Key Insights

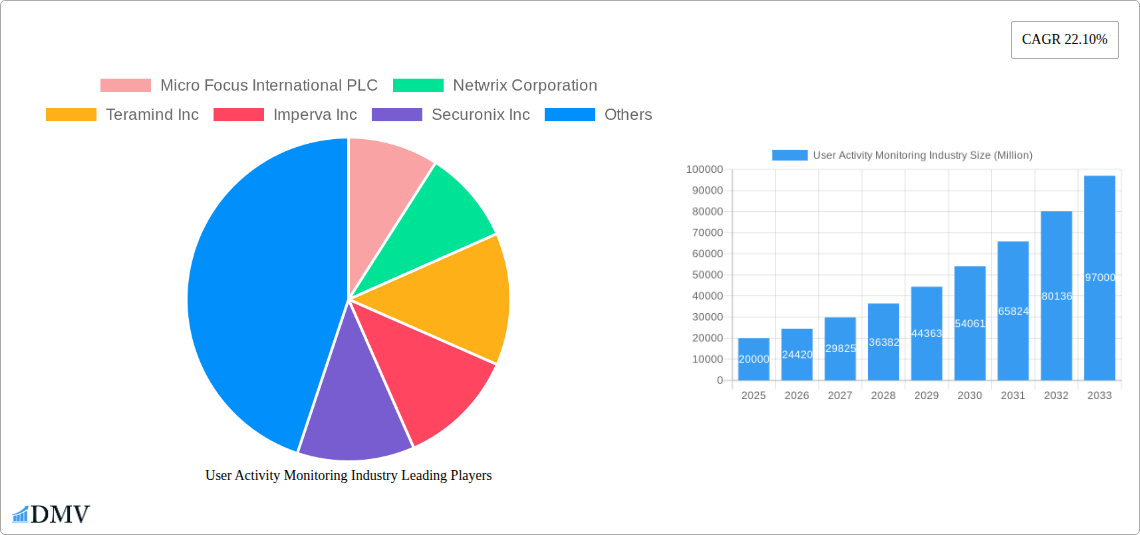

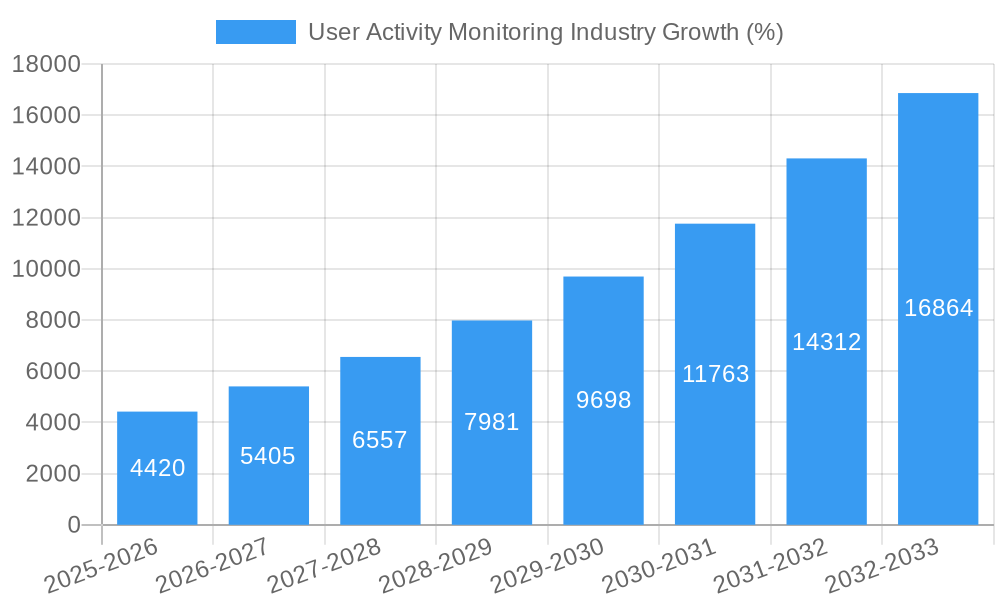

The User Activity Monitoring (UAM) market is experiencing robust growth, driven by the increasing need for enhanced cybersecurity, regulatory compliance, and improved employee productivity. The market, currently valued at an estimated $XX billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 22.10% from 2025 to 2033. This significant growth is fueled by several key factors. The rising adoption of cloud-based applications and remote work models has increased the attack surface for organizations, making real-time user activity monitoring crucial for threat detection and prevention. Furthermore, stringent data privacy regulations like GDPR and CCPA are compelling businesses to implement robust UAM solutions to ensure compliance and avoid hefty penalties. The increasing sophistication of cyberattacks also necessitates advanced UAM capabilities that can detect insider threats and malicious activities effectively. Segmentation analysis reveals that the large enterprise segment holds a significant market share, driven by their higher budgets and greater need for comprehensive security solutions. The BFSI and IT & Telecom sectors are key end-user industries, owing to their sensitive data and critical infrastructure.

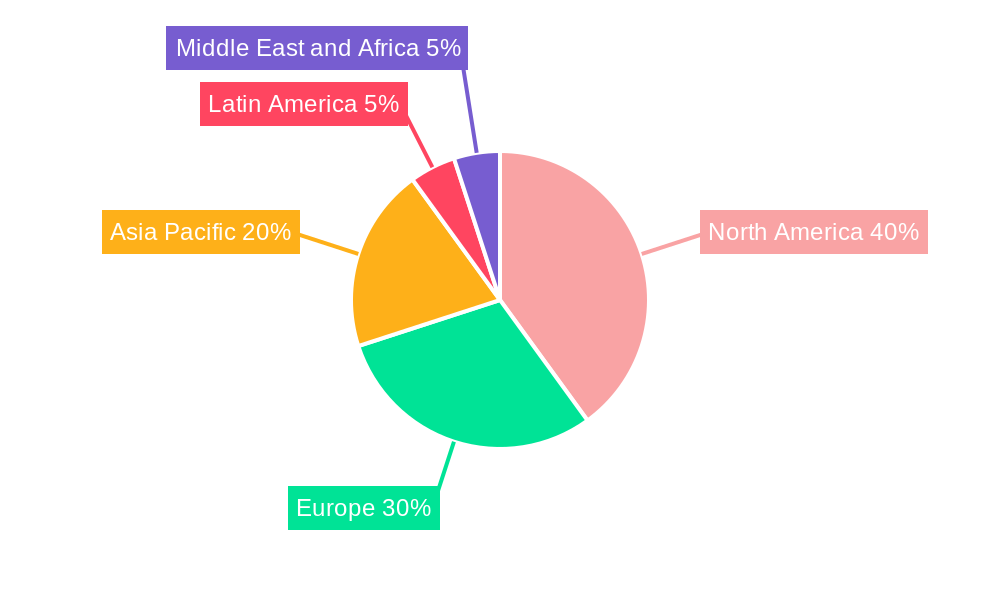

The UAM market presents promising opportunities for vendors offering solutions that integrate AI and machine learning for advanced threat detection and anomaly identification. The market is also witnessing a shift towards cloud-based UAM deployments, offering scalability and cost-effectiveness. However, challenges remain, including the rising cost of implementation and the complexity of managing large volumes of UAM data. Data privacy concerns and the need for user consent also require careful consideration. The competitive landscape is dynamic, with established players like Micro Focus, Splunk, and Imperva competing with emerging innovative startups. Future growth hinges on the continued development of sophisticated UAM technologies capable of addressing the evolving threat landscape and adapting to the increasing complexities of modern IT environments. Geographical expansion, particularly in emerging markets in Asia-Pacific, also presents significant opportunities for market growth.

User Activity Monitoring Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the User Activity Monitoring (UAM) industry, projecting a market size exceeding $XX Billion by 2033. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. It delves into market composition, technological advancements, leading players, and future growth opportunities, offering invaluable insights for stakeholders.

User Activity Monitoring Industry Market Composition & Trends

The User Activity Monitoring market, valued at $XX Billion in 2024, is experiencing significant growth driven by increasing cyber threats and the rising adoption of cloud computing. Market concentration is moderate, with several key players holding substantial shares, but a fragmented landscape also exists, particularly amongst smaller niche providers. Innovation is primarily fueled by the need for advanced threat detection and prevention capabilities, coupled with regulatory pressures demanding enhanced data security and compliance. Substitute products are limited, mostly focusing on basic logging solutions lacking the sophisticated analytics of UAM.

- Market Share Distribution (2024): Top 5 players account for approximately XX% of the market.

- M&A Activity (2019-2024): Total M&A deal value exceeded $XX Billion, reflecting consolidation and expansion strategies.

- End-User Profiles: Primarily large enterprises in BFSI, IT & Telecom, and Healthcare, with growing adoption among SMEs.

- Regulatory Landscape: Increasingly stringent data privacy regulations (e.g., GDPR, CCPA) are driving demand for UAM solutions.

User Activity Monitoring Industry Industry Evolution

The UAM market exhibits a robust growth trajectory, projected to expand at a CAGR of XX% during 2025-2033. This growth is propelled by several factors. Technological advancements, particularly in AI and machine learning, are enabling more accurate threat detection and real-time response. The increasing sophistication of cyberattacks necessitates more comprehensive monitoring solutions, fueling demand for advanced UAM systems. Furthermore, shifting consumer demands towards enhanced data security and privacy are driving adoption across various industries. The market witnessed a surge in adoption post-2020 driven by the rapid shift to remote work, increasing the attack surface for many organizations. Adoption rates across key industries grew between XX% and XX% during the period 2020-2024.

Leading Regions, Countries, or Segments in User Activity Monitoring Industry

North America currently dominates the UAM market, driven by strong technological innovation, early adoption of advanced security solutions, and a robust regulatory landscape emphasizing data protection. Within applications, Network Monitoring and Database Monitoring currently lead the segments, driven by the need to protect critical infrastructure and sensitive data. Large Enterprises also represent the largest segment due to greater resources and higher risk profiles.

- Key Drivers – North America: High cybersecurity awareness, strong regulatory framework (e.g., NIST Cybersecurity Framework), substantial investments in IT security.

- Key Drivers – Large Enterprises: Higher risk profiles, greater resources for security investment, stringent compliance requirements.

- Key Drivers – Network Monitoring: Growing reliance on interconnected systems, increasing threat landscape targeting network vulnerabilities.

User Activity Monitoring Industry Product Innovations

Recent innovations in the UAM space include enhanced AI-powered threat detection, behavioral analytics, and seamless integration with existing security information and event management (SIEM) systems. These advancements are enabling more proactive threat response, improved compliance, and reduced operational costs. Companies are focusing on providing intuitive user interfaces and customizable dashboards to improve user experience and ease of use. Unique selling propositions include real-time alerts, automated incident response, and sophisticated reporting capabilities.

Propelling Factors for User Activity Monitoring Industry Growth

Several factors are contributing to the growth of the UAM market. Technological advancements in AI and machine learning are enhancing the accuracy and efficiency of threat detection. The increasing frequency and sophistication of cyberattacks drive demand for robust security solutions. Stringent data privacy regulations, coupled with rising cybersecurity awareness, mandate the adoption of UAM across various sectors. Economic growth and increased digitalization are further fueling market expansion.

Obstacles in the User Activity Monitoring Industry Market

The UAM market faces several challenges, including the high initial investment costs associated with deploying advanced monitoring systems. The complexity of implementing and managing UAM solutions can pose an obstacle for smaller organizations lacking the necessary expertise. Concerns about data privacy and potential misuse of monitored data create challenges, requiring robust data governance policies. Furthermore, the intensely competitive landscape, with established players and emerging startups, puts pressure on profit margins.

Future Opportunities in User Activity Monitoring Industry

Emerging opportunities lie in extending UAM capabilities to encompass emerging technologies such as IoT devices and cloud-native applications. The development of more sophisticated analytics and predictive capabilities will drive market expansion. Growing adoption in emerging economies and expansion into new industry verticals present significant opportunities. Focus on user-friendly interfaces and integration with existing security ecosystems will further enhance market penetration.

Major Players in the User Activity Monitoring Industry Ecosystem

- Micro Focus International PLC

- Netwrix Corporation

- Teramind Inc

- Imperva Inc

- Securonix Inc

- LogRhythm Inc

- Centrify Corporation

- CyberArk Software Ltd

- Ezwim B V

- Splunk Inc

- Forcepoint

Key Developments in User Activity Monitoring Industry Industry

- July 2022: Imperva Inc. announced Imperva Data Security Fabric (DSF), enhancing data protection for AWS enterprise data lakes. This significantly expands Imperva's market reach within the cloud security domain.

- May 2022: CyberArk Software Ltd. launched a USD 30 Million global investment fund (CyberArk Ventures), boosting innovation and fostering partnerships within the cybersecurity ecosystem. This move demonstrates a strategic commitment to nurturing future security solutions.

Strategic User Activity Monitoring Industry Market Forecast

The UAM market is poised for continued strong growth, driven by escalating cyber threats, increasing regulatory pressures, and technological advancements. The focus on AI-powered solutions, cloud security, and user-friendly interfaces will shape future market dynamics. Emerging opportunities in new verticals and expanding geographic regions represent substantial untapped potential, indicating a bright outlook for the UAM industry.

User Activity Monitoring Industry Segmentation

-

1. Application

- 1.1. System Monitoring

- 1.2. Application Monitoring

- 1.3. File Monitoring

- 1.4. Network Monitoring

- 1.5. Database Monitoring

-

2. Enterprise

- 2.1. Small & Medium Enterprises

- 2.2. Large Enterprises

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Retail

- 3.3. IT & Telecom

- 3.4. Healthcare

- 3.5. Manufacturing

- 3.6. Other End-user Industries

User Activity Monitoring Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

User Activity Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 22.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need Among Organizations to Optimize Employee Productivity; Need for Enhanced Control Over Employees and Third-Party Vendors in Enterprises

- 3.3. Market Restrains

- 3.3.1. High Cost of Innovation for Developing Robust UAM Solutions

- 3.4. Market Trends

- 3.4.1. Increasing Need Among Organizations to Optimize Employee Productivity to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. System Monitoring

- 5.1.2. Application Monitoring

- 5.1.3. File Monitoring

- 5.1.4. Network Monitoring

- 5.1.5. Database Monitoring

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Small & Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. IT & Telecom

- 5.3.4. Healthcare

- 5.3.5. Manufacturing

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. System Monitoring

- 6.1.2. Application Monitoring

- 6.1.3. File Monitoring

- 6.1.4. Network Monitoring

- 6.1.5. Database Monitoring

- 6.2. Market Analysis, Insights and Forecast - by Enterprise

- 6.2.1. Small & Medium Enterprises

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. Retail

- 6.3.3. IT & Telecom

- 6.3.4. Healthcare

- 6.3.5. Manufacturing

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. System Monitoring

- 7.1.2. Application Monitoring

- 7.1.3. File Monitoring

- 7.1.4. Network Monitoring

- 7.1.5. Database Monitoring

- 7.2. Market Analysis, Insights and Forecast - by Enterprise

- 7.2.1. Small & Medium Enterprises

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. Retail

- 7.3.3. IT & Telecom

- 7.3.4. Healthcare

- 7.3.5. Manufacturing

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. System Monitoring

- 8.1.2. Application Monitoring

- 8.1.3. File Monitoring

- 8.1.4. Network Monitoring

- 8.1.5. Database Monitoring

- 8.2. Market Analysis, Insights and Forecast - by Enterprise

- 8.2.1. Small & Medium Enterprises

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. Retail

- 8.3.3. IT & Telecom

- 8.3.4. Healthcare

- 8.3.5. Manufacturing

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. System Monitoring

- 9.1.2. Application Monitoring

- 9.1.3. File Monitoring

- 9.1.4. Network Monitoring

- 9.1.5. Database Monitoring

- 9.2. Market Analysis, Insights and Forecast - by Enterprise

- 9.2.1. Small & Medium Enterprises

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. Retail

- 9.3.3. IT & Telecom

- 9.3.4. Healthcare

- 9.3.5. Manufacturing

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. System Monitoring

- 10.1.2. Application Monitoring

- 10.1.3. File Monitoring

- 10.1.4. Network Monitoring

- 10.1.5. Database Monitoring

- 10.2. Market Analysis, Insights and Forecast - by Enterprise

- 10.2.1. Small & Medium Enterprises

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. BFSI

- 10.3.2. Retail

- 10.3.3. IT & Telecom

- 10.3.4. Healthcare

- 10.3.5. Manufacturing

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa User Activity Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Micro Focus International PLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Netwrix Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Teramind Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Imperva Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Securonix Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 LogRhythm Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Centrify Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 CyberArk Software Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Ezwim B V *List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Splunk Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Forcepoint

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Micro Focus International PLC

List of Figures

- Figure 1: Global User Activity Monitoring Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America User Activity Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America User Activity Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe User Activity Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe User Activity Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific User Activity Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific User Activity Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America User Activity Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America User Activity Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa User Activity Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa User Activity Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America User Activity Monitoring Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America User Activity Monitoring Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America User Activity Monitoring Industry Revenue (Million), by Enterprise 2024 & 2032

- Figure 15: North America User Activity Monitoring Industry Revenue Share (%), by Enterprise 2024 & 2032

- Figure 16: North America User Activity Monitoring Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America User Activity Monitoring Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America User Activity Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America User Activity Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe User Activity Monitoring Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe User Activity Monitoring Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe User Activity Monitoring Industry Revenue (Million), by Enterprise 2024 & 2032

- Figure 23: Europe User Activity Monitoring Industry Revenue Share (%), by Enterprise 2024 & 2032

- Figure 24: Europe User Activity Monitoring Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Europe User Activity Monitoring Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Europe User Activity Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe User Activity Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific User Activity Monitoring Industry Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Pacific User Activity Monitoring Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific User Activity Monitoring Industry Revenue (Million), by Enterprise 2024 & 2032

- Figure 31: Asia Pacific User Activity Monitoring Industry Revenue Share (%), by Enterprise 2024 & 2032

- Figure 32: Asia Pacific User Activity Monitoring Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Asia Pacific User Activity Monitoring Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Asia Pacific User Activity Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific User Activity Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America User Activity Monitoring Industry Revenue (Million), by Application 2024 & 2032

- Figure 37: Latin America User Activity Monitoring Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: Latin America User Activity Monitoring Industry Revenue (Million), by Enterprise 2024 & 2032

- Figure 39: Latin America User Activity Monitoring Industry Revenue Share (%), by Enterprise 2024 & 2032

- Figure 40: Latin America User Activity Monitoring Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Latin America User Activity Monitoring Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Latin America User Activity Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America User Activity Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa User Activity Monitoring Industry Revenue (Million), by Application 2024 & 2032

- Figure 45: Middle East and Africa User Activity Monitoring Industry Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East and Africa User Activity Monitoring Industry Revenue (Million), by Enterprise 2024 & 2032

- Figure 47: Middle East and Africa User Activity Monitoring Industry Revenue Share (%), by Enterprise 2024 & 2032

- Figure 48: Middle East and Africa User Activity Monitoring Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 49: Middle East and Africa User Activity Monitoring Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 50: Middle East and Africa User Activity Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa User Activity Monitoring Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global User Activity Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global User Activity Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global User Activity Monitoring Industry Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 4: Global User Activity Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global User Activity Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global User Activity Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: User Activity Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global User Activity Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: User Activity Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global User Activity Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: User Activity Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global User Activity Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: User Activity Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global User Activity Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: User Activity Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global User Activity Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global User Activity Monitoring Industry Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 18: Global User Activity Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 19: Global User Activity Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global User Activity Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global User Activity Monitoring Industry Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 22: Global User Activity Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global User Activity Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global User Activity Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global User Activity Monitoring Industry Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 26: Global User Activity Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 27: Global User Activity Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global User Activity Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global User Activity Monitoring Industry Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 30: Global User Activity Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 31: Global User Activity Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global User Activity Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global User Activity Monitoring Industry Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 34: Global User Activity Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 35: Global User Activity Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the User Activity Monitoring Industry?

The projected CAGR is approximately 22.10%.

2. Which companies are prominent players in the User Activity Monitoring Industry?

Key companies in the market include Micro Focus International PLC, Netwrix Corporation, Teramind Inc, Imperva Inc, Securonix Inc, LogRhythm Inc, Centrify Corporation, CyberArk Software Ltd, Ezwim B V *List Not Exhaustive, Splunk Inc, Forcepoint.

3. What are the main segments of the User Activity Monitoring Industry?

The market segments include Application, Enterprise, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need Among Organizations to Optimize Employee Productivity; Need for Enhanced Control Over Employees and Third-Party Vendors in Enterprises.

6. What are the notable trends driving market growth?

Increasing Need Among Organizations to Optimize Employee Productivity to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Innovation for Developing Robust UAM Solutions.

8. Can you provide examples of recent developments in the market?

July 2022: Imperva Inc announced Imperva Data Security Fabric (DSF) which provides data-centric protection and compliance for enterprise data lakes built on Amazon Web Services (AWS). Imperva reinforced its commitment to securing data and all paths to it by allowing AWS customers to secure their data with one comprehensive platform, leveraging a unified security model across Amazon Aurora, Amazon Redshift, Amazon Relational Database Service (Amazon RDS), Amazon DynamoDB, Amazon Athena, and AWS CloudFormation without requiring any changes to their existing data infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "User Activity Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the User Activity Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the User Activity Monitoring Industry?

To stay informed about further developments, trends, and reports in the User Activity Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence