Key Insights

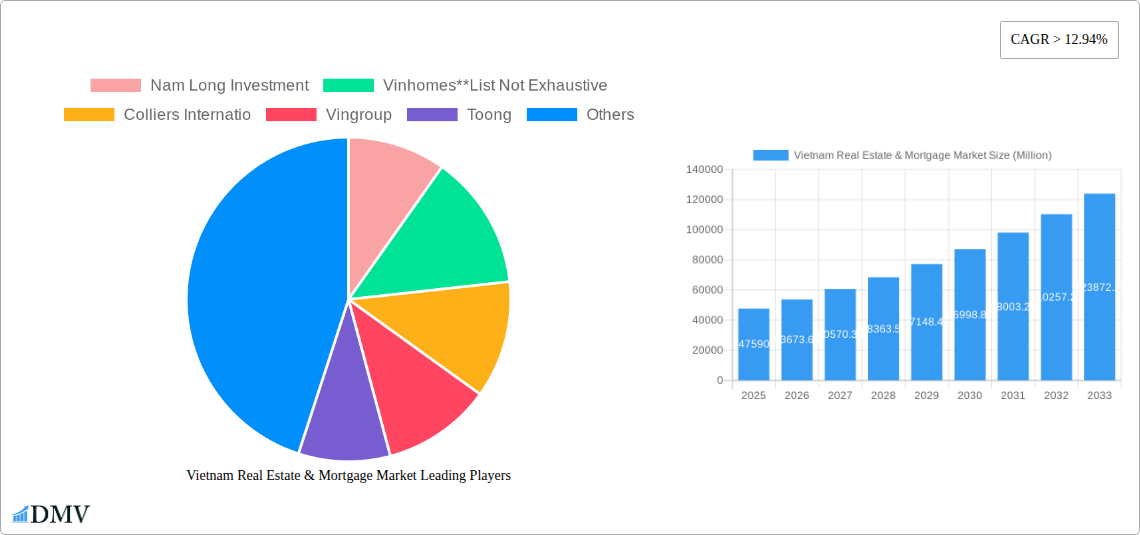

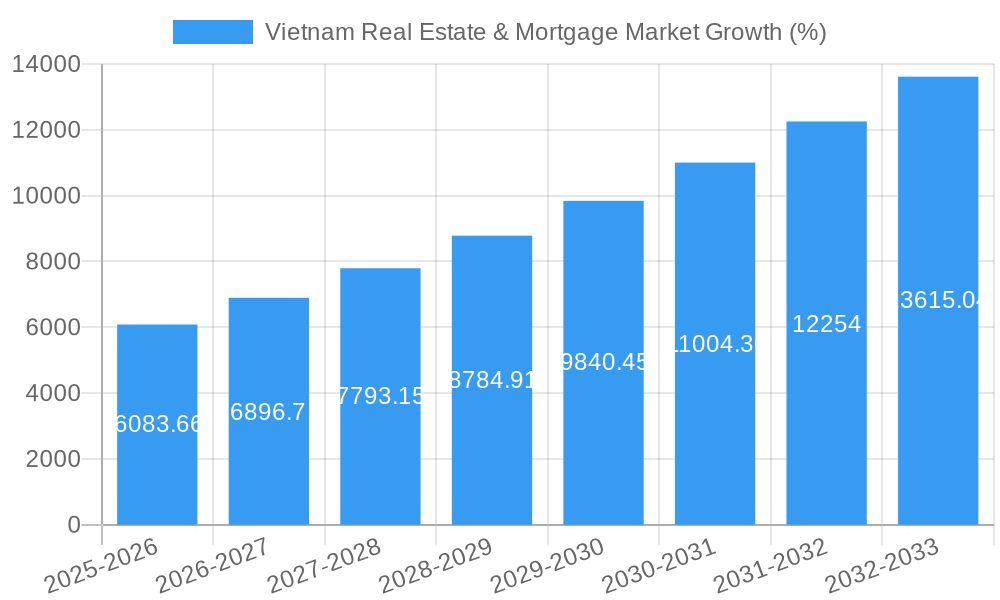

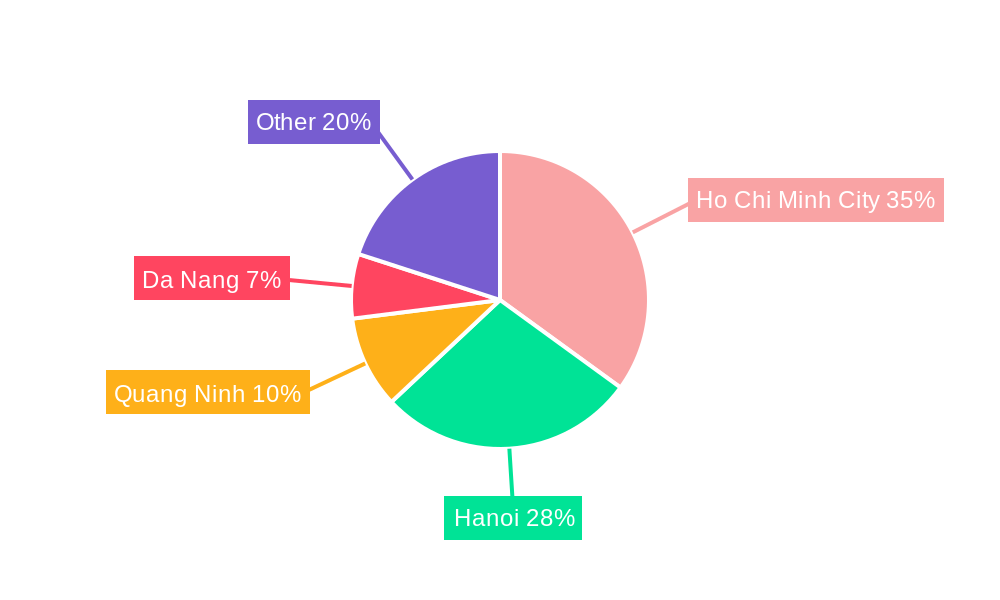

The Vietnam real estate and mortgage market exhibits robust growth, projected to reach a market size of $47.59 billion in 2025, boasting a Compound Annual Growth Rate (CAGR) exceeding 12.94%. This expansion is fueled by several key factors. Rapid urbanization, particularly in major cities like Ho Chi Minh City and Hanoi, is driving significant demand for residential, retail, and commercial properties. A burgeoning middle class with increasing disposable income further fuels this demand, particularly in the affordable and premium segments. Government initiatives aimed at infrastructure development and economic diversification are also contributing positively to market growth. However, challenges remain. Interest rate fluctuations and potential regulatory changes could impact mortgage accessibility and investment decisions. Furthermore, supply chain disruptions and material cost increases pose challenges to developers. The market segmentation reveals diverse opportunities. The residential segment, encompassing affordable, premium, and luxury housing, constitutes a significant portion of the market. The commercial sector, encompassing retail, logistics/industrial, and office spaces, presents another lucrative avenue for investment, particularly in high-growth cities like Da Nang and Quang Ninh. Key players such as Vinhomes, Novaland Group, and Vingroup are actively shaping the market landscape through large-scale developments and innovative projects. The forecast period (2025-2033) anticipates continued expansion, though the rate of growth may moderate slightly due to potential market saturation in certain segments and macroeconomic factors.

Looking ahead, the Vietnamese real estate market's future hinges on several key aspects. Sustained economic growth and controlled inflation are crucial for maintaining investor confidence. Effective regulation and transparency in the mortgage sector will promote financial stability and responsible lending practices. Furthermore, strategic infrastructure investments, particularly in transportation and utilities, are essential for supporting rapid urbanization and fostering development in secondary cities. The market will likely see increased focus on sustainable and technologically advanced construction practices, along with a shift towards specialized segments like co-working spaces and green buildings to meet evolving consumer preferences. The competitive landscape will remain dynamic, with established players and new entrants vying for market share through innovation and strategic partnerships.

Vietnam Real Estate & Mortgage Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Vietnam real estate and mortgage market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's composition, evolution, and future trajectory. We analyze key segments including residential, retail, logistics/industrial, hospitality, and office properties across premium, luxury, and affordable value categories, focusing on key cities like Ho Chi Minh City, Hanoi, Quang Ninh, and Da Nang. The report also highlights significant investments, such as Foxconn's USD 300 million expansion and Novaland's USD 250 million financing, shaping the market's landscape.

Vietnam Real Estate & Mortgage Market Market Composition & Trends

This section delves into the competitive dynamics of the Vietnamese real estate and mortgage market. We examine market concentration, identifying major players and their respective market share. Key aspects include innovation catalysts driving market evolution, the regulatory landscape impacting investment decisions, and the presence of substitute products influencing consumer choices. Furthermore, the report analyzes end-user profiles to understand demand drivers and explores significant M&A activities, including deal values and their impact on market consolidation.

- Market Concentration: Analysis of market share distribution among major players like Vingroup, Novaland Group, and Vinhomes. (Specific market share percentages will be provided in the full report).

- M&A Activity: Detailed overview of significant mergers and acquisitions, including deal values (e.g., Novaland's USD 250 million financing). (Further details and specific deal values will be provided in the full report).

- Regulatory Landscape: Assessment of government policies and regulations impacting the real estate and mortgage sectors.

- Innovation Catalysts: Identification of technological advancements and innovative business models shaping the market.

Vietnam Real Estate & Mortgage Market Industry Evolution

This section provides a comprehensive analysis of the Vietnam real estate and mortgage market's growth trajectory from 2019 to 2033. We examine historical data (2019-2024) and project future trends (2025-2033), identifying key growth drivers and technological advancements influencing market dynamics. The impact of shifting consumer demands, including preferences for specific property types and locations, is also analyzed. We incorporate specific data points, such as compound annual growth rates (CAGR) for different segments, to provide a quantitative understanding of market evolution. Analysis includes the influence of factors like urbanization, rising disposable incomes, and changing lifestyles on the demand for various property types.

Leading Regions, Countries, or Segments in Vietnam Real Estate & Mortgage Market

This section identifies the dominant regions, countries, and segments within the Vietnamese real estate and mortgage market. We analyze key cities (Ho Chi Minh City, Hanoi, Quang Ninh, Da Nang) and property types (Residential, Retail, Logistics/Industrial, Hospitality, Office) across value segments (Premium, Luxury, Affordable). Dominance factors are explored in detail, providing a comprehensive understanding of the market’s geographical and sectoral distribution.

Key Drivers: Bullet points outlining investment trends, regulatory support, and infrastructure development for each leading segment and region. (Specific data and examples will be provided in the full report).

Dominance Factors: In-depth analysis of factors contributing to the dominance of specific regions, countries, or segments. (Specific data and analysis will be provided in the full report, highlighting the reasons for dominance in different segments).

Vietnam Real Estate & Mortgage Market Product Innovations

This section details product innovations, applications, and performance metrics within the Vietnam real estate and mortgage market. We analyze new building materials, smart home technologies, and innovative financing solutions. Specific examples of unique selling propositions and technological advancements are highlighted, focusing on their impact on market competitiveness.

Propelling Factors for Vietnam Real Estate & Mortgage Market Growth

Key growth drivers for the Vietnamese real estate and mortgage market are explored in this section. We analyze economic factors (e.g., GDP growth, rising disposable incomes), technological advancements (e.g., proptech solutions), and supportive government policies (e.g., infrastructure investments) that contribute to market expansion. Specific examples illustrate the influence of each driver.

Obstacles in the Vietnam Real Estate & Mortgage Market Market

This section identifies and analyzes barriers and restraints that impact the growth of the Vietnam real estate and mortgage market. We examine regulatory challenges, supply chain disruptions (e.g., material shortages), and competitive pressures impacting market dynamics. Quantifiable impacts of these obstacles on market growth are discussed.

Future Opportunities in Vietnam Real Estate & Mortgage Market

This section highlights promising future opportunities within the Vietnamese real estate and mortgage market. We analyze potential new markets, emerging technologies, and shifting consumer trends likely to shape future growth. Focus areas include the expansion of affordable housing options, sustainable development initiatives, and the growing demand for specialized commercial real estate properties.

Major Players in the Vietnam Real Estate & Mortgage Market Ecosystem

- Nam Long Investment

- Vinhomes

- Colliers International

- Vingroup

- Toong

- Dat Xanh Group

- Hung Thinh Real Estate Business Investment Corporation

- Sun Group

- FLC Group

- Phat Dat Corporation

- Novaland Group

Key Developments in Vietnam Real Estate & Mortgage Market Industry

June 2023: Foxconn receives approval for a USD 246 million investment in two new projects in Quang Ninh province. This signifies significant foreign direct investment (FDI) boosting industrial real estate demand.

February 2023: Foxconn announces a USD 300 million investment to expand its manufacturing facility in North Vietnam, leasing 111 acres in Bac Giang province for approximately USD 62.5 million until February 2057. This major expansion highlights the growing appeal of Vietnam for manufacturing and related real estate development.

June 2022: Novaland secures USD 250 million in financing from a consortium led by Warburg Pincus, strengthening its market position and indicating investor confidence in the Vietnamese real estate market.

Strategic Vietnam Real Estate & Mortgage Market Market Forecast

The Vietnam real estate and mortgage market is poised for continued growth, driven by robust economic expansion, increasing urbanization, and significant foreign investment. The projected growth in various segments, fueled by both domestic and international demand, positions the market for substantial expansion over the forecast period (2025-2033). Opportunities in affordable housing, sustainable developments, and industrial real estate are expected to be key drivers of future market potential. The ongoing government support for infrastructure development and improvements to the regulatory environment further contribute to a positive outlook.

Vietnam Real Estate & Mortgage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Retail

- 1.3. Logistics/Industrial

- 1.4. Hospitality

- 1.5. Office

-

2. Value

- 2.1. Premium

- 2.2. Luxury

- 2.3. Affordable

-

3. Key Cities

- 3.1. Ho Chi Minh City

- 3.2. Hanoi

- 3.3. Quang Ninh

- 3.4. Da Nang

Vietnam Real Estate & Mortgage Market Segmentation By Geography

- 1. Vietnam

Vietnam Real Estate & Mortgage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 12.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ho Chi Minh City and Hanoi were experiencing rapid urban expansion; Streamlined Real Estate Lending Service

- 3.3. Market Restrains

- 3.3.1. Declining property values as a result of volatile housing markets

- 3.4. Market Trends

- 3.4.1. Increased Population and Urbanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Real Estate & Mortgage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Retail

- 5.1.3. Logistics/Industrial

- 5.1.4. Hospitality

- 5.1.5. Office

- 5.2. Market Analysis, Insights and Forecast - by Value

- 5.2.1. Premium

- 5.2.2. Luxury

- 5.2.3. Affordable

- 5.3. Market Analysis, Insights and Forecast - by Key Cities

- 5.3.1. Ho Chi Minh City

- 5.3.2. Hanoi

- 5.3.3. Quang Ninh

- 5.3.4. Da Nang

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nam Long Investment

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vinhomes**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Colliers Internatio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vingroup

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toong

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dat Xanh Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hung Thinh Real Estate Business Investment Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sun Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FLC Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Phat Dat Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Novaland Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Nam Long Investment

List of Figures

- Figure 1: Vietnam Real Estate & Mortgage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Real Estate & Mortgage Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Value 2019 & 2032

- Table 4: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 5: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Value 2019 & 2032

- Table 9: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 10: Vietnam Real Estate & Mortgage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Real Estate & Mortgage Market?

The projected CAGR is approximately > 12.94%.

2. Which companies are prominent players in the Vietnam Real Estate & Mortgage Market?

Key companies in the market include Nam Long Investment, Vinhomes**List Not Exhaustive, Colliers Internatio, Vingroup, Toong, Dat Xanh Group, Hung Thinh Real Estate Business Investment Corporation, Sun Group, FLC Group, Phat Dat Corporation, Novaland Group.

3. What are the main segments of the Vietnam Real Estate & Mortgage Market?

The market segments include Type, Value, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Ho Chi Minh City and Hanoi were experiencing rapid urban expansion; Streamlined Real Estate Lending Service.

6. What are the notable trends driving market growth?

Increased Population and Urbanization.

7. Are there any restraints impacting market growth?

Declining property values as a result of volatile housing markets.

8. Can you provide examples of recent developments in the market?

February 2023: Foxconn announced an investment of USD 300 million to expand its manufacturing facility in North Vietnam. Now, the supplier is leasing a new site in the Quang Chau Industrial Park in Bac Giang province, east of Hanoi. A South China Morning Post report reveals that Foxconn has signed a lease with Saigon-Bac Giang Industrial Park Corp for a plot of 111 acres for approximately USD 62.5 million. The lease will run until February 2057.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Real Estate & Mortgage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Real Estate & Mortgage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Real Estate & Mortgage Market?

To stay informed about further developments, trends, and reports in the Vietnam Real Estate & Mortgage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence