Key Insights

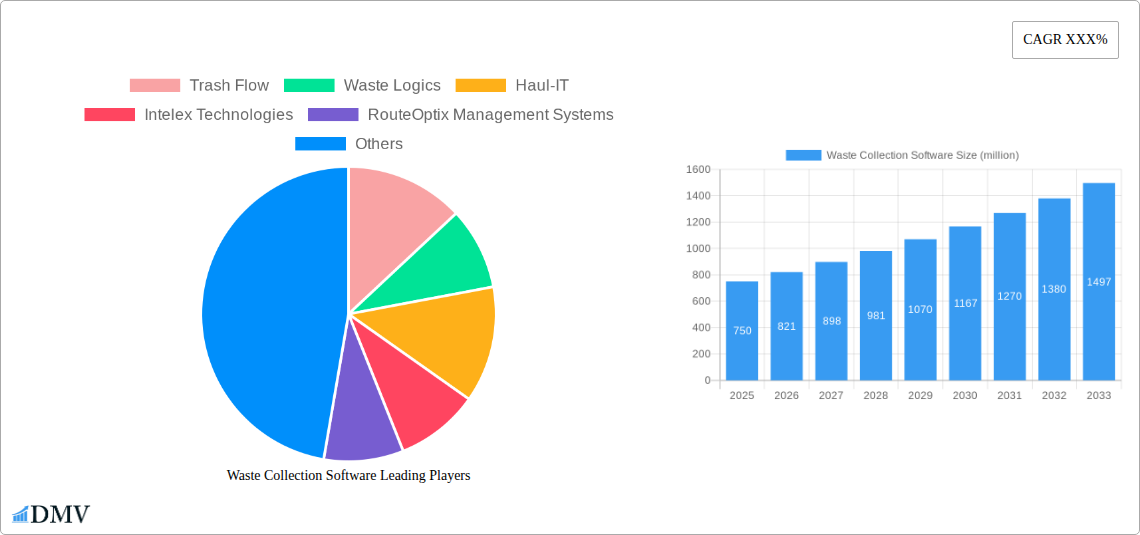

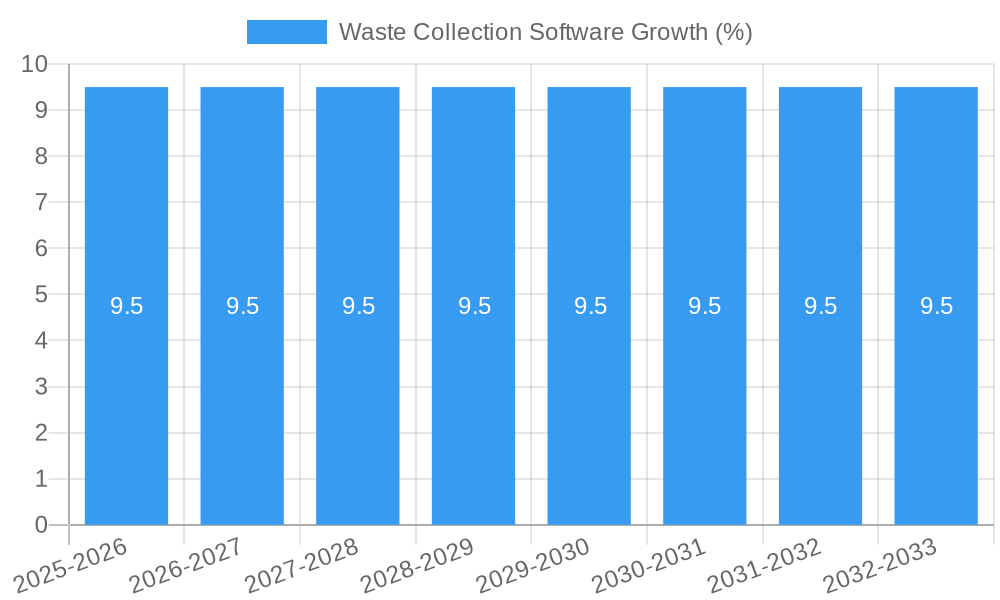

The global Waste Collection Software market is experiencing robust expansion, driven by the increasing need for efficient waste management solutions. With an estimated market size of approximately \$750 million in 2025, the sector is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of around 9.5% through 2033. This upward trajectory is primarily fueled by the growing adoption of smart technologies in waste management, stricter environmental regulations, and the escalating demand for optimized logistics and operational efficiency among waste management companies. The software solutions are crucial for streamlining route planning, managing customer data, optimizing fleet operations, and ensuring compliance with environmental standards, thereby reducing operational costs and improving service delivery.

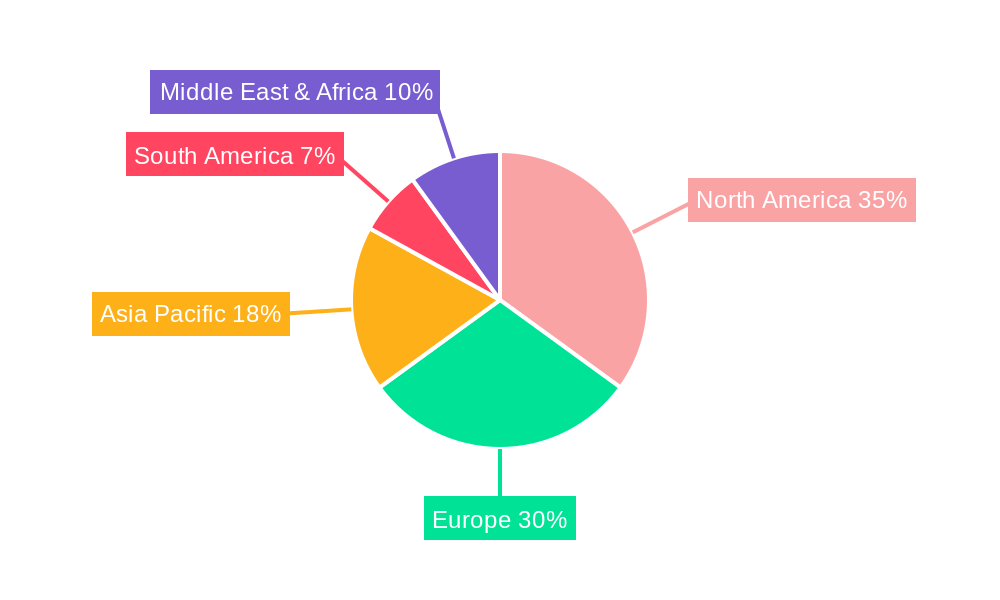

The market is segmented by application into Small and Medium Enterprises (SMEs) and Large Enterprises, with both segments showing increasing investment in digital transformation. Cloud-based solutions are dominating the market due to their scalability, accessibility, and cost-effectiveness, although on-premise solutions continue to be relevant for organizations with specific security or customization needs. Key market drivers include the increasing volume of waste generated globally, the push towards sustainable waste management practices, and the need for real-time data analytics to enhance decision-making. However, challenges such as high initial implementation costs and the need for skilled personnel to manage these advanced systems may pose some restraint to accelerated growth. North America and Europe currently lead the market, with Asia Pacific emerging as a significant growth region due to rapid urbanization and industrialization.

Unlocking Efficiency: A Comprehensive Report on the Waste Collection Software Market (2019–2033)

This in-depth report provides a definitive analysis of the global Waste Collection Software market, meticulously examining its present state and forecasting its trajectory through 2033. Navigating the complexities of waste management operations, this report offers invaluable insights for stakeholders seeking to optimize efficiency, reduce operational costs, and embrace sustainable practices through cutting-edge technology. We delve into market dynamics, technological advancements, regional dominance, key players, and future opportunities, equipping you with the knowledge to make informed strategic decisions in this evolving sector.

Waste Collection Software Market Composition & Trends

The Waste Collection Software market exhibits a moderately concentrated landscape, with a mix of established players and emerging innovators shaping its competitive environment. Key innovation catalysts include the increasing demand for route optimization, real-time tracking, and automated billing solutions, driving the development of more sophisticated software platforms. Regulatory landscapes, particularly those focusing on environmental compliance and waste reduction targets, exert significant influence, pushing adoption of advanced waste management technologies. While direct substitute products are limited, traditional manual methods and less integrated software solutions represent indirect competition. End-user profiles span a diverse range, from Small and Medium Enterprises (SMEs) seeking cost-effective and scalable solutions to Large Enterprises requiring robust, comprehensive systems capable of managing vast operations. Mergers and Acquisitions (M&A) activities are prevalent, with recent deal values estimated in the hundreds of millions, indicating strategic consolidation and a drive for market share. For instance, significant M&A activity has been observed, with estimated deal values in the range of $100 million to $500 million, reflecting the industry's dynamic nature. The market share distribution shows a trend where specialized waste collection software providers are gaining traction over generic ERP systems, particularly within niche segments.

Waste Collection Software Industry Evolution

The Waste Collection Software industry has witnessed a remarkable evolution driven by a confluence of technological advancements and escalating operational demands. From its nascent stages of basic scheduling and dispatch, the market has transformed into a sophisticated ecosystem of intelligent solutions. The study period, 2019–2024, saw an average annual growth rate (AAGR) of approximately 8%, fueled by increasing digitization across various industries. This growth trajectory is projected to accelerate, with an estimated AAGR of 12% during the forecast period of 2025–2033. Technological advancements have been the bedrock of this transformation. Early adoption of GPS tracking and basic routing algorithms gave way to advanced AI-powered route optimization engines that dynamically adjust routes based on real-time traffic, weather, and bin fill levels, leading to an estimated 20% reduction in fuel consumption for early adopters. Mobile applications for drivers and customers have become standard, enhancing communication, enabling real-time status updates, and facilitating digital proof of service. Furthermore, the integration of IoT sensors in waste bins to monitor fill levels has revolutionized collection strategies, moving from fixed schedules to demand-driven, efficient pickups. This shift has been instrumental in reducing unnecessary trips and optimizing resource allocation, with companies reporting a decrease in missed collections by over 15%. Shifting consumer demands, driven by heightened environmental awareness and a desire for transparency, have also played a crucial role. Municipalities and private waste haulers are under increasing pressure to demonstrate sustainability, improve citizen engagement, and provide accurate data on waste streams. This has led to a surge in demand for software that offers comprehensive reporting capabilities, waste diversion tracking, and customer-facing portals for service requests and query management. The base year, 2025, stands as a pivotal point, reflecting a mature market ready for further innovation and widespread adoption of next-generation features. The adoption metrics clearly indicate this trend, with cloud-based solutions now accounting for over 70% of new implementations, a significant jump from the 40% observed in 2019. On-premise solutions, while still present, are seeing a gradual decline in market share, particularly among SMEs. This evolution signifies a move towards more agile, scalable, and data-driven waste management practices, setting the stage for continued innovation and market expansion.

Leading Regions, Countries, or Segments in Waste Collection Software

The Waste Collection Software market is currently dominated by North America, driven by robust technological adoption, stringent environmental regulations, and a strong presence of key industry players. Within this region, the Cloud-based segment for Small and Medium Enterprises (SMEs) is exhibiting particularly strong growth and leadership.

- North America's Dominance: The United States and Canada are at the forefront of waste management technology adoption. High levels of infrastructure investment, coupled with a proactive approach to environmental sustainability, have created a fertile ground for advanced waste collection software. Government initiatives promoting smart city development and efficient resource management further bolster the market.

- Cloud-based Solutions for SMEs: The shift towards cloud-based waste collection software is a defining trend, especially for SMEs. These solutions offer unparalleled scalability, flexibility, and cost-effectiveness, eliminating the need for significant upfront IT infrastructure investment. SMEs can readily access advanced features like route optimization, real-time tracking, and automated billing through subscription models, enabling them to compete more effectively with larger enterprises. Estimated adoption of cloud-based solutions among SMEs has risen by over 50% since 2019.

- Key Drivers for SME Cloud Adoption:

- Reduced IT Overhead: SMEs can avoid substantial capital expenditure on hardware and software licenses.

- Scalability & Flexibility: Cloud solutions easily adapt to changing business needs and operational volumes.

- Enhanced Accessibility: Access to software from any device, anywhere, improving operational agility.

- Faster Deployment: Cloud-based systems can be implemented significantly faster than on-premise solutions, often within weeks.

- Automatic Updates & Maintenance: Vendors handle all software updates and maintenance, freeing up SME resources.

- Large Enterprises' Continued Reliance: While SMEs are rapidly embracing cloud solutions, Large Enterprises are also investing heavily in cloud-based and hybrid models. Their focus is on sophisticated integrations with existing ERP systems, advanced analytics, and comprehensive compliance reporting. The sheer scale of their operations necessitates robust and feature-rich platforms.

- On-Premise Transition: On-premise solutions, though still utilized, are gradually ceding market share to cloud-based alternatives. Legacy systems are being phased out as companies recognize the operational and financial benefits of cloud deployment. However, certain industries with stringent data security requirements or unique integration needs may continue to opt for on-premise deployments.

- Industry Developments Impacting Dominance: Increased government mandates for waste diversion and recycling reporting are pushing all segments towards more sophisticated tracking and reporting capabilities, which are more readily available and cost-effective through cloud-based platforms. Furthermore, the burgeoning circular economy principles are driving demand for software that can facilitate the tracking and management of various waste streams for reuse and recycling. The estimated market penetration of waste collection software in North America for SMEs is projected to reach 85% by 2028.

Waste Collection Software Product Innovations

Recent product innovations in waste collection software are revolutionizing operational efficiency and sustainability. Advanced AI algorithms now enable highly precise route optimization, reducing mileage by up to 25% and fuel consumption by 15% through dynamic rerouting based on real-time traffic and bin fill levels. Predictive analytics are being integrated to forecast waste generation patterns, allowing for proactive resource allocation. Furthermore, the emergence of IoT-enabled smart bins, seamlessly integrated with software platforms, provides real-time fill-level data, shifting collection from schedule-based to need-based. Mobile applications for drivers now offer augmented reality features for efficient bin identification and enhanced safety protocols. These innovations are crucial for improving service delivery and reducing the environmental footprint of waste management operations.

Propelling Factors for Waste Collection Software Growth

Several key factors are propelling the growth of the waste collection software market. Technologically, the increasing adoption of IoT devices, AI, and machine learning is enabling smarter, more efficient waste collection routes and operations, leading to significant cost savings. Economically, the rising operational costs of traditional waste management, including fuel and labor, are driving a demand for software solutions that offer optimization and automation. Regulatory mandates for improved waste management, recycling, and environmental compliance are also significant drivers, compelling businesses and municipalities to invest in advanced tracking and reporting capabilities. For instance, government incentives for digital transformation in municipal services are estimated to have boosted market growth by 10% in the last two years.

Obstacles in the Waste Collection Software Market

Despite robust growth, the waste collection software market faces several obstacles. Regulatory challenges can arise from varying data privacy laws and cybersecurity standards across different regions, complicating software deployment and compliance for global operators. Supply chain disruptions, particularly for hardware components like IoT sensors, can impact the timely implementation of integrated solutions. Competitive pressures from numerous vendors offering similar feature sets can lead to price wars, impacting profit margins. Furthermore, the initial cost of implementing sophisticated software, especially for smaller enterprises, can be a barrier, although the growing prevalence of cloud-based, subscription models is mitigating this concern. The estimated cost of data breaches for waste management companies can exceed $1 million, prompting cautious investment in robust cybersecurity features.

Future Opportunities in Waste Collection Software

Emerging opportunities in the waste collection software market are abundant. The expanding smart city initiatives worldwide present a significant avenue for growth, integrating waste management systems with broader urban infrastructure. The increasing focus on the circular economy is creating demand for software that can track and manage reusable materials and complex recycling streams. Advancements in AI and predictive analytics offer further potential for hyper-efficient operations and waste reduction strategies. The underserved markets in developing economies, with their growing populations and increasing waste generation, represent a substantial untapped potential for software adoption. Exploring niche applications, such as specialized hazardous waste tracking or industrial waste management, also presents promising avenues.

Major Players in the Waste Collection Software Ecosystem

- Trash Flow

- Waste Logics

- Haul-IT

- Intelex Technologies

- RouteOptix Management Systems

- Carolina Software

- Dakota's Waste Management

- Routeware

- Soft-Pakacturers

- CompuWeigh

- Danaher Corporation

- AMCS

Key Developments in Waste Collection Software Industry

- 2023/08: Launch of advanced AI-powered route optimization by AMCS, resulting in an estimated 18% reduction in collection times for pilot customers.

- 2023/11: Waste Logics announces strategic partnership with IoT sensor provider, enabling real-time bin fill level monitoring for enhanced efficiency.

- 2024/02: RouteOptix Management Systems acquires a smaller competitor, expanding its market reach and service offerings.

- 2024/05: Intelex Technologies releases a new module for advanced waste diversion tracking, supporting circular economy initiatives.

- 2024/09: Haul-IT integrates a customer-facing mobile app, improving communication and service requests, leading to a reported 20% increase in customer satisfaction.

- 2025/01: Soft-Pakacturers introduces a cloud-based platform tailored for small and medium enterprises, offering scalable and affordable waste management solutions.

- 2025/04: CompuWeigh rolls out enhanced reporting features, allowing for detailed environmental compliance documentation, crucial for regulatory adherence.

- 2025/07: Routeware expands its service offerings to include advanced analytics for waste stream profiling and forecasting.

- 2025/10: Carolina Software launches a new module for hazardous waste tracking, addressing critical safety and compliance needs.

- 2026/02: Danaher Corporation announces significant investment in R&D for predictive waste generation modeling.

Strategic Waste Collection Software Market Forecast

The strategic outlook for the Waste Collection Software market remains exceptionally positive, driven by persistent global trends towards operational efficiency, environmental sustainability, and digital transformation. The forecast period (2025–2033) is poised for substantial growth, fueled by the widespread adoption of cloud-based solutions and the increasing integration of AI, IoT, and predictive analytics. These technologies are not only optimizing collection routes and resource allocation, leading to significant cost savings estimated at over 15% for fuel and labor, but also enabling better waste diversion and recycling management. The growing emphasis on circular economy principles and stricter environmental regulations worldwide will continue to mandate sophisticated software capabilities for tracking, reporting, and compliance. Emerging markets present untapped potential, offering opportunities for rapid expansion and market penetration. The market is expected to witness continued innovation, with a focus on seamless integration, enhanced user experience, and data-driven decision-making, solidifying its role as a critical enabler of modern, sustainable waste management practices. The market size is projected to reach several billion dollars by 2033.

Waste Collection Software Segmentation

-

1. Application

- 1.1. Small and Medium Enterprises

- 1.2. Large Enterprises

-

2. Type

- 2.1. Cloud-based

- 2.2. On-premise

Waste Collection Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Waste Collection Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Waste Collection Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Small and Medium Enterprises

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud-based

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Waste Collection Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Small and Medium Enterprises

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud-based

- 6.2.2. On-premise

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Waste Collection Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Small and Medium Enterprises

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud-based

- 7.2.2. On-premise

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Waste Collection Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Small and Medium Enterprises

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud-based

- 8.2.2. On-premise

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Waste Collection Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Small and Medium Enterprises

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud-based

- 9.2.2. On-premise

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Waste Collection Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Small and Medium Enterprises

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud-based

- 10.2.2. On-premise

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Trash Flow

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Waste Logics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Haul-IT

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intelex Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RouteOptix Management Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Carolina Software

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dakota's Waste Management

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Routeware

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Soft-Pakacturers

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CompuWeigh

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Danaher Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AMCS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Trash Flow

List of Figures

- Figure 1: Global Waste Collection Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Waste Collection Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Waste Collection Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Waste Collection Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America Waste Collection Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Waste Collection Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Waste Collection Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Waste Collection Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Waste Collection Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Waste Collection Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America Waste Collection Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Waste Collection Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Waste Collection Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Waste Collection Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Waste Collection Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Waste Collection Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Waste Collection Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Waste Collection Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Waste Collection Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Waste Collection Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Waste Collection Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Waste Collection Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Waste Collection Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Waste Collection Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Waste Collection Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Waste Collection Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Waste Collection Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Waste Collection Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Waste Collection Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Waste Collection Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Waste Collection Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Waste Collection Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Waste Collection Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Waste Collection Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Waste Collection Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Waste Collection Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Waste Collection Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Waste Collection Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Waste Collection Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Waste Collection Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Waste Collection Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Waste Collection Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Waste Collection Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Waste Collection Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Waste Collection Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Waste Collection Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Waste Collection Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Waste Collection Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Waste Collection Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Waste Collection Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Waste Collection Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Waste Collection Software?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Waste Collection Software?

Key companies in the market include Trash Flow, Waste Logics, Haul-IT, Intelex Technologies, RouteOptix Management Systems, Carolina Software, Dakota's Waste Management, Routeware, Soft-Pakacturers, CompuWeigh, Danaher Corporation, AMCS.

3. What are the main segments of the Waste Collection Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Waste Collection Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Waste Collection Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Waste Collection Software?

To stay informed about further developments, trends, and reports in the Waste Collection Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence