Significant R&D investment in novel sorbent materials for enhanced SOx capture, impacting the future of desulphurisation control.

Strategic Flue Gas Pollution Control Market Forecast

The strategic outlook for the Flue Gas Pollution Control market is exceptionally positive, driven by sustained global demand for cleaner air and industrial sustainability. The forecast period (2025-2033) anticipates continued robust growth, fueled by increasingly stringent environmental regulations and technological advancements in air pollution abatement technologies. Key growth catalysts include the expanding application of denitrification control and desulphurisation control systems in emerging economies, alongside the integration of smart technologies for optimized dust removal control. Opportunities in Carbon Capture, Utilization, and Storage (CCUS) and the development of more efficient, cost-effective solutions will further bolster market potential, ensuring the sector's pivotal role in achieving global environmental objectives and driving significant economic value in the coming years.

Flue Gas Pollution Control Segmentation

-

1. Application

- 1.1. Chemical

- 1.2. Municipalities

- 1.3. Others

-

2. Type

- 2.1. Dust Removal Control

- 2.2. Desulphurisation Control

- 2.3. Denitrification Control

- 2.4. Others

Flue Gas Pollution Control Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Flue Gas Pollution Control REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flue Gas Pollution Control Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Chemical

- 5.1.2. Municipalities

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Dust Removal Control

- 5.2.2. Desulphurisation Control

- 5.2.3. Denitrification Control

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Flue Gas Pollution Control Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Chemical

- 6.1.2. Municipalities

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Dust Removal Control

- 6.2.2. Desulphurisation Control

- 6.2.3. Denitrification Control

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Flue Gas Pollution Control Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Chemical

- 7.1.2. Municipalities

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Dust Removal Control

- 7.2.2. Desulphurisation Control

- 7.2.3. Denitrification Control

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Flue Gas Pollution Control Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Chemical

- 8.1.2. Municipalities

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Dust Removal Control

- 8.2.2. Desulphurisation Control

- 8.2.3. Denitrification Control

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Flue Gas Pollution Control Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Chemical

- 9.1.2. Municipalities

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Dust Removal Control

- 9.2.2. Desulphurisation Control

- 9.2.3. Denitrification Control

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Flue Gas Pollution Control Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Chemical

- 10.1.2. Municipalities

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Dust Removal Control

- 10.2.2. Desulphurisation Control

- 10.2.3. Denitrification Control

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Haldor Topsoe

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wood Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fuel Tech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Burns & Mcdonnell

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ducon Technologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Babcock & Wilcox Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Steinmüller Babcock Environment GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clyde Bergemann Power Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Doosan Power Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Flsmidth & Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bilfinger Noell GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Feida Environmental

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Haldor Topsoe

List of Figures

- Figure 1: Global Flue Gas Pollution Control Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Flue Gas Pollution Control Revenue (million), by Application 2024 & 2032

- Figure 3: North America Flue Gas Pollution Control Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Flue Gas Pollution Control Revenue (million), by Type 2024 & 2032

- Figure 5: North America Flue Gas Pollution Control Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Flue Gas Pollution Control Revenue (million), by Country 2024 & 2032

- Figure 7: North America Flue Gas Pollution Control Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Flue Gas Pollution Control Revenue (million), by Application 2024 & 2032

- Figure 9: South America Flue Gas Pollution Control Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Flue Gas Pollution Control Revenue (million), by Type 2024 & 2032

- Figure 11: South America Flue Gas Pollution Control Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Flue Gas Pollution Control Revenue (million), by Country 2024 & 2032

- Figure 13: South America Flue Gas Pollution Control Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Flue Gas Pollution Control Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Flue Gas Pollution Control Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Flue Gas Pollution Control Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Flue Gas Pollution Control Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Flue Gas Pollution Control Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Flue Gas Pollution Control Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Flue Gas Pollution Control Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Flue Gas Pollution Control Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Flue Gas Pollution Control Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Flue Gas Pollution Control Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Flue Gas Pollution Control Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Flue Gas Pollution Control Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Flue Gas Pollution Control Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Flue Gas Pollution Control Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Flue Gas Pollution Control Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Flue Gas Pollution Control Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Flue Gas Pollution Control Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Flue Gas Pollution Control Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Flue Gas Pollution Control Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Flue Gas Pollution Control Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Flue Gas Pollution Control Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Flue Gas Pollution Control Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Flue Gas Pollution Control Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Flue Gas Pollution Control Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Flue Gas Pollution Control Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Flue Gas Pollution Control Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Flue Gas Pollution Control Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Flue Gas Pollution Control Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Flue Gas Pollution Control Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Flue Gas Pollution Control Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Flue Gas Pollution Control Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Flue Gas Pollution Control Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Flue Gas Pollution Control Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Flue Gas Pollution Control Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Flue Gas Pollution Control Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Flue Gas Pollution Control Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Flue Gas Pollution Control Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Flue Gas Pollution Control Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flue Gas Pollution Control?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Flue Gas Pollution Control?

Key companies in the market include Haldor Topsoe, Wood Group, Fuel Tech, Burns & Mcdonnell, Ducon Technologies, Babcock & Wilcox Company, Steinmüller Babcock Environment GmbH, Clyde Bergemann Power Group, Doosan Power Systems, Flsmidth & Co., Bilfinger Noell GmbH, Feida Environmental.

3. What are the main segments of the Flue Gas Pollution Control?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flue Gas Pollution Control," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flue Gas Pollution Control report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flue Gas Pollution Control?

To stay informed about further developments, trends, and reports in the Flue Gas Pollution Control, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence