Key Insights

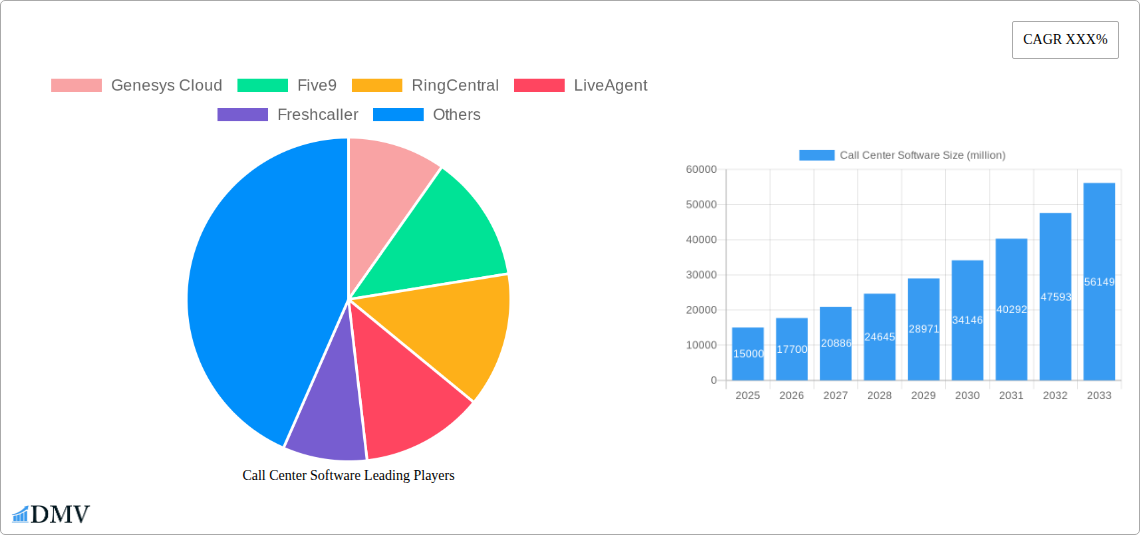

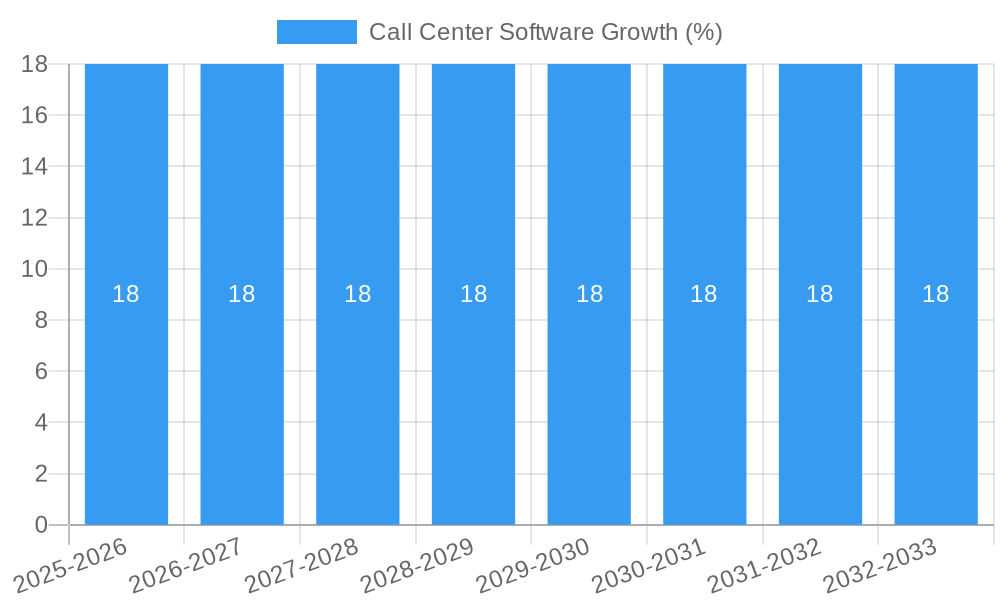

The global Call Center Software market is poised for substantial growth, projected to reach an estimated market size of approximately $15 billion by 2025. This upward trajectory is fueled by a robust Compound Annual Growth Rate (CAGR) of around 18-20% over the forecast period of 2025-2033, indicating a dynamic and expanding industry. The primary drivers behind this surge include the escalating demand for enhanced customer experience (CX), the increasing adoption of cloud-based solutions for scalability and cost-effectiveness, and the growing need for advanced analytics and AI-powered features to optimize call center operations. Businesses are increasingly recognizing the strategic importance of efficient customer communication for brand loyalty and revenue generation, making sophisticated call center software a critical investment. The market is broadly segmented by application into large enterprises and SMEs, with both segments exhibiting strong growth potential as businesses of all sizes prioritize customer engagement.

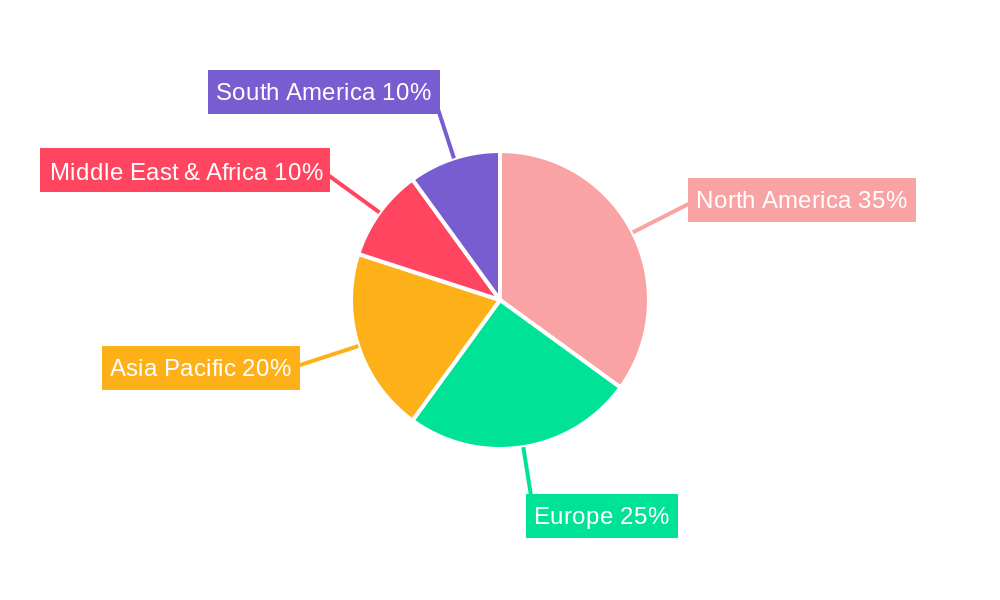

The market's expansion is further propelled by emerging trends such as the integration of omnichannel capabilities, allowing for seamless communication across various channels like voice, email, chat, and social media. The rise of AI-driven chatbots and virtual assistants is revolutionizing customer service by handling routine inquiries, freeing up human agents for more complex issues, and improving first-contact resolution rates. While the market enjoys significant growth drivers, certain restraints, such as the initial implementation costs and the need for skilled personnel to manage complex systems, could pose challenges. However, the increasing availability of flexible pricing models and the development of user-friendly interfaces are mitigating these concerns. Geographically, North America is expected to maintain a leading position due to its early adoption of advanced technologies and a strong focus on customer satisfaction. Asia Pacific, driven by rapid digitalization and a burgeoning SME sector, presents a significant growth opportunity.

Call Center Software Market Composition & Trends

The call center software market exhibits a dynamic composition, characterized by a blend of established giants and innovative disruptors. Market concentration is moderately fragmented, with key players like Genesys Cloud, Five9, RingCentral, Zendesk Talk, and Talkdesk holding substantial market share, estimated to be over 50 million dollars collectively for the top five. However, the proliferation of specialized solutions from companies such as LiveAgent, Freshcaller, Avaya, and CloudTalk fuels intense competition and drives innovation.

- Innovation Catalysts: The relentless pursuit of enhanced customer experience (CX) and operational efficiency stands as a primary catalyst. Advancements in Artificial Intelligence (AI), machine learning (ML), and automation are transforming traditional call center functionalities into sophisticated customer engagement hubs. The increasing adoption of omnichannel strategies, integrating voice, chat, email, and social media, further necessitates integrated and intelligent software solutions.

- Regulatory Landscapes: Compliance with data privacy regulations such as GDPR and CCPA significantly influences software development and deployment, with companies investing millions in ensuring adherence. Government initiatives promoting digital transformation and customer service excellence also play a crucial role.

- Substitute Products: While direct substitutes are limited, functionalities offered by broader CRM platforms and standalone communication tools can be seen as indirect competitors, especially for smaller businesses. However, specialized call center software offers a depth of features and integrations that remain unmatched.

- End-User Profiles: The market caters to a diverse range of end-users, from large enterprises seeking scalable and robust solutions to SMEs demanding cost-effective and agile platforms. Industries such as telecommunications, BFSI, healthcare, and retail represent significant user bases, each with unique requirements.

- M&A Activities: The market has witnessed significant M&A activity, with substantial deal values exceeding 500 million dollars in the last three years, as larger players consolidate their offerings and expand their market reach. Strategic acquisitions of niche technology providers are common, aiming to integrate advanced AI capabilities or expand channel support.

Call Center Software Industry Evolution

The call center software industry has undergone a remarkable evolution, transforming from basic telephony systems to sophisticated, AI-powered customer engagement platforms. Throughout the historical period of 2019–2024, the market experienced a steady compound annual growth rate (CAGR) of approximately 18%, driven by the accelerating digital transformation across businesses and the increasing importance of customer experience as a competitive differentiator. The base year of 2025 is projected to see this growth continue robustly, with an estimated market size of over 20 billion dollars.

The initial phases of this evolution were marked by the widespread adoption of Voice over Internet Protocol (VoIP) technology, enabling cost savings and greater flexibility. This paved the way for the rise of cloud-based call center solutions, offering scalability, accessibility, and reduced upfront infrastructure costs. Companies like Genesys Cloud, Five9, and RingCentral were early pioneers in this shift, providing Software-as-a-Service (SaaS) models that democratized access to advanced call center functionalities. The estimated adoption rate of cloud-based solutions within the large enterprise segment alone is expected to surpass 85% by 2025.

Technological advancements have been the primary engine of this evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) has revolutionized agent productivity and customer self-service capabilities. AI-powered chatbots and virtual assistants, capable of handling a significant volume of routine inquiries (estimated to handle over 30% of customer interactions in some sectors by 2027), have become commonplace. Sentiment analysis, predictive routing, and intelligent agent assistance are now integral features, enhancing first-contact resolution rates by an estimated 20%.

Shifting consumer demands have also played a pivotal role. Today's customers expect seamless, personalized, and immediate support across multiple channels. This omnichannel imperative has driven the demand for integrated solutions that offer a unified view of customer interactions, regardless of the channel. The rise of digital channels like live chat, social media messaging, and in-app support has necessitated software that can effectively manage and orchestrate these diverse communication streams. The forecast period of 2025–2033 is expected to witness an even more profound transformation, with AI and automation becoming deeply embedded in every facet of the customer journey, leading to a projected market size exceeding 50 billion dollars by 2033, with a continued CAGR of around 15%. The focus will increasingly shift towards proactive engagement, hyper-personalization, and predictive customer service.

Leading Regions, Countries, or Segments in Call Center Software

The North American region currently dominates the call center software market, driven by a confluence of factors including early adoption of advanced technologies, significant investment in customer experience initiatives, and a robust presence of large enterprises. The United States, in particular, stands out as the leading country due to its mature technological infrastructure and a high concentration of global corporations that prioritize customer service excellence. The estimated market share for North America is over 40% of the global call center software market.

Within this dominant region, the Application: Large Enterprises segment commands the largest share, accounting for approximately 65% of the total market. Large enterprises possess the financial resources and strategic imperative to invest in comprehensive, scalable, and feature-rich call center solutions that can manage high volumes of customer interactions and support complex workflows. The demand for advanced analytics, robust integrations with existing enterprise systems, and sophisticated omnichannel capabilities is particularly strong within this segment.

The Type: Cloud-Based deployment model is overwhelmingly preferred across all segments and regions, with an estimated market penetration of over 80% by 2025. This preference is fueled by the inherent advantages of cloud solutions, including scalability, flexibility, reduced IT overhead, faster deployment times, and continuous updates. For large enterprises, cloud-based platforms offer the agility to adapt to changing business needs and fluctuating demand, ensuring consistent service delivery without significant capital expenditure.

Key Drivers of Dominance in North America:

- High Investment in CX: North American companies consistently rank customer experience as a top business priority, leading to substantial investments in call center technology.

- Technological Innovation Hub: The region is a hotbed for AI, ML, and cloud computing innovation, providing a fertile ground for the development and adoption of cutting-edge call center software.

- Regulatory Support for Digitalization: Government and industry initiatives promoting digital transformation encourage businesses to adopt advanced software solutions.

- Presence of Major Technology Companies: Leading call center software vendors, including Genesys Cloud, Five9, and RingCentral, are headquartered or have a significant presence in North America, fostering market growth and innovation.

Dominance Factors in Large Enterprises Application:

- Scalability and Performance: Large enterprises require solutions that can handle millions of calls and interactions daily, with high availability and robust performance.

- Integration Capabilities: Seamless integration with CRM, ERP, and other enterprise systems is crucial for a unified view of the customer and streamlined operations.

- Advanced Features: Demand for AI-powered analytics, workforce optimization, omnichannel routing, and sophisticated reporting tools is high.

- Security and Compliance: Meeting stringent data security and regulatory compliance standards (e.g., PCI DSS, HIPAA) is paramount.

While other regions like Europe and Asia-Pacific are experiencing rapid growth and increasing adoption, North America's established market and continuous innovation solidify its leading position in the call center software landscape. The SME segment is also a significant growth area, with cloud-based solutions offering increasingly accessible and affordable options.

Call Center Software Product Innovations

Recent product innovations in call center software are heavily driven by AI and automation, aimed at enhancing both agent efficiency and customer satisfaction. Solutions now incorporate advanced natural language processing (NLP) for intelligent routing of inquiries to the most qualified agents, reducing average handling time by an estimated 15%. Predictive analytics are being deployed to anticipate customer needs and proactively offer support, minimizing churn. Furthermore, the integration of generative AI is enabling automated response generation and sophisticated knowledge base management, empowering agents with real-time information and personalized customer insights. Companies are also focusing on hyper-personalization through data-driven insights, allowing for tailored customer interactions across all touchpoints.

Propelling Factors for Call Center Software Growth

The call center software market is propelled by several key factors. The escalating importance of exceptional customer experience (CX) as a competitive differentiator is a primary driver, pushing businesses to invest in solutions that enhance customer satisfaction and loyalty. The accelerating digital transformation across industries necessitates integrated and scalable communication platforms. Technological advancements, particularly in Artificial Intelligence (AI) and Machine Learning (ML), are enabling more intelligent automation, personalized interactions, and data-driven insights, significantly improving operational efficiency. Furthermore, the growing trend of remote work has increased the demand for flexible, cloud-based call center solutions that support distributed teams. The global market is projected to reach over 40 billion dollars by 2028.

Obstacles in the Call Center Software Market

Despite robust growth, the call center software market faces several obstacles. High implementation costs and complexity can be a barrier, especially for small and medium-sized enterprises (SMEs), with initial setup costs sometimes exceeding 50,000 dollars. Integration challenges with legacy systems can also hinder seamless adoption, leading to operational inefficiencies. Stringent data privacy regulations and compliance requirements add a layer of complexity and necessitate significant investment in security measures. Furthermore, the rapidly evolving technological landscape requires continuous updates and training, which can be a resource-intensive undertaking for some organizations. Intense market competition also pressures vendors on pricing and necessitates constant innovation.

Future Opportunities in Call Center Software

Emerging opportunities in the call center software market are abundant. The expanding adoption of AI and automation will continue to drive innovation, with advanced capabilities like predictive customer service and hyper-personalized interactions becoming standard. The increasing demand for omnichannel solutions that seamlessly integrate voice, chat, email, and social media presents a significant growth area. Furthermore, the penetration of cloud-based solutions into emerging economies and the growing need for specialized call center software tailored to specific industry verticals, such as healthcare and BFSI, offer substantial expansion prospects. The rise of the metaverse and its potential impact on customer interaction also presents nascent opportunities for innovative engagement strategies.

Major Players in the Call Center Software Ecosystem

- Genesys Cloud

- Five9

- RingCentral

- LiveAgent

- Freshcaller

- Zendesk Talk

- Talkdesk

- Avaya

- CloudTalk

Key Developments in Call Center Software Industry

- 2023 Q4: Genesys Cloud announced enhanced AI capabilities, including advanced sentiment analysis and agent assist tools, further optimizing customer interactions.

- 2023 Q3: Five9 launched new integrations with leading CRM platforms, aiming to provide a more unified customer view and streamline workflows for businesses.

- 2023 Q2: RingCentral expanded its global cloud infrastructure, bolstering its ability to serve large enterprises with robust and scalable communication solutions.

- 2023 Q1: Zendesk Talk introduced new self-service portal features powered by AI, aiming to deflect a higher percentage of customer inquiries.

- 2022 Q4: Talkdesk acquired an AI-powered platform to enhance its natural language processing (NLP) capabilities, improving bot performance and voice analytics.

- 2022 Q3: Avaya unveiled a refreshed suite of cloud-based contact center solutions, focusing on hybrid work environments and enhanced agent experience.

- 2022 Q2: CloudTalk introduced advanced analytics dashboards, providing deeper insights into call center performance and customer behavior.

- 2022 Q1: LiveAgent expanded its channel support, integrating more social media messaging platforms into its unified inbox.

Strategic Call Center Software Market Forecast

The strategic outlook for the call center software market remains exceptionally strong, driven by the unrelenting focus on customer experience and the transformative power of emerging technologies. The forecast period from 2025 to 2033 is set to witness continued robust growth, fueled by the widespread adoption of AI, machine learning, and automation across all business sizes and industries. The shift towards cloud-based solutions will solidify, offering unparalleled scalability and flexibility. Opportunities abound in hyper-personalization, proactive customer engagement, and the seamless integration of diverse communication channels. Businesses that leverage these advancements to deliver exceptional, data-driven customer journeys will undoubtedly gain a significant competitive advantage, solidifying the market's trajectory towards over 60 billion dollars by the end of the forecast period.

Call Center Software Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Type

- 2.1. Cloud-Based

- 2.2. On-Premise

Call Center Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Call Center Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Call Center Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud-Based

- 5.2.2. On-Premise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Call Center Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud-Based

- 6.2.2. On-Premise

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Call Center Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud-Based

- 7.2.2. On-Premise

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Call Center Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud-Based

- 8.2.2. On-Premise

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Call Center Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud-Based

- 9.2.2. On-Premise

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Call Center Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud-Based

- 10.2.2. On-Premise

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Genesys Cloud

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Five9

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RingCentral

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LiveAgent

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Freshcaller

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zendesk Talk

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Talkdesk

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Avaya

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Channels

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CloudTalk

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Genesys Cloud

List of Figures

- Figure 1: Global Call Center Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Call Center Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Call Center Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Call Center Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America Call Center Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Call Center Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Call Center Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Call Center Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Call Center Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Call Center Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America Call Center Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Call Center Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Call Center Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Call Center Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Call Center Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Call Center Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Call Center Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Call Center Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Call Center Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Call Center Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Call Center Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Call Center Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Call Center Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Call Center Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Call Center Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Call Center Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Call Center Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Call Center Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Call Center Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Call Center Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Call Center Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Call Center Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Call Center Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Call Center Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Call Center Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Call Center Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Call Center Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Call Center Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Call Center Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Call Center Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Call Center Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Call Center Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Call Center Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Call Center Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Call Center Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Call Center Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Call Center Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Call Center Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Call Center Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Call Center Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Call Center Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Call Center Software?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Call Center Software?

Key companies in the market include Genesys Cloud, Five9, RingCentral, LiveAgent, Freshcaller, Zendesk Talk, Talkdesk, Avaya, Channels, CloudTalk.

3. What are the main segments of the Call Center Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Call Center Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Call Center Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Call Center Software?

To stay informed about further developments, trends, and reports in the Call Center Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence