Key Insights

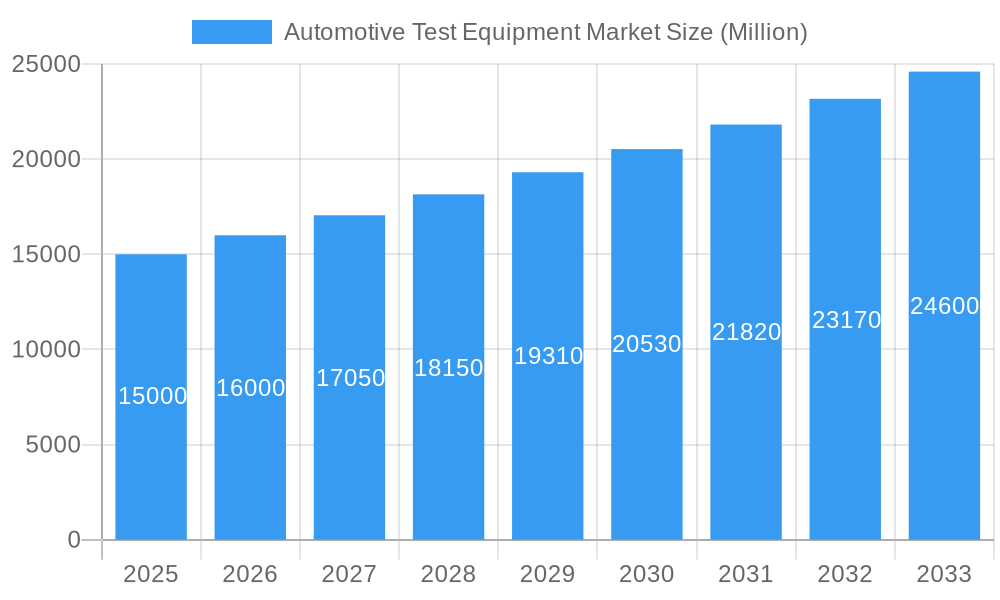

The automotive test equipment market is experiencing robust growth, driven by the increasing complexity of vehicles and stringent regulatory requirements for safety and emissions. The market's Compound Annual Growth Rate (CAGR) exceeding 6.50% from 2019 to 2024 indicates significant expansion. This growth is fueled by several key factors: the rising adoption of advanced driver-assistance systems (ADAS), the increasing demand for electric and hybrid vehicles, and the implementation of stricter emission standards globally. Manufacturers are investing heavily in sophisticated testing solutions to ensure product quality, performance, and compliance. Key market segments include engine testing, emissions testing, and component testing, each exhibiting unique growth trajectories based on technological advancements and regulatory pressures. The competitive landscape is marked by a mix of established players like INFICON, Pfeiffer Vacuum GmbH, and ATEQ Corp, alongside emerging companies offering innovative solutions. Geographic expansion, particularly in developing economies with rapidly growing automotive industries, presents significant opportunities for market players. Challenges include high initial investment costs associated with advanced testing equipment and the need for skilled personnel to operate and maintain these systems.

Automotive Test Equipment Market Market Size (In Billion)

Looking ahead to 2033, the market is projected to continue its upward trajectory. The increasing integration of connected car technologies and autonomous driving features will necessitate even more comprehensive testing protocols, stimulating demand for advanced test equipment. The shift towards sustainable mobility, including electric and hydrogen vehicles, will further drive demand for specialized testing solutions. To maintain a competitive edge, companies will need to focus on innovation, strategic partnerships, and the development of customized solutions tailored to specific automotive testing needs. Furthermore, robust after-sales service and support will be crucial to retain customers and build strong brand loyalty within this technologically advanced and demanding market. The market size in 2025 is estimated to be approximately $15 Billion (this is an estimated value based on the provided CAGR and assuming a reasonable base year value; the actual value would require additional data), projecting to reach a substantially larger market size by 2033.

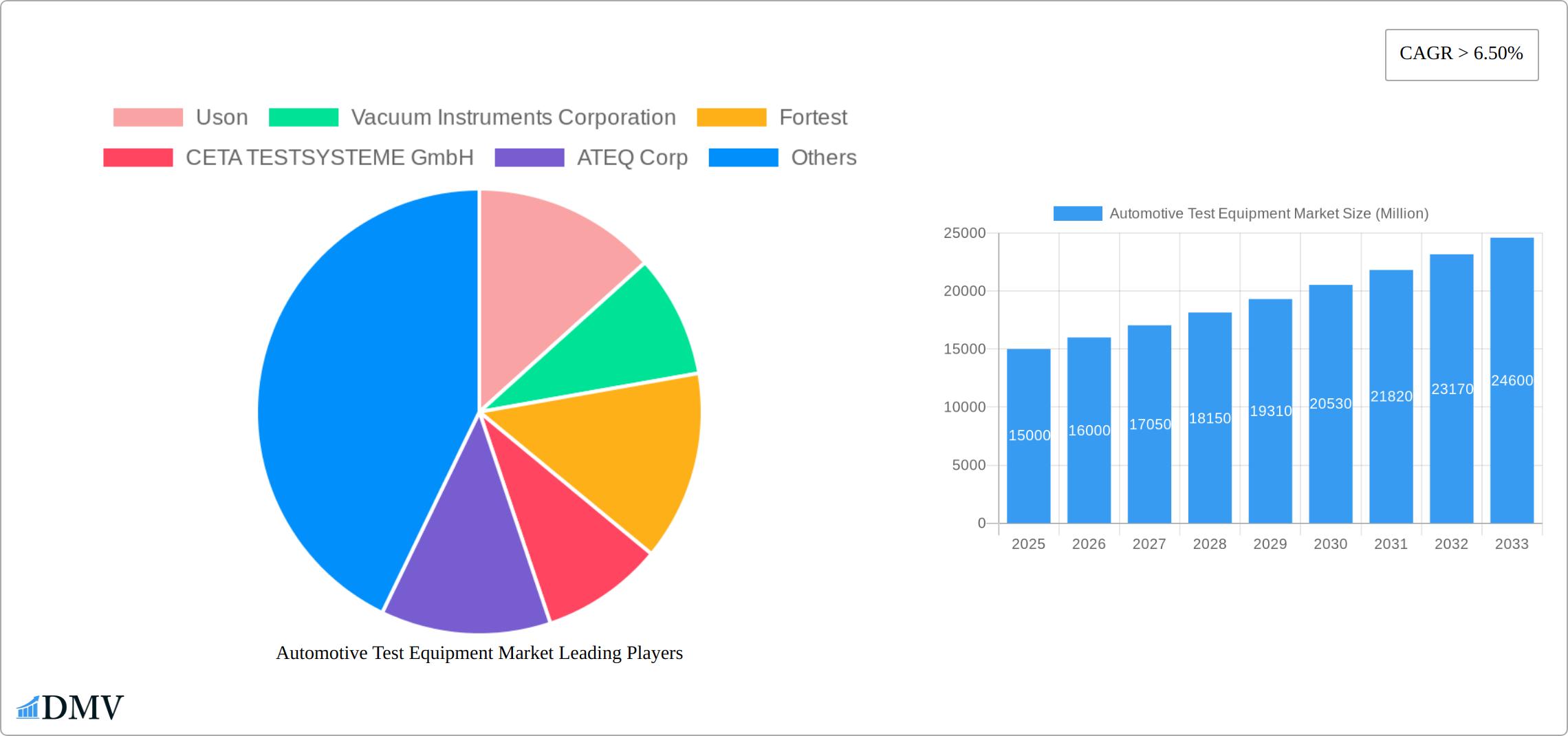

Automotive Test Equipment Market Company Market Share

Automotive Test Equipment Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Automotive Test Equipment Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The global market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Automotive Test Equipment Market Composition & Trends

This section delves into the competitive landscape of the Automotive Test Equipment market, analyzing market concentration, innovation drivers, regulatory influences, and the impact of mergers and acquisitions (M&A) activity. We explore the interplay of substitute products and end-user profiles, providing a nuanced understanding of market dynamics. Market share distribution among key players is meticulously examined, along with the financial implications of significant M&A deals, with aggregate deal values estimated at xx Million in the historical period.

- Market Concentration: Analysis of market share held by top 5 players, revealing a moderately concentrated market with xx% market share held by the top players.

- Innovation Catalysts: Detailed examination of technological advancements driving market growth, such as the adoption of AI and automation in testing procedures.

- Regulatory Landscape: Assessment of the impact of global and regional regulations on product development and market access.

- Substitute Products: Evaluation of the competitive threat from alternative testing methodologies and their potential market impact.

- End-User Profiles: Segmentation of end-users based on vehicle type (passenger cars, commercial vehicles), and their varying testing needs.

- M&A Activity: Analysis of key M&A deals, including deal values and their impact on market consolidation and competitive dynamics (e.g., the strategic partnership between Vacuum Instruments Corporation and ATEQ Corp in 2020).

Automotive Test Equipment Market Industry Evolution

This section charts the evolution of the Automotive Test Equipment market, examining market growth trajectories, technological advancements, and the shifting demands of the automotive industry. We analyze the influence of factors such as increasing vehicle electrification, autonomous driving technology, and evolving emission standards on market growth. The market experienced a growth rate of xx% from 2019 to 2024, driven primarily by [mention specific factors like increased adoption of electric vehicle testing equipment]. Adoption rates for key technologies are quantified and analyzed, providing insights into future market trends. The market is projected to reach xx Million by 2033, driven by increasing demand for advanced driver-assistance systems (ADAS) and autonomous vehicles testing equipment.

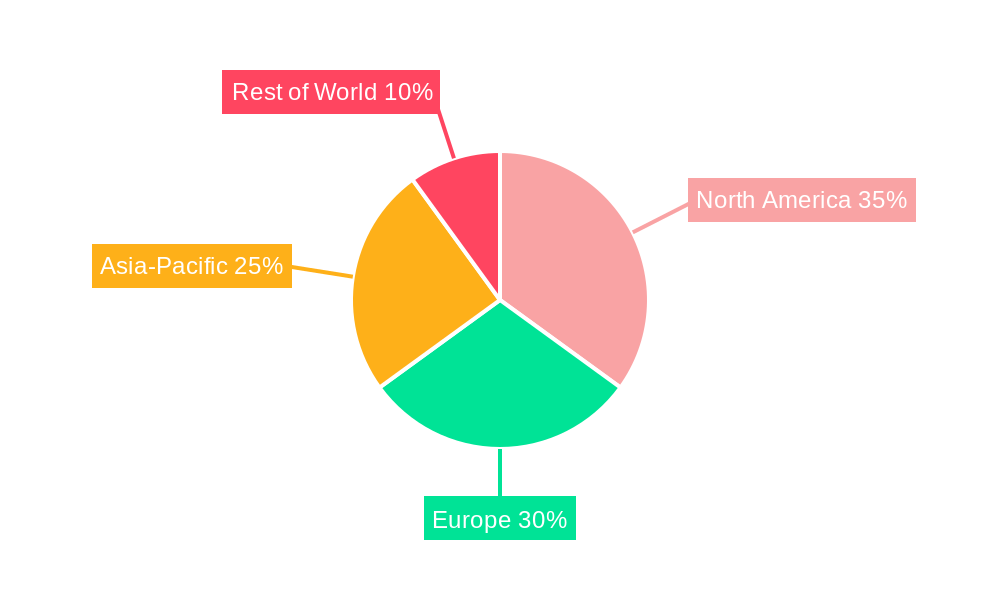

Leading Regions, Countries, or Segments in Automotive Test Equipment Market

This section delves into the foremost regions, countries, and pivotal market segments that are currently shaping the Automotive Test Equipment Market. Our analysis scrutinizes the underlying dynamics of their leadership, encompassing critical factors such as evolving investment patterns, proactive governmental initiatives, and sector-specific technological breakthroughs that accelerate adoption and innovation.

- Key Drivers for Dominant Region/Segment:

- A strong and continually expanding automotive manufacturing ecosystem.

- Proactive governmental policies that actively encourage and support the integration of cutting-edge technologies within the automotive industry.

- Substantial and sustained research and development (R&D) investments, particularly in the realm of advanced automotive technologies like autonomous driving, connected car features, and electrification.

- A growing demand for advanced diagnostics and validation solutions to ensure vehicle safety, performance, and compliance with increasingly complex standards.

- In-depth Analysis of Dominance Factors:

We provide a comprehensive examination of the factors underpinning the leadership of identified regions and segments. This includes an exploration of advanced infrastructure development crucial for testing facilities, shifting consumer preferences towards safer and more sophisticated vehicles, and the overall robust economic growth that fuels automotive production and aftermarket services. Furthermore, we consider the impact of established automotive hubs and the strategic presence of key manufacturers and component suppliers.

Automotive Test Equipment Market Product Innovations

This section details recent product innovations in automotive testing equipment. We highlight advancements in areas like leak detection, emission testing, and performance evaluation, focusing on unique selling propositions and technological breakthroughs enhancing testing accuracy, speed, and efficiency. The integration of AI and machine learning into testing platforms is a significant area of focus, facilitating data analysis and predictive maintenance. These innovations are driving increased adoption in various automotive segments.

Propelling Factors for Automotive Test Equipment Market Growth

The Automotive Test Equipment Market is experiencing robust expansion, propelled by a confluence of dynamic forces. These include:

- Technological Advancements: The relentless pace of innovation is yielding more sophisticated, intelligent, and integrated testing equipment. These advancements enhance testing accuracy, reduce test cycle times, and offer deeper insights into vehicle performance and component integrity. This includes the adoption of AI and machine learning in diagnostic tools.

- Stringent Emission Regulations: Global authorities are continuously tightening emission standards to address environmental concerns. This necessitates the development and deployment of highly advanced emission testing equipment that can accurately measure a wider range of pollutants and validate compliance with evolving norms.

- Growth of the Electric Vehicle (EV) Market: The accelerating global transition towards electric mobility is a significant growth catalyst. The unique complexities of EV powertrains, battery systems, and charging infrastructure demand specialized testing equipment for battery management systems (BMS), thermal management, power electronics, and overall vehicle safety and performance validation.

- Increasing Complexity of Vehicle Systems: Modern vehicles are equipped with an ever-increasing number of complex electronic control units (ECUs), sensors, and advanced driver-assistance systems (ADAS). This complexity mandates sophisticated testing solutions for functional, performance, and cybersecurity validation.

- Focus on Vehicle Safety and Reliability: Manufacturers are prioritizing vehicle safety and long-term reliability. This drives the demand for comprehensive testing solutions across the entire product lifecycle, from component testing to end-of-line vehicle inspection.

Obstacles in the Automotive Test Equipment Market

Despite its promising growth trajectory, the Automotive Test Equipment market encounters several significant challenges:

- Regulatory Hurdles: Navigating the intricate and constantly evolving regulatory frameworks across different geographical regions presents a substantial challenge. Keeping abreast of and ensuring compliance with diverse testing standards and certification requirements demands continuous adaptation and investment.

- Supply Chain Disruptions: The global automotive industry is susceptible to disruptions in its intricate supply chains. Such disruptions can impact the availability of critical components for test equipment manufacturing, leading to production delays and increased costs.

- Intense Competition: The market is characterized by fierce competition among a diverse range of players, from established global corporations to innovative niche providers. This intense competition can lead to pricing pressures, requiring manufacturers to focus on differentiation through technology, quality, and customer service.

- High Development Costs: The development of advanced automotive test equipment, especially for cutting-edge technologies like EVs and ADAS, requires substantial research, development, and capital investment, which can be a barrier to entry for smaller companies.

- Skilled Workforce Shortage: The operation and maintenance of sophisticated automotive test equipment require a highly skilled workforce. A shortage of trained technicians and engineers can hinder the efficient deployment and utilization of these advanced tools.

Future Opportunities in Automotive Test Equipment Market

Future opportunities for growth include:

- Expansion into Emerging Markets: Untapped potential in developing economies with growing automotive industries.

- Development of Advanced Testing Technologies: Continuous innovation in areas like autonomous vehicle testing and connected car technologies.

- Focus on Sustainability: Demand for testing equipment supporting sustainable automotive practices.

Major Players in the Automotive Test Equipment Market Ecosystem

- Uson

- Vacuum Instruments Corporation

- Fortest

- CETA TESTSYSTEME GmbH

- ATEQ Corp

- CTS Cincinnati

- InterTech Development Company

- LACO Technologies

- INFICON

- TASI Group

- Pfeiffer Vacuum GmbH

- Cosmo Instruments Co ltd

- TQC Automation & Test Solutions

- GMJ Systems & Automations Pvt Ltd

- Horiba, Ltd.

- Keysight Technologies

- National Instruments

- Siemens AG

- Bosch Rexroth AG

- AVL List GmbH

- List Not Exhaustive

Key Developments in Automotive Test Equipment Market Industry

- Oct 2020: Vacuum Instruments Corporation and ATEQ Corp. North America entered into a strategic partnership, expanding their combined leak-testing product range and expertise, particularly relevant to electric vehicle battery and fuel cell testing.

- Feb 2022: ATEQ Corp. partnered with North Central Manufacturing Solutions, enhancing its local service capabilities in the Upper Midwest region.

Strategic Automotive Test Equipment Market Forecast

The Automotive Test Equipment Market is poised for significant growth over the forecast period, driven by the confluence of technological innovation, rising demand for electric vehicles, and stringent emission regulations. The increasing adoption of advanced driver-assistance systems and the ongoing development of autonomous driving technologies will further fuel market expansion. The market's potential is substantial, with opportunities across various segments and geographic regions.

Automotive Test Equipment Market Segmentation

-

1. End-user

- 1.1. HVAC/R

- 1.2. Automotive & Transportation

- 1.3. Medical & Pharmaceutical

- 1.4. Packaging

- 1.5. Industrial

- 1.6. Others

Automotive Test Equipment Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

Automotive Test Equipment Market Regional Market Share

Geographic Coverage of Automotive Test Equipment Market

Automotive Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand from Oil and Gas Industry Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. HVAC/R

- 5.1.2. Automotive & Transportation

- 5.1.3. Medical & Pharmaceutical

- 5.1.4. Packaging

- 5.1.5. Industrial

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. North America Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 6.1.1. HVAC/R

- 6.1.2. Automotive & Transportation

- 6.1.3. Medical & Pharmaceutical

- 6.1.4. Packaging

- 6.1.5. Industrial

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 7. Europe Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 7.1.1. HVAC/R

- 7.1.2. Automotive & Transportation

- 7.1.3. Medical & Pharmaceutical

- 7.1.4. Packaging

- 7.1.5. Industrial

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 8. Asia Pacific Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 8.1.1. HVAC/R

- 8.1.2. Automotive & Transportation

- 8.1.3. Medical & Pharmaceutical

- 8.1.4. Packaging

- 8.1.5. Industrial

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 9. South America Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 9.1.1. HVAC/R

- 9.1.2. Automotive & Transportation

- 9.1.3. Medical & Pharmaceutical

- 9.1.4. Packaging

- 9.1.5. Industrial

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 10. Middle East Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 10.1.1. HVAC/R

- 10.1.2. Automotive & Transportation

- 10.1.3. Medical & Pharmaceutical

- 10.1.4. Packaging

- 10.1.5. Industrial

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Uson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vacuum Instruments Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fortest

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CETA TESTSYSTEME GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ATEQ Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CTS Cincinnati

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 InterTech Development Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LACO Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 INFICON

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TASI Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfeiffer Vacuum GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cosmo Instruments Co ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TQC Automation & Test Solutions

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GMJ Systems & Automations Pvt Ltd**List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Uson

List of Figures

- Figure 1: Global Automotive Test Equipment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 3: North America Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 4: North America Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 7: Europe Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 8: Europe Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 11: Asia Pacific Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Asia Pacific Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 15: South America Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: South America Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 19: Middle East Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 20: Middle East Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 2: Global Automotive Test Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 4: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: US Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 10: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Germany Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: UK Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: France Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Russia Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Spain Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 18: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: India Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: China Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 24: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Brazil Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Argentina Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 28: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: UAE Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Saudi Arabia Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Test Equipment Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Automotive Test Equipment Market?

Key companies in the market include Uson, Vacuum Instruments Corporation, Fortest, CETA TESTSYSTEME GmbH, ATEQ Corp, CTS Cincinnati, InterTech Development Company, LACO Technologies, INFICON, TASI Group, Pfeiffer Vacuum GmbH, Cosmo Instruments Co ltd, TQC Automation & Test Solutions, GMJ Systems & Automations Pvt Ltd**List Not Exhaustive.

3. What are the main segments of the Automotive Test Equipment Market?

The market segments include End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand from Oil and Gas Industry Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Oct 2020 - Vacuum Instruments Corporation and ATEQ Corp. North America entered into a strategic partnership. The partnership offers the world's largest leak-testing product range and the best experts in leak-testing technologies. ATEQ and VIC combine experiences with key applications, like electric vehicle batteries and fuel cells, in order to provide comprehensive and reliable solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Test Equipment Market?

To stay informed about further developments, trends, and reports in the Automotive Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence