Key Insights

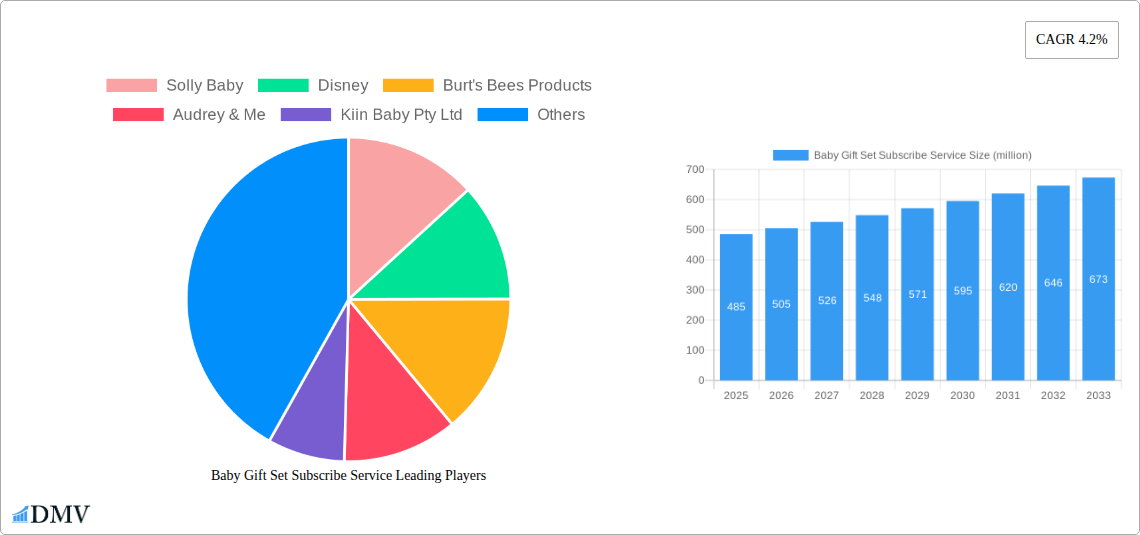

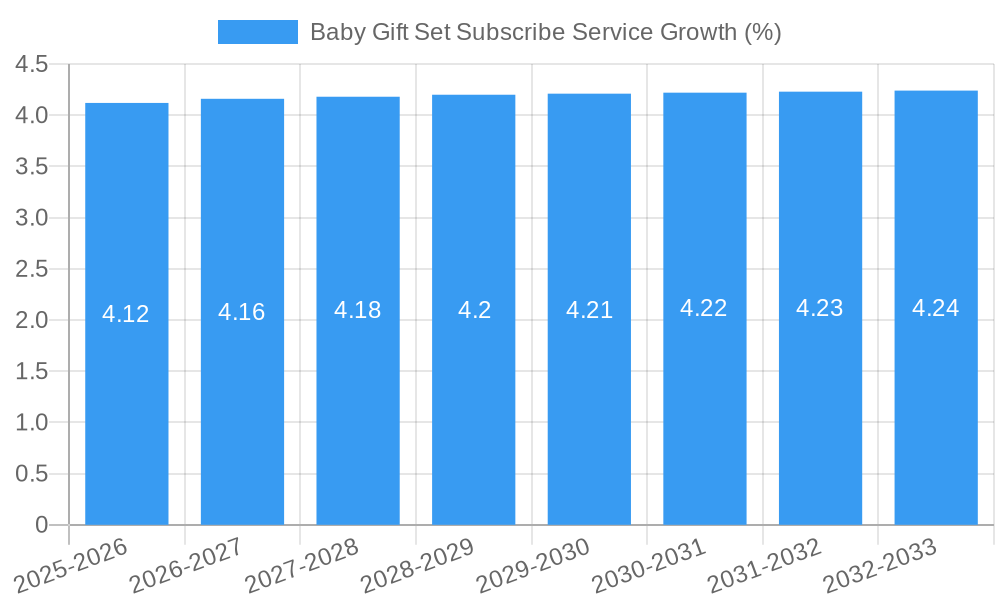

The global Baby Gift Set Subscription Service market is poised for significant expansion, projected to reach an estimated market size of $485 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.2% anticipated throughout the forecast period of 2025-2033. This growth is fueled by an evolving consumer landscape that increasingly values convenience, curated experiences, and personalized gifting solutions for newborns and young children. Key drivers include the rising birth rates in emerging economies, a growing disposable income among millennial and Gen Z parents, and the strong influence of social media in promoting subscription box culture. The convenience of receiving a regular supply of essential baby items, from apparel and toys to developmental products, directly addresses the time constraints faced by new parents, making subscription services an attractive proposition. Furthermore, the trend towards premium and eco-friendly baby products is also a significant contributor, as subscription services often curate high-quality, sustainable, and often niche brands, appealing to a discerning customer base.

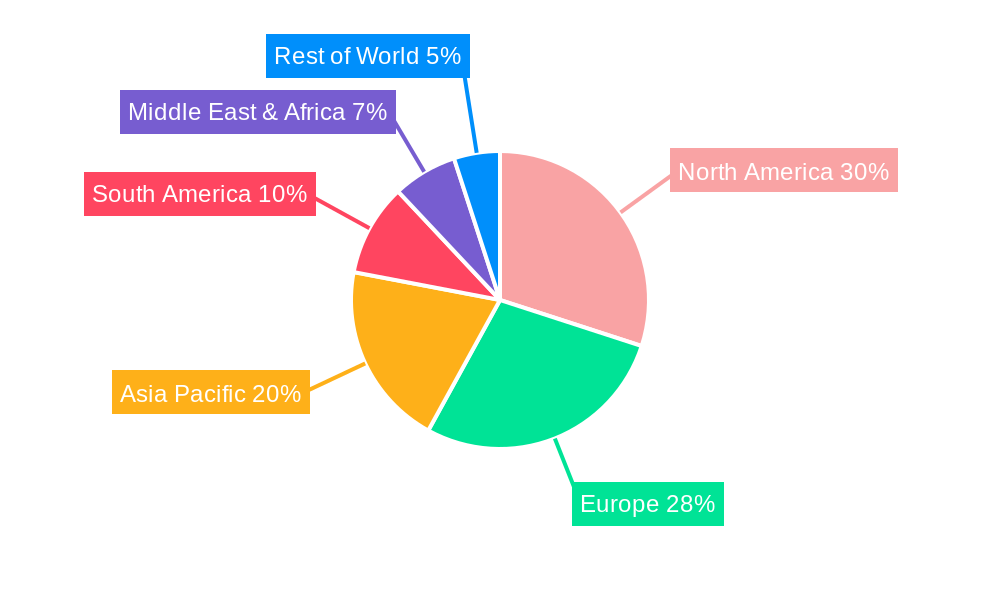

The market is characterized by diverse segmentation, with "Apparel" and "Toys" emerging as dominant categories within the "Type" segment, catering to the continuous needs of growing infants and toddlers. The "Application" segment sees a balanced demand across "Baby Girl," "Baby Boy," and "All" (unisex) options, reflecting inclusive market trends. Geographically, North America and Europe currently represent the largest markets due to established e-commerce infrastructure and high consumer spending power. However, the Asia Pacific region, particularly China and India, is expected to exhibit the fastest growth, driven by increasing internet penetration, a burgeoning middle class, and a cultural emphasis on celebrating new life. Restraints such as intense competition from traditional retail channels and the potential for subscription fatigue among consumers are being actively addressed by service providers through enhanced personalization, unique product offerings, and flexible subscription models. Leading companies like Solly Baby, Disney, and Burt's Bees Products are innovating with themed boxes, eco-conscious options, and loyalty programs to maintain a competitive edge.

Here is an SEO-optimized and insightful report description for the Baby Gift Set Subscribe Service Market, designed to boost search visibility and captivate stakeholders:

Baby Gift Set Subscribe Service Market Composition & Trends

The baby gift set subscription service market is characterized by a dynamic blend of established players and emerging innovators, with a growing emphasis on personalized and sustainable offerings. Market concentration is moderate, with a few leading companies holding significant market share while numerous niche providers cater to specific consumer demands. Innovation catalysts include the increasing desire for curated gifting experiences, the rise of e-commerce and subscription models, and a growing awareness of eco-friendly and ethically sourced baby products. Regulatory landscapes are largely permissive, primarily focusing on product safety standards, which influences ingredient sourcing and material choices. Substitute products include one-time gift purchases, DIY gift baskets, and individual baby product purchases, though the convenience and curated nature of subscription boxes offer a distinct advantage. End-user profiles are diverse, encompassing expectant parents, gift-givers for baby showers and birthdays, and those seeking regular supplies of essential baby items. Mergers and acquisitions (M&A) activities are expected to increase as larger companies seek to expand their subscription service portfolios and smaller, innovative brands aim for broader market reach. Projected M&A deal values are estimated to reach several hundred million dollars by the end of the forecast period, underscoring strategic consolidation. The market share distribution is anticipated to shift gradually, with personalized and sustainable options gaining traction, potentially reaching a combined XX% of the total market by 2033.

- Market Concentration: Moderate, with a blend of large and small providers.

- Innovation Catalysts: Personalization, e-commerce, sustainability.

- Regulatory Landscape: Primarily focused on product safety and compliance.

- Substitute Products: One-time gift purchases, DIY baskets.

- End-User Profiles: Expectant parents, gift-givers, recurring buyers.

- M&A Activities: Anticipated to increase, with projected deal values in the hundreds of million dollars.

Baby Gift Set Subscribe Service Industry Evolution

The baby gift set subscription service industry has witnessed substantial evolution since 2019, driven by significant technological advancements and a discernible shift in consumer demands towards convenience, personalization, and ethical considerations. The market growth trajectory, projected to expand at a compound annual growth rate (CAGR) of approximately XX% from 2025 to 2033, is a testament to the increasing adoption of subscription-based models for baby essentials and gifts. Initial adoption metrics in the historical period (2019-2024) were driven by the novelty of curated boxes and the convenience for busy parents. Technological advancements, particularly in e-commerce platform development and data analytics, have enabled more sophisticated personalization options, allowing subscribers to tailor boxes based on baby's age, gender (Baby Girl, Baby Boy, All), and specific needs, including product types like Toy, Apparel, and Other. The base year of 2025 marks a pivotal point where these personalized offerings are becoming mainstream, with an estimated XX% of subscribers actively customizing their boxes. Shifting consumer demands are a paramount factor; parents are increasingly seeking high-quality, organic, and eco-friendly products, leading to a surge in demand for brands that prioritize sustainability and ethical sourcing. This trend has prompted many companies to revamp their product offerings and supply chains. The industry's evolution is also marked by the integration of smart technologies, such as AI-powered recommendation engines that suggest optimal product selections, further enhancing the customer experience and driving repeat subscriptions. The estimated market size for baby gift set subscription services is projected to reach over $XX million by 2025 and is expected to continue its upward climb, fueled by these evolving industry dynamics and a growing global birth rate, particularly in developed economies. The forecast period (2025–2033) will likely see further innovation in subscription models, including flexible delivery schedules and tiered pricing structures, catering to a wider spectrum of consumer budgets and preferences, solidifying its position as a vital segment within the broader baby care market.

Leading Regions, Countries, or Segments in Baby Gift Set Subscribe Service

The North American region, specifically the United States, is projected to dominate the baby gift set subscription service market throughout the forecast period (2025–2033). This dominance is underpinned by a confluence of robust economic indicators, a strong e-commerce infrastructure, and a deeply ingrained culture of celebrating births and baby milestones with thoughtful gifting. Within North America, the Application: All segment is expected to exhibit the highest growth and market share, reflecting the universal appeal of baby gift sets for both baby girls and baby boys, as well as for gender-neutral options, making it a highly versatile and sought-after category for gift-givers and new parents alike. Furthermore, the Type: Apparel segment consistently ranks as a top performer, driven by the perennial demand for high-quality, comfortable, and stylish clothing for infants and toddlers.

Key drivers contributing to North America's leadership include:

- High Disposable Income: Consumers in the United States possess substantial disposable income, enabling them to invest in premium and subscription-based baby products. This financial capacity directly translates to a higher propensity to subscribe to recurring gift services.

- Advanced E-commerce Penetration: The widespread adoption of online shopping and established logistics networks ensure efficient delivery and accessibility of subscription boxes across the country. The convenience factor of online purchasing aligns perfectly with the busy lifestyles of modern parents and gift-givers.

- Cultural Emphasis on Gifting: Celebrations like baby showers and first birthdays are significant cultural events in the US, creating a strong demand for curated gift sets that offer a unique and memorable gifting experience.

- Brand Loyalty and Subscription Culture: Consumers are increasingly comfortable with and loyal to subscription models, viewing them as a cost-effective and convenient way to receive regular supplies of desired products. This established subscription culture bolsters the growth of baby gift set services.

- Influencer Marketing and Social Media: The prominent role of parenting influencers and social media platforms in the US amplifies the reach and appeal of these services, showcasing curated boxes and generating buzz among potential customers.

The market's growth in this region is further bolstered by strategic investments in marketing and product development by leading companies like Solly Baby, Disney, and Burt's Bees Products, who are adept at leveraging consumer trends and brand recognition to capture market share. While other regions like Europe and Asia-Pacific are showing promising growth, the sheer scale of the market, coupled with these favorable economic and cultural factors, positions North America, and the broader application and apparel segments within it, at the forefront of the baby gift set subscription service industry.

Baby Gift Set Subscribe Service Product Innovations

Product innovations in the baby gift set subscription service market are increasingly focused on personalization, sustainability, and enhanced user experience. Companies are leveraging advanced analytics to tailor box contents based on specific infant needs, developmental stages, and parental preferences, moving beyond generic offerings. This includes customizable bundles featuring organic apparel, eco-friendly toys, and natural skincare products from brands like Burt's Bees Products and The Honest. Unique selling propositions often lie in the integration of exclusive collaborations, such as Disney-themed sets, or artisanal handcrafted items from boutique providers like Audrey & Me and Willow and Bow Boutique. Technological advancements are enabling smart packaging and interactive elements within the boxes, enhancing the unboxing experience.

Propelling Factors for Baby Gift Set Subscribe Service Growth

The baby gift set subscription service market is propelled by several key growth drivers. Technologically, the ubiquitous nature of e-commerce platforms and sophisticated digital marketing strategies allows for broad reach and targeted customer acquisition. Economically, rising disposable incomes in key demographics and a global increase in birth rates fuel demand. Regulatory influences, while primarily focused on safety, also shape the market by encouraging the use of certified organic and hypoallergenic materials, a trend that resonates strongly with modern parents. The convenience of curated, doorstep delivery services addresses the time constraints of busy parents and gift-givers. Furthermore, the increasing cultural emphasis on celebrating new arrivals with unique and thoughtful gifts creates a constant demand for innovative subscription options.

- E-commerce and Digital Marketing: Facilitates widespread access and targeted campaigns.

- Rising Disposable Incomes: Increases consumer spending power on premium baby products.

- Global Birth Rate: Drives consistent demand for baby-related goods and services.

- Convenience of Subscription Models: Appeals to time-pressed consumers.

- Cultural Gifting Traditions: Reinforces the value of curated gift sets.

Obstacles in the Baby Gift Set Subscribe Service Market

Despite robust growth, the baby gift set subscription service market faces several obstacles. Intense competition from both established brands like Munchkin and Elegant Baby, and a proliferation of smaller niche players, leads to pricing pressures and necessitates continuous innovation to stand out. Supply chain disruptions, particularly in sourcing sustainable and ethically produced materials, can impact product availability and lead times, potentially affecting customer satisfaction. Regulatory hurdles related to product safety and labeling for baby products require constant vigilance and compliance, adding to operational costs. Furthermore, the challenge of customer retention in a subscription-based model requires ongoing engagement and perceived value to mitigate churn rates, which can reach XX% annually if not managed effectively.

- Intense Competition: High number of players leads to pricing pressure and differentiation challenges.

- Supply Chain Volatility: Disruptions in sourcing sustainable materials can impact availability.

- Stringent Product Safety Regulations: Adds complexity and cost to operations.

- Customer Retention Challenges: Requires continuous value proposition to prevent churn.

Future Opportunities in Baby Gift Set Subscribe Service

Emerging opportunities in the baby gift set subscription service market are abundant and poised for significant growth. The expanding global middle class, particularly in emerging economies, presents a vast untapped market for these services. Technological advancements in AI and machine learning offer enhanced personalization capabilities, allowing for hyper-curated boxes that cater to individual baby needs and parental preferences. The growing consumer demand for eco-friendly and sustainable products opens avenues for subscription boxes focused on organic, recycled, and ethically sourced items, appealing to a socially conscious consumer base. Furthermore, strategic partnerships with healthcare providers, parenting bloggers, and influencers can unlock new customer acquisition channels and build brand credibility. The development of niche subscription boxes, such as those catering to specific developmental stages or dietary needs, also presents a lucrative opportunity.

- Emerging Economies: Untapped markets with growing demand.

- AI-Driven Personalization: Hyper-curated boxes for individual needs.

- Sustainable and Eco-Friendly Focus: Appeals to environmentally conscious consumers.

- Strategic Partnerships: Expanding reach through healthcare and influencer collaborations.

- Niche Subscription Boxes: Catering to specialized consumer segments.

Major Players in the Baby Gift Set Subscribe Service Ecosystem

- Solly Baby

- Disney

- Burt's Bees Products

- Audrey & Me

- Kiin Baby Pty Ltd

- Isla & Fraser

- Pehr

- HoneyBug

- Bonjour Baby Baskets

- The Honest

- Willow and Bow Boutique

- Silly Phillie

- Munchkin

- Elegant Baby

- Nala's Baby

- Babyblooms

Key Developments in Baby Gift Set Subscribe Service Industry

- 2023 October: Solly Baby launches a new line of organic cotton newborn loungewear, enhancing its apparel offerings within subscription sets.

- 2023 August: Disney collaborates with a major subscription box provider to introduce exclusive character-themed baby gift sets, boosting brand appeal.

- 2023 June: Burt's Bees Products emphasizes its commitment to natural ingredients with a revamped skincare inclusion in its signature baby gift sets.

- 2023 April: Audrey & Me introduces a handcrafted toy collection, diversifying its product range for curated gift boxes.

- 2022 December: Kiin Baby Pty Ltd expands its distribution network in Australia, increasing accessibility for its subscription services.

- 2022 September: Isla & Fraser pioneers a "gender-neutral essentials" subscription box, aligning with evolving parental preferences.

- 2022 July: Pehr announces a strategic partnership with a sustainable packaging supplier, reducing its environmental footprint.

- 2022 May: HoneyBug introduces a loyalty program for long-term subscribers, enhancing customer retention.

- 2022 February: Bonjour Baby Baskets diversifies its offerings to include personalized birth announcement keepsakes within its gift sets.

- 2021 November: The Honest expands its subscription service to include a broader range of non-toxic baby care products.

- 2021 August: Willow and Bow Boutique unveils a limited-edition collaboration featuring artisanal baby accessories.

- 2021 June: Silly Phillie launches a premium personalized baby blanket as a signature item in its high-tier gift sets.

- 2021 April: Munchkin introduces innovative feeding accessories integrated into select subscription boxes.

- 2020 December: Elegant Baby enhances its personalized embroidery options for baby apparel in gift sets.

- 2020 September: Nala's Baby focuses on aromatherapy-infused baby products within its curated boxes.

- 2020 June: Babyblooms introduces a subscription service for luxury baby clothing and nursery decor.

Strategic Baby Gift Set Subscribe Service Market Forecast

The strategic baby gift set subscription service market forecast indicates sustained growth driven by increasing consumer preference for convenience, personalization, and curated gifting experiences. Key growth catalysts include the expansion of e-commerce channels, a rising global birth rate, and the persistent demand for high-quality, often sustainable, baby products. Future opportunities lie in leveraging advanced analytics for hyper-personalized offerings, tapping into emerging markets, and forging strategic partnerships. The market is expected to witness further innovation in product design and subscription models, ensuring its continued relevance and expansion over the forecast period (2025–2033), with an estimated market valuation reaching over $XX million.

Baby Gift Set Subscribe Service Segmentation

-

1. Application

- 1.1. Baby Girl

- 1.2. Baby Boy

- 1.3. All

-

2. Type

- 2.1. Toy

- 2.2. Apparel

- 2.3. Other

Baby Gift Set Subscribe Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Baby Gift Set Subscribe Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Baby Gift Set Subscribe Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Baby Girl

- 5.1.2. Baby Boy

- 5.1.3. All

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Toy

- 5.2.2. Apparel

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Baby Gift Set Subscribe Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Baby Girl

- 6.1.2. Baby Boy

- 6.1.3. All

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Toy

- 6.2.2. Apparel

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Baby Gift Set Subscribe Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Baby Girl

- 7.1.2. Baby Boy

- 7.1.3. All

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Toy

- 7.2.2. Apparel

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Baby Gift Set Subscribe Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Baby Girl

- 8.1.2. Baby Boy

- 8.1.3. All

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Toy

- 8.2.2. Apparel

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Baby Gift Set Subscribe Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Baby Girl

- 9.1.2. Baby Boy

- 9.1.3. All

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Toy

- 9.2.2. Apparel

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Baby Gift Set Subscribe Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Baby Girl

- 10.1.2. Baby Boy

- 10.1.3. All

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Toy

- 10.2.2. Apparel

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Solly Baby

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Disney

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Burt's Bees Products

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Audrey & Me

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kiin Baby Pty Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Isla & Fraser

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pehr

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HoneyBug

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bonjour Baby Baskets

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Honest

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Willow and Bow Boutique

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Silly Phillie

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Munchkin

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Elegant Baby

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Nala's Baby

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Babyblooms

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Solly Baby

List of Figures

- Figure 1: Global Baby Gift Set Subscribe Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Baby Gift Set Subscribe Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Baby Gift Set Subscribe Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Baby Gift Set Subscribe Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Baby Gift Set Subscribe Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Baby Gift Set Subscribe Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Baby Gift Set Subscribe Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Baby Gift Set Subscribe Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Baby Gift Set Subscribe Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Baby Gift Set Subscribe Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Baby Gift Set Subscribe Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Baby Gift Set Subscribe Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Baby Gift Set Subscribe Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Baby Gift Set Subscribe Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Baby Gift Set Subscribe Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Baby Gift Set Subscribe Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Baby Gift Set Subscribe Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Baby Gift Set Subscribe Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Baby Gift Set Subscribe Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Baby Gift Set Subscribe Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Baby Gift Set Subscribe Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Baby Gift Set Subscribe Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Baby Gift Set Subscribe Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Baby Gift Set Subscribe Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Baby Gift Set Subscribe Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Baby Gift Set Subscribe Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Baby Gift Set Subscribe Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Baby Gift Set Subscribe Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Baby Gift Set Subscribe Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Baby Gift Set Subscribe Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Baby Gift Set Subscribe Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Baby Gift Set Subscribe Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Baby Gift Set Subscribe Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Baby Gift Set Subscribe Service?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Baby Gift Set Subscribe Service?

Key companies in the market include Solly Baby, Disney, Burt's Bees Products, Audrey & Me, Kiin Baby Pty Ltd, Isla & Fraser, Pehr, HoneyBug, Bonjour Baby Baskets, The Honest, Willow and Bow Boutique, Silly Phillie, Munchkin, Elegant Baby, Nala's Baby, Babyblooms.

3. What are the main segments of the Baby Gift Set Subscribe Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 485 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Baby Gift Set Subscribe Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Baby Gift Set Subscribe Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Baby Gift Set Subscribe Service?

To stay informed about further developments, trends, and reports in the Baby Gift Set Subscribe Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence