Key Insights

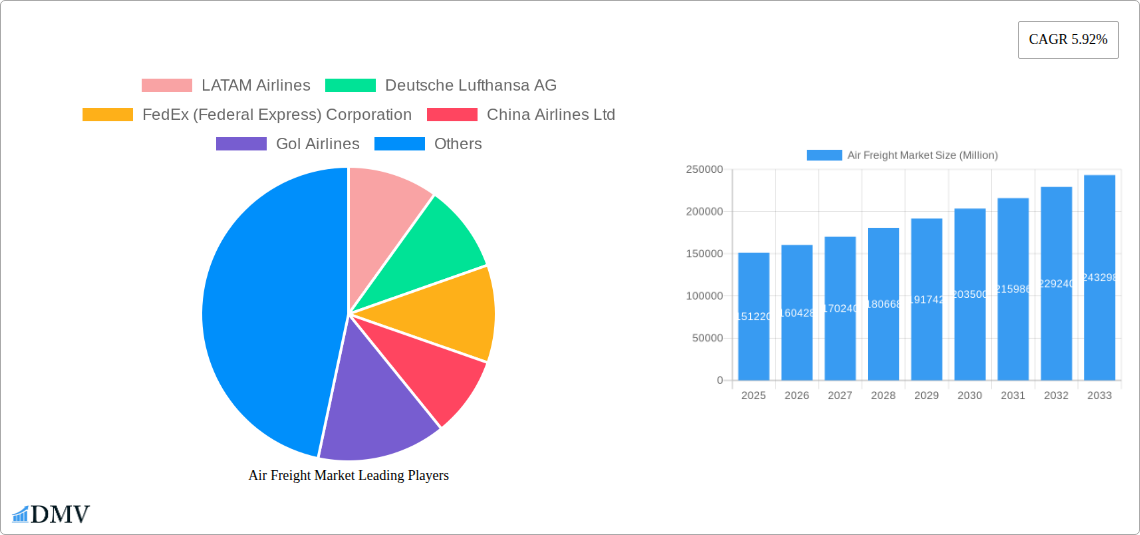

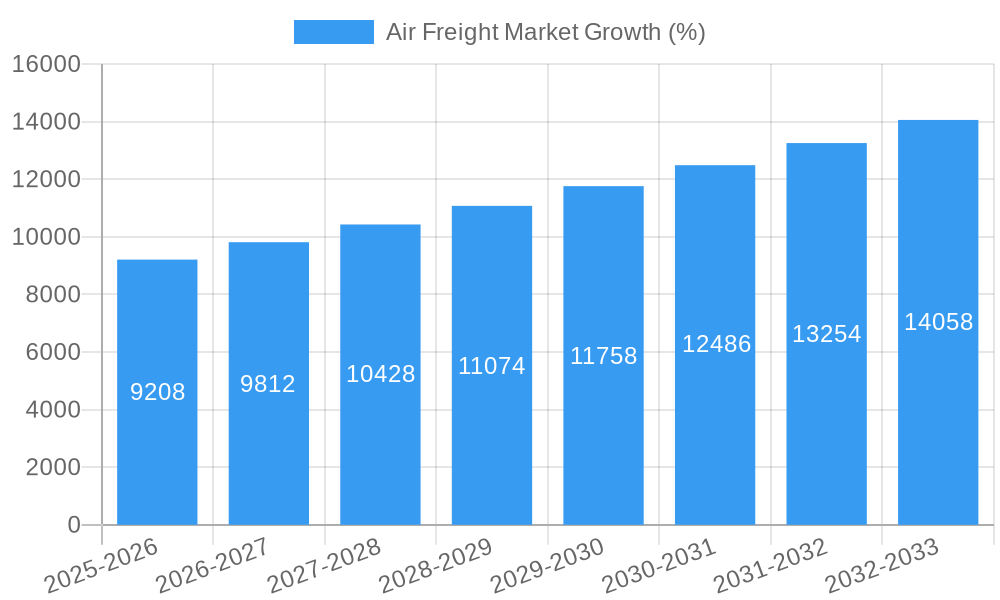

The global air freight market, valued at $151.22 billion in 2025, is projected to experience robust growth, driven by the expansion of e-commerce, increasing globalization, and the rise of time-sensitive industries like pharmaceuticals and technology. A compound annual growth rate (CAGR) of 5.92% from 2025 to 2033 indicates a significant market expansion, with the market expected to surpass $250 billion by 2033. Key growth drivers include the increasing demand for faster and more reliable delivery services, particularly in cross-border trade, coupled with the ongoing technological advancements improving efficiency and tracking within the air freight supply chain. The market is segmented by service type (forwarding, airlines, mail), destination (domestic, international), and carrier type (belly cargo, freighter), each segment contributing unique dynamics to the overall market growth. While challenges such as fluctuating fuel prices and geopolitical instability exist, the overall outlook remains positive, fueled by the long-term trends towards greater global interconnectedness and the need for rapid goods movement.

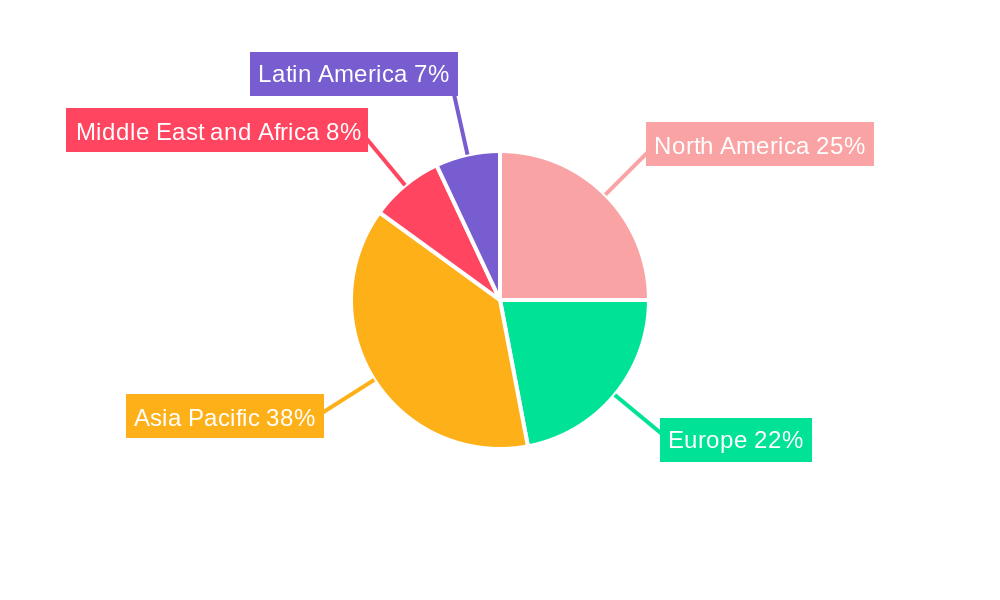

The competitive landscape is characterized by a mix of large, established international players like FedEx, DHL, and numerous airline carriers, along with regional players catering to specific geographic needs. Companies are continually investing in infrastructure improvements, fleet modernization, and technological enhancements to optimize their operations and improve service offerings. The Asia-Pacific region, with its booming e-commerce market and rapidly developing economies, is anticipated to be a key growth driver, followed by North America and Europe. Regional variations in market growth will depend on factors including economic development, infrastructure investment, and government regulations. The market’s success depends on the ongoing ability of stakeholders to adapt to fluctuating demand, manage logistical complexities, and stay ahead of the curve in technological innovation.

Air Freight Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global air freight market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) and expert projections to deliver a comprehensive understanding of market trends, opportunities, and challenges. The market is segmented by service (Forwarding, Airlines, Mail), destination (Domestic, International), and carrier type (Belly Cargo, Freighter), providing granular insights into specific market dynamics. Key players analyzed include LATAM Airlines, Deutsche Lufthansa AG, FedEx Corporation, China Airlines Ltd, Gol Airlines, Cathay Pacific Airways Limited, The Emirates Group, American Airlines, AirBridgeCargo Airlines, Magma Aviation Limited, Delta Airlines, Japan Airlines Co Ltd, Cargojet Inc, United Airlines, Cargolux Airlines International SA, Azul Airlines, International Consolidated Airlines Group SA, All Nippon Airways Co Ltd (ANA), Deutsche Post DHL, Copa Airlines, and Qatar Airways Company QCSC, amongst others. The report projects a market size of xx Million by 2033.

Air Freight Market Composition & Trends

This section delves into the competitive landscape of the air freight market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. We analyze market share distribution among key players, revealing the dominance of a few major airlines and logistics providers, and quantify M&A activity through deal values (xx Million in total deal value over the study period).

Market Concentration: A detailed analysis of the Herfindahl-Hirschman Index (HHI) will illustrate the level of concentration within the market, highlighting the presence of both large multinational corporations and smaller, specialized players.

Innovation Catalysts: Examination of technological advancements driving efficiency and sustainability within the air freight industry, including automation, data analytics, and the development of more fuel-efficient aircraft.

Regulatory Landscape: Assessment of the impact of international and national regulations on air freight operations, including safety standards, environmental regulations, and trade policies.

Substitute Products: Analysis of alternative transportation modes (sea freight, rail freight) and their impact on the air freight market share.

End-User Profiles: Profiling of major end-users across various industries (e.g., e-commerce, pharmaceuticals, manufacturing) to understand their specific needs and preferences.

M&A Activities: Review of significant M&A deals within the air freight industry during the study period, analyzing their strategic implications and market impact (xx Million in total deal value predicted in 2025). Examples will include a detailed look at at least three significant mergers or acquisitions with their impact on market share and competitive dynamics.

Air Freight Market Industry Evolution

This section charts the historical and projected growth trajectories of the air freight market, highlighting key technological advancements and shifts in consumer demands. The analysis will incorporate detailed growth rate figures (e.g., a CAGR of xx% during the forecast period) and adoption metrics for emerging technologies. Specific events impacting growth will be detailed, like the impact of the pandemic on demand or the effects of geopolitical instability. This section further explores changes in consumer behaviour, such as the rise of e-commerce and its implications for the demand for faster air freight solutions.

Leading Regions, Countries, or Segments in Air Freight Market

This section identifies the dominant regions, countries, and segments within the air freight market, based on revenue and volume. We provide a detailed analysis of the factors driving their dominance, including investment trends, government support, and infrastructure development.

By Service: Analysis of the leading segment between Forwarding, Airlines, and Mail services, highlighting growth drivers for the dominant sector.

By Destination: In-depth comparison of the domestic vs. international air freight markets, identifying key drivers for each segment’s growth.

By Carrier Type: Detailed examination of the dominance of either Belly Cargo or Freighter services, analyzing their strengths and weaknesses.

Key Drivers (Examples):

- Significant investment in airport infrastructure in specific regions.

- Government policies promoting air cargo transportation.

- High concentration of manufacturing and export activities in certain countries.

Air Freight Market Product Innovations

This section highlights recent and emerging innovations in air freight technology and services, including advancements in aircraft design, logistics software, and tracking technologies. We emphasize unique selling propositions and their impact on market competitiveness. Examples include the development of larger and more fuel-efficient aircraft, improved cargo handling systems to reduce transit times and costs, and the implementation of advanced tracking and monitoring systems.

Propelling Factors for Air Freight Market Growth

This section identifies the key drivers fueling the growth of the air freight market. These include technological advancements (e.g., automation, AI), economic factors (e.g., global trade growth), and supportive regulatory environments (e.g., streamlined customs procedures).

Obstacles in the Air Freight Market

This section examines the challenges hindering the growth of the air freight market. These include regulatory hurdles (e.g., complex customs regulations), supply chain disruptions (e.g., geopolitical instability), and intense competition among carriers. Quantitative impact will be discussed. For example, a recent disruption caused a xx% increase in transportation costs.

Future Opportunities in Air Freight Market

This section explores emerging opportunities within the air freight market, such as expansion into new markets (e.g., developing economies), adoption of new technologies (e.g., drones for last-mile delivery), and adapting to evolving consumer needs (e.g., increased demand for faster and more reliable delivery).

Major Players in the Air Freight Market Ecosystem

- LATAM Airlines

- Deutsche Lufthansa AG

- FedEx (Federal Express) Corporation

- China Airlines Ltd

- Gol Airlines

- Cathay Pacific Airways Limited

- The Emirates Group

- American Airlines

- AirBridgeCargo Airlines

- Magma Aviation Limited

- Delta Airlines

- Japan Airlines Co Ltd

- Cargojet Inc

- United Airlines

- Cargolux Airlines International SA

- Azul Airlines

- International Consolidated Airlines Group SA

- All Nippon Airways Co Ltd (ANA)

- Deutsche Post DHL

- Copa Airlines

- Qatar Airways Company QCSC

Key Developments in Air Freight Market Industry

- [Month/Year]: Launch of a new, fuel-efficient aircraft model by [Manufacturer Name], impacting fuel costs and emissions.

- [Month/Year]: Significant investment in automated cargo handling systems at [Airport Name], boosting efficiency.

- [Month/Year]: Merger between [Company A] and [Company B], resulting in a significant shift in market share.

- [Month/Year]: Implementation of new regulations impacting air freight operations in [Region/Country].

- [Month/Year]: Introduction of a new tracking and monitoring technology improving supply chain visibility.

Strategic Air Freight Market Forecast

This section summarizes the key growth catalysts and opportunities shaping the future of the air freight market, emphasizing the potential for continued expansion driven by technological advancements, e-commerce growth, and the ongoing globalization of trade. The market is poised for substantial growth over the forecast period, driven by factors such as increasing global trade, the rise of e-commerce, and technological advancements. The report offers a strategic outlook on the market's potential, identifying key areas for investment and growth.

Air Freight Market Segmentation

-

1. Service

- 1.1. Forwarding

- 1.2. Airlines

- 1.3. Mail

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Carrier Type

- 3.1. Belly Cargo

- 3.2. Freighter

Air Freight Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Russia

- 3.5. Rest of Europe

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Qatar

- 4.4. South Africa

- 4.5. Rest of Middle East and Africa

-

5. Latin America

- 5.1. Brazil

- 5.2. Mexico

- 5.3. Argentina

- 5.4. Colombia

- 5.5. Rest of Latin America

Air Freight Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Global Trade; Growth of E-commerce

- 3.3. Market Restrains

- 3.3.1. High Operational Costs; Capacity Constraints

- 3.4. Market Trends

- 3.4.1. Growing Demand For The Air Freight Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Forwarding

- 5.1.2. Airlines

- 5.1.3. Mail

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Carrier Type

- 5.3.1. Belly Cargo

- 5.3.2. Freighter

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. Middle East and Africa

- 5.4.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Asia Pacific Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Forwarding

- 6.1.2. Airlines

- 6.1.3. Mail

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.3. Market Analysis, Insights and Forecast - by Carrier Type

- 6.3.1. Belly Cargo

- 6.3.2. Freighter

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. North America Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Forwarding

- 7.1.2. Airlines

- 7.1.3. Mail

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.3. Market Analysis, Insights and Forecast - by Carrier Type

- 7.3.1. Belly Cargo

- 7.3.2. Freighter

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Forwarding

- 8.1.2. Airlines

- 8.1.3. Mail

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.3. Market Analysis, Insights and Forecast - by Carrier Type

- 8.3.1. Belly Cargo

- 8.3.2. Freighter

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East and Africa Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Forwarding

- 9.1.2. Airlines

- 9.1.3. Mail

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.3. Market Analysis, Insights and Forecast - by Carrier Type

- 9.3.1. Belly Cargo

- 9.3.2. Freighter

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Latin America Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Forwarding

- 10.1.2. Airlines

- 10.1.3. Mail

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.3. Market Analysis, Insights and Forecast - by Carrier Type

- 10.3.1. Belly Cargo

- 10.3.2. Freighter

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Asia Pacific Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 Japan

- 11.1.3 India

- 11.1.4 South Korea

- 11.1.5 Rest of Asia Pacific

- 12. North America Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 France

- 13.1.4 Russia

- 13.1.5 Rest of Europe

- 14. Middle East and Africa Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Saudi Arabia

- 14.1.2 United Arab Emirates

- 14.1.3 Qatar

- 14.1.4 South Africa

- 14.1.5 Rest of Middle East and Africa

- 15. Latin America Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Mexico

- 15.1.3 Argentina

- 15.1.4 Colombia

- 15.1.5 Rest of Latin America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 LATAM Airlines

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Deutsche Lufthansa AG

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 FedEx (Federal Express) Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 China Airlines Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Gol Airlines

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cathay Pacific Airways Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 The Emirates Group

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 American Airlines

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 AirBridgeCargo Airlines

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Magma Aviation Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Delta Airlines

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Japan Airlines Co Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Cargojet Inc **List Not Exhaustive 7 3 Other Companie

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 United Airlines

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Cargolux Airlines International SA

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Azul Airlines

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 International Consolidated Airlines Group SA

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.18 All Nippon Airways Co Ltd (ANA)

- 16.2.18.1. Overview

- 16.2.18.2. Products

- 16.2.18.3. SWOT Analysis

- 16.2.18.4. Recent Developments

- 16.2.18.5. Financials (Based on Availability)

- 16.2.19 Deutsche Post DHL

- 16.2.19.1. Overview

- 16.2.19.2. Products

- 16.2.19.3. SWOT Analysis

- 16.2.19.4. Recent Developments

- 16.2.19.5. Financials (Based on Availability)

- 16.2.20 Copa Airlines

- 16.2.20.1. Overview

- 16.2.20.2. Products

- 16.2.20.3. SWOT Analysis

- 16.2.20.4. Recent Developments

- 16.2.20.5. Financials (Based on Availability)

- 16.2.21 Qatar Airways Company QCSC

- 16.2.21.1. Overview

- 16.2.21.2. Products

- 16.2.21.3. SWOT Analysis

- 16.2.21.4. Recent Developments

- 16.2.21.5. Financials (Based on Availability)

- 16.2.1 LATAM Airlines

List of Figures

- Figure 1: Global Air Freight Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Air Freight Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Air Freight Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Air Freight Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Air Freight Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Air Freight Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Air Freight Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Air Freight Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Air Freight Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Air Freight Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Air Freight Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Asia Pacific Air Freight Market Revenue (Million), by Service 2024 & 2032

- Figure 13: Asia Pacific Air Freight Market Revenue Share (%), by Service 2024 & 2032

- Figure 14: Asia Pacific Air Freight Market Revenue (Million), by Destination 2024 & 2032

- Figure 15: Asia Pacific Air Freight Market Revenue Share (%), by Destination 2024 & 2032

- Figure 16: Asia Pacific Air Freight Market Revenue (Million), by Carrier Type 2024 & 2032

- Figure 17: Asia Pacific Air Freight Market Revenue Share (%), by Carrier Type 2024 & 2032

- Figure 18: Asia Pacific Air Freight Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Asia Pacific Air Freight Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: North America Air Freight Market Revenue (Million), by Service 2024 & 2032

- Figure 21: North America Air Freight Market Revenue Share (%), by Service 2024 & 2032

- Figure 22: North America Air Freight Market Revenue (Million), by Destination 2024 & 2032

- Figure 23: North America Air Freight Market Revenue Share (%), by Destination 2024 & 2032

- Figure 24: North America Air Freight Market Revenue (Million), by Carrier Type 2024 & 2032

- Figure 25: North America Air Freight Market Revenue Share (%), by Carrier Type 2024 & 2032

- Figure 26: North America Air Freight Market Revenue (Million), by Country 2024 & 2032

- Figure 27: North America Air Freight Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Air Freight Market Revenue (Million), by Service 2024 & 2032

- Figure 29: Europe Air Freight Market Revenue Share (%), by Service 2024 & 2032

- Figure 30: Europe Air Freight Market Revenue (Million), by Destination 2024 & 2032

- Figure 31: Europe Air Freight Market Revenue Share (%), by Destination 2024 & 2032

- Figure 32: Europe Air Freight Market Revenue (Million), by Carrier Type 2024 & 2032

- Figure 33: Europe Air Freight Market Revenue Share (%), by Carrier Type 2024 & 2032

- Figure 34: Europe Air Freight Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Air Freight Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Air Freight Market Revenue (Million), by Service 2024 & 2032

- Figure 37: Middle East and Africa Air Freight Market Revenue Share (%), by Service 2024 & 2032

- Figure 38: Middle East and Africa Air Freight Market Revenue (Million), by Destination 2024 & 2032

- Figure 39: Middle East and Africa Air Freight Market Revenue Share (%), by Destination 2024 & 2032

- Figure 40: Middle East and Africa Air Freight Market Revenue (Million), by Carrier Type 2024 & 2032

- Figure 41: Middle East and Africa Air Freight Market Revenue Share (%), by Carrier Type 2024 & 2032

- Figure 42: Middle East and Africa Air Freight Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Air Freight Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Latin America Air Freight Market Revenue (Million), by Service 2024 & 2032

- Figure 45: Latin America Air Freight Market Revenue Share (%), by Service 2024 & 2032

- Figure 46: Latin America Air Freight Market Revenue (Million), by Destination 2024 & 2032

- Figure 47: Latin America Air Freight Market Revenue Share (%), by Destination 2024 & 2032

- Figure 48: Latin America Air Freight Market Revenue (Million), by Carrier Type 2024 & 2032

- Figure 49: Latin America Air Freight Market Revenue Share (%), by Carrier Type 2024 & 2032

- Figure 50: Latin America Air Freight Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Latin America Air Freight Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Air Freight Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Air Freight Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Global Air Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Global Air Freight Market Revenue Million Forecast, by Carrier Type 2019 & 2032

- Table 5: Global Air Freight Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia Pacific Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Russia Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Saudi Arabia Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: United Arab Emirates Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Qatar Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Mexico Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Colombia Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Latin America Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Air Freight Market Revenue Million Forecast, by Service 2019 & 2032

- Table 34: Global Air Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 35: Global Air Freight Market Revenue Million Forecast, by Carrier Type 2019 & 2032

- Table 36: Global Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: China Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: India Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Korea Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Air Freight Market Revenue Million Forecast, by Service 2019 & 2032

- Table 43: Global Air Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 44: Global Air Freight Market Revenue Million Forecast, by Carrier Type 2019 & 2032

- Table 45: Global Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United States Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Canada Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Air Freight Market Revenue Million Forecast, by Service 2019 & 2032

- Table 49: Global Air Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 50: Global Air Freight Market Revenue Million Forecast, by Carrier Type 2019 & 2032

- Table 51: Global Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: United Kingdom Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Germany Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: France Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Russia Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Air Freight Market Revenue Million Forecast, by Service 2019 & 2032

- Table 58: Global Air Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 59: Global Air Freight Market Revenue Million Forecast, by Carrier Type 2019 & 2032

- Table 60: Global Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 61: Saudi Arabia Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: United Arab Emirates Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Qatar Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Air Freight Market Revenue Million Forecast, by Service 2019 & 2032

- Table 67: Global Air Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 68: Global Air Freight Market Revenue Million Forecast, by Carrier Type 2019 & 2032

- Table 69: Global Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Mexico Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Argentina Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Colombia Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Latin America Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Freight Market?

The projected CAGR is approximately 5.92%.

2. Which companies are prominent players in the Air Freight Market?

Key companies in the market include LATAM Airlines, Deutsche Lufthansa AG, FedEx (Federal Express) Corporation, China Airlines Ltd, Gol Airlines, Cathay Pacific Airways Limited, The Emirates Group, American Airlines, AirBridgeCargo Airlines, Magma Aviation Limited, Delta Airlines, Japan Airlines Co Ltd, Cargojet Inc **List Not Exhaustive 7 3 Other Companie, United Airlines, Cargolux Airlines International SA, Azul Airlines, International Consolidated Airlines Group SA, All Nippon Airways Co Ltd (ANA), Deutsche Post DHL, Copa Airlines, Qatar Airways Company QCSC.

3. What are the main segments of the Air Freight Market?

The market segments include Service, Destination, Carrier Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Global Trade; Growth of E-commerce.

6. What are the notable trends driving market growth?

Growing Demand For The Air Freight Market.

7. Are there any restraints impacting market growth?

High Operational Costs; Capacity Constraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air Freight Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air Freight Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air Freight Market?

To stay informed about further developments, trends, and reports in the Air Freight Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence