Key Insights

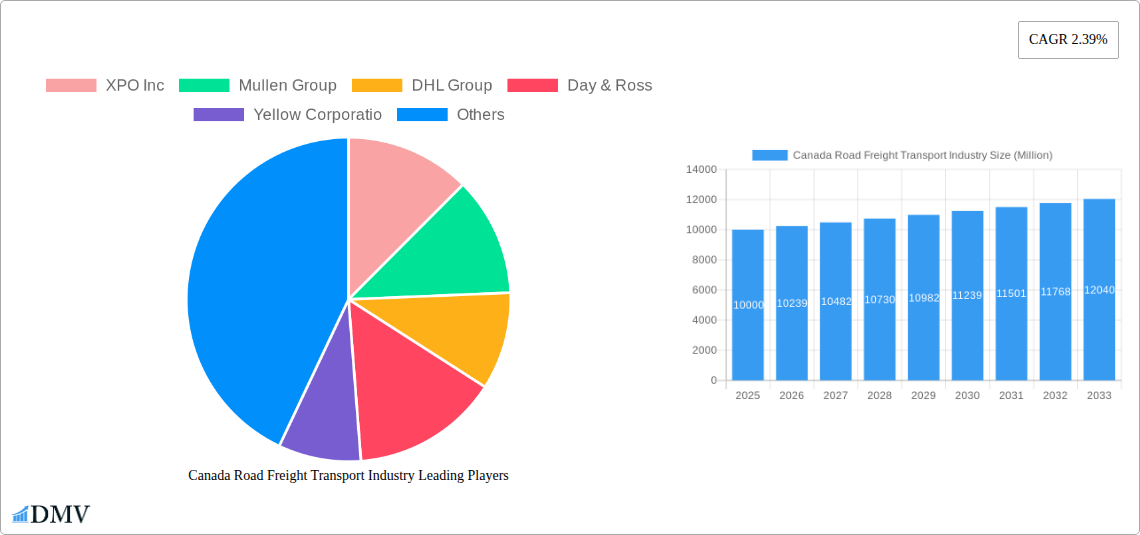

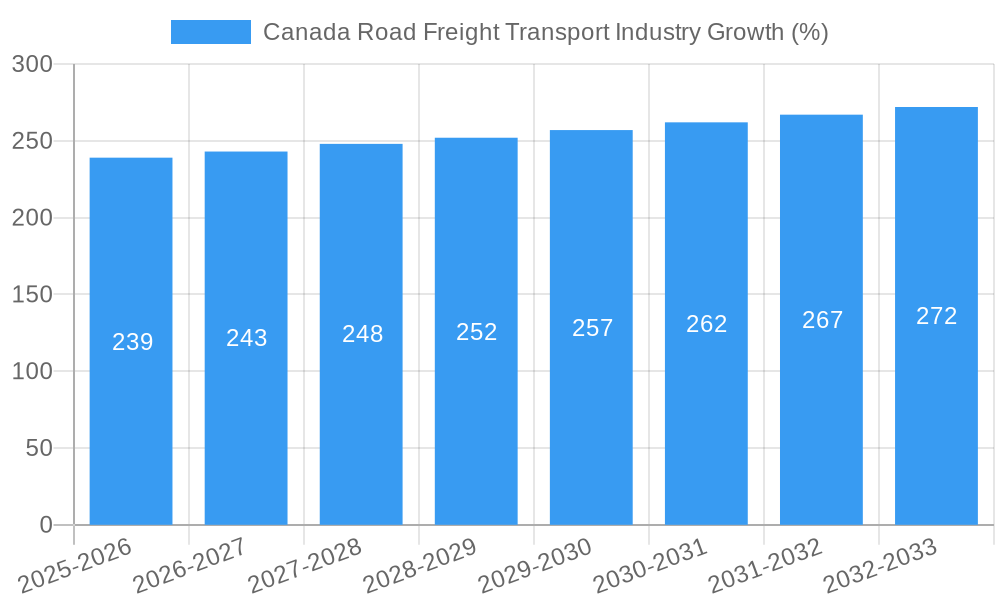

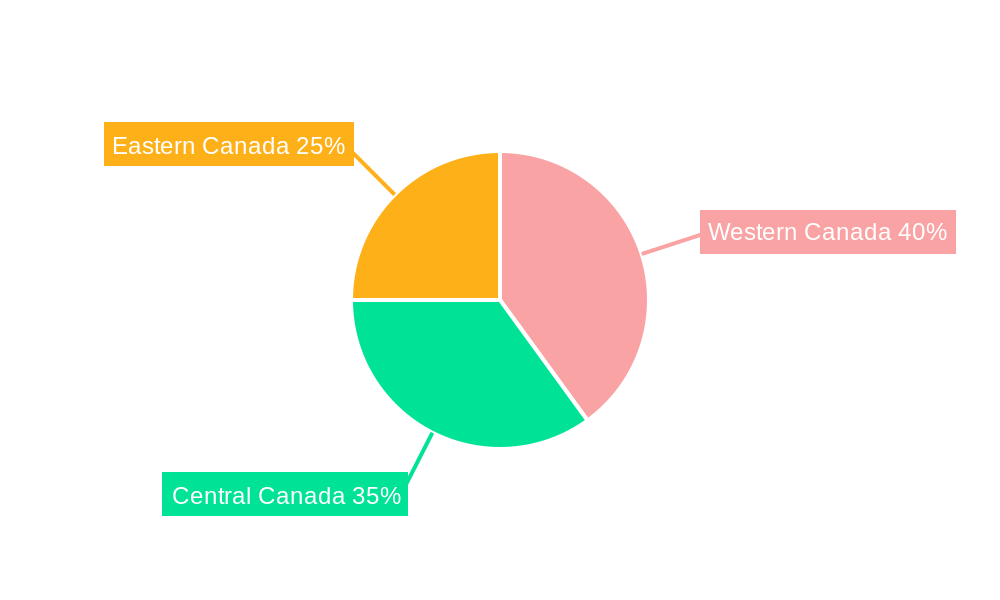

The Canadian road freight transport industry, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by robust e-commerce expansion, increasing cross-border trade, and the nation's diverse industrial landscape. The 2.39% CAGR suggests a consistent, albeit moderate, expansion over the forecast period (2025-2033). Key growth drivers include the burgeoning e-commerce sector demanding efficient last-mile delivery solutions, the expansion of manufacturing and resource extraction industries (oil & gas, mining) requiring extensive freight movement, and increased cross-border trade with the US. Growth within the various segments – from temperature-controlled goods to LTL and FTL trucking – will be influenced by the specific needs of these driving industries and related logistical complexities. The industry faces challenges, however, including driver shortages, escalating fuel costs, and evolving regulations impacting operational efficiency and sustainability. These restraints, while present, are likely to be mitigated by ongoing technological advancements in fleet management, route optimization software, and the increasing adoption of autonomous vehicle technologies in the long term. The geographic distribution of growth will likely favor regions with strong industrial hubs and proximity to major trade routes, such as Western and Central Canada.

The industry's segmentation offers valuable insights into market dynamics. While full-truckload (FTL) shipments will remain dominant, the less-than-truckload (LTL) segment is expected to witness significant growth driven by the increase in smaller and more frequent shipments associated with e-commerce. The temperature-controlled segment, critical for food and pharmaceutical transportation, represents a significant portion of the market and is likely to grow in line with overall market trends. The dominance of specific players (XPO Inc, Mullen Group, DHL, etc.) will be challenged by the emergence of smaller, specialized logistics providers catering to niche market segments and emphasizing sustainability. Regional variations in growth will reflect the concentration of key industries and infrastructure development across Eastern, Central, and Western Canada. The long-haul segment will experience consistent demand due to the geographic expanse of Canada, while shorter-haul trucking will see fluctuations depending on local economic activity and consumer spending.

Canada Road Freight Transport Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian road freight transport industry, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. We analyze key trends, major players, and future growth opportunities, providing a crucial understanding of this multi-billion dollar market. Discover the forces shaping the future of Canadian road freight, including technological advancements, evolving regulatory landscapes, and strategic M&A activity.

Canada Road Freight Transport Industry Market Composition & Trends

The Canadian road freight transport industry, valued at xx Million in 2025, is characterized by a moderately concentrated market with key players such as XPO Inc, Mullen Group, DHL Group, Day & Ross, Yellow Corporation, FedEx, United Parcel Service of America Inc (UPS), C H Robinson, J B Hunt Transport Inc, and Ryder System Inc. Market share distribution varies significantly across segments, with xx% dominated by the top 5 players in 2025. Innovation is driven by the need for increased efficiency, technological integration (e.g., route optimization software, AI-powered dispatch), and enhanced supply chain visibility. Regulatory changes, including emission standards and driver regulations, significantly impact operational costs and strategies. Substitute products, such as rail and air freight, exert competitive pressure, especially for long-haul transportation. End-user profiles are diverse, encompassing agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others. M&A activity remains robust, with notable transactions influencing market consolidation and service expansion.

- Market Concentration: Moderately concentrated, with the top 5 players holding xx% market share in 2025.

- Innovation Catalysts: Efficiency gains, technological integration (AI, route optimization), enhanced supply chain visibility.

- Regulatory Landscape: Evolving emission standards and driver regulations significantly impacting operations.

- Substitute Products: Rail and air freight present competition, particularly for long-haul routes.

- End-User Profiles: Diversified across various sectors including Agriculture, Manufacturing, Oil & Gas, and Retail.

- M&A Activity: Significant transactions shaping market consolidation and service expansion, with total deal values exceeding xx Million in the past five years.

Canada Road Freight Transport Industry Industry Evolution

The Canadian road freight transport industry has experienced consistent growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to several factors: increasing e-commerce driving last-mile delivery demands, expansion of manufacturing and industrial activities, and a growing need for efficient logistics solutions across diverse sectors. Technological advancements, such as the implementation of telematics and advanced GPS tracking systems, are enhancing operational efficiency and reducing transit times. Shifting consumer demands, particularly towards faster and more reliable delivery, are driving innovation within the industry. The forecast period (2025-2033) projects continued growth, albeit at a slightly moderated CAGR of xx%, driven by factors like increasing automation, sustainable transportation solutions, and evolving regulatory environments. The adoption of technology such as AI-powered route optimization is expected to increase by xx% by 2033.

Leading Regions, Countries, or Segments in Canada Road Freight Transport Industry

The Canadian road freight transport market shows strong regional variations. Ontario and Quebec, due to their higher population density and industrial activity, represent the leading regions. However, significant growth is also observed in Western Canada, fuelled by the resource sector and expanding interprovincial trade.

- Key Drivers:

- Ontario & Quebec: High population density, extensive industrial activity, strong manufacturing base.

- Western Canada: Resource sector growth (Oil & Gas, Mining), increasing interprovincial trade.

- Dominant Segments:

- Goods Configuration: Solid goods represent a larger share due to the dominance of manufactured goods and retail shipments.

- Temperature Control: Non-temperature controlled shipments dominate, but temperature-controlled logistics are witnessing growth in food and pharmaceutical sectors.

- End-User Industry: Wholesale and retail trade, followed by manufacturing, represent the largest end-user segments.

- Destination: Domestic transportation accounts for the bulk of the market.

- Truckload Specification: Full-Truck-Load (FTL) dominates, reflecting the prevalent nature of large-scale shipments.

- Containerization: Non-Containerized freight makes up the majority.

- Distance: Short-haul transportation represents a larger portion, linked to urban and regional distribution networks.

The dominance of these segments is driven by factors such as established infrastructure, proximity to major markets, and high demand for specific transportation services.

Canada Road Freight Transport Industry Product Innovations

Recent innovations focus on enhancing efficiency and sustainability. C.H. Robinson's new AI-powered appointment scheduling technology significantly reduces administrative overhead and optimizes delivery times. The adoption of telematics and GPS tracking systems improve route planning, fuel efficiency, and real-time monitoring of shipments. Furthermore, the integration of Electric Vehicles (EVs) and alternative fuels is gaining traction, addressing growing concerns about environmental impact. These innovations contribute to reduced costs, improved delivery times, and greater sustainability within the industry.

Propelling Factors for Canada Road Freight Transport Industry Growth

Growth is fueled by several interconnected factors. The rise of e-commerce continues to drive demand for last-mile delivery services. Increased manufacturing and industrial activity necessitates efficient transportation solutions. Government investments in infrastructure development further enhance logistical capabilities. Finally, the ongoing adoption of technological advancements such as AI and IoT improves operational efficiency and reduces costs.

Obstacles in the Canada Road Freight Transport Industry Market

Significant challenges persist. Driver shortages represent a critical constraint, impacting capacity and potentially driving up costs. Fuel price volatility directly affects operational expenses. Stringent regulatory compliance requirements add complexity and costs to operations. Finally, intense competition among established players and new entrants contributes to price pressures.

Future Opportunities in Canada Road Freight Transport Industry

Future opportunities lie in expanding into underserved regions, leveraging technological advancements like autonomous vehicles and drone delivery, and focusing on sustainability initiatives. The growing demand for cold-chain logistics and specialized transportation solutions also presents significant growth potential. Furthermore, the increasing emphasis on supply chain resilience and diversification presents new strategic opportunities for players willing to adapt.

Major Players in the Canada Road Freight Transport Industry Ecosystem

- XPO Inc (XPO Inc)

- Mullen Group (Mullen Group)

- DHL Group (DHL Group)

- Day & Ross

- Yellow Corporation

- FedEx (FedEx)

- United Parcel Service of America Inc (UPS) (UPS)

- C H Robinson (C H Robinson)

- J B Hunt Transport Inc (J B Hunt Transport Inc)

- Ryder System Inc (Ryder System Inc)

Key Developments in Canada Road Freight Transport Industry Industry

- February 2024: C.H. Robinson launches AI-powered appointment scheduling technology, boosting efficiency and reducing transit times.

- January 2024: Mullen Group acquires ContainerWorld Forwarding Services Inc., expanding its logistics and warehousing segment by an estimated USD 150 Million in annual revenue.

- October 2023: Ryder System acquires Impact Fulfillment Services, significantly expanding its supply chain services and adding 15 operations across nine states.

Strategic Canada Road Freight Transport Industry Market Forecast

The Canadian road freight transport industry is poised for continued growth, driven by technological innovation, expanding e-commerce, and increasing demand across diverse sectors. Opportunities exist in leveraging emerging technologies, enhancing supply chain resilience, and focusing on sustainable practices. The market is expected to reach xx Million by 2033, representing a significant expansion of the current market size. Strategic partnerships and investments in technology will be key for players to capitalize on future growth potential.

Canada Road Freight Transport Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Canada Road Freight Transport Industry Segmentation By Geography

- 1. Canada

Canada Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Rules and Regulations4.; Higher Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Eastern Canada Canada Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 XPO Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Mullen Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 DHL Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Day & Ross

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Yellow Corporatio

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 FedEx

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 United Parcel Service of America Inc (UPS)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 C H Robinson

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 J B Hunt Transport Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Ryder System Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 XPO Inc

List of Figures

- Figure 1: Canada Road Freight Transport Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Road Freight Transport Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Road Freight Transport Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Road Freight Transport Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Canada Road Freight Transport Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Canada Road Freight Transport Industry Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Canada Road Freight Transport Industry Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Canada Road Freight Transport Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Canada Road Freight Transport Industry Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Canada Road Freight Transport Industry Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Canada Road Freight Transport Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Canada Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Eastern Canada Canada Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Western Canada Canada Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Central Canada Canada Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Road Freight Transport Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 15: Canada Road Freight Transport Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 16: Canada Road Freight Transport Industry Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 17: Canada Road Freight Transport Industry Revenue Million Forecast, by Containerization 2019 & 2032

- Table 18: Canada Road Freight Transport Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 19: Canada Road Freight Transport Industry Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 20: Canada Road Freight Transport Industry Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 21: Canada Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Road Freight Transport Industry?

The projected CAGR is approximately 2.39%.

2. Which companies are prominent players in the Canada Road Freight Transport Industry?

Key companies in the market include XPO Inc, Mullen Group, DHL Group, Day & Ross, Yellow Corporatio, FedEx, United Parcel Service of America Inc (UPS), C H Robinson, J B Hunt Transport Inc, Ryder System Inc.

3. What are the main segments of the Canada Road Freight Transport Industry?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Stringent Rules and Regulations4.; Higher Costs.

8. Can you provide examples of recent developments in the market?

February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.January 2024: Mullen Group Ltd has entered into a letter of intent (LOI) to acquire Richmond, British Columbia-based ContainerWorld Forwarding Services Inc. and its operating subsidiaries. The transaction will close in the second quarter of 2024, subject to regulatory approval and final closing conditions. ContainerWorld will operate within Mullen Group's Logistics & Warehousing segment ("L&W segment") and it is expected to generate annualized revenue of approximately USD 150 million.October 2023: Ryder System has entered into a definitive agreement to acquire IFS Holdings, known as Impact Fulfillment Services. The 3PL provides a range of services, including contract packaging and manufacturing, warehousing and more. The deal aims to expand Ryder’s supply chain services by adding 15 operations across nine states, involving California, Florida, Georgia, Illinois, North Carolina, Ohio, Pennsylvania, Texas and Utah.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the Canada Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence