Key Insights

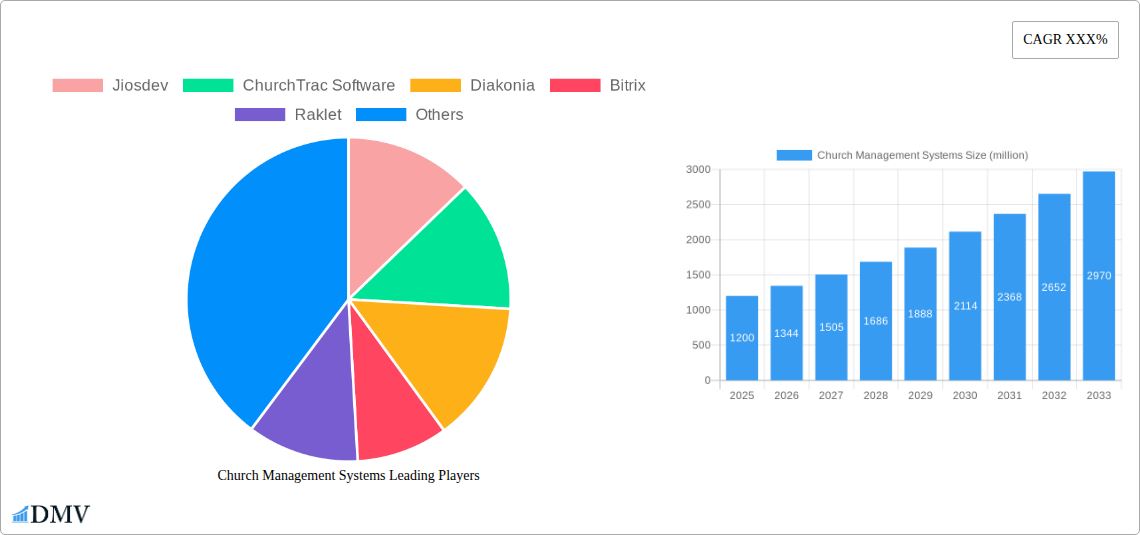

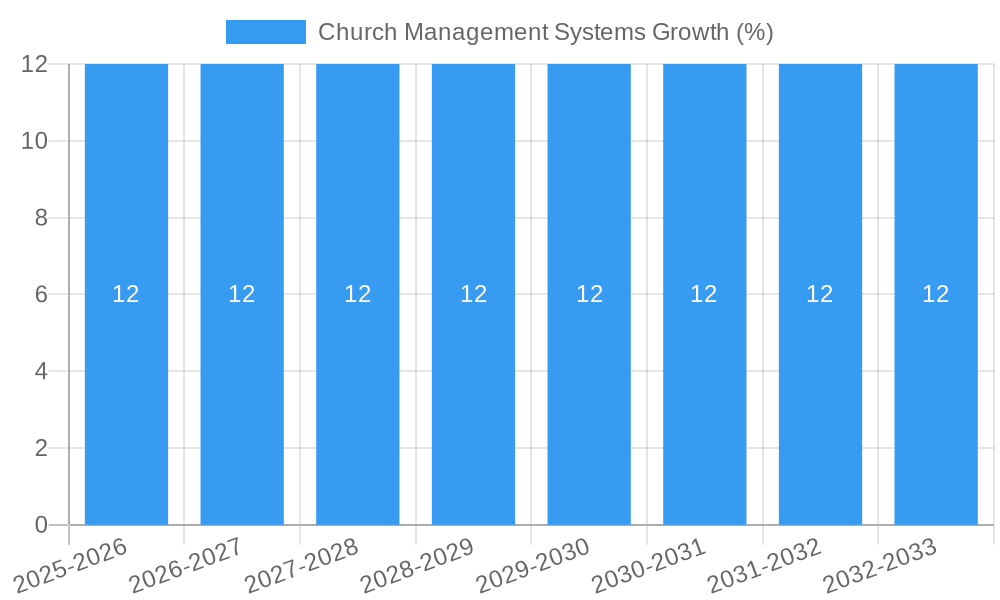

The global Church Management Systems (CMS) market is experiencing robust growth, driven by the increasing need for efficient digital tools to manage church operations, engage congregations, and streamline administrative tasks. With an estimated market size of approximately $1.2 billion in 2025, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of around 12% through 2033. This significant growth is fueled by a growing adoption of cloud-based solutions, offering enhanced accessibility, scalability, and cost-effectiveness for religious organizations of all sizes. Key drivers include the desire for improved member communication, streamlined online giving and donation management, and the necessity to adapt to evolving digital engagement preferences of congregants, particularly younger demographics. Furthermore, the pandemic accelerated the digital transformation within the religious sector, highlighting the critical role of CMS in facilitating virtual services, online communities, and remote pastoral care.

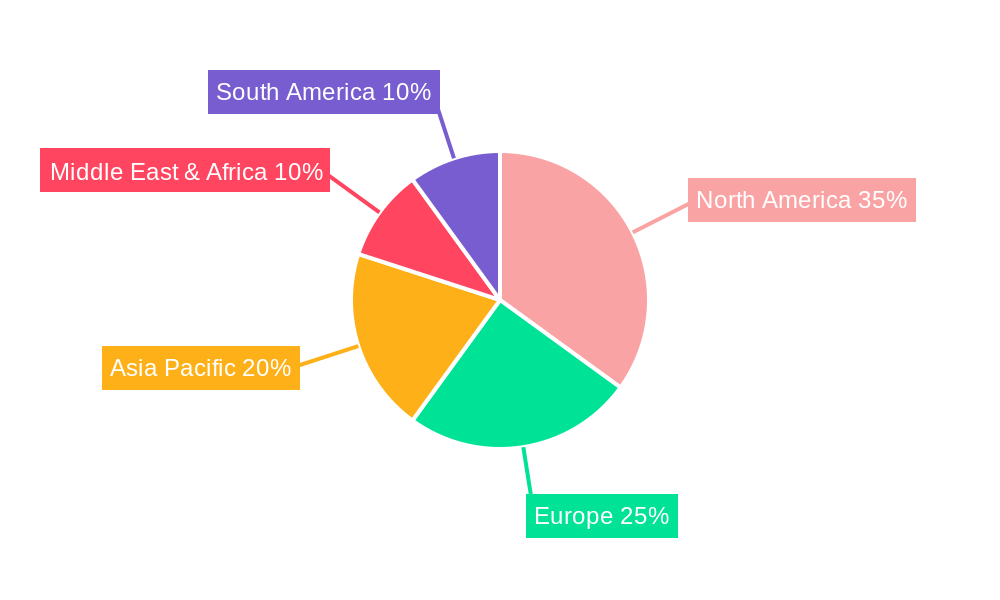

The CMS market is segmented by application into PC terminals and mobile terminals, with mobile solutions gaining increasing traction due to the ubiquitous nature of smartphones. Cloud-based CMS are dominating the market, offering greater flexibility and lower upfront costs compared to on-premises solutions. While the market is characterized by a competitive landscape with established players like ACS Technologies, PowerChurch Software, and Planning Center, as well as emerging innovators, the trend towards integrated platforms that offer comprehensive features – from event management and volunteer coordination to financial tracking and digital outreach – is a significant market dynamic. Restraints, such as potential data security concerns and the initial investment in learning new software, are being addressed through enhanced security protocols and user-friendly interfaces. The North American region currently holds a significant market share, with substantial growth also anticipated in the Asia Pacific and European markets as digital adoption continues to rise.

Church Management Systems Market Composition & Trends

The Church Management Systems market is characterized by a moderate level of concentration, with a significant portion of market share held by established players and a growing influx of niche providers. Innovation catalysts are primarily driven by the increasing need for streamlined administrative processes, enhanced member engagement, and efficient financial management within religious organizations. Regulatory landscapes, while not overtly restrictive, often revolve around data privacy and security compliance, influencing software development and deployment strategies. Substitute products, such as general-purpose CRM software or basic spreadsheets, are being increasingly displaced by specialized church management solutions that offer tailored functionalities. End-user profiles are diverse, ranging from small, local congregations to large, multi-site denominations, each with distinct requirements for scalability and feature sets. Merger and acquisition activities are moderate, with larger companies acquiring smaller, innovative firms to expand their product portfolios and market reach. The M&A deal value is estimated to be in the range of hundreds of millions of dollars, reflecting strategic consolidations aimed at capturing greater market share and technological advancements.

- Market Share Distribution: Leading companies hold substantial market shares, with top players commanding over XX million in revenue. The long tail of smaller providers collectively accounts for approximately XX million in revenue.

- M&A Deal Values: Recent M&A activities indicate an average deal valuation of XX million, driven by strategic acquisitions of companies with strong recurring revenue models and innovative feature sets.

Church Management Systems Industry Evolution

The Church Management Systems industry has witnessed a dynamic evolution, primarily driven by the digital transformation sweeping across all sectors, including religious institutions. Over the study period of 2019–2033, the market has transitioned from basic record-keeping tools to comprehensive, integrated platforms designed to foster community, manage operations, and facilitate outreach. The base year of 2025 represents a pivotal point where cloud-based solutions have become the dominant deployment model, offering scalability, accessibility, and cost-effectiveness compared to traditional on-premises installations. Technological advancements have been rapid, with a consistent focus on enhancing user experience, incorporating mobile-first design principles, and integrating artificial intelligence for personalized communication and data analytics. The adoption metrics reveal a significant surge in cloud-based solutions, with an estimated XX% of new implementations in 2025 opting for this model. This shift is propelled by the increasing comfort of religious organizations with cloud technology and the inherent benefits it offers in terms of reduced IT overhead and enhanced data security.

During the historical period of 2019–2024, the market saw steady growth as churches recognized the need for digital tools to manage their growing congregations and complex administrative tasks. Early adoption was driven by essential functionalities like member databases, donation tracking, and event scheduling. However, the forecast period of 2025–2033 promises accelerated growth, fueled by the integration of advanced features such as online giving platforms with recurring donation options, sophisticated communication tools including automated SMS and email campaigns, and robust volunteer management systems. The demand for mobile accessibility has also surged, with a significant percentage of church leaders and members now expecting seamless access to church information and services through smartphones and tablets. This has led to the development of dedicated mobile applications that mirror the functionality of web-based platforms. Shifting consumer demands, influenced by general societal expectations of digital convenience, are pushing church management system providers to continuously innovate and offer more intuitive, feature-rich, and integrated solutions. The growth trajectory is further influenced by the increasing emphasis on community building and member engagement, with systems now offering features for online small groups, discipleship tracking, and personalized communication. The overall market growth rate is projected to be between XX% and XX% annually during the forecast period, with the estimated year of 2025 showing a strong upward trend in adoption and revenue.

Leading Regions, Countries, or Segments in Church Management Systems

The Church Management Systems market exhibits a pronounced dominance within specific segments and geographical regions, driven by distinct investment trends and regulatory support. In terms of Application, the PC Terminal segment has historically held a significant share, serving as the primary interface for administrative staff and leadership to manage core operations. However, the Mobile Terminal segment is experiencing explosive growth, fueled by the increasing reliance on smartphones and tablets for day-to-day church activities. This shift is particularly evident in younger demographics and in churches with geographically dispersed congregations or active outreach programs. The convenience of accessing member data, managing events, and communicating with constituents on the go has made mobile solutions indispensable.

In terms of Type, the Cloud-based deployment model has firmly established its dominance, surpassing On-premises solutions. The shift towards cloud is a global phenomenon, driven by the inherent advantages of scalability, reduced IT infrastructure costs, and enhanced data accessibility from anywhere, at any time. The cost-effectiveness of subscription-based cloud services, often in the range of thousands to tens of thousands of dollars annually per church, makes them an attractive option for organizations with varying budget constraints. Regulatory support for cloud adoption, particularly concerning data security and privacy, has also matured, instilling confidence in religious institutions to entrust their sensitive data to reputable cloud providers.

Key Drivers for Mobile Terminal Dominance:

- Increasing smartphone penetration globally, exceeding XX% in many developed nations.

- Demand for real-time access to member information and communication tools.

- Growth of mobile-first engagement strategies by churches.

- Development of user-friendly mobile applications by leading providers.

Key Drivers for Cloud-based Dominance:

- Significant cost savings on IT hardware and maintenance, estimated at XX% annually for churches.

- Enhanced data security and disaster recovery capabilities offered by specialized cloud infrastructure.

- Scalability to accommodate fluctuating membership and event demands.

- Automatic software updates and feature enhancements without manual intervention.

Geographically, North America, particularly the United States and Canada, represents the largest and most mature market for church management systems. This is attributed to a strong tradition of organized religion, a high rate of church attendance, and a proactive adoption of technology by religious institutions. Countries like the United Kingdom, Australia, and parts of Western Europe also show significant adoption rates, mirroring the technological readiness and operational needs of their religious communities. Emerging markets in Asia and Africa are also showing promising growth trajectories, albeit from a smaller base, as digital infrastructure improves and the need for organized church management becomes more apparent. The investment trends in these dominant regions are characterized by substantial budget allocations towards digital transformation initiatives within churches, often involving significant investments in comprehensive church management suites, ranging from hundreds of thousands to millions of dollars for larger denominations.

Church Management Systems Product Innovations

Recent product innovations in Church Management Systems are revolutionizing how religious organizations operate and engage with their congregations. A key advancement is the integration of AI-powered personalized communication tools, enabling more targeted outreach and member engagement. Online giving platforms have evolved beyond basic donation collection to include seamless recurring giving options, pledge management, and even peer-to-peer fundraising capabilities, processing millions in donations annually. Furthermore, sophisticated volunteer management modules are streamlining recruitment, scheduling, and communication, significantly reducing administrative burden. Performance metrics for these innovations show an average XX% increase in online donation engagement and a YY% reduction in administrative time spent on volunteer coordination. The unique selling proposition of these advanced systems lies in their ability to foster deeper community connections and optimize resource allocation, ultimately supporting the core mission of religious institutions.

Propelling Factors for Church Management Systems Growth

Several key factors are propelling the growth of the Church Management Systems market. Technologically, the pervasive adoption of cloud computing and mobile devices has created a fertile ground for sophisticated, accessible solutions. Economically, the increasing recognition among religious organizations of the efficiency gains and cost savings offered by specialized software drives investment. Many churches are allocating significant portions of their annual budgets, sometimes in the range of tens of thousands to hundreds of thousands of dollars, towards these systems. Regulatory influences, particularly concerning data privacy and security, are indirectly driving growth by pushing for more robust and compliant solutions. The sheer volume of members and financial transactions managed by churches, often in the millions annually, necessitates efficient and secure management tools.

Obstacles in the Church Management Systems Market

Despite robust growth, the Church Management Systems market faces several obstacles. Regulatory challenges, while not overtly prohibitive, can add complexity to compliance, especially concerning data handling across different jurisdictions. Supply chain disruptions, though less prevalent for software, can impact the availability of hardware components for on-premises deployments if chosen. Competitive pressures are significant, with a crowded market forcing providers to constantly innovate and differentiate their offerings to capture market share, which can be in the millions. Moreover, the initial investment cost, while often offset by long-term savings, can be a barrier for smaller or financially constrained religious organizations, with some comprehensive systems costing upwards of hundreds of thousands of dollars. Resistance to change within some traditional church structures can also slow adoption rates.

Future Opportunities in Church Management Systems

Emerging opportunities in the Church Management Systems market are abundant. The expansion into developing economies presents a vast untapped potential, with religious institutions there increasingly seeking digital solutions to manage their growing congregations, processing millions in potential revenue. Technological advancements, such as the integration of advanced analytics for member engagement and predictive modeling for resource allocation, offer further avenues for growth. The growing trend of hybrid service models (both in-person and online) necessitates integrated platforms that can seamlessly manage both aspects, opening new market segments. Furthermore, the demand for highly customizable and modular solutions that can adapt to the unique needs of diverse religious denominations presents a significant opportunity for providers.

Major Players in the Church Management Systems Ecosystem

- Jiosdev

- ChurchTrac Software

- Diakonia

- Bitrix

- Raklet

- Planning Center

- PastorsLine

- ACS Technologies

- PowerChurch Software

- Shelby Systems

Key Developments in Church Management Systems Industry

- 2023 (Q4): Launch of AI-powered personalized communication features by Planning Center, enhancing member engagement and retention.

- 2024 (Q1): Jiosdev introduces a robust online giving platform with enhanced recurring donation management, processing millions in secure transactions.

- 2024 (Q2): Shelby Systems announces strategic partnership with a leading church accounting software provider, offering a more integrated financial management solution.

- 2024 (Q3): ChurchTrac Software rolls out a comprehensive mobile application, significantly increasing accessibility for church staff and volunteers.

- 2025 (Q1): Diakonia unveils enhanced volunteer management tools, streamlining coordination for events expecting thousands of attendees.

- 2025 (Q2): Raklet announces expansion into new international markets, catering to a growing demand for cloud-based solutions estimated in the millions of dollars.

- 2025 (Q3): ACS Technologies acquires a niche church event management platform, expanding its service portfolio.

- 2025 (Q4): PastorsLine enhances its SMS marketing capabilities, allowing churches to reach millions of members more effectively.

- 2026 (Q1): Bitrix integrates advanced analytics dashboards, providing deeper insights into member engagement and operational efficiency.

- 2026 (Q2): PowerChurch Software releases a major update to its donation tracking module, improving accuracy and reporting for millions in annual contributions.

Strategic Church Management Systems Market Forecast

The strategic forecast for the Church Management Systems market indicates continued robust growth, driven by the increasing digitalization of religious organizations and the demand for integrated, user-friendly solutions. Key growth catalysts include the persistent adoption of cloud-based platforms, the expansion of mobile functionalities for enhanced accessibility, and the ongoing innovation in features like online giving, member engagement, and administrative automation, which collectively manage millions in church operations. The market potential is substantial, fueled by both the expansion into new geographical regions and the deepening penetration within existing ones, as churches increasingly recognize the value of these systems in optimizing operations and fostering stronger community bonds.

Church Management Systems Segmentation

-

1. Application

- 1.1. PC Terminal

- 1.2. Mobile Terminal

-

2. Type

- 2.1. Cloud-based

- 2.2. On-premises

Church Management Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Church Management Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Church Management Systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. PC Terminal

- 5.1.2. Mobile Terminal

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud-based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Church Management Systems Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. PC Terminal

- 6.1.2. Mobile Terminal

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud-based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Church Management Systems Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. PC Terminal

- 7.1.2. Mobile Terminal

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud-based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Church Management Systems Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. PC Terminal

- 8.1.2. Mobile Terminal

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud-based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Church Management Systems Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. PC Terminal

- 9.1.2. Mobile Terminal

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud-based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Church Management Systems Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. PC Terminal

- 10.1.2. Mobile Terminal

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud-based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Jiosdev

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ChurchTrac Software

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Diakonia

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bitrix

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Raklet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Planning Center

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PastorsLine

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ACS Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PowerChurch Software

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shelby Systems

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Jiosdev

List of Figures

- Figure 1: Global Church Management Systems Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Church Management Systems Revenue (million), by Application 2024 & 2032

- Figure 3: North America Church Management Systems Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Church Management Systems Revenue (million), by Type 2024 & 2032

- Figure 5: North America Church Management Systems Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Church Management Systems Revenue (million), by Country 2024 & 2032

- Figure 7: North America Church Management Systems Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Church Management Systems Revenue (million), by Application 2024 & 2032

- Figure 9: South America Church Management Systems Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Church Management Systems Revenue (million), by Type 2024 & 2032

- Figure 11: South America Church Management Systems Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Church Management Systems Revenue (million), by Country 2024 & 2032

- Figure 13: South America Church Management Systems Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Church Management Systems Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Church Management Systems Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Church Management Systems Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Church Management Systems Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Church Management Systems Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Church Management Systems Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Church Management Systems Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Church Management Systems Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Church Management Systems Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Church Management Systems Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Church Management Systems Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Church Management Systems Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Church Management Systems Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Church Management Systems Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Church Management Systems Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Church Management Systems Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Church Management Systems Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Church Management Systems Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Church Management Systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Church Management Systems Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Church Management Systems Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Church Management Systems Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Church Management Systems Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Church Management Systems Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Church Management Systems Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Church Management Systems Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Church Management Systems Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Church Management Systems Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Church Management Systems Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Church Management Systems Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Church Management Systems Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Church Management Systems Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Church Management Systems Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Church Management Systems Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Church Management Systems Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Church Management Systems Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Church Management Systems Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Church Management Systems Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Church Management Systems?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Church Management Systems?

Key companies in the market include Jiosdev, ChurchTrac Software, Diakonia, Bitrix, Raklet, Planning Center, PastorsLine, ACS Technologies, PowerChurch Software, Shelby Systems.

3. What are the main segments of the Church Management Systems?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Church Management Systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Church Management Systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Church Management Systems?

To stay informed about further developments, trends, and reports in the Church Management Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence