Key Insights

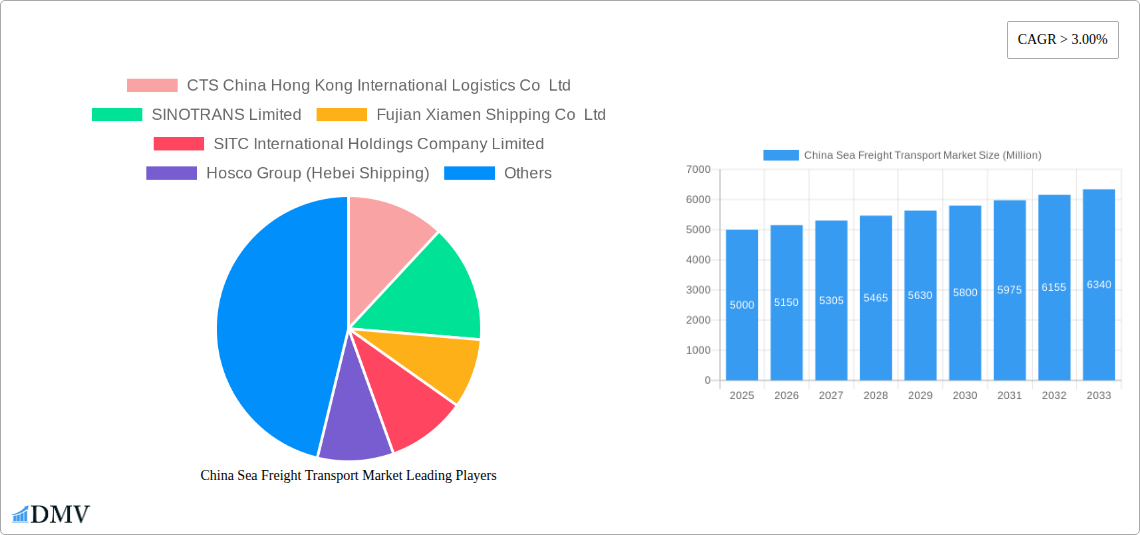

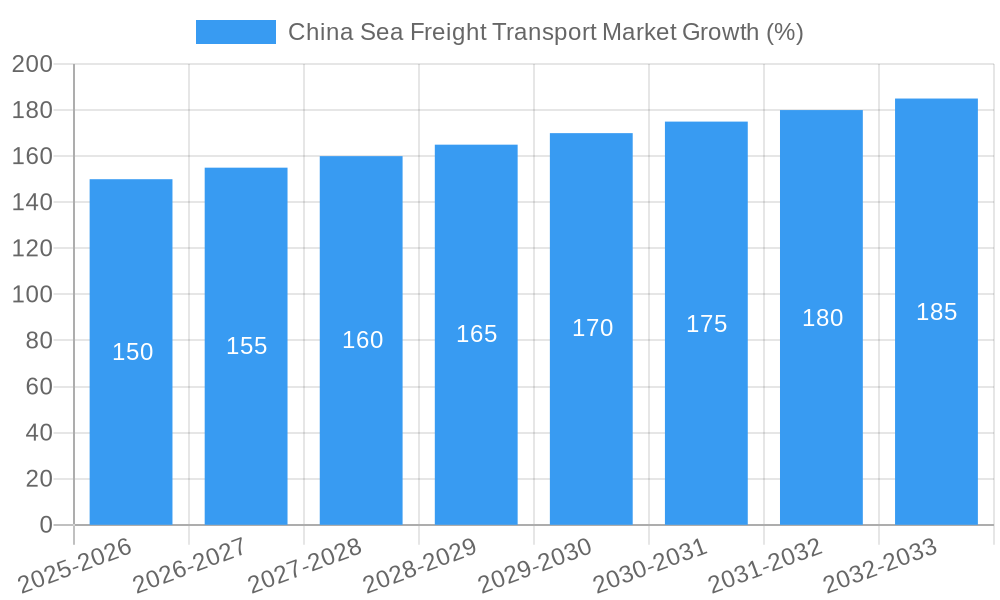

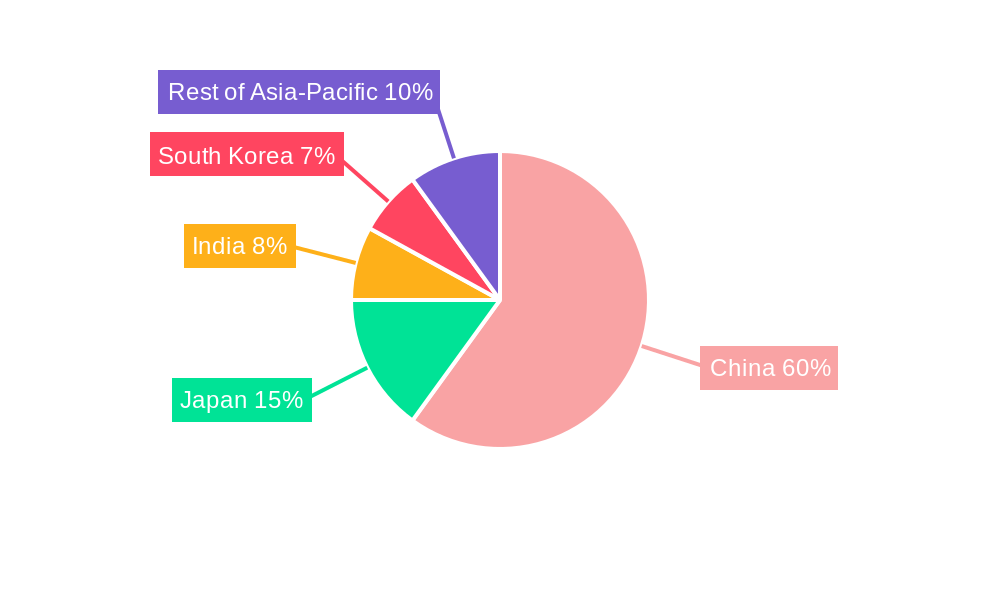

The China sea freight transport market, exhibiting a CAGR exceeding 3.00%, presents a robust and expanding sector within the global maritime industry. Driven by China's robust manufacturing and export-oriented economy, coupled with increasing global trade, the market is witnessing significant growth. Key drivers include rising e-commerce activity fueling demand for containerized cargo, the expansion of China's infrastructure (ports and logistics networks), and a growing need for efficient and cost-effective transportation of bulk and liquid cargo, particularly within Asia-Pacific. The market is segmented by cargo type (containerized, bulk, liquid), vessel type (container ships, bulk carriers, tankers), and end-use industry (manufacturing, retail, agriculture). While the precise market size for 2025 is unavailable, considering a conservative estimate based on the provided CAGR and a plausible starting point, we can project substantial market value within the millions of dollars. The Asia-Pacific region, particularly China, Japan, India, and South Korea, dominates the market due to their significant manufacturing output and strategic geographic location. However, potential restraints include global economic fluctuations, geopolitical uncertainties impacting trade routes, and the ongoing challenges of maintaining sustainable and environmentally friendly shipping practices. Leading players like COSCO Shipping Lines, China Merchants Group, and others leverage their extensive networks and fleet capacities to capture market share. The market's future growth will likely be shaped by technological advancements in vessel efficiency, digitalization of logistics, and the increasing adoption of sustainable shipping solutions to meet environmental regulations and consumer demands.

The competitive landscape is characterized by both large state-owned enterprises and privately held companies. The continued expansion of China's economy and its pivotal role in global trade will undoubtedly fuel further market growth in the coming years. Industry consolidation and strategic alliances could also reshape the competitive dynamics, as companies seek to optimize their operations and enhance their global reach. Furthermore, the evolving demands for faster delivery times and enhanced supply chain resilience will necessitate ongoing innovation within the industry. Continuous investments in port infrastructure, technological upgrades, and sustainable practices will be crucial for companies seeking sustained success in this competitive yet dynamic market.

This insightful report delivers a comprehensive analysis of the China Sea Freight Transport Market, providing a detailed overview of market dynamics, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market size in 2025 is estimated at xx Million, with projections for significant growth over the forecast period.

China Sea Freight Transport Market Market Composition & Trends

This section delves into the intricate composition of the China Sea Freight Transport Market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We analyze the market share distribution among key players, revealing the competitive landscape. For instance, COSCO Shipping Lines and China Merchants Group hold substantial market share, while other significant players like SITC International Holdings Company Limited, Fujian Xiamen Shipping Co Ltd, and CTS China Hong Kong International Logistics Co Ltd contribute significantly. The report further investigates the impact of M&A activities, analyzing deal values and their influence on market consolidation. We also explore the role of regulatory changes, technological advancements (like automation in ports and AI-powered logistics), and the emergence of substitute transportation modes in shaping market trends. Our analysis includes:

- Market Concentration: Detailed breakdown of market share held by leading players.

- Innovation Catalysts: Assessment of technological advancements and their impact on efficiency and cost reduction.

- Regulatory Landscape: Analysis of governmental policies and their influence on market access and operations.

- Substitute Products: Evaluation of alternative transportation methods and their competitive pressure on sea freight.

- End-User Profiles: Segmentation of end-users across Manufacturing, Retail, and Agriculture sectors, highlighting their specific needs and preferences.

- M&A Activities: Analysis of significant mergers and acquisitions, including deal values and their strategic implications. Total M&A deal value in the last 5 years is estimated at xx Million.

China Sea Freight Transport Market Industry Evolution

This section provides a detailed analysis of the evolutionary trajectory of the China Sea Freight Transport Market, covering the historical period (2019-2024) and extending to the forecast period (2025-2033). We examine market growth trajectories, pinpointing significant growth rates and identifying periods of acceleration or deceleration. Technological advancements, such as the adoption of smart containers, digitalization of shipping processes, and the integration of blockchain technology for enhanced transparency and security, are analyzed in detail, with specific data points on adoption metrics provided. The evolution of consumer demands, including the increasing preference for faster and more reliable shipping services, and the impact of these shifts on market dynamics are discussed. The report also analyzes the influence of global trade patterns, geopolitical events, and economic fluctuations on market growth. The compound annual growth rate (CAGR) for the period 2025-2033 is projected to be xx%.

Leading Regions, Countries, or Segments in China Sea Freight Transport Market

This section identifies the dominant regions, countries, and segments within the China Sea Freight Transport Market across various categorizations.

By Cargo Type:

- Containerized Cargo: This segment is anticipated to maintain its dominant position due to its high volume and efficiency. Key drivers include increasing globalization and the rise of e-commerce.

- Bulk Cargo: The bulk cargo segment is projected to experience steady growth, driven by the robust demand for raw materials in various industries.

- Liquid Cargo: The liquid cargo segment is expected to witness moderate growth, fueled by the transportation of petroleum products and chemicals.

By Vessel Type:

- Container Ships: The container ship segment will continue to dominate, owing to the high volume of containerized cargo.

- Bulk Carriers: Bulk carriers will see consistent demand aligning with bulk cargo transport needs.

- Tankers: The tanker segment's growth will be tied to the demand for liquid cargo transportation.

By End-Use Industry:

- Manufacturing: The manufacturing sector remains the largest end-user, significantly contributing to the market's growth.

- Retail: The retail sector's contribution is expanding due to the growth of e-commerce and the increasing demand for faster delivery.

- Agriculture: The agricultural sector shows moderate growth, driven by the transportation of agricultural products.

China Sea Freight Transport Market Product Innovations

Recent innovations in the China Sea Freight Transport Market focus on enhancing efficiency, reducing costs, and improving sustainability. This includes advancements in vessel design, such as larger container ships and more fuel-efficient engines. The integration of technology, like IoT sensors for real-time cargo monitoring and AI-powered route optimization, further enhances efficiency and predictability. The adoption of eco-friendly fuels and practices is also gaining momentum, aligning with global sustainability goals. These innovations are leading to improved delivery times, reduced environmental impact, and cost savings for shipping companies.

Propelling Factors for China Sea Freight Transport Market Growth

Several key factors are driving the growth of the China Sea Freight Transport Market. These include:

- Expanding Global Trade: Increased international trade creates higher demand for sea freight services.

- Growth of E-commerce: The boom in online retail fuels the need for efficient and reliable shipping solutions.

- Infrastructure Development: Investments in port infrastructure and logistics networks enhance capacity and efficiency.

- Government Initiatives: Supportive government policies and regulations foster market growth.

Obstacles in the China Sea Freight Transport Market Market

The China Sea Freight Transport Market faces several challenges including:

- Geopolitical Risks: International tensions and trade disputes can disrupt supply chains.

- Fluctuating Fuel Prices: Fuel price volatility impacts operational costs and profitability.

- Environmental Regulations: Stringent environmental regulations necessitate investments in cleaner technologies.

- Intense Competition: The market is highly competitive, leading to price pressures and margin compression.

Future Opportunities in China Sea Freight Transport Market

Future opportunities lie in:

- Technological Advancements: The adoption of AI, IoT, and blockchain offers significant potential for efficiency improvements.

- Sustainable Practices: Demand for eco-friendly shipping solutions is expected to increase.

- Expansion into New Markets: Growth in emerging economies presents new opportunities for expansion.

Major Players in the China Sea Freight Transport Market Ecosystem

- CTS China Hong Kong International Logistics Co Ltd

- SINOTRANS Limited

- Fujian Xiamen Shipping Co Ltd

- SITC International Holdings Company Limited

- Hosco Group (Hebei Shipping)

- Jincheng International Shipping Agency

- COSCO Shipping Lines

- China Merchants Group

- C&K Ocean Shipping Company

- Nanjing Ocean Shipping Co Ltd

Key Developments in China Sea Freight Transport Market Industry

- 2022 Q4: COSCO Shipping Lines launched a new fleet of LNG-powered container ships.

- 2023 Q1: China Merchants Group invested in a new port facility in Southeast Asia.

- 2023 Q3: SITC International Holdings announced a strategic partnership with a technology provider for digital logistics solutions. (Further developments to be added)

Strategic China Sea Freight Transport Market Market Forecast

The China Sea Freight Transport Market is poised for sustained growth over the forecast period (2025-2033), driven by robust global trade, the expansion of e-commerce, and ongoing technological advancements. The increasing adoption of sustainable practices and the development of new infrastructure will further contribute to market expansion. While challenges such as geopolitical risks and fluctuating fuel prices remain, the long-term outlook for the market remains positive, with significant opportunities for market participants to capitalize on.

China Sea Freight Transport Market Segmentation

- 1. Water Transport Services

- 2. Vessel Leasing and Rental Services

- 3. Cargo Ha

- 4. Supporti

China Sea Freight Transport Market Segmentation By Geography

- 1. China

China Sea Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation

- 3.3. Market Restrains

- 3.3.1 4.; South Korea's logistics infrastructure

- 3.3.2 while generally well-developed

- 3.3.3 can experience congestion in key areas

- 3.3.4 such as ports and highways4.; Like many other countries

- 3.3.5 South Korea faced issues related to labor shortages in the logistics sector.

- 3.4. Market Trends

- 3.4.1. Positive Trend of Chinese Imports and Exports.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Water Transport Services

- 5.2. Market Analysis, Insights and Forecast - by Vessel Leasing and Rental Services

- 5.3. Market Analysis, Insights and Forecast - by Cargo Ha

- 5.4. Market Analysis, Insights and Forecast - by Supporti

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Water Transport Services

- 6. China China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8. India China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 CTS China Hong Kong International Logistics Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 SINOTRANS Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Fujian Xiamen Shipping Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SITC International Holdings Company Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hosco Group (Hebei Shipping)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Jincheng International Shipping Agency**List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 COSCO Shipping Lines

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 China Merchants Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 C&K Ocean Shipping Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nanjing Ocean Shipping Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 CTS China Hong Kong International Logistics Co Ltd

List of Figures

- Figure 1: China Sea Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Sea Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: China Sea Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Sea Freight Transport Market Revenue Million Forecast, by Water Transport Services 2019 & 2032

- Table 3: China Sea Freight Transport Market Revenue Million Forecast, by Vessel Leasing and Rental Services 2019 & 2032

- Table 4: China Sea Freight Transport Market Revenue Million Forecast, by Cargo Ha 2019 & 2032

- Table 5: China Sea Freight Transport Market Revenue Million Forecast, by Supporti 2019 & 2032

- Table 6: China Sea Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: China Sea Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: China Sea Freight Transport Market Revenue Million Forecast, by Water Transport Services 2019 & 2032

- Table 16: China Sea Freight Transport Market Revenue Million Forecast, by Vessel Leasing and Rental Services 2019 & 2032

- Table 17: China Sea Freight Transport Market Revenue Million Forecast, by Cargo Ha 2019 & 2032

- Table 18: China Sea Freight Transport Market Revenue Million Forecast, by Supporti 2019 & 2032

- Table 19: China Sea Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Sea Freight Transport Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the China Sea Freight Transport Market?

Key companies in the market include CTS China Hong Kong International Logistics Co Ltd, SINOTRANS Limited, Fujian Xiamen Shipping Co Ltd, SITC International Holdings Company Limited, Hosco Group (Hebei Shipping), Jincheng International Shipping Agency**List Not Exhaustive, COSCO Shipping Lines, China Merchants Group, C&K Ocean Shipping Company, Nanjing Ocean Shipping Co Ltd.

3. What are the main segments of the China Sea Freight Transport Market?

The market segments include Water Transport Services, Vessel Leasing and Rental Services, Cargo Ha, Supporti.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation.

6. What are the notable trends driving market growth?

Positive Trend of Chinese Imports and Exports..

7. Are there any restraints impacting market growth?

4.; South Korea's logistics infrastructure. while generally well-developed. can experience congestion in key areas. such as ports and highways4.; Like many other countries. South Korea faced issues related to labor shortages in the logistics sector..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Sea Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Sea Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Sea Freight Transport Market?

To stay informed about further developments, trends, and reports in the China Sea Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence