Key Insights

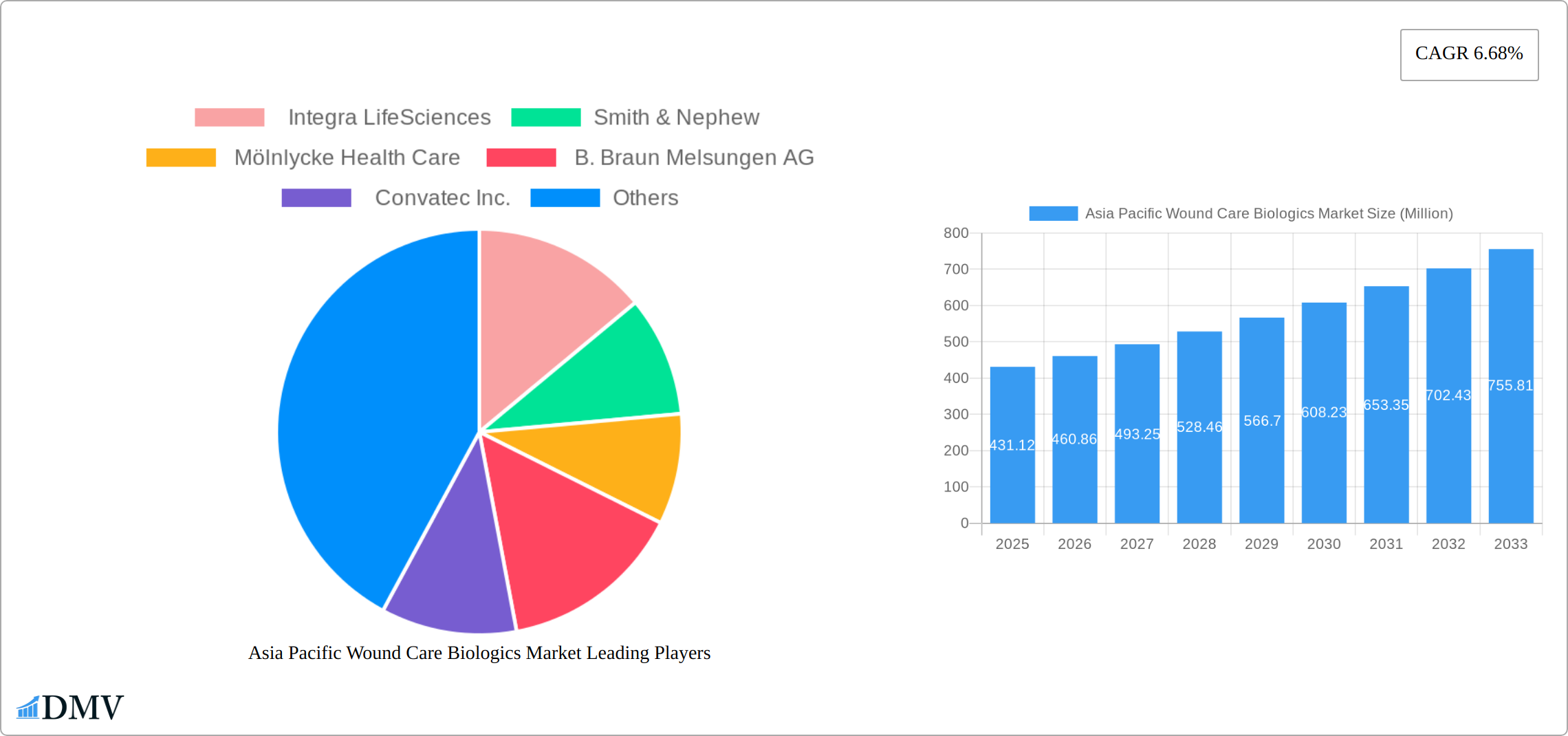

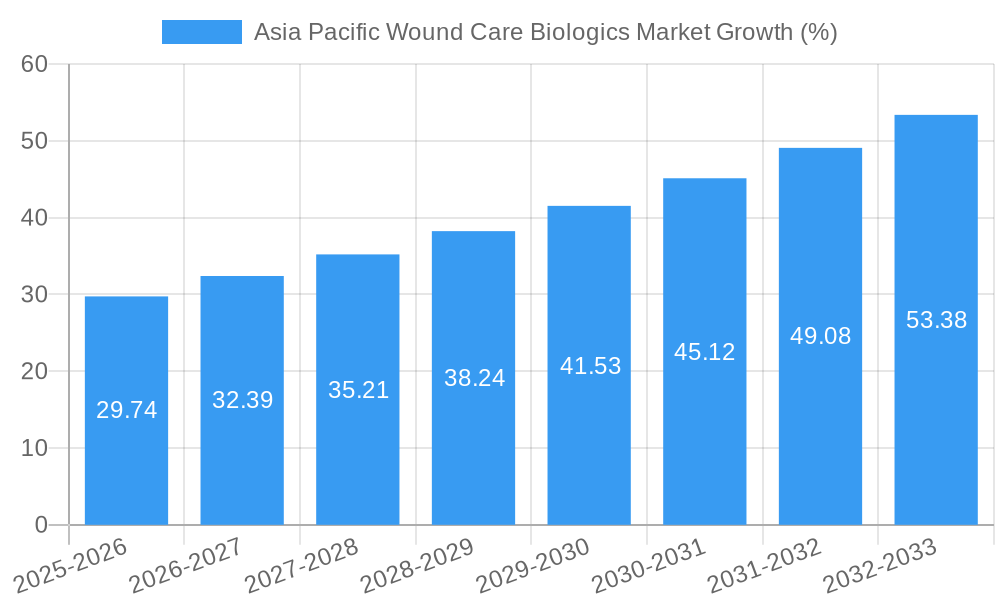

The Asia Pacific wound care biologics market is experiencing robust growth, projected to reach \$431.12 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.68% from 2025 to 2033. This expansion is driven by several key factors. The rising prevalence of chronic wounds, such as diabetic ulcers and pressure ulcers, fueled by aging populations and increasing incidence of diabetes across the region, is a major catalyst. Furthermore, advancements in biologic wound care technologies, offering superior healing outcomes compared to traditional methods, are driving adoption. Increased healthcare expenditure and improved healthcare infrastructure in several key Asia-Pacific nations, notably China, India, and Japan, further contribute to market growth. The market is segmented by product type (biological skin substitutes and topical agents), wound type (ulcers, surgical and traumatic wounds, burns), and end-user (hospitals/clinics, ambulatory surgical centers, and other end-users). The segment comprising biological skin substitutes is expected to dominate due to their efficacy in treating complex wounds. Hospitals and clinics constitute the largest end-user segment, reflecting the importance of these facilities in managing chronic and acute wounds. Significant growth potential exists within the ambulatory surgical centers segment, driven by the increasing preference for outpatient procedures. Competition among established players like Integra LifeSciences, Smith & Nephew, Mölnlycke Health Care, B. Braun Melsungen AG, and Convatec Inc. is intense, spurring innovation and driving down prices, making advanced wound care more accessible.

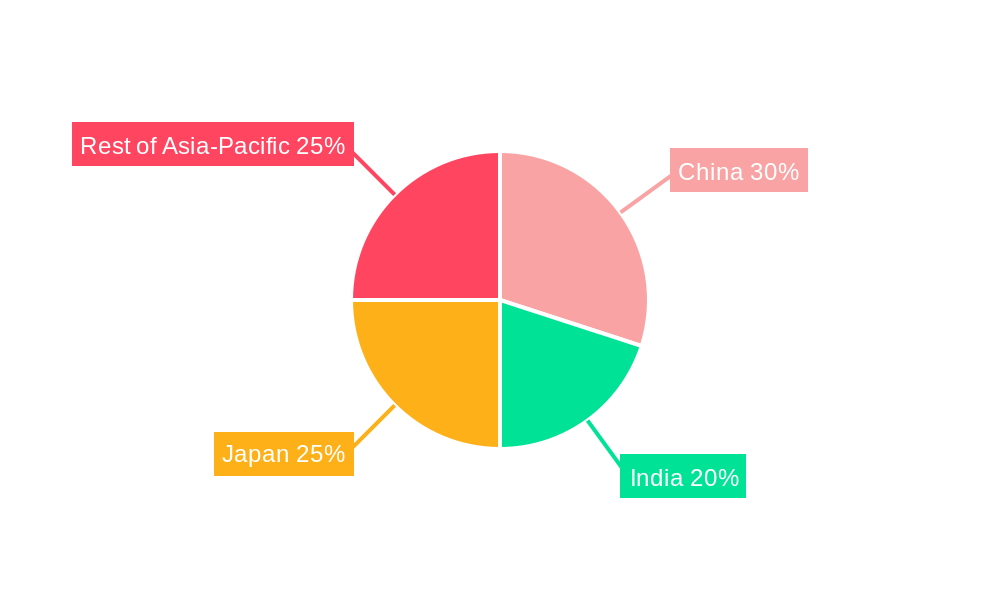

The geographical distribution within Asia Pacific shows varying growth trajectories. China, India, and Japan are expected to be the dominant markets due to their large populations and expanding healthcare sectors. However, other nations in the region, including South Korea, Taiwan, and Australia, will also contribute significantly to the overall market growth. The market's growth trajectory is influenced by factors such as government healthcare policies, reimbursement rates, and the availability of skilled healthcare professionals trained in advanced wound care techniques. Regulatory approvals for new biologics and their integration into clinical guidelines will also play a significant role in shaping the market's future. Challenges such as high treatment costs and the need for specialized training for healthcare professionals remain, but ongoing innovation and improved accessibility are mitigating these obstacles.

Asia Pacific Wound Care Biologics Market Market Composition & Trends

The Asia Pacific Wound Care Biologics Market is characterized by a moderate level of market concentration, with several key players such as Integra LifeSciences, Smith & Nephew, Mölnlycke Health Care, B. Braun Melsungen AG, and Convatec Inc. dominating the market. The market share distribution is as follows: Integra LifeSciences holds approximately 25%, Smith & Nephew around 20%, Mölnlycke Health Care about 18%, B. Braun Melsungen AG with 15%, and Convatec Inc. with 12%. The remaining market share is fragmented among smaller players.

Innovation Catalysts: The market is driven by continuous innovations in wound care biologics, particularly in biological skin substitutes and topical agents. Technological advancements, such as the development of eco-friendly hydrogels, are pushing the boundaries of what is possible in wound healing.

Regulatory Landscapes: Regulatory bodies across the Asia Pacific region are increasingly supportive of biologics, with streamlined approval processes for innovative products. This has led to a surge in new product launches and clinical trials.

Substitute Products: While traditional wound care products still hold a significant market share, the shift towards biologics is evident due to their superior healing properties and reduced risk of infection.

End-User Profiles: The primary end-users are hospitals and clinics, accounting for 60% of the market, followed by ambulatory surgical centers at 25%, and other end-users at 15%. The demand from these sectors is driven by the need for effective and fast-healing solutions.

M&A Activities: The market has seen several mergers and acquisitions, with a total deal value reaching xx Million in the past year. These activities are aimed at expanding product portfolios and strengthening market presence.

The interplay of these factors creates a dynamic environment where companies are continuously striving to innovate and capture a larger market share.

Asia Pacific Wound Care Biologics Market Industry Evolution

The Asia Pacific Wound Care Biologics Market has experienced significant growth over the study period of 2019-2033, with a notable acceleration in recent years. The base year of 2025 marks a pivotal point, with the market size estimated at xx Million, projected to grow at a CAGR of 7.5% during the forecast period of 2025-2033. This growth is primarily driven by technological advancements and increasing awareness of the benefits of biologics in wound care.

Technological advancements have been a key driver of market evolution. The introduction of advanced biological skin substitutes and topical agents has revolutionized wound care, offering faster healing times and improved patient outcomes. For instance, the development of hydrogels, such as the one unveiled by the Tokyo University of Science in February 2024, showcases the potential of these innovations. This hydrogel, made from seaweed and carbonated water, not only accelerates wound healing but also addresses the common issue of temporary wound site dilation.

Shifting consumer demands are also influencing the market. There is a growing preference for non-invasive and eco-friendly treatments, which aligns with the trend towards biologics. Hospitals and clinics, the primary end-users, are increasingly adopting these products due to their proven efficacy and the demand for high-quality care. Additionally, the rise in chronic wounds, such as diabetic ulcers and pressure ulcers, has further propelled the market, as these conditions require specialized care that biologics can provide.

The historical period of 2019-2024 saw a steady increase in market adoption, with growth rates averaging around 5%. However, the forecast period anticipates a more robust expansion, driven by ongoing research and development efforts and the entry of new players into the market. The integration of digital health solutions and telemedicine is also expected to play a role in the market's evolution, enhancing the delivery and management of wound care.

Leading Regions, Countries, or Segments in Asia Pacific Wound Care Biologics Market

The Asia Pacific Wound Care Biologics Market is dominated by several key regions, countries, and segments, each contributing uniquely to the market's growth and dynamics.

Dominant Region: East Asia, particularly Japan and South Korea, leads the market due to their advanced healthcare infrastructure and high adoption rates of innovative wound care solutions.

Dominant Country: Japan stands out as a leader, with a market share of approximately 30%. The country's focus on technological innovation and a well-established regulatory framework supports the growth of biologics in wound care.

Dominant Segment:

Product: Biological Skin Substitutes are the leading product segment, capturing around 45% of the market. These products are favored for their ability to promote faster healing and reduce the risk of infection.

Wound Type: Ulcers, including diabetic and pressure ulcers, dominate the wound type segment with a 50% market share. The prevalence of these conditions in the aging population drives demand.

End User: Hospitals and clinics are the dominant end-users, holding 60% of the market. Their need for advanced and effective wound care solutions fuels this segment's growth.

Key drivers for the dominance of these regions, countries, and segments include:

- Investment Trends: Increased investments in healthcare infrastructure and R&D in countries like Japan and South Korea are boosting the market. For example, Japan's investment in healthcare technology reached xx Million in 2024.

- Regulatory Support: Favorable regulations and streamlined approval processes for biologics in Japan and other East Asian countries facilitate market growth.

- Technological Advancements: The continuous development of new products, such as the hydrogel from Tokyo University of Science, enhances the market's appeal and drives adoption.

- Consumer Awareness: Growing awareness of the benefits of biologics among healthcare professionals and patients contributes to the dominance of these segments.

The dominance of these regions, countries, and segments is further reinforced by their ability to adapt to changing market conditions and consumer needs. For instance, Japan's healthcare system has been quick to integrate new technologies and treatments, ensuring that the latest wound care biologics are readily available to patients. Similarly, the focus on ulcers and biological skin substitutes reflects the market's response to prevalent health issues and the demand for effective solutions.

Asia Pacific Wound Care Biologics Market Product Innovations

Product innovations in the Asia Pacific Wound Care Biologics Market are driving significant advancements in wound care. The introduction of biological skin substitutes and topical agents has revolutionized treatment options, offering improved healing outcomes. A notable example is the innovative hydrogel developed by the Tokyo University of Science in February 2024, which utilizes seaweed and carbonated water to accelerate healing and prevent temporary wound site dilation. These innovations highlight the market's commitment to developing eco-friendly and potent therapeutic solutions, enhancing patient care and outcomes.

Propelling Factors for Asia Pacific Wound Care Biologics Market Growth

Several factors are propelling the growth of the Asia Pacific Wound Care Biologics Market:

- Technological Advancements: Innovations such as the eco-friendly hydrogel from Tokyo University of Science are enhancing treatment efficacy and market appeal.

- Economic Factors: Rising healthcare expenditure in countries like Japan and South Korea supports the adoption of advanced wound care solutions.

- Regulatory Support: Streamlined approval processes for biologics in the region facilitate market expansion and product launches.

These factors collectively contribute to the market's robust growth trajectory.

Obstacles in the Asia Pacific Wound Care Biologics Market Market

The Asia Pacific Wound Care Biologics Market faces several obstacles:

- Regulatory Challenges: Varied regulatory requirements across countries can delay product launches and increase costs.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of raw materials and finished products.

- Competitive Pressures: Intense competition among key players can lead to price wars and reduced profit margins.

These challenges can hinder market growth and require strategic solutions to overcome.

Future Opportunities in Asia Pacific Wound Care Biologics Market

Emerging opportunities in the Asia Pacific Wound Care Biologics Market include:

- New Markets: Expansion into emerging markets like Southeast Asia, where healthcare infrastructure is rapidly developing.

- Technological Innovations: Continued advancements in biologics, such as smart wound dressings and personalized treatments.

- Consumer Trends: Increasing demand for non-invasive and eco-friendly wound care solutions.

These opportunities present avenues for market growth and innovation.

Major Players in the Asia Pacific Wound Care Biologics Market Ecosystem

Key Developments in Asia Pacific Wound Care Biologics Market Industry

February 2024: The Tokyo University of Science unveiled a cutting-edge wound treatment gel that harnesses the power of seaweed and carbonated water. This innovative hydrogel accelerates wound healing significantly and prevents the common issue of temporary wound site dilation, a drawback often seen in traditional gels. These promising outcomes pave the way for the future clinical adoption of eco-friendly and potent therapeutic gels, impacting market dynamics by introducing new product categories and enhancing treatment options.

June 2023: The Manipal Center for Interprofessional Advanced Wound Care, affiliated with Coloplast India, collaborated with the Manipal College of Nursing (MCON) to conduct a successful two-day hands-on workshop. The workshop was aimed at enhancing the skills of staff nurses, MBBS graduates, and nursing students in advanced wound care. The workshop encouraged the sharing of best practices and knowledge among healthcare professionals, fostering a collaborative approach to improve patient outcomes. This development supports market growth by increasing the adoption of advanced wound care techniques and enhancing professional skills.

Strategic Asia Pacific Wound Care Biologics Market Market Forecast

The Asia Pacific Wound Care Biologics Market is poised for significant growth over the forecast period of 2025-2033, driven by technological advancements, increasing healthcare investments, and favorable regulatory environments. The market's potential is further enhanced by the rising prevalence of chronic wounds and the demand for effective, non-invasive treatments. Future opportunities in new markets and the continuous innovation in biologics are expected to propel the market forward, ensuring sustained growth and improved patient care.

Asia Pacific Wound Care Biologics Market Segmentation

-

1. Product

- 1.1. Biological Skin Substitutes

- 1.2. Topical Agents

-

2. Wound Type

-

2.1. Ulcers

- 2.1.1. Diabetic Foot Ulcers

- 2.1.2. Venous Ulcers

- 2.1.3. Pressure Ulcers

- 2.1.4. Other Ulcers

- 2.2. Surgical and Traumatic Wounds

- 2.3. Burns

-

2.1. Ulcers

-

3. End User

- 3.1. Hospitals/Clinics

- 3.2. Ambulatory Surgical Centers

- 3.3. Other End Users

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. South Korea

- 4.6. Rest of Asia-Pacific

Asia Pacific Wound Care Biologics Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia Pacific Wound Care Biologics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Burn Injuries and Road Accidents; Government Initiatives Regarding Wound Care Treatment

- 3.3. Market Restrains

- 3.3.1. High Treatment Cost; Stringent Regulatory Guidelines and Challenges Faced by the Manufacturers

- 3.4. Market Trends

- 3.4.1. The Diabetic Foot Ulcers Segment Is Expected to Hold a Significant Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Biological Skin Substitutes

- 5.1.2. Topical Agents

- 5.2. Market Analysis, Insights and Forecast - by Wound Type

- 5.2.1. Ulcers

- 5.2.1.1. Diabetic Foot Ulcers

- 5.2.1.2. Venous Ulcers

- 5.2.1.3. Pressure Ulcers

- 5.2.1.4. Other Ulcers

- 5.2.2. Surgical and Traumatic Wounds

- 5.2.3. Burns

- 5.2.1. Ulcers

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals/Clinics

- 5.3.2. Ambulatory Surgical Centers

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. South Korea

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Biological Skin Substitutes

- 6.1.2. Topical Agents

- 6.2. Market Analysis, Insights and Forecast - by Wound Type

- 6.2.1. Ulcers

- 6.2.1.1. Diabetic Foot Ulcers

- 6.2.1.2. Venous Ulcers

- 6.2.1.3. Pressure Ulcers

- 6.2.1.4. Other Ulcers

- 6.2.2. Surgical and Traumatic Wounds

- 6.2.3. Burns

- 6.2.1. Ulcers

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals/Clinics

- 6.3.2. Ambulatory Surgical Centers

- 6.3.3. Other End Users

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. South Korea

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Japan Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Biological Skin Substitutes

- 7.1.2. Topical Agents

- 7.2. Market Analysis, Insights and Forecast - by Wound Type

- 7.2.1. Ulcers

- 7.2.1.1. Diabetic Foot Ulcers

- 7.2.1.2. Venous Ulcers

- 7.2.1.3. Pressure Ulcers

- 7.2.1.4. Other Ulcers

- 7.2.2. Surgical and Traumatic Wounds

- 7.2.3. Burns

- 7.2.1. Ulcers

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals/Clinics

- 7.3.2. Ambulatory Surgical Centers

- 7.3.3. Other End Users

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. India Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Biological Skin Substitutes

- 8.1.2. Topical Agents

- 8.2. Market Analysis, Insights and Forecast - by Wound Type

- 8.2.1. Ulcers

- 8.2.1.1. Diabetic Foot Ulcers

- 8.2.1.2. Venous Ulcers

- 8.2.1.3. Pressure Ulcers

- 8.2.1.4. Other Ulcers

- 8.2.2. Surgical and Traumatic Wounds

- 8.2.3. Burns

- 8.2.1. Ulcers

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals/Clinics

- 8.3.2. Ambulatory Surgical Centers

- 8.3.3. Other End Users

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. South Korea

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Biological Skin Substitutes

- 9.1.2. Topical Agents

- 9.2. Market Analysis, Insights and Forecast - by Wound Type

- 9.2.1. Ulcers

- 9.2.1.1. Diabetic Foot Ulcers

- 9.2.1.2. Venous Ulcers

- 9.2.1.3. Pressure Ulcers

- 9.2.1.4. Other Ulcers

- 9.2.2. Surgical and Traumatic Wounds

- 9.2.3. Burns

- 9.2.1. Ulcers

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals/Clinics

- 9.3.2. Ambulatory Surgical Centers

- 9.3.3. Other End Users

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. South Korea

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South Korea Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Biological Skin Substitutes

- 10.1.2. Topical Agents

- 10.2. Market Analysis, Insights and Forecast - by Wound Type

- 10.2.1. Ulcers

- 10.2.1.1. Diabetic Foot Ulcers

- 10.2.1.2. Venous Ulcers

- 10.2.1.3. Pressure Ulcers

- 10.2.1.4. Other Ulcers

- 10.2.2. Surgical and Traumatic Wounds

- 10.2.3. Burns

- 10.2.1. Ulcers

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals/Clinics

- 10.3.2. Ambulatory Surgical Centers

- 10.3.3. Other End Users

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. South Korea

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Asia Pacific Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Biological Skin Substitutes

- 11.1.2. Topical Agents

- 11.2. Market Analysis, Insights and Forecast - by Wound Type

- 11.2.1. Ulcers

- 11.2.1.1. Diabetic Foot Ulcers

- 11.2.1.2. Venous Ulcers

- 11.2.1.3. Pressure Ulcers

- 11.2.1.4. Other Ulcers

- 11.2.2. Surgical and Traumatic Wounds

- 11.2.3. Burns

- 11.2.1. Ulcers

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Hospitals/Clinics

- 11.3.2. Ambulatory Surgical Centers

- 11.3.3. Other End Users

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. Japan

- 11.4.3. India

- 11.4.4. Australia

- 11.4.5. South Korea

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. China Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 13. Japan Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 14. India Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 15. South Korea Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 16. Taiwan Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 17. Australia Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Asia-Pacific Asia Pacific Wound Care Biologics Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Integra LifeSciences

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Smith & Nephew

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Mölnlycke Health Care

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 B. Braun Melsungen AG

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Convatec Inc.

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.1 Integra LifeSciences

List of Figures

- Figure 1: Asia Pacific Wound Care Biologics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Wound Care Biologics Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 4: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asia Pacific Wound Care Biologics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asia Pacific Wound Care Biologics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Asia Pacific Wound Care Biologics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Asia Pacific Wound Care Biologics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan Asia Pacific Wound Care Biologics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia Asia Pacific Wound Care Biologics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific Asia Pacific Wound Care Biologics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 16: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 17: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 19: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 21: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 22: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 23: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 26: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 27: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 31: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 32: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 33: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 36: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 37: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 38: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 39: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 41: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 42: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 43: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: Asia Pacific Wound Care Biologics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Wound Care Biologics Market?

The projected CAGR is approximately 6.68%.

2. Which companies are prominent players in the Asia Pacific Wound Care Biologics Market?

Key companies in the market include Integra LifeSciences, Smith & Nephew , Mölnlycke Health Care , B. Braun Melsungen AG, Convatec Inc..

3. What are the main segments of the Asia Pacific Wound Care Biologics Market?

The market segments include Product, Wound Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 431.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Burn Injuries and Road Accidents; Government Initiatives Regarding Wound Care Treatment.

6. What are the notable trends driving market growth?

The Diabetic Foot Ulcers Segment Is Expected to Hold a Significant Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

High Treatment Cost; Stringent Regulatory Guidelines and Challenges Faced by the Manufacturers.

8. Can you provide examples of recent developments in the market?

February 2024: The Tokyo University of Science unveiled a cutting-edge wound treatment gel that harnesses the power of seaweed and carbonated water. This innovative hydrogel accelerates wound healing significantly and prevents the common issue of temporary wound site dilation, a drawback often seen in traditional gels. These promising outcomes pave the way for the future clinical adoption of eco-friendly and potent therapeutic gels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Wound Care Biologics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Wound Care Biologics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Wound Care Biologics Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Wound Care Biologics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence