Key Insights

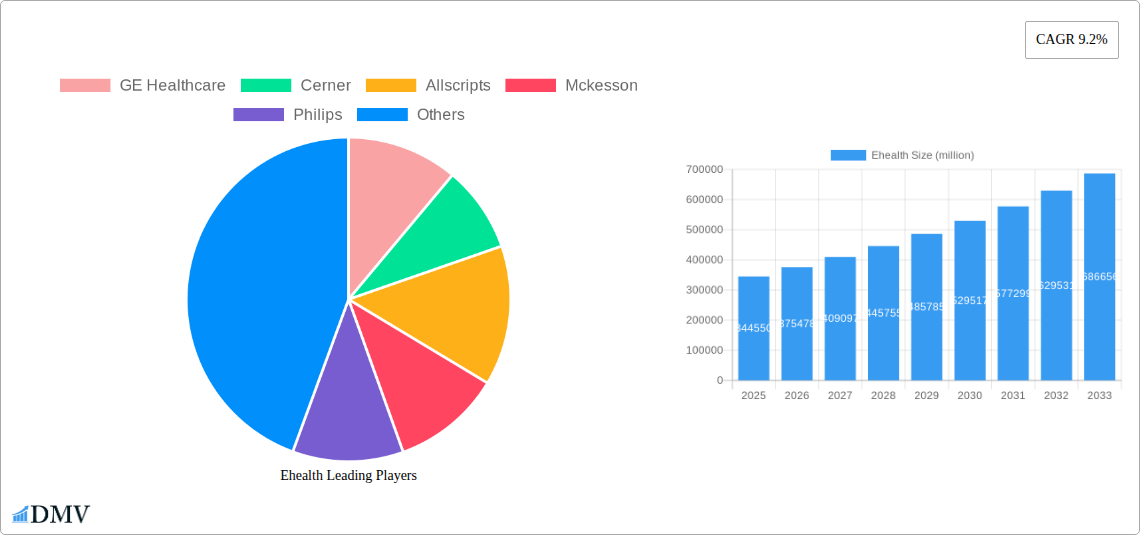

The global eHealth market is poised for significant expansion, projected to reach a substantial $344,550 million by 2025, driven by a robust compound annual growth rate (CAGR) of 9.2%. This impressive growth trajectory is fueled by an increasing demand for accessible, efficient, and patient-centric healthcare solutions. Key drivers include the escalating adoption of digital technologies in healthcare delivery, the growing prevalence of chronic diseases requiring continuous monitoring, and the imperative to reduce healthcare costs while improving patient outcomes. The integration of telemedicine, remote patient monitoring, electronic health records (EHRs), and mobile health (mHealth) applications are transforming how healthcare is accessed and managed. Evolving patient expectations for convenience and personalized care are further accelerating this digital transformation. The market segmentation reflects this widespread adoption, with eHealth solutions and services catering to a diverse range of end-users, including healthcare providers seeking to streamline operations, payers aiming for cost efficiencies, and empowered healthcare consumers demanding greater control over their health journeys. Pharmacies are also embracing eHealth to enhance prescription management and patient engagement.

Ehealth Market Size (In Billion)

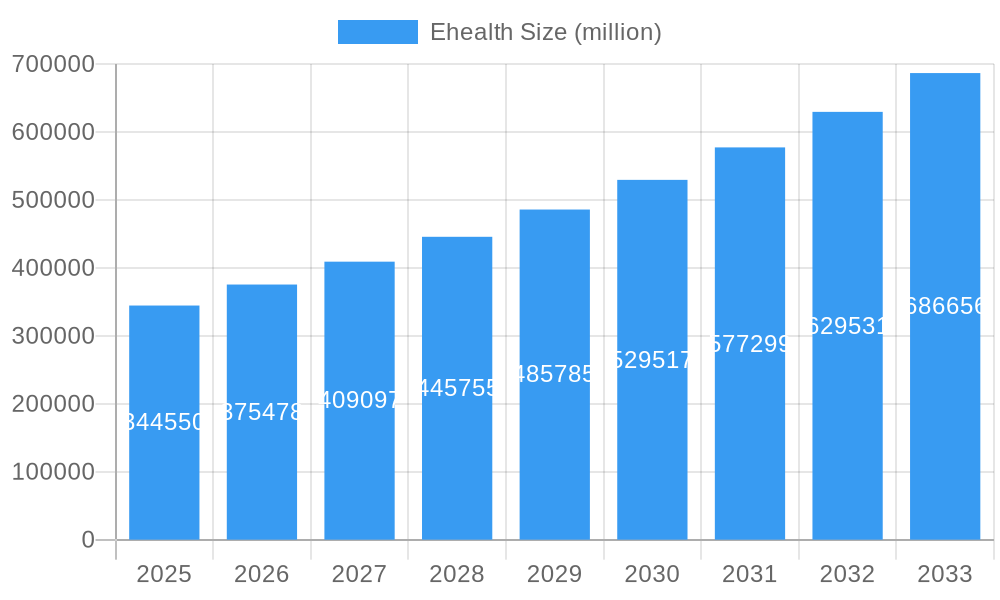

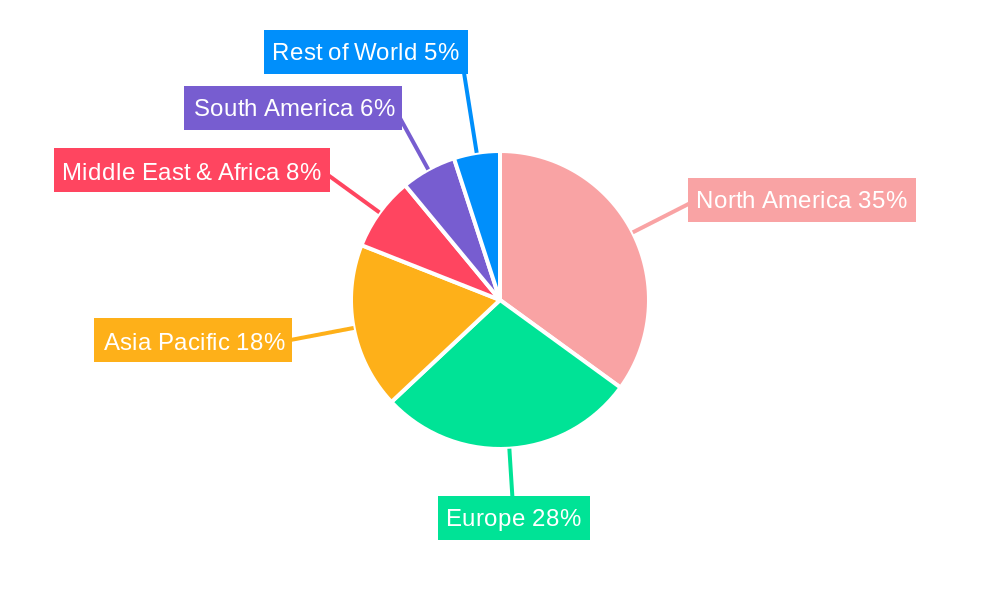

The eHealth market's expansion is characterized by several transformative trends. Predictive analytics and artificial intelligence are becoming integral for personalized treatment plans and early disease detection. The rise of wearable technology and the Internet of Medical Things (IoMT) are enabling continuous data collection for proactive health management. Furthermore, cloud-based eHealth platforms are gaining traction for their scalability and data security. Despite this promising outlook, certain restraints, such as data privacy concerns, stringent regulatory frameworks, and the digital divide limiting access for some populations, need to be addressed. However, ongoing advancements in cybersecurity, clearer regulatory guidelines, and initiatives to improve digital literacy are mitigating these challenges. Geographically, North America and Europe are leading the market due to their established healthcare infrastructures and early adoption of digital health. The Asia Pacific region, however, is emerging as a high-growth market due to increasing investments in healthcare IT and a large, tech-savvy population. The competitive landscape features key players like GE Healthcare, Cerner, Allscripts, McKesson, Philips, and Siemens Healthineers, all actively innovating and expanding their eHealth portfolios to capture a significant share of this dynamic and expanding market.

Ehealth Company Market Share

Ehealth Market Composition & Trends

The global eHealth market is characterized by a dynamic interplay of established technology giants and agile innovators, reflecting a significant market concentration among a few dominant players while fostering a vibrant landscape for specialized solutions. This report delves into the intricate market composition, analyzing key trends that are reshaping the healthcare technology sector. We evaluate the catalysts for innovation, driven by the increasing demand for accessible, efficient, and patient-centric healthcare. The evolving regulatory landscapes across various geographies play a crucial role, with stringent data privacy laws and digital health adoption frameworks influencing market strategies. Furthermore, the report scrutinizes substitute products and services, assessing their potential impact on market share, alongside detailed end-user profiles – encompassing Healthcare Providers, Payers, Healthcare Consumers, Pharmacies, and Others End Users – to understand diverse needs and adoption patterns. Mergers and acquisitions (M&A) activities are a significant indicator of market consolidation and strategic expansion; for instance, M&A deal values in the historical period (2019-2024) are estimated to be in the billions, with several multi-million dollar acquisitions significantly altering market share distribution. The study identifies key players, including GE Healthcare, Cerner, Allscripts, McKesson, Philips, Siemens Healthineers, IBM, Optum, Medtronic, Epic Systems, Athenahealth, and Cisco Systems, whose collective market share represents a substantial portion of the global eHealth market.

- Market Share Distribution: Analysis of key player market share and the fragmentation within niche segments.

- Innovation Catalysts: Focus on R&D investments, emerging technologies like AI and IoT, and the growing need for remote patient monitoring.

- Regulatory Landscapes: Examination of HIPAA, GDPR, and other regional digital health regulations influencing market entry and operations.

- Substitute Products: Assessment of traditional healthcare delivery models versus the adoption of eHealth solutions.

- End-User Profiles: In-depth understanding of the distinct requirements and adoption rates of Healthcare Providers, Payers, Healthcare Consumers, Pharmacies, and Other End Users.

- M&A Activities: Review of significant merger and acquisition trends, with deal values analyzed to understand market consolidation and strategic partnerships.

Ehealth Industry Evolution

The eHealth industry has undergone a profound transformation throughout the study period (2019–2033), marked by unprecedented technological advancements and a significant shift in consumer expectations. The historical period (2019–2024) witnessed the initial acceleration of digital health adoption, spurred by increasing chronic disease prevalence and the growing demand for personalized healthcare interventions. Base year (2025) figures indicate a robust market foundation, with significant investments flowing into digital health infrastructure and innovative service delivery models. The forecast period (2025–2033) is poised for exponential growth, driven by the pervasive integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Medical Things (IoMT) into mainstream healthcare practices. The adoption of eHealth Solutions, including Electronic Health Records (EHRs), telehealth platforms, and remote patient monitoring systems, has seen a compound annual growth rate (CAGR) of approximately 18% during the historical period and is projected to maintain a CAGR of over 20% through 2033. EHealth Services, encompassing digital health consulting, data analytics, and virtual care delivery, are also experiencing substantial growth, with market penetration reaching over 60% among healthcare providers in developed nations by 2025. Shifting consumer demands are a major impetus, with individuals actively seeking convenient, accessible, and proactive health management tools. This has led to a surge in demand for mobile health (mHealth) applications, wearable devices, and personalized health insights. The industry's evolution is further underscored by a growing emphasis on data interoperability and security, with investments in cybersecurity solutions for eHealth platforms projected to exceed $50 billion globally by 2030. The integration of genomics and precision medicine into digital health platforms is another key evolutionary trend, promising to revolutionize disease prevention and treatment strategies. The healthcare industry's digital transformation is not merely about technology; it is a fundamental reimagining of how healthcare is accessed, delivered, and managed, creating a more efficient, equitable, and patient-empowered ecosystem. The estimated market size for eHealth solutions and services, currently standing at over $150 billion in the base year of 2025, is forecasted to surpass $500 billion by 2033, reflecting a significant expansion in market valuation and reach.

Leading Regions, Countries, or Segments in Ehealth

The eHealth market's leadership is currently most pronounced in North America, driven by a confluence of strong technological infrastructure, significant healthcare spending, and proactive governmental initiatives supporting digital health innovation. Within this region, the United States stands out as a dominant country, propelled by a robust ecosystem of leading technology companies, including Epic Systems, Cerner, and Optum, and a high adoption rate of advanced eHealth Solutions and Services among its extensive network of Healthcare Providers and Payers. The segment of Healthcare Providers consistently leads in the adoption and utilization of eHealth technologies, reflecting the immediate need for enhanced operational efficiency, improved patient care coordination, and streamlined data management. This dominance is further bolstered by substantial investments in Electronic Health Records (EHRs), telehealth infrastructure, and patient engagement platforms, aiming to optimize clinical workflows and reduce administrative burdens. The type of eHealth Solutions, particularly integrated EHR systems and cloud-based data management platforms, are critical enablers for this segment.

- Dominant Region (North America): Characterized by high investment in digital health, favorable regulatory environments, and early adoption of advanced technologies.

- Key Drivers: Significant private and public sector investment in healthcare IT infrastructure, strong presence of innovative eHealth companies, and a mature payer system actively promoting value-based care through digital means.

- Dominant Country (United States): A powerhouse in eHealth due to its advanced technological landscape and a large, complex healthcare system ripe for digital transformation.

- Key Drivers: Extensive R&D expenditure, a high concentration of leading eHealth vendors, and widespread adoption of telehealth and remote monitoring.

- Dominant Segment (Healthcare Providers): This segment actively utilizes eHealth to enhance patient care, improve operational efficiency, and manage vast amounts of health data.

- Key Drivers: The imperative to meet evolving patient demands for convenience and accessibility, the need for interoperability between different healthcare entities, and the drive for cost containment through digital efficiencies.

- Dominant Type (eHealth Solutions - Integrated EHR Systems): These solutions are foundational for digital healthcare operations, enabling comprehensive patient record management and seamless data exchange.

- Key Drivers: Regulatory mandates for digital record-keeping, the benefits of centralized patient data for improved clinical decision-making, and the growing demand for interoperable systems to facilitate care coordination.

- Dominant Application (Healthcare Providers): The primary beneficiaries and adopters of eHealth, leveraging its capabilities to transform clinical practice and patient engagement.

- Key Drivers: The direct impact on patient outcomes, the potential for significant cost savings through optimized workflows, and the ongoing pressure to innovate and meet evolving healthcare standards.

Ehealth Product Innovations

Recent eHealth product innovations are revolutionizing patient care and operational efficiency. Advanced AI-powered diagnostic tools are enhancing accuracy and speed in disease detection, while sophisticated telehealth platforms are expanding remote access to specialists. Remote patient monitoring devices, integrated with intelligent analytics, are enabling proactive interventions for chronic conditions, preventing hospital readmissions and improving patient outcomes. The development of personalized health applications, leveraging genomic data and wearable sensor technology, offers users unprecedented insights into their well-being, driving preventative health behaviors. These innovations, characterized by user-friendly interfaces and robust data security, are key selling propositions, demonstrating significant technological advancements in areas like predictive analytics and secure data transmission.

Propelling Factors for Ehealth Growth

The eHealth market is propelled by several interconnected factors. Technological advancements are paramount, with AI, IoT, and cloud computing enabling more sophisticated and accessible solutions. Increasing healthcare expenditure globally, coupled with a growing demand for cost-effective and efficient healthcare delivery, provides a strong economic impetus. Furthermore, supportive government policies and initiatives promoting digital health adoption, along with evolving patient expectations for personalized and convenient care, are crucial accelerators for sustained growth in this vital sector.

Obstacles in the Ehealth Market

Despite its promising trajectory, the eHealth market faces significant hurdles. Regulatory complexities and data privacy concerns remain a major challenge, requiring constant adaptation to evolving compliance standards like HIPAA and GDPR. Interoperability issues between disparate healthcare systems hinder seamless data exchange and limit the full potential of integrated solutions. High implementation costs and the need for extensive IT infrastructure upgrades can be a barrier for smaller healthcare providers. Finally, resistance to change from traditional healthcare professionals and digital literacy gaps among certain patient demographics also present obstacles to widespread adoption and market expansion.

Future Opportunities in Ehealth

The eHealth market is ripe with emerging opportunities. The expansion of telehealth services into underserved rural and remote areas offers significant growth potential. The integration of wearable technology and IoMT devices for continuous health monitoring presents a vast market for preventative and chronic care management solutions. The increasing adoption of AI and machine learning in diagnostics, drug discovery, and personalized treatment plans will unlock new frontiers. Furthermore, the growing demand for mental health support through digital platforms and the development of value-based care models enabled by eHealth data analytics represent substantial future opportunities for market expansion and innovation.

Major Players in the Ehealth Ecosystem

- GE Healthcare

- Cerner

- Allscripts

- McKesson

- Philips

- Siemens Healthineers

- IBM

- Optum (A Subsidiary of Unitedhealth Group)

- Medtronic

- Epic Systems

- Athenahealth

- Cisco Systems

Key Developments in Ehealth Industry

- January 2024: Launch of AI-powered diagnostic imaging software by Siemens Healthineers, enhancing radiology workflows.

- November 2023: Cerner (now Oracle Health) announced expanded telehealth integrations, improving remote patient consultations.

- September 2023: Philips introduced a new generation of remote patient monitoring devices with advanced AI analytics.

- July 2023: Epic Systems reported over 250 million patients actively using its EHR system, demonstrating widespread adoption.

- April 2023: Optum significantly invested in expanding its data analytics capabilities for population health management.

- February 2023: Allscripts unveiled its new cloud-native EHR platform, focusing on interoperability and scalability.

- December 2022: McKesson expanded its digital pharmacy solutions portfolio, enhancing patient access to medications.

- October 2022: GE Healthcare launched its AI-driven operational efficiency platform for hospitals.

- August 2022: Medtronic announced advancements in its connected insulin pump technology for diabetes management.

- May 2022: Athenahealth enhanced its patient portal functionalities, improving engagement and communication.

- March 2022: IBM's Watson Health continued to integrate AI into clinical decision support systems.

- January 2022: Cisco Systems bolstered its healthcare networking solutions to support increased data traffic from connected medical devices.

Strategic Ehealth Market Forecast

The eHealth market's strategic outlook remains exceptionally strong, driven by an accelerating digital transformation in healthcare. Future growth will be significantly shaped by the increasing demand for personalized medicine, remote patient monitoring, and AI-driven diagnostics, projected to contribute billions in market value. Continued investments in cloud infrastructure, cybersecurity, and interoperability solutions will be critical for realizing the full potential of eHealth. The expansion of telehealth services globally, particularly in emerging economies, presents a vast untapped market. Strategic collaborations between technology providers, healthcare organizations, and regulatory bodies will be essential to navigate evolving landscapes and capitalize on emerging opportunities, ensuring sustained innovation and widespread adoption of digital health solutions.

Ehealth Segmentation

-

1. Application

- 1.1. Healthcare Providers

- 1.2. Payers

- 1.3. Healthcare Consumers

- 1.4. Pharmacies

- 1.5. Others End Users

-

2. Type

- 2.1. eHealth Solutions

- 2.2. eHealth Services

Ehealth Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ehealth Regional Market Share

Geographic Coverage of Ehealth

Ehealth REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ehealth Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Healthcare Providers

- 5.1.2. Payers

- 5.1.3. Healthcare Consumers

- 5.1.4. Pharmacies

- 5.1.5. Others End Users

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. eHealth Solutions

- 5.2.2. eHealth Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ehealth Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Healthcare Providers

- 6.1.2. Payers

- 6.1.3. Healthcare Consumers

- 6.1.4. Pharmacies

- 6.1.5. Others End Users

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. eHealth Solutions

- 6.2.2. eHealth Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ehealth Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Healthcare Providers

- 7.1.2. Payers

- 7.1.3. Healthcare Consumers

- 7.1.4. Pharmacies

- 7.1.5. Others End Users

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. eHealth Solutions

- 7.2.2. eHealth Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ehealth Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Healthcare Providers

- 8.1.2. Payers

- 8.1.3. Healthcare Consumers

- 8.1.4. Pharmacies

- 8.1.5. Others End Users

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. eHealth Solutions

- 8.2.2. eHealth Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ehealth Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Healthcare Providers

- 9.1.2. Payers

- 9.1.3. Healthcare Consumers

- 9.1.4. Pharmacies

- 9.1.5. Others End Users

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. eHealth Solutions

- 9.2.2. eHealth Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ehealth Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Healthcare Providers

- 10.1.2. Payers

- 10.1.3. Healthcare Consumers

- 10.1.4. Pharmacies

- 10.1.5. Others End Users

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. eHealth Solutions

- 10.2.2. eHealth Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GE Healthcare

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cerner

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Allscripts

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mckesson

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Philips

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens Healthineers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IBm

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Optum (A Subsidiary of Unitedhealth Group)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Medtronic

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Epic Systems

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AthenahealtH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cisco Systems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 GE Healthcare

List of Figures

- Figure 1: Global Ehealth Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Ehealth Revenue (million), by Application 2025 & 2033

- Figure 3: North America Ehealth Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Ehealth Revenue (million), by Type 2025 & 2033

- Figure 5: North America Ehealth Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Ehealth Revenue (million), by Country 2025 & 2033

- Figure 7: North America Ehealth Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Ehealth Revenue (million), by Application 2025 & 2033

- Figure 9: South America Ehealth Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Ehealth Revenue (million), by Type 2025 & 2033

- Figure 11: South America Ehealth Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Ehealth Revenue (million), by Country 2025 & 2033

- Figure 13: South America Ehealth Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Ehealth Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Ehealth Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Ehealth Revenue (million), by Type 2025 & 2033

- Figure 17: Europe Ehealth Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Ehealth Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Ehealth Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Ehealth Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Ehealth Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Ehealth Revenue (million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Ehealth Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Ehealth Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Ehealth Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Ehealth Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Ehealth Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Ehealth Revenue (million), by Type 2025 & 2033

- Figure 29: Asia Pacific Ehealth Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Ehealth Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Ehealth Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ehealth Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Ehealth Revenue million Forecast, by Type 2020 & 2033

- Table 3: Global Ehealth Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Ehealth Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Ehealth Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Ehealth Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Ehealth Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Ehealth Revenue million Forecast, by Type 2020 & 2033

- Table 12: Global Ehealth Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Ehealth Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Ehealth Revenue million Forecast, by Type 2020 & 2033

- Table 18: Global Ehealth Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Ehealth Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Ehealth Revenue million Forecast, by Type 2020 & 2033

- Table 30: Global Ehealth Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Ehealth Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Ehealth Revenue million Forecast, by Type 2020 & 2033

- Table 39: Global Ehealth Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Ehealth Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Ehealth Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ehealth?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the Ehealth?

Key companies in the market include GE Healthcare, Cerner, Allscripts, Mckesson, Philips, Siemens Healthineers, IBm, Optum (A Subsidiary of Unitedhealth Group), Medtronic, Epic Systems, AthenahealtH, Cisco Systems.

3. What are the main segments of the Ehealth?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 344550 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ehealth," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ehealth report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ehealth?

To stay informed about further developments, trends, and reports in the Ehealth, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence