Key Insights

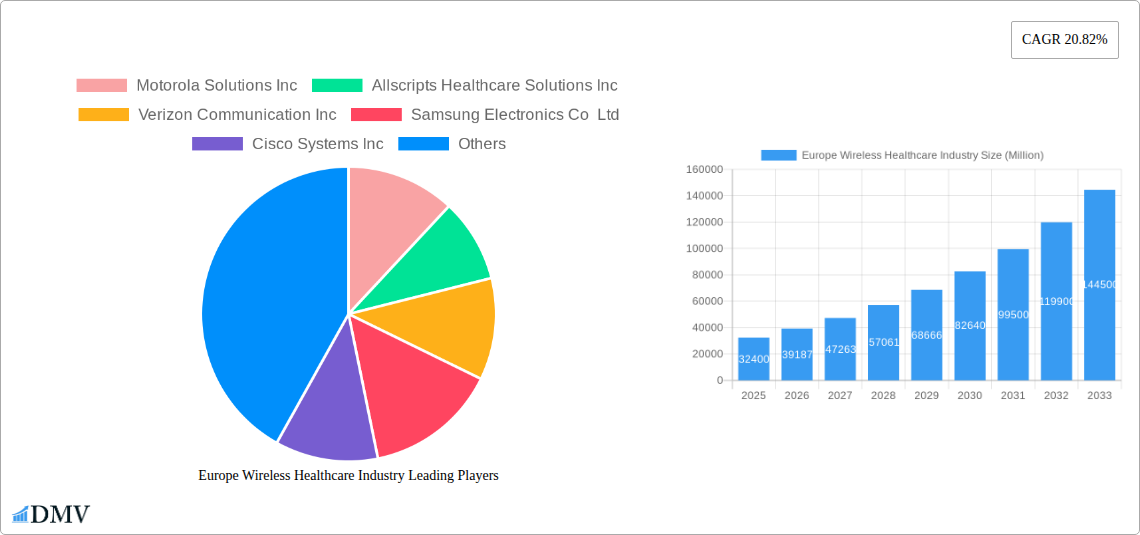

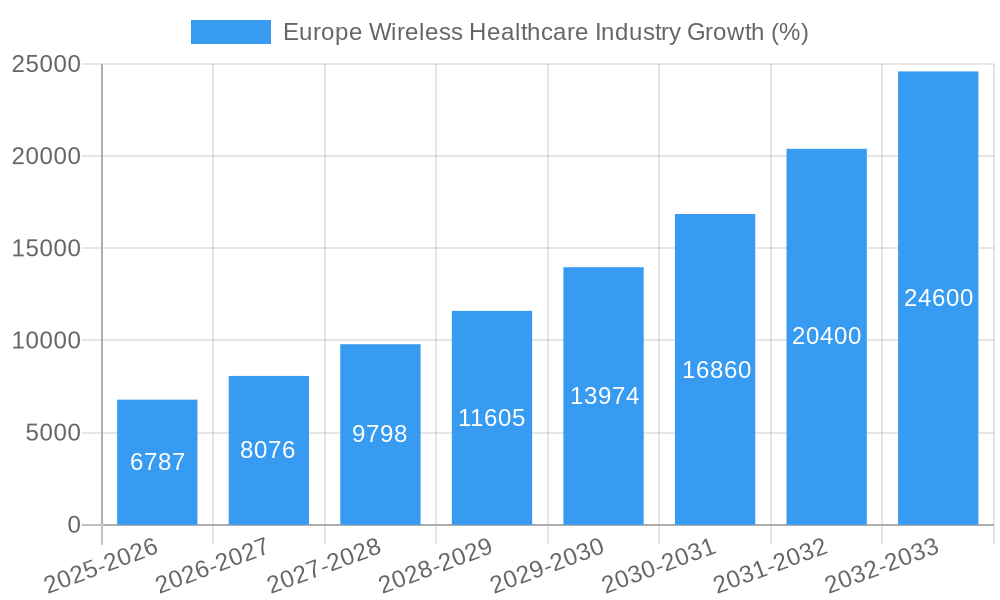

The European wireless healthcare market is experiencing robust growth, projected to reach €32.40 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 20.82% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of remote patient monitoring (RPM) technologies, fueled by an aging population and the rising prevalence of chronic diseases, is significantly boosting market demand. Wireless solutions offer convenient and cost-effective ways to track vital signs, administer medication remotely, and provide timely interventions, reducing hospital readmissions and improving patient outcomes. Secondly, advancements in 5G and IoT technologies are enabling the development of more sophisticated and reliable wireless healthcare devices and systems, further accelerating market growth. The integration of artificial intelligence (AI) and machine learning (ML) in these systems enhances data analysis and predictive capabilities, leading to more personalized and proactive healthcare management. Furthermore, government initiatives aimed at promoting digital healthcare and telehealth across Europe are providing a strong impetus for market expansion. Finally, the growing preference for home-based care, particularly among elderly patients, is creating lucrative opportunities for wireless healthcare solutions.

However, the market faces certain challenges. Data security and privacy concerns surrounding the transmission and storage of sensitive patient information remain a significant restraint. Ensuring robust cybersecurity measures and adhering to stringent data protection regulations, like GDPR, is crucial for market confidence and growth. Moreover, the high initial investment costs associated with implementing wireless healthcare infrastructure and training healthcare professionals on the use of new technologies can pose a barrier to adoption, particularly in smaller healthcare facilities and rural areas. Nevertheless, the long-term benefits of improved patient care, reduced healthcare costs, and enhanced efficiency are expected to outweigh these challenges, paving the way for sustained and substantial growth in the European wireless healthcare market throughout the forecast period. Key players such as Motorola Solutions, Allscripts, Verizon, Samsung, and Cisco are actively shaping the market through continuous innovation and strategic partnerships. The strong presence of these companies signals the significant investment and potential for future growth.

Europe Wireless Healthcare Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Europe Wireless Healthcare Industry, projecting a market valuation of €XX Million by 2033. It covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report delves deep into market composition, technological advancements, key players, and future growth opportunities, offering invaluable insights for stakeholders across the industry.

Europe Wireless Healthcare Industry Market Composition & Trends

The European Wireless Healthcare market, valued at €XX Million in 2024, is characterized by a moderately concentrated landscape with key players vying for market share. Innovation is driven by the convergence of IoT, AI, and cloud computing, leading to the development of sophisticated telehealth solutions. Stringent regulatory frameworks, particularly concerning data privacy (GDPR) and medical device approvals, shape market dynamics. Substitute products, such as traditional wired systems, face increasing competition from the superior efficiency and convenience of wireless solutions. The end-user profile encompasses hospitals & nursing homes, home care providers, pharmaceutical companies, and various other applications. M&A activity has been significant, with deals totaling an estimated €XX Million in the past five years, driven by a desire to expand market reach and enhance technological capabilities.

- Market Share Distribution (2024): Top 5 players hold approximately XX% of the market.

- M&A Deal Values (2019-2024): Estimated at €XX Million, with an average deal size of €XX Million.

- Key Innovation Catalysts: IoT, AI, Cloud Computing, Big Data Analytics.

- Regulatory Landscape: GDPR, Medical Device Regulations (MDR), varying national regulations.

Europe Wireless Healthcare Industry Industry Evolution

The European Wireless Healthcare market has exhibited robust growth throughout the historical period (2019-2024), with a CAGR of XX%. This growth trajectory is projected to continue during the forecast period (2025-2033), driven by several factors. Technological advancements, such as the miniaturization of sensors and the development of low-power wide-area networks (LPWANs), are expanding the capabilities and affordability of wireless healthcare solutions. Simultaneously, a rising elderly population, coupled with a growing preference for remote healthcare and increased chronic disease prevalence, is fueling the demand for these technologies. The adoption rate of wireless technologies in healthcare settings has been steadily increasing, with a significant uptick observed in recent years, particularly in hospitals and nursing homes. This trend is expected to accelerate, driven by both technological improvements and favorable regulatory environments in several European countries. The market is expected to reach €XX Million by 2033, showcasing a strong growth momentum.

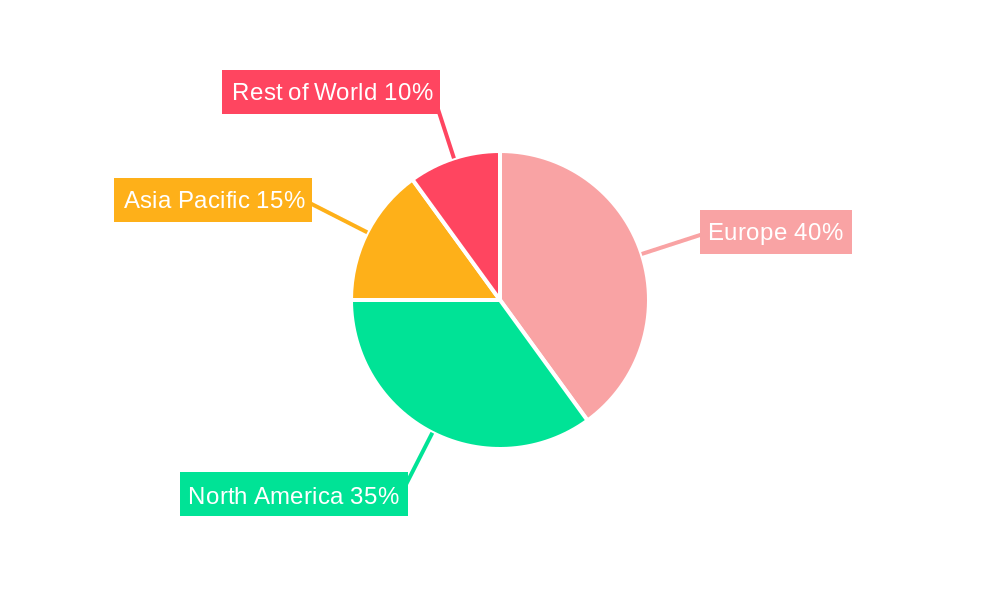

Leading Regions, Countries, or Segments in Europe Wireless Healthcare Industry

Germany and the UK are currently the leading markets in Europe for wireless healthcare, accounting for approximately XX% of the total market value. This dominance is fueled by high healthcare spending, advanced technological infrastructure, and strong regulatory support. The Hospitals and Nursing Homes segment currently holds the largest market share, driven by high adoption rates of wireless patient monitoring systems and other connected healthcare solutions. However, the Home Care segment is experiencing rapid growth, driven by an aging population and increasing demand for remote patient monitoring.

- Key Drivers for Germany and the UK: High healthcare expenditure, robust digital infrastructure, supportive government initiatives.

- Hospitals and Nursing Homes Segment Drivers: Increased demand for patient monitoring, improved efficiency and workflow optimization.

- Home Care Segment Drivers: Aging population, rising preference for remote monitoring, government-backed telehealth programs.

- Hardware Segment Dominance: Driven by increasing demand for wearable sensors, mobile devices, and network infrastructure.

Europe Wireless Healthcare Industry Product Innovations

Recent product innovations have focused on enhancing the accuracy, reliability, and user-friendliness of wireless healthcare solutions. For example, the introduction of advanced sensor technologies, combined with cloud-based data analytics, has enabled the development of early warning systems that can detect patient deterioration. This trend is leading to better patient outcomes and reduced healthcare costs. Miniaturization of devices and improvements in power efficiency are also broadening the range of applications for wireless technology in healthcare settings.

Propelling Factors for Europe Wireless Healthcare Industry Growth

Technological advancements, such as the Internet of Medical Things (IoMT), artificial intelligence (AI), and 5G connectivity, are key drivers for market growth. Favorable government policies promoting telehealth and digital health initiatives, coupled with increasing healthcare expenditure across the region, are further contributing factors. The rising prevalence of chronic diseases and an aging population fuels the demand for convenient and cost-effective remote monitoring solutions.

Obstacles in the Europe Wireless Healthcare Industry Market

Significant barriers include stringent regulatory hurdles related to data privacy and medical device approvals, which can delay product launches and increase development costs. Supply chain disruptions, particularly concerning semiconductor components, have caused production delays and price increases. Intense competition among established players and new entrants also presents a challenge. Concerns surrounding cybersecurity and data breaches related to patient data pose a significant risk.

Future Opportunities in Europe Wireless Healthcare Industry

Emerging opportunities lie in the expansion of telehealth services in rural areas, the integration of AI and machine learning for predictive diagnostics, and the development of personalized and preventative care solutions. The adoption of 5G networks promises to enhance the speed and reliability of wireless healthcare applications, opening up new possibilities for real-time remote monitoring and emergency response. The development of new wearable sensor technologies with advanced functionalities will further expand the market.

Major Players in the Europe Wireless Healthcare Industry Ecosystem

- Motorola Solutions Inc

- Allscripts Healthcare Solutions Inc

- Verizon Communication Inc

- Samsung Electronics Co Ltd

- Cisco Systems Inc

- Philips Healthcare

- Extreme Networks Inc

- Apple Inc

- AT&T Inc

- Qualcomm Inc

Key Developments in Europe Wireless Healthcare Industry Industry

- June 2022: GE Healthcare launched Portrait Mobile, a wireless patient monitoring system enhancing patient care and early detection of deterioration.

- March 2022: Tunstall Healthcare expanded its German market presence through the acquisition of BeWo Unternehmensgruppe, strengthening its telehealth and telecare offerings.

Strategic Europe Wireless Healthcare Industry Market Forecast

The European Wireless Healthcare market is poised for significant growth over the next decade, driven by converging technological advancements, supportive regulatory landscapes, and evolving healthcare demands. The increasing adoption of remote patient monitoring, coupled with the expansion of 5G networks and the integration of AI, will unlock substantial opportunities for market players. The potential for improved healthcare outcomes, reduced costs, and enhanced patient convenience will underpin continued market expansion throughout the forecast period.

Europe Wireless Healthcare Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Application

- 2.1. Hospitals and Nursing Homes

- 2.2. Home Care

- 2.3. Pharmaceuticals

- 2.4. Other Applications

Europe Wireless Healthcare Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Wireless Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.82% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Connected Devices in Healthcare; Increasing Adoption of Internet of Things (IoT) and Wearable Devices in Healthcare to Drive the Wireless Healthcare Market

- 3.3. Market Restrains

- 3.3.1. Lack of Networking Infrastructure; Data Security and Device Certification Challenges; Impact of COVID-19 on the Industry

- 3.4. Market Trends

- 3.4.1. Home Care is Expected to Gain Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Wireless Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Hospitals and Nursing Homes

- 5.2.2. Home Care

- 5.2.3. Pharmaceuticals

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Germany Europe Wireless Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Wireless Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Wireless Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Wireless Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Wireless Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Wireless Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Wireless Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Motorola Solutions Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Allscripts Healthcare Solutions Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Verizon Communication Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Samsung Electronics Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cisco Systems Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Philips Healthcare

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Extreme Networks Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Apple Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 AT&T Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Qualcomm Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: Europe Wireless Healthcare Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Wireless Healthcare Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Wireless Healthcare Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Wireless Healthcare Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Wireless Healthcare Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Europe Wireless Healthcare Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: Europe Wireless Healthcare Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Europe Wireless Healthcare Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Europe Wireless Healthcare Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Wireless Healthcare Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Europe Wireless Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Wireless Healthcare Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: France Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Europe Wireless Healthcare Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 26: Europe Wireless Healthcare Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 27: Europe Wireless Healthcare Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Europe Wireless Healthcare Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 29: Europe Wireless Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Wireless Healthcare Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: France Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Wireless Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Wireless Healthcare Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wireless Healthcare Industry?

The projected CAGR is approximately 20.82%.

2. Which companies are prominent players in the Europe Wireless Healthcare Industry?

Key companies in the market include Motorola Solutions Inc, Allscripts Healthcare Solutions Inc , Verizon Communication Inc, Samsung Electronics Co Ltd, Cisco Systems Inc, Philips Healthcare, Extreme Networks Inc, Apple Inc, AT&T Inc, Qualcomm Inc.

3. What are the main segments of the Europe Wireless Healthcare Industry?

The market segments include Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Connected Devices in Healthcare; Increasing Adoption of Internet of Things (IoT) and Wearable Devices in Healthcare to Drive the Wireless Healthcare Market.

6. What are the notable trends driving market growth?

Home Care is Expected to Gain Significant Share.

7. Are there any restraints impacting market growth?

Lack of Networking Infrastructure; Data Security and Device Certification Challenges; Impact of COVID-19 on the Industry.

8. Can you provide examples of recent developments in the market?

June 2022: GE Healthcare introduced Portrait Mobile, a wireless patient monitoring system that is continuously monitoring a patient’s stay. The wireless patient monitoring system assists clinicians in detecting patient deterioration. Portrait Mobile comprises patient-worn wireless sensors that communicate with a mobile monitor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wireless Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wireless Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wireless Healthcare Industry?

To stay informed about further developments, trends, and reports in the Europe Wireless Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence